Global Monopotassium phosphate Market Size, Share, And Business Benefits By Grade (Industrial Grade, Fertilizer Grade, Food Grade, Others), By Form (Powder, Crystal, Liquid), By Application (Medical Field, Compound Fertilizer Production, Metaphosphate Production, Others), By End-use(Food and Beverage, Pharmaceutical, Animal Feed and Pet Food, Personal Care and Cosmetics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: January 2025

- Report ID: 137029

- Number of Pages: 245

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

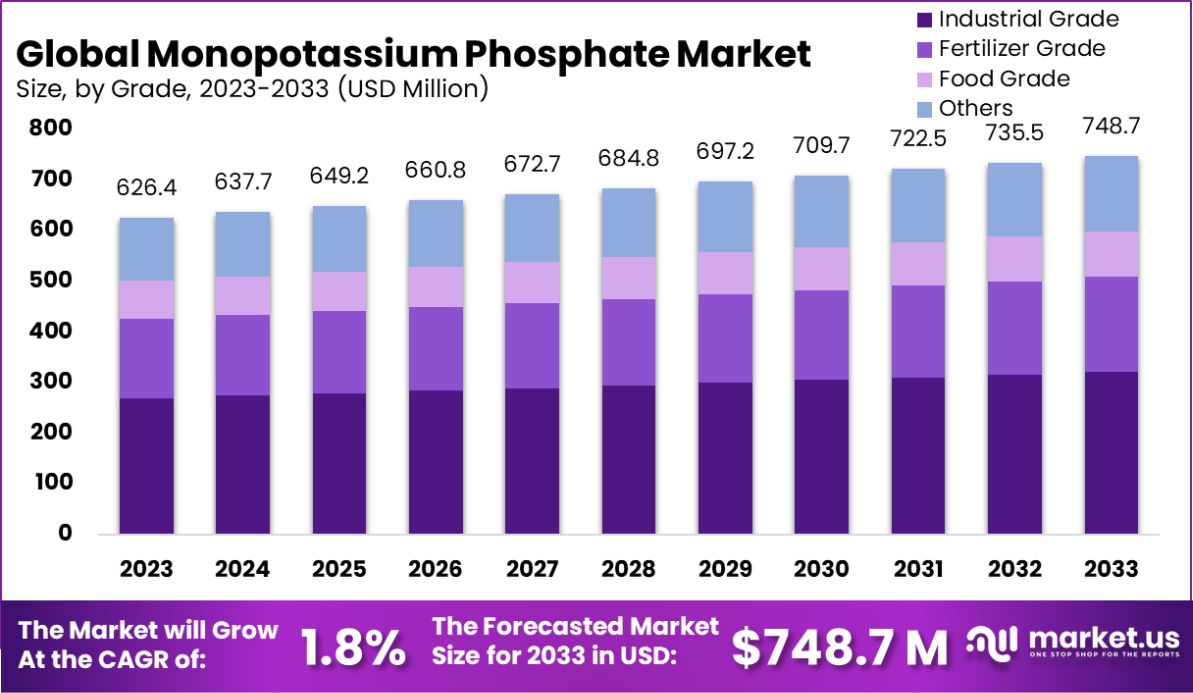

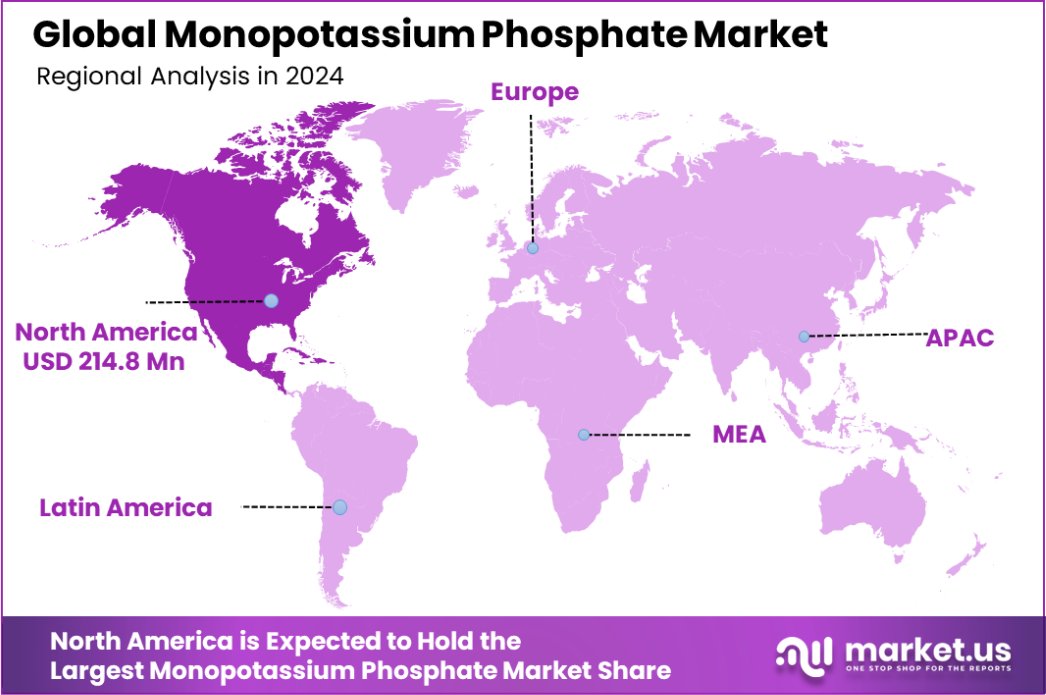

The Global Monopotassium phosphate Market is expected to be worth around USD 748.7 Million by 2033, up from USD 626.4 Million in 2023, and grow at a CAGR of 1.8% from 2024 to 2033. North America holds 36.3% of the Monopotassium phosphate market, USD 214.8 million.

Monopotassium phosphate (MKP), chemically denoted as KH₂PO₄, is a water-soluble compound extensively utilized in agriculture as a fertilizer, in the food industry as an additive, and in pharmaceuticals as a buffering agent. Its dual provision of potassium and phosphorus makes it indispensable for plant nutrition, thereby playing a pivotal role in enhancing crop yield and quality.

In the industrial landscape, MKP’s significance is underscored by its diverse applications. In agriculture, it serves as a high-efficiency source of phosphorus and potassium, essential macronutrients that support root development and improve plant resistance to diseases.

The food industry employs MKP as an emulsifying agent and pH stabilizer, ensuring product consistency and extending shelf life. Additionally, in pharmaceuticals, MKP functions as a buffering agent, maintaining the stability of medicinal formulations.

Several factors are propelling the growth of the MKP market. The escalating global population has intensified the demand for food, prompting the adoption of effective fertilizers to boost agricultural productivity.

Concurrently, the rising consumer inclination towards processed and convenience foods has augmented the need for food additives like MKP. Moreover, advancements in pharmaceutical manufacturing processes have increased the utilization of MKP to ensure product stability and efficacy.

Notably, the Recommended Dietary Allowance (RDA) for phosphorus for adults aged 19 and older is 700 mg per day, while the Daily Value (DV) for phosphorus is 1,250 mg for adults and children aged 4 years and older, as established by the FDA.

Emerging trends within the MKP market include a shift towards sustainable and eco-friendly agricultural practices. Farmers are increasingly adopting MKP due to its low salt index, which minimizes soil salinity issues and promotes sustainable farming.

Furthermore, the expansion of the hydroponics industry, which relies on water-soluble fertilizers like MKP, is contributing to market growth. In the food sector, the clean label movement is driving manufacturers to use additives perceived as natural and safe, positioning MKP favorably.

Additionally, U.S. consumption of monosodium and disodium phosphate (including MKP) in 2022 was estimated at 19 million kilograms, while China ranked first worldwide in total exports with 26 million kilograms. The United States led total imports with 14 million kilograms in the same year.

Looking ahead, the MKP market is poised for significant growth. The global emphasis on food security, coupled with the need for sustainable agricultural inputs, is expected to drive demand. Technological innovations in fertilizer application methods, such as fertigation and foliar feeding, are likely to enhance MKP utilization efficiency, further stimulating market expansion.

Key Takeaways

- The Global Monopotassium phosphate Market is expected to be worth around USD 748.7 Million by 2033, up from USD 626.4 Million in 2023, and grow at a CAGR of 1.8% from 2024 to 2033.

- The Monopotassium Phosphate market is dominated by the Industrial Grade at 43.2% market share.

- The powder form of Monopotassium Phosphate leads with a 47.2% share in market preference.

- A major application of Monopotassium Phosphate is in Compound fertilizer production, holding 52.3%.

- In the food and beverage sector, Monopotassium Phosphate has a significant 29.2% end-use share.

- In North America, the Monopotassium Phosphate market holds 36.3%, totaling USD 214.8 million.

Business Benefits of Monopotassium Phosphate

Monopotassium phosphate (MKP) offers several business benefits, particularly in the food and agriculture industries, as derived from government regulations and documents. MKP is widely recognized and regulated as a safe and effective food additive. It serves multiple functional roles in the food industry, including as a malting or fermenting aid, a nutrient supplement, a pH control agent, and a stabilizer or thickener.

In agriculture, MKP is valued for its high solubility and nutritional value as a fertilizer, providing essential phosphorus and potassium to plants, which supports their growth and health. The regulatory status of MKP under the U.S. Food and Drug Administration (FDA) and Environmental Protection Agency (EPA) as Generally Recognized as Safe (GRAS) and in various food and packaging regulations underscores its utility and safety.

Additionally, MKP’s chemical properties make it suitable for use in a variety of commercial applications beyond food and agriculture. It’s used in products ranging from toothpaste to flame retardants, demonstrating its versatility and economic importance across multiple industries.

Understanding and leveraging the regulated uses of MKP can significantly benefit businesses by aligning product formulations with regulatory standards, ensuring safety, and enhancing product functionality. This aligns with broader environmental and health standards, potentially reducing regulatory hurdles and fostering trust with consumers and clients.

By Grade Analysis

The industrial grade monopotassium phosphate dominates the market with a significant 43.2% share.

In 2023, Industrial Grade held a dominant market position in the By Grade segment of the Monopotassium Phosphate Market, commanding a 43.2% share. This segment benefits from widespread applications in various industrial processes where high purity and reliability are essential. Following closely, Fertilizer Grade accounted for 33.5% of the market share.

The demand in this segment is driven by the increasing need for high-efficiency fertilizers in the agriculture sector to support higher yields. The Food Grade segment, with a 23.3% share, is bolstered by its use in food products as a buffering and leavening agent, showcasing a steady climb in demand aligned with the growth in food processing industries.

These segments reflect a diverse market application spectrum, each catering to specific quality requirements and regulatory standards. Industrial Grade’s prominence is linked to its critical role in manufacturing and chemical industries, whereas Fertilizer Grade benefits from agricultural advancements.

Food Grade, though smaller in comparison, is expected to witness moderate growth due to rising consumer preferences for processed foods and regulatory approvals emphasizing safety and quality in food additives.

By Form Analysis

Powder form of monopotassium phosphate is preferred, accounting for 47.2% of the market distribution.

In 2023, Powder held a dominant market position in the By Form segment of the Monopotassium Phosphate Market, with a 47.2% share. This format’s preference stems from its ease of handling, storage, and application efficiency in various industrial processes. Following closely, Crystal form captured a significant market portion, marked by a 30.5% share.

This segment benefits from its purity and solubility, which are critical for high-precision applications in the food and pharmaceutical industries. Meanwhile, the Liquid form accounted for 22.3% of the market, favored for its immediate solubility and ease of application, particularly in agricultural and chemical sectors where rapid assimilation into processes is required.

These variations in market share reflect differing functional advantages and application areas. Powder forms are predominantly used in fertilizer mixtures and industrial applications due to their stability and extended shelf life. Crystal forms are often preferred in scientific settings and specialty agriculture due to their precise dosing capabilities.

Conversely, the liquid form is indispensable in scenarios requiring quick absorption and ease of handling, such as in drip irrigation systems and direct feed applications in various manufacturing processes. Each form caters to specific market needs, influencing their adoption rates and market positions.

By Application Analysis

In applications, 52.3% of monopotassium phosphate is utilized in compound fertilizer production.

In 2023, Compound Fertilizer Production held a dominant market position in the By Application segment of the Monopotassium Phosphate Market, with a 52.3% share. This segment benefits significantly from the growing demand for high-efficiency fertilizers in the agricultural sector, driven by the need to improve crop yields per hectare. Following Compound Fertilizer Production, the Medical Field accounted for 27.4% of the market share.

The utility of Monopotassium phosphate in this segment is primarily attributed to its use in pharmaceutical formulations and nutritional supplements, where it serves as a buffering agent and a nutrient source. Lastly, Metaphosphate Production held a 20.3% share, where its application in water treatment processes and industrial cleaning solutions underscores its importance.

The dominance of Compound fertilizer production is linked to the intensifying global focus on sustainable agriculture and the efficient use of arable land. The Medical Field’s substantial share is supported by rising health awareness and the expanding global healthcare industry, which continually demands high-quality pharmaceutical and nutraceutical products.

Meanwhile, the relevance of Metaphosphate Production in industrial applications highlights the ongoing need for effective water-softening solutions and specialized industrial cleaners, reflecting broader industrial growth trends. Each application area leverages the unique properties of Monopotassium phosphate to meet specific industry requirements, shaping the market dynamics.

By End-Use Analysis

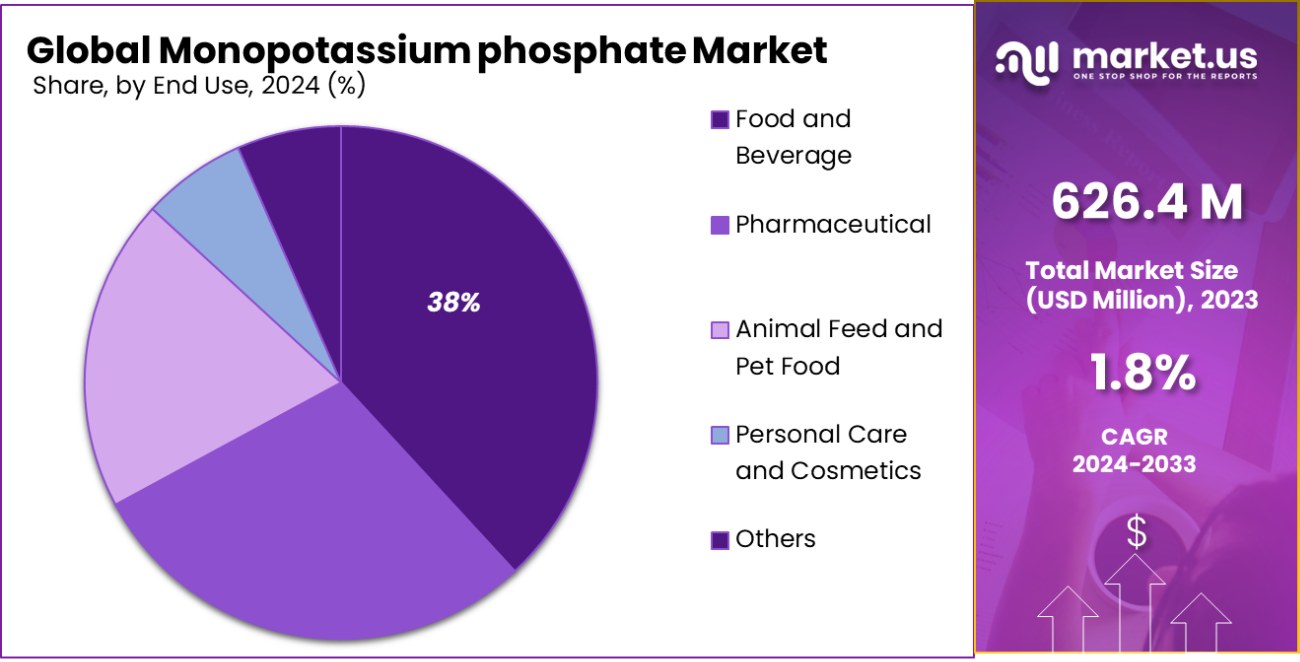

The food and beverage sector incorporates 29.2% of the market’s end-use of monopotassium phosphate.

In 2023, Food and Beverage held a dominant market position in the By End-Use segment of the Monopotassium Phosphate Market, with a 29.2% share. This sector’s substantial share is largely due to its widespread use as a food additive, where it acts as an emulsifier, buffer, and nutrient supplement in various processed and convenience foods.

The Pharmaceutical sector followed, capturing a 25.8% market share, driven by Monopotassium phosphate’s role in medicinal products as an electrolyte replenisher and pH stabilizer.

Animal Feed and Pet Food took a 23.6% share, benefiting from the compound’s use in enhancing the nutritional content and quality of feed products. Lastly, Personal Care and Cosmetics accounted for 21.4% of the market, where it is valued for its buffering and conditioning properties in skincare and haircare formulations.

The Food and Beverage industry’s lead in this segment can be attributed to the growing consumer demand for healthier and better-quality food products, which require specialized ingredients like Monopotassium phosphate. In Pharmaceuticals, its critical role in formulations ensures steady demand, linked to global health trends and aging populations.

In Animal Feed and Pet Food, its application reflects an increasing focus on animal health and nutritional standards. Meanwhile, in Personal Care and Cosmetics, evolving consumer preferences towards safe and multifunctional ingredients drive its inclusion in product formulations, illustrating the diverse applications of Monopotassium phosphate across various end-use sectors.

Key Market Segments

By Grade

- Industrial Grade

- Fertilizer Grade

- Food Grade

- Others

By Form

- Powder

- Crystal

- Liquid

By Application

- Medical Field

- Compound Fertilizer Production

- Metaphosphate Production

- Others

By End-use

- Food and Beverage

- Pharmaceutical

- Animal Feed and Pet Food

- Personal Care and Cosmetics

- Others

Driving Factors

Increased Demand in High-Efficiency Agricultural Practices

The growing global emphasis on sustainable agriculture and the need for high-yield crop production are major driving factors for the monotassium phosphate Market. As farmers seek more efficient ways to utilize arable land, the demand for effective fertilizers like Monopotassium phosphate increases.

This compound’s ability to enhance crop growth and soil quality makes it a key player in modern agricultural strategies, aligning with trends toward more environmentally friendly farming practices.

Expansion of Global Pharmaceutical Industries

The expansion of the pharmaceutical industry worldwide significantly contributes to the demand for Monopotassium phosphate. Its role as a pH stabilizer and electrolyte replenisher in various medicinal and health supplement formulations is crucial.

As healthcare sectors evolve and expand, especially in developing countries, the need for reliable and effective pharmaceutical ingredients continues to drive market growth. This trend is bolstered by aging populations and increasing health consciousness among consumers.

Rise in Processed Foods and Nutritional Supplements

An increase in consumer demand for processed foods and nutritional supplements is another key driver of the Monopotassium phosphate market. With lifestyle changes and the fast pace of modern living, more people are turning to convenience foods that require reliable and safe food additives.

Monopotassium phosphate, known for its buffering and nutritional properties, is extensively used to maintain the quality and safety of these products, further stimulating its demand in the food and beverage sector.

Restraining Factors

Fluctuating Raw Material Prices Impact Production Costs

Volatility in the prices of raw materials required to produce Monopotassium phosphate is a significant restraining factor for the market. These fluctuations can lead to inconsistent production costs, affecting profitability for manufacturers. High variability in cost can also make budgeting and price-setting challenging, potentially deterring investment in production capacity expansion.

This instability often results from geopolitical tensions, economic instability, and changes in global trade policies, impacting the supply chain and overall market growth.

Environmental Concerns Over Chemical Fertilizers Usage

Growing environmental concerns regarding the use of chemical fertilizers, including Monopotassium phosphate, act as a major market restraint. There is increasing scrutiny on the long-term impacts of these fertilizers on soil health, water quality, and biodiversity.

Regulatory pressures and the push for more sustainable farming practices encourage the adoption of organic alternatives, potentially limiting the market reach of chemical-based products. This shift is driven by both regulatory frameworks and a rising consumer preference for environmentally friendly agricultural products.

Regulatory and Compliance Challenges in Pharmaceuticals

The stringent regulatory and compliance standards in the pharmaceutical industry pose another restraint on the Monopotassium phosphate market. As an ingredient used in drug formulations and health supplements, Monopotassium phosphate must meet high safety and efficacy standards set by health authorities worldwide.

The complex and time-consuming approval processes for pharmaceutical additives can delay product launches and add to development costs, thereby restraining market growth. These challenges are compounded by the need for continuous innovation and adaptation to evolving regulatory environments.

Growth Opportunity

Rising Demand for Fertilizers in the Agriculture Sector

Monopotassium phosphate is widely used as a fertilizer, providing essential nutrients like potassium and phosphorus to crops. The rising global population is increasing the need for higher crop yields to meet food demand. Farmers are adopting efficient fertilizers to boost agricultural productivity, which is driving the market for monopotassium phosphate.

Additionally, the focus on sustainable farming practices and soil health management further strengthens its adoption. The agriculture sector will remain a key growth area for monopotassium phosphate in the coming years.

Growing Use in the Food and Beverage Industry

Monopotassium phosphate is gaining popularity as a food additive due to its properties as a stabilizer, pH regulator, and thickening agent. It is commonly used in dairy products, beverages, and processed foods to improve quality and shelf life. The growing demand for packaged and convenience foods is boosting the need for food-grade monopotassium phosphate.

Health-conscious consumers are also driving the adoption of products with added nutrients, creating further opportunities for the market within the food and beverage industry.

Increasing Applications in Pharmaceutical Formulations

The pharmaceutical industry uses monopotassium phosphate in the production of medicines, particularly as a buffering agent and a source of potassium and phosphorus. Its role in maintaining pH balance in drug formulations makes it essential for many medical products.

With the rising prevalence of chronic diseases and increasing demand for over-the-counter medications, the pharmaceutical sector offers significant growth potential for monopotassium phosphate. The growing focus on enhancing drug stability and formulation quality will further drive its usage in this sector.

Latest Trends

Integration of Eco-Friendly Manufacturing Practices

The monopotassium phosphate market is experiencing a shift towards more sustainable manufacturing practices. Producers are increasingly adopting eco-friendly methods to reduce environmental impact and meet regulatory standards.

This includes improving waste management, using renewable energy sources, and minimizing chemical runoff in production processes. As sustainability becomes a crucial factor for consumers and stakeholders, companies that innovate in this area are likely to gain a competitive edge, creating significant opportunities within the market.

Enhancement of Water-Soluble Fertilizers for Efficiency

Water-soluble fertilizers, including monopotassium phosphate, are becoming more advanced due to technological innovations. These fertilizers offer high efficiency in nutrient delivery, which is particularly beneficial for modern irrigation systems like drip or sprinkler irrigation.

The trend towards precision agriculture is driving the demand for these products as farmers seek to optimize water usage and nutrient application. This trend is expected to continue growing, further expanding the market for water-soluble monopotassium phosphate products.

Expansion in Biofortification Practices in Agriculture

Biofortification, the process of increasing the nutritional value of crops through agricultural practices, is emerging as a key trend. Monopotassium phosphate is used to fortify crops with potassium and phosphorus, essential nutrients for plant growth. As the global focus on health and nutrition intensifies, the demand for biofortified crops is rising.

This development is promoting the use of monopotassium phosphate in agriculture, presenting new growth avenues for the market. The trend is supported by government initiatives and research in agricultural science, pushing forward market expansion.

Regional Analysis

In North America, the monopotassium phosphate market holds a 36.3% share, valued at USD 214.8 million.

The Monopotassium phosphate market exhibits distinct regional dynamics with significant variations in market size and growth drivers. In North America, the market is highly developed, capturing 36.3% of the global share, valued at USD 214.8 million. This region’s dominance can be attributed to advanced agricultural practices and a robust food processing industry demanding high-quality fertilizers and food additives.

Europe follows, where environmental sustainability and high standards for food safety enhance the demand for Monopotassium phosphate as a preferred agricultural additive. The market benefits from stringent EU regulations promoting eco-friendly farming practices.

Asia Pacific presents rapid growth opportunities, driven by increasing agricultural activities and industrialization. Countries like China and India are pivotal, leveraging Monopotassium phosphate to meet the rising demand for food and high-efficiency fertilizers. This region’s market expansion is fueled by a growing population and economic development.

Meanwhile, the Middle East & Africa and Latin America are emerging regions in the market. These areas are witnessing gradual adoption due to rising awareness about modern farming techniques and government initiatives aimed at improving crop yields. Although smaller in market share, these regions offer potential growth driven by agricultural development and an increasing focus on food security.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the global Monopotassium phosphate market, key players are diversifying their approach to secure and expand their market share in 2023. Among the notable companies, CF Industries Holdings, Inc., ICL Group, and Yara International ASA stand out due to their significant influence and strategic initiatives.

CF Industries Holdings, Inc., a leader in nitrogen and phosphate fertilizer production, is capitalizing on its large-scale operations and distribution networks to meet the rising global demand for high-efficiency fertilizers. Their focus on sustainable practices and the expansion of their phosphate production capacity are pivotal in maintaining their market dominance.

ICL Group is another key player, known for its integrated supply chain and specialization in mineral-based products. ICL’s strategic focus on innovation and sustainability, particularly in water-soluble fertilizers, positions them well within the market. Their targeted approach in regions with intensive agriculture practices helps leverage growth opportunities in emerging markets.

Yara International ASA, with its global presence and comprehensive product portfolio, focuses on tailored solutions that address specific crop nutrition needs. Yara’s emphasis on digital farming tools and environmentally friendly products aligns with the growing trend towards sustainable agriculture and precision farming, making them a prominent player in the market.

The market landscape in 2023 is also influenced by regional players like Haifa Group and Hubei Xingfa Chemicals Group Co., Ltd., who are enhancing their production capabilities and exploring new applications of Monopotassium phosphate in food, pharmaceuticals, and agriculture. As regional demands evolve, these companies are adapting innovative approaches to stay competitive in a market driven by quality, efficiency, and sustainability.

Top Key Players in the Market

- Allan Chemical

- Azot-Trans

- CF Industries Holdings, Inc

- Charkit Chemical

- Foodchem International Corporation

- Green Kosumosu Fertilizer

- Guizhou Chanhen Chemical Corporation

- Haifa Group

- Hubei Xingfa Chemicals Group Co., Ltd.

- ICL Group

- Jiangsu Mupro IFT

- Lianyungang Dongtai Food Ingredients

- Master Plant-Prod

- Nutrien Ltd.

- Pharmaceutical Associates

- Prayon S.A.

- Sandoz

- Shifang Talent Chemical

- Sichuan Blue Sword Chemical (Group) Co., Ltd.

- Sinochem Group

- Yara International ASA

Recent Developments

- In 2023, CF Industries focused on clean energy, reporting $1.53 billion in net earnings and advancing decarbonization efforts, including acquiring the Waggaman ammonia facility

- In 2023, Charkit Chemical enhanced its distribution of monopotassium phosphate, focusing on improving supply chain efficiency. This development supports their commitment to meet increasing demands in the agriculture and food industries by ensuring the availability of high-quality products.

Report Scope

Report Features Description Market Value (2023) USD 626.4 Million Forecast Revenue (2033) USD 748.7 Million CAGR (2024-2033) 1.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Grade (Industrial Grade, Fertilizer Grade, Food Grade, Others), By Form (Powder, Crystal, Liquid), By Application (Medical Field, Compound Fertilizer Production, Metaphosphate Production, Others), By End-use(Food and Beverage, Pharmaceutical, Animal Feed and Pet Food, Personal Care and Cosmetics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Allan Chemical, Azot-Trans, CF Industries Holdings, Inc, Charkit Chemical, Foodchem International Corporation, Green Kosumosu Fertilizer, Guizhou Chanhen Chemical Corporation, Haifa Group, Hubei Xingfa Chemicals Group Co., Ltd., ICL Group, Jiangsu Mupro IFT, Lianyungang Dongtai Food Ingredients, Master Plant-Prod, Nutrien Ltd., Pharmaceutical Associates, Prayon S.A., Sandoz, Shifang Talent Chemical, Sichuan Blue Sword Chemical (Group) Co., Ltd., Sinochem Group, Yara International ASA Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Monopotassium phosphate MarketPublished date: January 2025add_shopping_cartBuy Now get_appDownload Sample

Monopotassium phosphate MarketPublished date: January 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Allan Chemical

- Azot-Trans

- CF Industries Holdings, Inc

- Charkit Chemical

- Foodchem International Corporation

- Green Kosumosu Fertilizer

- Guizhou Chanhen Chemical Corporation

- Haifa Group

- Hubei Xingfa Chemicals Group Co., Ltd.

- ICL Group

- Jiangsu Mupro IFT

- Lianyungang Dongtai Food Ingredients

- Master Plant-Prod

- Nutrien Ltd.

- Pharmaceutical Associates

- Prayon S.A.

- Sandoz

- Shifang Talent Chemical

- Sichuan Blue Sword Chemical (Group) Co., Ltd.

- Sinochem Group

- Yara International ASA