Global Pink Hydrogen Market Size, Share, Business Benefits Report By Form (Liquid, Gas), By Purity Level (High Purity, Standard Purity), By Distribution Method (Pipeline Delivery, Compressed Hydrogen Cylinders, Liquid Hydrogen Transport), By Technology (Electrolysis, Steam Methane Reforming, Thermochemical Water Splitting), By End-use (Transportation, Chemical, Petrochemical, Steel, Domestic, Others) , By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 135648

- Number of Pages: 329

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global Pink Hydrogen Market size is expected to be worth around USD 238.4 Billion by 2033, from USD 16.9 Billion in 2023, growing at a CAGR of 30.3% during the forecast period from 2024 to 2033.

Pink Hydrogen refers to hydrogen that is produced through the process of electrolysis using nuclear energy as the power source. Unlike other forms of hydrogen production, such as green hydrogen (produced with renewable energy) or blue hydrogen (produced from natural gas with carbon capture), pink hydrogen leverages nuclear reactors to generate electricity, which is then used to split water into hydrogen and oxygen. The key advantage of pink hydrogen is that it can produce hydrogen at a low carbon intensity since nuclear energy produces little to no direct CO2 emissions.

As of 2023, the global production of pink hydrogen is still limited but is expected to grow as governments and organizations explore nuclear energy as part of their clean energy transition. In countries like France, where nuclear power is a significant part of the energy mix, there have been pilot projects exploring the feasibility of pink hydrogen production.

Industry reports suggest that pink hydrogen could become a competitive player in the global hydrogen market, with some estimates predicting a market value of over USD 300 billion by 2050, depending on the expansion of nuclear energy infrastructure and electrolysis technologies.

In 2023, the global hydrogen market was valued at approximately USD 150 billion, with pink hydrogen representing a small but growing share. Industry experts project that pink hydrogen could capture around 15% of the total hydrogen production market by 2040, potentially reaching a market value of USD 300 billion by 2050. This growth is driven by increasing investments in nuclear-powered electrolysis systems, government incentives, and innovation in hydrogen production technologies.

Governments worldwide are showing strong support for the development of hydrogen, including pink hydrogen. For instance, the European Union has invested over EUR 8 billion in hydrogen-related technologies under its Hydrogen Strategy for a Climate-Neutral Europe, which includes funding for nuclear-powered hydrogen projects.

Similarly, in France, which relies heavily on nuclear energy, the government is funding pilot projects to explore the feasibility of large-scale pink hydrogen production. The French government has allocated EUR 2 billion to support the hydrogen industry as part of its National Hydrogen Strategy, with a focus on producing clean hydrogen through both renewable and nuclear-powered methods.

Moreover, partnerships and collaborations are accelerating the commercialization of pink hydrogen. EDF Group and Areva H2Gen have partnered to build a 1.2 MW electrolyzer using nuclear power for hydrogen production, marking a key step in advancing pink hydrogen technology.

In addition, the U.S. Department of Energy (DOE) announced a USD 100 million investment in 2023 to support the development of next-generation electrolyzers powered by nuclear energy. This public-private collaboration is expected to increase hydrogen production efficiency and reduce costs, making pink hydrogen a more competitive option in the global energy transition.

For instance, Canada and Japan, both heavily invested in nuclear energy, are exploring pink hydrogen as a viable option for achieving their clean energy targets. The global investment in nuclear-powered hydrogen projects is anticipated to exceed USD 10 billion by 2030, driven by the increasing need for low-carbon hydrogen in industrial sectors.

Key Takeaways

- Pink Hydrogen Market size is expected to be worth around USD 238.4 Billion by 2033, from USD 16.9 Billion in 2023, growing at a CAGR of 30.3%.

- Liquid pink hydrogen held a dominant market position, capturing more than 52.3% of the total market share.

- High Purity pink hydrogen held a dominant market position, capturing more than 67.1% of the total market share.

- Pipeline Delivery held a dominant market position, capturing more than 57.1% of the total pink hydrogen distribution share.

- Electrolysis held a dominant market position, capturing more than 53.6% of the pink hydrogen production market.

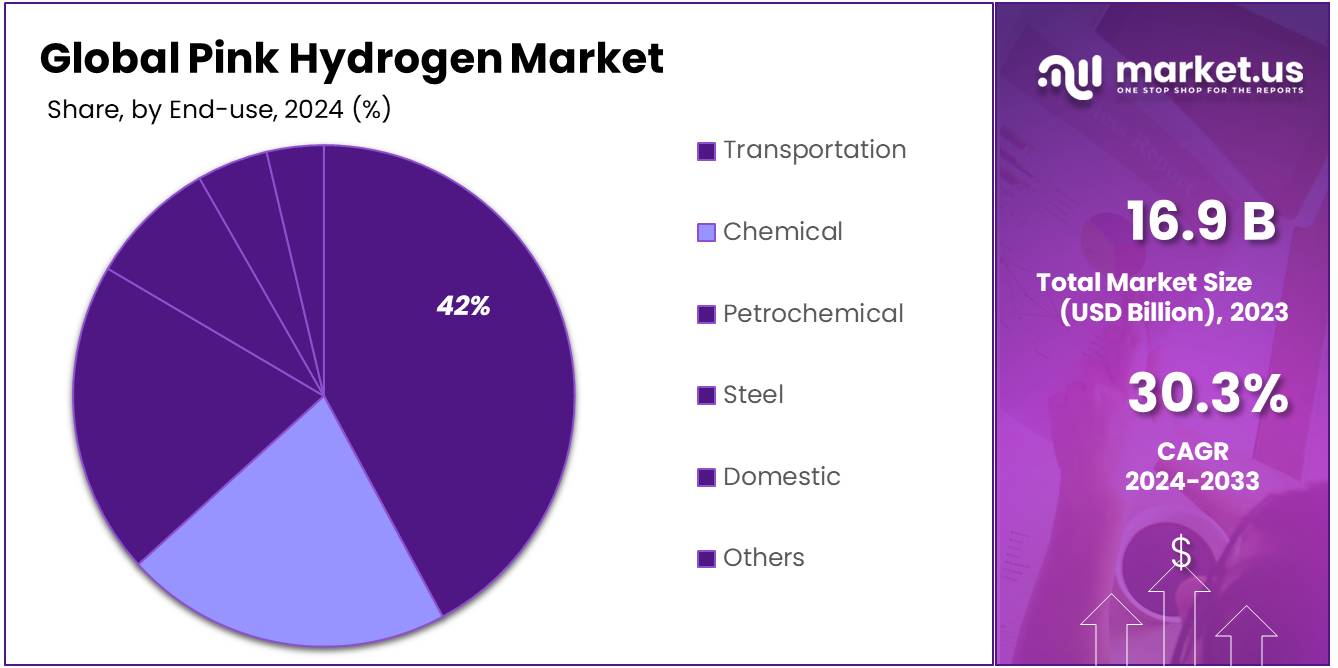

- Transportation held a dominant market position, capturing more than 34.4% of the total pink hydrogen market share.

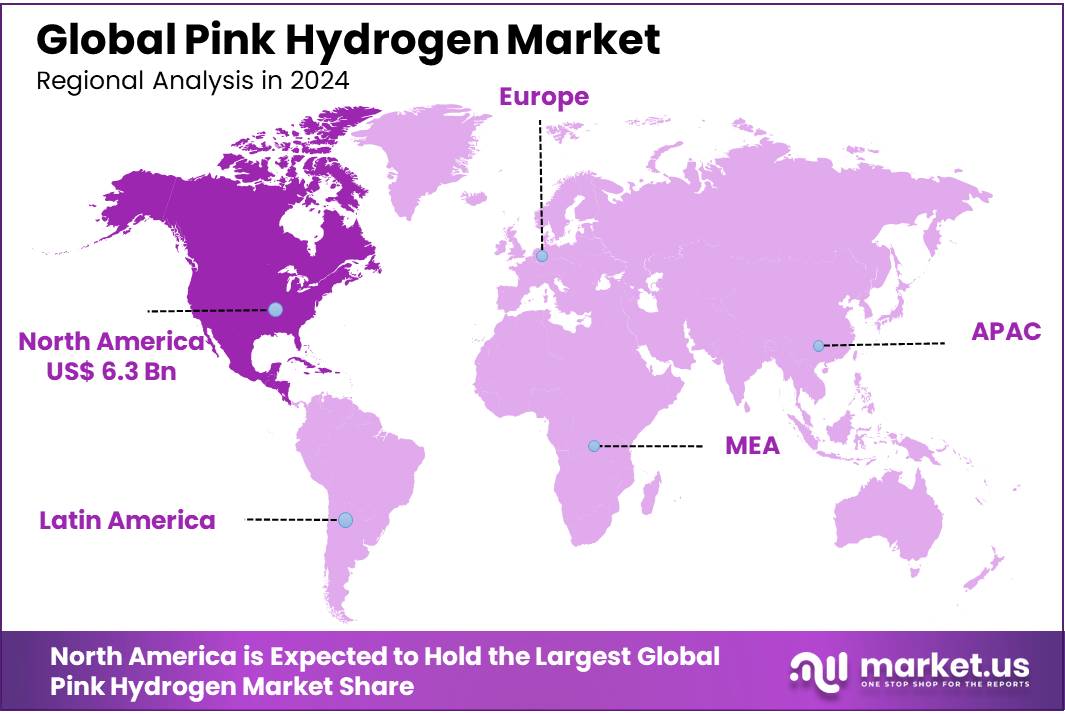

- North America dominates the pink hydrogen market, capturing 35.6% of the global share, valued at USD 6.3 billion.

Pink Hydrogen Business Benefits

Pink hydrogen, generated through the electrolysis of water using nuclear power, presents a promising business opportunity in the hydrogen market due to its economic benefits and efficiency. Unlike other forms of hydrogen production, pink hydrogen operates at a capacity factor of 90%, meaning it can continuously produce a significant amount of hydrogen due to the consistent power supply from nuclear energy. This is much higher compared to green hydrogen’s capacity factor, which ranges between 20% to 40% due to the intermittent nature of renewable energy sources.

According to Lazard’s estimates, these subsidies could reduce the levelized cost of hydrogen (LCOH) for pink hydrogen to about 0.5 euros per kilogram, making it cheaper than green hydrogen, which can cost between 3.20 and 7 euros per kilogram without subsidies. This cost advantage makes pink hydrogen a competitive alternative, especially for industries requiring large volumes of hydrogen for processes like fertilizers, oil refining, and steel production.

Furthermore, pink hydrogen has the potential to significantly lower production costs and reduce emissions, aligning with global carbon reduction targets. The use of nuclear power, which has a lower carbon footprint compared to fossil fuel-based methods, further enhances the sustainability aspect of pink hydrogen production.

By Form

Liquid pink hydrogen dominates the market, capturing 52.3% of the share, highlighting its growing significance in the energy sector.

In 2023, Liquid pink hydrogen held a dominant market position, capturing more than 52.3% of the total market share. Liquid hydrogen is preferred due to its higher energy density, making it easier to store and transport over long distances. This is especially important for industries like transportation and energy storage, where the demand for hydrogen in liquid form is growing rapidly.

Liquid hydrogen can be stored at low temperatures, making it more versatile for various applications. This form is also widely used in the aerospace sector for rocket fuel, and as global interest in space exploration grows, so does the demand for liquid hydrogen.

On the other hand, Gas pink hydrogen is gaining traction, particularly in local markets and applications where transportation and storage requirements are less complex. The gas form is primarily used for industrial applications, such as refining, chemical manufacturing, and steel production.

Although it holds a smaller share compared to liquid hydrogen, its demand is steadily increasing due to its easier handling and lower infrastructure costs. As infrastructure for gas hydrogen expands, especially in countries with well-established natural gas pipelines, its market share is expected to grow at a moderate pace over the next few years.

By Purity Level

High-purity pink hydrogen leads the market with a 67.1% share, reflecting its critical role in advanced applications and industries.

In 2023, High Purity pink hydrogen held a dominant market position, capturing more than 67.1% of the total market share. High-purity hydrogen is essential for industries that require hydrogen with minimal impurities, such as pharmaceuticals, electronics, and aerospace. The demand for high-purity hydrogen is growing as these industries need consistent quality and performance from their hydrogen supply.

The aerospace sector, in particular, uses high-purity hydrogen for rocket propulsion systems, while the electronics industry requires it for manufacturing semiconductors. As more industries push for cleaner, more efficient hydrogen for specialized applications, high-purity pink hydrogen will continue to dominate the market.

Standard Purity pink hydrogen, while holding a smaller share, is still significant for a variety of industrial uses. It is commonly used in sectors like refining, chemical production, and steel manufacturing, where the hydrogen does not need to be as highly purified.

The lower cost of standard purity hydrogen makes it an attractive option for large-scale applications where extreme purity is not a critical factor. As the hydrogen market expands, the demand for standard purity pink hydrogen is expected to grow, especially in regions focusing on cost-effective, large-volume hydrogen applications.

By Distribution Method

Pipeline delivery of pink hydrogen captures 57.1% of the market share, emphasizing its efficiency and widespread adoption in distribution.

In 2023, Pipeline Delivery held a dominant market position, capturing more than 57.1% of the total pink hydrogen distribution share. This method is widely preferred due to its cost-effectiveness and efficiency in transporting large quantities of hydrogen over long distances.

Pipelines are already well-established in regions with existing natural gas infrastructure, making them an ideal choice for hydrogen delivery in areas like North America and Europe. As hydrogen production grows, especially in regions with abundant renewable energy or nuclear power, pipeline delivery is expected to remain the most practical and scalable solution for distributing large volumes of hydrogen to industrial hubs and consumers.

Compressed Hydrogen Cylinders hold a smaller but important share of the market, primarily used for on-site applications and regions lacking pipeline infrastructure. This method is particularly suitable for small-scale industrial operations, laboratories, and refueling stations for hydrogen-powered vehicles. Although transporting hydrogen in compressed cylinders is more expensive compared to pipelines, its flexibility makes it a popular choice in remote or emerging markets where hydrogen infrastructure is still being developed.

Liquid Hydrogen Transport is emerging as a key method, particularly for international transportation and large-scale energy applications. Liquid hydrogen offers the benefit of high energy density and can be stored and transported over long distances more efficiently than its gaseous form.

However, it requires significant infrastructure investment for cryogenic storage and transport. As demand for hydrogen increases globally, liquid hydrogen transport is expected to see substantial growth, especially with rising interest in hydrogen for aerospace, energy storage, and global trade.

By Technology

Electrolysis dominates the pink hydrogen market with a 53.6% share, showcasing its pivotal role in sustainable hydrogen production.

In 2023, Electrolysis held a dominant market position, capturing more than 53.6% of the pink hydrogen production market. This technology uses electricity, often derived from nuclear energy in the case of pink hydrogen, to split water into hydrogen and oxygen.

Electrolysis is seen as the most efficient and clean method for hydrogen production, particularly as it aligns with the global push for decarbonization. The ability to produce hydrogen with low or zero carbon emissions makes electrolysis the preferred choice in regions where renewable or nuclear energy is abundant. As investments in electrolyzer technology improve, the cost of electrolysis is expected to decrease, further expanding its market share in the coming years.

Steam Methane Reforming (SMR), while historically the dominant method for hydrogen production, holds a smaller share in the pink hydrogen market. This method uses natural gas to produce hydrogen but results in higher carbon emissions compared to electrolysis.

However, it remains widely used in regions where natural gas is cheap and plentiful. SMR is often coupled with carbon capture technologies to reduce its environmental impact, but it still lags behind electrolysis in terms of sustainability, especially as more regions move toward green and clean energy solutions.

Thermochemical Water Splitting, a less common but emerging technology, is gaining interest due to its potential to use heat from nuclear reactors or concentrated solar power. This process splits water into hydrogen and oxygen at high temperatures, offering the advantage of being able to integrate into existing nuclear infrastructure.

However, the technology is still in development, and its commercial viability is yet to be fully proven on a large scale. As research and innovation progress, thermochemical water splitting could become a significant contributor to the production of pink hydrogen, offering a sustainable and efficient alternative.

By End-use

Transportation accounts for 34.4% of the pink hydrogen market, highlighting its growing adoption in sustainable mobility and logistics solutions.

In 2023, Transportation held a dominant market position, capturing more than 34.4% of the total pink hydrogen market share. This segment is primarily driven by the increasing adoption of hydrogen fuel cell vehicles (FCVs) and hydrogen-powered trucks. With growing concerns over carbon emissions and a shift toward clean energy, many countries are investing heavily in hydrogen infrastructure for transportation.

In particular, regions like Europe, Japan, and California are leading the way in developing hydrogen refueling stations and supporting policies for hydrogen-powered mobility. As the demand for cleaner transportation options rises, pink hydrogen is expected to play a crucial role in powering the next generation of fuel cell vehicles and reducing the reliance on fossil fuels.

The Chemical and Petrochemical sectors are also significant end-users of pink hydrogen. Together, they accounted for a notable share of the market in 2023. Hydrogen is used in a wide range of chemical processes, such as ammonia production and hydrogenation reactions in the production of plastics, fertilizers, and pharmaceuticals.

As industries increasingly focus on reducing their carbon footprints, the demand for clean hydrogen, including pink hydrogen, is expected to grow. The steel industry, a major consumer of hydrogen for producing green steel, is another key driver. The global push toward carbon-neutral steel production, especially in Europe and Asia, is expected to further boost the demand for hydrogen in this sector.

The Domestic sector, including residential use for energy storage and heating, remains a smaller segment but is gaining traction in areas with high renewable energy integration. With green hydrogen and pink hydrogen being seen as viable alternatives for off-grid solutions, demand for hydrogen-based heating and power is expected to grow steadily.

Key Market Segments

By Form

- Liquid

- Gas

By Purity Level

- High Purity

- Standard Purity

By Distribution Method

- Pipeline Delivery

- Compressed Hydrogen Cylinders

- Liquid Hydrogen Transport

By Technology

- Electrolysis

- Steam Methane Reforming

- Thermochemical Water Splitting

By End-use

- Transportation

- Chemical

- Petrochemical

- Steel

- Domestic

- Others

Drivers

Government Regulations and Carbon Reduction Targets

Governments across the globe are setting stringent carbon emission reduction targets to combat climate change. The European Union, for example, has set an ambitious goal to become carbon-neutral by 2050, which includes reducing emissions from industrial sectors.

In 2023, the EU invested over EUR 8 billion in clean hydrogen technologies, including projects focused on using nuclear power for hydrogen production. By 2030, the EU aims to produce up to 10 million tons of green hydrogen annually, with a portion of this coming from nuclear-powered methods. As countries strive to meet these targets, demand for pink hydrogen is expected to increase, as it aligns with long-term sustainability goals.

International Energy Agency (IEA) and Clean Energy Transitions

The International Energy Agency (IEA) forecasts that hydrogen will play a significant role in decarbonizing the global energy system, especially in sectors that are difficult to electrify. In its 2023 report, the IEA highlighted that hydrogen could account for 18% of global energy demand by 2050. Within this, low-carbon hydrogen like pink hydrogen is seen as a key solution to replace fossil fuels in hard-to-abate industries.

Governments are recognizing this potential and aligning their policies with hydrogen development. The IEA’s report indicates that, in order to meet future energy goals, countries will need to ramp up investments in hydrogen production, with a focus on cleaner technologies, including nuclear-powered electrolysis for pink hydrogen.

Increased Investments in Nuclear-Based Hydrogen Projects

As part of the global effort to transition toward cleaner energy, governments and private investors are significantly increasing their investments in nuclear-based hydrogen projects. Japan, for example, is heavily investing in nuclear hydrogen production technologies, with the government earmarking over USD 2 billion in subsidies to support this sector over the next decade.

This investment is part of Japan’s broader hydrogen strategy, which aims to produce 3 million tons of hydrogen annually by 2030, with a portion of this to be derived from nuclear power. Canada is also exploring the potential of nuclear energy for hydrogen production, with the Ontario Power Generation (OPG) planning to produce pink hydrogen from its nuclear reactors starting in 2024.

This trend is being replicated in other parts of the world, as countries seek to diversify their energy portfolios and reduce dependence on fossil fuels. In 2024, France and the U.K. are expected to announce significant investments in nuclear hydrogen technologies, further driving the growth of the pink hydrogen market.

Policy Support and Innovation

Governments are not just providing funding; they are also implementing policies to support the adoption of clean hydrogen technologies. For example, the U.S. Department of Energy has announced plans to support the development of advanced electrolysis systems for hydrogen production, including systems powered by nuclear reactors. In 2023, the U.S. allocated USD 1.5 billion toward hydrogen-related R&D, with a specific focus on improving the efficiency of nuclear-powered electrolysis.

Moreover, the growing interest in nuclear fusion and advanced nuclear technologies presents further opportunities for expanding pink hydrogen production. As these technologies mature, they are expected to bring down the costs of nuclear hydrogen, making it even more competitive against other low-carbon hydrogen options, such as green hydrogen. As such, the continued government support for nuclear energy and hydrogen innovation is likely to be one of the strongest driving forces for the growth of the pink hydrogen market in the next decade.

Restraints

High Production Costs of Pink Hydrogen

As of 2023, the cost of producing pink hydrogen via nuclear-powered electrolysis is estimated to be around USD 4 to 6 per kg, which is significantly higher than grey hydrogen (USD 1.5 per kg) and blue hydrogen (USD 2.5 to 3 per kg). While there is potential for these costs to decrease as technology advances, the initial high costs of nuclear power and electrolysis technology make it a less attractive option for large-scale hydrogen production.

For example, the Canadian government has invested more than USD 2 billion in clean hydrogen projects, but the majority of this funding is directed toward green hydrogen rather than pink hydrogen, due to its lower costs and quicker scalability.

Challenges in Infrastructure Development

Another major barrier to the widespread use of pink hydrogen is the lack of infrastructure to store, transport, and distribute it. While pipeline delivery and liquid hydrogen transport have been developed for traditional hydrogen, adapting existing infrastructure to accommodate pink hydrogen—which requires energy-intensive production methods and specialized storage facilities—presents a major challenge.

As of 2023, there are fewer than 50 hydrogen refueling stations globally that are equipped to handle clean hydrogen types like pink hydrogen. For example, in the European Union, where hydrogen infrastructure development is progressing, it is expected to take until 2030 to establish a network capable of supporting large-scale use of clean hydrogen, including pink hydrogen.

Government Support and Investment Gaps

While governments are heavily investing in hydrogen as a clean energy solution, the focus has largely been on green hydrogen, which uses renewable energy sources like wind and solar for electrolysis. As of 2024, the European Commission has allocated around EUR 8 billion for green hydrogen projects under its Hydrogen Strategy for a Climate-Neutral Europe. However, investments in pink hydrogen, which relies on nuclear energy, are still limited.

Governments are cautious about supporting nuclear energy-based hydrogen due to political and environmental concerns surrounding nuclear power. For instance, despite nuclear energy’s low-carbon potential, only a small portion of the hydrogen funding in Japan (which is a leader in hydrogen development) is directed at pink hydrogen. In 2023, Japan allocated about USD 400 million for hydrogen projects, but a significant portion of this was focused on green hydrogen derived from renewable sources.

Opportunity

Rising Demand for Clean Hydrogen

The demand for clean hydrogen is rapidly increasing across various industries, especially those with high emissions, such as steel, chemicals, and transportation. According to the International Energy Agency (IEA), the global hydrogen demand is expected to grow by over 6% annually from 2023 to 2030, with a significant portion of this demand coming from cleaner hydrogen sources.

Governments are setting stringent emission reduction targets, further driving the demand for cleaner hydrogen alternatives like pink hydrogen. For example, the European Union’s Hydrogen Strategy aims to produce 10 million tons of clean hydrogen by 2030, a significant portion of which is expected to come from nuclear-powered electrolysis.

Government Support and Funding

Governments worldwide are backing nuclear energy as part of their clean energy strategies, which directly benefits the pink hydrogen market. In 2023, the United States Department of Energy (DOE) allocated USD 1.5 billion to support the development of nuclear-powered hydrogen production technologies.

Similarly, the Canadian government has committed to USD 2 billion in clean hydrogen technologies, with several of these initiatives aimed at utilizing nuclear power to produce low-carbon hydrogen. With such substantial funding and support, the nuclear hydrogen sector is set to benefit from rapid technological advancements and scaling efforts, making pink hydrogen a viable alternative for large-scale hydrogen production.

Infrastructure Development and Technological Advancements

As nuclear energy technology advances and new reactors are developed, the cost of producing pink hydrogen is expected to decline significantly. Innovations in small modular reactors (SMRs) and more efficient electrolysis technologies are expected to reduce capital costs and improve the efficiency of hydrogen production.

According to the World Nuclear Association, SMRs, which are smaller and more flexible than traditional nuclear reactors, could play a key role in enabling the production of hydrogen in remote areas or regions with existing nuclear infrastructure. As of 2023, SMRs are projected to contribute to a 5-10% reduction in hydrogen production costs by 2030, further boosting the economic viability of pink hydrogen.

Moreover, as countries like France, Canada, and the UK continue to invest in nuclear power, the infrastructure for nuclear hydrogen production will expand. The development of new hydrogen pipelines and refueling stations will help address the logistical challenges associated with hydrogen distribution. This will enhance the overall market for pink hydrogen, especially in industrial sectors where hydrogen is used in large quantities, such as refining and chemical production.

Long-term Prospects and Market Penetration

The long-term prospects for pink hydrogen are increasingly positive, with several initiatives driving its market growth. With hydrogen projected to meet 18% of global energy needs by 2050, according to the International Renewable Energy Agency (IRENA), the market for pink hydrogen is set to grow significantly.

In 2023, global investments in hydrogen technologies reached over USD 10 billion, with an estimated 30% of these funds directed towards low-carbon hydrogen solutions, including those powered by nuclear energy.

As the cost of production decreases, government regulations tighten, and infrastructure for hydrogen distribution expands, pink hydrogen has the potential to become a key player in the global clean energy transition.

By 2035, pink hydrogen could account for up to 15% of the global hydrogen market, contributing to a cleaner and more sustainable energy future. The convergence of government support, technological advancements, and rising demand positions pink hydrogen as a major opportunity for growth in the global energy landscape.

Trends

Government and Industry Support for Nuclear-Powered Hydrogen

Governments worldwide are increasingly investing in nuclear-powered hydrogen production to meet net-zero emission targets. For example, in 2023, the European Commission announced plans to invest over EUR 4.5 billion in hydrogen technologies, with a focus on clean hydrogen produced using nuclear energy.

The U.S. Department of Energy is also funding various pilot projects that explore the potential of nuclear electrolysis for hydrogen production. The Canadian government has set aside USD 1.5 billion for clean hydrogen initiatives, including those aimed at scaling up nuclear-powered electrolysis. With such strong government backing, nuclear-powered hydrogen production is gaining momentum, and experts expect it to play a critical role in the global hydrogen economy by 2030.

Rising Interest from Industrial Players

Industrial players in sectors such as chemical manufacturing, refining, and steel production are increasingly looking toward pink hydrogen as a solution for reducing their carbon emissions.

In 2023, the Chemical Industry Association noted that several major chemical companies, including BASF and Dow, are exploring the use of low-carbon hydrogen, including pink hydrogen, to replace fossil fuels in high-emission processes. These companies have already started testing the integration of nuclear-powered hydrogen into their operations, focusing on improving efficiency and scalability.

Technological Advances in Electrolysis and Nuclear Integration

Technological innovations in electrolyzer design and nuclear energy integration are another driving force behind the growth of pink hydrogen. In 2023, several research and development projects, such as the UK’s Hydrogen Nuclear Project, received over USD 2 billion in funding. These projects aim to improve the efficiency and cost-effectiveness of high-temperature electrolysis powered by nuclear reactors.

The goal is to bring down the overall cost of pink hydrogen production, making it competitive with other forms of hydrogen, such as green hydrogen. Experts estimate that by 2030, the cost of producing hydrogen through nuclear-powered electrolysis could decrease by 30-40%, enabling widespread commercial adoption.

Regional Analysis

North America dominates the pink hydrogen market, capturing 35.6% of the global share, valued at USD 6.3 billion. The region’s leadership is driven by robust governmental support for nuclear energy and advanced technological infrastructure.

The United States leads in nuclear technology and has implemented significant initiatives to promote clean hydrogen as part of its broader energy transition strategy. With major projects underway to enhance nuclear reactor outputs for hydrogen production, North America is poised to maintain its market dominance.

In Europe, there is a strong push towards decarbonizing the energy sector, with significant investments flowing into clean hydrogen projects, including those powered by nuclear energy. The European Union’s ambitious targets for reducing greenhouse gas emissions and the supportive regulatory framework help drive the growth of pink hydrogen.

European countries are increasingly focusing on integrating nuclear energy into their national energy strategies, recognizing its potential to provide substantial clean hydrogen supply to meet industrial and transportation needs.

The Asia Pacific region is rapidly emerging as a key player in the pink hydrogen market. Countries like China, South Korea, and Japan are investing heavily in nuclear technology and hydrogen infrastructure.

Asia Pacific’s strategic pivot towards nuclear energy for hydrogen production is supported by government policies aimed at enhancing energy security and reducing carbon emissions. The region’s extensive manufacturing base and growing demand for clean energy solutions are expected to propel substantial market growth.

The Middle East & Africa and Latin America are exploring the potential of pink hydrogen, albeit from a smaller base. These regions are gradually developing their nuclear capabilities and exploring partnerships with advanced economies to leverage nuclear technology for hydrogen production. While currently small players, their strategic geographic positions and natural resource endowments offer significant potential for future growth in the pink hydrogen sector.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The pink hydrogen market is characterized by significant involvement from both established energy giants and innovative startups, focusing on leveraging nuclear energy for hydrogen production. Key players like Air Products and Chemicals, Shell, and General Electric are leading the charge with large-scale investments in hydrogen production projects.

Air Products, for example, has partnered with the U.S. Department of Energy to develop clean hydrogen technologies, including the use of nuclear energy. Their projects are expected to contribute substantially to the U.S. Hydrogen Strategy, which aims to generate 10 million tons of clean hydrogen by 2030. Shell is also actively involved in scaling hydrogen production, with plans to integrate nuclear power into their existing clean energy initiatives, especially in North America and Europe.

Additionally, ITM Power, Nel ASA, and McPhy Energy are expanding their footprint in the pink hydrogen market by focusing on electrolysis technologies powered by nuclear energy. These companies are critical to reducing the overall cost of pink hydrogen production by developing more efficient electrolyzers. Iberdrola, a major renewable energy company, and Siemens Energy are also capitalizing on their expertise in energy generation and infrastructure to support the integration of nuclear energy into the hydrogen value chain.

Toyota Motor Corporation is collaborating with other industry leaders to scale up hydrogen-powered transportation, which could significantly boost demand for pink hydrogen in the coming years. Ballard Power Systems and Plug Power are focusing on hydrogen fuel cells, with plans to incorporate nuclear-based hydrogen into their supply chains. Together, these key players are working to meet the increasing demand for clean hydrogen, supported by government initiatives and the global push for net-zero emissions.

Top Key Players

- Air Products

- Air Products and Chemicals

- Ballard Power Systems

- Engie

- Everfuel

- Exelon Corporation

- General Electric

- H2 Mobility Deutschland

- Hydrogen Systems

- Hydrogenious LOHC Technologies

- Iberdrola SA

- ITM Power

- Linde

- Linde Plc

- McPhy Energy

- Nel ASA

- OKG Aktiebolag

- Plug Power

- SGH2Energy

- Shell

- Siemens

- Siemens Energy

- Toyota Motor Corporation

Recent Developments

In 2023, Air Products continued to expand its portfolio of clean hydrogen projects, particularly in the U.S. and Europe. The company has committed USD 10 billion to green and clean hydrogen initiatives as part of its strategy to achieve net-zero emissions by 2050.

In 2024, Ballard Power announced plans to invest USD 100 million in expanding its fuel cell production and electrolysis systems, with a focus on Europe and North America.

Report Scope

Report Features Description Market Value (2023) USD 16.9 Bn Forecast Revenue (2033) USD 238.4 Bn CAGR (2024-2033) 30.3% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Liquid, Gas), By Purity Level (High Purity, Standard Purity), By Distribution Method (Pipeline Delivery, Compressed Hydrogen Cylinders, Liquid Hydrogen Transport), By Technology (Electrolysis, Steam Methane Reforming, Thermochemical Water Splitting), By End-use (Transportation, Chemical, Petrochemical, Steel, Domestic, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Air Products, Air Products and Chemicals, Ballard Power Systems, Engie, Everfuel, Exelon Corporation, General Electric, H2 Mobility Deutschland, Hydrogen Systems, Hydrogenious LOHC Technologies, Iberdrola SA, ITM Power, Linde, Linde Plc, McPhy Energy, Nel ASA, OKG Aktiebolag, Plug Power, SGH2Energy, Shell, Siemens, Siemens Energy, Toyota Motor Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Air Products

- Air Products and Chemicals

- Ballard Power Systems

- Engie

- Everfuel

- Exelon Corporation

- General Electric

- H2 Mobility Deutschland

- Hydrogen Systems

- Hydrogenious LOHC Technologies

- Iberdrola SA

- ITM Power

- Linde

- Linde Plc

- McPhy Energy

- Nel ASA

- OKG Aktiebolag

- Plug Power

- SGH2Energy

- Shell

- Siemens

- Siemens Energy

- Toyota Motor Corporation