Global Beet Gummies Market Size, Share and Report Analysis By Type (Conventional, Organic), By Packaging Type (Bottles/Jars, Pouches, Blister Packs, Others), By Distribution Channel ( Supermarkets And Hypermarkets, Convenience Stores, Pharmacies And Specialty Stores, E-commerce, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 175401

- Number of Pages: 217

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

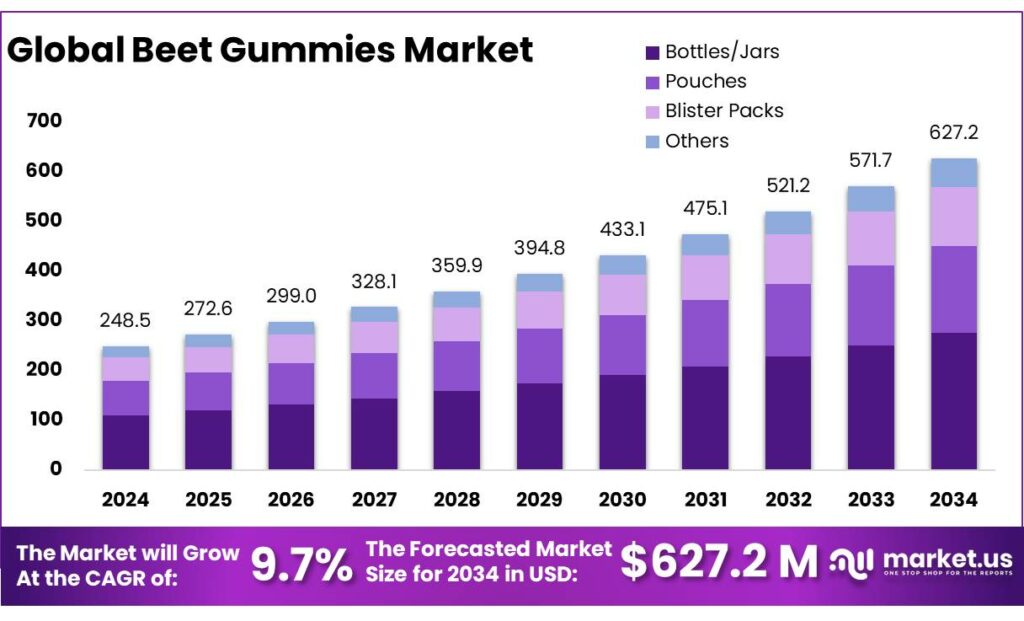

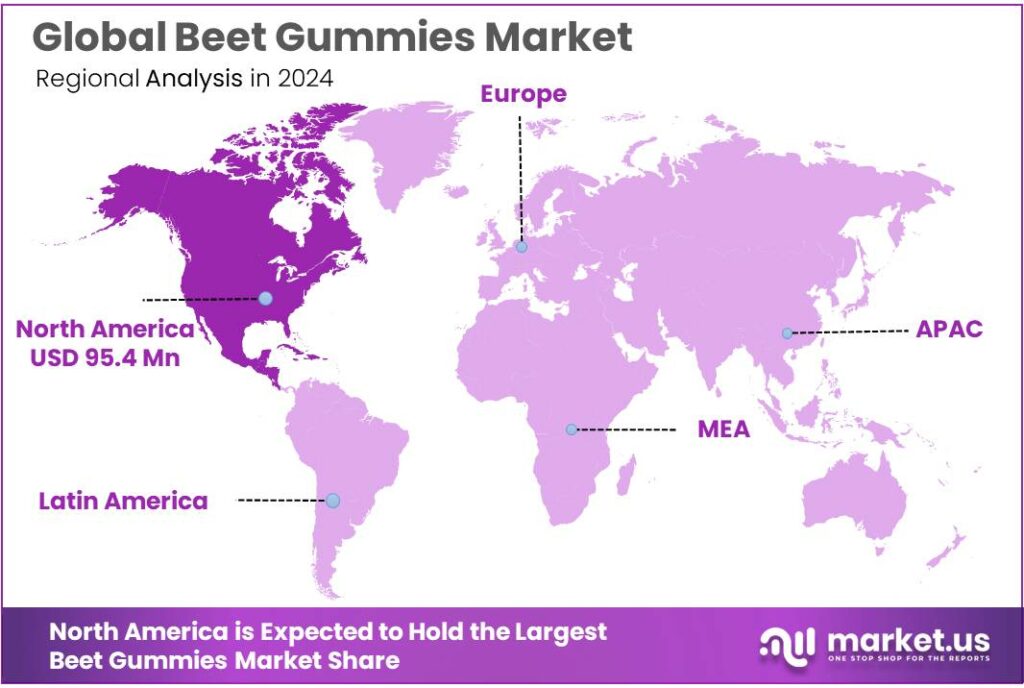

Global Beet Gummies Market size is expected to be worth around USD 627.2 Million by 2034, from USD 248.5 Million in 2024, growing at a CAGR of 9.7% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 38.4% share, holding USD 95.4 Million in revenue.

Beet gummies are positioned at the intersection of functional confectionery and dietary supplements, using beetroot-derived ingredients to deliver a “better-for-you” format that is portable, flavored, and easy to dose. From a formulation lens, the category is typically anchored in beetroot’s nutritional profile—43 calories per 100 g, alongside 9.6 g carbs, 6.8 g sugar, 2.8 g fiber, 1.6 g protein, and 0.2 g fat—which supports “plant-based” and “vegetable-powered” messaging while remaining compatible with gummy textures and taste-masking requirements.

From an industrial scenario perspective, beet gummies sit at the intersection of three supply chains—plant-based ingredients, confectionery processing, and regulated nutrition/health products. On the ingredient side, beet-derived inputs are increasingly standardized to fit high-throughput gummy production.

This aligns with the broader beetroot powder ingredient economy, which was estimated at around USD 477.5 million and is forecast to reach approximately USD 755.86 million by 2034—a useful proxy for the upstream capacity supporting beet-based formats, including gummies. On the demand side, supplement usage remains mainstream in key markets: the Council for Responsible Nutrition reported 75% of Americans use dietary supplements, while CDC NHANES data showed 57.6% of U.S. adults reported supplement use in the past 30 days.

Key demand drivers include consumer preference for “food-like” supplementation and heightened scrutiny of sugar in better-for-you products. WHO guidance recommends keeping free sugars to <10% of total energy intake, with additional benefits below 5% —pressure that is pushing beet gummies toward lower-sugar recipes, smaller serving sizes, and alternative sweeteners. Regulation and claims discipline also shape industrial outcomes: in the U.S., dietary supplement manufacturing is governed by FDA’s dietary supplement CGMP requirements under 21 CFR Part 111, reinforcing expectations around quality systems, labeling control, and traceability.

Regulation and government-led frameworks also influence commercialization. In the U.S., dietary supplement manufacturers are subject to Current Good Manufacturing Practice requirements under 21 CFR Part 111, which affects everything from supplier qualification and in-process controls to labeling and batch records—important for gummies due to moisture sensitivity and active-ingredient uniformity. In the EU, product communication is further constrained by nutrition and health-claims rules under Regulation (EC) No 1924/2006, making claim substantiation and wording a material go-to-market consideration.

Key Takeaways

- Beet Gummies Market size is expected to be worth around USD 627.2 Million by 2034, from USD 248.5 Million in 2024, growing at a CAGR of 9.7%.

- Conventional held a dominant market position, capturing more than a 67.2% share.

- Bottles/Jars held a dominant market position, capturing more than a 44.1% share.

- Supermarkets & Hypermarkets held a dominant market position, capturing more than a 39.8% share.

- North America dominates Beet Gummies with 38.4% share, valued at 95.4 Mn.

By Type Analysis

Conventional Beet Gummies dominate with a strong 67.2% market share

In 2024, Conventional held a dominant market position, capturing more than a 67.2% share, driven by strong consumer trust in familiar formulations and widespread retail availability. This segment benefits from established supply chains, stable ingredient sourcing, and cost-effective manufacturing processes that help brands maintain consistent pricing. Conventional beet gummies also appeal to a broad audience that prefers straightforward, non-specialized supplement formats, making them a preferred choice in both mass-market and online channels.

By Packaging Type Analysis

Bottles and Jars lead the market with a solid 44.1% share

In 2024, Bottles/Jars held a dominant market position, capturing more than a 44.1% share, mainly because this packaging format offers strong protection, ease of storage, and familiarity for consumers. Brands prefer bottles and jars as they help maintain product freshness, prevent moisture exposure, and support longer shelf life. Their durability during transport and handling also makes them suitable for both retail and e-commerce distribution. For consumers, the convenience of resealable lids and clear product visibility adds to the appeal, strengthening the category’s overall acceptance.

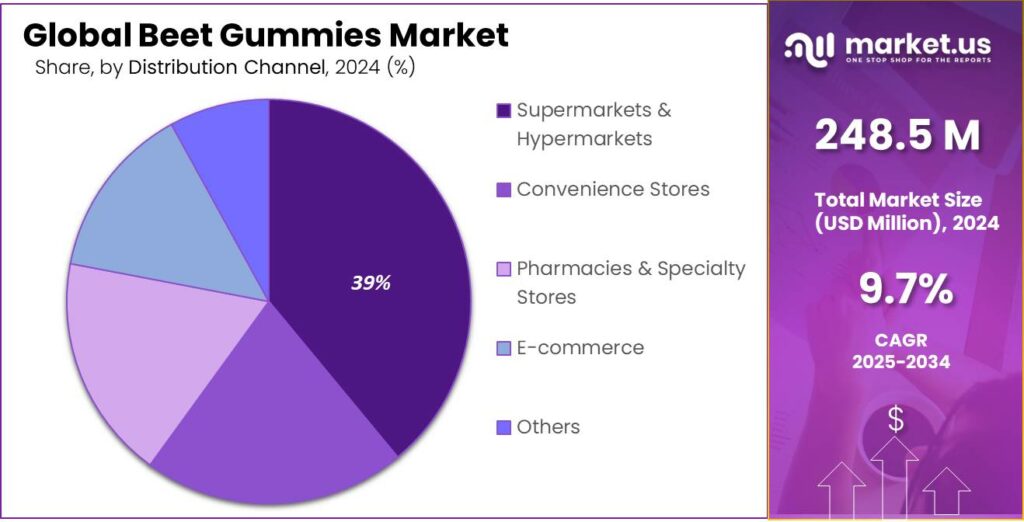

By Distribution Channel Analysis

Supermarkets & Hypermarkets take the lead with a strong 39.8% share

In 2024, Supermarkets & Hypermarkets held a dominant market position, capturing more than a 39.8% share, supported by their wide reach, strong brand visibility, and ability to offer multiple beet gummy options in one place. Consumers prefer these outlets because they can compare products, check quality, and access promotional offers during regular grocery shopping. The organized layout, product sampling in some stores, and trusted retail environment make these channels a natural fit for health-focused items like beet gummies.

Key Market Segments

By Type

- Conventional

- Organic

By Packaging Type

- Bottles/Jars

- Pouches

- Blister Packs

- Others

By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Pharmacies & Specialty Stores

- E-commerce

- Others

Emerging Trends

Low-sugar reformulation is the latest trend reshaping Beet Gummies

One major latest trend in beet gummies during 2024–2025 is a clear shift toward low-sugar or no-added-sugar formats, driven by stronger public health messaging and tighter label scrutiny. Gummies are naturally associated with sweetness, but buyers increasingly expect a “functional” product to fit into healthier daily habits. This trend is less about removing enjoyment and more about balancing taste with modern nutrition expectations, so the product still feels easy and pleasant to use.

Global guidance is a major push factor behind this change. The World Health Organization (WHO) recommends that free sugars should stay below 10% of total energy intake, and notes that reducing further to below 5%—about 25 g per day—brings additional health benefits. These numbers appear frequently in public health conversations, making sugar a quick “yes/no” filter for many shoppers. For beet gummies, this means brands are being nudged to rethink the classic gummy recipe—because consumers may like the format, but they do not want to feel they are taking a sweet treat disguised as wellness.

In 2024 and moving into 2025, label visibility has also become a strong force shaping product decisions. In the U.S., FDA’s Nutrition Facts label changes require “Added sugars” to be listed in grams and as percent Daily Value, and FDA continues to explain how added sugars appear on labels so consumers can compare products more easily.

Government-linked food initiatives are reinforcing the same direction. Under India’s Eat Right platform, FSSAI promotes reduction of fat, sugar and salt, encouraging consumers to gradually reduce intake and encouraging manufacturers to reformulate products. For beet gummies, this kind of messaging supports a market where “reduced sugar” claims and cleaner ingredient lists feel more credible and more aligned with national health priorities. Even when the initiative is broad, it influences what retailers highlight and what shoppers feel proud to buy.

Drivers

Convenience-led supplement buying is a major driver pushing Beet Gummies into the mainstream

One major driving factor for beet gummies is the steady move toward “easy-to-take” wellness products, where consumers want benefits without changing daily routines. Gummies fit naturally into modern shopping habits because they feel closer to food than medicine, and they reduce the friction many people feel with tablets or powders. This matters because supplement use is already common at the population level. In the United States, 57.6% of adults aged 20+ reported using a dietary supplement in the previous 30 days (NHANES 2017–2018), showing how large the base of routine supplement users already is.

In 2024 and 2025, the industrial scenario around beet gummies benefits from two practical realities: familiar retail behavior and scalable compliance systems. Gummies are easy to merchandise near vitamins, functional snacks, and checkout health displays, so they earn visibility without heavy education. At the same time, manufacturers can plug beet gummies into established supplement quality frameworks. In the U.S., dietary supplement makers are subject to FDA’s Current Good Manufacturing Practice rules under 21 CFR Part 111, which covers companies that manufacture, package, label, or hold dietary supplements—this creates a predictable compliance pathway for brands scaling production and distribution.

Another reason convenience is pushing beet gummies forward is that consumers are becoming more label-aware, especially about sugar, and that pressure is reshaping gummy formulation rather than reducing demand. WHO recommends that free sugars should be less than 10% of total energy intake, and notes that going below 5%—about 25 g/day—brings added health benefits. Government-led public health messaging also supports this demand shift by making “better choices” a visible national topic, which indirectly lifts functional, plant-based products.

Restraints

High sugar content concerns act as a key restraint on Beet Gummies adoption

One major restraining factor facing the beet gummies segment is concern about sugar content in gummy supplements, which can make health-conscious consumers hesitate before purchase. Gummies are beloved for their chewiness and sweet taste, but that very sweetness can be a double-edged sword in markets where consumers are increasingly aware of the health risks tied to added sugars. Many traditional gummy formats still rely on sugar or syrup to achieve a pleasant texture and flavor, and this becomes a liability as global nutrition guidelines tighten around sugar intake.

The World Health Organization (WHO) recommends that free sugars make up less than 10% of total energy intake for both adults and children, and suggests that a further reduction to below 5% offers additional health benefits. This guidance has shaped consumer expectations and media conversations around sugar, making “sugar-lite” positioning much more important for any sweet supplement.

In 2024 and into 2025, this concern is particularly relevant because many buyers looking for functional benefits from beet root—such as nitrate-linked blood flow support—also want to avoid products they feel could undermine their general health goals. Even though beet itself is a vegetable, when formulated into gummies it is commonly paired with sweeteners to make it palatable. For customers who are watching their weight, blood sugar, or dental health, any added grams of sugar can reduce the attractiveness of a product.

The WHO’s recommendation for <10% of energy from free sugars has filtered into national dietary guidelines and public health messaging in many countries, including India’s Food Safety and Standards Authority of India (FSSAI), which actively campaigns on reducing sugar consumption under initiatives such as the Eat Right Movement.

Public health data also highlight why sugar concerns are top of mind. The WHO reports that overweight and obesity have nearly tripled since 1975, and high sugar diets are one of the lifestyle factors linked to weight gain and metabolic diseases. These broad trends influence both consumer psychology and retailer assortment strategies, with many stores highlighting low-sugar options more prominently on shelves.

Opportunity

Sports-and-lifestyle wellness positioning is a major growth opportunity for Beet Gummies

A clear growth opportunity for beet gummies is their fit with the expanding “move more, feel better” lifestyle that many governments and health bodies are pushing. In 2024, the World Health Organization (WHO) reported that nearly one third (31%) of adults worldwide—about 1.8 billion people—did not meet recommended physical activity levels in 2022. This matters for the beet gummies category because a large, mainstream audience is trying to add more walking, gym sessions, cycling, or weekend sports into everyday life, and many of them prefer convenient products that feel simple and familiar.

Government-backed initiatives help create the demand environment that makes this positioning easier to sell. In India, FSSAI launched ‘The Eat Right Movement’ on 10 July 2018, bringing together industry and public stakeholders to encourage healthier food choices and responsible practices. While this initiative is not specific to gummies, it supports a wider shift toward health-conscious purchasing and clearer nutrition expectations, which benefits functional products that can explain their role in a straightforward way.

This opportunity also grows alongside broader nutrition guidance that keeps plant foods in focus. WHO advice highlights that eating at least 400 g (five portions) of fruits and vegetables per day supports better health outcomes. Beet gummies can be marketed carefully as a convenient beet-derived product that fits a modern wellness lifestyle—without implying they replace whole vegetables. The winning approach is to position them as a complement for people who want functional ingredients but struggle with consistency due to busy schedules.

From an industry execution point of view, scaling this opportunity is practical because the supplement manufacturing pathway is well-defined. In the U.S., firms that manufacture, package, label, or hold dietary supplements are subject to dietary supplement CGMP requirements under 21 CFR Part 111, which supports quality consistency as brands expand distribution.

Regional Insights

North America dominates Beet Gummies with 38.4% share, valued at 95.4 Mn

North America leads the Beet Gummies market because the region already has a strong, routine supplement-buying culture and the retail systems to scale convenient formats quickly. Dominating Region: North America holds 38.4% share, valued at 95.4 Mn in 2024, supported by wide shelf presence across mass retail, clubs, pharmacies, and fast-growing online channels.

Demand is underpinned by high supplement penetration in the U.S.; CDC/NCHS data show 57.6% of adults aged 20+ used a dietary supplement in the past 30 days, indicating a large base of consumers already comfortable with daily supplementation—an ideal fit for gummy formats. Purchasing power also remains resilient: CRN’s 2024 consumer survey reported a median monthly supplement spend of $50 in 2024, suggesting shoppers continue prioritizing supplements even when budgets are watched closely.

From a channel perspective, North America benefits from strong e-commerce infrastructure that supports repeat purchases and subscription-like behavior for wellness products. The U.S. Census Bureau reported that e-commerce accounted for 15.8% of total retail sales in Q3 2025, and e-commerce sales rose 5.2% versus Q3 2024, helping functional products like beet gummies reach consumers beyond physical store catchments.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Garden of Life maintains strong leadership in the plant-based gummies space, offering USDA Organic and Non-GMO Project Verified items across 50+ product categories. Its distribution spans 40,000+ retail outlets in North America, supported by NSF Certified manufacturing. The company’s beet-infused gummies often feature 100% vegan ingredients and traceable sourcing programs.

Goli Nutrition Inc. accelerated category growth with its signature gummy line, selling products across 70+ countries and reaching more than 200,000 retail points globally. Its beet-root–based innovations align with wellness trends, and the company’s manufacturing follows FDA-registered, cGMP-certified processes. Goli’s digital presence exceeds 5 million followers across platforms, supporting rapid brand scaling.

SmartyPants Vitamins strengthens its beet gummies presence through wide U.S. retail coverage spanning more than 30,000 stores nationwide. The brand offers multi-benefit gummies, often formulated with 10+ essential nutrients per serving. Its parent company was acquired by Unilever in 2020, enabling broader distribution and enhanced product innovation capacity.

Top Key Players Outlook

- SmartyPants Vitamins

- Pharmvista Inc.

- Garden of Life

- Goli Nutrition Inc.

- Zahlers

- Wild & Organic LLC

- Havasu Nutrition

- MRO MaryRuth, LLC

Recent Industry Developments

2024, Goli leveraged social commerce — including campaigns that drove $4.1 M in revenue in 30 days on TikTok Shop — underscoring its ability to connect health trends with engaged audiences.

In 2024–2025, Zahlers has strengthened its presence with its Chapter Six Beet Root Gummies, each delivering 500 mg beet root extract combined with cherry fruit extract to support overall wellness, energy, and heart health in an easy-to-take gummy form.

Report Scope

Report Features Description Market Value (2024) USD 248.5 Mn Forecast Revenue (2034) USD 627.2 Mn CAGR (2025-2034) 9.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Conventional, Organic), By Packaging Type (Bottles/Jars, Pouches, Blister Packs, Others), By Distribution Channel ( Supermarkets And Hypermarkets, Convenience Stores, Pharmacies And Specialty Stores, E-commerce, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape SmartyPants Vitamins, Pharmvista Inc., Garden of Life, Goli Nutrition Inc., Zahlers, Wild & Organic LLC, Havasu Nutrition, MRO MaryRuth, LLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- SmartyPants Vitamins

- Pharmvista Inc.

- Garden of Life

- Goli Nutrition Inc.

- Zahlers

- Wild & Organic LLC

- Havasu Nutrition

- MRO MaryRuth, LLC