Global Automotive Textiles Market By Product Type (Woven, Non-Woven, Composite, Others), By Textile Type (Leather, Polyester, Nylon, Vinyl, PVC, Others), By vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Trucks, Buses & Coaches, Others), By Application (Upholstery, Safety devices, Tires, Engine Components, Others), By Sales Channel (OEM, Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 13987

- Number of Pages: 245

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

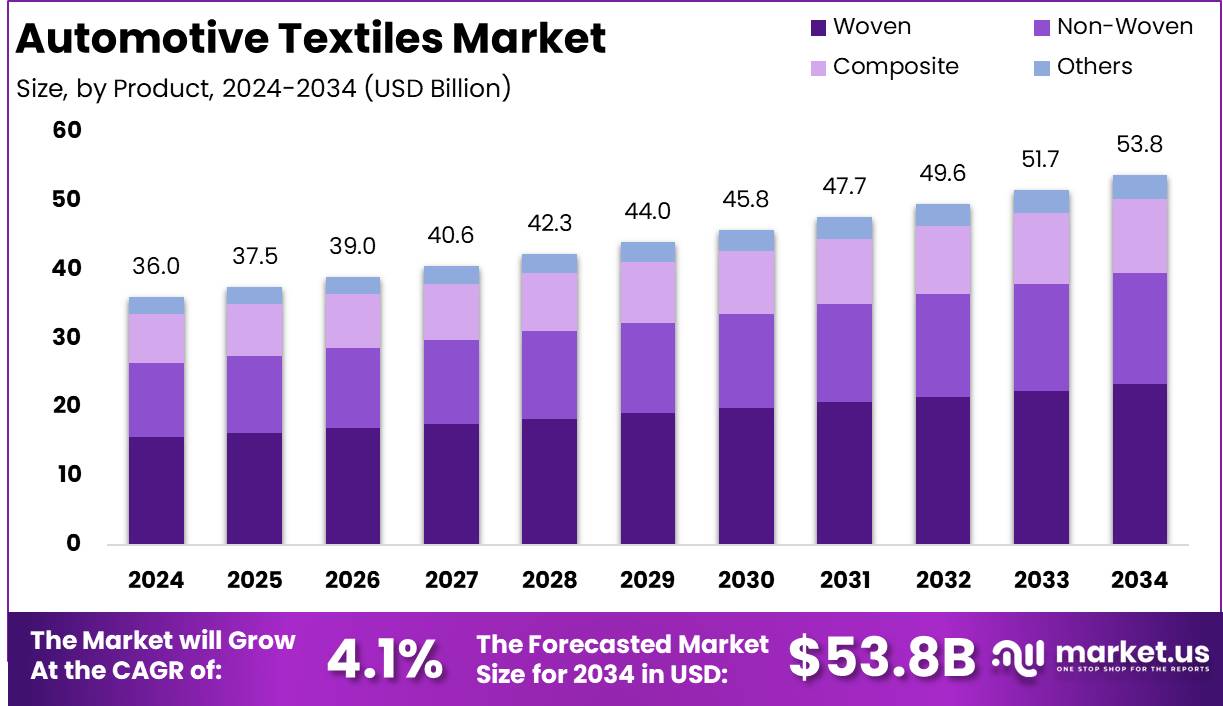

The Global Automotive Textiles Market size is expected to be worth around USD 53.8 Billion by 2034 from USD 36.0 Billion in 2024, growing at a CAGR of 4.1% during the forecast period from 2025 to 2034.

Automotive textiles refer to the specialized fabrics and materials used in the interior and exterior components of vehicles. These textiles include fabrics for seat coverings, upholstery, carpeting, headliners, door panels, and more.

The primary function of automotive textiles is to provide comfort, safety, and aesthetic appeal while ensuring durability, functionality, and compliance with industry regulations. Automotive textiles are typically engineered to withstand the harsh conditions within vehicles, such as temperature fluctuations, wear and tear, and exposure to UV rays and chemicals.

The automotive textiles market encompasses the production, distribution, and application of textiles used in various parts of vehicles. This market is driven by innovations in fabric technologies, material sourcing, and consumer demands for improved vehicle interiors. Market segments include seats, carpets, airbags, door panels, and other safety components.

Automotive textiles are increasingly becoming integral to the overall vehicle design, with a significant emphasis on the use of sustainable and high-performance materials. In recent years, the industry has experienced notable transformations driven by advancements in smart textiles and the growing demand for eco-friendly solutions.

Several factors are driving the growth of the automotive textiles market. First, the increasing focus on passenger comfort and safety has resulted in higher demand for advanced textiles that provide both durability and aesthetic value.

The demand for automotive textiles is closely linked to the rising consumer preference for higher-quality interiors in vehicles. Consumers increasingly seek premium fabrics, including leather alternatives and eco-friendly materials, which has propelled the development of high-performance textiles.

The automotive textiles market presents numerous opportunities, particularly within the sustainability and technological innovation sectors. As global attention shifts toward sustainability, there is a significant opportunity for manufacturers to invest in developing textiles made from renewable resources or recycled materials.

According to Auto123, the global automotive production is projected to reach 90 million vehicles in 2024, marking a steady increase in manufacturing activity. Notably, North America remains a significant contributor, with Canada producing between 1.5 and 2.0 million vehicles annually, while the U.S. maintains production levels around 10 to 11 million units.

Industry analysts estimate a total of 89.6 million vehicles to be built worldwide in 2024, with key markets such as India (6.3%), South Korea (4.5%), Germany (4.4%), and Mexico (4.3%) collectively accounting for 72.7% of global production. This rising vehicle output is expected to drive demand for automotive textiles, particularly as manufacturers seek lightweight, durable materials to enhance vehicle performance and comfort

The automotive textiles market, as reported by Fibre2Fashion, accounts for 20% of global textile production, consuming over 1 million tons annually. Modern vehicles incorporate approximately 11-15 kg of fabric for both interior and exterior purposes, with an average car using around 50 square yards of fabric for components such as seat covers, curtains, and other interior features. This trend reflects the increasing significance of textiles in the automotive sector.

Key Takeaways

- The global automotive textiles market is projected to reach USD 53.8 billion by 2034, growing at a CAGR of 4.1% from USD 36.0 billion in 2024.

- Woven automotive textiles lead the market with a 43.4% share in 2024, driven by their high strength, durability, and cost-effectiveness in automotive applications.

- Polyester automotive textiles hold the largest share at 34.4% in 2024, owing to their durability and resistance to wear.

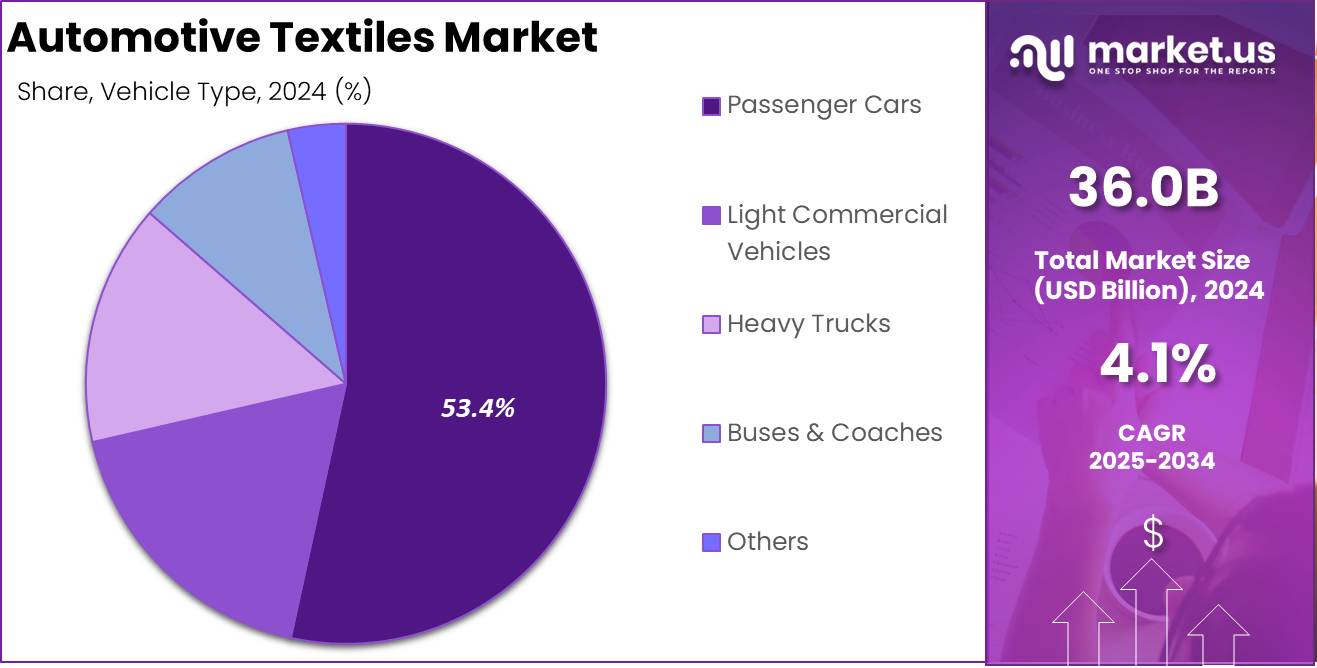

- Passenger cars dominate the market with a 53.4% share in 2024, fueled by rising demand for comfort, aesthetics, and technology in consumer vehicles.

- Upholstery dominates with 44.7% of the market share in 2024, due to extensive use in vehicle interiors such as seating and trim applications.

- The Asia Pacific region holds a commanding 45.9% share of the global automotive textiles market in 2024, supported by strong automotive manufacturing in China, Japan, and India.

By Product Analysis

In 2024, Woven Automotive Textiles Dominate the Market with 43.4% Share

In 2024, woven automotive textiles held a dominant market position in the By Product Type category, capturing more than 43.4% of the total market share. Woven textiles, due to their high strength, durability, and cost-effectiveness, have become a preferred choice in automotive applications, particularly for seat covers, upholstery, and interior trims.

These textiles offer excellent structural integrity and aesthetic appeal, which are critical factors in meeting both functional and consumer demand in the automotive sector.

The non-woven automotive textiles segment has gained significant traction in the market, with increasing utilization in various applications such as soundproofing, insulation, and filtration within vehicles. The simplicity of their manufacturing process, coupled with cost-effectiveness, makes them a preferred choice for mass production.

Furthermore, rising demand for lightweight, eco-friendly alternatives has further accelerated the adoption of non-woven materials in automotive components, driving the growth of this segment.

Composite automotive textiles are experiencing growing demand, particularly due to their superior performance characteristics, including high strength-to-weight ratios, thermal resistance, and fuel efficiency improvements.

These materials are increasingly being used in high-performance vehicle components such as dashboards and flooring systems, where lightweight and durability are paramount. The segment continues to expand as automakers prioritize the development of advanced, high-performance materials to meet evolving market requirements.

The others category, which includes specialized and niche textile products, continues to hold a distinct role within the automotive textiles market. This segment includes materials for advanced airbag systems, flame-retardant fabrics, and decorative trims, among others.

While it represents a smaller portion of the overall market, it is characterized by ongoing innovation, driven by the need for enhanced safety features and the integration of cutting-edge technologies in modern vehicle designs.

By Textile Type Analysis

In 2024, Polyester Automotive Textiles Dominate the Market with 34.4% Share

In 2024, polyester automotive textiles held a dominant position in the By Textile Type category, capturing more than 34.4% of the total market share. Polyester is widely used in automotive applications due to its excellent durability, resistance to wear, and cost-effectiveness.

Its versatility allows for its use in a variety of vehicle components such as seat covers, upholstery, and interior linings. The material’s ability to withstand environmental factors like humidity and UV exposure further drives its strong market presence in the automotive textiles sector.

The leather automotive textiles segment continues to hold a significant market share, driven by consumer demand for premium, aesthetically appealing, and high-quality vehicle interiors. Leather‘s luxurious feel and appearance make it a preferred choice for high-end vehicles, especially for seats, steering wheels, and interior trims. The segment is expected to experience steady demand, particularly in the luxury and premium vehicle segments, where comfort and visual appeal are paramount.

Nylon automotive textiles capture a notable portion of the market, known for their lightweight properties, high strength, and resistance to abrasion. Nylon is commonly used in automotive applications that require durable, high-performance materials, such as airbags, safety belts, and seat fabrics. The continued emphasis on safety and performance in vehicle design supports the growth of this segment within the automotive textiles market.

The vinyl automotive textiles segment accounts for a substantial share of the market, primarily due to its affordability and versatility. Vinyl is frequently used for seat covers, door panels, and dashboards, offering a balance between cost-effectiveness and durability. It is also popular in applications where easy maintenance and cleaning are essential, contributing to the material’s enduring demand in the automotive sector.

PVC automotive textiles represent a significant portion of the market, valued for their water resistance, flexibility, and durability. PVC is commonly found in applications such as vehicle upholstery, flooring mats, and interior panels.

Its relatively low cost and ability to withstand harsh conditions make it a popular choice in both mid-range and budget vehicle segments.

The others category in automotive textiles comprises a range of niche materials used for specific applications, such as specialized insulation fabrics, fire-retardant materials, and custom-designed components.

While this segment represents a smaller share of the market, it is characterized by continuous innovation driven by technological advancements and the increasing integration of safety features in vehicles

By Vehicle Type Analysis

In 2024, Passenger Cars Automotive Textiles Dominate the Market with 53.4% Share

In 2024, passenger cars held a dominant market position in the By Vehicle Type category, capturing more than 53.4% of the total market share. The growing demand for passenger cars, driven by consumer preferences for comfort, aesthetics, and technological advancements, significantly contributes to the increased adoption of automotive textiles in this segment.

Materials such as woven fabrics, polyester, and leather are widely used in the interior components of passenger vehicles, including seats, dashboards, and upholstery, driving the continued growth of this market.

Light commercial vehicles (LCVs), including vans and smaller trucks, represent a key segment in the automotive textiles market. These vehicles demand durable and cost-effective textile materials for both functional and aesthetic purposes, including seating, floor mats, and interiors.

The increasing use of LCVs in urban logistics, along with the rise of e-commerce, is driving a steady demand for automotive textiles, particularly those that offer durability and ease of maintenance.

The heavy trucks segment accounts for a significant portion of the market, where textiles are primarily used for seating, flooring, and interior trims. Materials like high-performance fabrics and vinyl are preferred due to their ability to withstand harsh conditions and heavy wear.

As the logistics and transportation industries continue to expand globally, the demand for automotive textiles in heavy trucks is expected to grow, driven by the need for enhanced comfort, durability, and low maintenance.

Buses and coaches represent a smaller but important segment in the automotive textiles market. Textiles in this category are mainly used for seating and upholstery, focusing on both durability and passenger comfort. With increasing urbanization and demand for public transportation solutions, this segment is likely to witness a steady demand for automotive textiles that balance cost-effectiveness with quality and comfort for large passenger volumes.

The others category encompasses a range of specialized vehicles, including recreational vehicles (RVs), electric vehicles (EVs), and specialized fleet vehicles. While this segment holds a smaller share of the market, it is characterized by increasing innovation and the incorporation of advanced materials tailored to specific vehicle needs. The rise of electric and autonomous vehicles, along with customized applications, is likely to drive future growth in this niche segment.

By Application Analysis

In 2024, upholstery Automotive Textiles Dominate the Market with 44.7% Share

In 2024, upholstery held a dominant market position in the By Application category of automotive textiles, capturing more than 44.7% of the total market share. Upholstery materials, including woven fabrics, leather, and synthetic textiles, are extensively used in vehicle interiors for seating, door panels, and trim applications.

The growth of this segment is driven by consumer demand for comfort, design aesthetics, and durability, with automakers increasingly focusing on premium and customizable options for interior finishes in passenger cars and luxury vehicles.

Safety devices such as airbags, seat belts, and protective coverings are essential applications of automotive textiles. The safety segment continues to hold a significant share of the market, driven by stringent safety regulations and advancements in vehicle safety features.

High-performance textiles, including non-woven and composite materials, are commonly used in the production of airbags and seat belt webbing due to their strength, reliability, and ability to meet safety standards.

The tires segment in automotive textiles is primarily focused on the use of reinforcing fabrics such as nylon and polyester. These materials are integral in tire construction, providing the necessary strength, flexibility, and durability for tire performance. With the continuous development of fuel-efficient and high-performance tires, the demand for specialized textiles that enhance tire longevity and safety is on the rise, contributing to the growth of this segment.

Engine components also utilize automotive textiles, particularly in the form of thermal-resistant materials, insulation fabrics, and seals. These textiles play a critical role in protecting engine parts from high temperatures and chemical exposure.

As the automotive industry increasingly prioritizes fuel efficiency and emission reductions, the demand for textiles that can withstand extreme conditions and offer durability in engine compartments continues to grow.

The others category encompasses a range of niche applications such as automotive carpets, soundproofing materials, and custom fabrics used for specialized vehicle parts.

Although this segment represents a smaller share of the market, it is characterized by innovation in the development of specialized textiles for specific automotive needs, including sustainability and advanced technologies in electric vehicles (EVs) and autonomous vehicles.

By Sales Channel Analysis

In 2024, OEM Automotive Textiles Dominate the Market with 74.4% Share

In 2024, Original Equipment Manufacturers (OEM) held a dominant position in the sales channel segment of the automotive textiles market, capturing more than 74.4% of the market share. This market leadership can be attributed to the consistent demand from automobile manufacturers for high-quality textiles that meet stringent safety, durability, and aesthetic standards.

The OEM segment remains a significant driver of the automotive textiles market, owing to the growing adoption of innovative fabric technologies, such as smart textiles and eco-friendly materials, within the automotive production process.

As automotive manufacturers focus on enhancing vehicle performance, comfort, and sustainability, OEMs are increasingly incorporating advanced textiles in various vehicle components, including seating, interior panels, and headliners. These factors, combined with the rising production rates of vehicles globally, contribute to the continued growth of the OEM segment within the automotive textiles market.

The aftermarket segment in the automotive textiles market, while smaller in comparison to OEM, continues to demonstrate steady growth. The demand for aftermarket automotive textiles is driven by the increasing consumer inclination towards vehicle customization, along with the rising trend of vehicle maintenance and repairs.

This segment encompasses textiles used for upgrading or replacing existing materials, such as seat covers, floor mats, and interior upholstery.

The aftermarket segment benefits from growing awareness of textile-based solutions that enhance vehicle comfort and aesthetics, as well as increasing disposable incomes that enable consumers to invest in premium automotive interior products.

As the global automotive market becomes more diversified with aftermarket offerings, this segment is expected to expand further, driven by consumer preferences for personalization and product longevity.

Key Market Segments

By Product Type

- Woven

- Non-Woven

- Composite

- Others

By Textile Type

- Leather

- Polyester

- Nylon

- Vinyl

- PVC

- Others

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Trucks

- Buses & Coaches

- Others

By Application

- Upholstery

- Safety devices

- Tires

- Engine Components

- Others

By Sales Channel

- OEM

- Aftermarket

Driver

Increasing Demand for Lightweight and Fuel-Efficient Vehicles

The global automotive textiles market is witnessing significant growth due to the increasing demand for lightweight and fuel-efficient vehicles. As manufacturers focus on reducing vehicle weight to enhance fuel efficiency and reduce carbon emissions, automotive textiles have become essential in the development of lighter vehicles.

Textiles used in components such as seat covers, airbags, and interior linings contribute significantly to weight reduction without compromising safety or comfort. These materials are engineered to deliver high performance while maintaining low weight, which helps automakers meet regulatory standards for fuel economy and environmental sustainability.

The growing adoption of electric vehicles (EVs) further accelerates this trend, as these vehicles require more efficient energy use and lightweight construction to improve range and battery performance. The integration of advanced textile materials, such as carbon fibers and composite fabrics, allows for both the structural integrity of various vehicle components and the achievement of a lighter overall vehicle mass.

As demand for electric and hybrid vehicles rises, so does the need for high-performance automotive textiles that contribute to achieving these vehicles’ sustainability and performance goals. This trend is expected to continue throughout 2024, driving growth in the automotive textiles market and contributing to technological innovations in lightweight materials.

Restraint

High Cost of Advanced Automotive Textiles

One of the primary restraints hindering the growth of the automotive textiles market is the high cost of advanced textile materials. High-performance textiles, such as carbon fiber composites and specialty fabrics, come with a significant price premium. While these materials offer enhanced properties such as greater durability, lighter weight, and higher resistance to wear and tear, their production costs can be prohibitive for automakers, particularly in lower-cost segments of the market. The adoption of such high-end materials remains limited to premium vehicle models or specific components, restricting their widespread use in mass-market vehicles.

This price sensitivity is particularly acute in regions where price competitiveness is a key factor in automotive sales, such as in developing markets. Despite the growing trend toward sustainable and high-tech materials, the initial investment required for advanced textiles can act as a deterrent.

Additionally, the integration of these materials into manufacturing processes may require new technologies and production methods, further increasing costs. As a result, automotive manufacturers may face challenges in balancing the benefits of advanced textile technologies with their cost-effectiveness, potentially slowing the pace of adoption and affecting overall market growth. However, as manufacturing technologies evolve and economies of scale are realized, this restraint may gradually diminish.

Opportunity

Growth in Demand for Sustainable Materials

A significant opportunity for the automotive textiles market lies in the growing demand for sustainable materials. As consumers and regulators increasingly prioritize environmental responsibility, there is a shift toward the adoption of eco-friendly textiles in the automotive industry.

These sustainable materials are derived from renewable resources, such as bio-based polymers and natural fibers, which offer significant environmental advantages over traditional petroleum-based fabrics. As governments worldwide impose stricter emissions regulations and consumers become more eco-conscious, the automotive industry is responding by seeking materials that reduce environmental impact throughout their lifecycle.

This shift towards sustainable automotive textiles is further fueled by the increasing popularity of electric and hybrid vehicles, which are often marketed as environmentally friendly alternatives to traditional combustion engine vehicles. Automotive manufacturers are keen to position themselves as leaders in sustainability, and incorporating sustainable textiles into their vehicle designs is one effective way to achieve this. From interior fabrics to insulation materials, the use of eco-friendly textiles can significantly lower a vehicle’s overall carbon footprint.

The growing availability of sustainable textile alternatives, combined with consumer demand for greener vehicles, represents a significant growth opportunity for the automotive textiles market. By investing in innovative materials and production techniques, manufacturers can capture this expanding market and meet the evolving demands of environmentally conscious consumers.

Trends

Technological Advancements in Smart Textiles

A notable trend shaping the automotive textiles market is the integration of smart textile technologies. Smart textiles, also known as e-textiles, are fabrics embedded with sensors and conductive fibers that can interact with external stimuli, such as heat, pressure, or motion. These advanced textiles have the potential to revolutionize vehicle interiors by offering enhanced functionality.

For instance, they can enable seat coverings to adjust their temperature based on the passenger’s preference, or incorporate touch-sensitive controls into seat upholstery, allowing for more intuitive user interfaces. Additionally, smart textiles can be used for health monitoring, providing real-time data on driver or passenger well-being, such as detecting changes in body temperature or heart rate.

The application of smart textiles also extends to safety features, such as airbags or seat belts, which can be made more responsive and adaptive by incorporating sensors that detect the intensity of a collision and adjust accordingly. This technology can contribute to improved vehicle safety and offer consumers a higher level of comfort and convenience.

As automakers invest more heavily in in-car technology and the Internet of Things (IoT), smart textiles are poised to become an integral part of future vehicle designs. The ongoing innovation in this field promises to increase the functionality and appeal of automotive textiles, driving demand for these advanced materials in 2024 and beyond.

Regional Analysis

Asia Pacific Automotive Textiles Market with Largest Market Share 45.9% in 2024

The Asia Pacific region is poised to dominate the global automotive textiles market, accounting for 45.9% of the market share in 2024, valued at approximately USD 17.9 billion. This substantial market share can be attributed to the region’s robust automotive manufacturing sector, particularly in countries such as China, Japan, and India.

The growing demand for lightweight, durable, and sustainable automotive materials, along with the expanding middle-class population and increased car production, is further driving the region’s market growth. Additionally, the rise in electric vehicle production in Asia Pacific, coupled with innovations in textile technologies, is expected to sustain the region’s dominance in the coming years.

North America is a key player in the automotive textiles market, driven primarily by technological advancements and the demand for high-performance textiles in vehicles. The region’s automotive sector continues to innovate with smart textiles and eco-friendly materials, aligning with consumer preferences for sustainability.

As of 2024, the market is expected to grow steadily, supported by rising automotive production in the United States and Canada. However, North America is expected to capture a smaller share compared to Asia Pacific.

Europe holds a significant share of the automotive textiles market, driven by the increasing adoption of sustainable and eco-friendly materials in the automotive sector. Countries such as Germany, France, and Italy are leading the shift toward the use of recycled fabrics, natural fibers, and low-impact production processes.

The region is expected to continue to witness steady growth, particularly in electric vehicles and premium automotive segments, where high-quality and environmentally conscious textiles are in demand.

The Latin American automotive textiles market is witnessing gradual growth, supported by an expanding automotive industry in countries like Brazil and Mexico. While the market share remains relatively smaller compared to other regions, the rising demand for both commercial and passenger vehicles is expected to fuel future growth.

In particular, the region’s low-cost labor and growing manufacturing capabilities provide opportunities for cost-effective production of automotive textiles, presenting a positive outlook for the market.

The Middle East & Africa region represents a smaller segment of the global automotive textiles market, with market growth driven by increasing automotive production and sales in the Middle Eastern countries, particularly the UAE and Saudi Arabia.

While the market remains limited in size, the demand for luxury vehicles, along with the region’s expanding infrastructure and automotive sector, provides a foundation for gradual growth. Increased investments in the automotive industry and a growing preference for premium vehicle interiors are expected to support market development in the region.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The global automotive textiles market in 2024 is marked by an evolving competitive landscape, with key players demonstrating significant innovations and strategic moves to maintain or enhance market positioning. Among these, Disco Corporation continues to lead in precision cutting technologies, which are integral to the production of automotive fabrics, especially in the area of electronic textiles.

Advanced Dicing Technologies is another prominent player, known for its advanced dicing technologies that support high-precision applications in automotive components, including textiles used for electronic interfaces. Kulicke & Soffa Industries, Inc. plays a crucial role in semiconductor packaging and assembly, facilitating the integration of smart textiles into vehicles.

Companies like Load point Bearings and Engis Corporation have strengthened their presence by delivering high-quality bearing and abrasive solutions, respectively, critical for the production of durable automotive fabrics. Meyer Burger Technology AG has capitalized on the increasing demand for sustainable textile manufacturing technologies, with a strong emphasis on energy-efficient production processes.

The Chinese players, such as Beijing Technol Science and Shanghai Sinyang Semiconductor Materials Co., Ltd., have emerged as strong contenders, providing high-performance materials at competitive prices. Additionally, companies like Kasco Abrasives, South Bay Technology, Inc., and Kinik Company continue to lead in offering specialized abrasives for textile processing.

Meanwhile, Asahi Diamond Industrial Co., Ltd. maintains a strong market presence through its innovative diamond-coated tools, which improve the efficiency and quality of automotive textile production. These players collectively highlight the diverse technological advancements driving the market forward, catering to the evolving needs of the global automotive industry.

Top Key Players in the Market

- Acme Mills

- ASGLAWO Technofibre GmbH

- Aunde SA

- Auto Textiles S.A.

- Autoliv Inc.

- Autotech Nonwovens

- Baltex Inc.

- Borgers AG

- CMI Enterprises Inc.

- Dupont

- Global Safety Textile GmbH

- International Textile Group

- Johnson Controls

- Lear Corporation

- Reliance Industries Limited

- Sage Automotive Interiors Inc.

- SMS Auto Fabrics

- Suminoe Textile Co. Ltd.

- Toyota Boshoku Corporation

Recent Developments

- In January 3, 2023, Stein Fibers LLC, a distributor of textile solutions, revealed its acquisition of Fibertex Corp.’s North American fiber operations. This strategic move enhances Stein Fibers’ product offerings in the region and strengthens its ability to meet growing customer demand.

- On January 15, 2023, Governor Glenn Youngkin of Virginia disclosed that Apex Mills, a producer of specialty warp knit fabrics for industrial and technical uses, would invest $3.1 million to expand its operations. The company will acquire a former HanesBrands facility in Patrick County, fulfilling contracts for Hanes and creating 44 new jobs while preserving 96 existing positions.

- In January 18, 2024, RefrigiWear, the leading provider of insulated work apparel, announced its acquisition of Avaska, a well-established brand known for its premium quality, modern European-style insulated workwear. This acquisition helps expand RefrigiWear’s portfolio and better addresses the needs of customers in cold environments.

- In 2023, Intradeco Holdings, a global manufacturer of casual and thermal apparel, acquired Indera Mills, a major supplier of thermal underwear. The acquisition positions Intradeco as a key player in the thermal garment sector across North America, Mexico, and Canada.

- In 2024, Leigh Fibres acquired Martex Fibre, rebranding it as Revive Fibre. The transaction strengthens Leigh Fibres’ position as the leading textile recycler in North America while allowing Revive Fibre to operate as a sister company under shared management.

- On February 5, 2025, Lear Corporation announced a collaboration with General Motors to integrate its ComfortMax Seat technology into GM’s vehicle offerings. This first-of-its-kind seat will combine thermal comfort features with superior manufacturing efficiency, setting a new standard in automotive seating.

Report Scope

Report Features Description Market Value (2024) USD 36.0 Billion Forecast Revenue (2034) USD 53.8 Billion CAGR (2025-2034) 4.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Woven, Non-Woven, Composite, Others), By Textile Type (Leather, Polyester, Nylon, Vinyl, PVC, Others), By vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Trucks, Buses & Coaches, Others), By Application (Upholstery, Safety devices, Tires, Engine Components, Others), By Sales Channel (OEM, Aftermarket) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Acme Mills, ASGLAWO Technofibre GmbH, Aunde SA, Auto Textiles S.A., Autoliv Inc., Autotech Nonwovens, Baltex Inc., Borgers AG, CMI Enterprises Inc., Dupont, Global Safety Textile GmbH, International Textile Group, Johnson Controls, Lear Corporation, Reliance Industries Limited, Sage Automotive Interiors Inc., SMS Auto Fabrics, Suminoe Textile Co. Ltd., Toyota Boshoku Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Textiles MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Automotive Textiles MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Acme Mills

- ASGLAWO Technofibre GmbH

- Aunde SA

- Auto Textiles S.A.

- Autoliv Inc.

- Autotech Nonwovens

- Baltex Inc.

- Borgers AG

- CMI Enterprises Inc.

- Dupont

- Global Safety Textile GmbH

- International Textile Group

- Johnson Controls

- Lear Corporation

- Reliance Industries Limited

- Sage Automotive Interiors Inc.

- SMS Auto Fabrics

- Suminoe Textile Co. Ltd.

- Toyota Boshoku Corporation