Automotive Hydraulics System Market Size, Share, Growth Analysis By Sales Channel (OEM, Aftermarket), By Component (Master Cylinder, Reservoir, Slave Cylinder, Hose), By On-Highway Vehicles (Passenger Cars, Heavy Commercial Vehicles, Light Commercial Vehicles), By Off-Highway Vehicles (Agriculture Equipment, Construction Equipment), By Application (Brakes, Tappets, Clutch, Suspension), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 141461

- Number of Pages: 228

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

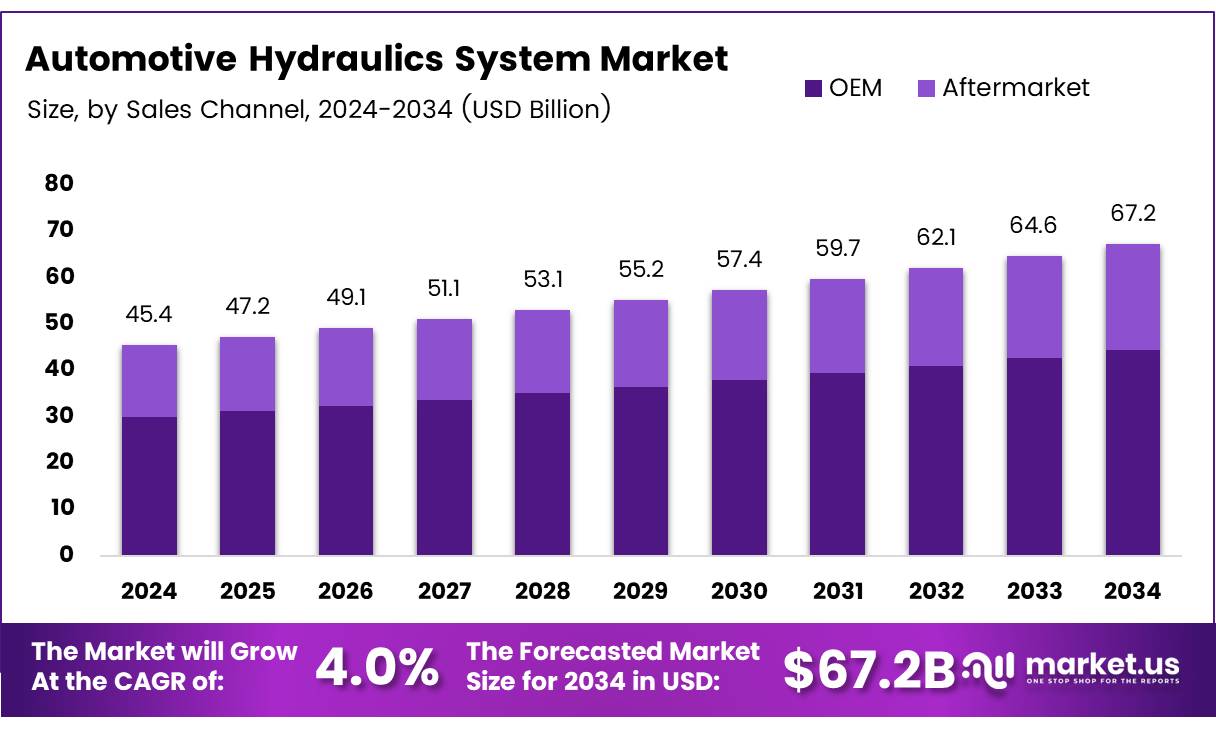

The Global Automotive Hydraulics System Market size is expected to be worth around USD 67.2 Billion by 2034, from USD 45.4 Billion in 2024, growing at a CAGR of 4.0% during the forecast period from 2025 to 2034.

The automotive hydraulics system is a critical component used in various automotive applications, ranging from braking and steering to power transmission and suspension systems. It operates on the principle of using fluid under pressure to create mechanical motion, offering enhanced control, safety, and efficiency. A growing trend in the automotive hydraulics system market is the adoption of hydraulic hybrid systems. These systems utilize hydraulic accumulators to capture and store energy that would otherwise be wasted during braking.

According to the National Renewable Energy Laboratory (NREL), hydraulic hybrid systems can capture up to 70% of kinetic energy lost during braking, storing it for reuse during acceleration. This energy recovery process plays a key role in improving overall vehicle efficiency and reducing fuel consumption, particularly in urban environments with frequent stop-and-go traffic.

The automotive hydraulics system market has been experiencing significant growth, driven by rising demand for more energy-efficient and eco-friendly solutions in the automotive sector. With increasing consumer preference for hybrid and electric vehicles, hydraulic systems have gained popularity for their role in improving fuel efficiency and reducing carbon emissions. The market is further supported by ongoing advancements in hydraulic technology, such as the development of more efficient hydraulic fluid and better accumulator designs.

Government investments and regulations are also contributing to the expansion of the automotive hydraulics system market. Regulatory bodies worldwide are pushing for stricter fuel efficiency standards and promoting the adoption of hybrid and electric vehicles.

As a result, hydraulic systems are being seen as an essential technology in meeting these new standards. Additionally, policies aimed at reducing automotive carbon footprints are creating opportunities for hydraulic hybrid systems to emerge as a mainstream solution.

Furthermore, according to NREL, hydraulic hybrid vehicles can potentially improve fuel economy by 25% to 30% compared to non-hybrid vehicles, primarily due to their efficient regenerative braking systems. This makes them particularly beneficial in urban settings, where frequent braking results in higher fuel consumption for traditional vehicles. As government initiatives continue to encourage the use of more energy-efficient technologies, the demand for automotive hydraulic systems is expected to accelerate.

The market for automotive hydraulic systems presents substantial growth opportunities, particularly with the increasing adoption of hybrid vehicles and the push for greater environmental sustainability in the automotive sector. As governments invest in clean energy technologies, hydraulic systems, particularly in hybrid vehicles, will likely see widespread implementation in the coming years.

Key Takeaways

- The global automotive hydraulics system market is projected to reach USD 67.2 billion by 2034, up from USD 45.4 billion in 2024, growing at a 4.0% CAGR from 2025 to 2034.

- In 2024, the OEM segment dominates the market, holding 65.5% of the total market share.

- The Master Cylinder leads the By Component Analysis segment due to its vital role in braking and clutch systems.

- The Passenger Cars segment holds the largest share in the By On-Highway Vehicles Analysis.

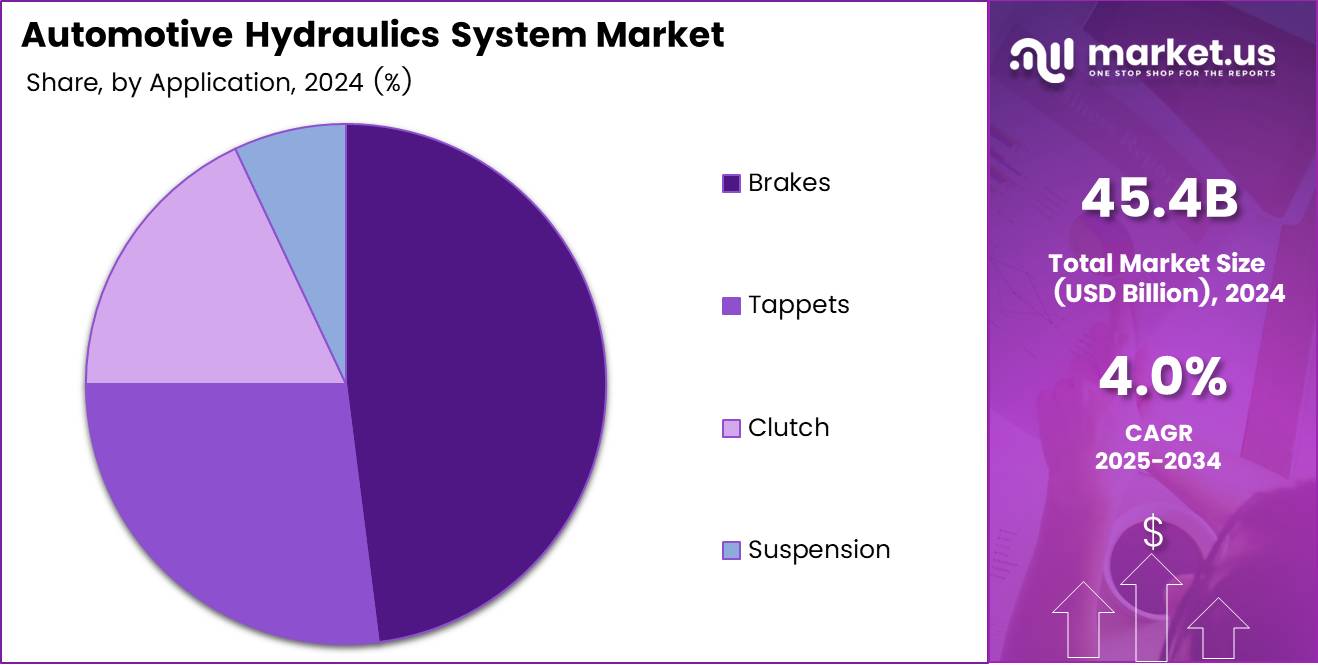

- The Brakes application segment dominates the market, driven by vehicle safety and regulatory standards.

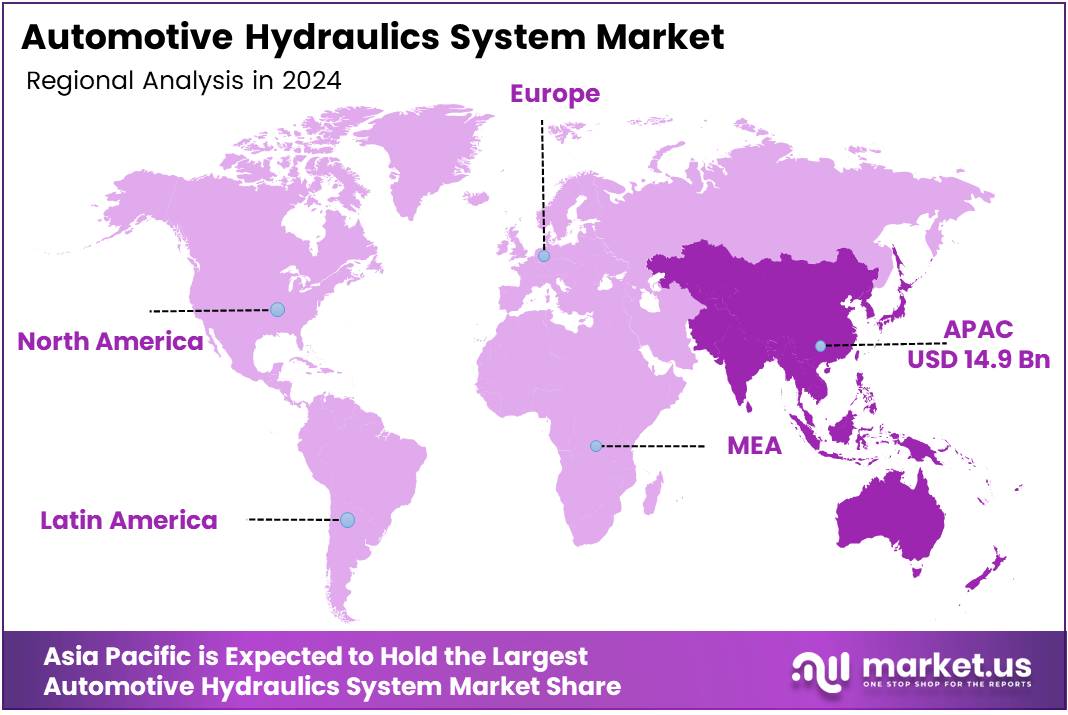

- Asia Pacific leads the global market, holding 33.4% of the market share, valued at approximately USD 14.9 billion.

Sales Channel Analysis

OEM Dominates Automotive Hydraulics System Market with 65.5% Share in 2024, Driven by Increased Vehicle Production

In 2024, the Original Equipment Manufacturer (OEM) segment held a dominant market position in the Automotive Hydraulics System market, capturing 65.5% of the total market share.

This strong performance can be attributed to the continuous growth in vehicle production and the increasing integration of advanced hydraulic systems by automakers for enhanced vehicle performance and efficiency. OEMs benefit from long-term contracts with automobile manufacturers, ensuring a steady demand for hydraulic systems in the production of new vehicles.

OEM hydraulic systems are often preferred for their high quality, reliability, and compatibility with the latest vehicle designs. These systems are typically installed during the manufacturing process, meeting stringent standards for safety and performance. As the global automotive industry moves towards more technologically advanced vehicles, the demand for OEM hydraulic systems is expected to remain robust.

In contrast, the Aftermarket segment, while holding a smaller share, continues to experience growth, fueled by the increasing number of vehicles on the road and the demand for replacement parts. Aftermarket hydraulic systems offer cost-effective alternatives for vehicle maintenance and repair, but they face challenges in terms of brand loyalty and product standardization when compared to OEM options.

Component Analysis

Master Cylinder Dominates Automotive Hydraulics System Market in 2024

In 2024, the Master Cylinder held a dominant position in the By Component Analysis segment of the Automotive Hydraulics System Market. This component plays a crucial role in converting mechanical force into hydraulic pressure, making it integral to systems like braking and clutch operations. Its efficiency and reliability in ensuring vehicle safety have propelled its widespread adoption, resulting in its leading market share.

In comparison, the Reservoir, Slave Cylinder, and Hose components also contribute significantly to the overall hydraulic system, though to a lesser extent. The Reservoir is responsible for storing hydraulic fluid, while the Slave Cylinder transfers hydraulic pressure to other parts of the system.

The Hose ensures the safe and efficient transportation of fluid between components. Despite their importance, these components collectively hold a smaller share compared to the Master Cylinder, which continues to drive the market’s overall growth in the automotive hydraulic system sector.

On-Highway Vehicles Analysis

Passenger Cars Lead the Automotive Hydraulics System Market in 2024 Due to Rising Consumer Demand and Technological Advancements

In 2024, the Passenger Cars segment holds the dominant position in the By On-Highway Vehicles Analysis of the Automotive Hydraulics System Market. This strong performance can be attributed to the growing demand for advanced, fuel-efficient, and safer vehicles, where hydraulic systems play a critical role in enhancing driving experience and vehicle performance.

The integration of hydraulic technologies in steering, braking, suspension, and clutch systems has significantly contributed to the growth in this segment. The shift towards electric and hybrid vehicles also further boosts the adoption of hydraulic systems due to their role in energy efficiency and performance optimization.

In contrast, the Heavy Commercial Vehicles segment is expected to experience steady growth, driven by the increasing demand for logistics and transportation services. Hydraulic systems in these vehicles are essential for lifting, loading, and enhancing vehicle stability.

The Light Commercial Vehicles segment holds a smaller share, but its growth prospects remain strong, supported by urbanization trends and increasing adoption of small commercial vehicles for last-mile delivery services.

Application Analysis

Brakes Dominate the Automotive Hydraulics System Market, Leading the Way in 2024

In 2024, the Brakes application segment held a dominant market position in the Automotive Hydraulics System Market. This leadership is largely driven by the increasing emphasis on vehicle safety, performance, and stringent regulatory standards globally.

Hydraulic braking systems, known for their high reliability, precision, and superior stopping power, continue to be a critical component in automotive design, especially with the rise of electric and autonomous vehicles that demand advanced braking technologies.

The Tappets segment plays a crucial role in engine efficiency, regulating valve timing to optimize engine performance, though it represents a smaller share compared to braking systems. The Clutch segment, essential in manual transmission vehicles, and the Suspension segment, which enhances comfort and vehicle stability, both contribute to the overall hydraulic system but follow braking in market significance.

The demand for these components grows alongside automotive innovation, but the Brakes segment maintains its commanding share due to its direct impact on safety and driving performance.

Key Market Segments

By Sales Channel

- OEM

- Aftermarket

By Component

- Master Cylinder

- Reservoir

- Slave Cylinder

- Hose

By On-Highway Vehicles

- Passenger Cars

- Heavy Commercial Vehicles

- Light Commercial Vehicles

By Off-Highway Vehicles

- Agriculture Equipment

- Construction Equipment

By Application

- Brakes

- Tappets

- Clutch

- Suspension

Drivers

Rising Demand for Electric Vehicles (EVs) Boosts Hydraulic System Adoption

The growing demand for electric vehicles (EVs) is significantly driving the automotive hydraulics system market. EVs require hydraulic systems for essential functions such as power steering and braking. As electric vehicle adoption increases globally, the need for efficient hydraulic solutions is becoming more prominent. In addition, advancements in hydraulic technology, such as improved performance, greater reliability, and enhanced durability, are further propelling market growth.

As manufacturers work to make hydraulic systems more efficient and cost-effective, these innovations ensure that the systems meet the needs of the modern automotive industry.

Another major driver is the increasing focus on vehicle safety, where hydraulic systems are crucial in modern braking, suspension, and steering systems. These systems enhance overall vehicle safety by ensuring smoother handling and quicker response times, which are critical to driver and passenger protection.

Lastly, the rising demand for heavy-duty vehicles like commercial trucks, construction equipment, and agricultural machinery is adding momentum to the market. These vehicles rely on hydraulic systems for various functions such as lifting, digging, and steering, thus amplifying the need for advanced and durable hydraulic solutions. Together, these factors are expected to continue fueling the automotive hydraulics system market’s expansion in the coming years.

Restraints

High Cost of Hydraulic Systems Affects Market Growth

The high cost associated with automotive hydraulic systems is a significant restraint in the market. Developing and installing hydraulic systems involves advanced technology, which drives up both production and initial purchase costs for manufacturers and consumers alike.

Additionally, the complexity of these systems means that maintenance and repair can be expensive and time-consuming, further adding to the overall vehicle cost. This often results in a higher price tag for vehicles equipped with hydraulic systems, which can deter potential buyers who are looking for more affordable options.

Furthermore, the need for specialized expertise and tools to maintain and repair hydraulic systems can also be a barrier for many service providers, as it requires specific training and investment in equipment. This creates a challenge for vehicle owners who might face difficulty finding cost-effective or convenient service options.

As a result, the high cost and the specialized nature of automotive hydraulic systems can limit their widespread adoption and market growth, especially in regions where cost sensitivity is a key concern for consumers.

Growth Factors

Integration of Hydraulics in Hybrid and Electric Vehicles Presents New Market Growth

The automotive hydraulics systems market is poised for significant growth, driven by several emerging trends. One of the biggest opportunities is the integration of hydraulic systems in hybrid and electric vehicles.

These vehicles, with their increased reliance on electric components, offer a perfect platform to replace older mechanical and manual systems with more efficient hydraulic solutions. This transition can enhance vehicle performance by improving control, reducing weight, and offering smoother operation.

Another promising development is the advancement of hydraulic fluids, which are becoming more efficient and long-lasting, enabling systems to operate at higher standards and extend vehicle lifespan. Additionally, the automotive industry’s growth in emerging markets, especially in countries like India, Brazil, and Southeast Asia, presents a substantial opportunity for hydraulic systems, as demand for automobiles continues to rise.

Finally, with vehicles moving towards higher levels of automation, hydraulic systems will be vital for ensuring vehicle safety, control, and reliability, especially in areas like braking, suspension, and steering.

The increased focus on autonomous driving and safety features is likely to drive demand for sophisticated hydraulic solutions, creating a solid growth trajectory for the market. These trends combined make the automotive hydraulics market an exciting space for innovation and investment in the coming years.

Emerging Trends

Shift Toward Electrification of Hydraulic Systems Boosts Market Potential

The automotive hydraulics system market is seeing a significant shift with the increasing electrification of hydraulic systems. This trend is largely driven by the need to enhance fuel efficiency and reduce carbon emissions, aligning with global sustainability goals. Hybrid and fully electric hydraulic systems are being integrated into vehicles, allowing for smoother energy transfer and more precise control.

Alongside this, innovative hydraulic pump designs are emerging, which prioritize space optimization, reduced weight, and improved performance. These advanced pumps support both traditional and electric vehicles by ensuring better energy use and reduced vehicle strain.

In line with this, miniaturization is gaining traction, with manufacturers developing smaller, more compact hydraulic components that can fit seamlessly into modern vehicle designs without compromising on performance. This is crucial as vehicle designs become more space-conscious, and hydraulic systems need to adapt accordingly.

Additionally, vehicle lightweighting trends are impacting hydraulic system design. The use of lighter materials in hydraulic components, such as aluminum and composites, is helping reduce overall vehicle weight. This, in turn, enhances fuel efficiency and supports the broader trend of vehicle electrification, which relies heavily on weight reduction for optimal performance.

As these trends converge, the automotive hydraulics market is poised for substantial growth, as manufacturers and suppliers develop more efficient and sustainable solutions.

Regional Analysis

Asia Pacific leads the Automotive Hydraulics System Market with 33.4% share and USD 14.9 billion

The automotive hydraulics system market is experiencing diverse growth across various regions, driven by evolving technological advancements and increasing vehicle production. Asia Pacific holds the dominant position in the market, accounting for 33.4% of the global market share, valued at approximately USD 14.9 billion.

The region’s dominance can be attributed to the high demand for automotive systems in countries such as China, Japan, and India, which are major manufacturing hubs for both passenger and commercial vehicles. Furthermore, the region benefits from a robust automotive industry, technological innovations in hydraulic systems, and a growing preference for fuel-efficient and environmentally friendly vehicles.

Regional Mentions:

North America follows as a significant market, contributing a substantial share of the global automotive hydraulics system market. The United States, as the key player, drives the demand for hydraulic systems in both light and heavy commercial vehicles. The market in this region is bolstered by technological developments in the automotive sector, as well as rising investments in autonomous vehicle technologies and electric vehicles (EVs), which further incorporate hydraulic systems for enhanced performance.

Europe also holds a considerable market share, supported by the presence of established automotive manufacturers such as Volkswagen, BMW, and Mercedes-Benz. The demand for advanced hydraulic systems in this region is particularly strong due to stringent government regulations promoting safety and fuel efficiency. Additionally, the growing trend towards luxury and electric vehicles is expected to propel market growth in the coming years.

In Latin America, the market is primarily driven by the automotive sector in Brazil and Mexico, where the production of commercial vehicles and heavy-duty trucks is a significant contributor to market demand. However, economic factors and political uncertainties may influence the region’s growth prospects.

Middle East & Africa holds a smaller market share compared to other regions but continues to see a gradual increase in demand, primarily driven by the expansion of automotive manufacturing facilities in the region and rising disposable income in countries like the UAE and Saudi Arabia.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2024, the global automotive hydraulics system market remains highly competitive, with several key players positioning themselves to capitalize on the growing demand for advanced, high-performance components. Among these, JTEKT Corporation stands out due to its diversified product offerings and strong focus on technological innovation, particularly in electric and hybrid vehicle applications. The company’s integration of hydraulic components with electric power steering and other vehicle systems underpins its leadership in the market.

Robert Bosch GmbH and ZF Friedrichshafen AG are also major contributors, leveraging their extensive automotive expertise and global presence to maintain a dominant position. Bosch’s integration of digital solutions in hydraulic systems, alongside ZF’s focus on next-generation mobility and sustainability, positions both companies well to meet the evolving needs of the automotive industry, especially in terms of fuel efficiency and emissions reduction.

BorgWarner Inc. and Schaeffler Technologies AG & Co. emphasize their strategic investments in electric vehicle (EV) technologies, positioning themselves to benefit from the shifting market toward electrification. Both companies are aligning their hydraulic system offerings with the development of electric and hybrid powertrains, capitalizing on the rising demand for energy-efficient solutions.

Warner Electric and MZW Motor, while smaller, remain important players through their specialized hydraulic systems, catering to niche automotive applications with a focus on performance and durability.

Overall, competition in the automotive hydraulics system market is expected to intensify as these players continue to innovate and expand their portfolios to meet the growing demand for cleaner, more efficient vehicle technologies.

Top Key Players in the Market

- JTEKT Corporation

- Warner Electric.

- Robert Bosch GmbH.

- Nexteer

- BorgWarner Inc.

- Hitachi Astemo Americas, Inc.

- Schaeffler Technologies AG & Co.

- ZF Friedrichshafen AG

- MZW Motor

- FTE Automotive Group

Recent Developments

- In August 2023, Samvardhana Motherson International completed the acquisition of a 100% stake in Rollon Hydraulics, marking a significant step in enhancing its global presence in the hydraulic solutions market. The acquisition strengthens Motherson’s ability to deliver high-quality hydraulic products to a broader customer base.

- In July 2023, Bosch Rexroth successfully acquired HydraForce, a leading provider of hydraulic valves and controls, to expand its global hydraulics portfolio. This acquisition is aimed at improving Bosch Rexroth’s competitive position in the industrial automation and mobile hydraulics sectors.

- In November 2024, Fortress, a global player in industrial technologies, acquired Texas Hydraulics, a leading manufacturer of hydraulic cylinders and systems. The deal is expected to enhance Fortress’s product offerings and strengthen its position in the growing hydraulic solutions market.

Report Scope

Report Features Description Market Value (2024) USD 45.4 Billion Forecast Revenue (2034) USD 67.2 Billion CAGR (2025-2034) 4.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Sales Channel (OEM, Aftermarket), By Component (Master Cylinder, Reservoir, Slave Cylinder, Hose), By On-Highway Vehicles (Passenger Cars, Heavy Commercial Vehicles, Light Commercial Vehicles), By Off-Highway Vehicles (Agriculture Equipment, Construction Equipment), By Application (Brakes, Tappets, Clutch, Suspension) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape JTEKT Corporation, Warner Electric., Robert Bosch GmbH., Nexteer, BorgWarner Inc., Hitachi Astemo Americas, Inc., Schaeffler Technologies AG & Co., ZF Friedrichshafen AG, MZW Motor, FTE Automotive Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Hydraulics System MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

Automotive Hydraulics System MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- JTEKT Corporation

- Warner Electric.

- Robert Bosch GmbH.

- Nexteer

- BorgWarner Inc.

- Hitachi Astemo Americas, Inc.

- Schaeffler Technologies AG & Co.

- ZF Friedrichshafen AG

- MZW Motor

- FTE Automotive Group