Global Electrohydraulic Actuator Market Based on Product (Control Electrohydraulic Actuator, Switch Electrohydraulic Actuator), Based on Application (Oil and Gas, Power, Industrial, Other Applications), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 17527

- Number of Pages: 217

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

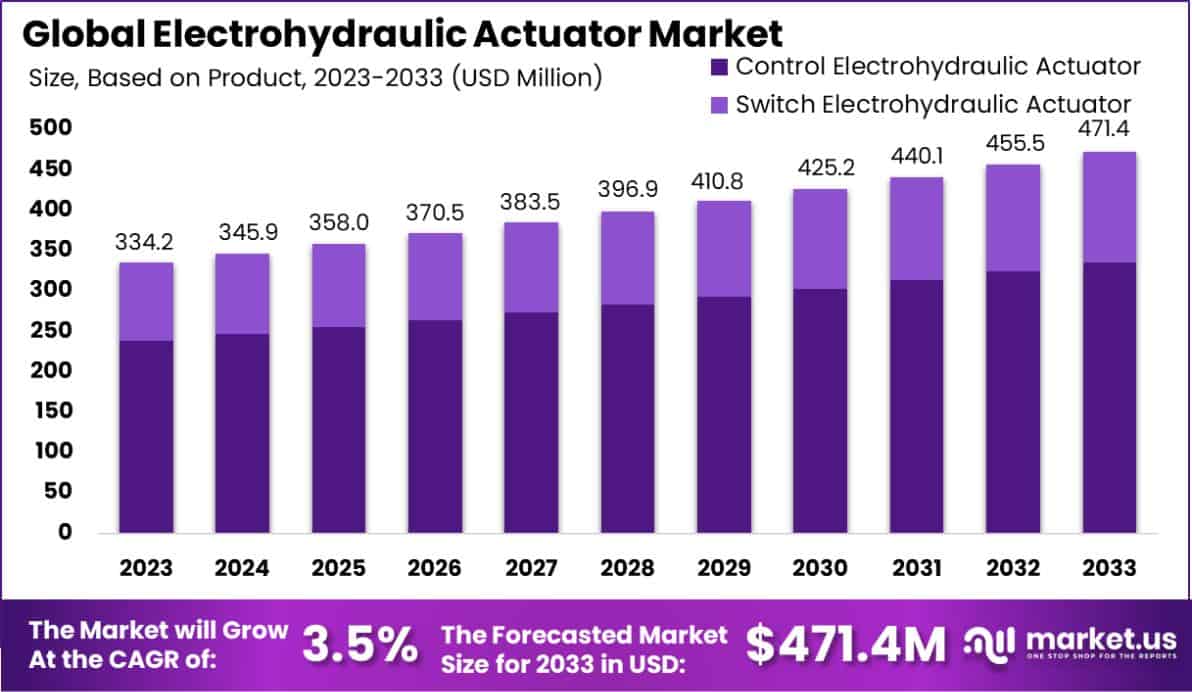

The Global Electrohydraulic Actuator Market size is expected to be worth around USD 471.4 Million by 2033, From USD 334.2 Million by 2023, growing at a CAGR of 3.5% during the forecast period from 2024 to 2033.

An electrohydraulic actuator (EHA) is a system that combines hydraulic power with electrical control to achieve high-precision actuation in automation and robotics. It uses an electric motor to drive a hydraulic pump, which generates fluid pressure to move a piston, thus delivering controlled motion. EHAs are notable for their power density, high force capacity, and fine control abilities.

The Electrohydraulic Actuator Market encompasses industries that require precise motion control and high-force actuation, such as aerospace, automotive, and smart manufacturing. This market is driven by the increasing automation of production processes and the need for more energy-efficient and maintenance-friendly systems.

The expansion of the Electrohydraulic Actuator Market is propelled by advancements in automation technologies and the growing need for reliable and efficient motion control systems in industrial applications.

Demand in the market is bolstered by sectors like aerospace and automotive, where precision and reliability in actuation are critical, driving the adoption of EHAs for more versatile and robust system designs.

There is a significant opportunity for the market in the integration of IoT and smart technologies, which enhance the functionality and monitoring capabilities of EHAs, offering new avenues for growth and innovation in traditional and emerging applications.

The Electrohydraulic Actuator Market is poised for robust growth, driven by escalating global demand for advanced, efficient motion control systems across a spectrum of industrial applications. The market benefits particularly from the exponential increase in electricity usage, which is expanding at twice the rate of other energy forms.

This surge underscores the critical shift toward smart, safe, and sustainable transport systems, particularly in the electric and hybrid vehicle sectors. The stringent global emission standards are accelerating the demand for sophisticated electrohydraulic actuators that enhance vehicle efficiency and performance.

Further bolstering this trend is the U.S. government’s recent infrastructure bill, which allocates over $7 billion to fortify the battery supply chain, spanning battery materials refining to components manufacturing. This legislative move is pivotal in mitigating one of the significant barriers in the electric vehicle (EV) market—limited operational range and inadequate charging infrastructure.

Despite the robust push towards electrification, the existing infrastructure supports approximately 25,000 Level 2 fast-charging stations, starkly lower than the 115,000 gas stations, indicating substantial growth potential for enhanced electrohydraulic solutions in this space.

Additionally, the substantial federal investment in higher education R&D, with a $1.7 billion increase from FY 2017 to FY 2018 totaling $42 billion, further catalyzes advancements in electrohydraulic actuation technologies, promising more innovative, efficient solutions that could reshape motion control standards globally.

Key Takeaways

- The Global Electrohydraulic Actuator Market size is expected to be worth around USD 471.4 Million by 2033, From USD 334.2 Million by 2023, growing at a CAGR of 3.5% during the forecast period from 2024 to 2033.

- In 2023, Control Electrohydraulic Actuator held a dominant market position in the Based on Product segment of the Electrohydraulic Actuator Market, with a 71.3% share.

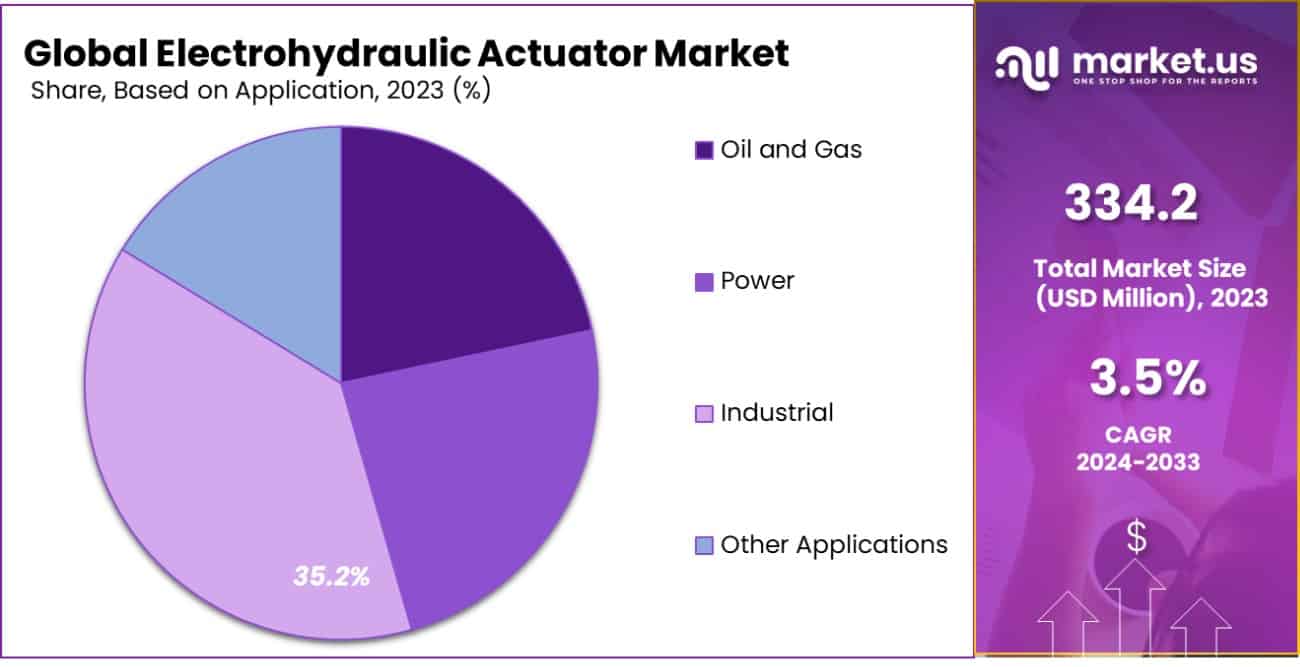

- In 2023, Industrial held a dominant market position in the Based on Application segment of the Electrohydraulic Actuator Market, with a 35.2% share.

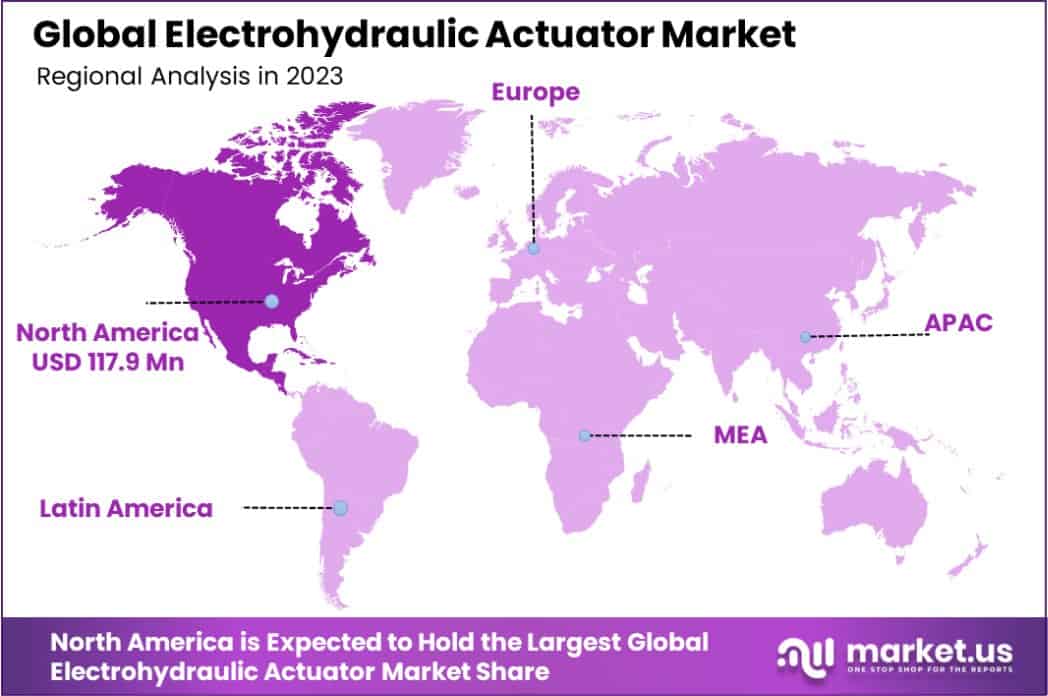

- North America dominated a 35.3% market share in 2023 and held USD 117.9 Million in revenue from the Electrohydraulic Actuator Market.

Based on Product Analysis

In 2023, the Control Electrohydraulic Actuator segment held a dominant market position in the Electrohydraulic Actuator Market, commanding a 71.3% share. This substantial market share underscores the pivotal role that Control Electrohydraulic Actuators play in applications requiring precise motion control under varying operational conditions.

The high adoption rate of these actuators is primarily attributed to their robustness, accuracy, and efficiency in continuous control operations across multiple industries, including oil and gas, power generation, and manufacturing.

Conversely, the Switch Electrohydraulic Actuator segment, while smaller, still plays a critical role in applications that demand reliable switching operations. These actuators are particularly valued for their durability and performance in harsh environments, making them indispensable in sectors such as water management and heavy machinery.

Together, these segments reflect a highly specialized market where performance and application-specific attributes drive demand. The overwhelming dominance of Control Electrohydraulic Actuators is indicative of their integral role in automated systems, where precise control is essential for operational efficiency and safety.

As industries continue to advance technologically, the demand for sophisticated control solutions like electrohydraulic actuators is expected to grow, further influencing market dynamics and competitive strategies.

Based on Application Analysis

In 2023, the Industrial segment held a dominant market position in the Based on Application segment of the Electrohydraulic Actuator Market, with a 35.2% share. This prominence reflects the critical importance of advanced actuation technology in various industrial applications, such as manufacturing, metal processing, and automotive assembly.

Electrohydraulic actuators are favored in these settings for their high force and precision control capabilities, essential for complex automation processes and improving operational efficiency.

Other significant sectors utilizing electrohydraulic actuators include Oil and Gas and Power, which require robust systems for their harsh and demanding environments. These actuators are particularly valued for their reliability and durability, capable of operating under extreme conditions while ensuring safety and performance.

The diverse applications of electrohydraulic actuators underscore their adaptability and efficiency across different sectors. As industries increasingly seek more sophisticated and reliable automation solutions to enhance productivity and safety, the demand for electrohydraulic actuators is expected to grow.

This will likely lead to further innovations and developments within the market, potentially increasing the share of industrial applications even more significantly in the future.

Key Market Segments

Based on Product

- Control Electrohydraulic Actuator

- Switch Electrohydraulic Actuator

Based on Application

- Oil and Gas

- Power

- Industrial

- Other Applications

Drivers

Key Drivers of Electrohydraulic Actuators Growth

In the Electrohydraulic Actuator Market, the main growth driver is the increasing automation in various industries such as oil and gas, power generation, and manufacturing. These sectors demand precise control systems for enhanced efficiency and safety, which electrohydraulic actuators provide due to their high force capability and precise motion control.

Furthermore, advancements in technology have led to improvements in the durability and efficiency of these actuators, making them more appealing to industries that operate in harsh environments.

The integration of smart features and IoT connectivity in actuators is also boosting their adoption, as these features offer real-time data monitoring and control, leading to reduced downtime and maintenance costs.

This trend is expected to continue, propelling the market forward as industries seek more reliable and efficient automation solutions.

Restraint

Challenges Facing Electrohydraulic Actuators

One significant restraint in the Electrohydraulic Actuator Market is the high initial investment and maintenance costs associated with these systems. Electrohydraulic actuators involve complex designs and use high-quality materials to ensure reliability and efficiency, especially in demanding industrial environments.

This complexity increases the initial purchase price, making them less accessible for small to medium-sized enterprises. Additionally, these actuators require regular maintenance to operate effectively, which can lead to further financial burden due to the need for specialized skills and periodic replacement of parts.

These economic factors can deter potential users, particularly in regions where cost efficiency is a priority, thus slowing down market growth in certain sectors.

Opportunities

Expanding Markets for Electrohydraulic Actuators

The Electrohydraulic Actuator Market is poised for growth through expanding applications in renewable energy and infrastructure projects. As global efforts to enhance sustainability intensify, industries such as wind and solar energy are adopting electrohydraulic actuators for their reliability and precision in controlling motion and force.

These actuators are ideal for use in environments where robustness and precise control are crucial, like adjusting solar panels or operating wind turbine blades. Additionally, ongoing urbanization and infrastructure development worldwide create further demand for these actuators in projects involving water management and construction machinery.

This expansion into new and diverse fields presents significant opportunities for market growth, as more sectors recognize the benefits of electrohydraulic technology in improving operational efficiency and environmental sustainability.

Challenges

Technical Hurdles in Actuator Adoption

A key challenge facing the Electrohydraulic Actuator Market is the complexity of integration and compatibility issues with existing systems. Many industries have legacy equipment that is not readily compatible with modern electrohydraulic actuators, requiring extensive modifications or complete system overhauls.

This integration challenge can deter businesses from upgrading to more efficient systems due to the high cost and potential for operational disruptions during the transition. Additionally, the technical expertise required to design, install, and maintain these advanced actuators can be a barrier, particularly in regions with limited access to skilled professionals.

As such, companies may hesitate to adopt these technologies despite their potential benefits, limiting market expansion and innovation in sectors that are slow to modernize.

Growth Factors

Growth Drivers for Electrohydraulic Actuators

The Electrohydraulic Actuator Market is benefiting significantly from the increasing demand for automation and precision control across various industries. These actuators are highly valued for their robustness and precision, especially in sectors like aerospace, automotive, and manufacturing where exact movements are crucial.

As industries strive for greater efficiency and lower operational costs, the adaptability of electrohydraulic actuators to work in harsh environments makes them indispensable. Additionally, the growing emphasis on safety and regulatory compliance in industries such as oil and gas and mining has driven the adoption of these actuators, which are capable of operating reliably under extreme conditions.

This trend is supported by technological advancements that enhance the performance and connectivity of these systems, making them more attractive to businesses looking to invest in future-proof automation solutions.

Emerging Trends

New Trends in Actuator Technology

Emerging trends in the Electrohydraulic Actuator Market focus on enhancing connectivity and integrating smart technologies. The adoption of the Internet of Things (IoT) and artificial intelligence (AI) within these systems is transforming how they operate, providing real-time monitoring, predictive maintenance, and advanced control capabilities.

This digital transformation allows for more precise and efficient operations, reducing downtime and maintenance costs. Furthermore, there’s a growing shift towards environmentally friendly actuators, with manufacturers developing systems that use biodegradable fluids and energy-efficient designs to meet stringent environmental regulations.

Another significant trend is the miniaturization of actuators, which makes them suitable for a broader range of applications, including medical devices and compact industrial machinery, broadening their market potential and driving innovation in various sectors.

Regional Analysis

In the Electrohydraulic Actuator Market, North America emerges as the dominant region with a substantial market share of 35.3%, translating to a value of USD 117.9 million. This prominence is driven by robust industrial automation and advanced manufacturing practices, particularly in the United States and Canada, where there is a high adoption rate of automation technologies across sectors such as automotive, aerospace, and oil & gas.

In Europe, the market is fueled by stringent regulatory standards requiring high precision and efficiency in industrial operations, alongside a strong presence of automotive and aerospace manufacturers who are key users of electrohydraulic actuators.

The Asia Pacific region is witnessing rapid growth due to industrialization and increasing investments in infrastructure projects, especially in China and India, making it a fast-expanding market for these actuators.

The Middle East & Africa and Latin America are experiencing gradual growth. In the Middle East & Africa, the development is linked to the oil & gas sector, whereas in Latin America, the growth is slower but steady, driven by the modernization of traditional industries and increasing foreign direct investments in manufacturing sectors.

Each region’s unique industrial dynamics shape the demand and application spectrum of electrohydraulic actuators, reflecting varied growth trajectories across the global market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the global Electrohydraulic Actuator Market, Bosch Rexroth AG, Parker Hannifin Corporation, and Eaton Corporation stand out as key players, each contributing uniquely to the market dynamics in 2023.

Bosch Rexroth AG leverages its extensive expertise in drive and control technologies to innovate highly efficient and reliable electrohydraulic actuators. Their products are renowned for precision and durability, making them preferred choices in sectors demanding rigorous control mechanisms, such as industrial automation and heavy machinery.

Parker Hannifin Corporation, with its broad range of motion and control technologies, has continued to enhance its product offerings by integrating smart technology features. Their focus on IoT-enabled actuators allows for advanced monitoring and diagnostics, catering to the growing demand for predictive maintenance solutions that reduce downtime and operational costs in critical industries.

Eaton Corporation remains a strong competitor, emphasizing sustainability and energy efficiency in their electrohydraulic solutions. Their actuators are designed to meet the stringent environmental standards increasingly sought after in industries like renewable energy and construction, providing them with a competitive edge in markets moving towards greener technologies.

Together, these companies not only drive technological advancements within the market but also shape competitive strategies through their focus on innovation, reliability, and sustainability, positioning themselves strongly in the global landscape of electrohydraulic actuators.

Top Key Players in the Market

- Bosch Rexroth AG

- Parker Hannifin Corporation

- Eaton Corporation

- Moog Inc.

- Wipro Infrastructure Engineering

- Rotork plc

- IMI Precision Engineering

- Oilgear

- Atos Spa

- Rexa, LLC

- Other Key Players

Recent Developments

- In October 2024, Danfoss Power Solutions, Fully transitioned to designing exclusively electro-hydraulic components, abandoning mechanical interfaces to focus on advanced digital control systems for enhanced performance and efficiency.

- In October 2024, Wipro Infrastructure Engineering, Acquired Columbus Hydraulics, enhancing its North American market presence, adding 150 skilled employees and a 120,000-square-foot plant to its hydraulic cylinder manufacturing portfolio.

Report Scope

Report Features Description Market Value (2023) USD 334.2 Million Forecast Revenue (2033) USD 471.4 Million CAGR (2024-2033) 3.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Based on Product(Control Electrohydraulic Actuator, Switch Electrohydraulic Actuator), Based on Application(Oil and Gas, Power, Industrial, Other Applications) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Bosch Rexroth AG, Parker Hannifin Corporation, Eaton Corporation, Moog Inc., Wipro Infrastructure Engineering, Rotork plc, IMI Precision Engineering, Oilgear, Atos Spa, Rexa, LLC, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Electrohydraulic Actuator MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample

Electrohydraulic Actuator MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Bosch Rexroth AG

- Parker Hannifin Corporation

- Eaton Corporation

- Moog Inc.

- Wipro Infrastructure Engineering

- Rotork plc

- IMI Precision Engineering

- Oilgear

- Atos Spa

- Rexa, LLC

- Other Key Players