Global Bulk Material Handling System Market By Type (Stacker, Stacker Cum Reclaimer, Band Conveyor, Bucket Wheel Excavator, Stripping Shovel, Rope Shovel, Bucket Elevator, And Ship Loader And Unloader), By Application (Mining, Packaging, Construction, Manufacturing, And Sea Ports & Cargo Terminals), By Region And Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends And Forecast 2023-2032

- Published date: March 2025

- Report ID: 26859

- Number of Pages: 309

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

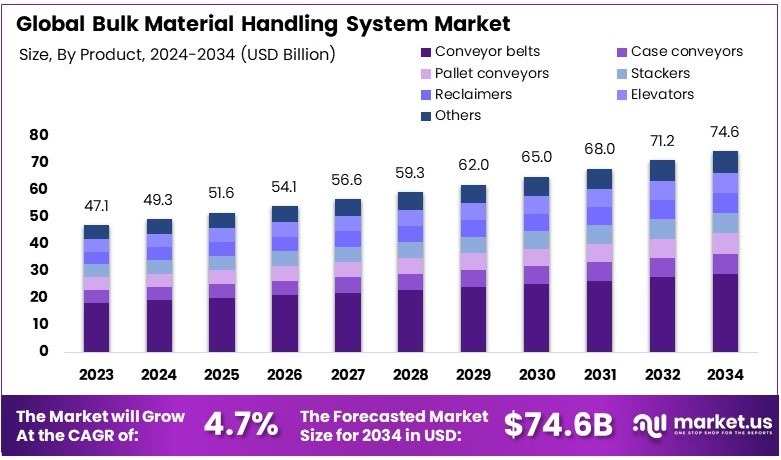

The Global Bulk Material Handling System Market size is expected to be worth around USD 74.6 Billion by 2034, from USD 47.1 Billion in 2024, growing at a CAGR of 4.7% during the forecast period from 2025 to 2034.

A bulk material handling system is used to transport large quantities of materials such as grains, coal, or minerals. It typically involves conveyors, cranes, and other equipment to move bulk goods efficiently. These systems are essential in industries like mining, agriculture, and logistics, where materials need to be moved in large volumes.

The bulk material handling system market covers the industry involved in designing, manufacturing, and selling bulk material handling equipment. This market serves sectors such as mining, agriculture, and construction. As industries expand and demand for more efficient transport systems grows, there are significant opportunities for the market to evolve and expand.

The bulk material handling system market is experiencing growth due to increased demand for automation and efficient transport solutions. For example, in mining and agriculture, there is a need for high-capacity equipment to move large amounts of material. Moreover, industries like logistics and construction are adopting these systems to improve operations, leading to market expansion.

Technological advancements and a rise in global trade are fueling demand for bulk material handling systems. According to the United Nations Conference on Trade and Development (UNCTAD), global trade in goods and services is projected to grow by $350 billion in 2024. This trend increases the need for efficient material handling systems across industries, creating growth opportunities.

The market for bulk material handling systems remains competitive, with several companies offering advanced solutions. While the market is growing, it is also becoming saturated with both established players and new entrants. Companies are focusing on innovation and offering equipment with improved efficiency, automation capabilities, and energy-saving features to stay ahead of the competition.

On a broader scale, the adoption of bulk material handling systems impacts industries by improving efficiency in material transport and reducing operational costs. In particular, these systems play a vital role in supporting large-scale projects in mining, construction, and logistics. On a local level, they help businesses streamline operations, resulting in higher productivity.

Key Takeaways

- The Bulk Material Handling System Market was valued at USD 47.1 billion in 2024 and is expected to reach USD 74.6 billion by 2034, with a CAGR of 4.7%.

- In 2024, Conveyor Belts led the product segment with 34.8%, driven by their efficiency in material transportation.

- In 2024, Manufacturers dominated the sales channel with 68.2%, benefiting from direct procurement by industries.

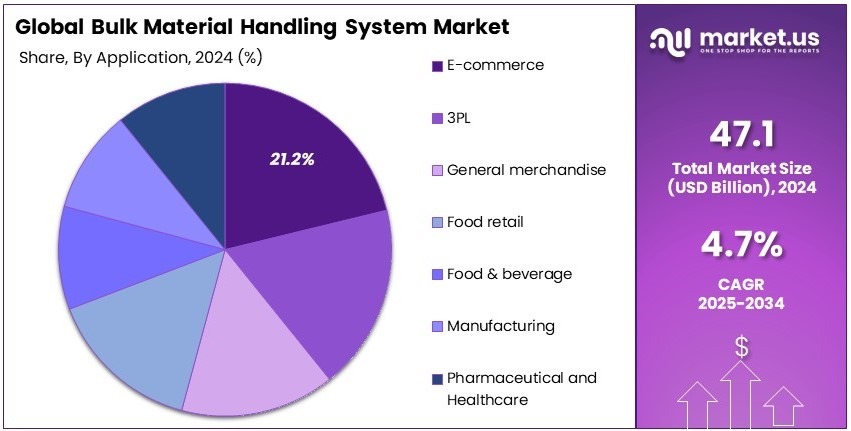

- In 2024, E-commerce accounted for 21.2% in the application segment, fueled by the rapid growth of online retail.

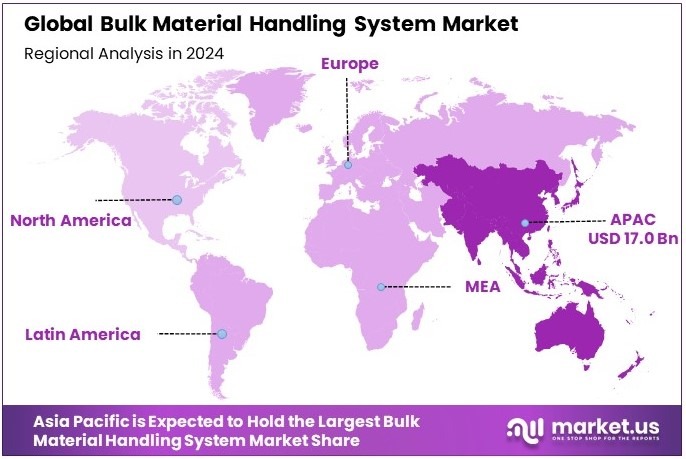

- In 2024, APAC held 36.1% and valued at USD 17.00 billion, supported by industrial expansion and infrastructure development.

Product Analysis

Conveyor Belts dominate with 34.8% due to their widespread use in material handling across various industries.

The Bulk Material Handling System market is primarily driven by the Conveyor Belts sub-segment, which holds the largest share at 34.8%. Conveyor belts are essential in various sectors, including manufacturing, mining, and logistics, as they facilitate the continuous movement of materials, making operations more efficient.

The demand for conveyor belts is supported by the increasing automation in industries that require the rapid transport of bulk materials like coal, grains, and packaged goods. Their versatility in handling various materials, combined with their cost-effectiveness, positions conveyor belts as a go-to solution in the bulk material handling market.

Other product types, such as Case Conveyors and Pallet Conveyors, contribute to the market but hold smaller shares. Case conveyors are mainly used for the movement of cases and boxes in packaging and warehousing operations, while pallet conveyors handle pallets used in manufacturing and distribution.

Both sub-segments are important, but they serve more specific needs compared to the versatile conveyor belt systems. Stackers, reclaimers, and elevators are also key players in the market but are typically used in more specialized applications like mining and large-scale material handling operations.

Application Analysis

E-commerce dominates with 21.2% due to the surge in online shopping and the need for efficient distribution systems.

The application of Bulk Material Handling Systems in the E-commerce sector leads the market with a share of 21.2%. The rapid growth of online shopping has resulted in a significant increase in demand for efficient warehousing, sorting, and shipping systems. Bulk material handling systems are critical for ensuring that goods are processed quickly and accurately in large distribution centers.

As e-commerce giants like Amazon and Walmart continue to expand, the need for automated systems that can manage high volumes of orders has driven the demand for these systems. This has led to the adoption of conveyor belts, robotic sorting systems, and automated packaging lines, all of which improve operational efficiency and reduce human error.

The 3PL (Third-Party Logistics) and General Merchandise applications also contribute to the market’s growth. These sectors require efficient material handling systems for warehousing, sorting, and shipping. Food & Beverage and Manufacturing industries also rely on bulk material handling systems to maintain smooth production lines.

The Pharmaceutical/Healthcare sector plays a smaller but important role in driving demand for highly specialized handling systems that meet stringent safety and quality standards. These sub-segments continue to evolve with technological advancements that enhance material handling capabilities, but E-commerce remains the dominant application due to its rapid growth.

Sales Channel Analysis

Manufacturers dominate with 68.2% due to their direct supply and custom solutions for industries.

In the Bulk Material Handling System market, the Manufacturers sub-segment leads the sales channel segment, capturing 68.2% of the market. Manufacturers play a central role in producing tailored material handling solutions that meet the specific needs of various industries. By offering customized systems, manufacturers ensure that clients get the most efficient and reliable solutions for their operations.

These systems are often integrated into production lines, warehouses, and distribution centers, helping to streamline material handling and reduce labor costs. Manufacturers also provide installation and maintenance services, ensuring that their systems remain functional and efficient over time.

The Distributors sub-segment, while important, holds a smaller share of the market. Distributors typically work with manufacturers to supply material handling systems to businesses in need of standardized solutions.

Their role is crucial in providing access to bulk handling equipment across regions, but they generally focus on reselling rather than custom manufacturing. The market’s reliance on manufacturers for tailored, high-performance solutions means that this sub-segment has a more significant impact on overall market growth.

Key Market Segments

By Product

- Conveyor Belts

- Case Conveyors

- Pallet Conveyors

- Stackers

- Reclaimers

- Elevators

- Others

By Application

- 3PL

- E-commerce

- General Merchandise

- Food Retail

- Food & Beverage

- Manufacturing

- Pharmaceutical/Healthcare

By Sales Channel

- Manufacturers

- Distributors

Driving Factors

Increased Automation Drives Market Growth

The increased demand for automated material handling in warehouses is a significant driving factor for the Bulk Material Handling System market. As e-commerce continues to expand, companies are looking for more efficient ways to manage inventory and streamline operations. Automated systems help reduce manual labor and improve accuracy, making warehouses more productive and cost-effective.

This shift is not limited to warehouses; industries involved in construction and mining are also seeking more efficient systems to transport and manage bulk materials. These sectors require heavy-duty equipment that can handle large volumes of materials with speed and precision. Automation and robotics are being integrated into material handling processes to improve operational efficiency and reduce human error.

The growing need for efficient supply chain and logistics operations further drives the market, as companies strive to optimize their material handling capabilities to meet increasing demand for fast and reliable delivery services.

Restraining Factors

High Costs and Integration Challenges Restrain Market Growth

Despite the benefits, there are several factors restraining the growth of the Bulk Material Handling System market. The high initial investment for bulk material handling equipment is one of the key challenges. The cost of acquiring and installing automated systems can be significant, making it difficult for smaller businesses to invest in these technologies.

Additionally, operational challenges related to system integration with existing infrastructure pose another hurdle. Adapting new systems to work seamlessly with older equipment and processes can result in high implementation costs and operational disruptions.

Furthermore, the vulnerability of these systems to supply chain disruptions, such as raw material shortages or transportation delays, affects their efficiency. Lastly, traditional bulk material handling systems may struggle to adapt to new materials and changing production needs, limiting their flexibility in modern manufacturing environments.

Growth Opportunities

Infrastructure Investments and Sustainability Drive Opportunities

There are several growth opportunities in the Bulk Material Handling System market. One notable opportunity is the rise in investments in infrastructure projects and the growing construction industry. As countries invest in infrastructure, there will be an increased need for bulk material handling systems to manage construction materials such as cement, steel, and aggregates.

Another significant opportunity lies in the shift toward sustainable and energy-efficient material handling systems. As companies prioritize sustainability, there is a growing demand for systems that reduce energy consumption and minimize environmental impact.

Additionally, the agricultural and food processing sectors are expanding their use of material handling systems, creating new opportunities for innovation in these industries. The adoption of predictive analytics for improved equipment performance also presents growth potential. Predictive maintenance and real-time monitoring can optimize the efficiency of bulk handling systems, leading to reduced downtime and lower operating costs.

Emerging Trends

Innovation and IoT Shape Market Trends

Several trending factors are influencing the Bulk Material Handling System market. The increased use of autonomous vehicles in material transport is revolutionizing the industry. These vehicles are capable of transporting bulk materials without the need for human intervention, improving efficiency and safety in warehouses and industrial settings.

Development of AI and machine learning algorithms is also optimizing material flow by predicting and adjusting operations based on real-time data. This can help companies improve performance and reduce bottlenecks in the handling process.

Additionally, wearable technology is being used to improve worker efficiency in material handling. Devices such as smart gloves or exoskeletons can enhance worker safety and productivity. Finally, the growing interest in IoT-enabled bulk handling systems is making real-time monitoring and control a reality. These systems provide valuable insights into the performance of equipment, helping companies optimize operations and prevent potential issues before they occur.

Regional Analysis

Asia Pacific Dominates with 36.1% Market Share

Asia Pacific leads the Bulk Material Handling System Market with a 36.1% share, valued at USD 17.0 billion. The region’s dominance is driven by rapid industrialization, particularly in countries like China and India. These nations have seen significant investments in infrastructure, mining, and manufacturing, all of which require efficient material handling solutions to support growing demand.

The presence of major manufacturing hubs and the region’s strong focus on automation and technological advancements play a key role in this market’s growth. Additionally, Asia Pacific benefits from lower labor costs and large-scale production capabilities, which attract businesses looking to optimize their supply chain and material handling systems. The rise of e-commerce and the development of large ports in countries like China and Japan also contribute to the region’s dominance.

Looking ahead, Asia Pacific’s growth in the bulk material handling system market is expected to continue, driven by ongoing urbanization, infrastructure projects, and the need for more efficient logistics systems. With continued investments in automation, robotics, and smart technology, the region’s market share will likely expand further as demand for advanced material handling solutions increases across key industries.

Regional Mentions:

- North America: North America, with its focus on advanced technologies, holds a strong market presence, especially in the energy and automotive sectors. The region’s demand for innovative, energy-efficient solutions continues to fuel the market’s growth.

- Europe: Europe’s market is characterized by stringent environmental regulations and a focus on sustainability. Germany and the UK are key players, focusing on integrating eco-friendly systems into bulk material handling processes.

- Middle East & Africa: The Middle East and Africa are investing heavily in infrastructure development, particularly in the oil, gas, and construction sectors. This is driving the adoption of bulk material handling systems to improve efficiency and safety.

- Latin America: Latin America is seeing growth in its material handling market as industries such as mining and agriculture modernize. Brazil and Mexico are major contributors to the market expansion, driven by increased demand for efficient logistics and material handling systems.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The Bulk Material Handling System market is driven by several leading companies, with Beumer Group, Continental AG, Crown Equipment Corporation, and Daifuku Co., Ltd. being among the most influential players. These companies provide innovative solutions designed to optimize the transportation and handling of bulk materials across various industries, such as mining, manufacturing, and logistics.

Beumer Group is recognized for its extensive experience in bulk material handling systems, particularly in the areas of conveying, loading, and storage solutions. The company is known for its reliable and energy-efficient systems that cater to industries such as cement, mining, and logistics.

Continental AG offers high-performance conveyor belts and bulk material handling systems. With a focus on automation and integration, the company’s products support industries such as mining, automotive, and manufacturing by improving efficiency and reducing operational costs.

Crown Equipment Corporation specializes in material handling solutions, particularly in forklift trucks and automated systems. The company is noted for its innovative, high-tech equipment, which is used in various sectors, including warehousing, logistics, and retail.

Daifuku Co., Ltd. is a major player in the material handling sector, providing advanced automation and logistics solutions. The company offers integrated systems for industries such as automotive, electronics, and general manufacturing, helping improve efficiency and productivity in material handling processes.

These companies are leaders in the Bulk Material Handling System market, offering a wide range of products that improve operational efficiency and reduce costs. Through continuous innovation, they address the growing demand for automation and scalable solutions in material handling across industries. Their advanced technologies continue to drive growth in the sector.

Major Companies in the Market

- Beumer Group

- Continental AG

- Crown Equipment Corporation

- Daifuku Co., Ltd.

- Honeywell International Inc.

- Jungheinrich AG

- MHS Conveyor

- Mitsubishi Electric Corporation

- SSI Schaefer Group

- TGW Logistics Group GmbH

Recent Developments

- Italian Excellence in Materials Handling: In September 2024, companies like Bedeschi and Bonfiglioli have been praised for their advanced engineering solutions and reliable equipment, reinforcing the “Made in Italy” brand as a symbol of excellence in industrial machinery. This commitment to high standards has solidified Italy’s position as a leader in the global materials handling industry.

- Magway Ltd: In June 2024, Magway Ltd unveiled its innovative magnetic propulsion system at Wincanton’s W² Innovation Centre in Northamptonshire, designed to revolutionize bulk material transport. This technology allows for precise control over the movement of loads up to 250 kilograms, achieving a throughput capacity of 1,000 tonnes per hour.

Report Scope

Report Features Description Market Value (2024) USD 47.1 Billion Forecast Revenue (2034) USD 74.6 Billion CAGR (2025-2034) 4.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Conveyor Belts, Case Conveyors, Pallet Conveyors, Stackers, Reclaimers, Elevators, Others), By Application (3PL, E-commerce, General Merchandise, Food Retail, Food & Beverage, Manufacturing, Pharmaceutical or Healthcare), By Sales Channel (Manufacturers, Distributors) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Beumer Group, Continental AG, Crown Equipment Corporation, Daifuku Co., Ltd., Honeywell International Inc, Jungheinrich AG, MHS Conveyor, Mitsubishi Electric Corporation, SSI Schaefer Group, TGW Logistics Group GmbH Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Bulk Material Handling System MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Bulk Material Handling System MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Beumer Group

- Continental AG

- Crown Equipment Corporation

- Daifuku Co., Ltd.

- Honeywell International Inc.

- Jungheinrich AG

- MHS Conveyor

- Mitsubishi Electric Corporation

- SSI Schaefer Group

- TGW Logistics Group GmbH