Global Automotive Electric Fuel Pumps Market By Product (Brushed DC, Brushless DC), By Technology (Turbine style, Sliding Vane, Roller Vane), By Application (LCVs, Cars, HCVs), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 140693

- Number of Pages: 234

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

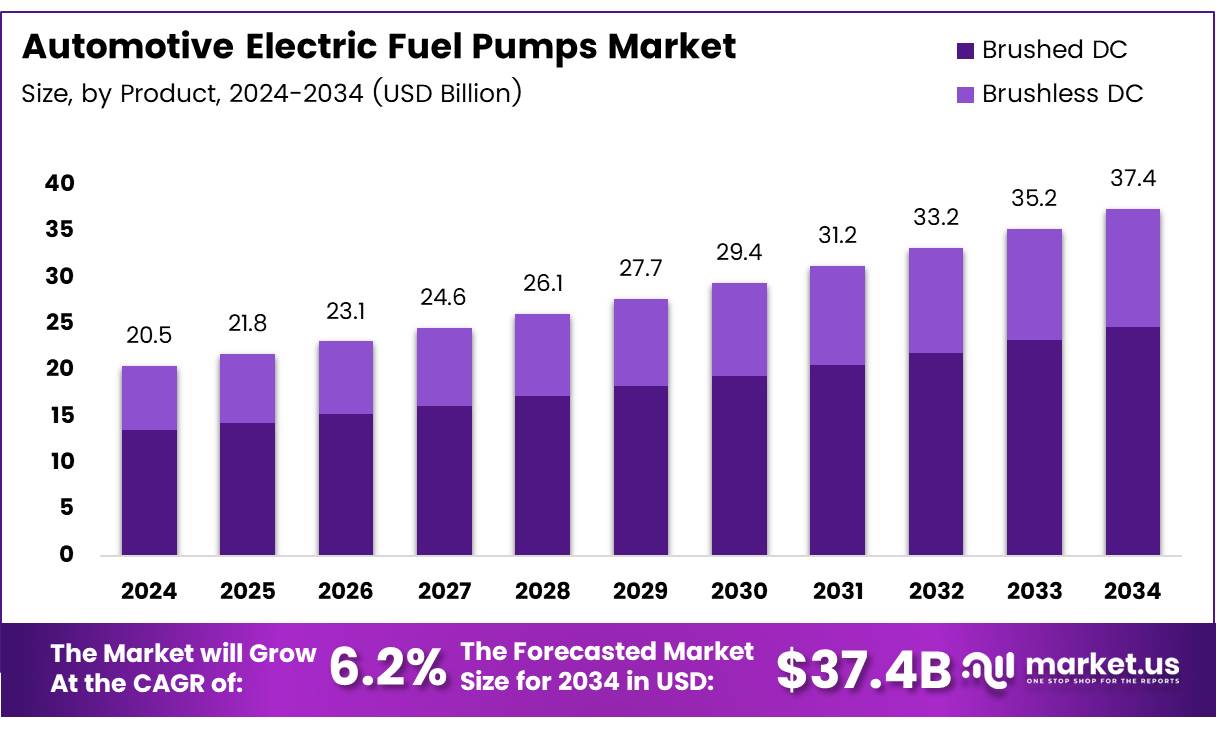

The Global Automotive Electric Fuel Pumps Market size is expected to be worth around USD 37.4 Billion by 2034, from USD 20.5 Billion in 2024, growing at a CAGR of 6.2% during the forecast period from 2025 to 2034.

The automotive electric fuel pumps market has witnessed a significant transformation in recent years, driven by the increasing demand for electric vehicles (EVs) and hydrogen-powered vehicles. Automotive electric fuel pumps play a crucial role in efficiently transferring fuel or electricity to power the vehicle’s engine or battery.

These pumps are designed to improve fuel efficiency, enhance performance, and reduce emissions, which are crucial factors for meeting regulatory standards in the automotive sector. With the global automotive industry rapidly shifting towards electrification, electric fuel pumps are becoming integral components, especially for electric and hydrogen fuel cell vehicles.

The rise of battery electric vehicles (BEVs) and hydrogen fuel cell electric vehicles (FCEVs) has spurred innovations in automotive fuel pumps. As of 2024, for instance, 1.3 million new EVs were sold in the U.S., reflecting a 7% growth compared to the previous year, according to Kelley Blue Book.

Similarly, the California Department of Motor Vehicles (DMV) reports that 14,429 FCEVs are now active in the state, signaling a shift toward cleaner alternatives. Furthermore, the recent inauguration of the Campbell East Hamilton Hydrogen Station, which adds over 1,200 kilograms of daily fueling capacity, underscores the growing importance of hydrogen as a viable energy source for the automotive industry, consequently increasing the demand for advanced fuel pump technologies.

The automotive electric fuel pumps market is expected to experience robust growth over the next decade, driven by rising global demand for sustainable transportation solutions. The shift to electric and hydrogen-powered vehicles presents a significant opportunity for manufacturers of fuel pump systems to develop innovative technologies that can cater to new fueling needs.

Furthermore, government incentives and subsidies for EVs and green technology are providing strong support for this market. According to the California Air Resources Board (ARB), the number of hydrogen fuel cell vehicles (FCEVs) is expected to increase significantly, making these fuel pumps essential for future infrastructure.

Government regulations aimed at reducing carbon emissions are also a driving force behind the adoption of electric and hydrogen-powered vehicles. These vehicles require specialized fuel pumps designed to operate efficiently under varying conditions, ensuring optimal performance. With the rising adoption of electric vehicles and FCEVs, automakers are investing heavily in next-gen electric fuel pump technologies.

The U.S. is a prime example, where, in 2024, over 1.3 million new EVs were sold, according to Kelley Blue Book. Such growth reflects a strong opportunity for pump manufacturers to expand their market share.

Additionally, initiatives like the Campbell East Hamilton Hydrogen Station in California, as reported by Energy, are setting the stage for further infrastructure investments. As the fueling network grows, the demand for high-performance electric fuel pumps will increase in tandem, presenting a promising opportunity for companies in this sector to innovate and capture market share.

Key Takeaways

- The global automotive electric fuel pumps market is projected to reach USD 37.4 billion by 2034, growing at a CAGR of 6.2% from 2025 to 2034.

- Brushed DC electric fuel pumps dominated the market in 2024, holding a 66.4% share due to cost-effectiveness, reliability, and established technology.

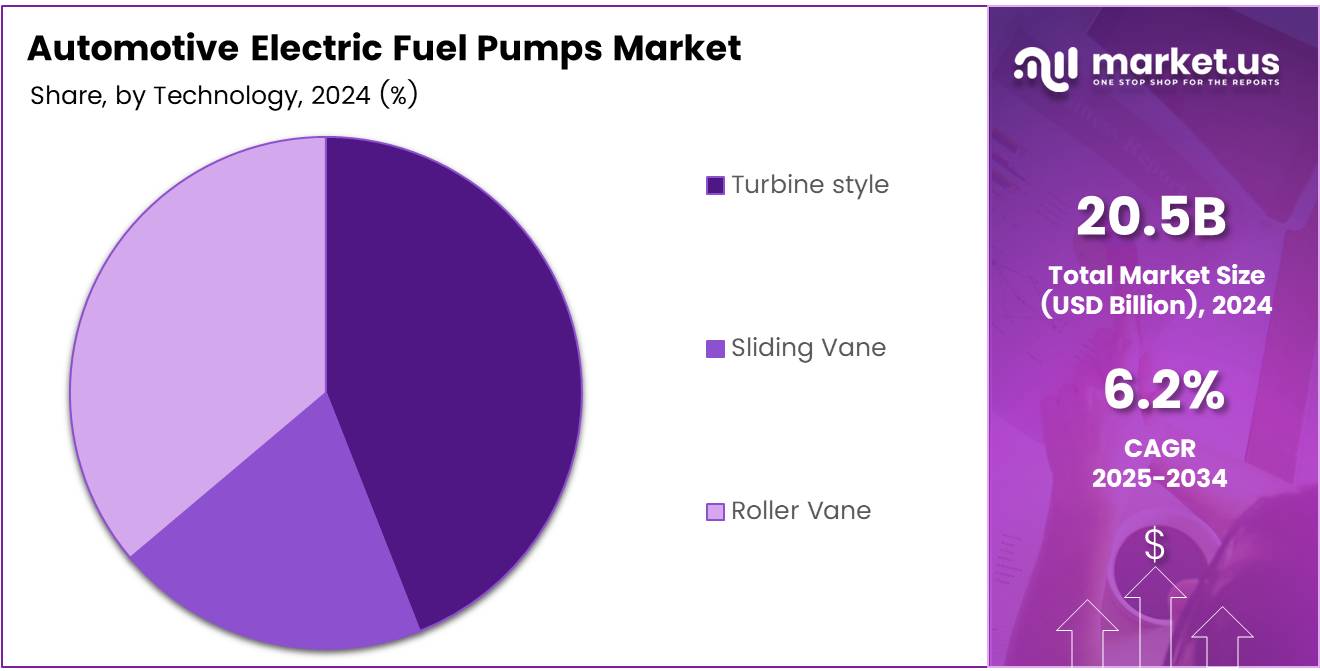

- Turbine style electric fuel pumps led the technology segment in 2024, driven by superior performance, efficiency, and reliability.

- Light Commercial Vehicles (LCVs) were the dominant application in 2024, driven by increased demand in logistics, transportation, and e-commerce sectors.

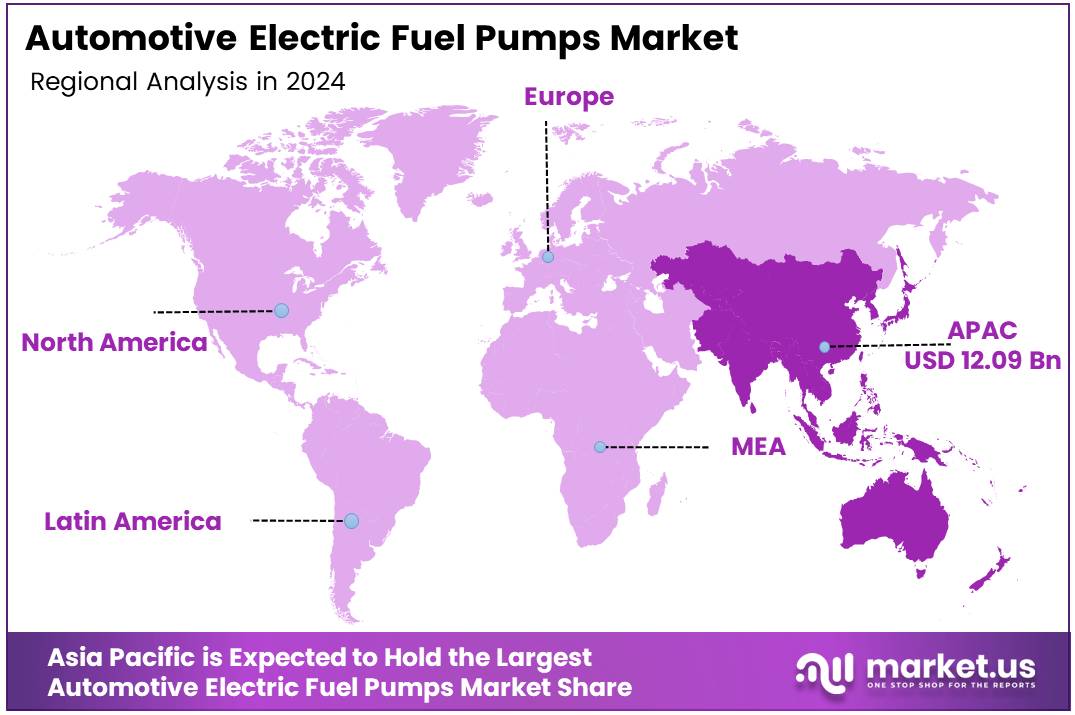

- The Asia Pacific region dominated the market in 2024, accounting for 59% of the global market share, with growth fueled by major automotive manufacturing hubs in China, Japan, and South Korea.

Product Analysis

Brushed DC Dominates Automotive Electric Fuel Pumps Market with 66.4% Share in 2024

In 2024, Brushed DC electric fuel pumps led the market in the By Product Analysis segment of the Automotive Electric Fuel Pumps Market, commanding a significant 66.4% share. This dominance is largely attributed to the widespread adoption of Brushed DC motors in automotive fuel pump systems due to their cost-effectiveness, reliability, and established technology.

Brushed DC pumps have a long history of use in various automotive applications, making them the preferred choice for many vehicle manufacturers. Their simplicity and robust performance in a wide range of conditions continue to drive demand across the global automotive sector.

On the other hand, Brushless DC motors, while steadily gaining traction due to their higher efficiency, longer lifespan, and quieter operation, hold a smaller yet notable share of the market.

The increasing focus on fuel efficiency and sustainability is contributing to the gradual shift toward Brushless DC motors, though the transition remains slower compared to Brushed DC, mainly due to higher initial costs and the existing reliance on Brushed DC technologies in the automotive industry.

As innovation in electric propulsion continues, Brushless DC motors are expected to gain a larger share, but Brushed DC will likely maintain its dominance in the near term.

Technology Analysis

Turbine Style Leads Automotive Electric Fuel Pumps Market with a Dominant Share in 2024

In 2024, Turbine style electric fuel pumps held a dominant position in the By Technology Analysis segment of the Automotive Electric Fuel Pumps Market, capturing a substantial share due to its superior performance, efficiency, and reliability.

Turbine style pumps are widely used in modern automotive applications due to their ability to deliver high flow rates while maintaining consistent pressure, making them ideal for fuel systems in both traditional and electric vehicles. Their design, which incorporates rotating turbine blades, allows for smooth operation and low maintenance, making them a preferred choice among automotive manufacturers.

Sliding Vane pumps, known for their ability to maintain consistent fuel delivery under varying conditions, accounted for a notable share of the market. Though they offer high performance in high-viscosity fluids, they remain less common in automotive applications due to their complexity and higher cost compared to turbine pumps.

Roller Vane pumps, while offering similar benefits in terms of efficiency and reliability, continue to capture a smaller portion of the market. These pumps are more common in niche applications where compact size and durability are critical, but they do not yet challenge the dominance of turbine style pumps in the broader automotive market.

As the automotive sector evolves, each technology will continue to find its niche, but turbine style pumps will likely remain the market leader.

Application Analysis

LCVs Lead Automotive Electric Fuel Pumps Market with Dominant Share in 2024

In 2024, Light Commercial Vehicles (LCVs) held a dominant position in the By Application Analysis segment of the Automotive Electric Fuel Pumps Market, capturing a significant share. This is primarily due to the growing demand for LCVs in commercial sectors, including logistics, transportation, and e-commerce, where fuel efficiency and reliable fuel delivery systems are crucial.

As businesses expand their fleets of LCVs, the need for durable and high-performance electric fuel pumps has increased, driving growth in this segment. The affordability and efficiency of electric fuel pumps in LCVs further support their widespread adoption.

Cars, while holding a substantial portion of the market, have seen slower growth compared to LCVs. The automotive industry’s focus on fuel efficiency, combined with advancements in electric vehicle technology, has somewhat shifted attention away from conventional fuel pumps in personal vehicles.

Nevertheless, electric fuel pumps continue to play a critical role in internal combustion engine (ICE) vehicles, with consistent demand driven by new model launches and fuel system enhancements.

Heavy Commercial Vehicles (HCVs) represent a smaller share of the market due to their less frequent use of electric fuel pumps compared to LCVs. However, as the push for cleaner technologies continues, the demand for fuel-efficient electric pumps in HCVs is expected to increase over the coming years, contributing to market growth in this segment.

Key Market Segments

By Product

- Brushed DC

- Brushless DC

By Technology

- Turbine style

- Sliding Vane

- Roller Vane

By Application

- LCVs

- Cars

- HCVs

Drivers

Rising Demand for Fuel Efficiency Boosts Market for Electric Fuel Pumps

The growing demand for fuel-efficient vehicles is a key driver for the automotive electric fuel pump market. As consumers and manufacturers alike prioritize better vehicle performance, especially in terms of fuel economy, there is an increasing need for high-quality, reliable electric fuel pumps.

These pumps play a critical role in maintaining fuel flow consistency and optimizing engine performance. Furthermore, the rise in electric and hybrid vehicle adoption further accelerates the need for advanced fuel pumps.

Electric vehicles (EVs) and hybrid models require specialized fuel systems to manage power delivery efficiently, increasing the demand for innovative electric fuel pump solutions. Technological advancements also fuel this market, as automakers continue to invest in next-gen systems like variable fuel pressure pumps that provide better performance and energy efficiency.

Moreover, the tightening of global emission regulations is pushing for cleaner, more efficient fuel systems, which directly increases the demand for electric fuel pumps. With governments and industries focusing on reducing carbon footprints and enhancing vehicle efficiency, the electric fuel pump market stands poised for sustained growth.

Restraints

Shift Toward Alternative Fuels Poses Challenges for Electric Fuel Pumps Market

One of the major restraints for the automotive electric fuel pump market is the growing shift toward alternative fuel technologies. As electric vehicles (EVs) and other alternative fuel options, like hydrogen fuel cells, become more popular, the need for traditional fuel pumps is expected to decrease. This is because these technologies do not rely on conventional combustion engines that require fuel pumps.

Additionally, the price sensitivity in emerging markets further limits market growth. In many regions, consumers are more focused on affordable vehicle options, leading them to favor less advanced, lower-cost fuel pump solutions over the higher-priced electric fuel pumps. In these markets, the cost-benefit analysis leans toward cheaper alternatives, which can hold back the widespread adoption of more advanced, efficient technologies.

As a result, while the electric fuel pump market has significant growth potential in more developed regions, its expansion could be constrained in price-sensitive areas where cost considerations outweigh performance upgrades. This trend highlights the challenge of balancing innovation and affordability in a global automotive market that is increasingly diverse in terms of economic conditions and consumer expectations.

Growth Factors

Rising Hybrid Vehicle Production Creates Strong Growth Potential for Electric Fuel Pumps

The growing production of hybrid vehicles is one of the most promising growth opportunities for the automotive electric fuel pump market. Hybrid vehicles require electric fuel pumps to ensure efficient fuel delivery and seamless integration of their internal combustion and electric powertrains. As more consumers and automakers shift toward hybrid models, the demand for electric fuel pumps is expected to increase significantly.

Additionally, the automotive market’s expansion in emerging economies like Asia-Pacific and Latin America is another key opportunity. With rising vehicle production and sales in these regions, the need for advanced fuel systems, including electric fuel pumps, is set to grow.

The emergence of autonomous vehicles also presents an exciting opportunity, as these vehicles will rely on more sophisticated fuel systems, which could boost the demand for high-performance electric fuel pumps.

Furthermore, advancements in the Internet of Things (IoT) are opening new doors for the market. The integration of IoT technologies into fuel pumps allows for remote monitoring, diagnostics, and real-time system updates, offering improved performance and reliability. This technological evolution not only enhances the efficiency of fuel pumps but also creates value for automakers and consumers alike, paving the way for greater adoption of electric fuel pumps in the evolving automotive landscape.

Emerging Trends

Integration of Advanced Fuel Systems Drives Innovation in Electric Fuel Pumps

A key trend shaping the automotive electric fuel pump market is the integration of these pumps into advanced fuel management systems. These systems help ensure that fuel is delivered more efficiently and at the right pressure, which enhances overall vehicle performance and fuel economy.

Another growing trend is the miniaturization of fuel pumps. As electric and hybrid vehicles continue to evolve, space becomes more limited, and manufacturers are focusing on designing smaller, more compact electric fuel pumps to fit into these vehicles without compromising performance.

In line with this, the rise of smart fuel pumps is also transforming the market. These pumps can now be monitored and controlled remotely through mobile apps or onboard diagnostics, making them more user-friendly and efficient. This trend aligns with the growing demand for connected and intelligent vehicle systems.

Additionally, even though electric vehicles (EVs) do not require traditional fuel pumps, they are increasingly using electric fuel pumps for other functions, like cooling systems and battery management. These advanced pumps are essential for maintaining optimal performance in EVs, highlighting their expanded role in modern automotive technology.

As these trends continue to shape the market, the demand for innovative and high-performance electric fuel pumps is expected to rise, positioning them as crucial components in the future of automotive systems.

Regional Analysis

Asia Pacific leads with 59% market share valued at USD 37.4 billion driven by strong automotive production and EV adoption

The Asia Pacific region dominates the automotive electric fuel pumps market, accounting for 59% of the global market share. The region is valued at USD 37.4 billion and continues to grow rapidly due to the extensive automotive manufacturing presence in countries such as China, Japan, and South Korea.

The increasing adoption of electric vehicles (EVs) and stringent environmental regulations in these markets are driving demand for more advanced fuel pump technologies. Government initiatives promoting cleaner fuels and green technologies further contribute to this growth.

Regional Mentions:

In North America, the market growth is largely driven by the U.S., where automotive technology is advancing rapidly, and consumer demand for fuel-efficient vehicles continues to rise. The growth of electric vehicles, alongside federal and state-level incentives for EV adoption, has spurred the demand for electric fuel pumps. North America remains a key player in the market, with continued investments in automotive innovations and infrastructure for EVs.

Europe has a strong presence in the automotive electric fuel pumps market as well, with countries like Germany, France, and the UK leading the transition to electric and hybrid vehicles. The region’s focus on sustainability, supported by stringent emission regulations, is fostering growth in fuel pump technology that aligns with fuel efficiency and low-emission standards.

In the Middle East & Africa (MEA), demand is gradually increasing, particularly in key markets like Saudi Arabia and the UAE, as the automotive sector modernizes. The region is witnessing growing investments in the automotive sector, which is expected to positively influence the market for electric fuel pumps.

Latin America has a smaller but steadily growing market for automotive electric fuel pumps, driven by rising consumer demand in countries like Brazil for more fuel-efficient vehicles amid improving economic conditions in the region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2024, the global Automotive Electric Fuel Pumps Market remains highly competitive, with key players driving innovation and market expansion. Aptiv and Continental AG continue to dominate with their advanced fuel pump technologies that align with the increasing demand for electric and hybrid vehicles. These companies are not only focusing on traditional fuel pumps but are integrating their products into electric vehicle (EV) powertrains, where fuel pump designs are becoming more complex to support electric drivetrains and increased fuel efficiency.

General Motors and Vitesco Technologies are also making significant strides in the electric fuel pump market, driven by the need to meet stricter fuel efficiency standards and sustainability goals. Vitesco, in particular, stands out for its emphasis on creating eco-friendly fuel delivery solutions for EVs and hybrid models, positioning itself as a leader in fuel pump systems that support alternative powertrains.

Mitsubishi Electric Corporation, Denso, and Bosch are known for their deep R&D investments and continued focus on electrification. Bosch’s fuel pump systems are renowned for their efficiency, reliability, and adaptability to both conventional and electric vehicles, while Denso’s innovative solutions offer enhanced fuel management for growing EV platforms.

Companies like Mikuni Corporation, Pierburg, and Delphi Technologies are focusing on smaller, specialized electric fuel pumps for performance vehicles, while Johnson Electric and Siemens target the OEM and aftermarket segments with their affordable, high-performance fuel pump solutions.

Overall, in 2024, the competition remains intense, with key players focusing on innovation, fuel efficiency, and the shift to hybrid and electric vehicle platforms. These companies are well-positioned to lead the market, offering cutting-edge technologies and tailored solutions for a rapidly evolving automotive sector.

Top Key Players in the Market

- Aptiv

- Continental AG

- General Motors

- Pricol Limited

- Vitesco Technologies

- Mitsubishi Electric Corporation

- Magneti Marelli

- Aisin Seiki

- Mikuni Corporation

- Delphi Technologies

- Hitachi Automotive Systems

- Denso Corporation

- Johnson Electric

- Siemens

- Pierburg

- Robert Bosch GmbH

- Visteon Corporation

- Tenneco Inc.

- Daewha

Recent Developments

- In Dec 2023, 10,000 fuel pumps across various regions were upgraded to include Electric Vehicle (EV) charging stations, marking a significant step towards widespread EV adoption and infrastructure development. This move is part of a broader initiative to make EV charging as accessible and convenient as traditional refueling stations.

- In Mar 2023, ZF invested in CarPay-Diem, a mobile fueling and in-vehicle energy payment platform, to enhance their services for fleet customers. The investment aims to streamline energy payments and fueling processes, offering a more seamless and efficient experience for businesses managing large vehicle fleets.

- In Mar 2024, London-based Heat Geek raised €4.3 million in funding to drive the adoption of heat pump technology in the UK. The investment will support the company’s efforts to revolutionize the UK’s heating sector with environmentally friendly, energy-efficient solutions.

Report Scope

Report Features Description Market Value (2024) USD 20.5 Billion Forecast Revenue (2034) USD 37.4 Billion CAGR (2025-2034) 6.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Brushed DC, Brushless DC), By Technology (Turbine style, Sliding Vane, Roller Vane), By Application (LCVs, Cars, HCVs) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Aptiv, Continental AG, General Motors, Pricol Limited, Vitesco Technologies, Mitsubishi Electric Corporation, Magneti Marelli, Aisin Seiki, Mikuni Corporation, Delphi Technologies, Hitachi Automotive Systems, Denso Corporation, Johnson Electric, Siemens, Pierburg, Robert Bosch GmbH, Visteon Corporation, Tenneco Inc., Daewha Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Electric Fuel Pumps MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

Automotive Electric Fuel Pumps MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Aptiv

- Continental AG

- General Motors

- Pricol Limited

- Vitesco Technologies

- Mitsubishi Electric Corporation

- Magneti Marelli

- Aisin Seiki

- Mikuni Corporation

- Delphi Technologies

- Hitachi Automotive Systems

- Denso Corporation

- Johnson Electric

- Siemens

- Pierburg

- Robert Bosch GmbH

- Visteon Corporation

- Tenneco Inc.

- Daewha