Global Recreational Boating Market Size, Share, Growth Analysis By Boat Type (Sailboats, Yachts, Personal Watercraft (PWC), Inboard Boats, Outboard Boats, Inflatable Boats, Others), By Engine (Diesel, Gas), By Activity Type (Fishing, Watersports, Cruising, Others), By End-User (Commercial, Private), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 140085

- Number of Pages: 207

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

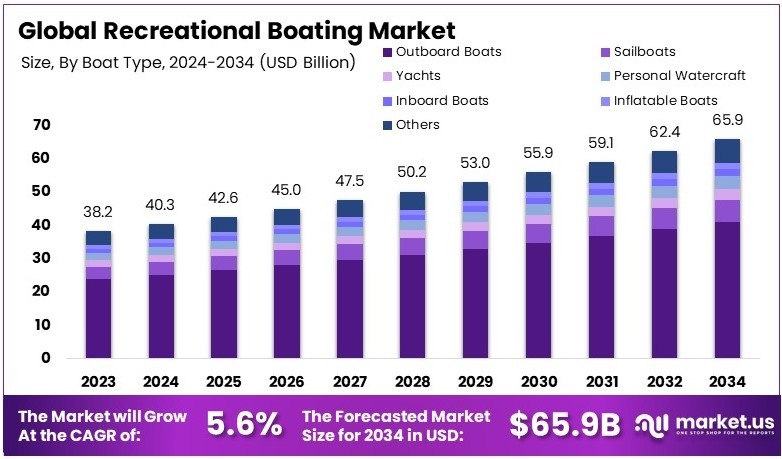

The Global Recreational Boating Market size is expected to be worth around USD 65.9 Billion by 2034, from USD 38.2 Billion in 2024, growing at a CAGR of 5.6% during the forecast period from 2025 to 2034.

Recreational Boating is the activity of using boats for leisure and enjoyment. It includes sailing, motor boating, and yachting. Enthusiasts engage in cruising, fishing, and water sports. The activity is pursued by individuals and families. It provides relaxation, adventure, and social opportunities on lakes, rivers, and coastal waters regularly today.

Recreational Boating Market includes companies that offer boats, accessories, and services. It covers boat sales, rentals, maintenance, and repairs. Firms target leisure and tourism. Providers focus on quality products and reliable support. The market serves customers who seek enjoyable and safe boating experiences on water in different locations every day.

In 2022, the recreational boating industry saw significant growth as 100 million Americans participated in boating activities. This increase reflects broader trends in leisure spending, boosted by rising disposable incomes.

In the same period, outdoor recreation activities attracted 168.1 million participants, which accounts for about 55% of the U.S. population aged six and older. This substantial engagement underscores a growing public interest in outdoor and recreational pursuits, influenced by an improved economic climate and more available leisure time.

Additionally, the popularity of water sports surged by over 9% in 2023, indicating a strong demand within the recreational boating market. This growth is complemented by international marine tourism trends, such as those observed in the Faroe Islands, where visitor numbers doubled to 130,000 in 2023.

This boom in tourism resulted in a doubling of tourism-related income to €125 million, making it account for 6% of the nation’s GDP. These figures highlight the broader economic impact of recreational boating and related activities, demonstrating how they contribute significantly to local economies through tourism and leisure spending.

Moreover, regulatory efforts by government bodies have been pivotal in ensuring the safety and sustainability of boating activities. For instance, the U.S. Coast Guard has implemented stringent regulations requiring all recreational boats to have personal flotation devices for each person onboard.

Many states have also mandated that boat operators undergo safety education courses and obtain a boating license. These regulations not only enhance safety but also encourage responsible boating practices, contributing to the industry’s ongoing competitiveness and market growth.

Key Takeaways

- The Recreational Boating Market was valued at USD 38.2 billion in 2024 and is projected to reach USD 65.9 billion by 2034, with a CAGR of 5.6%.

- In 2024, Outboard Boats dominate the boat type segment with 62.3%, reflecting high consumer preference for agile, performance-driven vessels.

- In 2024, Diesel leads the engine type segment with 74.1%, driven by its efficiency and reliability in powering modern boats.

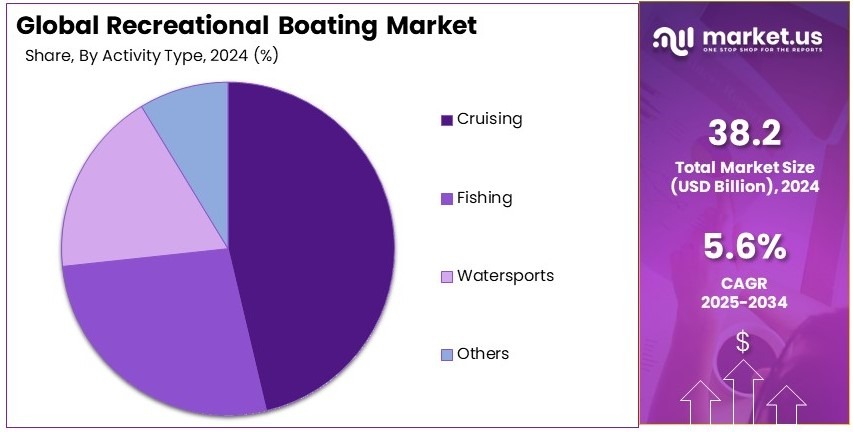

- In 2024, Cruising is the preferred activity, offering leisure experiences that drive demand in the recreational boating segment.

- In 2024, Private Users dominate the end-user segment, underscoring the market’s focus on personalized boating experiences and strong brand loyalty.

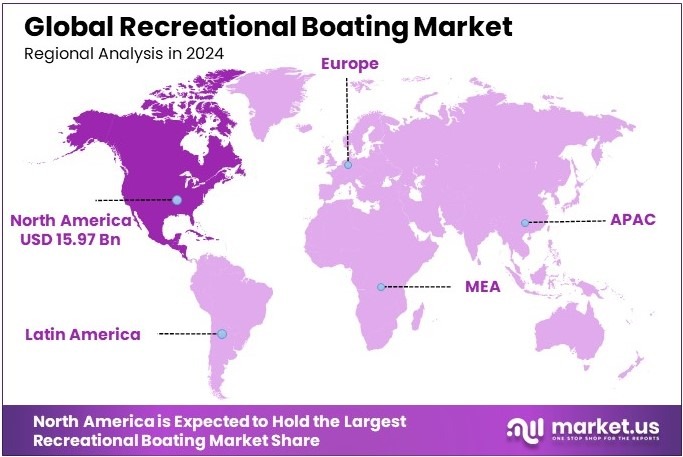

- In 2024, North America leads the regional segment with 41.8%, highlighting its strategic market significance with a USD 15.97 billion value.

Boat Type Analysis

Outboard Boats dominate with 62.3% due to their versatility and ease of maintenance.

Outboard boats are the most popular type in the recreational boating market, primarily because of their ease of use, maintenance, and versatility. They are suitable for a variety of boating activities, from fishing to cruising, making them a top choice for both seasoned boaters and newcomers.

Sailboats offer a more traditional boating experience and are preferred by boating enthusiasts who enjoy the skill and interaction with the environment that sailing requires. They contribute to the market by appealing to a niche segment that values sustainability and the sport of sailing.

Yachts are luxury vessels used for leisure and are typically equipped with sophisticated amenities. They cater to high-end consumers and contribute significantly to the market’s profitability through high initial purchase prices and ongoing maintenance costs.

Personal Watercraft (PWC), such as jet skis, are popular for their adrenaline-pumping action and are favored by younger demographics. They boost market growth by appealing to thrill-seekers.

Inboard boats are chosen for their aesthetic and power, often used in watersports like water skiing and wakeboarding. They have a stable market presence due to their high performance.

Inflatable boats are important for their portability and storage ease, making them ideal for casual boaters and fishermen. They play a critical role in expanding boating access to new users.

Engine Type Analysis

Diesel engines dominate with 74.1% due to their durability and fuel efficiency.

Diesel engines are preferred in the recreational boating market for their long-term durability and efficiency. They are particularly prevalent in larger boats such as yachts, where their ability to provide sustained power and better fuel economy at high loads is invaluable.

Diesel’s dominance is further solidified by its lower maintenance requirements compared to gas engines, making it a favored choice for serious boaters who spend a lot of time on the water.

Gas engines, while less dominant, are still common in smaller boats and personal watercraft where high speed and lighter weights are advantageous. They remain popular due to their lower initial cost and the availability of fuel.

Activity Type Analysis

Cruising dominates the activity type segment due to its popularity among families and casual boaters.

Cruising is a favored activity in recreational boating, appealing widely to families and individuals looking to enjoy leisure time on the water. This activity’s popularity is underpinned by the desire for relaxing and scenic water travel, from short day trips to extended voyages. Cruising‘s dominance is also driven by the availability of boats designed specifically for comfort and durability in varied marine environments.

Fishing is a significant part of the boating market, supported by enthusiasts and sports fishermen who value the accessibility to fishing spots that only boats can provide.

Watersports are increasingly popular, contributing to market growth through the demand for specialized boats like inboard boats and personal watercraft.

End-User Analysis

Private users dominate the market, making up the majority of boat owners.

Private ownership is the largest segment in the end-user category of the recreational boating market. Individuals who own boats for personal and family use constitute the bulk of the market. This segment’s strength lies in the wide range of boating activities available, from fishing to cruising, which attracts a diverse demographic.

Commercial use, while smaller, includes rental services, boating clubs, and training centers. These services are essential for providing access to boating experiences without the commitment of ownership, catering especially to tourists and occasional users.

Key Market Segments

By Boat Type

- Sailboats

- Yachts

- Personal Watercraft (PWC)

- Inboard Boats

- Outboard Boats

- Inflatable Boats

- Others

By Engine

- Diesel

- Gas

By Activity Type

- Fishing

- Watersports

- Cruising

- Others

By End-User

- Commercial

- Private

Driving Factors

Rising Disposable Income and Marine Leisure Drives Market Growth

The recreational boating market enjoys robust momentum from several driving factors. Consumers now have more disposable income and a growing passion for marine leisure. This interest fuels increased spending on boats and related services, while a broader audience discovers the joy of water-based activities.

Boat rental and sharing services further boost market appeal. These cost-effective options let more individuals enjoy boating without full ownership expenses. Rental models offer flexibility and attract younger consumers. In cities and coastal towns, shared boating experiences are consistently growing.

Advancements in boat design, automation, and fuel efficiency drive further expansion. Manufacturers invest in innovative technologies to create safer, faster, and eco-friendly vessels. Modern boats feature improved controls and streamlined engines. These upgrades reduce costs and elevate performance, market appeal.

Increasing participation in water sports and tourism reinforces market growth. Families and adventure seekers enjoy water skiing, jet skiing, and leisure cruises. Tourist destinations and coastal resorts promote boating events and festivals. These experiences create community engagement and boost local economies, further driving demand and interest in recreational boating.

Restraining Factors

High Cost and Environmental Compliance Restraints Market Growth

The recreational boating market faces several restraints that challenge growth. High initial costs discourage new buyers and limit market expansion. Expensive maintenance further adds to the burden. These factors create hesitation among potential customers. The high price barrier makes recreational boating a luxury for many enthusiasts. Overall cost remains prohibitive.

Strict environmental regulations also pose challenges. Marine emission restrictions force boat makers to invest in cleaner technology. These rules increase production costs and slow down innovation. Compliance with environmental laws can be expensive and time-consuming. The focus on reducing emissions sometimes limits design and performance options significantly.

Seasonal dependency impacts demand and usage patterns significantly. In many regions, boating is popular only during warmer months. Off-season periods lead to lower utilization and reduced revenue. This fluctuation makes planning and investment challenging for boat manufacturers and service providers. Business operations must adapt to changing seasonal trends indeed.

A shortage of marina infrastructure further restrains growth. Many key regions lack adequate docking facilities and repair services. Limited access to marinas discourages boat ownership and reduces leisure opportunities. Investment in docking and marina development remains slow. This scarcity hinders expansion and forces enthusiasts to seek alternatives for boat storage.

Growth Opportunities

Smart and Sustainable Innovations Provides Opportunities

The recreational boating market unlocks growth opportunities through smart technologies. Integration of IoT-based monitoring systems improves vessel performance and safety. Boat owners benefit from real-time data on fuel efficiency and engine diagnostics. These digital tools enable proactive maintenance and smoother operations, attracting tech-savvy customers and boosting overall market confidence significantly.

Growth in electric and hybrid boats presents a major opportunity. Eco-friendly vessels reduce emissions and lower fuel costs. Manufacturers focus on sustainable innovations to meet evolving consumer values. This trend attracts environmentally conscious buyers. Electric boats offer quiet operation and sleek design, while hybrid models deliver power and efficiency remarkably.

Expansion of boating clubs and subscription-based ownership models offers new revenue streams. These models lower the entry barrier for enthusiasts. Customers can access premium vessels without full ownership costs. Clubs provide regular maintenance, group events, and expert guidance. This flexible approach appeals to a broad range of recreational users universally.

Increasing demand for luxury and custom-built recreational boats drives further growth. Consumers seek personalized designs and high-end features. Manufacturers respond by offering bespoke options and superior craftsmanship. These luxury vessels combine comfort with performance. Premium models attract affluent buyers looking for unique boating experiences and enhanced leisure time on water.

Emerging Trends

Sustainable and Digital Trends Are Latest Trending Factor

The recreational boating market experiences trending factors that shape its future. Sustainable and solar-powered boats are gaining popularity. These eco-friendly vessels reduce energy costs and lower emissions. Consumers are drawn to environmentally responsible options. The move towards green boating reflects broader trends in renewable energy and sustainable practices across industries.

Advanced GPS and navigation systems enhance boating safety and convenience. Modern devices offer precise location tracking and real-time updates. These technologies improve route planning and reduce risks during voyages. Boaters benefit from enhanced security and navigation. The integration of digital mapping and weather forecasting supports safer journeys on open waters.

Adoption of 3D printing in boat manufacturing introduces lightweight and durable designs. This technology reduces production time and material waste. Custom components are created with precision and speed. Manufacturers can experiment with innovative shapes and structures. 3D printing offers a competitive edge by lowering costs and enhancing product quality significantly.

The growth of online sales channels and virtual showrooms transforms boat purchases. Digital platforms allow customers to view boat specifications and design options. Virtual tours offer immersive experiences from home. This trend expands market reach and simplifies buying processes. Online channels make boat shopping accessible and appealing to modern consumers.

Regional Analysis

North America Dominates with 41.8% Market Share

North America leads the Recreational Boating Market with a 41.8% share, valuing USD 15.97 billion. This dominance is driven by the region’s strong boating culture, high disposable incomes, and extensive coastlines.

The region benefits from advanced manufacturing capabilities and a wide range of boating activities from fishing to yachting. The presence of numerous lakes and favorable weather conditions also contribute to the thriving recreational boating scene.

The future of North America in the global Recreational Boating Market looks promising as more individuals and families are drawn to boating as a leisure activity. The trend towards eco-friendly boats and innovative maritime technology is expected to enhance market growth, potentially increasing North America’s market share.

Regional Mentions:

- Europe: Europe stands strong in the Recreational Boating Market due to its rich maritime heritage and extensive boating facilities. The region is known for its luxury yacht manufacturing and scenic boating destinations, which attract a significant number of boating enthusiasts each year.

- Asia Pacific: Asia Pacific is growing in the Recreational Boating Market, led by increasing wealth in countries like China and Australia. Rising interest in maritime sports and leisure activities supports this growth, making the region a burgeoning market for recreational boats.

- Middle East & Africa: The Middle East and Africa are seeing increased activity in the Recreational Boating Market with the development of coastal tourism and luxury water-related activities. The region’s warm climate and beautiful waterscapes provide ideal conditions for recreational boating.

- Latin America: Latin America is developing in the Recreational Boating Market, driven by its natural beauty and increasing tourism. The region is enhancing its boating infrastructure to better accommodate local and international boaters, fostering growth in this sector.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

In the dynamic Recreational Boating market, four companies stand out as leaders due to their significant contributions and innovations: Brunswick Corporation, Groupe Beneteau, Yamaha Motor Co., Ltd., and Azimut-Benetti Group. These top players are pivotal in setting trends and driving the industry forward globally.

Brunswick Corporation leads with a broad portfolio of boats and marine engines, excelling in both innovation and market penetration. Brunswick’s focus on technology and sustainability in manufacturing has enabled it to offer some of the most reliable and eco-friendly products in the market, appealing to environmentally conscious consumers.

Groupe Beneteau is renowned for its diverse range of sailing and motor boats, which are popular among both casual boaters and sailing enthusiasts. The company’s commitment to quality and design excellence ensures its strong position in various global markets, particularly in Europe.

Yamaha Motor Co., Ltd., primarily known for outboard motors and personal watercraft, continues to excel due to its strong reputation in reliability and performance. Yamaha’s innovations in engine technology and boat design significantly contribute to its competitive edge, especially in Asian and North American markets.

Azimut-Benetti Group, a leader in luxury yachts, sets the standard for high-end recreational boating. Their focus on craftsmanship, advanced technology, and bespoke design caters to the upper echelons of the market, securing their status as a top player in the luxury segment.

These companies not only drive substantial sales and innovation within the Recreational Boating market but also influence industry standards for quality, performance, and sustainability. Their strategies often lead the way in shaping consumer preferences and introducing new technologies. As the market continues to evolve, these key players are expected to remain at the forefront, adapting to changes in consumer behavior and environmental regulations.

Major Companies in the Market

- Brunswick Corporation

- Groupe Beneteau

- Yamaha Motor Co., Ltd.

- Azimut-Benetti Group

- Ferretti Group

- Marine Products Corporation

- Malibu Boats, Inc.

- Polaris Inc.

- Sunseeker International Limited

- HanseYachts AG

- MasterCraft Boat Holdings, Inc.

- Princess Yachts Limited

- Grand Banks Yachts Limited

Recent Developments

- BRP: On October 2024, BRP Inc. announced plans to sell its marine assets, including brands like Alumacraft, Manitou, and Telwater. This strategic move aims to streamline BRP’s focus on core product lines, excluding its Sea-Doo personal watercraft and related pontoons.

- Freedom Boat Club: On December 2024, Freedom Boat Club announced the opening of its second Brisbane location at Rivergate Marina, Murarrie, on January 10, 2025. This expansion reflects the growing demand for membership-based boating experiences, allowing members unlimited access to a diverse fleet without the responsibilities of ownership.

- Arc: On September 2023, electric boat startup Arc raised $70 million in a Series B funding round led by Menlo Ventures, with participation from existing investors like Eclipse Ventures and Andreessen Horowitz. This investment supports Arc’s mission to revolutionize the boating industry with high-performance electric watercraft, including models like the Arc One and Arc Sport.

Report Scope

Report Features Description Market Value (2024) USD 38.2 Billion Forecast Revenue (2034) USD 65.9 Billion CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Boat Type (Sailboats, Yachts, Personal Watercraft (PWC), Inboard Boats, Outboard Boats, Inflatable Boats, Others), By Engine (Diesel, Gas), By Activity Type (Fishing, Watersports, Cruising, Others), By End-User (Commercial, Private) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Brunswick Corporation, Groupe Beneteau, Yamaha Motor Co., Ltd., Azimut-Benetti Group, Ferretti Group, Marine Products Corporation, Malibu Boats, Inc., Polaris Inc., Sunseeker International Limited, HanseYachts AG, MasterCraft Boat Holdings, Inc., Princess Yachts Limited, Grand Banks Yachts Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Global Recreational Boating MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

Global Recreational Boating MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Brunswick Corporation

- Groupe Beneteau

- Yamaha Motor Co., Ltd.

- Azimut-Benetti Group

- Ferretti Group

- Marine Products Corporation

- Malibu Boats, Inc.

- Polaris Inc.

- Sunseeker International Limited

- HanseYachts AG

- MasterCraft Boat Holdings, Inc.

- Princess Yachts Limited

- Grand Banks Yachts Limited