Global Heavy Duty Heat Pump Market Size, Share, Growth Analysis By Type (Air-Water Heat Pumps, Air-Air Heat Pumps, Ground Source Heat Pumps, Hybrid Heat Pumps), By Power Range (5 to 10 MW, 10 to 20 MW, 20 to 40 MW), By End-Use (Residential, Commercial, Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 84441

- Number of Pages: 202

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

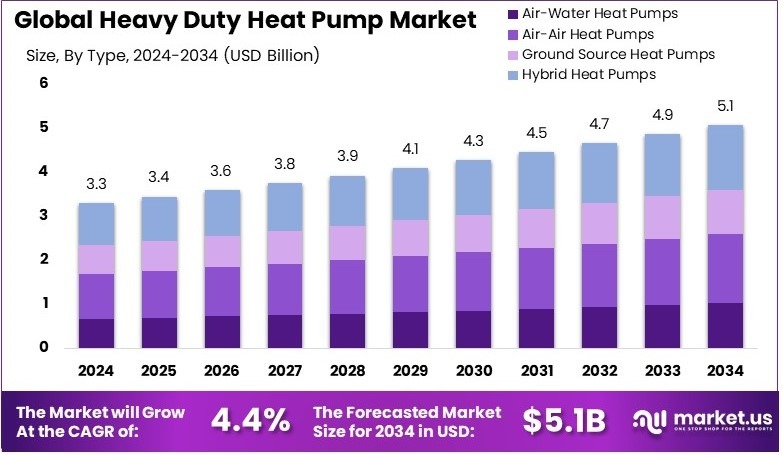

The Global Heavy Duty Heat Pump Market size is expected to be worth around USD 5.1 Billion by 2034, from USD 3.3 Billion in 2024, growing at a CAGR of 4.4% during the forecast period from 2025 to 2034.

A heavy duty heat pump is an industrial-grade system used for heating and cooling large spaces. It transfers heat between the indoors and outdoors efficiently, even under extreme weather conditions, suitable for commercial and industrial applications.

The heavy duty heat pump market encompasses the manufacturing, sale, and distribution of robust heat pump systems for industrial and commercial use. This market serves sectors that require reliable and efficient temperature control solutions.

The heavy-duty heat pump market is growing due to the increasing demand for energy-efficient heating solutions. Heat pumps are three to five times more efficient than traditional heating systems, leading to significant reductions in energy use and costs. For example, using these pumps can cut greenhouse energy consumption by up to 70%, offering substantial savings for industries like agriculture.

Furthermore, the shift towards sustainable energy sources is accelerated by global environmental concerns and stringent regulations. In 2021, low-temperature industrial heating was responsible for 171 million metric tons of CO2 emissions in the United States, which was 3.5% of the total energy-related CO2 emissions. This underscores the impact of heavy-duty heat pumps on reducing carbon footprints across various sectors, thereby driving their adoption and market expansion.

Key Takeaways

- Heavy Duty Heat Pump Market was valued at USD 3.3 Billion in 2024 and is expected to reach USD 5.1 Billion by 2034 with a CAGR of 4.4%.

- In 2024, Air-Air Heat Pumps lead the product segment with 31%, favored for efficient air distribution in cooling applications.

- In 2024, the 10 to 20 MW power range dominates with 35%, reflecting an optimal balance between capacity and energy efficiency.

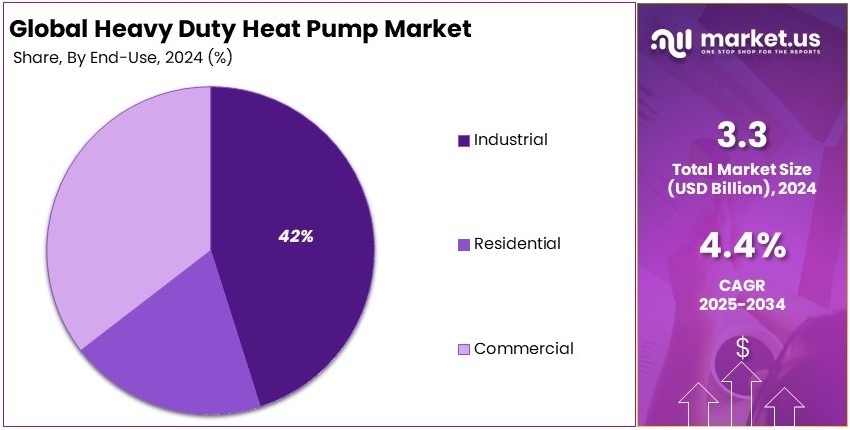

- In 2024, the Industrial End-use leads with 42%, driven by high energy demands and extensive process heating requirements.

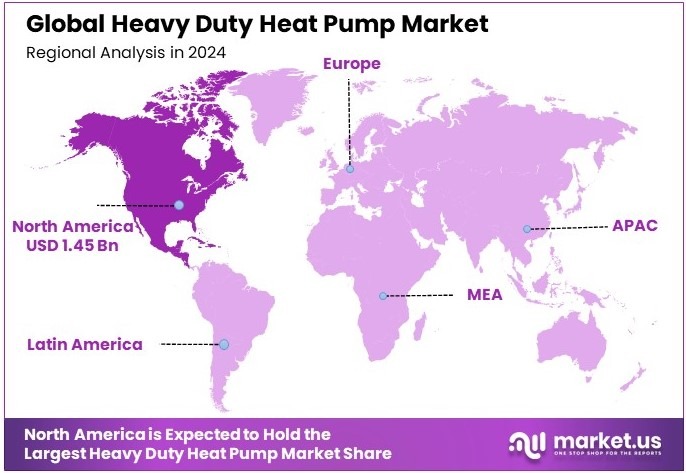

- In 2024, North America dominates with 44% share, contributing approximately USD 1.45 Billion in revenue from heavy-duty installations.

Type Analysis

Air-Air Heat Pumps dominate with 31% due to their versatility and energy efficiency.

The air-air heat pump segment leads the market with a 31% share. Air-air heat pumps are popular because they are both energy-efficient and versatile. These heat pumps work by transferring heat from the outside air to warm or cool indoor spaces. In regions with mild climates, air-air heat pumps are especially effective, as they offer a reliable and cost-effective solution for heating and cooling without needing a complex installation.

Additionally, they require less maintenance compared to other types of heat pumps, which boosts their adoption. This makes air-air heat pumps the go-to option for residential and commercial applications. Their growing adoption is supported by the global push for more energy-efficient, environmentally friendly heating and cooling solutions.

On the contrary, air-water heat pumps and ground source heat pumps, while still important, have smaller market shares. Air-water heat pumps are commonly used in settings where hot water is required in addition to space heating, while ground source heat pumps are more efficient in areas with extreme temperatures.

Hybrid heat pumps, though innovative, represent a niche market, as they combine multiple heat sources to provide a more flexible solution. Nevertheless, their market share remains smaller compared to air-air heat pumps due to their higher cost and complexity.

Power Range Analysis

10 to 20 MW dominates with 35% due to its applicability in large industrial and commercial projects.

The power range of 10 to 20 MW holds the largest market share at 35%. This segment is primarily driven by large-scale industrial and commercial applications, where substantial heating or cooling capacities are required. Industrial facilities, such as manufacturing plants, often require heat pumps with high power output to maintain the necessary environmental conditions for operations.

Similarly, large commercial construction like shopping malls or office complexes also benefit from heat pumps in this power range, offering reliable temperature regulation over large areas.

As the demand for energy-efficient solutions in industrial sectors increases, heat pumps in this range provide an optimal balance between capacity, efficiency, and cost-effectiveness. These factors contribute to the dominance of the 10 to 20 MW power range in the heavy-duty heat pump market.

In contrast, the 5 to 10 MW power range, while still significant, caters more to medium-sized businesses or smaller industrial setups. Heat pumps in this range are ideal for smaller commercial buildings or facilities that do not require large-scale energy solutions.

The 20 to 40 MW range, on the other hand, is used for extremely large-scale operations, though it accounts for a smaller portion of the market. These high-capacity heat pumps are often used in industries with heavy energy demands but are not as commonly needed as the 10 to 20 MW options.

End-Use Analysis

Industrial dominates with 42% due to its widespread application across manufacturing and energy sectors.

The industrial end-use segment holds the largest market share at 42%. Heat pumps in industrial applications are essential for regulating temperatures in manufacturing processes, maintaining consistent working conditions, and supporting energy production.

Industries like chemicals, steel, and pharmaceuticals require significant energy for their operations, making heat pumps a vital component for reducing energy consumption and costs. The increasing focus on sustainability and energy efficiency within these industries drives the adoption of heavy-duty heat pumps, as they reduce operational costs while meeting stringent environmental regulations.

The growing trend toward industrial decarbonization further accelerates the demand for efficient heating and cooling systems, including heat pumps, in large-scale industrial applications.

Meanwhile, the commercial segment is steadily growing, as businesses look for energy-efficient solutions to reduce overhead costs. Commercial buildings such as offices, hotels, and retail spaces often rely on heat pumps for their heating, ventilation, and air conditioning (HVAC) systems.

While they represent a smaller share of the market compared to industrial applications, their growth prospects remain strong due to increasing awareness of energy-saving solutions. The residential market, although smaller in comparison, still holds relevance, particularly in regions where heat pumps are being integrated into residential energy efficiency programs.

Key Market Segments

By Type

- Air-Water Heat Pumps

- Air-Air Heat Pumps

- Ground Source Heat Pumps

- Hybrid Heat Pumps

By Power Range

- 5 to 10 MW

- 10 to 20 MW

- 20 to 40 MW

By End-Use

- Residential

- Commercial

- Industrial

Driving Factors

Rising Demand for Energy-Efficient Heating and Cooling Solutions Drives Market Growth

The increasing demand for energy-efficient heating and cooling solutions is a significant factor driving the growth of the heavy-duty heat pump market. As energy consumption and environmental concerns continue to rise, consumers and businesses are seeking more sustainable alternatives. Heat pumps offer a highly efficient solution for both heating and cooling needs, making them a preferred choice for many sectors.

The adoption of renewable energy sources is further accelerating the integration of heat pumps. Many heat pumps are now designed to work seamlessly with solar or wind energy, providing a clean and cost-effective alternative to traditional heating and cooling systems.

In addition, stringent environmental regulations are encouraging the use of low-emission alternatives like heat pumps, driving their popularity in residential, commercial, and industrial applications.

Furthermore, the growing need for heating solutions in industrial and commercial sectors, which require reliable, energy-efficient systems, contributes to the expansion of the market. This combination of energy efficiency, renewable energy integration, and regulatory support is significantly boosting the demand for heavy-duty heat pumps.

Restraining Factors

High Installation Costs and Limited Awareness Restrain Market Growth

Despite their advantages, several factors hinder the widespread adoption of heavy-duty heat pumps. One of the main restraints is the high initial installation cost when compared to traditional heating and cooling systems. The upfront investment required for a heat pump system can be a deterrent for many potential customers, especially in price-sensitive markets.

Additionally, there is limited awareness regarding heat pump technology in certain regions, which slows market adoption. Many consumers and businesses are not familiar with the benefits of heat pumps, and the lack of education around this technology creates a barrier to entry.

The complexity of installation and integration with existing systems also presents challenges. Installing a heat pump often requires significant modifications to existing infrastructure, which can be time-consuming and costly. Moreover, heat pumps may face variability in performance in extreme climatic conditions, making them less effective in certain environments and reducing their attractiveness to potential buyers.

Growth Opportunities

Expansion and Innovation Provide Market Growth Opportunities

The heavy-duty heat pump market presents significant growth opportunities through expansion and innovation. One key opportunity is the expansion into emerging markets with developing infrastructure. As these regions continue to grow and modernize, there is an increasing need for energy-efficient solutions in both residential and commercial sectors.

Another growth opportunity lies in the innovation of hybrid heat pump systems that integrate renewable energy sources. These systems combine the efficiency of heat pumps with the sustainability of solar or wind energy, offering enhanced performance and environmental benefits.

The integration of advanced digital controls is also a promising avenue for increasing efficiency and providing users with better management capabilities.

In addition, the growing demand for sustainable construction is driving the adoption of heat pumps. As more buildings are designed with energy efficiency in mind, heat pumps are becoming an integral part of green building standards, further expanding the market’s reach.

Emerging Trends

Smart Controls and Technological Advancements Are Latest Trending Factors

The latest trends in the heavy-duty heat pump market revolve around smart controls and technological advancements that enhance user experience and system performance. The integration of IoT-based smart controls is gaining traction, allowing users to monitor and control their heat pump systems remotely, resulting in better energy management and convenience.

Advancements in low-temperature heat pump technology are also a key trend. These innovations allow heat pumps to function efficiently even in colder climates, broadening their applicability in regions with lower temperatures.

Additionally, there is a growing focus on noise reduction and improving system aesthetics, making heat pumps more appealing for residential and commercial installations. Finally, collaboration between manufacturers and governments for policy-driven incentives is emerging as an important trend.

Regional Analysis

North America Dominates with 44% Market Share in the Heavy Duty Heat Pump Market

North America leads the heavy-duty heat pump market with a significant 44% share, valued at USD 1.45 billion. This dominance is driven by the region’s strong focus on energy efficiency, widespread adoption of renewable energy solutions, and growing demand for sustainable heating and cooling technologies in both residential and commercial sectors. North America’s market presence is also bolstered by the push for green building standards and energy-saving incentives.

The key factors driving North America’s dominant market share include robust government incentives for energy-efficient technologies, particularly in the U.S. and Canada. Tax credits, rebates, and policies supporting energy-efficient systems are encouraging consumers and businesses to invest in heat pumps.

Additionally, the increasing focus on sustainability and reducing carbon footprints is a major contributor. Energy-efficient heat pumps are seen as a long-term solution for reducing operational costs in both residential and commercial buildings.

Further, technological advancements in heat pump systems, including improvements in efficiency, reliability, and noise reduction, are boosting their adoption. The region’s advanced infrastructure and high rate of urbanization support the installation and integration of these systems, further driving growth.

Regional Mentions:

- Europe: Europe is expanding rapidly in the heavy-duty heat pump market, supported by ambitious energy efficiency targets and a strong regulatory framework. Countries like Germany and Sweden are at the forefront, with government incentives driving adoption in both residential and commercial sectors.

- Asia Pacific: Asia Pacific is seeing an increasing demand for energy-efficient heating and cooling solutions, particularly in countries like Japan and South Korea. Rising urbanization and government mandates on energy efficiency are key growth drivers in the region.

- Middle East & Africa: The Middle East and Africa are slowly adopting heavy-duty heat pumps, particularly in the commercial sector, as countries push for sustainable development and green technologies. However, the market remains in its early stages compared to other regions.

- Latin America: Latin America is gradually recognizing the benefits of energy-efficient heat pumps, especially in countries like Brazil and Mexico. As awareness of renewable energy solutions grows, the demand for sustainable heating and cooling options is expected to increase.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The heavy-duty heat pump market is driven by several key players who provide cutting-edge solutions for industrial and commercial applications. Atlas Copco AB, GEA Group Aktiengesellschaft, Johnson Controls, and MAN Energy Solutions are among the top players, contributing significantly to the market’s growth and technological advancements.

Atlas Copco AB stands out as a leader in the heavy-duty heat pump market due to its diverse product portfolio and extensive expertise in energy-efficient solutions. The company offers innovative heat pump technologies that cater to large-scale industrial applications. Atlas Copco’s strong commitment to sustainability and energy efficiency positions it as a dominant player in this market.

GEA Group Aktiengesellschaft is another prominent player, known for providing energy-efficient solutions in various sectors, including the heavy-duty heat pump market. GEA’s heat pump systems are widely used in the food and beverage industry, where energy efficiency and sustainability are key considerations. The company’s advanced technologies and robust R&D capabilities continue to strengthen its position in the market.

Johnson Controls is a global leader in building technology, and its heavy-duty heat pumps are used in a variety of industrial and commercial applications. With a focus on energy conservation and smart building systems, Johnson Controls has made significant advancements in integrating heat pump technology with sustainable building practices. Its broad reach and strong market presence make it a key player in this segment.

MAN Energy Solutions is renowned for its industrial-grade heat pump systems. With an emphasis on high-performance solutions, MAN Energy Solutions provides tailored heat pump systems for energy-intensive industries, including chemicals, food processing, and district heating. The company’s expertise in energy management and renewable energy solutions further solidifies its role as a leader in the market.

Together, these companies are driving innovation in the heavy-duty heat pump market. Their focus on sustainability, energy efficiency, and industrial applications continues to shape the market and position them for future growth.

Major Companies in the Market

- Atlas Copco AB

- GEA Group Aktiengesellschaft

- Johnson Controls

- MAN Energy Solutions

- Oilon Group Oy

- OCHSNER

- Piller Blowers & Compressors GmbH

- Qvantum Energi AB

- Siemens Energy

- Swegon Ltd

- Trane Technologies International Limited

- Turboden S.p.A.

- Dalrada Climate Technology

Recent Developments

- Carrier Global and Viessmann Climate Solutions: In January 2024, Carrier Global Corporation finalized its €12 billion acquisition of Viessmann Climate Solutions, a leading German manufacturer of heating and refrigeration systems. This strategic move aims to enhance Carrier’s position in the European heat pump market, expanding its portfolio with Viessmann’s advanced technologies.

- Quatt: In July 2024, Amsterdam-based smart heat pump specialist Quatt announced the successful raising of €25 million in a growth equity funding round led by Blue Earth Capital. The investment is intended to support the development of new products and facilitate international expansion, reflecting increasing demand for energy-efficient heating solutions.

Report Scope

Report Features Description Market Value (2024) USD 3.3 Billion Forecast Revenue (2034) USD 5.1 Billion CAGR (2025-2034) 4.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Air-Water Heat Pumps, Air-Air Heat Pumps, Ground Source Heat Pumps, Hybrid Heat Pumps), By Power Range (5 to 10 MW, 10 to 20 MW, 20 to 40 MW), By End-Use (Residential, Commercial, Industrial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Atlas Copco AB, GEA Group Aktiengesellschaft, Johnson Controls, MAN Energy Solutions, Oilon Group Oy, OCHSNER, Piller Blowers & Compressors GmbH, Qvantum Energi AB, Siemens Energy, Swegon Ltd, Trane Technologies International Limited, Turboden S.p.A., Dalrada Climate Technology Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Heavy Duty Heat Pump MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

Heavy Duty Heat Pump MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Atlas Copco AB

- GEA Group Aktiengesellschaft

- Johnson Controls

- MAN Energy Solutions

- Oilon Group Oy

- OCHSNER

- Piller Blowers & Compressors GmbH

- Qvantum Energi AB

- Siemens Energy

- Swegon Ltd

- Trane Technologies International Limited

- Turboden S.p.A.

- Dalrada Climate Technology