Global Aloe Vera Extracts Market Size, Share, And Business Benefits By Product (Liquid, Capsules or Tablets, Powder, Gels, Others), By Application (Cosmetics, Food and Beverages, Pharmaceuticals, Others), By Distribution Channel (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: May 2025

- Report ID: 149133

- Number of Pages: 366

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

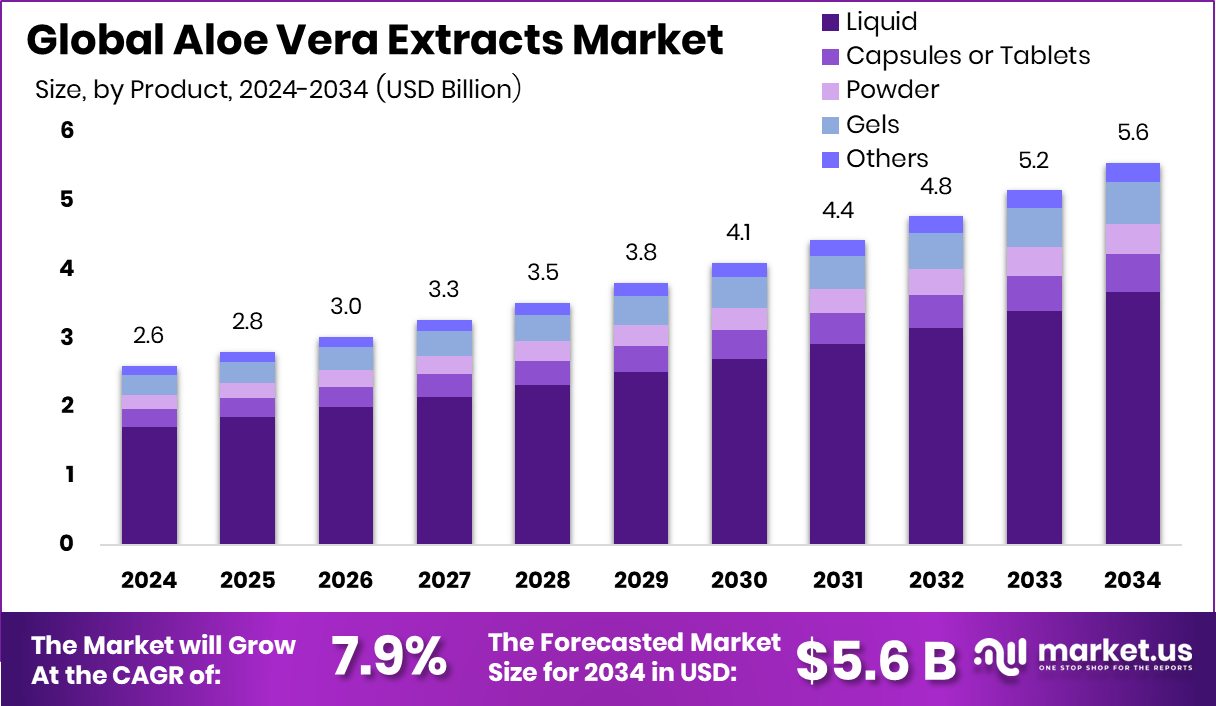

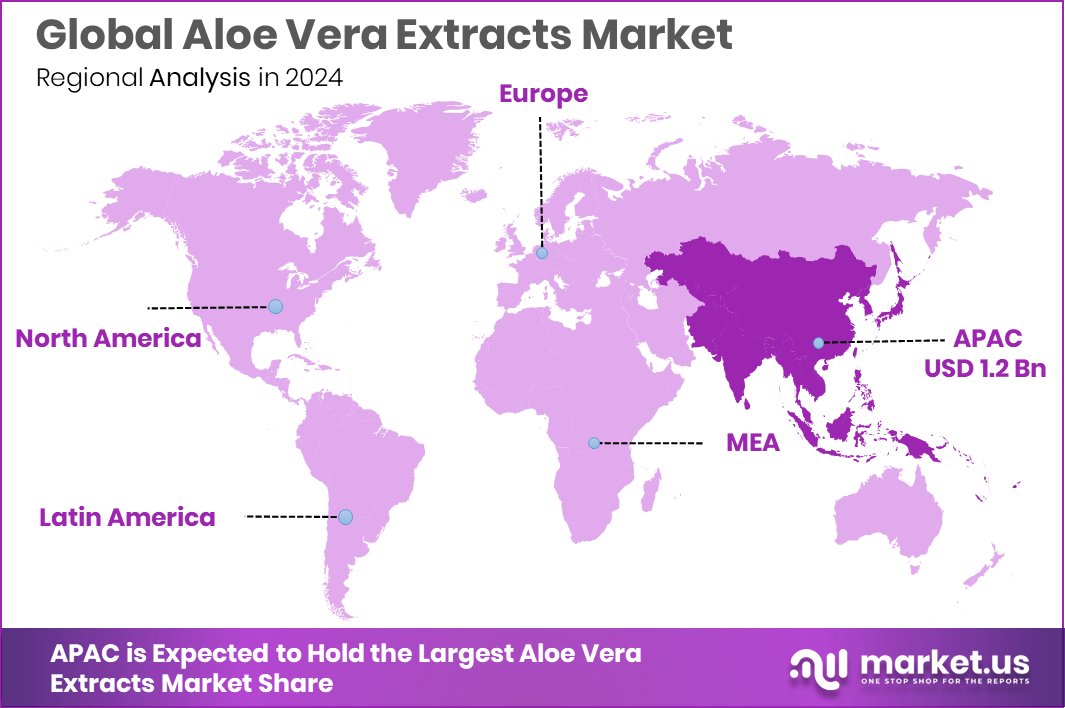

Global Aloe Vera Extracts Market is expected to be worth around USD 5.6 billion by 2034, up from USD 2.6 billion in 2024, and grow at a CAGR of 7.9% from 2025 to 2034. Aloe Vera Extracts in Asia-Pacific valued at USD 1.2 Bn, holding 46.8%.

Aloe vera extracts are concentrated substances derived from the leaves of the aloe vera plant, known for their soothing, healing, and moisturizing properties. These extracts can be in the form of gel, powder, or liquid and are widely used in personal care, food, and pharmaceutical products. The gel inside the aloe leaf contains bioactive compounds like vitamins, enzymes, amino acids, and antioxidants that contribute to its therapeutic value.

The aloe vera extracts market revolves around the cultivation, processing, and commercial use of aloe-based products across multiple industries. This market includes producers, processors, formulators, and end-use companies in sectors such as cosmetics, food and beverages, nutraceuticals, and medicines.

Growing consumer interest in plant-based and organic products is pushing the demand for aloe extracts. The market spans across different forms like gel, powder, and capsules, each catering to specific applications such as skincare, health drinks, or herbal medicines. As per an industry report, Aloe vera farming qualifies for a 30% subsidy on total cultivation costs under the National Medicinal Plants Board (NMPB) and NAM schemes.

Rising awareness about natural skincare and wellness is driving the growth of aloe vera extracts. People are increasingly looking for chemical-free products, and aloe fits perfectly into this shift. Moreover, the extract’s antibacterial and anti-inflammatory benefits are prompting its inclusion in a wide variety of personal care items. Continuous innovation in herbal formulations is also broadening their use across functional foods and beverages.

Key Takeaways

- Global Aloe Vera Extracts Market is expected to be worth around USD 5.6 billion by 2034, up from USD 2.6 billion in 2024, and grow at a CAGR of 7.9% from 2025 to 2034.

- In the Aloe Vera Extracts Market, the liquid form dominated with a 66.9% share due to versatile applications.

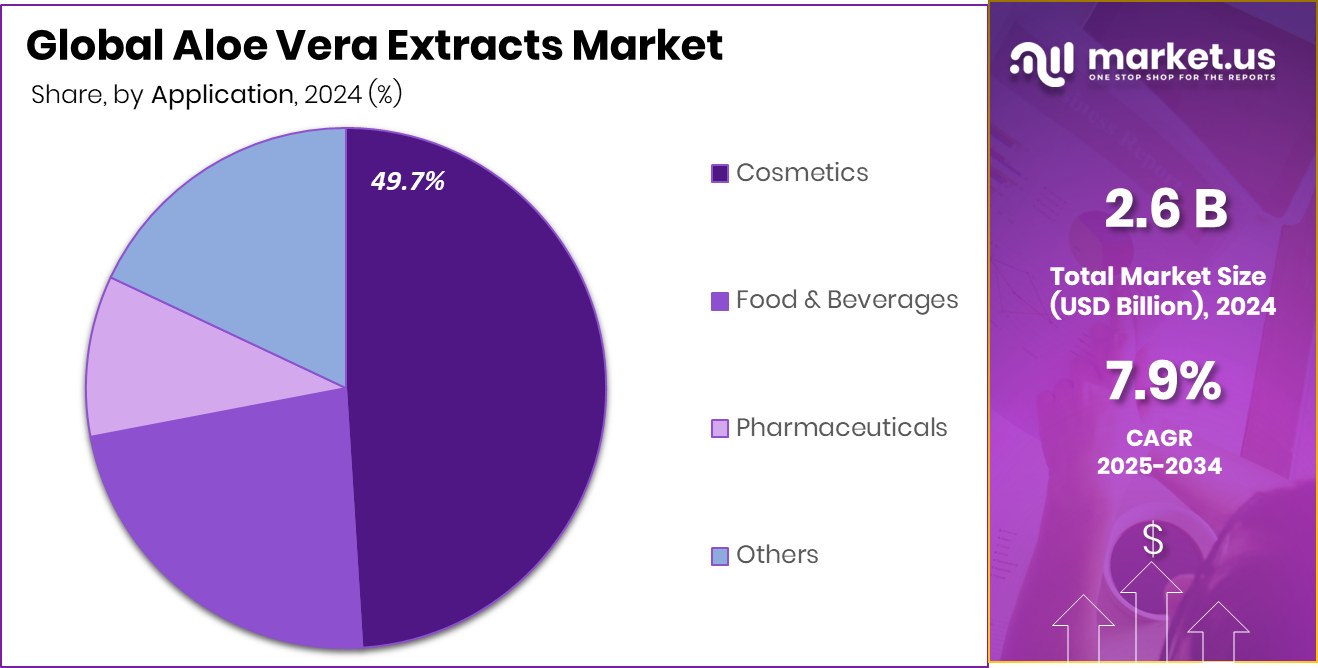

- Cosmetics led the application segment, holding 49.7% share, driven by rising natural skincare product demand.

- Offline distribution channel captured 66.1% share, supported by strong retail presence and consumer trust in in-store purchases.

- Asia-Pacific leads the Aloe Vera Extracts Market with 46.8% share, generating USD 1.2 Bn.

By Product Analysis

In 2024, Liquid held 66.9% in the Aloe Vera Extracts Market by Product.

In 2024, Liquid held a dominant market position in the By Product segment of the Aloe Vera Extracts Market, with a 66.9% share. This leading share is primarily attributed to the widespread use of liquid aloe vera extracts in personal care, cosmetic formulations, and health beverages.

Liquid extracts are easy to blend into lotions, creams, juices, and gels, making them the preferred form among manufacturers. The high water content in aloe vera naturally lends itself to liquid processing, preserving the plant’s bioactive properties more effectively compared to other forms.

Consumers often favor liquid extracts due to their direct application ease, whether for skincare routines or oral intake. The rising trend of natural hydration and detox products has also fueled the demand for liquid-based aloe vera drinks, which are promoted for digestive and skin benefits.

Additionally, the liquid form is commonly used in spa and treatments, further supporting its commercial appeal. With the clean-label movement gaining traction, companies are introducing aloe-infused liquid products with minimal additives, appealing to health-conscious buyers.

By Application Analysis

Cosmetics application dominated with a 49.7% share in the Aloe Vera Extracts Market segment.

In 2024, Cosmetics held a dominant market position in the By Application segment of the Aloe Vera Extracts Market, with a 49.7% share. This significant share is driven by the strong integration of aloe vera extracts in skincare and personal care products, where the ingredient is valued for its moisturizing, soothing, and anti-inflammatory benefits. From facial creams and body lotions to sunburn relief gels and aftershave balms, aloe vera’s natural healing properties have made it a staple in cosmetic formulations worldwide.

The growing consumer shift toward herbal and chemical-free beauty products has reinforced the preference for aloe-infused cosmetics. In particular, its ability to support hydration and calm skin irritations has made it a favored component in products targeting sensitive skin. As beauty trends evolve toward clean and sustainable ingredients, aloe vera’s plant-based origin adds market credibility and appeal.

The cosmetic industry’s constant innovation in product development, such as aloe-based sheet masks, mists, and under-eye gels, continues to drive volume demand for aloe extracts. With a 49.7% share in 2024, the cosmetic application segment not only dominates the aloe vera extracts market but also signals strong future potential as skincare routines become increasingly centered around natural and functional botanical ingredients.

By Distribution Channel Analysis

Offline channel led distribution with 66.1% in the Aloe Vera Extracts Market globally.

In 2024, Offline held a dominant market position in the By Distribution Channel segment of the Aloe Vera Extracts Market, with a 49.7% share. This dominance is largely due to consumer preference for physically inspecting health and beauty products before purchase, especially those related to skincare, wellness, and dietary supplements.

Pharmacies, specialty stores, supermarkets, and cosmetic outlets continue to be trusted points of sale, where shoppers can verify product authenticity, examine labels, and receive in-person recommendations.

Offline channels also benefit from the established presence of aloe vera-based products in traditional retail spaces, where regular promotions and personal consultations enhance consumer engagement. Many consumers still associate offline buying with higher reliability for herbal and natural products, particularly in regions where e-commerce penetration remains moderate.

Additionally, wellness-focused retailers and health stores have played a key role in expanding aloe extract product visibility across urban and semi-urban areas. Product demonstrations and sampling initiatives in stores further influence purchase behavior.

Key Market Segments

By Product

- Liquid

- Capsules or Tablets

- Powder

- Gels

- Others

By Application

- Cosmetics

- Food and Beverages

- Pharmaceuticals

- Others

By Distribution Channel

- Offline

- Online

Driving Factors

Rising Demand for Natural Skincare Products Globally

One of the main factors driving the aloe vera extracts market is the growing demand for natural skincare products across the world. People are becoming more aware of what they apply to their skin and are shifting away from chemical-based creams and lotions. Aloe vera is well-known for its gentle and soothing properties, which makes it a top choice for moisturizers, sunburn relief, and anti-aging products.

As more consumers look for herbal and organic alternatives, aloe vera is becoming a preferred ingredient in cosmetic formulations. This rising trend is especially strong in countries with hot climates, where skin hydration is a common concern. The clean-label movement is also boosting aloe vera’s popularity in the beauty market.

Restraining Factors

Lack of Standardization in Aloe Vera Extracts

A major factor holding back the aloe vera extracts market is the lack of proper standardization across products. Many aloe vera-based items available in the market vary in purity, quality, and strength. Some contain very little real aloe extract, while others may have added chemicals that reduce their natural value.

This inconsistency creates confusion among consumers and affects trust in aloe-based products. Without clear labeling and uniform standards, buyers often struggle to identify which products are genuine. It also becomes difficult for companies to meet international regulatory requirements.

This issue is especially challenging for exports and medical applications, where high-quality assurance is necessary. As a result, the market growth slows down due to uncertainty and weak product credibility.

Growth Opportunity

Expanding Use in Functional Food and Beverages

A major growth opportunity for the aloe vera extracts market lies in its increasing use in functional food and beverage products. Aloe vera is now being added to juices, smoothies, energy drinks, and even snacks due to its digestive and immune-boosting benefits.

As more people look for natural ways to stay healthy, aloe-infused consumables are gaining attention. Its refreshing taste, combined with health perks, makes it ideal for daily wellness drinks. Food companies are also exploring innovative formats like aloe water and aloe yogurt.

With rising health awareness and a push for clean-label ingredients, the food and beverage industry is opening new doors for aloe vera extracts, especially among younger, health-conscious consumers looking for everyday functional nutrition.

Latest Trends

Growing Popularity of Aloe-Infused Functional Beverages

A notable trend in the aloe vera extracts market is the increasing incorporation of aloe vera into functional beverages. Consumers are showing a growing interest in health drinks that offer natural benefits, and aloe vera is gaining attention for its potential digestive and skin health properties.

This shift is influenced by the broader movement towards clean-label products and plant-based wellness solutions. As a result, beverage companies are exploring innovative ways to include aloe vera in their product lines, such as aloe-infused waters, juices, and smoothies.

This trend is particularly evident in regions like Asia-Pacific, where traditional herbal remedies are being integrated into modern health products. The appeal of aloe vera in beverages lies in its refreshing taste and perceived health benefits, aligning with consumer desires for natural and functional ingredients in their diets.

Regional Analysis

In Asia-Pacific, Aloe Vera Extracts reached 46.8% market share, worth USD 1.2 Bn.

In 2024, Asia-Pacific held the dominant position in the global Aloe Vera Extracts Market, accounting for 46.8% of the total share, valued at USD 1.2 billion. This strong regional performance is largely driven by high consumer awareness of herbal remedies, widespread use of aloe vera in traditional medicine, and growing demand in cosmetics and functional beverages.

North America and Europe followed with steady demand for aloe-based skincare and dietary supplements, driven by consumer preference for clean-label, plant-derived ingredients. In these regions, aloe vera extracts are prominently featured in anti-aging creams, organic drinks, and digestive wellness products.

Meanwhile, the Middle East & Africa region witnessed gradual adoption, supported by increasing awareness and rising investments in natural cosmetics. Latin America showed emerging growth potential due to the expansion of aloe farming and interest in botanical ingredients.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Foodchem International Corporation, based in Shanghai, China, has established itself as a prominent supplier of food ingredients, including aloe vera extracts. Their extensive product portfolio caters to various industries, such as food and beverages, pharmaceuticals, and cosmetics. Foodchem’s commitment to quality and innovation has enabled it to meet the diverse needs of clients worldwide, contributing to its strong presence in the market.

Lily of the Desert Organic, headquartered in the United States, is renowned for its organic aloe vera products. The company emphasizes the purity and efficacy of its offerings, which include juices and gels derived from whole leaf and inner fillet aloe vera. Their focus on organic cultivation and processing methods aligns with the growing consumer demand for natural and health-promoting products, solidifying their position in the North American market.

Natural Aloe de Costa Rica, located in Costa Rica, leverages the country’s favorable climate for aloe cultivation. The company specializes in producing high-quality aloe vera extracts, supplying raw materials to various sectors, including cosmetics and nutraceuticals. Their strategic location and dedication to sustainable farming practices have made them a reliable source of premium aloe vera extracts in the Latin American region.

Top Key Players in the Market

- Agromayal Botanica S.A. de C.V.

- Aloe Global

- Aloe Jaumave S.A de C.V

- Aloe Laboratories

- Aloe Queen Inc.

- Aloecorp

- Ashland LLC.

- Calmino Group AB

- Concentrated Aloe Corporation

- Foodchem International Corporation

- Lily of the Desert Organic

- Natural Aloe de Costa Rica

- NaturAloe

- Rahn USA Corp.

- Terry Laboratories, L.L.C.

Recent Developments

- In December 2024, Aloecorp Inc. completed the acquisition of Pharmachem Innovations, LLC’s Aloe Vera division. This move brought a modern processing unit into Aloecorp’s operations, raising their total facility count in Mexico to three. With this addition, the company significantly boosted its production capabilities to meet rising global demand for premium Aloe Vera extracts, further solidifying its leadership in the industry.

- In February 2025, Ashland unveiled a new skincare ingredient named Collapeptyl at the PCHi event in China. This innovative product is a hyalopeptide hybrid designed to mimic and boost 20 types of the skin’s collagen ecosystem, aiming to provide “instant glass-like, glowy skin.”

Report Scope

Report Features Description Market Value (2024) USD 2.6 Billion Forecast Revenue (2034) USD 5.6 Billion CAGR (2025-2034) 7.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Liquid, Capsules or Tablets, Powder, Gels, Others), By Application (Cosmetics, Food and Beverages, Pharmaceuticals, Others), By Distribution Channel (Offline, Online) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Agromayal Botanica S.A. de C.V., Aloe Global, Aloe Jaumave S.A de C.V, Aloe Laboratories, Aloe Queen Inc., Aloecorp, Ashland LLC., Calmino Group AB, Concentrated Aloe Corporation, Foodchem International Corporation, Lily of the Desert Organic, Natural Aloe de Costa Rica, NaturAloe, Rahn USA Corp., Terry Laboratories, L.L.C. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Agromayal Botanica S.A. de C.V.

- Aloe Global

- Aloe Jaumave S.A de C.V

- Aloe Laboratories

- Aloe Queen Inc.

- Aloecorp

- Ashland LLC.

- Calmino Group AB

- Concentrated Aloe Corporation

- Foodchem International Corporation

- Lily of the Desert Organic

- Natural Aloe de Costa Rica

- NaturAloe

- Rahn USA Corp.

- Terry Laboratories, L.L.C.