Global Pasta Sauce Market Size, Share and Future Trends Analysis Report By Product Type (Tomato-Based Sauces, Pesto-Based Sauces, Alfredo-Based Sauces), By Packaging Type (Glass Bottles, PET, Cans, Pouches, Cartons), By Distribution Channel (Supermarkets, Specialty Stores, Convenience Stores, Online Retailing, Others) , Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 148740

- Number of Pages: 233

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

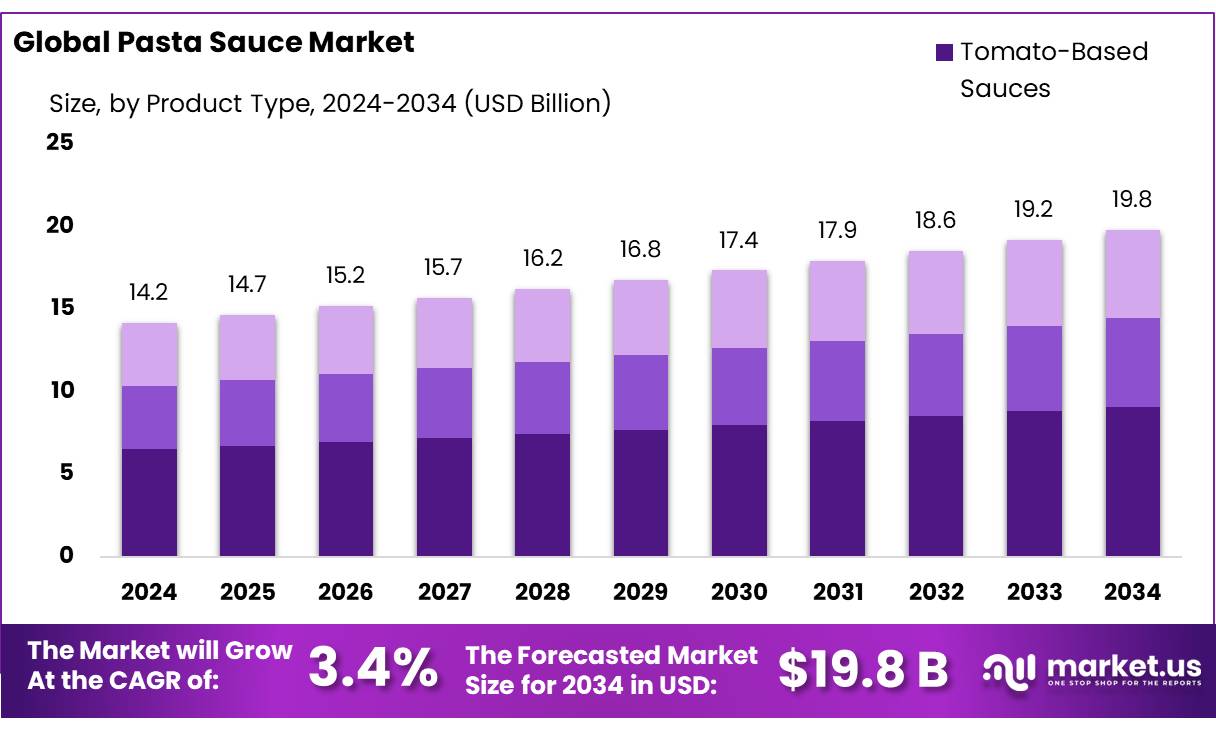

The Global Pasta Sauce Market size is expected to be worth around USD 19.8 Billion by 2034, from USD 14.2 Billion in 2024, growing at a CAGR of 3.4% during the forecast period from 2025 to 2034.

Pasta sauce concentrates, primarily derived from processed tomatoes, play a pivotal role in India’s food processing industry, catering to both domestic consumption and export markets. India, being the second-largest producer of tomatoes globally, is projected to produce approximately 21.54 million tonnes in the 2024–25 season, marking a 1% increase from the previous year. This abundant production provides a robust foundation for the pasta sauce concentrate sector, ensuring a steady supply of raw materials.

The industrial landscape for pasta sauce concentrates is further bolstered by significant government initiatives aimed at enhancing the food processing sector. The Pradhan Mantri Formalisation of Micro Food Processing Enterprises (PMFME) scheme, launched with a budget of ₹10,000 crore and extended to 2025–26, offers credit-linked subsidies, shared infrastructure, and targeted support through the One District One Product (ODOP) framework. This scheme emphasizes formalizing the micro food processing sector, thereby boosting the productivity and competitiveness of Micro, Small, and Medium Enterprises (MSMEs).

In addition, the Production Linked Incentive Scheme for Food Processing Industry (PLISFPI), approved with an outlay of ₹10,900 crore, aims to support the creation of global food manufacturing champions and promote Indian brands of food products. This scheme provides financial incentives to food manufacturing entities that meet specified sales and investment criteria, thereby encouraging expansion and modernization within the sector.

State-level initiatives complement these national programs. For instance, Uttar Pradesh has set a target to increase the processing of horticultural produce from 6% to 20% by 2027, with an investment of ₹11,000 crore to develop mega food processing units and enhance infrastructure under the PMFME scheme . Similarly, Delhi is expanding its incubation infrastructure to support micro food enterprises, establishing two incubation centers with ₹4.5 crore funding from the Union Food Processing Industries Ministry.

Key Takeaways

- Pasta Sauce Market size is expected to be worth around USD 19.8 Billion by 2034, from USD 14.2 Billion in 2024, growing at a CAGR of 3.4%.

- Tomato-Based Sauces held a dominant market position, capturing more than a 45.9% share of the pasta sauce.

- Glass Bottles held a dominant market position in pasta sauce packaging, capturing more than a 38.6% share.

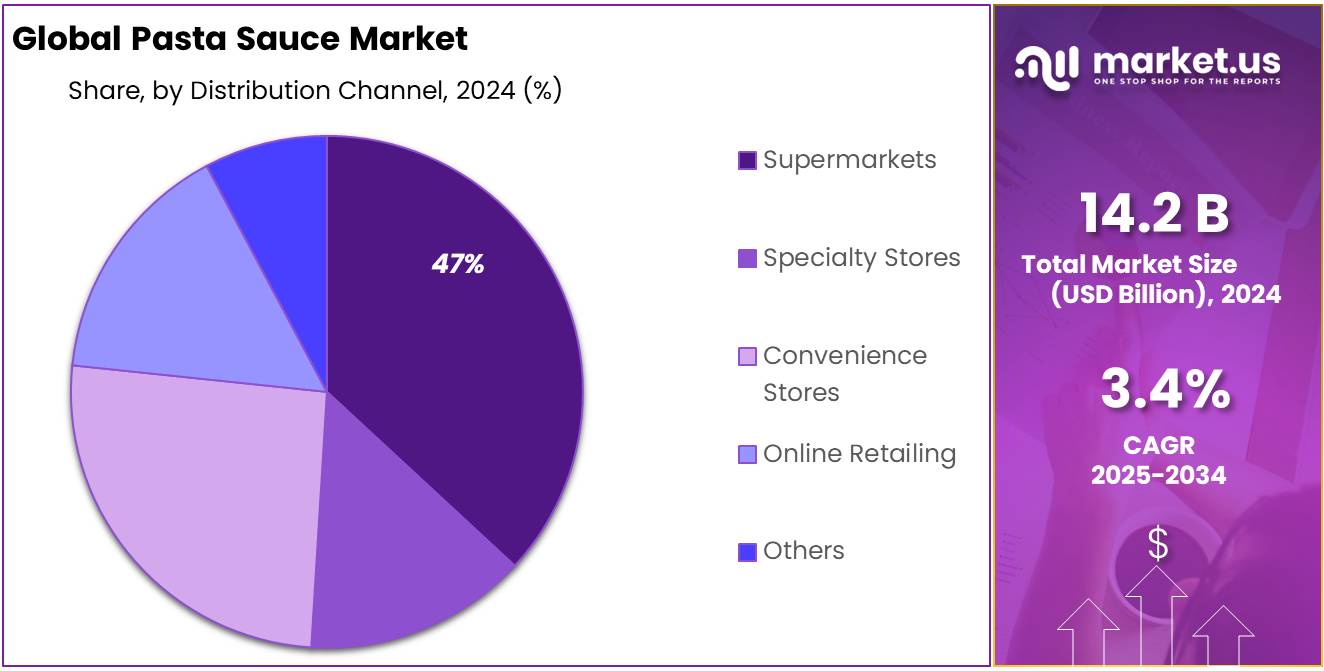

- Supermarkets held a dominant market position in pasta sauce distribution, capturing more than a 47.4% share.

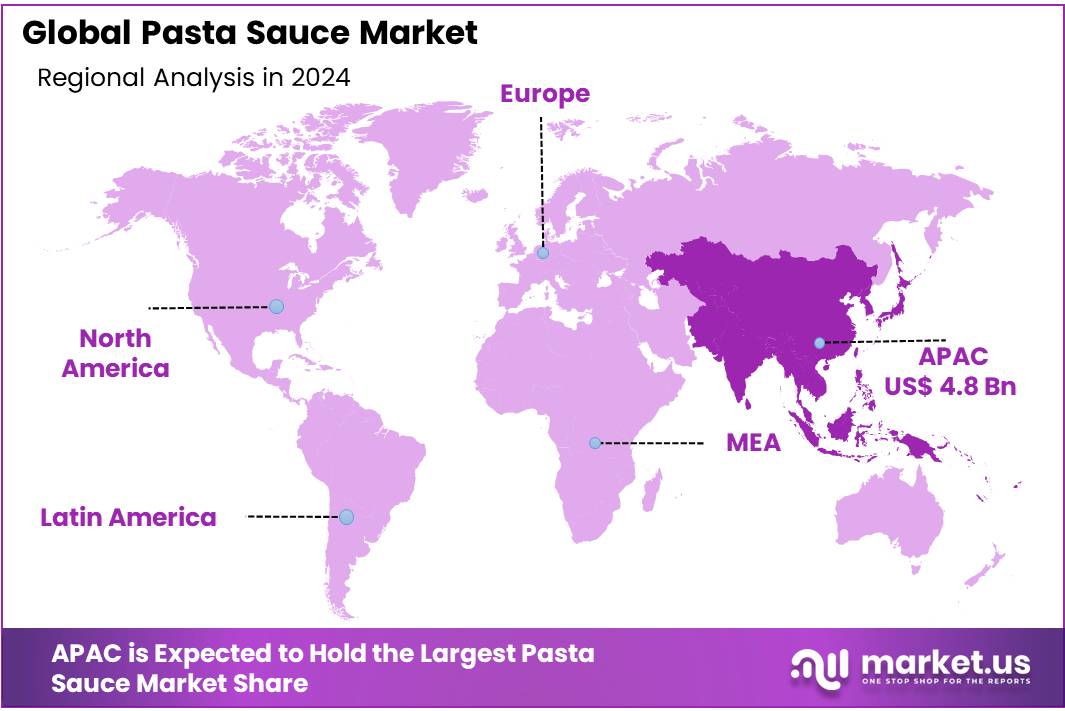

- Asia-Pacific (APAC) region emerged as the leading market for pasta sauces, capturing a significant 34.5% share, equivalent to approximately USD 4.8 billion in market value.

By Product Type

Tomato-Based Sauces lead the market with 45.9% share in 2024, driven by their versatility and consumer preference.

In 2024, Tomato-Based Sauces held a dominant market position, capturing more than a 45.9% share of the pasta sauce segment. This strong presence is largely due to their widespread use across various cuisines and the natural appeal of tomatoes as a base ingredient. Consumers favor tomato-based sauces for their rich flavor, ease of pairing with different pasta types, and perceived health benefits such as being a source of antioxidants.

Over the years, the consistent demand for classic and innovative tomato sauce variants, including marinara and arrabbiata, has helped maintain their market dominance. In 2025, this segment is expected to retain its leadership as producers continue to innovate with organic and preservative-free options, catering to health-conscious buyers and expanding their reach in both retail and foodservice channels.

By Packaging Type

Glass Bottles lead the pasta sauce packaging market with 38.6% share in 2024, favored for preserving freshness and premium appeal.

In 2024, Glass Bottles held a dominant market position in pasta sauce packaging, capturing more than a 38.6% share. This preference stems from the material’s ability to maintain the sauce’s freshness and flavor over time, making it a trusted choice among consumers. Glass packaging also offers a premium look and feel, which appeals to buyers seeking quality and authenticity in their products.

Additionally, glass is recyclable and perceived as environmentally friendly, which aligns well with growing consumer demand for sustainable packaging solutions. In 2025, the use of glass bottles is expected to remain strong as manufacturers continue to highlight its benefits in product preservation and brand differentiation in competitive retail markets.

By Distribution Channel

Supermarkets dominate pasta sauce sales with a 47.4% share in 2024, thanks to convenience and variety.

In 2024, supermarkets held a dominant market position in pasta sauce distribution, capturing more than a 47.4% share. This leadership is largely driven by the convenience they offer to consumers, who prefer one-stop shopping for a wide range of products. Supermarkets provide easy access to numerous pasta sauce brands and varieties, often supported by promotions and attractive pricing that encourage purchases.

The growing trend of organized retail and expansion of supermarket chains in urban and suburban areas has further strengthened this channel’s position. Looking ahead to 2025, supermarkets are expected to maintain their dominance as they continue to enhance the shopping experience through improved product displays and loyalty programs, catering well to evolving consumer preferences.

Key Market Segments

By Product Type

- Tomato-Based Sauces

- Traditional Sauce

- Marinara Sauce

- Meat Sauce

- Mushroom Sauce

- Roasted Garlic Sauce

- Cheese Sauce

- Tomato and Basil Sauce

- Others

- Pesto-Based Sauces

- Traditional Basil Pesto Sauce

- Sun-Dried Tomato Pesto Sauce

- Others

- Alfredo-Based Sauces

- Traditional Alfredo Sauce

- Garlic Alfredo Sauce

- Cheese Alfredo Sauce

- Others

By Packaging Type

- Glass Bottles

- PET

- Cans

- Pouches

- Cartons

By Distribution Channel

- Supermarkets

- Specialty Stores

- Convenience Stores

- Online Retailing

- Others

Drivers

Rising Consumer Demand for Convenient and Healthy Food Options Drives Pasta Sauce Market Growth

One of the major driving factors for the growth of the pasta sauce market is the increasing consumer demand for convenient, ready-to-use food products that also offer health benefits. In today’s fast-paced lifestyle, more people are seeking quick meal solutions without compromising on nutrition and taste. Pasta sauces fit perfectly into this trend, offering an easy way to prepare flavorful meals at home without spending too much time cooking from scratch.

According to the United States Department of Agriculture (USDA), the consumption of processed tomato products, which include pasta sauces, has steadily increased over recent years. In 2023, the per capita consumption of processed tomato products in the US reached about 20.6 pounds, reflecting a growing preference for these products as staples in many households.

Moreover, the global shift towar healthier eating habits is encouraging manufacturers to develop pasta sauces with natural ingredients, no added preservatives, and reduced sodium content. The Food and Agriculture Organization (FAO) of the United Nations has emphasized the importance of such clean-label products, aligning with consumer awareness about food safety and nutrition.

Government initiatives in several countries also support the production and promotion of healthy food products. For instance, programs encouraging sustainable agriculture and organic farming contribute to the availability of high-quality raw materials like tomatoes, which are central to pasta sauce production. This helps ensure a steady supply of natural ingredients for healthier pasta sauce options.

Restraints

High Sodium Content in Pasta Sauces Raises Health Concerns

A significant challenge facing the pasta sauce market is the high sodium content prevalent in many commercially available sauces. Excessive sodium intake is linked to various health issues, including high blood pressure, heart disease, and stroke. The World Health Organization (WHO) recommends a daily sodium intake of less than 2,000 mg, yet many processed foods, including pasta sauces, contribute substantially to this intake.

In Australia, for instance, a study found that the average sodium content in pasta sauces remained high, with minimal reduction between 2008 and 2011. In 2011, the mean sodium content was 423 mg per 100 grams, which exceeds the UK’s 2012 target of 330 mg per 100 grams .

Similarly, in the United States, the Food and Drug Administration (FDA) has set a sodium limit of 230 mg per serving for a product to be labeled as “healthy.” However, many tomato-based sauces surpass this threshold, raising concerns among health-conscious consumers.

These health concerns have prompted a shift in consumer preferences towards low-sodium and clean-label pasta sauces. Brands are responding by reformulating products to reduce sodium levels and using natural ingredients to appeal to health-conscious buyers. This trend is supported by government initiatives encouraging the reduction of sodium in processed foods to improve public health outcomes.

Opportunity

Growth Opportunity: Rising Demand for Health-Conscious and Plant-Based Pasta Sauces

The pasta sauce market is witnessing a significant growth opportunity driven by the increasing consumer preference for healthier and plant-based food options. This shift is propelled by heightened health awareness, dietary trends favoring plant-based diets, and a growing demand for clean-label products.

The vegan pasta sauce industry experienced substantial expansion from 2020 to 2024, fueled by the rising popularity of plant-based diets, clean-label products, and allergen-free alternatives. The report indicates that brands are focusing on organic and gluten-free formulations while emphasizing sustainability initiatives in their packaging. This trend is expected to continue, with investments in research and development in plant-based food and a growing perception of sustainability contributing to the market’s growth in the coming years.

Additionally, the U.S. Department of Agriculture (USDA) has launched initiatives to increase access to healthy foods in underserved communities. For instance, the USDA and Reinvestment Fund introduced the Food Access and Retail Expansion Fund (FARE Fund) under the Healthy Food Financing Initiative. This program provides loans, grants, and technical assistance to food retailers and suppliers to enhance access to healthy food options, including healthier pasta sauces, in communities lacking adequate access.

Trends

Clean-Label and Organic Pasta Sauces Gain Traction

A significant trend in the pasta sauce market is the increasing consumer preference for clean-label and organic products. This shift is driven by heightened health consciousness and a desire for transparency in food labeling. Consumers are actively seeking sauces made with minimal, recognizable ingredients, free from artificial additives and preservatives.

According to a 2024 survey by the Organic Trade Association, 40% of consumers now prefer organic food products, reflecting a growing demand for organic ingredients in various food categories, including pasta sauces. This trend is further supported by data from the U.S. Department of Agriculture, which reports that organic food sales in the United States reached $62 billion in 2023, marking a 12% increase from the previous year.

In response to this demand, several pasta sauce manufacturers are reformulating their products to align with clean-label principles. Brands are eliminating artificial colors, flavors, and preservatives, opting instead for natural ingredients like tomatoes, herbs, and olive oil. For instance, Rao’s Homemade, a leading brand in the premium pasta sauce segment, emphasizes its use of simple, high-quality ingredients without added sugar or preservatives.

This movement towards clean-label and organic pasta sauces is not only a reflection of consumer preferences but also aligns with broader industry trends towards sustainability and ethical sourcing. As consumers become more informed about the environmental and health impacts of their food choices, the demand for products that are both healthy and environmentally friendly is expected to continue rising.

Regional Analysis

Asia-Pacific (APAC) Dominates Pasta Sauce Market with 34.5% Share, Valued at $4.8 Billion in 2024

In 2024, the Asia-Pacific (APAC) region emerged as the leading market for pasta sauces, capturing a significant 34.5% share, equivalent to approximately USD 4.8 billion in market value. This dominance is attributed to several factors, including the growing popularity of Italian cuisine, increasing disposable incomes, and a shift towards convenient meal solutions among consumers.

Product-wise, tomato-based and marinara sauces have been the largest revenue-generating segments, owing to their widespread acceptance and versatility in various dishes. However, segments like Alfredo and Four Cheese sauces are witnessing the fastest growth, reflecting a demand for richer and more diverse flavor profiles.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

B&G Foods, Inc. is a prominent player in the pasta sauce market, known for its diverse portfolio of food products. The company focuses on delivering high-quality sauces with a strong presence in retail channels across North America. Its commitment to innovation and adapting to consumer trends, such as clean-label and organic options, helps it maintain competitive advantage. B&G Foods leverages its extensive distribution network to reach a broad customer base.

Barilla is a leading Italian food company with a strong global footprint, particularly in pasta and pasta sauces. Renowned for authentic Italian flavors, Barilla offers a wide range of tomato-based and specialty sauces. The company emphasizes sustainability in sourcing and production, aligning with growing consumer demand for natural products. Barilla’s robust marketing and distribution strategies help sustain its leadership in the pasta sauce segment worldwide.

Bertolli, a brand under the Deoleo Group, specializes in Mediterranean-inspired pasta sauces. It is recognized for using quality ingredients like ripe tomatoes and olive oil, delivering authentic taste. Bertolli appeals to health-conscious consumers through offerings with no artificial preservatives. The brand benefits from a strong presence in North America and Europe, supported by continuous product innovation and strategic partnerships with retailers.

Top Key Players in the Market

- B&G Foods, Inc.

- Barilla G. e R. Fratelli S.p.A

- Bertolli

- Cento Fine Foods

- Conagra Brands, Inc.

- CSC Brands LP

- Del Monte Corporation

- Frontier Co-op

- Goya Foods, Inc.

- Mars, Incorporated and its Affiliates.

- Mizkan America, Inc.

- Mutti S.p.A. Industria Conserve Alimentari

- No Limit, LLC

- The Kraft Heinz Company

Recent Developments

In 2024, B&G Foods reported net sales of $1.93 billion, a 6.3% decrease from the previous year, primarily due to divestitures and reduced unit volumes.

In May 2024, Bertolli expanded its portfolio by introducing five new Italian frozen dishes, such as Chicken Alfredo and Meatball Rigatoni, tapping into the growing demand for convenient, ready-to-eat meals .

In 2024, Conagra reported net sales of approximately $12 billion, with the grocery and snacks segment contributing a substantial portion of this revenue.

Report Scope

Report Features Description Market Value (2024) USD 14.2 Billion Forecast Revenue (2034) USD 19.8 Billion CAGR (2025-2034) 3.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Tomato-Based Sauces, Pesto-Based Sauces, Alfredo-Based Sauces), By Packaging Type (Glass Bottles, PET, Cans, Pouches, Cartons), By Distribution Channel (Supermarkets, Specialty Stores, Convenience Stores, Online Retailing, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape B&G Foods, Inc., Barilla G. e R. Fratelli S.p.A, Bertolli, Cento Fine Foods, Conagra Brands, Inc., CSC Brands LP, Del Monte Corporation, Frontier Co-op, Goya Foods, Inc., Mars, Incorporated and its Affiliates., Mizkan America, Inc., Mutti S.p.A. Industria Conserve Alimentari, No Limit, LLC, The Kraft Heinz Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- B&G Foods, Inc.

- Barilla G. e R. Fratelli S.p.A

- Bertolli

- Cento Fine Foods

- Conagra Brands, Inc.

- CSC Brands LP

- Del Monte Corporation

- Frontier Co-op

- Goya Foods, Inc.

- Mars, Incorporated and its Affiliates.

- Mizkan America, Inc.

- Mutti S.p.A. Industria Conserve Alimentari

- No Limit, LLC

- The Kraft Heinz Company