Global Thiochemicals Market Size, Share, And Growth Analysis Report By Type (Mercaptans, Dimethyl Disulfide (DMDS), Dimethyl Sulfoxide (DMSO), Thioglycolic Acid and Ester, Thiourea, Others), By End-Use (Oil and Gas, Chemical and Plastics, Food and Beverages, Agrochemical, Animal Nutrition, Pharmaceuticals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 146053

- Number of Pages: 312

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

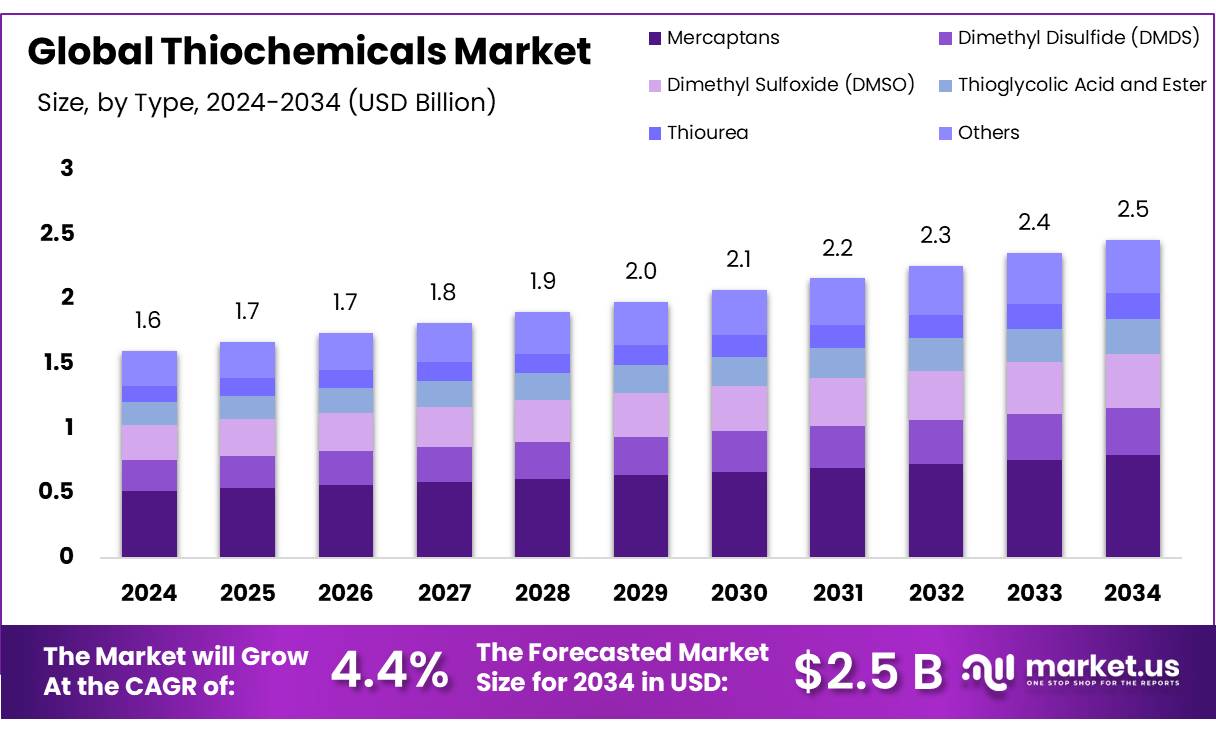

The Global Thiochemicals Market size is expected to be worth around USD 2.5 billion by 2034, from USD 1.6 billion in 2024, growing at a CAGR of 4.4% during the forecast period from 2025 to 2034.

The Thiochemicals Market is experiencing steady growth, driven by their critical role in various industrial applications. Thiochemicals are sulfur-containing compounds where oxygen atoms are replaced by sulfur, making them essential in processes such as desulfurization, polymerization and as intermediates in chemical synthesis. They are extensively utilized in industries like oil and gas, agriculture, pharmaceuticals, and personal care.

The market is experiencing steady growth, driven by industrialization, increasing demand for high-performance chemicals, and expanding applications across diverse sectors. Its significance lies in its ability to address critical industrial needs, such as enhancing fuel quality, improving animal feed, and supporting pharmaceutical advancements.

Key driving factors include stringent environmental regulations mandating low-sulfur fuels, boosting thiochemical use in refining processes, and growing awareness of animal nutrition, particularly in poultry. The pharmaceutical sector’s expansion, with thiochemicals used in drug synthesis, further propels growth. However, high production costs and toxicity concerns, such as the flammability of isopropyl mercaptan, pose challenges.

Future growth opportunities lie in sustainable biochemicals, with bio-based compounds gaining traction due to regulatory pressures and environmental awareness. Emerging markets in Africa, like South Africa and Kenya, offer untapped potential. Innovations in production technologies and expanding applications in wastewater treatment and personal care products are set to drive the market forward, ensuring its continued relevance in a rapidly evolving industrial landscape.

Key Takeaways

- The global Thiochemicals Market is projected to reach USD 2.5 billion by 2034, growing at a 4.4% CAGR from 2025 to 2034.

- Mercaptans dominate with a 32.2% market share in 2024, driven by oil & gas odorization and agrochemical uses.

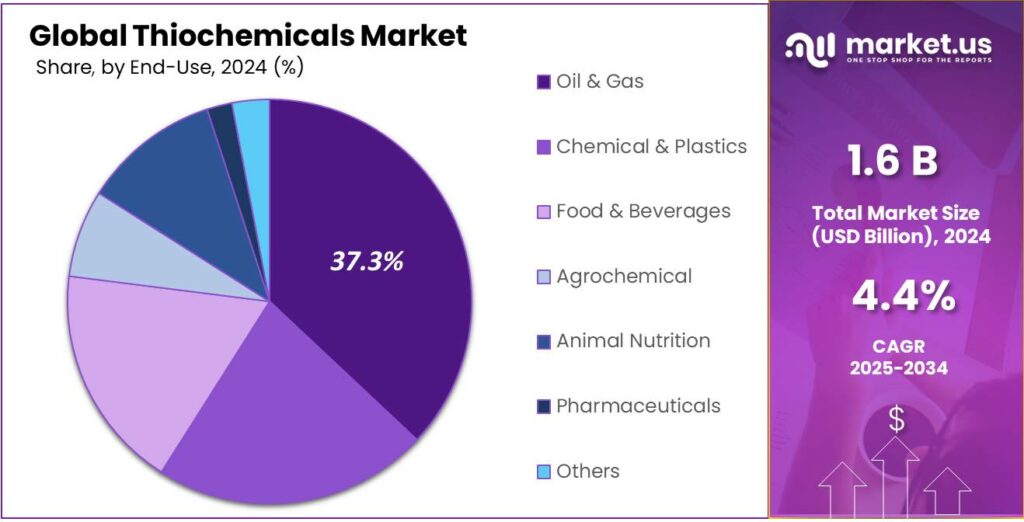

- The oil & gas sector holds the largest share a 37.3%, fueled by refining, odorization, and corrosion inhibition needs.

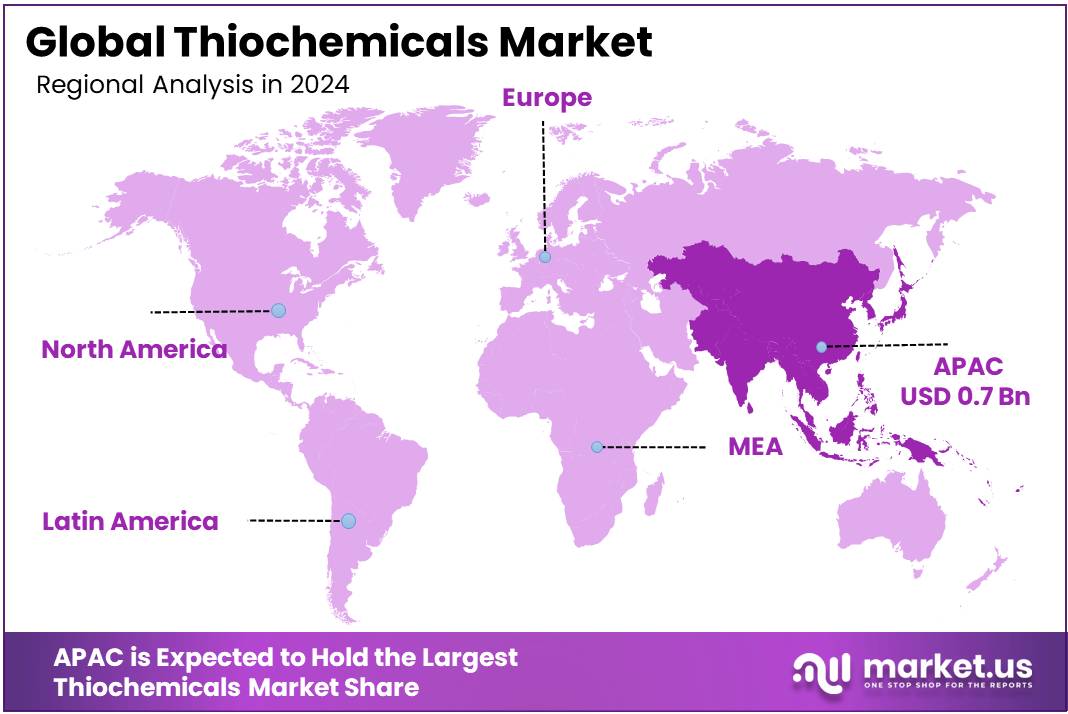

- Asia-Pacific (APAC) leads with a 46.7% market share of USD 0.7 Bn, supported by industrialization and agrochemical demand.

By Type

In 2024, Mercaptans held a dominant market position in the thiochemicals sector, capturing more than a 32.2% share. Their widespread use in industries like oil & gas, agriculture, and chemicals drove this strong demand. The segment’s growth was fueled by increasing applications in natural gas odorization, where mercaptans act as safety markers due to their strong smell.

Additionally, their role in agrochemicals and pharmaceuticals contributed to steady demand. Looking ahead to 2025, the mercaptans segment is expected to maintain its lead, supported by expanding shale gas exploration and stricter safety regulations in fuel processing. While other thiochemicals are growing, mercaptans remain the preferred choice for key industrial applications.

By End-Use

In 2024, The Oil And Gas sector dominated the thiochemicals market, holding more than a 37.3% share. This strong position was driven by the widespread use of thiochemicals in natural gas odorization, refining processes, and as corrosion inhibitors. With increasing shale gas production and stricter safety regulations, demand for these chemicals remained high.

The oil and gas segment is expected to maintain its lead, supported by ongoing energy exploration and the need for efficient refining solutions. While other industries like agrochemicals and pharmaceuticals are growing, oil and gas remains the largest consumer of thiochemicals due to its essential applications in fuel processing and safety compliance.

Key Market Segments

By Type

- Mercaptans

- Dimethyl Disulfide (DMDS)

- Dimethyl Sulfoxide (DMSO)

- Thioglycolic Acid and Ester

- Thiourea

- Others

By End-Use

- Oil and Gas

- Chemical and Plastics

- Food and Beverages

- Agrochemical

- Animal Nutrition

- Pharmaceuticals

- Others

Drivers

Major Driving Factor: Growing Demand in Agriculture and Petrochemical Industries

The thiochemicals market is experiencing significant growth, primarily driven by the escalating demand within the agriculture and petrochemical sectors. Thiochemicals, such as methyl mercaptan and dimethyl disulfide, play a crucial role in the synthesis of methionine, an essential amino acid used extensively as a feed additive in poultry and livestock industries.

The increasing global consumption of meat and dairy products has spurred the demand for enriched feed additives, thereby boosting the thiochemicals market. In the petrochemical industry, thiochemicals are used as catalysts in the production of various chemical compounds.

The rising global demand for fuel and the need for efficient fuel additives have led to an uptick in demand for thiochemicals that improve the octane rating in fuels. This application is particularly relevant as the world shifts towards cleaner and more efficient fuel sources to reduce environmental impact.

Restraints

Major Restraint: Environmental Concerns and Stringent Emission Regulations

One major challenge slowing down the growth of the thiochemicals market is the increasing environmental scrutiny and strict emission regulations worldwide. Thiochemicals, particularly organosulfur compounds like methyl mercaptan and hydrogen sulfide, are known for their toxicity and foul odor.

Their production and handling involve significant environmental risks, including the release of hazardous air pollutants (HAPs) and volatile organic compounds (VOCs). In Europe, the REACH regulation (Registration, Evaluation, Authorisation, and Restriction of Chemicals) under the European Chemicals Agency (ECHA) also imposes strict controls on thiochemicals due to their toxicological profiles.

Opportunity

Major Growth Factor: Surging Methionine Demand in Animal Nutrition

A key factor fueling the growth of the thiochemicals market is the rising global demand for methionine, a vital amino acid in animal feed. Methionine is essential for poultry, swine, and aquaculture industries to improve animal growth and immunity. Thiochemicals like methyl mercaptan are used as primary intermediates in methionine production, directly linking their demand to global livestock growth.

Government initiatives are also driving this momentum. India’s National Livestock Mission and China’s Five-Year Plan emphasize boosting domestic meat and dairy outputs through better feed quality. These policies are encouraging local methionine production, opening up fresh opportunities for thiochemical manufacturers in Asia.

Trends

Emerging Factor: Thiochemicals in Renewable Energy Applications

One emerging factor giving a fresh boost to the thiochemicals market is their growing role in renewable energy, especially in biogas desulfurization. As countries transition towards greener energy, the demand for clean biogas is rising — and the chemicals are stepping in as key players in the purification process.

Hydrogen sulfide (H₂S), a common impurity in biogas, must be removed to make it usable. Dimethyl disulfide (DMDS), a thiochemical, is increasingly used in pre-sulfide catalysts in hydroprocessing units and to control sulfur content in gas treatment facilities. This use is becoming especially relevant in Europe, where biogas production has surged.

This shift towards renewable energy is opening up a previously underexplored avenue for thiochemicals, showing that their role is no longer limited to traditional petrochemicals or animal feed — they’re quietly becoming part of the green transition too.

Regional Analysis

Asia-Pacific (APAC) Dominates the Thiochemicals Market with 46.7% Share, Valued at USD 0.7 Billion

The Asia-Pacific (APAC) region is the largest and fastest-growing market for thiochemicals, accounting for 46.7% of the global market share, with an estimated value of USD 0.7 billion. This dominance is driven by rapid industrialization, expanding agrochemical and pharmaceutical sectors, and increasing demand for oil & gas applications.

Countries such as China, India, Japan, and South Korea are key contributors due to their strong chemical manufacturing base and rising investments in specialty chemicals. The region benefits from cost-effective production, abundant raw material availability, and growing export opportunities.

Additionally, stringent environmental regulations in North America and Europe are shifting chemical production to APAC, further boosting market growth. The agrochemical sector, particularly in India and China, is a major consumer of thiochemicals, driven by high agricultural output and the need for advanced crop protection chemicals.

The pharmaceutical industry’s expansion, supported by increasing healthcare expenditure, is fueling demand for thiochemicals in drug synthesis. APAC is expected to maintain its leading position, supported by infrastructure development and rising foreign investments in chemical manufacturing. The region’s competitive advantage in low-cost production and strong end-user demand solidifies its dominance in the global thiochemicals market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

- Arkema is a leading player in the thiochemicals market, known for its advanced specialty chemicals and sustainable solutions. The company offers a wide range of sulfur-based products, including mercaptans and polysulfides, catering to industries like agrochemicals, oil & gas, and pharmaceuticals.

- Bruno Bock GmbH specializes in sulfur-based chemicals, particularly mercaptans and polysulfides, serving industries such as rubber, lubricants, and plastics. The German company is recognized for its high-quality products and customer-centric approach. With a strong emphasis on sustainability and safety.

- Hextar Global Berhad, a key player in the thiochemicals sector, provides sulfur derivatives for agrochemicals, oil & gas, and industrial applications. The Malaysian company focuses on expanding its product portfolio and enhancing production efficiency. Hextar’s strategic acquisitions and partnerships strengthen its market presence, positioning it as a growing competitor in the global thiochemicals industry.

- Chevron Phillips Chemical is a major thiochemicals producer, offering high-purity sulfur compounds for petrochemicals, refining, and specialty applications. The company leverages its extensive expertise and integrated supply chain to deliver reliable, high-performance products. Its commitment to sustainability and technological advancement ensures a strong foothold in the competitive thiochemicals market.

Top Key Players in the Market

- Arkema

- Bruno Bock GmbH

- Hextar Global Berhad

- Chevron Phillips Chemical Company LLC

- Daicel Corporation

- Dr. Spiess Chemische Fabrik GmbH

- Hebei Yanuo Bioscience Co. Ltd.

- Taizhou Sunny Chemical Co. Ltd.

- SHINYA CHEM

- Synergies Group

- Nanjing Guochen Chemical Co. Ltd.

Recent Developments

- In 2024, Arkema continues to lead in the thiochemicals market with a focus on sustainable solutions. The company highlighted its organosulfur compounds supporting industries like animal nutrition, agrochemicals, and energy.

- In 2025, Chevron Phillips expanded its Tessenderlo, Belgium facility by debottlenecking production units for ethyl mercaptan (EM) and tetrahydrothiophene (THT). This supports the chemical demand in oil and gas applications, such as gas odorants and leakage detection.

Report Scope

Report Features Description Market Value (2024) USD 1.6 Billion Forecast Revenue (2034) USD 2.5 Billion CAGR (2025-2034) 4.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Mercaptans, Dimethyl Disulfide (DMDS), Dimethyl Sulfoxide (DMSO), Thioglycolic Acid and Ester, Thiourea, Others), By End-Use (Oil and Gas, Chemical and Plastics, Food and Beverages, Agrochemical, Animal Nutrition, Pharmaceuticals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Arkema, Bruno Bock GmbH, Hextar Global Berhad, Chevron Phillips Chemical Company LLC, Daicel Corporation, Dr. Spiess Chemische Fabrik GmbH, Hebei Yanuo Bioscience Co. Ltd., Taizhou Sunny Chemical Co. Ltd., SHINYA CHEM, Synergies Group, Nanjing Guochen Chemical Co. Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Arkema

- Bruno Bock GmbH

- Hextar Global Berhad

- Chevron Phillips Chemical Company LLC

- Daicel Corporation

- Dr. Spiess Chemische Fabrik GmbH

- Hebei Yanuo Bioscience Co. Ltd.

- Taizhou Sunny Chemical Co. Ltd.

- SHINYA CHEM

- Synergies Group

- Nanjing Guochen Chemical Co. Ltd.