Global Fuel Injection Systems Market Size, Share, Growth Analysis By Type (Port Fuel Injection (PFI), Direct Fuel Injection (DFI), Throttle Body Fuel Injection (TBI), Common Rail Fuel Injection), By Fuel Type (Gasoline, Diesel, Alternative Fuels (CNG, LPG, Ethanol, etc.)), By Vehicle Type (Passenger Cars, Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs), Off-Highway Vehicles), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 144239

- Number of Pages: 268

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

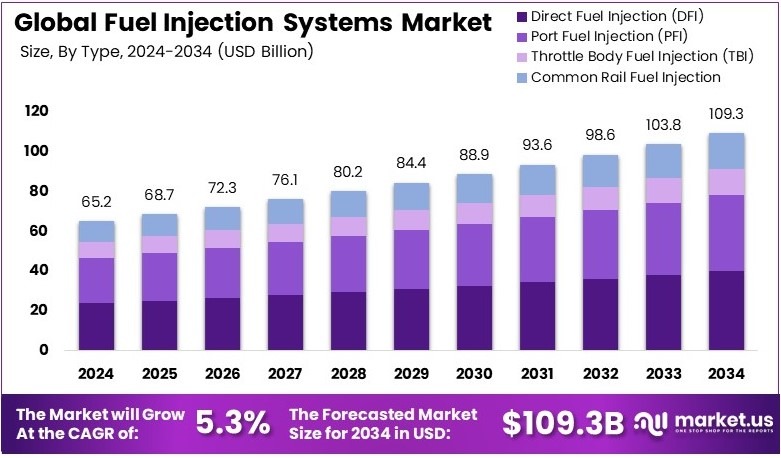

The Global Fuel Injection Systems Market size is expected to be worth around USD 109.3 Billion by 2034, from USD 65.2 Billion in 2024, growing at a CAGR of 5.3% during the forecast period from 2025 to 2034.

Fuel injection systems are used in vehicles to deliver fuel into the engine. These systems control the fuel-air mixture to improve engine efficiency and reduce emissions. They replace older carburetor systems. Common types include direct and port fuel injection, used in both petrol and diesel engines.

The fuel injection systems market refers to the global business of manufacturing and selling fuel delivery systems for vehicles. It includes technologies used in passenger cars, commercial vehicles, and industrial machines. The market is shaped by fuel efficiency regulations, emission norms, and the shift toward clean engine technologies.

Fuel injection systems help engines burn fuel more efficiently. They are used in almost all modern vehicles. With global vehicle production reaching 93.5 million units in 2023, according to the International Organization of Motor Vehicle Manufacturers, the demand for fuel injection systems continues to grow across both passenger and commercial vehicles.

The fuel injection systems market is gaining traction due to the need for cleaner emissions and better engine performance. As vehicles become more advanced, these systems must meet higher standards. In this context, demand is rising for solutions that improve power output while reducing fuel use and environmental impact.

To illustrate industry innovation, in March 2024, Volvo Group partnered with Westport Fuel Systems to launch a joint venture. This partnership aims to scale Westport’s High Pressure Direct Injection (HPDI™) technology globally. According to Volvo, this move supports cleaner combustion, especially for long-haul and off-road vehicles.

Additionally, global production growth boosts the market further. A 17% rise in production from 2022 shows strong recovery and rising demand. As vehicle numbers grow, automakers focus on fuel systems that can meet both performance and efficiency goals, making fuel injection a critical part of modern engine design.

On the flip side, competition in this market is intense. Established companies lead with advanced tech and large client networks. However, there is still space for innovation. Companies offering cleaner, cost-effective systems can tap into growing EV-hybrid segments and new emission rules worldwide.

At the local level, regions with strong automotive bases benefit from new investment. For example, cities like Gothenburg or Munich, with strong R&D hubs, attract fuel system firms. As a result, local economies see new jobs and technology growth from expanding fuel injection production.

Key Takeaways

- The Fuel Injection Systems Market was valued at USD 65.2 billion in 2024 and is expected to reach USD 109.3 billion by 2034, with a CAGR of 5.3%. Rising demand for fuel efficiency and emission control regulations drive market expansion.

- In 2024, Direct Fuel Injection (DFI) dominated with 36.7%, due to its superior fuel efficiency and performance benefits in modern vehicles.

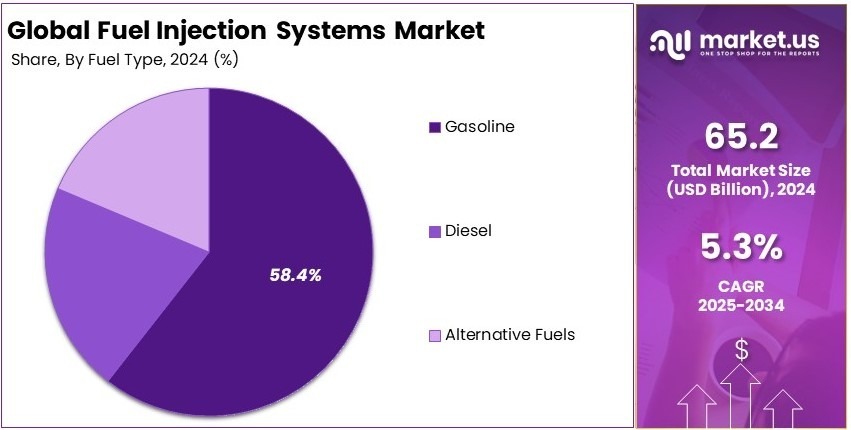

- In 2024, Gasoline fuel type led with 58.4%, as consumer preference shifted toward fuel-efficient gasoline-powered vehicles.

- In 2024, Passenger Cars accounted for 63.2%, driven by the widespread adoption of advanced fuel injection systems for better engine performance.

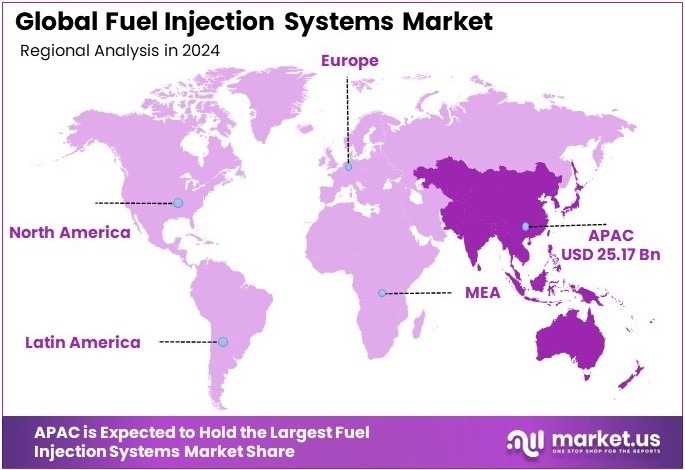

- In 2024, Asia Pacific dominated with 38.6% with valuation of USD 25.17 billion, supported by the expansion of the automotive industry and stringent emission norms in the region.

Type Analysis

Direct Fuel Injection (DFI) dominates with 36.7% due to its efficiency and performance enhancement.

In the fuel injection systems market, Direct Fuel Injection (DFI) emerges as the dominant sub-segment, capturing a 36.7% market share. This technology enhances fuel efficiency and engine performance, which are critical factors driving its adoption in modern vehicles. DFI allows precise control of the fuel-air mixture that enters the engine, leading to better combustion efficiency and lower emissions.

Port Fuel Injection (PFI) remains popular in budget vehicles due to its cost-effectiveness and reliability. Despite being overshadowed by DFI in terms of efficiency, PFI still plays a significant role in markets where cost concerns are paramount.

Throttle Body Fuel Injection (TBI) systems are simpler and cheaper than other types but offer less control over fuel dispersion, which can affect efficiency. However, their simplicity makes them suitable for certain light commercial applications.

Common Rail Fuel Injection is predominantly used in diesel engines to provide higher pressure and better fuel atomization. Its role in enhancing the performance of diesel engines, particularly in heavy-duty vehicles, underscores its importance in the commercial transport sector.

Fuel Type Analysis

Gasoline dominates with 58.4% due to its widespread availability and use in passenger vehicles.

Gasoline fuel injection systems lead the market with a 58.4% share, driven by the extensive use of gasoline engines in passenger cars worldwide. The availability of gasoline and its established infrastructure contribute to the dominance of this fuel type in the automotive sector.

Diesel systems are essential in commercial and heavy-duty vehicles due to their efficiency and durability. Diesel engines benefit significantly from advanced injection systems, which improve their performance and meet stringent emission standards.

Alternative Fuels such as CNG, LPG, and ethanol are gaining traction due to environmental concerns and the push for renewable energy sources. Fuel injection systems that can handle these alternative fuels are critical for enabling this transition and are seeing incremental growth in regions with supportive policies.

Vehicle Type Analysis

Passenger Cars dominate with 63.2% due to high consumer demand and production volumes.

The Passenger Cars segment leads the fuel injection system market with a 63.2% share, primarily due to high global production and sales volumes. The shift towards more environmentally friendly and fuel-efficient cars drives the adoption of advanced fuel injection systems in this segment.

Light Commercial Vehicles (LCVs) utilize various types of fuel injection systems to meet the demands of urban logistics and transportation. As e-commerce grows, so does the need for efficient LCVs that can navigate urban environments effectively.

Heavy Commercial Vehicles (HCVs) rely on robust fuel injection systems to handle long hauls and heavy loads. The efficiency and reliability of these systems are crucial for the economic operations of HCVs in industries like logistics and construction.

Off-Highway Vehicles require specially adapted fuel injection systems for high-performance needs in challenging environments. These vehicles are often used in agriculture and construction, where reliability and efficiency are paramount.

Key Market Segments

By Type

- Port Fuel Injection (PFI)

- Direct Fuel Injection (DFI)

- Throttle Body Fuel Injection (TBI)

- Common Rail Fuel Injection

By Fuel Type

- Gasoline

- Diesel

- Alternative Fuels (CNG, LPG, Ethanol, etc.)

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Off-Highway Vehicles

Driving Factors

Engine Efficiency and Emission Mandates Drives Market Growth

The fuel injection systems market is expanding steadily due to several strong growth drivers. One major factor is the increasing demand for high-performance engines. Automakers are under pressure to deliver better fuel economy without compromising power. Fuel injection systems help optimize combustion and deliver precise fuel delivery, which enhances both performance and efficiency.

Government mandates on emission reduction are also pushing the market forward. Countries in Europe, North America, and Asia have introduced strict emission regulations. Fuel injection technology supports cleaner engine operation, making it essential for compliance.

Another key trend is the shift from carburetors to fuel injection in two-wheelers. Especially in countries like India and Indonesia, regulatory changes and consumer expectations are driving the adoption of more efficient systems in motorcycles and scooters.

The growth of agricultural and construction equipment markets further supports demand. These vehicles require durable and fuel-efficient engines for heavy-duty operations. As the farming and infrastructure sectors expand in developing economies, the need for advanced injection systems rises.

Restraining Factors

Cost and Compatibility Barriers Restraints Market Expansion

Despite growing adoption, the fuel injection systems market faces notable restraints that affect its growth pace. A major challenge is the high cost of direct injection technology. Advanced systems require precision components and high-pressure mechanisms, which increase manufacturing and maintenance expenses.

Fuel injection systems are also vulnerable to fuel contamination and wear. Contaminated fuel can damage injectors and reduce efficiency. This is especially problematic in regions with inconsistent fuel quality, adding to repair and replacement costs for end-users.

Additionally, the demand for diesel engines is declining in passenger vehicles due to tightening emission norms and a shift toward gasoline and electric alternatives. Since many fuel injection systems are tailored for diesel powertrains, this trend limits market potential in that segment.

Retrofitting older vehicles with modern fuel injection technology presents further difficulties. Many legacy engines are not designed for high-pressure fuel delivery systems, and conversion often requires complex adjustments. As a result, vehicle owners may hesitate to upgrade, especially in price-sensitive markets.

Growth Opportunities

Clean Energy and Smart Engines Provides Opportunities

Several emerging opportunities are shaping the future of the fuel injection systems market. One of the most promising areas is the growing application of turbocharged gasoline direct injection (GDI) systems. These offer better power and fuel efficiency, making them ideal for downsized engines that meet both performance and environmental targets.

Research and development in biofuel-compatible systems is another strong opportunity. As governments and companies explore alternative fuels, the need for fuel injection systems that handle varying fuel compositions is increasing. These systems support broader environmental goals and can tap into new vehicle segments.

Expansion into Low Emission Zone (LEZ) compliant vehicles also presents growth potential. Urban centers are introducing LEZs that limit vehicle access based on emissions. Fuel injection technology helps vehicles meet these standards and remain road-compliant in cities like London, Paris, and Berlin.

Integration with advanced engine management systems (EMS) is further enhancing performance. By working closely with EMS, fuel injectors can adjust timing, quantity, and pressure in real time. This results in better fuel economy, reduced emissions, and smoother operation. These innovation-led opportunities signal a strong future for fuel injection systems, especially in the context of clean mobility and smart vehicle trends.

Emerging Trends

Precision and Electrification Are Latest Trending Factor

Several technological trends are reshaping the fuel injection systems market. One major trend is the use of piezoelectric injectors in high-precision applications. These injectors react faster than traditional solenoid-based systems, allowing for more accurate fuel delivery. They are particularly useful in luxury vehicles and performance-focused models where efficiency and response matter.

Another development is the rise of multi-point and sequential injection systems. These designs offer improved fuel distribution and combustion control, especially in multi-cylinder engines. This improves fuel economy and reduces emissions, making the technology attractive across both light-duty and commercial vehicles.

The adoption of electrically-controlled injection pumps is also on the rise. These systems are more efficient and offer better control than mechanical pumps, especially in hybrid and electronically-managed engines. They support real-time adjustments and make vehicles more responsive.

Additionally, the demand for port fuel injection systems is growing in mild hybrid vehicles. These systems are often used alongside direct injection to reduce costs and meet evolving emission standards. The combination of efficiency, precision, and adaptability is driving market interest.

Regional Analysis

Asia Pacific Dominates with 38.6% Market Share

Asia Pacific leads the Fuel Injection Systems Market with a 38.6% share, amounting to USD 25.17 billion. This dominance is driven by rapid industrial growth, increasing vehicle production, and stringent environmental regulations pushing for cleaner fuel technologies.

The region’s robust automotive sector, backed by major economies like China, Japan, and South Korea, contributes significantly to this market dominance. Innovations in fuel-efficient technologies and increasing adoption of electric vehicles support the expansion of fuel injection systems in Asia Pacific.

The future influence of Asia Pacific in the global Fuel Injection Systems Market is poised to grow. The region’s commitment to environmental standards and the shift towards more energy-efficient transportation options are expected to further enhance its market presence.

Regional Mentions:

- North America: North America holds a 28.4% share in the Fuel Injection Systems Market, influenced by technological advancements and stringent emissions standards. The integration of advanced technologies in automotive manufacturing is key to this region’s strong market presence.

- Europe: Europe controls a 26.1% market share, driven by high standards in automotive efficiency and emissions. The region’s focus on innovative and sustainable automotive technologies significantly contributes to its market stance.

- Middle East & Africa: With a 3.7% share, the Middle East & Africa are developing their market through increased adoption of modern automotive technologies and improving economic conditions, supporting a gradual market growth.

- Latin America: Latin America holds a 3.2% market share, where economic recovery and modernization in automotive standards are slowly transforming the automotive industry, including the adoption of newer fuel injection systems.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The Fuel Injection Systems Market is led by four major players: Robert Bosch GmbH, Denso Corporation, Continental AG, and Magneti Marelli S.p.A. These companies have built strong reputations based on quality, innovation, and global supply capabilities.

Their dominance is supported by a wide product range, including both gasoline and diesel injection systems. These firms are key suppliers to major vehicle manufacturers and provide advanced systems that improve engine performance, fuel efficiency, and emissions control.

R&D plays a major role in their success. Bosch and Denso invest heavily in developing high-pressure and electronic fuel injection technologies. Continental and Magneti Marelli focus on compact, cost-effective solutions for both conventional and hybrid vehicles.

These companies are also adapting to changing emission norms. As governments tighten regulations, the demand for efficient and cleaner injection systems rises. The top players are responding with new products, such as direct injection systems and hybrid-compatible technologies.

Strategic collaborations with automakers give them a strong position in both mature and emerging markets. Their global manufacturing and supply chain networks help meet high production demands while ensuring cost-efficiency and delivery speed.

As the automotive industry shifts towards electrification, fuel injection will continue to be important in hybrid and combustion engine vehicles. These top four companies are expected to lead the transition by offering smarter, cleaner, and more efficient systems.

Major Companies in the Market

- Robert Bosch GmbH

- Denso Corporation

- Continental AG

- Magneti Marelli S.p.A.

- Delphi Technologies (BorgWarner Inc.)

- Keihin Corporation

- Hitachi Astemo

- Stanadyne LLC

- Woodward L’Orange GmbH

- ASIMCO Technologies

- Zama Group

- Dell’Orto

- Mikuni Corporation

Recent Developments

- PHINIA: On January 21, 2025, PHINIA announced an enhanced technical partnership with Alpine Racing to support the Alpenglow hydrogen-powered concept car. PHINIA will supply DI-CHG direct hydrogen injectors and driver technology, contributing to the advancement of zero-emission motorsports.

- Volvo Group and Westport Fuel Systems: In March 2024, Volvo Group and Westport Fuel Systems Inc. established a joint venture to commercialize Westport’s High Pressure Direct Injection (HPDI™) fuel system technology. The collaboration aims to reduce CO₂ emissions in long-haul and off-road transportation sectors.

Report Scope

Report Features Description Market Value (2024) USD 65.2 Billion Forecast Revenue (2034) USD 109.3 Billion CAGR (2025-2034) 5.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Port Fuel Injection (PFI), Direct Fuel Injection (DFI), Throttle Body Fuel Injection (TBI), Common Rail Fuel Injection), By Fuel Type (Gasoline, Diesel, Alternative Fuels (CNG, LPG, Ethanol, etc.)), By Vehicle Type (Passenger Cars, Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs), Off-Highway Vehicles) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Robert Bosch GmbH, Denso Corporation, Continental AG, Magneti Marelli S.p.A., Delphi Technologies (BorgWarner Inc.), Keihin Corporation, Hitachi Astemo, Stanadyne LLC, Woodward L’Orange GmbH, ASIMCO Technologies, Zama Group, Dell’Orto, Mikuni Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Fuel Injection Systems MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Fuel Injection Systems MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Robert Bosch GmbH

- Denso Corporation

- Continental AG

- Magneti Marelli S.p.A.

- Delphi Technologies (BorgWarner Inc.)

- Keihin Corporation

- Hitachi Astemo

- Stanadyne LLC

- Woodward L'Orange GmbH

- ASIMCO Technologies

- Zama Group

- Dell'Orto

- Mikuni Corporation