Global Automotive Stainless Steel Market By Stainless Steel Type (Austenitic, Ferritic, Martensitic, Duplex, Precipitation-Hardening), By Application (Exhaust Systems, Structural Components, Fuel Tanks, Transmission Systems), By Vehicle Type (Passenger Cars, Light Commercial Vehicles (LCV), Heavy Commercial Vehicles (HCV), Electric Vehicles (EVs), Other Applications), By Distribution Channel (OEMs, Aftermarket), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 105422

- Number of Pages: 310

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

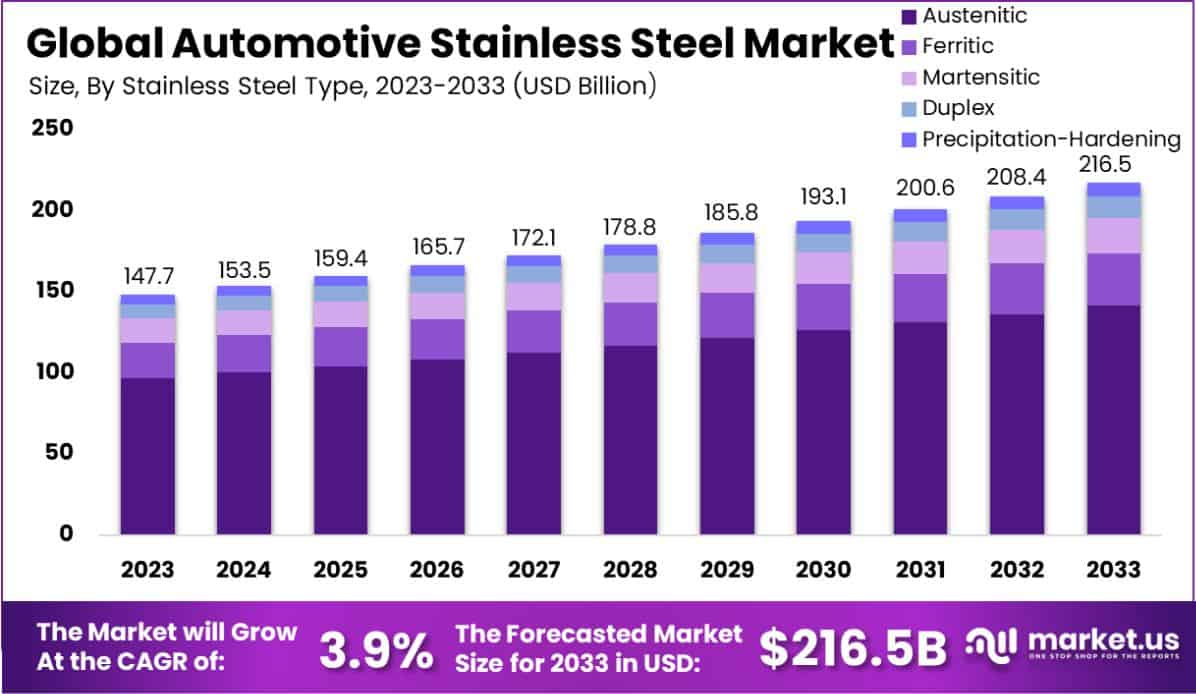

The Global Automotive Stainless Steel Market is expected to be worth around USD 216.5 Billion by 2033, up from USD 147.7 Billion by 2023, growing at a CAGR of 3.9% during the forecast period from 2024 to 2033.

Automotive stainless steel is a high-grade metal alloy primarily used in vehicle smart manufacturing due to its corrosion resistance, durability, and aesthetic appeal. It is utilized in various automotive components such as exhaust systems, grilles, and trims. Stainless steel enhances the longevity and performance of these parts, making it a preferred material in the automotive industry.

The Automotive Stainless Steel Market refers to the global industry involved in the production and distribution of stainless steel components for vehicles. This market is driven by the automotive sector’s demand for durable and corrosion-resistant materials that contribute to vehicle longevity and reduced maintenance costs.

The market’s expansion is bolstered by the rising demand for electric vehicles (EVs), which require stainless steel for battery housings and frames to ensure safety and durability. Additionally, advancements in steel alloy technology enhance the material’s properties, making it more appealing for automotive use.

Demand in the automotive stainless steel market is fueled by the automotive industry’s need for materials that ensure vehicle safety and longevity. The trend towards lighter, more fuel-efficient vehicles also increases the use of stainless steel, which offers strength without substantial weight.

The shift towards sustainable and eco-friendly manufacturing practices presents significant opportunities for the automotive stainless steel market. Innovations in recycling processes and the development of new, lighter, and stronger steel grades could see increased adoption across the automotive industry, particularly in luxury and commercial vehicles.

The automotive stainless steel market is currently witnessing significant transformation, influenced by strategic acquisitions and expansions by key players in the industry. This shift is exemplified by the recent acquisition by Worldwide Stainless Sdn Bhd (WSSB), which has agreed to purchase Bahru Stainless Sdn Bhd (BSSB) from Acerinox S.A…

A leader in the stainless steel sector based in Spain, for a deal worth US$95 million (approximately RM408 million). This acquisition is a strategic move by WSSB to enhance its market presence and supply chain capabilities in the Asia-Pacific region.

Simultaneously, Jindal Stainless is undertaking a substantial expansion strategy to solidify its standing on the global stage. The company has announced investments totaling Rs 5,400 crore, which include a 49 percent stake in a joint venture for a new 1.2 MTPA stainless steel melt shop in Indonesia.

Additionally, they are increasing their downstream capacity in Jajpur, Odisha, and acquiring a 54 percent equity stake in Chromeni Steels at Mundra, Gujarat. These developments are aimed at boosting Jindal Stainless’s melting and downstream capacities, thereby reinforcing its position as a formidable entity in the stainless steel industry.

These strategic moves by WSSB and Jindal Stainless underscore a robust growth trajectory for the automotive stainless steel market. They reflect a keen industry focus on expanding production capabilities and market reach, which are crucial for meeting the rising global demand for automotive stainless steel, driven by increasing vehicle production and the adoption of more stringent emissions standards.

This evolving landscape presents significant opportunities for stakeholders within the market to innovate and expand their operational footprints globally.

Key Takeaways

- The Global Automotive Stainless Steel Market is expected to be worth around USD 216.5 Billion by 2033, up from USD 147.7 Billion by 2023, growing at a CAGR of 3.9% during the forecast period from 2024 to 2033.

- In 2023, Austenitic held a dominant market position in the By Stainless Steel Type segment of the Automotive Stainless Steel Market, with a 65.4% share.

In 2023, Exhaust Systems held a dominant market position in the By Application segment of the Automotive Stainless Steel Market, with a 43.1% share.

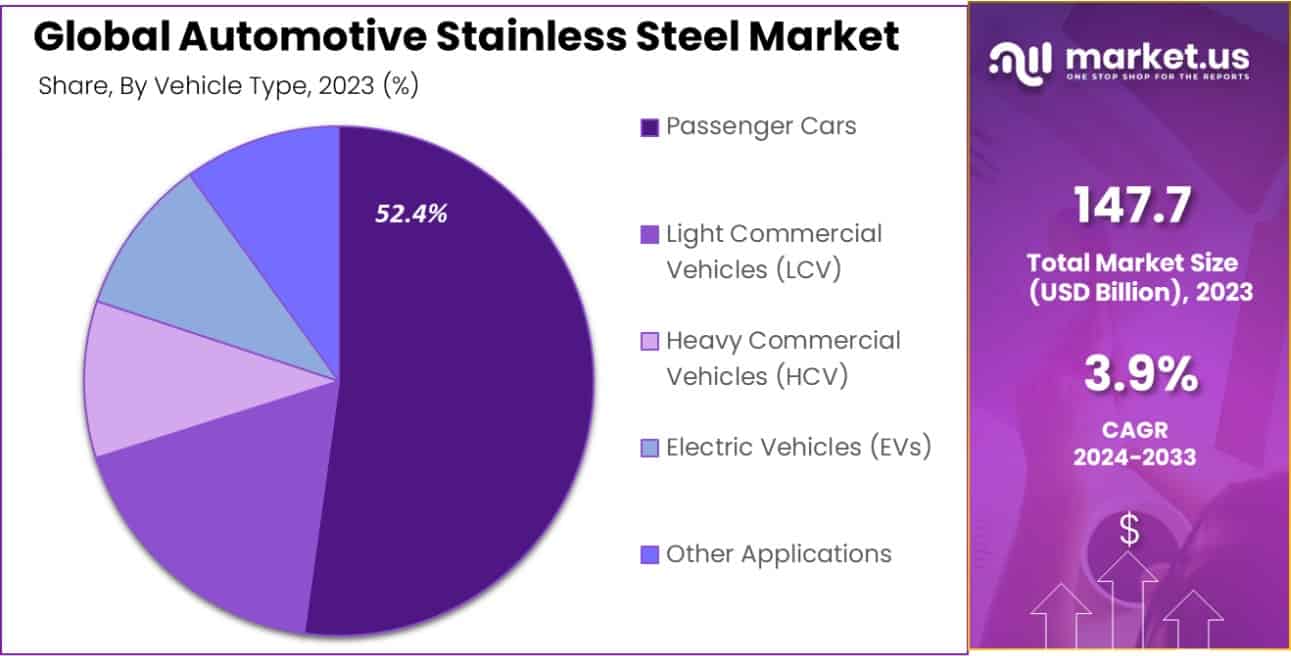

In 2023, Passenger Cars held a dominant market position in the By Vehicle Type segment of the Automotive Stainless Steel Market, with a 52.4% share.

In 2023, OEMs held a dominant market position in the By Distribution Channel segment of the Automotive Stainless Steel Market, with a 71.2% share. - Asia Pacific dominated a 50.3% market share in 2023 and held USD 74.2 Billion revenue of the Automotive Stainless Steel Market.

By Stainless Steel Type Analysis

In 2023, Austenitic held a dominant market position in the “By Stainless Steel Type” segment of the Automotive Stainless Steel Market, with a 65.4% share. Following Austenitic, Ferritic stainless steel accounted for 16.2% of the market, while Martensitic steel captured 10.1%.

Duplex and Precipitation-Hardening steels had smaller shares of 4.8% and 3.5%, respectively. This distribution reflects the distinct properties and applications of each stainless steel type within the automotive industry.

Austenitic stainless steel is highly favored for its superior corrosion resistance and excellent formability, making it indispensable in automotive applications that demand durability and flexibility. The significant market share of Austenitic stainless steel can be attributed to its widespread use in automotive exteriors and critical engine components.

On the other hand, Ferritic stainless steel, known for its moderate corrosion resistance and lower cost, is predominantly utilized in exhaust systems and decorative trims. Martensitic stainless steel, offering higher strength and wear resistance, finds its application in structural components and fasteners.

The smaller market penetrations of Duplex and Precipitation-Hardening steels are due to their specialized applications, which are typically limited to high-stress environments and advanced engineering applications requiring enhanced strength-to-weight ratios.

This segmentation highlights the strategic adoption of different stainless steel types, tailored to meet the evolving demands and performance criteria within the automotive sector.

By Applications Analysis

In 2023, Exhaust Systems held a dominant market position in the “By Application” segment of the Automotive Stainless Steel Market, with a 43.1% share. Structural Components followed with 26.9% of the market, while Fuel Tanks and Transmission Systems captured 17.5% and 12.5%, respectively. This segmentation underlines the pivotal roles different applications play in utilizing stainless steel to meet automotive industry requirements.

Exhaust Systems, comprising the largest market share, primarily use ferritic stainless steel due to its resistance to corrosion and high temperature. This is crucial for handling exhaust gases efficiently, ensuring durability and performance.

Structural Components, which include frames and supports, utilize a blend of austenitic and martensitic stainless steels, valued for their strength and formability. This allows for safety and stability in vehicle architecture.

Fuel Tanks benefit from austenitic stainless steel’s excellent corrosion resistance, which is essential for storing fuels safely and maintaining purity. Meanwhile, Transmission Systems employ martensitic and duplex stainless steels, which provide the necessary hardness and resistance to wear and tear, critical for the longevity and reliability of transmission components.

Each application’s reliance on specific types of stainless steel underscores their tailored functionalities designed to enhance the overall performance and safety of automotive vehicles.

By Vehicle Type Analysis

In 2023, Passenger Cars held a dominant market position in the “By Vehicle Type” segment of the Automotive Stainless Steel Market, with a 52.4% share. This was followed by Light Commercial Vehicles (LCV) at 20.6%, Heavy Commercial Vehicles (HCV) at 14.3%, Electric Vehicles (EVs) at 9.2%, and Other Applications at 3.5%.

This distribution illustrates the varied use of stainless steel across different vehicle types, reflecting each category’s specific requirements and growth dynamics.

Passenger Cars command the largest share due to their extensive production volumes globally and the critical role of stainless steel in enhancing safety, aesthetics, and vehicle longevity. Stainless steel is primarily used in exhaust systems, structural components, and aesthetic trims in this segment. Light Commercial Vehicles also rely significantly on stainless steel for durability and resistance to corrosion, particularly in frames and body panels.

Heavy Commercial Vehicles use stainless steel in more structurally demanding applications due to the material’s strength and fatigue resistance, essential for vehicles that operate under heavier loads and more strenuous conditions.

Electric Vehicles are increasingly adopting stainless steel to house batteries and other critical components, safeguarding against environmental factors and ensuring structural integrity. The categorization of stainless steel utilization underscores its indispensable nature across varying automotive applications, tailored to specific vehicle requirements.

By Distribution Channel Analysis

In 2023, OEMs held a dominant market position in the “By Distribution Channel” segment of the Automotive Stainless Steel Market, with a 71.2% share, compared to the Aftermarket, which held 28.8%. This considerable market share difference highlights the critical role of Original Equipment Manufacturers in the initial provisioning of stainless steel components within the automotive industry.

OEMs are the primary channel for stainless steel components, integrated during the initial manufacturing process of vehicles. The preference for OEMs can be attributed to their direct partnership with automotive manufacturers, ensuring that stainless steel parts meet stringent quality standards and specifications required for new vehicles.

These components are essential for various applications including exhaust systems, structural components, and engine parts, all of which benefit from the durability and corrosion resistance of stainless steel.

The Aftermarket’s smaller share underscores its role in replacement parts and upgrades. Despite its lesser share, the aftermarket remains vital for the maintenance and longevity of vehicles in operation, offering replacement parts that adhere to or exceed original specifications.

Consumers and repair shops rely on aftermarket providers for high-quality stainless steel components that ensure performance and safety are maintained throughout the vehicle’s lifecycle. This segmentation reveals the balanced ecosystem of stainless steel supply, dominated by OEMs but significantly supported by aftermarket services.

Key Market Segments

By Stainless Steel Type

- Austenitic

- Ferritic

- Martensitic

- Duplex

- Precipitation-Hardening

By Application

- Exhaust Systems

- Structural Components

- Fuel Tanks

- Transmission Systems

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles (LCV)

- Heavy Commercial Vehicles (HCV)

- Electric Vehicles (EVs)

- Other Applications

By Distribution Channel

- OEMs

- Aftermarket

Drivers

Stainless Steel Market Growth Drivers

The Automotive Stainless Steel Market is primarily driven by the increasing demand for vehicles that offer higher safety, enhanced aesthetics, and longer durability. As automotive manufacturers strive to meet stringent global standards for safety and emissions, the adoption of stainless steel has surged due to its superior properties, such as high resistance to corrosion, strength, and aesthetic appeal.

Stainless steel is crucial in critical areas like exhaust systems, which must withstand extreme temperatures and corrosive exhaust gases, and in structural components where strength and durability are paramount.

Additionally, the rise in electric vehicle production has further propelled the use of stainless steel, as it provides the necessary protection for battery systems against harsh conditions, ensuring vehicle safety and longevity. This trend is expected to continue as the global push towards greener and safer vehicles intensifies.

Restraint

Challenges in Stainless Steel Adoption

A significant restraint in the Automotive Stainless Steel Market is the high cost associated with stainless steel materials and processing. Stainless steel, known for its durability and corrosion resistance, often comes at a premium compared to other materials like aluminum or traditional steel.

This cost factor can be a major hurdle for automotive manufacturers, particularly in developing markets where cost efficiency is crucial. Additionally, the complexity involved in manufacturing and working with stainless steel can lead to increased production times and higher labor costs.

These factors combined make it challenging for manufacturers to maintain competitiveness while integrating stainless steel extensively across various automotive components. This economic barrier is likely to persist, influencing manufacturers’ decisions regarding material choice, especially in cost-sensitive segments of the market.

Opportunities

Expanding Opportunities in Stainless Steel

The Automotive Stainless Steel Market presents significant opportunities, particularly through the growing trends of vehicle electrification and lightweight materials. As the automotive industry shifts towards electric vehicles (EVs), the demand for stainless steel is expected to increase because of its ability to protect critical EV components like battery packs.

Stainless steel’s durability and resistance to environmental factors make it ideal for housing sensitive electric components. Additionally, the industry’s focus on reducing vehicle weight to enhance fuel efficiency and performance has highlighted stainless steel’s role in lightweight construction without compromising safety or durability.

These trends provide a pathway for stainless steel manufacturers to innovate and expand their product offerings to meet the evolving needs of the automotive sector, tapping into new market segments and reinforcing their presence in the industry.

Challenges

Navigating Stainless Steel Market Challenges

One of the main challenges facing the Automotive Stainless Steel Market is the competition from alternative materials like aluminum and composites, which are also lightweight and cost-effective. These materials are increasingly being chosen by automotive manufacturers for their lower cost and similar performance characteristics, such as high strength and corrosion resistance.

The competition is intensified by ongoing advancements in material science that enhance the qualities of these alternatives, making them more attractive for a wide range of automotive applications.

Additionally, the global supply chain issues affecting the availability and price stability of stainless steel add another layer of complexity, impacting manufacturers’ ability to consistently source high-quality stainless steel at competitive prices.

These challenges require stainless steel providers to continuously innovate and improve their offerings to remain competitive in a market that is becoming increasingly crowded with alternative solutions.

Growth Factors

Key Growth Factors in Stainless Steel

The growth of the Automotive Stainless Steel Market is bolstered by several key factors, including advancements in technology and increasing environmental regulations. Technological improvements in stainless steel production have made it possible to produce higher quality steel at lower costs, making stainless steel more accessible for automotive applications.

This is crucial as automotive manufacturers look to meet stricter safety and emissions regulations globally. Moreover, the shift towards more sustainable and eco-friendly manufacturing practices has increased the demand for materials like stainless steel that are durable, recyclable, and have minimal environmental impact over their lifecycle.

The ongoing push for cleaner, more fuel-efficient vehicles also supports the increased use of stainless steel, particularly in lightweight and high-strength components that enhance vehicle performance while reducing emissions. These factors collectively drive the continued expansion of the stainless steel market within the automotive sector.

Emerging Trends

Emerging Trends in Stainless Steel Market

Emerging trends in the Automotive Stainless Steel Market are significantly shaped by innovations aimed at enhancing vehicle efficiency and sustainability. A notable trend is the increasing use of high-strength and lightweight stainless steel grades that contribute to vehicle weight reduction without compromising safety or performance.

This is particularly important in the era of electric vehicles, where reducing weight can extend battery range and efficiency. Additionally, there is a growing interest in developing corrosion-resistant and heat-resistant stainless steels that can withstand harsher environments and more rigorous operating conditions.

This development is crucial for parts like exhaust systems and engine components. Another emerging trend is the integration of smart manufacturing processes that utilize automation and data analytics to optimize stainless steel production, reducing waste and improving consistency in quality, further driving the market’s growth and innovation.

Regional Analysis

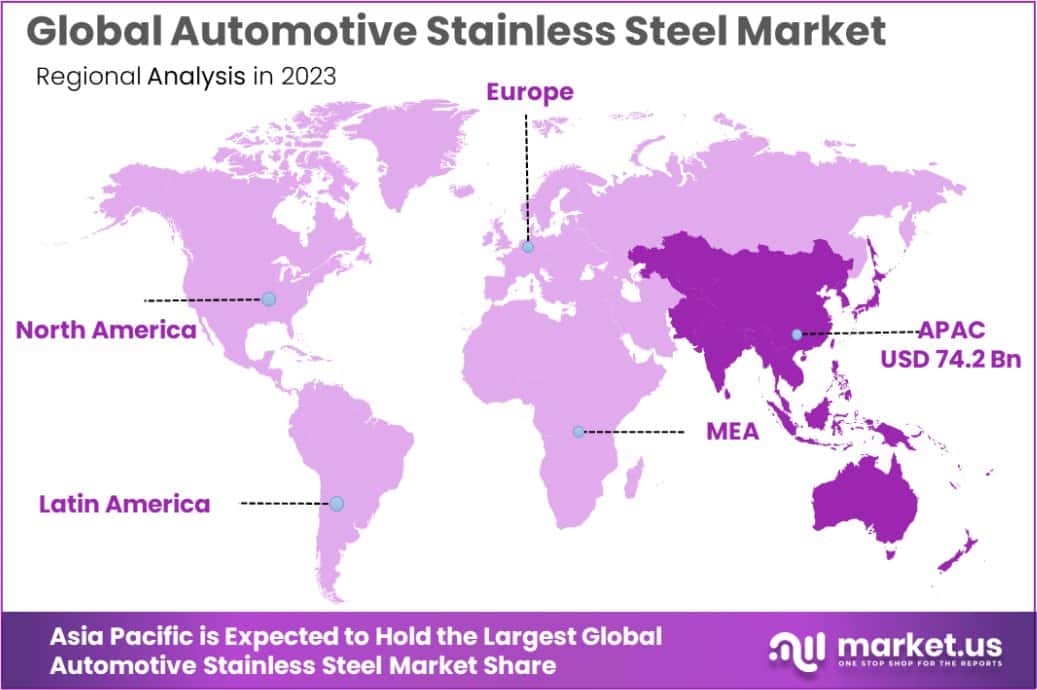

In the global landscape of the Automotive Stainless Steel Market, the Asia Pacific region emerges as the dominating force, accounting for 50.3% of the market share and valued at USD 74.2 billion.

This substantial market presence is driven by the region’s robust automotive manufacturing sector, particularly in China, Japan, and South Korea, which are not only major automotive producers but also significant consumers of stainless steel.

The emphasis on manufacturing efficiency and technological advancements in these countries supports their leading position.

Following Asia Pacific, Europe holds a significant position, benefiting from its advanced automotive industry and stringent environmental regulations that favor the adoption of high-quality stainless steel to reduce emissions and enhance vehicle longevity.

North America also represents a key market, with a focus on innovation in stainless steel applications, particularly for electric vehicles and fuel-efficient models.

Meanwhile, the Middle East & Africa and Latin America markets are smaller but growing, driven by increasing vehicle production and industrialization. These regions are witnessing gradual increases in automotive manufacturing capabilities, which in turn boosts the demand for automotive stainless steel, albeit at a slower pace compared to their global counterparts.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, key players in the global Automotive Stainless Steel Market, such as ThyssenKrupp AG, ArcelorMittal, and POSCO, have demonstrated strategic dominance and innovative approaches in addressing the evolving demands of the automotive industry.

ThyssenKrupp AG, with its extensive expertise in engineering and technology, continues to be a leader in providing high-quality stainless steel solutions tailored for automotive applications. The company’s focus on sustainable practices and efficiency in production techniques positions it well within the market, particularly in Europe where stringent environmental regulations drive demand for advanced, eco-friendly automotive components.

ArcelorMittal stands out for its global reach and comprehensive product range, which includes both flat and long stainless steel products. As the largest steel manufacturer in the world, ArcelorMittal leverages its vast network and innovative capabilities to meet the specific needs of the automotive sector, emphasizing lightweight and high-strength steel that contributes to fuel efficiency and improved performance.

The company’s ongoing commitment to R&D ensures it remains at the forefront of material science, particularly in developing steels that are easier to recycle, aligning with global sustainability goals.

POSCO, a giant in the Asian steel industry, continues to expand its influence in the automotive stainless steel market by capitalizing on robust growth in the Asia Pacific region. Known for its technological prowess and quality, POSCO focuses on producing specialized steel grades that cater to specific applications like electric vehicles, which are increasingly popular in its domestic and export markets.

Together, these companies not only shape the competitive landscape of the Automotive Stainless Steel Market but also drive innovation and sustainable practices that will likely set the standards for future developments in the industry. Their strategic initiatives and adaptive approaches ensure that they not only meet the current demands but are also well-prepared for future challenges in the automotive sector.

Top Key Players in the Market

- ThyssenKrupp AG

- ArcelorMittal

- POSCO

- Nippon Steel & Sumitomo Metal Corporation

- United States Steel Corporation

- Aperam

- Outokumpu

- Jindal Stainless

- Baosteel

- Tata Steel

- Stainless Steel Corporation of America

- Other Key Players

Recent Developments

- In October 2024, Yamaha and Caterham EVo Ltd are collaborating on ‘Project V,’ an electric sports coupe set for mass production by mid-2025. The vehicle was unveiled at the 2023 Goodwood Festival and the 2024 Tokyo Auto Salon.

- In October 2024, Accuron Technologies has established a New Ventures pillar and partnered with Hyundai CRADLE to invest in Xnergy Autonomous Power Technologies, aiming to strengthen its position in emerging markets and align with global sustainability trends.

- In March 2024, Jindal Stainless partners with JBM Auto to fabricate over 500 stainless steel electric buses, utilizing JT Tubes made from high-strength, low-carbon N7 stainless steel, enhancing the buses’ performance, strength, and durability.

Report Scope

Report Features Description Market Value (2023) USD 147.7 Billion Forecast Revenue (2033) USD 216.5 Billion CAGR (2024-2033) 3.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Stainless Steel Type (Austenitic, Ferritic, Martensitic, Duplex, Precipitation-Hardening), By Application (Exhaust Systems, Structural Components, Fuel Tanks, Transmission Systems), By Vehicle Type (Passenger Cars, Light Commercial Vehicles (LCV), Heavy Commercial Vehicles (HCV), Electric Vehicles (EVs), Other Applications), By Distribution Channel (OEMs, Aftermarket) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ThyssenKrupp AG, ArcelorMittal, POSCO, Nippon Steel & Sumitomo Metal Corporation, United States Steel Corporation, Aperam, Outokumpu, Jindal Stainless, Baosteel, Tata Steel, Stainless Steel Corporation of America, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Stainless Steel MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample

Automotive Stainless Steel MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- ThyssenKrupp AG

- ArcelorMittal

- POSCO

- Nippon Steel & Sumitomo Metal Corporation

- United States Steel Corporation

- Aperam

- Outokumpu

- Jindal Stainless

- Baosteel

- Tata Steel

- Stainless Steel Corporation of America

- Other Key Players