Global Car Air Purifiers Market Size, Share, Growth Analysis By Technology (HEPA, Ionic Filter, Activated Carbon, Other Technologies), By Vehicle Type (Luxury, Economical, Medium-Priced), By Sales Channel (OEM, Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 106623

- Number of Pages: 256

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

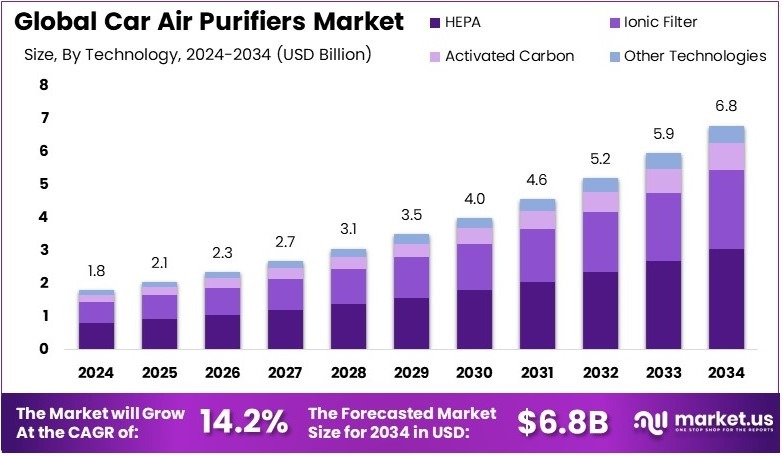

The Global Car Air Purifiers Market size is expected to be worth around USD 6.8 Billion by 2034, from USD 1.8 Billion in 2024, growing at a CAGR of 14.2% during the forecast period from 2025 to 2034.

Car air purifiers are compact devices that clean the air inside vehicles. They remove dust, smoke, odors, and allergens using filters or ionizers. These purifiers improve cabin air quality and provide a healthier driving experience, especially in polluted cities or for passengers with allergies or respiratory concerns.

The car air purifiers market involves the development and sale of in-vehicle air cleaning systems. It includes portable models and factory-installed units. Demand is driven by urban air pollution, health awareness, and comfort preferences. The market serves both individual car owners and commercial vehicle operators.

Car air purifiers are becoming more important as air pollution worsens. These devices help filter harmful particles inside vehicles. According to the American Lung Association, 131 million people in the U.S. were exposed to unhealthy air in 2024. This creates growing interest in clean-air solutions for personal transportation.

The car air purifiers market is rising with vehicle ownership. In the U.S., 91.7% of households owned at least one vehicle in 2022. As people spend more time in cars, clean air becomes a top priority. Therefore, demand for portable and easy-to-use air purifiers is increasing across cities.

Furthermore, ride-sharing growth is supporting the trend. With more drivers using their cars for business, keeping cabins clean matters more. In this context, air purifiers help build trust and ensure a healthy ride for both passengers and drivers. This opens space for innovation and low-cost solutions.

In contrast, air quality issues are widespread. A report by IQAir showed that only seven countries met WHO’s PM2.5 air quality standards in 2024. At the local level, about 44 million Americans live in areas with failing grades in all three pollution measures. This highlights a major need for personal air filters.

Despite rising demand, the market faces competition. Many brands offer similar features, making it harder for new entrants. However, brands with unique features like HEPA filters, ionizers, or smart sensors have a better chance. In addition, those focused on design and affordability can gain more attention in urban markets.

On the broader scale, car air purifiers support public health. They reduce exposure to harmful particles while commuting. This benefits people with asthma, allergies, or respiratory issues. As city air gets worse, the need for clean in-car environments will only grow stronger among health-conscious consumers.

Key Takeaways

- The Car Air Purifiers Market was valued at USD 1.8 billion in 2024 and is expected to reach USD 6.8 billion by 2034, with a CAGR of 14.2%. Growing concerns over in-car air quality and pollution drive demand.

- In 2024, HEPA technology dominated with 45%, due to its high efficiency in filtering fine particles and allergens.

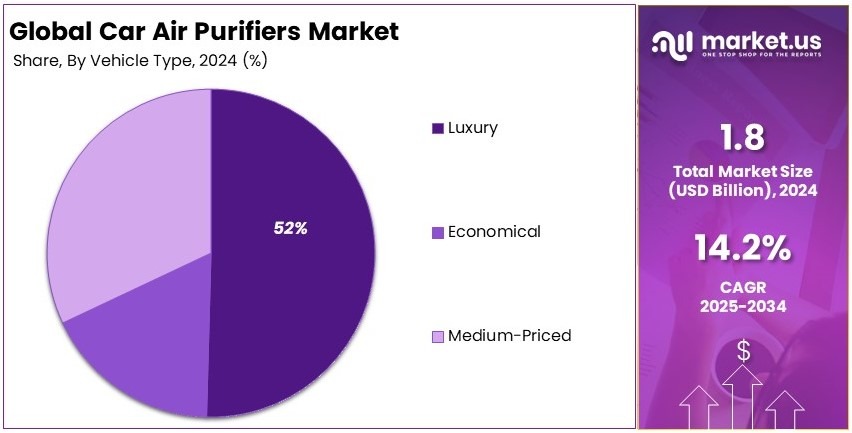

- In 2024, Luxury Vehicles led with 52%, as premium cars integrate advanced air purification systems as a standard feature.

- In 2024, Aftermarket sales dominated with 60%, driven by the increasing adoption of air purifiers in existing vehicles.

- In 2024, Ionic Filter technology gained popularity, offering odor removal and air sterilization benefits.

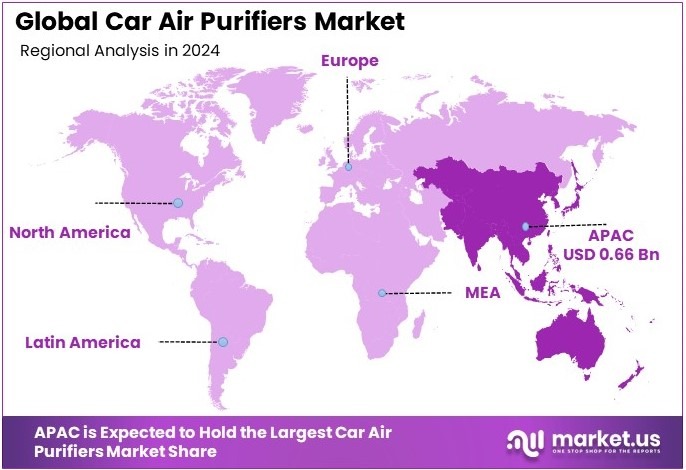

- In 2024, Asia Pacific led with 36.5% with valuation of USD 0.66 billion, driven by rising air pollution concerns and increased car sales in the region.

Technology Analysis

HEPA dominates with 45% due to its high efficiency in trapping air pollutants.

In the car air purifiers market, the HEPA (High-Efficiency Particulate Air) filter technology stands out as the leading segment, holding a 45% market share. This dominance is primarily due to HEPA filters’ ability to efficiently trap airborne particles, including dust, pollen, mold spores, and other pollutants, which is critical for maintaining a clean and healthy environment inside vehicles. Furthermore, as air quality concerns increase globally, the demand for HEPA-based car air purifiers continues to grow.

On the other hand, Ionic Filters employ ions to remove pollutants from the air, a method valued for its quiet operation and low power consumption. However, it is less effective at capturing larger particles compared to HEPA filters.

Activated Carbon filters are excellent at removing gases and odors, making them ideal for vehicles exposed to urban pollution and smog. They complement HEPA filters by trapping chemicals that HEPA cannot.

Other Technologies include UV light and electrostatic precipitators, which provide additional options for consumers looking for specific types of pollutant control in their vehicles.

Vehicle Type Analysis

Luxury vehicles dominate with 52% due to higher adoption rates of advanced technologies.

Luxury vehicles lead the vehicle type segment with a 52% market share, largely because these vehicles often come equipped with advanced technology features, including high-quality air purification systems. Owners of luxury cars place a high premium on interior comfort and air quality, driving demand for advanced car air purifiers in this segment.

In contrast, Economical vehicles are less likely to have factory-installed air purifiers, but they represent a potential growth area as consumers become more health-conscious. Meanwhile, Medium-Priced vehicles are gradually incorporating more advanced air purifying technologies as standard features, reflecting a broader industry trend towards better in-car air quality.

Sales Channel Analysis

Aftermarket dominates with 60% due to the ease of upgrades and customization.

The Aftermarket channel is the most significant in the sales of car air purifiers, holding a 60% market share. This dominance is driven by the ease with which consumers can purchase and install aftermarket air purifiers, providing a cost-effective solution for vehicle owners who wish to upgrade their existing cars without integrated air purification systems.

OEM (Original Equipment Manufacturer) installations are typically found in new cars, especially in the luxury segment. While OEM installations are growing, the flexibility and wide range of options available in the aftermarket continue to make it a more popular choice among consumers.

In each of these segments, ongoing innovations and the increasing consumer demand for healthier in-car environments are key drivers of growth in the car air purifiers market. Manufacturers are continuously improving the effectiveness and integration of air purifiers to meet the rising standards and expectations of modern consumers, thereby ensuring the segment’s expansion and evolution.

Key Market Segments

By Technology

- HEPA

- Ionic Filter

- Activated Carbon

- Other Technologies

By Vehicle Type

- Luxury

- Economical

- Medium-Priced

By Sales Channel

- OEM

- Aftermarket

Driving Factors

Health Awareness and Urban Mobility Drives Market Adoption

The car air purifiers market is growing steadily, fueled by rising awareness around in-vehicle air quality and its impact on health. Consumers are becoming more concerned about airborne pollutants, allergens, and microbes inside their cars, particularly in densely populated cities. This shift in awareness is pushing demand for compact and effective air purification devices tailored for cars.

The rise in urban air pollution, especially in metro cities such as Delhi, Beijing, and Los Angeles, has further intensified the need for clean air while commuting. Smog, dust, and harmful particles enter vehicle cabins through ventilation systems, raising health concerns for frequent drivers and passengers.

Additionally, the growth in personal vehicle ownership and increased ride-sharing activity has widened the use base. Owners of taxis, ride-hailing cars, and personal vehicles alike are seeking solutions to improve cabin air quality, particularly after the COVID-19 pandemic heightened hygiene consciousness.

Original equipment manufacturers (OEMs) are also beginning to integrate air purifiers as standard or optional accessories. This shift from aftermarket to factory-installed units signals mainstream adoption. Together, these drivers are expanding the consumer base and embedding car air purifiers into everyday driving needs, making them more than just luxury add-ons.

Restraining Factors

Cost and Technical Constraints Restraints Market Penetration

Despite increasing demand, several challenges are slowing the widespread adoption of car air purifiers. One of the most limiting factors is their reduced effectiveness in open traffic conditions. Vehicles frequently exposed to heavy pollution or traveling with windows down often experience limited air purification performance, which can reduce perceived value.

High product costs also hinder mass-market appeal. While premium car owners may invest in built-in or advanced purifiers, budget-conscious consumers often view them as non-essential. This price sensitivity, especially in developing economies, limits growth in entry- and mid-segment vehicle categories.

Compatibility issues present another concern. Compact vehicles, which dominate many urban markets, have limited dashboard or rear space, making installation difficult. In such cases, larger purifiers may block visibility or interfere with other components. Maintenance requirements, including frequent filter replacements and short operational life, add to the total cost of ownership. Consumers may avoid using the product regularly due to these ongoing costs.

Growth Opportunities

Innovation and Premium Segments Provides Opportunities

The car air purifiers market presents strong opportunities, particularly through product innovation and targeted applications. The development of compact, multi-functional air purifiers is a key opportunity. Devices that combine filtration with added features—such as ionizers, humidifiers, or aromatherapy—are gaining traction among urban commuters seeking enhanced driving comfort.

Another high-potential area is expansion into commercial fleets and public transport systems. Buses, corporate taxis, and shuttle services are increasingly investing in air quality management to ensure passenger safety and satisfaction. Large-scale adoption in these sectors could drive volume growth.

The demand for HEPA and activated carbon-based filtration technologies is also rising. These filters are known for their ability to trap fine particles, allergens, and odors, making them attractive for health-conscious consumers. Product positioning around advanced filtration performance is helping differentiate brands in a crowded market.

Luxury and premium car segments also offer promising ground. Custom-designed purifiers that blend with high-end interiors or are integrated with smart infotainment systems are appealing to premium buyers. These tailored solutions can command higher price points and create brand loyalty. As consumer preferences evolve, companies that align functionality with aesthetics and convenience will likely gain a competitive edge in this space.

Emerging Trends

Smart Features and Clean-tech Are Latest Trending Factor

Several emerging trends are reshaping the car air purifiers market toward smarter and cleaner technologies. One significant trend is the integration of air purifiers with vehicle HVAC and infotainment systems. This allows users to monitor air quality levels and control purification functions through built-in car displays, creating a seamless user experience.

Another trend is the growing use of UV-C and ionization technologies. These solutions target bacteria, viruses, and mold, offering advanced purification beyond standard dust and odor filtration. UV-based systems are especially gaining attention in post-pandemic conditions due to their disinfection capabilities.

Smartphone-controlled purifiers and app-enabled features are also in demand. Users prefer the convenience of adjusting settings, checking filter status, and receiving air quality alerts via their mobile devices. These connectivity features appeal to tech-savvy consumers who expect smart home-like functionality in their vehicles.

Additionally, there is a noticeable rise in demand for combo models that include aroma diffusion or humidification. These models not only clean the air but also enhance cabin ambiance and comfort. Such innovations are positioning car air purifiers as lifestyle accessories rather than basic utility products, signaling a trend toward personalization, wellness, and intelligent mobility solutions.

Regional Analysis

Asia Pacific Dominates with 36.5% Market Share with USD 0.66 Bn in the Car Air Purifiers Market

Asia Pacific leads the Car Air Purifiers Market with a significant 36.5% share and additional revenue of USD 0.66 billion. The region’s dominance is driven by increasing air pollution concerns, rising automobile sales, and heightened awareness about health benefits of air purifiers.

The market is influenced by the region’s large urban populations facing severe air quality issues, which boost demand for in-car air purification solutions. The presence of major automotive manufacturers who integrate air purifiers as standard features also contributes to market growth.

The future impact of Asia Pacific on the global market is expected to strengthen as urbanization continues and consumer awareness grows. Ongoing innovations in air purification technology, such as HEPA filters and activated carbon solutions, are likely to further drive the region’s market share.

Regional Mentions:

- North America: North America’s market for Car Air Purifiers is supported by an increasing trend towards health and wellness, particularly in urban areas with poor air quality. The market benefits from strong sales channels and a preference for high-end products with advanced features.

- Europe: Europe maintains a robust market for Car Air Purifiers, driven by strict air quality regulations and a high rate of technological adoption. European consumers show a strong preference for environmentally friendly and energy-efficient products.

- Middle East & Africa: The Middle East and Africa are experiencing growth in the Car Air Purifiers Market, primarily due to the increasing vehicle fleet and growing awareness of health issues caused by air pollution. The market is also helped by urban expansion and economic development in the region.

- Latin America: Latin America is seeing a rise in demand for Car Air Purifiers, spurred by urbanization and increasing concerns about the health impacts of air pollution. The market is further supported by rising middle-class income levels and the consequent increase in vehicle ownership.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The Car Air Purifiers Market is dominated by leading players such as Honeywell International Inc., 3M Company, Panasonic Holdings Corporation, and Eureka Forbes Limited. These companies stand out through product quality, advanced technology, and strong brand reputation.

Their leadership is based on delivering effective air filtration systems that remove dust, smoke, allergens, and harmful particles from car interiors. Honeywell and 3M use advanced HEPA and carbon filters. Panasonic and Eureka Forbes offer air purifiers with ionizers and compact designs suitable for various car models.

Innovation is a key driver. These companies continuously improve filtration performance, reduce noise levels, and add smart features like air quality indicators and auto-mode functions. Panasonic’s nanoe™ technology and Eureka Forbes’ compact portable models show their focus on both tech and convenience.

Wide distribution channels, including online platforms, auto accessory retailers, and electronics stores, strengthen their market reach. Their presence across multiple countries allows them to respond quickly to regional demands and pollution concerns.

As awareness of in-car air quality grows—especially in urban and high-pollution areas—these companies are positioned to meet rising consumer demand. The shift towards health-focused car accessories further supports their growth.

In the years ahead, the top four players will continue to lead with strong R&D, global access, and smart marketing, ensuring they remain competitive in the expanding Car Air Purifiers Market.

Major Companies in the Market

- Honeywell International Inc.

- 3M Company

- Panasonic Holdings Corporation

- Eureka Forbes Limited

- DENSO Corporation

- Sharp Electronics Corporation

- Shenzhen Agcen Environmental Protection Technology Co., Ltd.

- Koninklijke Philips N.V.

- Airbus Electronic Technology Co Ltd

- Eureka Forbes

- Other Key Players

Recent Developments

- Kronos Advanced Technologies Acquires Suarez Corporation Industries: On August 2024, Kronos announced plans to acquire Suarez Corporation Industries for up to $25 million, strengthening its direct-to-consumer marketing and air purification business.

- Hyundai, Kia, and Samsung Electronics: On January 2024, Hyundai and Kia partnered with Samsung Electronics to integrate the ‘SmartThings’ IoT platform into connected car services, potentially influencing in-vehicle air purification systems.

Report Scope

Report Features Description Market Value (2024) USD 1.8 Billion Forecast Revenue (2034) USD 6.8 Billion CAGR (2025-2034) 14.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology (HEPA, Ionic Filter, Activated Carbon, Other Technologies), By Vehicle Type (Luxury, Economical, Medium-Priced), By Sales Channel (OEM, Aftermarket) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Honeywell International Inc., 3M Company, Panasonic Holdings Corporation, Eureka Forbes Limited, DENSO Corporation, Sharp Electronics Corporation, Shenzhen Agcen Environmental Protection Technology Co., Ltd., Koninklijke Philips N.V., Airbus Electronic Technology Co Ltd, Eureka Forbes, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Honeywell International Inc.

- 3M Company

- Panasonic Holdings Corporation

- Eureka Forbes Limited

- DENSO Corporation

- Sharp Electronics Corporation

- Shenzhen Agcen Environmental Protection Technology Co., Ltd.

- Koninklijke Philips N.V.

- Airbus Electronic Technology Co Ltd

- Eureka Forbes

- Other key Players