Global Ride-sharing Apps Market Size, Share, Statistics Analysis Report By Type (E-hailing, Car Sharing, Car Rental, Station-based Mobility), By Vehicle Type (Electric Vehicle, ICE Vehicle, CNG/LPG Vehicle, Micro-mobility Vehicle), By Business Model (Business-to-Consumer (B2C), Business-to-Business (B2B), Peer-to-Peer (P2P)), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143712

- Number of Pages: 215

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Analysts’ Viewpoint

- Business Benefits

- New Revenue Streams

- China Ride-sharing Apps Market

- Type Analysis

- Vehicle Type Analysis

- Business Model Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Emerging Trends

- Key Player Analysis

- Top Opportunities Awaiting for Players

- Recent Developments

- Report Scope

Report Overview

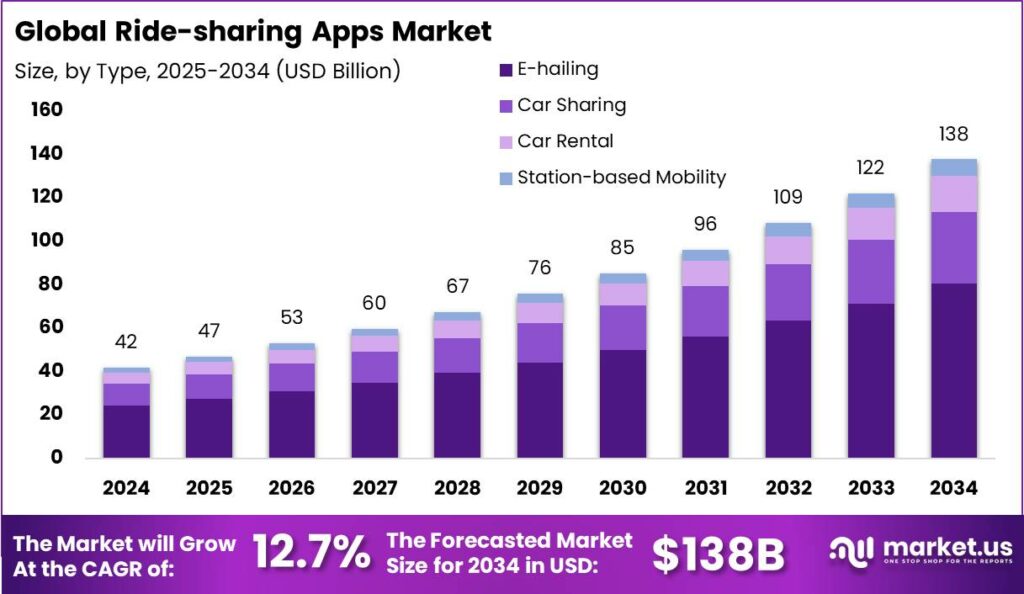

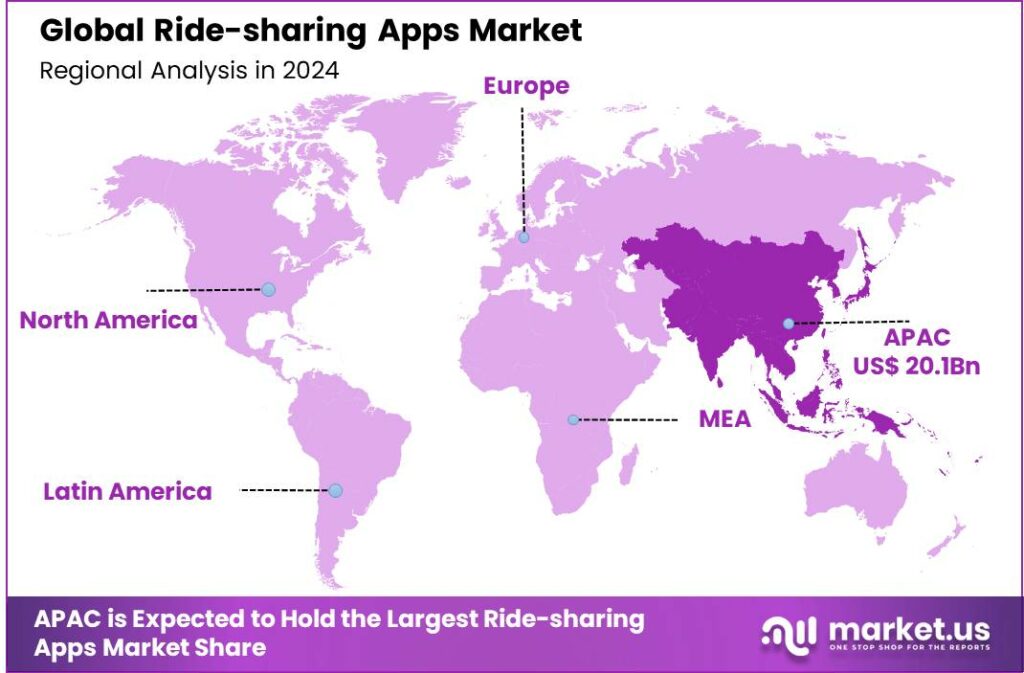

The Global Ride-sharing Apps Market size is expected to be worth around USD 138 Billion By 2034, from USD 41.7 Billion in 2024, growing at a CAGR of 12.70% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific dominated the global ride-sharing apps market with over 48.3% share and USD 20.1 billion in revenue. China’s ride-sharing market was valued at USD 8.60 billion, growing at a CAGR of 14.9%.

Ride-sharing apps facilitate shared rides on short notice. This mode of transportation utilizes digital platforms to connect drivers with passengers heading in the same direction, effectively optimizing vehicle usage and reducing travel costs. The core benefit lies in its convenience and cost-efficiency, as passengers can secure rides through mobile apps, which track the vehicle’s location and provide estimated arrival times.

The market for ride-sharing apps has expanded rapidly over the last decade, evolving into a pivotal component of urban mobility. Companies like Uber and Lyft have transformed the way people commute, making transportation as simple as a few taps on a smartphone. The market’s growth is propelled by the increasing urban population, rising smartphone penetration, and a growing shift towards cost-efficient and environmentally friendly travel options.

The primary drivers of the ride-sharing market include urbanization and the escalating cost of vehicle ownership. Urban centers are becoming more congested, making car ownership less practical due to high parking and maintenance costs. Additionally, the growing awareness of environmental issues drives many consumers to seek greener alternatives to solo driving.

Ride-sharing apps answer these needs by providing affordable and convenient transportation options that also contribute to reduced carbon emissions. Demand for ride-sharing services is influenced by several factors, including the integration of technology in daily life and the increasing need for cost-effective transportation in cities.

The convenience of booking rides through a mobile app appeals to a tech-savvy, younger demographic, while the economic benefits attract a broader audience. According to the latest insights from Zippia, Uber dominates the U.S. rideshare market with a commanding 71% share of sales, while Lyft holds the remaining 29%.

The global ridesharing market is anticipated to reach approximately $185.2 billion by 2026, reflecting its significant growth potential. Notably, 26% of ridesharing app users utilize these services on a monthly basis, and 36% of Americans have used a ridesharing service at least once. On a global scale, China leads with 44% of the population using rideshare services, followed by Russia at 42%, the United States at 36%, Brazil at 30%, and the United Kingdom at 11%.

For businesses, ride-sharing apps offer significant benefits, such as lower capital costs and expanded market reach. Unlike traditional taxi services, ride-sharing companies do not require investments in vehicle fleets; rather, they leverage existing vehicles owned by their drivers. This model reduces startup and operational costs, enabling rapid scalability and flexibility in service offerings.

Key Takeaways

- The Global Ride-sharing Apps Market is projected to reach a value of around USD 138 Billion by 2034, growing from USD 41.7 Billion in 2024, at a CAGR of 12.70% during the forecast period from 2025 to 2034.

- In 2024, the E-hailing segment held a dominant market position, capturing more than 58.4% share of the ride-sharing apps market.

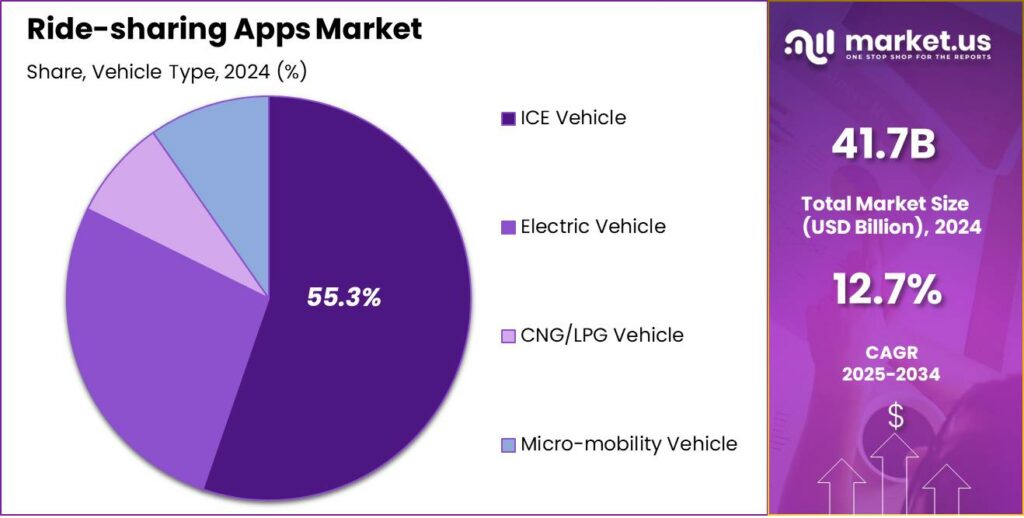

- The ICE Vehicle segment dominated the ride-sharing market in 2024, accounting for more than 55.3% share.

- The Business-to-Consumer (B2C) segment led the ride-sharing apps market in 2024, with a share of over 62.7%.

- In 2024, Asia-Pacific was the dominant region in the global ride-sharing apps market, holding more than 48.3% share, with revenue approximately amounting to USD 20.1 billion.

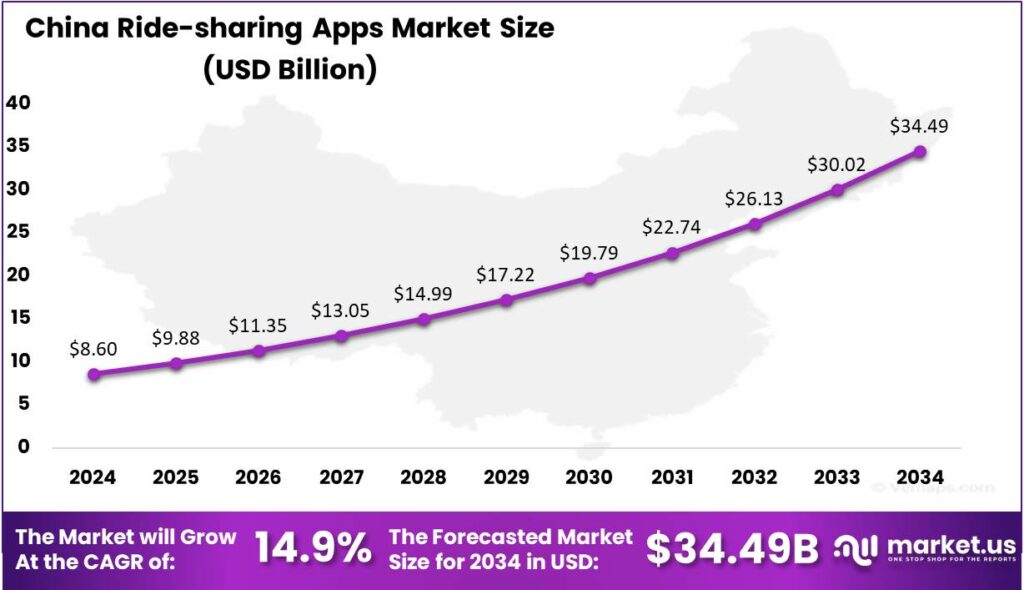

- The ride-sharing market in China was valued at around USD 8.60 billion in 2024, with a strong growth trajectory, exhibiting a CAGR of 14.9%.

Analysts’ Viewpoint

From an analyst’s perspective, the ride-sharing apps market presents compelling investment opportunities due to its substantial growth potential and pivotal role in modern urban transport infrastructures. Key impacting factors include technological advancements that enhance the user experience and operational efficiency, such as improved GPS systems, AI-driven algorithms for route optimization, and real-time traffic analysis.

However, the regulatory environment remains a critical concern, as governments worldwide scrutinize the safety, security, and employment standards within the ride-sharing industry. Compliance with these regulations and the ability to adapt to evolving legal frameworks are essential for sustained growth and profitability in this sector.

Business Benefits

Ride-sharing apps make transportation easy and convenient, allowing users to book rides instantly without waiting for taxis or public transport. In urban areas, 90% of ride-sharing users cite convenience as their primary reason for using these services, underscoring the value placed on time-saving and efficient transportation as per data provided by Worldmetrics.

Ride-sharing apps provide income opportunities through commissions, surge pricing and additional services like food delivery during off-peak hours. According to news.com.au.,in Australia, car owners have been earning an average of $1,000 per month by renting out their vehicles through platforms like Turo, turning idle cars into income-generating assets.

By promoting shared rides and carpooling, ride-sharing apps help reduce the number of vehicles on the road. This lowers traffic congestion and carbon emissions, contributing to cleaner air and sustainable urban mobility. These eco-friendly practices align with global efforts to combat climate change.

New Revenue Streams

- Commission-Based Model: The primary source of revenue for ride-sharing apps comes from taking a commission on each ride booked through the platform. This fee typically ranges from 20% to 30% of the fare, depending on the app and market conditions.

- Surge Pricing: During peak demand periods, ride-sharing apps implement surge pricing, which raises fares to balance supply and demand. Dynamic pricing during bad weather or major events helps companies maximize revenue and encourage more drivers, while also managing rider expectations during peak times.

- Subscription Services: Many ride-sharing platforms offer subscription plans that provide users with benefits such as discounted rides, priority pickups, or waived cancellation fees for a monthly fee.Services like Uber Pass or Lyft Pink offer users flat-rate access to perks, ensuring steady revenue for the company and boosting customer loyalty.

- In-App Advertising: Ride-sharing apps can generate additional revenue through in-app advertising by showing targeted ads from local businesses or brands. This method provides extra income without heavily impacting the user experience, allowing advertisers to reach a captive audience while offering platforms a new revenue stream.

- Delivery and Freight Services: Expanding beyond passenger transport, companies like Uber have ventured into delivery services and freight transportation. By leveraging their existing infrastructure, these platforms can explore new markets and revenue streams, diversifying offerings and stabilizing income across sectors.

China Ride-sharing Apps Market

In 2024, the market for ride-sharing apps in China was valued at approximately USD 8.60 billion. This sector is experiencing a robust growth trajectory, with a compound annual growth rate (CAGR) of 14.9%.

The significant expansion in this market can be attributed to several factors including increasing smartphone penetration, the rising popularity of shared economy platforms, and supportive government policies promoting sustainable transportation solutions. As urbanization continues to escalate in China, the demand for convenient and cost-effective travel options such as ride-sharing has surged, further propelling market growth.

The market is poised for sustained growth, driven by technological advancements and the integration of artificial intelligence and machine learning to enhance user experiences. The introduction of electric and autonomous vehicles into the ride-sharing fleets is also expected to bolster the market’s expansion, aligning with China’s environmental goals and reducing operational costs for providers.

In 2024, Asia-Pacific held a dominant market position in the global ride-sharing apps market, capturing more than a 48.3% share with revenue amounting to approximately USD 20.1 billion. This substantial market share can be primarily attributed to the high population density and rapid urbanization in key economies such as China and India.

The growth of the Asia-Pacific market is fueled by widespread smartphone adoption and growing internet access. A young, tech-savvy population is quickly embracing ride-sharing apps. Moreover, proactive government regulations aimed at reducing traffic congestion and carbon emissions are further driving market expansion.

Local players like Didi Chuxing in China and Ola in India have effectively utilized local knowledge and cultural insights to tailor their services, enabling successful expansion both domestically and into other regional markets. Their scalable business models and large user bases continue to strengthen Asia-Pacific’s dominance in the global ride-sharing industry.

In contrast, North America and Europe also show significant activity in the ride-sharing market but experience slower growth. These regions focus on regulatory frameworks and innovations like autonomous ride-sharing, but high vehicle ownership and well-established public transportation systems limit market penetration and growth compared to Asia-Pacific.

Type Analysis

In 2024, the E-hailing segment held a dominant market position within the ride-sharing apps market, capturing more than a 58.4% share. E-hailing refers to the process of booking rides via an app, where passengers can summon transportation to their location on demand.

The dominance of the E-hailing segment can be attributed to several pivotal factors. First, the integration of technology and user-friendly interfaces provides a seamless customer experience, from ride-hailing to payment and feedback. Additionally, the widespread adoption of smartphones and improved internet connectivity has enabled instant access to e-hailing services, fostering growth.

Consumer behavior plays a crucial role in e-hailing growth, as modern consumers prioritize speed, convenience, and digital solutions. E-hailing services meet these needs by quickly matching riders with nearby drivers. The ability to choose rides based on budget and style preferences further enhances customer satisfaction, strengthening the service’s market position.

Technological advancements are vital to e-hailing’s leadership, with big data analytics and AI optimizing routes and improving safety. These innovations boost operational efficiency and passenger security, fostering better service delivery and reliability, and encouraging users to prefer e-hailing over traditional transport or other ride-sharing options.

Vehicle Type Analysis

In 2024, the ICE Vehicle segment held a dominant position in the ride-sharing market, capturing more than a 55.3% share. This predominance can be attributed to the widespread availability and established infrastructure supporting internal combustion engine (ICE) vehicles.

Despite the surge in environmental consciousness and the push for sustainable transportation options, the Electric Vehicle (EV) segment in ride-sharing is still in a developmental phase. High initial purchase prices and concerns regarding charging infrastructure and range limit the rapid adoption of EVs in the ride-sharing industry.

The CNG/LPG vehicle segment adds diversity to the ride-sharing market by offering an eco-friendly alternative to traditional ICE vehicles at a competitive cost. It is especially appealing in regions where governments promote CNG/LPG as transitional fuels. The lower emissions from these vehicles help meet regulatory demands for reduced urban air pollution.

The micro-mobility vehicle segment, including bikes and scooters, is growing in high-density cities where traffic and parking are challenges. Ideal for short, intra-city trips, these vehicles complement public transit and are set to expand as cities enhance infrastructure to support them, diversifying the ride-sharing market.

Business Model Analysis

In 2024, the Business-to-Consumer (B2C) segment held a dominant market position within the ride-sharing apps market, capturing more than a 62.7% share. This segment’s strong performance can be attributed to its direct engagement with end users, offering them easy access to ride-sharing services through consumer-friendly apps.

The success of the B2C segment is fueled by major investments in marketing and customer experience by key players like Uber and Lyft. By focusing on user interface design and customer service, these companies ensure a seamless experience, boosting customer retention and encouraging frequent use, solidifying the B2C model’s dominance.

The B2C business model is highly scalable, enabling rapid expansion into new geographic areas. By leveraging existing technology platforms, ride-sharing companies can accommodate more users without significant costs, allowing them to capitalize on emerging markets with increasing demand for reliable and affordable transportation.

The B2C segment benefits from advanced technologies like AI, machine learning, and big data analytics, enhancing route optimization, dynamic pricing, and customer interactions. These innovations improve service delivery and operational efficiency, helping B2C ride-sharing services maintain a competitive edge and sustain their market lead.

Key Market Segments

By Type

- E-hailing

- Car Sharing

- Car Rental

- Station-based Mobility

By Vehicle Type

- Electric Vehicle

- ICE Vehicle

- CNG/LPG Vehicle

- Micro-mobility Vehicle

By Business Model

- Business-to-Consumer (B2C)

- Business-to-Business (B2B)

- Peer-to-Peer (P2P)

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Flexibility and Autonomy

Ride-sharing platforms, such as Uber and Lyft, offer drivers significant flexibility and autonomy in their work schedules. Unlike traditional employment structures, drivers can choose when and where to work, allowing them to tailor their driving hours to personal commitments or preferences.

This flexibility is particularly beneficial for individuals seeking supplementary income or those balancing multiple responsibilities. For instance, Uber drivers can log in and out at their convenience, choosing their own working hours. This autonomy enables drivers to optimize their work-life balance, accommodating personal needs and preferences.

Operating on multiple platforms allows drivers to maximize earnings by tapping into varying demand patterns. This model gives drivers more control over their income and work conditions, reflecting the growth of the gig economy.

Restraint

Legal and Compliance Challenges

The ride-sharing industry faces significant regulatory challenges as governments and local authorities grapple with integrating these services into existing legal frameworks. Companies like Uber and Lyft have encountered numerous legal challenges from governments and regulatory bodies worldwide. These challenges often stem from the clash between innovative business models and traditional transportation regulations.

Issues such as licensing requirements, insurance obligations, and labor classifications have led to legal disputes and operational restrictions in various regions. Ride-sharing companies must navigate complex regulations by engaging with policymakers, adapting business practices, and sometimes litigating to ensure operational viability. These regulatory restraints present ongoing challenges to the industry’s growth and sustainability.

Opportunity

Expansion into Autonomous Vehicles

The advent of autonomous vehicle (AV) technology presents a significant opportunity for the ride-sharing industry to revolutionize urban transportation. Companies like Uber are actively exploring partnerships with AV developers to integrate self-driving cars into their fleets.

The integration of AVs can lead to reduced operational costs by eliminating the need for human drivers, potentially resulting in lower fares for consumers and increased profit margins for companies. Moreover, autonomous vehicles can operate continuously without breaks, enhancing service availability and efficiency.

The global market for autonomous ride-sharing is set to grow significantly, offering a lucrative expansion opportunity. However, success depends on technological advancements, regulatory approvals, and public acceptance.

Challenge

Ensuring Driver Welfare and Fair Compensation

A significant challenge within the ride-sharing industry is addressing concerns related to driver welfare and fair compensation. While gig work offers flexibility, studies show issues like low pay, lack of benefits, and job insecurity. Ride-sharing drivers, for instance, often earn below minimum wage due to vehicle expenses and unpaid waiting times.

Additionally, the classification of drivers as independent contractors rather than employees means they are typically ineligible for benefits such as health insurance, paid leave, and retirement plans. This classification has been a point of contention, leading to legal battles and calls for policy reforms. Ensuring fair compensation and adequate protections for drivers remains a critical challenge that the industry must address to promote sustainable and equitable growth.

Emerging Trends

Ride-sharing apps have transformed urban transportation by adapting to technology and changing consumer preferences. One notable trend is the integration of electric vehicles (EVs) into ride-sharing fleets. Ride-sharing companies are increasingly adopting EVs to align with environmental goals and reduce operational costs.

Another significant development is the progression toward autonomous vehicles. Companies like Uber and Lyft are investing heavily in self-driving technology, conducting extensive testing, and forming strategic partnerships to integrate autonomous vehicles into their services.

Multi-modal integration is also shaping the future of ride-sharing apps. Platforms are expanding beyond traditional car rides to include services like bikes, scooters, and public transit options. This approach provides users with a range of transportation choices, enhancing flexibility and convenience in daily commutes.

Key Player Analysis

The ride-sharing industry has rapidly grown over the past decade, transforming commuting. As numerous companies compete for market share, a few key players have emerged as market leaders.

Uber Technologies, Inc. is the largest and most recognized player in the ride-sharing market. With a presence in over 900 metropolitan areas worldwide, Uber has revolutionized urban transportation. The company offers a wide range of services, from basic rides to UberX, to premium options like Uber Black.

Lyft, Inc. is the second-largest ride-sharing company in the U.S. and a significant player in North America. Known for its user-friendly interface and customer-first approach, Lyft focuses on building a strong, community-oriented brand. Lyft differentiates itself by offering various services like Lyft Line for carpooling and Lyft Lux for premium rides.

Via Transportation, Inc. has a unique business model in the ride-sharing space. Unlike traditional ride-hailing services, Via focuses on shared rides, pooling passengers who are traveling in the same direction. This model helps reduce costs and improve efficiency. Via’s innovative approach makes it a key player in the future of transportation, focusing on sustainability and smarter city transit solutions.

Top Key Players in the Market

- Uber Technologies, Inc.

- Lyft, Inc.

- Via Transportation, Inc.

- Zoox, Inc.

- Didi Chuxing Technology Co., Ltd.

- ANI Technologies

- Grab

- Gett

- Revel

- BlaBlaCar

- Other Major Players

Top Opportunities Awaiting for Players

In this dynamic landscape, several key opportunities have emerged for industry players.

- Integration of Autonomous Vehicles (AVs): The advancement of autonomous vehicle technology presents a transformative opportunity for ride-sharing companies. Collaborations between ride-sharing platforms and AV developers can enhance operational efficiency and reduce costs. Uber’s partnership with Waymo aims to integrate self-driving cars into its fleet, potentially transforming urban mobility.

- Expansion into Emerging Markets: Emerging markets, particularly in regions like Asia-Pacific, offer substantial growth potential due to increasing urbanization and a growing middle class. Ola has capitalized on this by building a strong presence in India and expanding to Australia and the UK, tailoring its services to local needs, which has fueled significant user base growth.

- Diversification of Mobility Services: Expanding service offerings beyond traditional ride-sharing can capture a broader customer base. Incorporating micromobility options, such as e-scooters and bikes, addresses the demand for short-distance travel. For example, Bolt has diversified its services to include scooters, becoming a prominent micromobility operator in Europe.

- Development of Super Apps: Creating integrated platforms that offer multiple services can enhance user engagement and loyalty. Uber’s ambition to evolve into a “super app” encompasses ride-sharing, food delivery, and travel bookings, providing a seamless user experience. This approach can increase customer retention and open additional revenue streams.

- Adoption of Sustainable Practices: Emphasizing sustainability by incorporating electric vehicles (EVs) aligns with global environmental goals and appeals to eco-conscious consumers. Companies like Yulu in India focus on providing EV-based mobility solutions, addressing both environmental concerns and urban congestion.

Recent Developments

- In July 2024, Lyft announced partnerships with autonomous vehicle companies, including May Mobility, to integrate self-driving cars into its ride-sharing network. This move is part of Lyft’s strategy to incorporate autonomous technology into its services.

- In December 2024, Zoomcar, known for its self-drive car rentals in India, is expanding into Bengaluru’s ride-sharing market with a new chauffeur-driven service. Customers can now book cars with drivers for anywhere between two hours and a month.

- In December 2024, Uber introduced its first international robotaxi service in Abu Dhabi. This initiative, in partnership with China’s WeRide, allows users to book autonomous vehicles through the Uber app. Initially, these vehicles include safety operators, with plans to transition to fully driverless rides in the future.

Report Scope

Report Features Description Market Value (2024) USD 41.7 Bn Forecast Revenue (2034) USD 138 Bn CAGR (2025-2034) 12.70% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (E-hailing, Car Sharing, Car Rental, Station-based Mobility), By Vehicle Type (Electric Vehicle, ICE Vehicle, CNG/LPG Vehicle, Micro-mobility Vehicle), By Business Model (Business-to-Consumer (B2C), Business-to-Business (B2B), Peer-to-Peer (P2P)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Uber Technologies, Inc., Lyft, Inc., Via Transportation, Inc., Zoox, Inc., Didi Chuxing Technology Co., Ltd., ANI Technologies, Grab, Gett, Revel, BlaBlaCar, Other Major Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Uber Technologies, Inc.

- Lyft, Inc.

- Via Transportation, Inc.

- Zoox, Inc.

- Didi Chuxing Technology Co., Ltd.

- ANI Technologies

- Grab

- Gett

- Revel

- BlaBlaCar

- Other Major Players