Global Car Carrier Market Report By Type (Open-Air, Enclosed), By Application (Automobile Sales Service, Terminals, Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 13388

- Number of Pages: 306

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

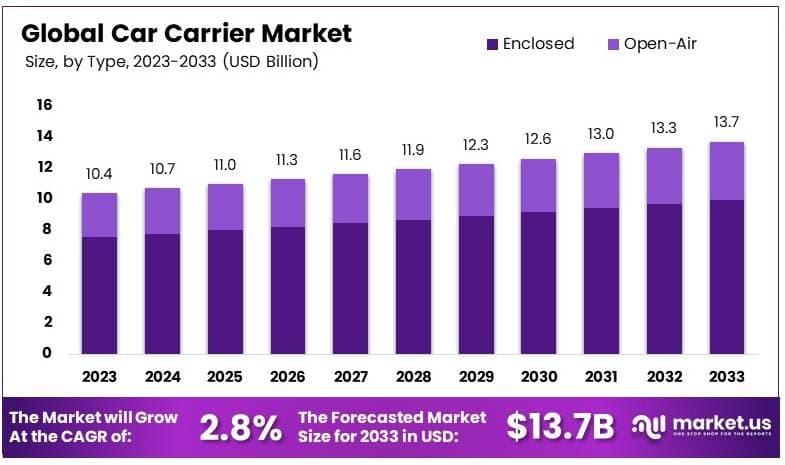

The Global Car Carrier Market size is expected to be worth around USD 13.7 Billion by 2033, from USD 10.4 Billion in 2023, growing at a CAGR of 2.8% during the forecast period from 2024 to 2033.

A car carrier is a specialized vehicle designed to transport multiple cars at once. These carriers are typically used by automotive manufacturers, dealerships, and logistics companies to move vehicles across long distances. They come in various types, including open-air and enclosed models, depending on the level of protection required for the vehicles being transported.

The car carrier market involves the production and operation of vehicles used to transport cars, including both domestic and international shipping. Growth in this market is influenced by factors such as the increasing demand for automobiles, the expansion of the global automotive industry, and the rising need for efficient transportation of vehicles.

The car carrier market is poised for growth, influenced by the increasing need for efficient vehicle logistics driven by high vehicle sales and ownership. The demand for car carriers is robust, supported by a well-established automotive industry and a resurgence in vehicle purchases post-economic downturns.

The Federal Motor Carrier Safety Administration (FMCSA) notes there are over 2 million registered carriers in the U.S., indicative of a robust infrastructure designed to support a wide array of transportation requirements—from private relocations to comprehensive auto dealership logistics.

The demand for car carrier services is closely linked to vehicle sales and ownership patterns. With 91.7% of U.S. households owning at least one vehicle, and 22.1% possessing three or more vehicles as of 2022, according to Forbes Advisor, there is a sustained need for transportation services.

This high ownership rate creates a stable demand for carriers, especially in a market where consumer preferences and auto dealership inventory rotations necessitate frequent vehicle transport.

The car carrier market is also influenced by economic factors and government regulations. The average annual cost of owning a car in the U.S. has surged to more than $12,000, as reported by AAA. This increase affects consumer behavior regarding vehicle purchases and upkeep, potentially altering the frequency and nature of vehicle transportation needs.

Moreover, regulations by bodies such as the FMCSA ensure that carriers adhere to safety and operational standards, which can affect market operations and competitive dynamics.

Despite the apparent demand, the car carrier industry faces challenges like market saturation and intense competitiveness. With a high number of registered carriers, companies are compelled to innovate and improve efficiency to differentiate themselves. The market’s competitive nature pushes carriers towards enhancing service quality and integrating advanced technologies for logistics management.

Key Takeaways

- The Car Carrier Market was valued at USD 10.4 billion in 2023 and is expected to reach USD 13.7 billion by 2033, with a CAGR of 2.8%.

- In 2023, Enclosed Car Carriers dominated the type segment with 72.6%, providing added protection during vehicle transportation.

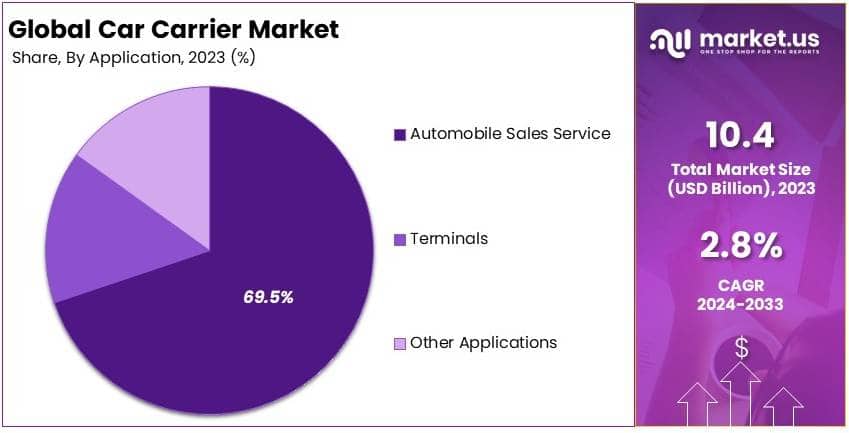

- In 2023, Automobile Sales Service led the application segment with 69.5%, highlighting its importance in transporting new vehicles.

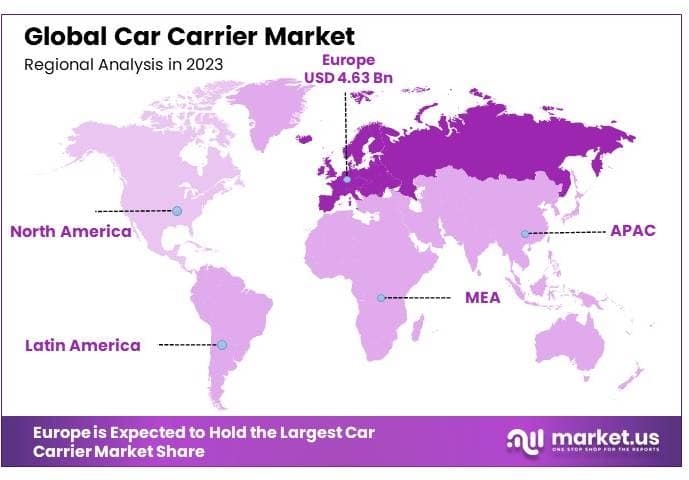

- In 2023, Europe led the market with 44.5%, driven by the strong automotive industry in the region.

Type Analysis

Enclosed car carriers dominate the market with 72.6% due to their enhanced protection against weather and theft.

In the car carrier market, there are two main types of carriers: open-air and enclosed. Enclosed car carriers are the dominant segment, greatly preferred for their ability to provide superior protection for vehicles during transportation.

These carriers are especially favored for transporting high-value, luxury travel, or vintage cars as they shield the vehicles from weather elements, road debris, and potential theft, thereby ensuring the car arrives at its destination in pristine condition.

The higher cost associated with enclosed carriers is often justified by the high level of protection they offer, making them a preferred choice for dealerships and individual owners who demand the best care for their vehicles.

Open-air car carriers are less expensive than their enclosed counterparts and are commonly used for standard vehicle transport. They are capable of transporting more vehicles at once, which reduces shipping costs. Despite their exposure to the elements, open-air carriers remain popular for short-distance transports and with dealerships moving large volumes of less expensive vehicles.

Application Analysis

Automobile sales services dominate the application segment with 69.5%, driven by the high volume of vehicles requiring transport from manufacturers to dealerships.

Carriers are primarily used in various applications, with automobile sales services being the predominant one. This segment’s dominance is driven by the constant need for efficient vehicle logistics from manufacturing plants to dealerships and ultimately to consumers.

Car carriers are essential in this sector to ensure that new vehicles are delivered timely and in sellable condition, which is crucial for maintaining brand reputation and customer satisfaction. The dependability and capability of transporting multiple vehicles safely make car carriers indispensable in the automotive sales industry.

Terminals represent another significant application of car carriers, serving as critical nodes in the automotive distribution network. These facilities often handle the temporary storage and subsequent redistribution of vehicles to different destinations, requiring robust and efficient transport solutions to move large volumes of cars.

Other applications include corporate fleets and rental services, where car carriers are used to relocate vehicles based on business demand or in response to regional rental needs. These sectors value the logistical efficiency and cost-effectiveness provided by both types of car carriers.

The ongoing demand in the automobile sales service sector underscores the market’s growth, driven by global automotive sales and the need for efficient distribution networks. As the automotive industry continues to evolve, with a growing focus on sustainability and efficiency, the car carrier market is expected to adapt and expand, reflecting broader trends in automotive technology and transport logistics.

Key Market Segments

By Type

- Open-Air

- Enclosed

By Application

- Automobile Sales Service

- Terminals

- Other Applications

Drivers

Growth in Automotive Production Drives Market Growth

The Car Carrier Market is significantly driven by the growth in global automotive production, which has increased the need for efficient transportation solutions for vehicles. As automotive manufacturers ramp up production to meet consumer demand, car carriers are becoming crucial for moving vehicles from production facilities to dealerships.

Additionally, the expansion of international trade is another major driver. With the globalization of the automotive industry, the cross-border transportation of vehicles is essential, increasing the demand for both sea and land-based car carriers.

The growing demand for electric vehicles (EVs) further boosts the market. As EV production increases, so does the need for specialized carriers that can safely transport these vehicles, which often have different requirements than traditional internal combustion engine (ICE) vehicles.

Finally, advancements in logistics and smart transportation infrastructure have improved the efficiency of car carriers. Innovations such as smart tracking systems and automation in loading and unloading processes contribute to the growth of the market, as they allow for faster and more reliable transport services.

Restraints

High Costs and Environmental Regulations Restraint Market Growth

Several factors restrain the growth of the Car Carrier Market. High fuel and operational costs are a significant challenge for companies in this sector, as fluctuating fuel prices can lead to unpredictable cost structures, making it difficult to maintain profitability.

Moreover, stringent environmental regulations have added pressure on car carrier companies to reduce emissions. These regulations require the adoption of cleaner, more expensive technologies, which increases operational costs.

The limited availability of skilled labor, especially in developed markets, adds another layer of difficulty. A shortage of experienced drivers and logistics personnel can slow down the efficiency of operations, hampering the growth of the industry.

Lastly, supply chain disruptions, exacerbated by global events such as the COVID-19 pandemic, have made it difficult for companies to operate smoothly. Delays in production and transportation can have a ripple effect, limiting the market’s expansion.

Opportunity

EV Transport and Emerging Markets Provide Opportunities

The Car Carrier Market is presented with several growth opportunities, especially in the context of electric vehicle (EV) transportation. As the global automotive industry shifts towards EVs, there is a growing need for specialized carriers that can accommodate the specific needs of these vehicles.

Expansion into emerging markets also presents a lucrative opportunity. With the rise of automotive sales in countries across Asia, Africa, and Latin America, car carrier services are increasingly required to meet growing demand in these regions.

The growth of digital and automated logistics systems offers another avenue for development. Innovations such as route optimization software and automated fleet management tools allow for more efficient and cost-effective transportation, helping companies gain a competitive edge.

Finally, the push towards sustainable transportation options, such as hybrid or fully electric car carriers, opens up opportunities to align with environmental goals and meet regulatory standards, attracting eco-conscious clients.

Challenges

Competition and Technological Challenges Market Growth

The Car Carrier Market faces several challenges that could hinder its growth. Rising competition in the logistics and transportation sector, driven by both traditional players and new entrants, puts pressure on car carrier companies to maintain competitive pricing and service quality.

Technological integration complexities also pose a significant challenge. While automation and digital tools offer operational improvements, their implementation can be costly and difficult, especially for smaller firms with limited resources.

Volatile fuel prices remain a constant challenge. Fluctuating fuel costs can significantly impact profit margins, making it difficult for companies to predict long-term operational expenses.

Lastly, increasing customer expectations for faster and more reliable delivery times create additional pressure on car carrier companies to optimize their operations and meet tight deadlines.

Growth Factors

Global Vehicle Sales and Supply Chain Expansion Are Growth Factors

The Car Carrier Market is benefiting from the increase in global vehicle sales, which directly drives the demand for vehicle transportation services. As more vehicles are sold worldwide, the need for carriers to transport these vehicles from production plants to dealerships grows.

The expansion of automotive supply chains, particularly with more manufacturers operating across multiple regions, also fuels demand for car carrier services. As production facilities become more decentralized, the need for efficient, long-distance transport increases.

Rising demand for efficient and reliable transportation services further contributes to market growth. As customers and businesses alike expect timely and secure deliveries, car carrier companies that provide high-quality services are seeing greater demand.

Additionally, the growing focus on reducing carbon emissions in the logistics industry is driving investments in greener, more efficient car carriers, further supporting the market’s growth trajectory.

Emerging Trends

Autonomous Carriers and EV Specialization Are Latest Trending Factor

The adoption of autonomous vehicle carriers is one of the latest trends in the Car Carrier Market. These autonomous carriers, though in the early stages of development, promise to revolutionize the industry by reducing labor costs and improving efficiency through automated operations.

The rising demand for specialized carriers tailored to electric vehicles (EVs) is another growing trend. As the global automotive industry shifts towards EVs, more companies are focusing on designing carriers that can safely transport these vehicles, meeting their unique specifications.

The growth in multi-carrier transportation services is also a notable trend. This approach allows companies to transport multiple types of vehicles simultaneously, optimizing space and reducing costs.

Lastly, the increased use of blockchain technology in logistics for tracking and managing car carrier operations is transforming the sector by enhancing transparency and efficiency, making it a key trend shaping the future of the market.

Regional Analysis

Europe Dominates with 44.5% Market Share

Europe leads the Car Carrier Market with a 44.5% share, generating USD 4.63 billion. This dominance is driven by the region’s strong automotive industry, the presence of major car manufacturers, and extensive trade within and outside the European Union. The demand for car carriers is fueled by high vehicle production and exports, particularly in countries like Germany, France, and Italy.

Europe’s well-developed transportation infrastructure and stringent regulations on vehicle safety and emissions further enhance the efficiency of the car carrier market. Additionally, the region’s focus on sustainable transportation practices and the growth of electric vehicle (EV) production are contributing factors. The logistics and shipping sectors in Europe are also well-established, supporting efficient vehicle transportation across the region and globally.

Europe’s leadership in the car carrier market is expected to strengthen as the region continues to invest in advanced transportation solutions and green logistics. The growing adoption of electric and autonomous vehicles will further boost demand for car carriers, particularly for EV-specific carriers, increasing Europe’s market share in the coming years.

Regional Mentions:

- North America: North America holds 30.2% of the Car Carrier Market. Its high share is due to robust demand for vehicles and the presence of established automotive manufacturers, especially in the United States. The region benefits from a well-connected transportation network and rising vehicle exports to global markets.

- Asia Pacific: Asia Pacific accounts for 18.6% of the market, driven by rapid industrialization, rising vehicle production, and growing consumer demand for cars. China, Japan, and South Korea lead this market, with significant investments in automotive manufacturing and logistics infrastructure.

- Middle East & Africa: With a 4.2% market share, this region is gradually expanding its car carrier industry, particularly through growing imports of luxury vehicles. Infrastructure development and trade expansion contribute to the market’s growth.

- Latin America: Latin America captures 2.5% of the market, with rising car imports and exports, especially in Brazil and Mexico. The region is seeing steady growth in vehicle logistics, driven by increasing trade agreements and improved transportation networks.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Car Carrier Market is highly competitive, with key players like Mitsui & Co. Ltd, Nippon Yusen KK, K Line, and EUKOR Car Carriers Inc. leading the industry. These companies focus on providing efficient vehicle transport services, serving major automotive manufacturers globally. They cater to both international and domestic markets, offering specialized car carrier solutions for different types of vehicles.

Their product and service offerings include vehicle shipping, customized transportation solutions, and trailer manufacturing for domestic transport. Companies like Boydstun Equipment Manufacturing and Cottrell Trailers specialize in producing car carrier trailers, while others like Nippon Yusen KK focus on large-scale shipping solutions.

In terms of market strategies, these companies aim to strengthen partnerships with automotive manufacturers and improve fleet efficiency. They emphasize reliability and sustainability, seeking to reduce emissions in vehicle transportation. Pricing strategies are competitive, focusing on offering cost-efficient services while maintaining high-quality standards.

Geographically, these companies have a global presence, with a strong foothold in key markets such as North America, Europe, and Asia Pacific. Companies like Mitsui & Co. and Lohr Industrie have a significant presence in multiple regions, leveraging their global networks to expand market reach.

Innovation is a key focus for these players, with investments in advanced car carrier designs, sustainable practices, and automation to enhance efficiency.

Their competitive edge lies in their established global networks, extensive fleets, and continuous innovation, which position them as leaders in the Car Carrier Market.

Top Key Players in the Market

- Mitsui & Co. Ltd

- Nippon Yusen KK

- K Line

- EUKOR Car Carriers Inc.

- Dongfeng Trucks

- Miller Industries Inc

- Tec Equipment Inc.

- Boydstun Equipment Manufacturing

- Landoll Corporation

- Wally-Mo Trailers

- Cottrell Trailers

- Kässbohrer Transport Technik GmbH

- Lohr Industrie

Recent Developments

- Hankook Tire: In October 2024, Hankook Tire introduced the SmartLine AL50 TBR, aimed at supporting the car hauler segment. This tire is designed for durability and load-bearing capability, featuring innovations such as Stiffness Control Contour Technology and a three-peak mountain snowflake rating for year-round performance.

- MSC: In April 2024, MSC launched a $700 million takeover bid for Norway’s Gram Car Carriers (GCC), offering a 28% premium for the company’s shares. The deal, supported by major shareholders holding over 55% of shares, proposes Nkr263.69 (approximately $24) per share, with additional dividend benefits for some shareholders.

- Metrans: In August 2024, Metrans launched innovative 20-foot containers for car transport, designed in collaboration with Slovenian and Austrian partners. These reinforced steel containers can transport up to two cars, integrating into existing intermodal transport routes and utilizing both rail and road logistics.

Report Scope

Report Features Description Market Value (2023) USD 10.4 Billion Forecast Revenue (2033) USD 13.7 Billion CAGR (2024-2033) 2.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Open-Air, Enclosed), By Application (Automobile Sales Service, Terminals, Other Applications) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Mitsui & Co. Ltd., Nippon Yusen KK, K Line, EUKOR Car Carriers Inc., Dongfeng Trucks, Miller Industries Inc., Tec Equipment Inc., Boydstun Equipment Manufacturing, Landoll Corporation, Wally-Mo Trailers, Cottrell Trailers, Kässbohrer Transport Technik GmbH, Lohr Industrie Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Mitsui & Co. Ltd

- Nippon Yusen KK

- K Line

- EUKOR Car Carriers Inc.

- Dongfeng Trucks

- Miller Industries Inc

- Tec Equipment Inc.

- Boydstun Equipment Manufacturing

- Landoll Corporation

- Wally-Mo Trailers

- Cottrell Trailers

- Kässbohrer Transport Technik GmbH

- Lohr Industrie