Global Flying Car Market By Mode of Operation (Manned Flying Cars, Unmanned Flying Cars), By Application (Military, Commercial, Civil), By Seating Capacity (One, Two, Four, More Than Four), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 101885

- Number of Pages: 234

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

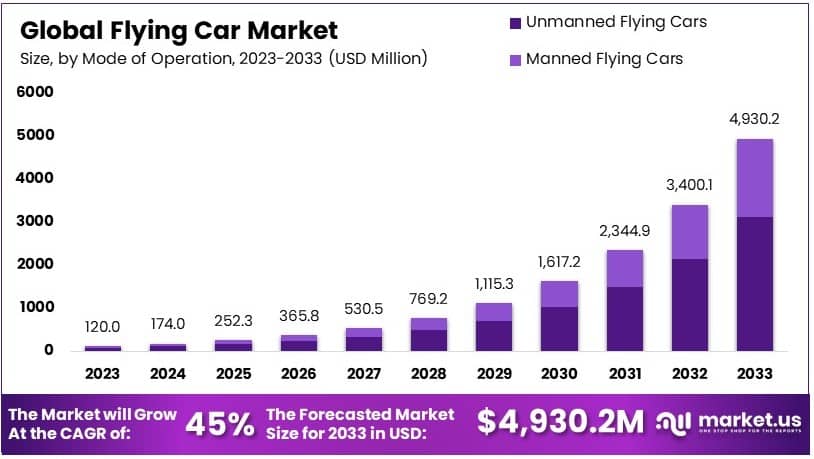

The Global Flying Car Market size is expected to be worth around USD 4,930.2 Million by 2033, from USD 120.0 Million in 2023, growing at a CAGR of 45.0% during the forecast period from 2024 to 2033.

A flying car is a vehicle designed for both road driving and flight. Using advanced technology like eVTOL (electric vertical takeoff and landing), it enables seamless transitions between ground and air travel. Flying cars aim to reduce congestion and provide efficient urban mobility, merging automotive and aviation capabilities.

The flying car market includes companies developing and producing these hybrid vehicles. This market serves sectors such as urban transportation, emergency response, and tourism. With technological advancements, companies work to make flying cars commercially viable, while governments adjust regulations to integrate these vehicles safely into shared airspace.

Regulations play a key role in supporting flying car adoption. In the U.S., the FAA established a new category for “powered-lift” aircraft, allowing eVTOLs to operate within the national airspace. Companies like Joby Aviation and Archer Aviation plan to launch air taxi services by 2025, showcasing progress in regulatory acceptance.

In China, XPeng AeroHT moves toward large-scale production, breaking ground on a facility capable of assembling 10,000 flying cars annually, targeting a 2026 market launch. This development signals significant production capacity, pushing forward the commercial feasibility of flying cars in the global market.

Government initiatives also drive growth. In the U.S., the “Jetsons Law,” passed in states like New Hampshire and Minnesota, establishes rules for cars that can fly. Similarly, the UK’s Future of Flight Action Plan aims to update regulations, potentially adding £45 billion to the economy by supporting new flight technologies.

As competition intensifies, companies focus on refining technology and securing regulatory approvals. With increased investments, flying cars are expected to transform urban transport, offering new solutions for congestion and mobility. This market holds substantial potential, yet relies on continuous innovation and supportive policy frameworks.

Key Takeaways

- The Flying Car Market was valued at USD 120.0 Million in 2023 and is expected to reach USD 4,930.2 Million by 2033, with a CAGR of 45.0%.

- In 2023, Unmanned Flying Cars lead with 63% in the mode of operation, indicating the push towards autonomous technology.

- In 2023, Military is the dominant application at 48%, driven by defense sector investments.

- In 2023, Two-Person seating capacity is prevalent, supporting compact aerial vehicles.

- In 2023, North America dominates with 38.0%, attributed to advancements in aerospace and defense.

Mode of Operation Analysis

Unmanned flying cars dominate with 63% due to advancements in autonomous technology and regulatory support.

The flying car market is segmented by mode of operation into manned and unmanned flying cars. The dominant sub-segment, unmanned flying cars, holds a 63% market share, primarily due to significant advances in autonomous vehicle technologies and increasingly supportive regulatory frameworks that facilitate their adoption.

This sub-segment benefits from continuous innovations in sensor technology, artificial intelligence, and machine learning, which enhance the safety and reliability of unmanned vehicles, making them particularly attractive for both commercial and civil applications.

In contrast, manned flying cars, though currently less dominant, play a crucial role in the market. These vehicles are essential for applications where human decision-making is critical, such as in complex, unpredictable environments.

The development of manned flying cars continues to benefit from advancements in lightweight materials and aerospace engineering, contributing to the overall growth of the flying car market.

Application Analysis

Military applications dominate with 48% due to strategic advantages and increased funding.

Flying cars have varied applications across military, commercial, and civil segments. The military segment emerges as the dominant sub-segment, accounting for 48% of the market. This dominance can be attributed to the strategic advantages flying cars offer, such as rapid deployment, vertical take-off and landing capabilities, and lower radar detectability.

Increased defense budgets and substantial investments in innovative airborne vehicles are further driving this segment’s growth.

The commercial segment, though not as dominant, is critical for the expansion of the flying car market, with uses ranging from aerial taxis to delivery services. This segment’s growth is spurred by urbanization and the increasing need for alternative transportation solutions in congested cities.

Meanwhile, the civil segment, which includes private flying cars for personal transportation, is growing due to technological advancements and the rising interest in personal air travel, signaling potential market expansion areas.

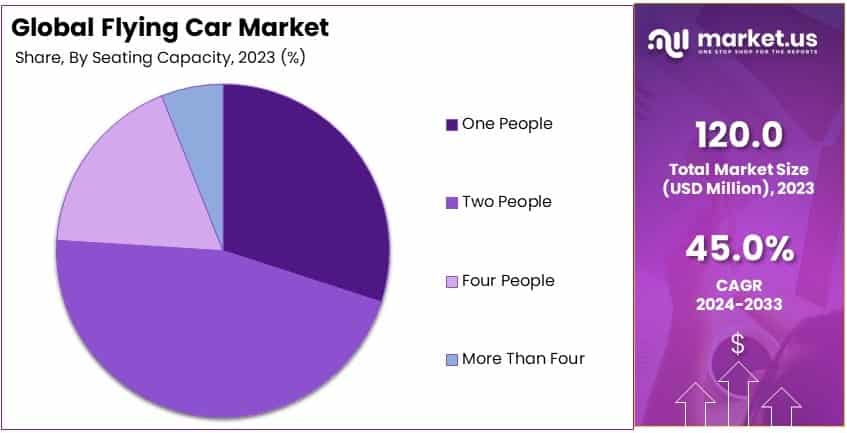

Seating Capacity Analysis

Two-person seating capacity leads due to optimal balance between performance and practicality.

The segmentation by seating capacity in the flying car market includes options for one, two, four, and more than four passengers. The two-person configuration is particularly prominent, favored for its balance between performance and practicality. This configuration meets the needs of most potential users, including commuters and small families, making it highly attractive for both private and commercial applications.

Single-seater flying cars are appealing for personal recreation and sport, offering agility and lower operational costs. However, their limited passenger capacity restricts broader market appeal.

Four-seater and larger capacity models cater to families and small groups, enhancing their utility for longer journeys and commercial uses such as air taxis. These larger models are pivotal in demonstrating the viability of flying cars for a range of applications, thereby supporting market growth across all segments.

Key Market Segments

By Mode of Operation

- Manned Flying Cars

- Unmanned Flying Cars

By Application

- Military

- Commercial

- Civil

By Seating Capacity

- One

- Two

- Four

- More Than Four

Drivers

Urban Mobility and Technological Advancements Drive Market Growth

The Flying Car Market’s expansion is strongly supported by rising smart mobility needs, significant R&D investments, government incentives, and advancements in battery technology. The demand for efficient urban mobility solutions has surged as cities grapple with congestion and limited transportation options.

Concurrently, substantial investments in research and development by major automotive and aerospace companies are accelerating innovation, leading to more reliable and accessible flying car models. Governments worldwide are recognizing the potential of this technology, providing tax breaks, subsidies, and grants to encourage adoption, which adds momentum to market growth.

Additionally, advancements in battery technology have made electric flying cars a more viable, sustainable option. Improved battery life, reduced weight, and faster charging capabilities are key technological shifts enabling flying cars to meet performance and environmental standards.

Restraints

High Costs and Regulatory Concerns Restrain Market Growth

The Flying Car Market faces substantial restraints due to high production and maintenance costs, regulatory challenges, infrastructure limitations, and public acceptance issues. Manufacturing and maintaining flying cars demand costly materials, complex engineering, and advanced technology, resulting in high initial and ongoing expenses that limit affordability for consumers and businesses.

Furthermore, regulatory frameworks are still under development in many regions, with safety and operational guidelines posing barriers for rapid deployment. In addition, the lack of suitable infrastructure—particularly for vertical takeoff and landing (VTOL) requirements—limits where these vehicles can operate, posing a significant obstacle to widespread adoption.

Lastly, public acceptance is still evolving, with safety concerns and trust issues influencing consumers’ readiness to embrace this new transportation mode. Combined, these factors restrain market growth, challenging stakeholders to address cost, safety, and regulatory issues to make flying cars a viable transportation solution.

Opportunity

Expanding Markets and Technological Integration Provide Opportunities

Opportunities within the Flying Car Market are emerging from expansion into developing markets, integration with AI and autonomous technologies, commercial applications beyond transportation, and partnerships with aerospace and automotive sectors.

Additionally, the integration of AI and autonomous features could enhance safety and user experience, making flying cars more appealing. Commercial use cases in sectors such as logistics, tourism, and emergency services present further applications, expanding the scope beyond personal travel.

Partnerships between tech firms and traditional manufacturers promote cross-sector innovation, combining expertise to refine flying car technologies. These factors create substantial opportunities for growth, as the market moves toward broader acceptance and varied applications.

Challenges

Technological and Regulatory Complexities Challenge Market Growth

The Flying Car Market confronts significant challenges, including technological reliability, airspace management, environmental impacts, and competition from existing mobility options. The technological complexity required for reliable, safe flying cars remains a hurdle, as ensuring consistent performance and addressing technical malfunctions are critical.

Airspace management, a vital component for safe operation, requires advanced control systems to prevent collisions and traffic issues, adding a layer of complexity to deployment. Environmental concerns, such as noise pollution and energy consumption, also pose challenges, as flying cars operate in close proximity to urban areas.

Furthermore, competition from traditional and emerging urban mobility solutions, like electric vehicles and autonomous shuttles, increases the pressure on flying car developers to offer distinct advantages.

Growth Factors

Demand for On-Demand Transport and Electric Vehicles Are Growth Factors

The growth of the Flying Car Market is further driven by rising demand for on-demand transport, expansion of electric vehicle (EV) markets, advancements in battery technology, and rapid developments in artificial intelligence (AI). The popularity of on-demand services in urban areas has created a demand for quick, versatile transport options that flying cars can fulfill.

The widespread adoption of electric vehicles has also supported flying car development, as EV infrastructure expands and consumer familiarity with electric propulsion grows. Advancements in battery technology, such as increased energy density and efficiency, make electric flying cars more viable, addressing power and performance needs.

Rapid progress in AI and machine learning is another growth factor, enabling autonomous flight capabilities and improving safety. Together, these factors strengthen the Flying Car Market’s potential to deliver innovative, high-performance solutions for future urban transportation.

Emerging Trends

Rise of Sustainability and Urban Mobility Initiatives Are Latest Trending Factors

Trending factors influencing the Flying Car Market include sustainability initiatives, urban air mobility (UAM) adoption, personal mobility demand, and smart city investments. A shift toward sustainable transportation has led to increased interest in electric and eco-friendly flying cars, aligning with global climate goals.

Urban air mobility initiatives, particularly in cities facing high traffic congestion, are accelerating interest in flying car solutions for short, intra-city commutes. Demand for personal mobility solutions, spurred by changing lifestyles and preferences, has created a niche for flying cars as private, convenient, and rapid transit options.

Moreover, the rise of smart city investments has introduced new infrastructure possibilities, supporting flying cars as part of integrated urban mobility networks.

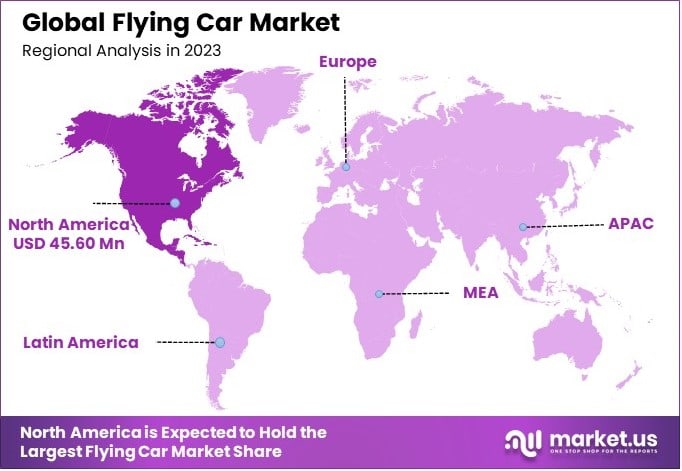

Regional Analysis

North America Dominates with 38.0% Market Share

North America leads the Flying Car Market with a 38.0% share, totaling USD 45.60 million. This dominance is driven by advanced R&D, strong investments in aerospace innovation, and favorable government regulations for urban air mobility (UAM). The U.S. is the largest contributor, with several key start-ups and tech firms pioneering the sector.

The region benefits from a robust tech ecosystem, high consumer interest, and strategic partnerships among automakers and aviation companies. Strong infrastructure for air traffic management and a focus on sustainable mobility further boost market growth. Government support for drone and air taxi trials accelerates development and commercialization.

North America’s influence in the flying car market is projected to grow. Advancements in battery technology, increasing UAM trials, and regulatory approvals will drive further expansion.

Regional Mentions:

- Europe: Europe sees significant growth, driven by strong investments in sustainable aviation and supportive regulations. Countries like Germany and France are leading development efforts in flying cars.

- Asia Pacific: Asia Pacific shows rapid progress, supported by large-scale urbanization, rising tech investments, and government initiatives for aerial mobility, especially in China and Japan.

- Middle East & Africa: The region experiences gradual growth, driven by initiatives in cities like Dubai, focusing on luxury air taxis and smart infrastructure development.

- Latin America: Latin America shows potential, supported by infrastructure projects and rising interest in UAM, particularly in Brazil, which leads in aerial mobility initiatives.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The flying car market is expanding rapidly, fueled by advancements in technology, demand for urban mobility solutions, and investments in electric vertical take-off and landing (eVTOL) vehicles. The top four companies in this sector are Airbus, Boeing Co, Lilium GmbH, and Volocopter GmbH. These firms maintain strong positions through innovation, partnerships, and strategic expansions.

Airbus is a pioneer in flying car development, focusing on autonomous air taxis and electric propulsion systems. Its focus on safety, sustainability, and scalability supports its leadership in urban air mobility.

Boeing Co is developing flying vehicles for both urban air taxis and logistics. It emphasizes strong safety protocols, engineering excellence, and collaborations with governments and tech firms, strengthening its market presence.

Lilium GmbH offers innovative eVTOL aircraft designed for fast, emission-free urban air travel. Its focus on electric propulsion and sustainable mobility makes it a leader in this emerging sector.

Volocopter GmbH specializes in autonomous air taxis and cargo drones. It targets urban centers with its electric air taxis, emphasizing safety, sustainability, and a strong regulatory framework.

These companies lead the flying car market through cutting-edge R&D, strategic investments, and robust partnerships, making them pioneers in future mobility.

Top Key Players in the Market

- Airbus

- AeroMobil

- Boeing Co

- EHang

- Lilium GmbH

- Volocopter GmbH

- Terrafugia

- PAL-V International B.V.

- Joby Aviation

- Other Key Players

Recent Developments

- XPeng AeroHT: In September 2024, XPeng AeroHT introduced the “Land Aircraft Carrier,” a modular flying car that combines a ground vehicle with an attachable aircraft module. The first public manned flight is scheduled for November 2024 at the China Airshow in Zhuhai. Pre-sales are expected to start later this year at a price below 2 million yuan (approximately $280,000), with deliveries anticipated in 2026.

- LEO Flight: On August 14, 2024, LEO Flight virtually unveiled the LEO Coupe, an all-electric flying car at Monterey Car Week. The LEO Coupe, featuring an electric jet propulsion system, offers speeds up to 200 mph and a range of 250 miles per charge. Production is planned for 2027, targeting early adopters and tech enthusiasts interested in innovative personal mobility.

- Aviterra and PAL-V: In March 2024, Aviterra, a Dubai-based company, signed an agreement with PAL-V to acquire over 100 Liberty flying cars for deployment in the Middle East and Africa. The PAL-V Liberty, a gyroplane-car hybrid, has a 500 km flight range and a maximum airspeed of 180 km/h, aimed at advancing regional air mobility solutions.

Report Scope

Report Features Description Market Value (2023) USD 120.0 Million Forecast Revenue (2033) USD 4,930.2 Million CAGR (2024-2033) 45.0% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Mode of Operation (Manned Flying Cars, Unmanned Flying Cars), By Application (Military, Commercial, Civil), By Seating Capacity (One, Two, Four, More Than Four) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Airbus, AeroMobil, Boeing Co., EHang, Lilium GmbH, Volocopter GmbH, Terrafugia, PAL-V International B.V., Joby Aviation, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Airbus

- AeroMobil

- Boeing Co

- EHang

- Lilium GmbH

- Volocopter GmbH

- Terrafugia

- PAL-V International B.V.

- Joby Aviation

- Other Key Players