Global Soluble Corn Fiber Market Size, Share, And Industry Analysis Report By Form (Powder, Liquid), By Application (Food and Food Processing, Dairy Products, Dietary Supplements, Animal Nutrition, Others), By Region, and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 134683

- Number of Pages: 345

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

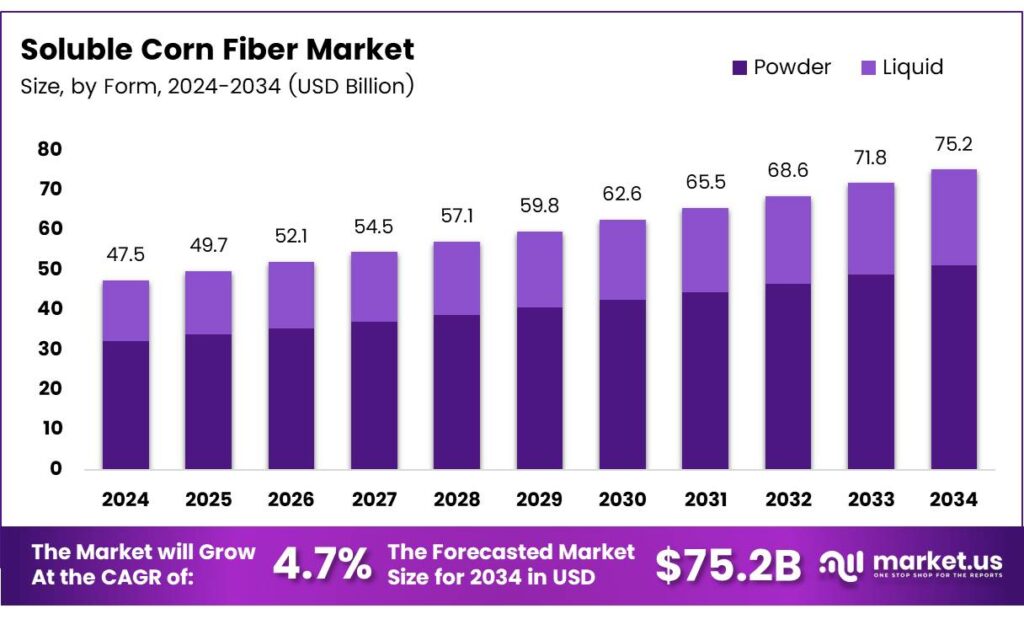

The Global Soluble Corn Fiber Market size is expected to be worth around USD 75.2 billion by 2034, from USD 47.5 billion in 2024, growing at a CAGR of 4.7% during the forecast period from 2025 to 2034.

The Soluble Corn Fiber Market represents a growing segment within functional ingredients, driven by rising consumer focus on digestive wellness, low-sugar foods, and clean-label nutrition. Manufacturers increasingly adopt soluble corn fiber because it blends easily into beverages, snacks, and bakery products while offering reduced sugar levels and improved fiber content without altering taste or texture.

Food producers reformulate products to meet fiber-enrichment targets, particularly in North America and Asia. Market expansion is further strengthened by government programs promoting healthier eating patterns and initiatives encouraging reduced sugar consumption. Meanwhile, regulatory bodies continue supporting fiber fortification in packaged foods, enabling broader commercial application across mainstream and specialty food categories.

- Global nutrition guidelines continue to push demand for fibre-rich ingredients, with international dietary agencies recommending 25–38 g/day depending on national standards. The World Health Organization also advises consuming more than 25 g/day, yet intake remains low worldwide; only 5% of Americans meet the recommended levels. This gap strengthens the market need for accessible fibre solutions such as soluble corn fibre.

Soluble fibre is well-accepted at 12–27 g/day, and even higher single-dose (40 g) and multi-dose (65 g/day) levels were well-tolerated in trials involving healthy adults. Nutritionally, sweet corn provides proteins, vitamins, natural sugars, and antioxidants like lutein and zeaxanthin, adding upstream value and supporting its role as a reliable raw material for soluble corn fibre development.

Furthermore, growth opportunities emerge as FMCG brands tap into low-glycemic food solutions. Companies prefer soluble corn fiber because it helps manage the glycemic response while enhancing product stability. Research continues reinforcing its value as a prebiotic ingredient, helping brands appeal to consumers seeking digestive balance, calorie reduction, and metabolic health through daily nutrition improvements.

Key Takeaways

- The Global Soluble Corn Fiber Market is projected to reach USD 75.2 billion by 2034, rising from USD 47.5 billion in 2024, at a CAGR of 4.7% during 2025–2034.

- Powder form leads the market with a dominant share of 73.9% in 2025.

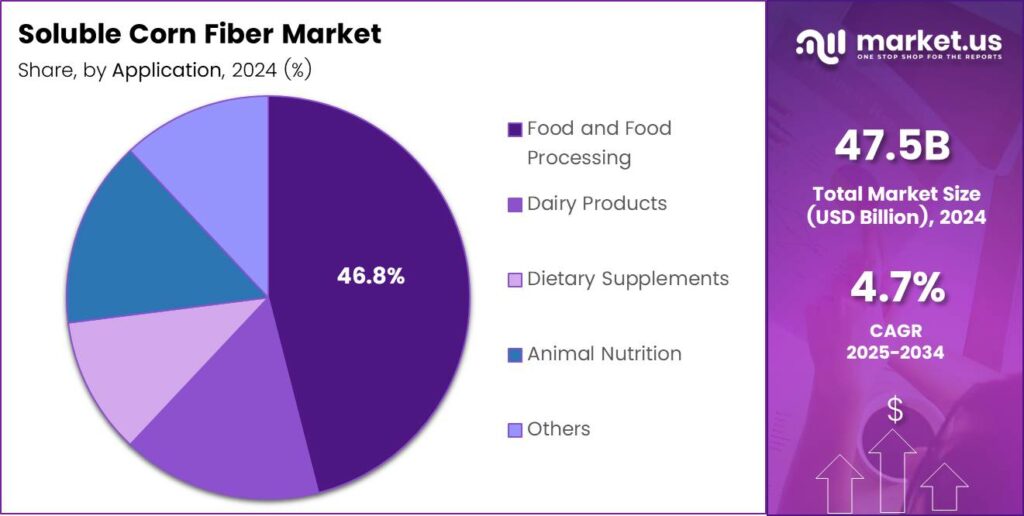

- Food and Food Processing is the top application segment with 46.8% share in 2025.

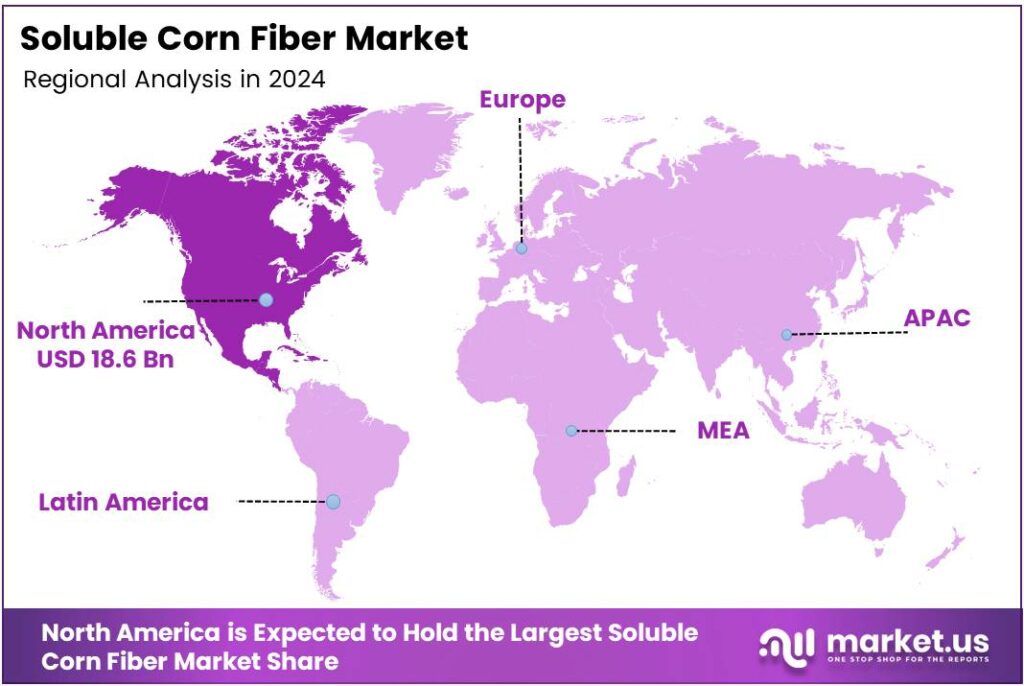

- North America remains the leading region with 39.1% market share valued at USD 18.6 billion.

By Form Analysis

Powder dominates the market with 73.9% due to its higher stability and wider functional usage.

In 2025, ‘Powder’ held a dominant market position in the ‘By Form’ Analysis segment of the Soluble Corn Fiber Market, with a 73.9% share. Its longer shelf life, easy handling, and excellent compatibility with dry food formulations continued supporting large-scale industrial adoption, especially across nutrition bars, powdered beverages, and bakery mixes.

Liquid soluble corn fiber maintained steady demand as manufacturers used it for beverages, syrups, and dairy-based drinks. Its smooth blending properties helped improve mouthfeel and sweetness replacement. Additionally, its ability to dissolve rapidly without altering product texture supported its continued application in ready-to-drink formulations across mainstream food and beverage brands.

By Application Analysis

Food and food processing dominate with 46.8% due to broad usage across packaged and functional foods.

In 2025, ‘Food and Food Processing’ held a dominant market position in the ‘By Application’ Analysis segment of the Soluble Corn Fiber Market, with a 46.8% share. Rising demand for low-sugar, high-fiber packaged snacks and beverages continued driving usage, especially as manufacturers replaced traditional sugars with healthier fiber-based alternatives.

Dairy Products represented another key application area as soluble corn fiber improved creaminess and reduced sugar in yogurts, milk drinks, and frozen desserts. Its neutral taste and digestive advantages encouraged dairy brands to expand their use across both mainstream and functional nutrition categories.

Dietary Supplements saw expanding adoption as consumers increasingly preferred fiber-enhanced gummies, tablets, and powdered nutrition blends. Soluble corn fiber’s digestive health benefits and prebiotic properties support its use in supplement formulations targeting gut health and metabolic wellness.

Animal Nutrition incorporated soluble corn fiber to improve gut performance and feed efficiency in livestock. Producers valued it for supporting balanced digestion while reducing reliance on costlier traditional feed ingredients. Its consistent performance kept demand stable across poultry, swine, and companion animal categories.

Key Market Segments

By Form

- Powder

- Liquid

By Application

- Food and Food Processing

- Dairy Products

- Dietary Supplements

- Animal Nutrition

- Others

Emerging Trends

Increasing Shift Toward Low-Sugar and High-Fiber Foods Shapes Market Trends

A key trend driving the soluble corn fiber market is the rapid rise of low-sugar product development. Many brands are cutting sugar to meet consumer expectations and comply with new labeling rules. Soluble corn fiber helps naturally reduce calorie levels while maintaining sweetness and mouthfeel. Clean-label and natural ingredient trends also strongly influence product innovation.

- Food companies increasingly prefer simpler ingredient lists, avoiding artificial thickeners and stabilizers. Soluble corn fiber fits this trend due to its plant-based origin and multifunctional use in texture improvement. The Dietary Guidelines for Americans, 2020–2025, states that more than 90% of women and 97% of men do not meet recommended dietary fiber intakes.

Gut health awareness is another major factor shaping demand. Consumers look for foods that support digestion and overall wellness. Soluble corn fiber acts as a prebiotic, which encourages healthy gut bacteria growth. This makes it a popular choice in functional snacks and beverages.

Drivers

Rising Use of Soluble Fibers in Functional Foods Drives Market Growth

Growing consumer interest in healthier food choices is pushing manufacturers to use more soluble corn fiber in everyday products. People prefer ingredients that support digestion, reduce sugar, and add natural fiber. This shift in lifestyle is helping the market expand steadily across both developed and emerging economies.

- Food and beverage companies are adding soluble corn fiber to snacks, bakery items, and drinks to improve nutrition without changing taste. European Food Safety Authority notes that 25 g/day of dietary fibre is considered adequate for normal laxation in adults, anchoring expectations around meaningful intake rather than token amounts.

Rising demand for functional beverages also boosts the market. Soluble corn fiber blends easily in liquids, making it suitable for fortified drinks, protein shakes, and meal replacements. As consumers seek easy-to-consume nutrition, the market benefits and achieves consistent long-term growth.

Restraints

High Production Costs of Fiber Ingredients Slow Market Expansion

One of the major limitations for the soluble corn fiber market is its relatively higher production cost compared to traditional ingredients. Advanced processing technologies are required to ensure purity and stability, which increases overall manufacturing expenses. This makes the product costlier for smaller food companies to adopt.

- Many manufacturers struggle to balance ingredient cost with competitive product pricing. Companies often hesitate to reformulate products using soluble corn fiber, especially in price-sensitive markets across Asia and Latin America. In the U.S., the USDA National Agricultural Statistics Service estimated corn for grain production in 2024 at 14.9 billion bushels, with an average yield of 179.3 bushels per acre.

Limited consumer awareness about the benefits of soluble corn fiber also adds pressure. While interest in functional foods is growing, not all regions fully recognize the health value of added fiber. This slows down adoption and reduces the willingness of brands to invest heavily in reformulation.

Growth Factors

Expanding Use of Fiber Ingredients in Nutrition Products Creates New Opportunities

The growing popularity of dietary supplements opens strong opportunities for soluble corn fiber. Consumers increasingly seek convenient nutrition formats such as gummies, powders, and chewable tablets. Soluble corn fiber works well in these products because it offers mild taste, good solubility, and digestive benefits.

Sports nutrition is another promising space. Athletes and fitness-focused consumers prefer products that support gut comfort and sustained energy. Soluble corn fiber improves digestive tolerance in protein shakes and pre-workout mixes, giving manufacturers a competitive edge in formulation.

Clean-label innovation is also creating room for growth. As brands avoid artificial additives, soluble corn fiber becomes a valuable natural option for improving texture, reducing sugar, and adding fiber. This allows companies to meet modern labeling expectations without compromising product performance.

Regional Analysis

North America Dominates the Soluble Corn Fiber Market with a Market Share of 39.1%, Valued at USD 18.6 Billion

North America leads the Soluble Corn Fiber Market owing to its strong functional food industry, widespread clean-label adoption, and high consumer awareness about digestive health. The region’s dominance, marked by a 39.1% share and valuation of USD 18.6 billion, is further supported by robust R&D investments and an expanding low-sugar product portfolio. Growing regulatory support for fiber-fortified formulations continues to strengthen market penetration.

Europe demonstrates steady growth driven by rising demand for natural ingredients and government emphasis on sugar reduction across processed foods. Manufacturers increasingly incorporate soluble corn fiber into bakery, beverages, and nutrition products. The region also benefits from a mature food innovation ecosystem and stringent regulatory frameworks promoting healthier alternatives.

Asia Pacific is emerging as a fast-growing market fueled by urban lifestyle shifts, greater interest in digestive wellness, and rapid expansion of the functional food sector. Increasing disposable incomes and rising adoption of Western dietary habits boost fiber-enriched food consumption. Local manufacturers are also scaling production capacities to meet growing domestic and export demand.

Latin America sees moderate but rising demand, driven by growing applications in beverages, bakery items, and dairy alternatives. Consumers are becoming more aware of low-calorie and fiber-rich diets, encouraging manufacturers to reformulate products. Economic improvements and broader availability of fortified packaged foods continue to support regional growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The global Soluble Corn Fiber Market in 2025 continues to expand as nutrition-focused consumers and food manufacturers shift toward low-sugar, high-fiber ingredients that support digestive health without compromising taste or texture. Leading companies are strengthening supply chains, scaling production efficiency, and expanding partnerships across beverage, bakery, dairy, and nutraceutical sectors.

Archer Daniels Midland Company maintains a strong presence through its deep agricultural integration and large-scale ingredient manufacturing capabilities. By leveraging its global distribution network and advanced processing technologies, ADM continues to support brands seeking reliable, cost-efficient soluble corn fiber for reformulating reduced-sugar products.

Tate and Lyle benefits from its established portfolio in specialty ingredients and its focus on functional fibers used in calorie-reduction applications. The company’s growing investments in health-oriented solutions allow it to partner closely with major food manufacturers aiming to meet consumer demand for digestive wellness.

Roquette Frères remains influential due to its expertise in plant-based ingredients and its strong R&D culture. With a focus on sustainable sourcing and innovative fiber technologies, Roquette supports product developers working on texture improvement and nutritional enhancement across global markets.

Ingredion Incorporated continues to expand its presence by offering versatile soluble corn fiber solutions tailored for beverages, snacks, and dairy alternatives. Its emphasis on formulation support and regional market customization helps manufacturers achieve sugar reduction goals while maintaining product quality and stability.

Top Key Players in the Market

- Archer Daniels Midland Company

- Tate and Lyle

- Roquette Frères

- Ingredion Incorporated

- Cargill

- Jianlong Biotechnology Co., Ltd

- Others

Recent Developments

- In 2025, ADM continues to operate its Nutrition segment, which includes the production and sale of soluble fiber, among other ingredients like plant-based proteins, natural flavors, and emulsifiers. The company’s corn processing plants grind, with hedging strategies in place for anticipated corn purchases to manage variability in costs.

- In 2025, Tate & Lyle launched a regenerative agriculture program in Europe in partnership with Regrow Ag, supporting French corn farmers through AI-driven solutions to enhance resilience, improve soil health, and promote sustainability in the food supply chain.

Report Scope

Report Features Description Market Value (2024) USD 47.5 Billion Forecast Revenue (2034) USD 75.2 Billion CAGR (2025-2034) 4.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Powder, Liquid), By Application (Food and Food Processing, Dairy Products, Dietary Supplements, Animal Nutrition, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Archer Daniels Midland Company, Tate and Lyle, Roquette Frères, Ingredion Incorporated, Cargill, Jianlong Biotechnology Co., Ltd., Others Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Soluble Corn Fiber MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample

Soluble Corn Fiber MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Archer Daniels Midland Company

- Tate and Lyle

- Roquette Frères

- Ingredion Incorporated

- Cargill

- Jianlong Biotechnology Co., Ltd

- Others