Global SiC and GaN Power Semiconductor Market Size, Share, Statistics Analysis Report By Material Type (SiC, GaN), By Power Range (Low Power, Medium Power, High Power), By Application (Automotive [Powertrain, On board Charger, Fast & Wireless Charging, Motor Drive, Traction Inverters, Lighting System, Others], Industrial [Power Supplies, Charging Equipment, Power Storage, Motor Drives, PV Inverter, Traction Motor Components, Lighting System, Robotics Control System, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 137943

- Number of Pages: 245

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

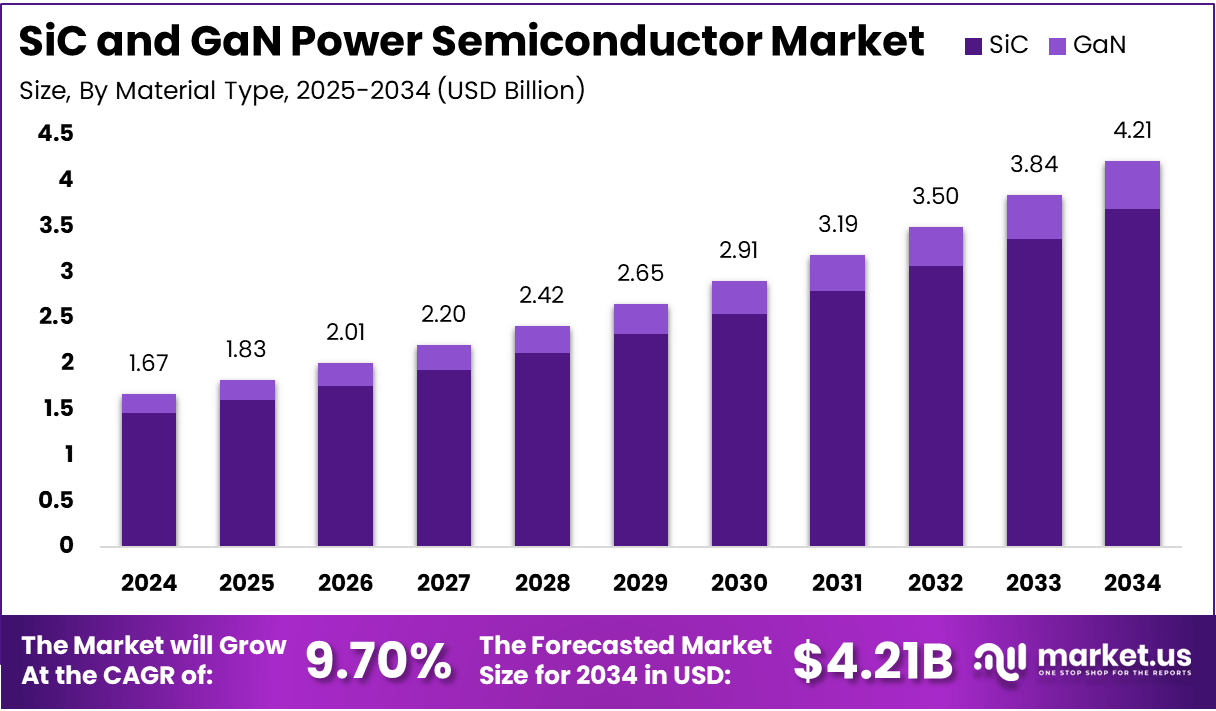

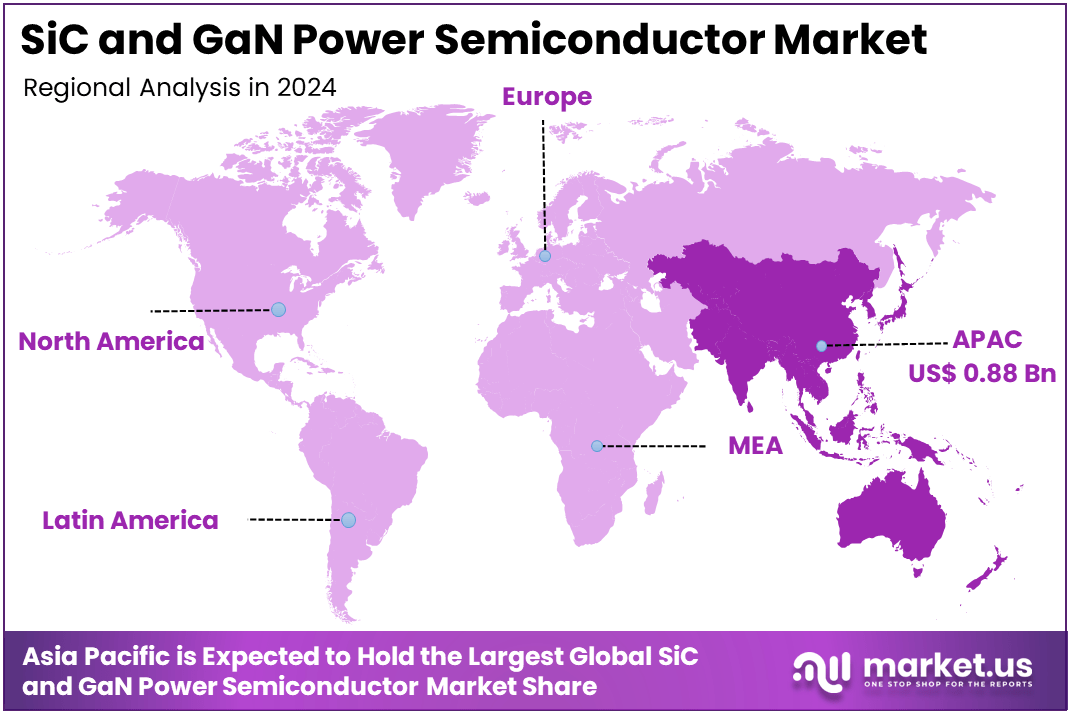

The Global SiC and GaN Power Semiconductor Market is expected to be worth around USD 42.1 Billion By 2034, up from USD 1.67 billion in 2024, growing at a CAGR of 9.70% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominant market position, capturing more than a 52.8% share and holding USD 0.88 billion in revenue.

Silicon Carbide (SiC) and Gallium Nitride (GaN) are wide-bandgap semiconductors that have revolutionized power electronics. SiC offers high thermal conductivity, high voltage tolerance, and efficiency, making it ideal for high-power applications like electric vehicles (EVs) and renewable energy systems.

GaN, on the other hand, excels in high-frequency operations and is commonly used in consumer electronics and telecommunications. Both materials enable devices to operate at higher voltages and temperatures, improving performance and energy efficiency.

This growth is largely attributed to the increasing demand for electric vehicles (EVs), the rising integration of renewable energy sources like solar and wind, and the need for efficient power management solutions in various sectors. As industries such as automotive, telecommunications, and industrial automation adopt these advanced semiconductors, the market is expected to expand significantly in the coming years.

With a bandgap of 3.26 eV, SiC devices can withstand higher electric fields than silicon, which reduces switching losses and improves efficiency. This characteristic is particularly beneficial in electric vehicles (EVs), where SiC devices contribute to lighter and more efficient power electronics systems.

Conversely, GaN power semiconductors are gaining traction due to their exceptional efficiency and compact size, which allow for higher power densities and faster switching speeds. GaN has a wider bandgap of approximately 3.4 eV, enabling devices to operate at higher voltages—When comparing the two technologies, SiC devices generally handle higher voltage ratings, often exceeding 1,200V, while GaN devices excel in high-frequency applications with voltage ratings typically between 600V and 900V.

Both materials are crucial in enhancing energy efficiency across various sectors. For example, in data centers, using GaN technology can lead to a reduction in energy consumption by up to 30%, translating into significant cost savings over time.

In specific applications, SiC devices are increasingly utilized in electric vehicles (EVs), with estimates suggesting that the adoption of SiC technology can improve the efficiency of EV powertrains by up to 20% compared to traditional silicon devices. Additionally, the renewable energy sector is also benefiting from SiC technology; for instance, SiC-based inverters can achieve efficiencies exceeding 98%, which is crucial for maximizing energy output from solar panels.

In terms of performance, GaN transistors can switch at frequencies up to 1 MHz or more, compared to traditional silicon devices that typically operate below 100 kHz. This capability allows for smaller passive components and lighter overall designs in power converters and amplifiers. Moreover, GaN technology enables power densities exceeding 100 W/in³, which is significantly higher than silicon alternatives.

The SiC and GaN power semiconductor market presents several growth opportunities. Technological advancements in manufacturing processes, such as the development of GaN chips on 300mm wafers, are reducing production costs and improving the scalability of these devices. Strategic partnerships between semiconductor manufacturers and end-user industries are accelerating the development of new applications and market penetration.

Several factors are driving the growth of SiC and GaN power semiconductors. The electric vehicle market plays a significant role, with SiC semiconductors being used in EV inverters to enhance efficiency and driving range. The renewable energy sector also heavily relies on these semiconductors for energy conversion in solar inverters and wind turbine converters, as both SiC and GaN offer higher efficiency and thermal tolerance compared to traditional materials.

Industrial automation and telecommunications, particularly the adoption of 5G, further boost the demand for these power semiconductors, which are crucial for handling higher power densities and improving system performance.

Silicon Carbide (SiC) and Gallium Nitride (GaN) are at the forefront of power semiconductor technology, each offering unique properties that cater to the evolving demands of modern electronic applications. SiC power semiconductors are especially valued for their ability to operate at high temperatures and voltages, making them ideal for high-performance applications.

Technological innovations are significantly enhancing the capabilities of SiC and GaN power semiconductors. Advances in manufacturing techniques, including the production of GaN chips on larger wafers, have reduced costs and increased efficiency, making these semiconductors more accessible. Furthermore, research into specialized SiC and GaN devices tailored for renewable energy applications is enabling more efficient energy conversion and storage.

The continual improvements in the reliability and thermal efficiency of these semiconductors are expanding their applications into more critical sectors, including aerospace and defense, where high-performance power management is crucial. These advancements are helping to position SiC and GaN as the leading choice for next-generation power semiconductor technologies.

Key Takeaways

- Market Growth: The global SiC and GaN Power Semiconductor Market was valued at USD 1.67 billion in 2024 and is projected to reach USD 42.1 billion by 2034, growing at a CAGR of 9.70% during the forecast period.

- By Material Type: SiC dominates the market with a substantial share of 87.7%, highlighting its significant role in high-performance applications.

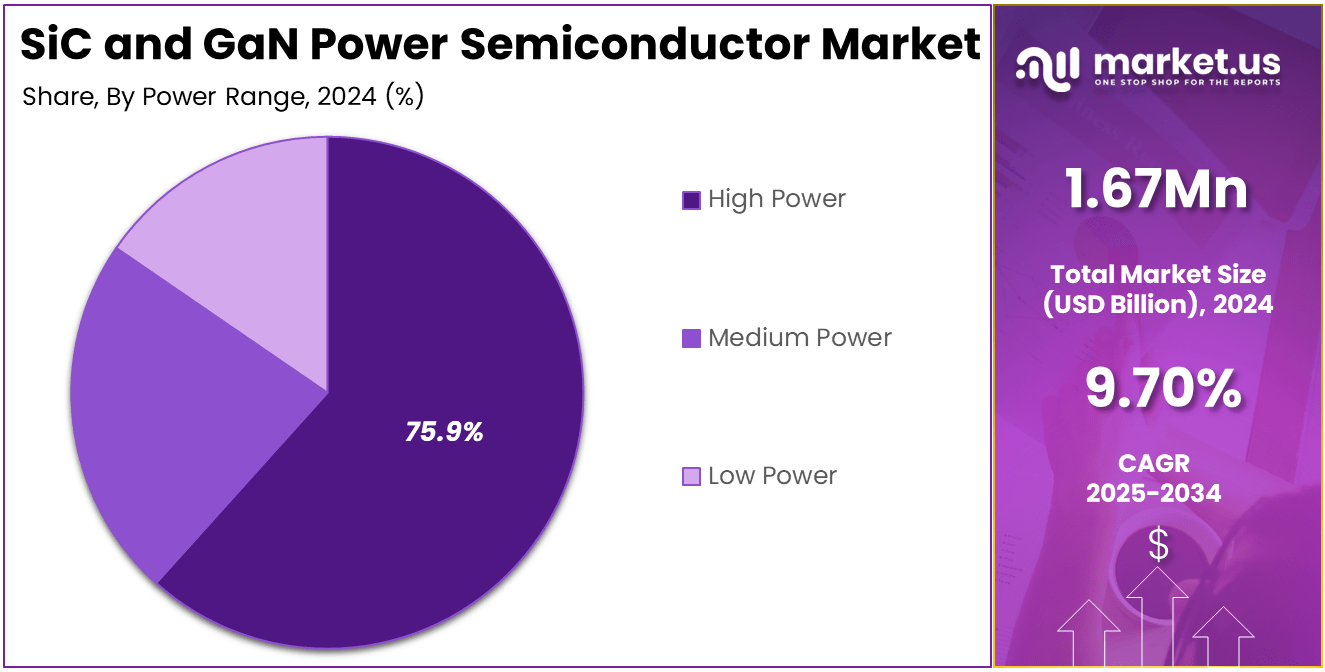

- By Power Range: The high-power segment holds the largest share of 75.9%, indicating a strong demand for SiC and GaN semiconductors in power-intensive industries such as automotive and renewable energy.

- By Application: The automotive sector accounts for 73.4% of the market, driven by the increasing adoption of electric vehicles (EVs) and the need for efficient power conversion systems.

- Geography: Asia Pacific leads the global market with a share of 52.8%, reflecting the region’s dominance in semiconductor manufacturing and the growing demand from automotive and industrial sectors.

By Material Type

In 2024, the SiC segment held a dominant market position, capturing more than an 87.7% share of the global SiC and GaN power semiconductor market. This leadership is primarily driven by the material’s exceptional ability to withstand high voltages and temperatures, making it the preferred choice for demanding applications such as electric vehicles (EVs), renewable energy systems, and industrial power conversion systems.

SiC’s high thermal conductivity and efficiency enable faster-switching speeds and reduce power losses, which are crucial factors in industries striving for energy efficiency and performance enhancement. The dominance of the SiC segment can be attributed to its widespread adoption in the automotive sector, particularly in EVs, where it plays a key role in improving the performance of inverters, chargers, and onboard systems.

The growing shift towards electric mobility has accelerated the demand for SiC power devices, as they offer significant improvements in power efficiency and driving range compared to traditional semiconductor materials like silicon. This has made SiC a vital component in the growing global electric vehicle market, which continues to expand as governments and consumers prioritize sustainable transportation solutions.

Additionally, SiC is increasingly used in renewable energy systems, particularly in solar inverters and wind turbine converters. These applications require efficient power conversion to handle fluctuating energy inputs and high power demands.

SiC’s ability to operate at higher voltages and frequencies while maintaining reliability makes it an ideal choice for these energy-intensive applications. The rising adoption of renewable energy sources further solidifies SiC’s position as the material of choice in the power semiconductor market.

By Power Range

In 2024, the High Power segment held a dominant market position, capturing more than a 75.9% share of the global SiC and GaN power semiconductor market. This dominance is largely driven by the growing demand for semiconductors capable of handling high voltage, high current, and demanding applications in sectors such as electric vehicles (EVs), industrial machinery, and renewable energy systems.

High-power devices are essential for these industries, where efficiency, reliability, and thermal management are crucial for optimal performance. The increasing shift toward electric mobility and renewable energy infrastructure has significantly contributed to the high power segment’s growth.

The automotive industry, particularly electric vehicles, is one of the major drivers of the High Power segment. SiC and GaN semiconductors are integral to the performance of EVs, where they are used in power electronics systems such as inverters, chargers, and onboard power management.

These power devices enhance energy efficiency, reduce power losses, and enable faster charging and better battery management, all of which are essential for the growing EV market. As the global automotive industry increasingly moves toward EVs, the demand for high-power semiconductors is expected to continue its upward trajectory.

Similarly, the renewable energy sector, including solar and wind power, significantly relies on high-power semiconductors for energy conversion and grid management. High-power devices are required for efficient power conversion in solar inverters and wind turbine converters, as well as for handling the high power output from these energy sources. With the global push towards renewable energy adoption and decarbonization, the demand for high-power semiconductors in these applications is expected to remain strong.

By Application

In 2024, the Automotive segment held a dominant market position, capturing more than a 73.4% share of the global SiC and GaN power semiconductor market. This leadership is primarily driven by the rapid adoption of electric vehicles (EVs), which require highly efficient power management systems to optimize energy usage, improve range, and enhance overall performance.

SiC and GaN semiconductors are integral components in key EV systems, such as powertrains, onboard chargers, traction inverters, and motor drives. These semiconductors allow for faster switching speeds, higher voltage tolerance, and improved thermal performance, which are essential for achieving the efficiency and performance levels demanded by modern EVs.

The automotive industry’s growing focus on sustainability and reducing carbon emissions has accelerated the demand for electric vehicles, contributing significantly to the automotive segment’s dominance. As the global electric vehicle market continues to expand, the need for advanced power semiconductors, particularly SiC and GaN, has surged.

These materials help to improve the energy efficiency of critical EV components, such as traction inverters and motor drives, by reducing power losses and enabling higher charging speeds, which are key features sought by consumers. As governments and consumers increasingly prioritize green technologies, the automotive sector’s demand for SiC and GaN semiconductors is expected to remain robust.

Additionally, SiC and GaN devices are becoming crucial in automotive applications beyond powertrain components. In areas such as fast and wireless charging, these semiconductors play a vital role by enabling higher charging speeds and more efficient energy transfer.

As EV adoption grows and the infrastructure for fast charging continues to develop, the demand for SiC and GaN semiconductors in charging stations will continue to rise, further solidifying the automotive segment’s dominance.

In comparison, the Industrial segment, while significant, holds a smaller share of the market. Industrial applications such as power supplies, motor drives, and PV inverters are increasingly adopting SiC and GaN devices, but they do not yet match the scale of demand seen in the automotive sector.

While the industrial market offers substantial growth potential, especially in power storage and robotics control systems, the automotive industry’s rapid growth driven by electric vehicle adoption remains the primary force behind the market’s overall expansion. This positions the Automotive segment as the leading force in the SiC and GaN power semiconductor market.

Key Market Segments

By Material Type

- SiC

- GaN

By Power Range

- Low Power

- Medium Power

- High Power

By Application

- Automotive

- Powertrain

- On board Charger

- Fast & Wireless Charging

- Motor Drive

- Traction Inverters

- Lighting System

- Others

- Industrial

- Power Supplies

- Charging Equipment

- Power Storage

- Motor Drives

- PV Inverter

- Traction Motor Components

- Lighting System

- Robotics Control System

- Others

Driving Factors

Surge in Electric Vehicle Adoption

The rapid adoption of electric vehicles (EVs) is a significant driving force behind the growth of the SiC and GaN power semiconductor market. As the automotive industry shifts towards electrification, there’s an increasing demand for power semiconductors that can efficiently handle high voltages and temperatures. SiC and GaN semiconductors are ideal for these applications due to their superior thermal conductivity and efficiency. For instance, SiC devices are used in EV inverters to enhance efficiency and performance.

The global electric vehicle market is projected to surpass USD 900 billion by 2030, further driving the need for SiC and GaN devices. This growth is fueled by increasing environmental awareness, government incentives, and advancements in battery technology. As more consumers and manufacturers embrace EVs, the demand for efficient power management solutions, such as SiC and GaN semiconductors, is expected to rise.

Additionally, the integration of renewable energy sources like solar and wind power into the grid requires efficient power conversion systems. SiC and GaN semiconductors are well-suited for these applications, further driving their adoption in the energy sector. Their ability to operate at higher voltages and frequencies makes them ideal for managing energy conversion in solar inverters and wind turbine converters.

Restraining Factors

High Production Costs

A significant challenge facing the SiC and GaN power semiconductor market is the high production costs associated with these materials. Manufacturing SiC and GaN devices require specialized equipment and processes, leading to higher capital expenditures.

For example, GaN power devices are primarily produced on silicon substrates, and existing silicon factories can be leveraged for their production, lowering capital costs. However, the initial investment remains substantial, which can be a barrier for smaller manufacturers and may limit market competition.

The cost of raw materials also contributes to the overall expense. SiC substrates, for instance, are more expensive than traditional silicon wafers, impacting the pricing of the final products. This cost disparity can make SiC and GaN devices less attractive compared to silicon-based alternatives, especially in cost-sensitive applications.

Furthermore, the complexity of the manufacturing process for SiC and GaN semiconductors can lead to lower yields and increased production times. This inefficiency not only raises costs but also affects the scalability of production, hindering the ability to meet growing market demand.

Growth Opportunities

Technological Advancements

Technological advancements present a significant growth opportunity for the SiC and GaN power semiconductor market. Ongoing research and development are leading to more efficient and cost-effective SiC and GaN devices, opening new applications and markets. For example, Infineon’s breakthrough in producing GaN chips on 300mm wafers is expected to reduce production costs and make GaN technology more accessible.

Advancements in manufacturing processes, such as the development of GaN chips on larger wafers, have reduced costs and increased efficiency, making these semiconductors more accessible. This innovation allows for higher yields and lower per-unit costs, which can drive adoption across various industries.

Additionally, the development of specialized SiC and GaN devices tailored for renewable energy applications is facilitating more efficient energy conversion and storage solutions. These advancements are crucial as the world transitions towards sustainable energy sources, creating a growing market for efficient power management solutions.

Challenging Factors

Supply Chain Constraints

Supply chain constraints pose a significant challenge to the SiC and GaN power semiconductor market. The specialized materials and manufacturing processes required for these semiconductors often rely on a limited number of suppliers, creating potential bottlenecks. This rapid growth can strain existing supply chains, leading to shortages and delays.

Geopolitical factors can further exacerbate these supply chain issues. Trade tensions and export restrictions can disrupt the flow of critical materials and components, affecting production schedules and increasing costs. For example, ON Semiconductor is diversifying and bolstering its supply chain in response to concerns over China’s promotion of local chip suppliers.

Additionally, the high demand for SiC and GaN semiconductors across various industries, including automotive, renewable energy, and telecommunications, can lead to competition for limited resources. This competition can result in increased prices and longer lead times, impacting manufacturers’ ability to meet market demand.

Growth Factors

A primary driver of this growth is the increasing adoption of electric vehicles (EVs). As the automotive industry shifts towards electrification, there’s a rising demand for power semiconductors capable of handling high voltages and temperatures. SiC and GaN semiconductors are ideal for these applications due to their superior thermal conductivity and efficiency. For instance, SiC devices are used in EV inverters to enhance efficiency and performance.

Additionally, the integration of renewable energy sources like solar and wind power into the grid requires efficient power conversion systems. SiC and GaN semiconductors are well-suited for these applications, further driving their adoption in the energy sector. Their ability to operate at higher voltages and frequencies makes them ideal for managing energy conversion in solar inverters and wind turbine converters.

Emerging Trends

The SiC and GaN power semiconductor market is witnessing several emerging trends that are shaping its future trajectory. One notable trend is the technological advancements in manufacturing processes. Companies are developing innovative methods to produce GaN chips on 300mm wafers, allowing for higher yields and reduced production costs. This development is expected to make GaN technology more accessible and cost-effective, potentially bringing GaN chip prices closer to those of silicon chips.

Another significant trend is the strategic acquisitions and partnerships among key industry players. For example, GlobalFoundries acquired Tagore Technology’s GaN technology to accelerate the development of advanced power management solutions. Such collaborations are aimed at enhancing technological capabilities and expanding market reach, positioning companies to better meet the growing demand for efficient power semiconductors.

Business Benefits

Investing in SiC and GaN power semiconductors offers several business benefits, particularly in terms of energy efficiency and performance. These semiconductors enable devices to operate at higher voltages and frequencies, improving performance and energy efficiency. For instance, SiC devices are used in EV inverters to enhance efficiency and performance.

The adoption of SiC and GaN semiconductors can also lead to cost savings over time. Their high efficiency reduces power losses, which can result in lower operational costs for businesses. Additionally, the ability to operate at higher temperatures and voltages can reduce the need for complex cooling systems, further contributing to cost savings.

Regional Analysis

In 2024, Asia Pacific held a dominant market position, capturing more than a 52.8% share of the global SiC and GaN power semiconductor market, with a revenue of approximately USD 0.88 billion. This leadership is primarily driven by the region’s strong manufacturing capabilities, technological advancements, and increasing demand for electric vehicles (EVs) and renewable energy systems.

Asia Pacific is home to some of the largest semiconductor manufacturers, particularly in countries like China, Japan, South Korea, and Taiwan, which contribute significantly to the production and development of SiC and GaN devices. The region’s well-established infrastructure and competitive pricing also make it a global hub for semiconductor manufacturing.

The automotive industry in Asia Pacific is a key driver of market growth, particularly due to the rapid adoption of electric vehicles (EVs). With China being the world’s largest EV market, the demand for efficient power semiconductor solutions, such as SiC and GaN devices, has skyrocketed.

These devices are crucial for improving the performance of EV inverters, onboard chargers, and traction motor drives, which are all key components of electric vehicles. The Asia Pacific region also benefits from supportive government policies aimed at promoting electric mobility, including subsidies, tax breaks, and incentives for EV manufacturers.

In addition to the automotive sector, Asia Pacific’s growing renewable energy sector, including solar and wind power, further fuels the demand for SiC and GaN power semiconductors. The need for efficient energy conversion and power management systems in these industries has led to the increasing adoption of SiC and GaN devices in solar inverters and wind turbine converters. As the region moves towards cleaner energy solutions, the demand for these semiconductors is expected to rise steadily in the coming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

Infineon Technologies AG expanded its presence in the GaN power semiconductor market by acquiring GaN Systems, a leading Canadian company specializing in GaN technology. This strategic acquisition, valued at $830 million, significantly enhanced Infineon’s capabilities in the rapidly evolving power semiconductor sector.

Infineon announced a breakthrough in GaN chip production by successfully manufacturing GaN chips on 300mm wafers. This advancement allows for 2.3 times more chips per wafer, potentially reducing production costs and making GaN technology more accessible across various applications.

ON Semiconductor Corporation announced plans to invest up to $2 billion to expand its semiconductor production in Roznov pod Radhostem, Czech Republic. This investment aims to establish a complete production process for silicon carbide (SiC) semiconductors, essential for automotive and renewable energy sectors.

ON Semiconductor introduced a new line of SiC power modules designed to improve energy efficiency in electric vehicles and renewable energy applications. These modules offer higher efficiency and faster switching capabilities, addressing the growing demand for advanced power solutions.

STMicroelectronics N.V. announced plans to invest €5 billion in a new semiconductor manufacturing facility in Catania, Italy. This investment aims to increase production capacity for SiC and GaN power semiconductors, supporting the growing demand in automotive and renewable energy markets.

STMicroelectronics launched a new series of SiC MOSFETs designed for high-efficiency power conversion applications. These devices offer improved performance and reliability, catering to the needs of electric vehicles and industrial power systems.

Top Key Players in the Market

- Infineon Technologies AG

- ON Semiconductor Corporation

- STMicroelectronics N.V.

- ROHM CO., LTD.

- Mitsubishi Electric Corporation

- Wolfspeed

- Renesas Electronics Corporation

- Alpha & Omega Semiconductor

- Fuji Electric Co., Ltd

- IQE PLC

- AGC Inc.

- Genesic Semiconductor Inc.

- Other Major Players

Recent Developments

- In 2024: Infineon Technologies AG announced a significant breakthrough in GaN technology, achieving the production of GaN chips on 300mm wafers. This innovation allows for 2.3 times more chips per wafer, which is expected to reduce production costs and enhance the scalability of GaN devices across various applications.

- In 2024: ON Semiconductor Corporation revealed plans to invest up to $2 billion to expand its SiC semiconductor production capabilities in the Czech Republic. This investment will support the growing demand for SiC power devices, especially in electric vehicles and renewable energy applications.

Report Scope

Report Features Description Market Value (2024) USD 1.67 Bn Forecast Revenue (2034) USD 42.1 Bn CAGR (2025-2034) 9.70% Largest Market North America Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material Type (SiC, GaN), By Power Range (Low Power, Medium Power, High Power), By Application (Automotive [Powertrain, Onboard Charger, Fast & Wireless Charging, Motor Drive, Traction Inverters, Lighting System, Others], Industrial [Power Supplies, Charging Equipment, Power Storage, Motor Drives, PV Inverter, Traction Motor Components, Lighting System, Robotics Control System, Others) Regional Analysis North America (US, Canada), Europe (Germany, UK, Spain, Austria, Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, Thailand, Rest of Asia-Pacific), Latin America (Brazil), Middle East & Africa(South Africa, Saudi Arabia, United Arab Emirates) Competitive Landscape Infineon Technologies AG, ON Semiconductor Corporation, STMicroelectronics N.V., ROHM CO., LTD., Mitsubishi Electric Corporation, Wolfspeed, Renesas Electronics Corporation, Alpha & Omega Semiconductor, Fuji Electric Co., Ltd, IQE PLC, AGC Inc., Genesic Semiconductor Inc., Other Major Players Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  SiC and GaN Power Semiconductor MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample

SiC and GaN Power Semiconductor MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Infineon Technologies AG

- ON Semiconductor Corporation

- STMicroelectronics N.V.

- ROHM CO., LTD.

- Mitsubishi Electric Corporation

- Wolfspeed

- Renesas Electronics Corporation

- Alpha & Omega Semiconductor

- Fuji Electric Co., Ltd

- IQE PLC

- AGC Inc.

- Genesic Semiconductor Inc.

- Other Major Players