Global Marine Electronics Market Size, Share, Statistics Analysis Report By Component (Hardware, Software, Services), By Type (Navigation System, Communication System, Entertainment System, Others), By Vessel Type (Merchant Marine, Naval Ships, Fishing Vessels, Recreational Boats, Offshore Oil & Gas), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 135482

- Number of Pages: 394

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

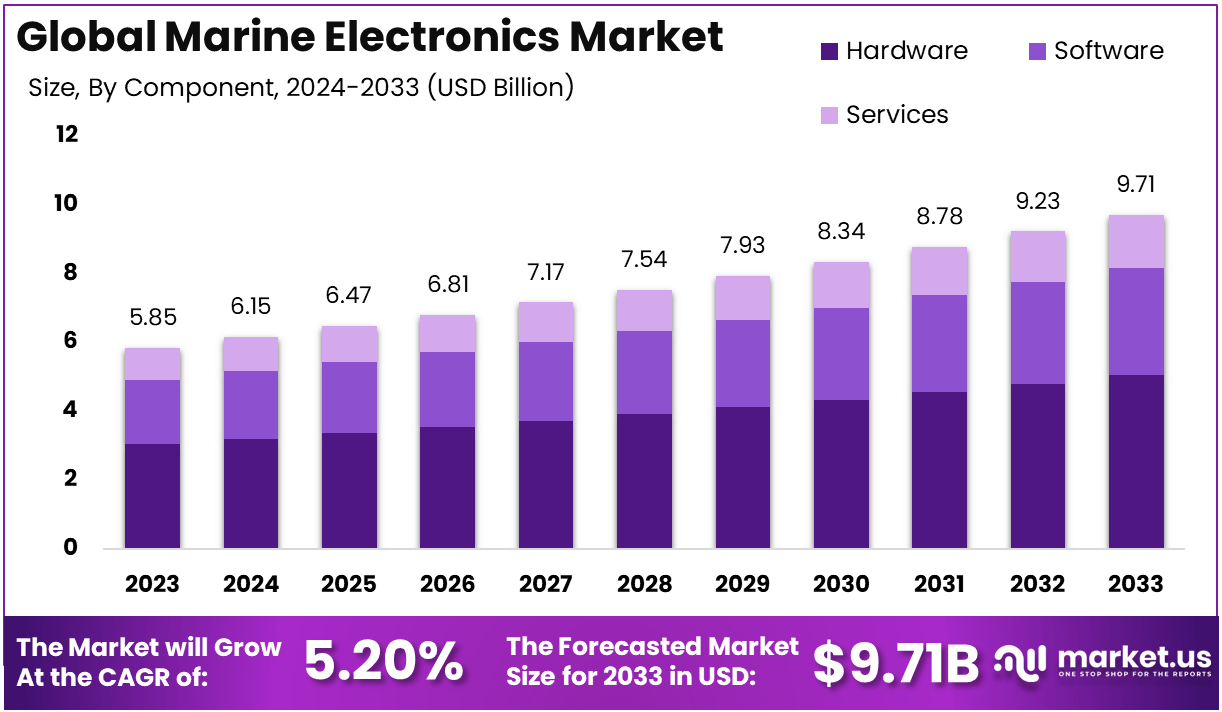

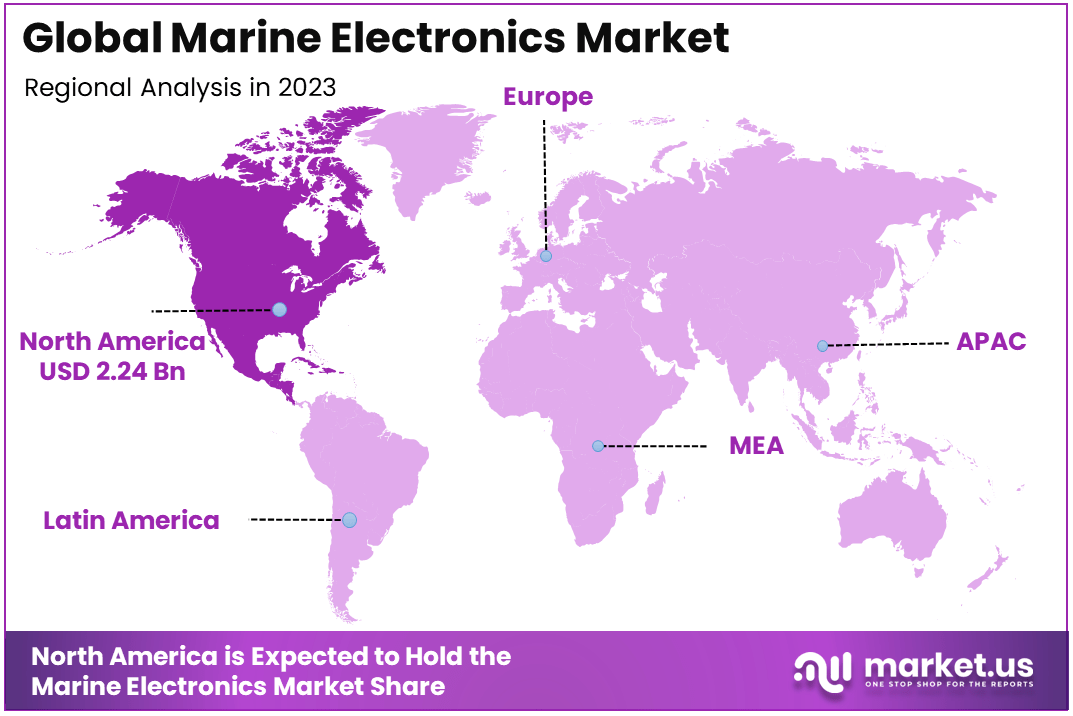

The Global Marine Electronics Market is expected to be worth around USD 9.71 Billion By 2033, up from USD 5.85 billion in 2023, growing at a CAGR of 5.20% during the forecast period from 2024 to 2033. In 2023, North America held a dominant market position, capturing more than a 38.3% share and holding USD 2.24 billion in revenue.

Marine electronics refers to the technology used in ships, boats, and other marine vessels to enhance sea navigation, communication, and safety. This includes a range of equipment such as radar systems, sonar, GPS devices, automated identification systems (AIS), depth finders, fish finders, and marine radios.

These systems help boat operators and crews make informed decisions while navigating challenging and often hazardous environments. Marine electronics also play a vital role in monitoring vessel performance, providing weather updates, and ensuring the safety of passengers and cargo.

With advancements in wireless technology and IoT (Internet of Things), marine electronics are becoming increasingly connected, enabling real-time data sharing and automated operations. The demand for these systems is growing in response to the increasing need for operational efficiency, safety, and compliance with environmental regulations within the maritime industry.

The global marine electronics market is a rapidly expanding sector, driven by the need for advanced technology in navigation, communication, and safety systems in the maritime industry. As global shipping traffic continues to grow, along with an increasing emphasis on maritime safety, the market for marine electronics is expected to see significant growth in the coming years.

This includes both recreational boating and commercial shipping, where the demand for cutting-edge technology to ensure vessel safety, efficiency, and sustainability is ever-increasing. In particular, innovations in GPS technology, radar systems, and fish-finding tools are making a profound impact on how the industry operates.

As the demand for advanced maritime electronics increases, manufacturers are focusing on providing integrated solutions that enhance the functionality, durability, and user experience of their products.

The increasing demand for enhanced maritime safety and navigation is one of the key drivers of the marine electronics market. With the global expansion of international trade and the rise in both recreational and commercial shipping activities, the need for accurate navigation and communication systems is at an all-time high.

Additionally, the adoption of stringent maritime safety regulations by governments worldwide has further spurred the demand for advanced marine electronics. The need to comply with international regulations such as the Global Maritime Distress and Safety System (GMDSS) and the International Maritime Organization (IMO) standards drives the growth of this market.

Technological advancements such as the integration of GPS, radar, and sonar systems into single cohesive solutions have also contributed significantly to the market’s growth. The market for marine electronics is seeing a substantial increase in demand, driven by both commercial and leisure applications.

On the commercial side, shipping companies are adopting more sophisticated systems to comply with safety standards and enhance operational efficiency. This includes high-tech navigation systems, automated vessel tracking, and enhanced communication systems.

On the recreational side, an increase in leisure boating activities and the growing trend of luxury yachts are significantly contributing to the market demand. Marine electronics such as advanced fish finders, GPS devices, and sonar are becoming more affordable and accessible, making them popular among recreational boaters.

Moreover, the growing adoption of wireless and IoT-enabled marine electronics is driving demand for integrated systems that offer convenience and enhanced performance.

There are several opportunities for growth in the marine electronics market. As the global shipping industry moves towards more sustainable operations, there is an increasing demand for energy-efficient and environmentally friendly marine electronics. This is leading to innovations in solar-powered navigation systems, eco-friendly materials for manufacturing marine equipment, and technologies that help reduce a vessel’s carbon footprint.

Additionally, the growing interest in autonomous vessels is opening up new markets for advanced marine electronics. These systems include automated navigation, real-time monitoring, and communication technologies that support unmanned operations. Furthermore, the rise of connected vessels, where marine electronics systems are integrated with the IoT, offers opportunities for data-driven decision-making and improved operational efficiency.

The demand for marine electronics is largely fueled by the rise in global maritime trade, with over 90% of the world’s goods transported by sea. This has led to an increased need for reliable navigation and communication systems on various vessel types, including commercial ships, fishing boats, and recreational vessels.

It is estimated that there are approximately 1.5 million commercial vessels operating globally, along with around 12 million recreational boats, all of which increasingly rely on advanced marine electronic systems for navigation, safety, and communication.

In terms of user demographics, the marine electronics market serves a diverse range of users, including shipping companies, fishing fleets, yacht owners, and government agencies involved in maritime operations.

Key Takeaways

- Market Growth: The global marine electronics market is projected to grow from USD 5.85 billion in 2023 to USD 9.71 billion by 2033, reflecting a CAGR of 5.20%.

- Dominant Component: Hardware leads the market, accounting for 61% of the total share in 2023, driven by the increasing demand for advanced navigation, communication, and safety systems.

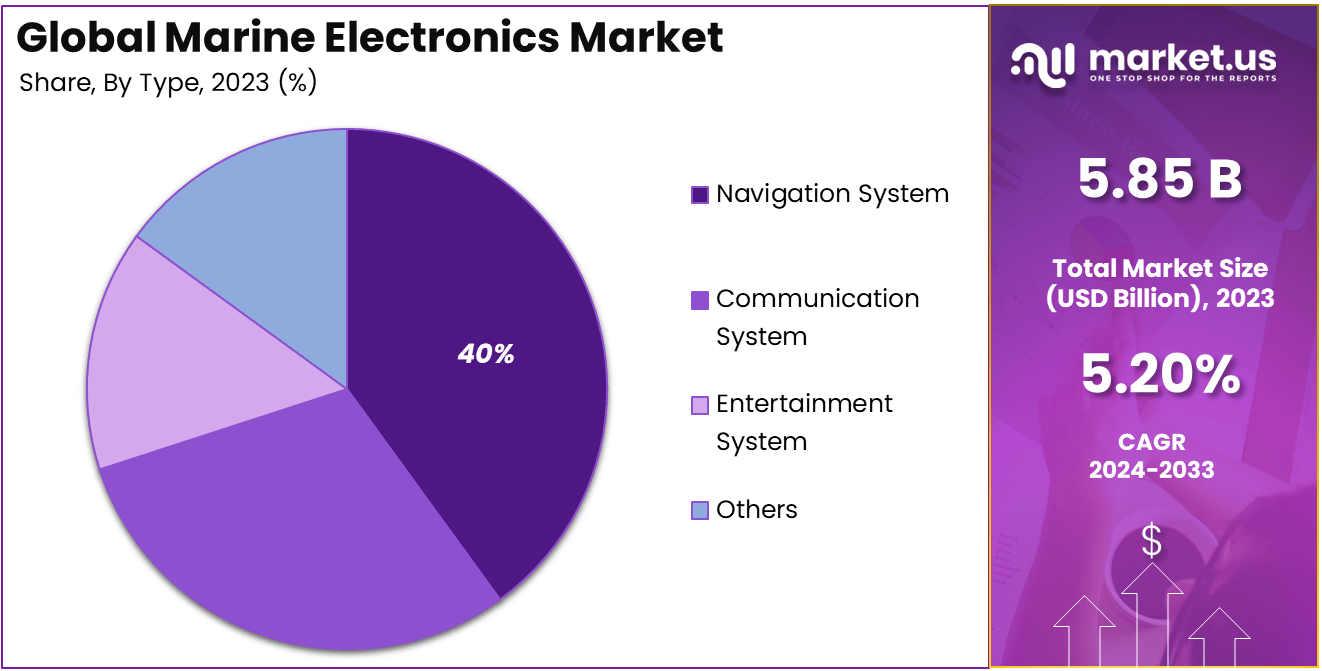

- Leading Type: The Navigation System segment holds the largest market share, contributing to 40% of the market in 2023, supported by the growing demand for precise and reliable navigation technologies in the marine industry.

- Key Vessel Type: The Merchant Marine segment is the largest end-use segment, accounting for 32% of the market in 2023, owing to the significant adoption of marine electronics in commercial shipping.

- Regional Dominance: North America holds the largest market share with 38.3% in 2023, driven by the strong presence of key players and increasing demand for high-tech solutions in both commercial and recreational marine sectors.

By Component

In 2023, the Hardware segment held a dominant market position, capturing more than a 61% share in the Marine Electronics Market. This dominance can be attributed to the increasing reliance on physical components such as navigation systems, communication devices, radar systems, and sensors, which are essential for the safe and efficient operation of marine vessels.

Hardware components, such as GPS units, sonar devices, radar, and communication equipment, play a crucial role in modernizing marine operations across both commercial and recreational sectors. As technology advances, the need for more accurate and robust hardware solutions becomes even more pronounced, contributing to the segment’s growth.

The rising demand for navigation, safety, and monitoring devices has significantly fueled the hardware market. With regulations on maritime safety becoming more stringent, many shipping companies and vessel operators are investing in advanced marine electronics hardware to ensure compliance with these safety standards. Additionally, hardware is integral to many vessel types, ranging from merchant ships to leisure boats, supporting the robust demand from multiple sectors.

Hardware’s substantial market share can also be attributed to its high initial investment costs. Since marine electronics hardware requires precise engineering and durability to withstand harsh marine environments, the upfront costs are relatively high, making the hardware market a significant portion of overall spending in the marine electronics industry. Moreover, hardware upgrades, along with the growing trend of automation and digitalization in maritime operations, are driving this segment’s continued growth.

By Type

In 2023, the Navigation System segment held a dominant market position, capturing more than a 40% share in the Marine Electronics Market. This leadership is primarily driven by the critical role navigation systems play in ensuring the safe and efficient movement of vessels.

As maritime navigation becomes increasingly complex due to larger vessels, global shipping routes, and stringent regulatory requirements, demand for advanced navigation systems continues to rise. These systems, which include GPS, radar, sonar, and integrated bridge systems, are essential for accurate route planning, collision avoidance, and overall vessel safety, particularly in busy maritime traffic zones.

The growing adoption of smart ships and autonomous vessels also contributes significantly to the dominance of navigation systems. With advancements in GPS and satellite technology, modern navigation systems offer higher precision and reliability, allowing vessel operators to optimize routes and reduce operational costs.

Moreover, as the marine industry faces rising pressure to meet safety and environmental regulations, enhanced navigation systems are viewed as a must-have investment to maintain compliance and prevent accidents.

In addition to safety, navigation systems play a pivotal role in operational efficiency. By integrating real-time weather data, traffic alerts, and operational parameters, these systems provide a comprehensive solution for decision-making, enabling maritime companies to optimize fuel consumption and streamline operations.

This increasing reliance on advanced navigation technology is expected to keep the segment as a major contributor to the marine electronics market. As the maritime industry continues to embrace digitalization and automation, the demand for sophisticated navigation systems is projected to grow further, solidifying its dominance.

By Vessel Type

In 2023, the Merchant Marine segment held a dominant market position, capturing more than a 32% share of the Marine Electronics Market. This leadership is largely due to the crucial role merchant marine vessels play in global trade, which drives significant demand for advanced marine electronics.

Merchant ships, such as container ships, bulk carriers, and tankers, often operate across vast distances and in diverse environmental conditions, making the reliability and precision of their electronic systems critical to their operations.

Technologies like radar, navigation systems, communication tools, and weather monitoring equipment are indispensable for ensuring safe voyages, especially when navigating busy or hazardous shipping routes. The rising volume of global maritime trade has fueled growth in the merchant marine sector, leading to an increased need for sophisticated electronic systems.

With trade volumes continuing to grow, there is a greater emphasis on efficiency, safety, and compliance with international regulations, all of which rely heavily on advanced marine electronics. These systems support efficient cargo handling, reduce operational risks, and optimize fuel consumption, all of which contribute to the overall profitability of merchant fleets.

In addition, regulatory pressures related to maritime safety and environmental protection are further driving the adoption of advanced technologies in the merchant marine industry. With increasing emphasis on reducing carbon emissions, modern marine electronics that monitor fuel consumption, emissions, and engine performance are becoming standard. This shift is expected to continue, further solidifying the market dominance of the merchant marine segment.

Key Market Segments

By Component

- Hardware

- Software

- Services

By Type

- Navigation System

- Communication System

- Entertainment System

- Others

By Vessel Type

- Merchant Marine

- Naval Ships

- Fishing Vessels

- Recreational Boats

- Offshore Oil & Gas

Driving Factors

Increasing Demand for Safer and More Efficient Marine Operations

The growth of global trade and the rising demand for safer and more efficient marine operations are key drivers propelling the Marine Electronics market. As shipping and maritime transport are integral to the world’s supply chain, maintaining the safety, security, and efficiency of vessels has become a primary concern.

Technological advancements in marine electronics, such as radar systems, navigation equipment, communication tools, and automation systems, are critical to addressing these demands. In particular, safety concerns surrounding marine travel and shipping have led to higher adoption rates of sophisticated navigation and monitoring systems.

For instance, GPS, electronic chart display, and information systems (ECDIS), radar, sonar, and other technologies are enhancing the operational safety of commercial vessels, reducing the risks associated with human error and environmental hazards.

This also ensures that vessels comply with international maritime regulations, such as the International Maritime Organization (IMO) guidelines, which demand the use of certain safety technologies. Another key driver is the rising need for fuel efficiency and cost-effective operations in the maritime industry.

By integrating advanced marine electronics such as predictive maintenance systems and engine performance monitoring tools, vessels can optimize fuel consumption, reduce emissions, and extend the lifespan of crucial equipment. This not only helps operators reduce costs but also ensures compliance with environmental regulations that mandate reduced emissions, such as the IMO’s sulfur cap regulation.

Restraining Factors

High Initial Investment and Maintenance Costs

One of the major restraints in the Marine Electronics market is the high initial investment required for sophisticated systems and the ongoing maintenance costs. Advanced marine electronics, such as radar systems, GPS, communication equipment, and integrated monitoring systems, can require a significant capital expenditure upfront.

The cost of procurement, installation, and the training required for proper use can be a considerable barrier for smaller companies or operators, particularly in developing regions. For instance, the installation of a high-end navigation system, integrated with sonar, radar, and automatic identification systems (AIS), can involve costs that may be prohibitive for smaller fleets or ship owners.

The cost of maintaining these systems over time is also a challenge, as it often includes regular software updates, hardware repairs, and technical support. Ships require a continuous supply of spare parts, and maintenance may need specialized expertise, further adding to operational expenses.

For smaller companies with limited financial resources, these high costs can deter investment in advanced electronics, even if they promise long-term operational efficiency. Moreover, ongoing training and skills development are necessary to ensure that marine electronics are utilized effectively and safely.

This requires investing in employee training programs, which can increase costs for shipping companies. With such large upfront costs, some operators may also delay upgrades or opt for outdated systems that may not offer the same level of efficiency, safety, or compliance with international standards.

Growth Opportunities

Increasing Focus on Environmental Sustainability

One of the most significant opportunities in the Marine Electronics market comes from the growing emphasis on environmental sustainability and the shipping industry’s efforts to reduce its carbon footprint. Regulatory bodies worldwide, including the International Maritime Organization (IMO), have imposed stricter regulations to limit emissions from shipping vessels. The focus on reducing fuel consumption, and emissions, and optimizing energy efficiency presents a tremendous opportunity for the marine electronics market to thrive.

Marine electronics, such as fuel monitoring systems, emissions control technology, and energy-efficient propulsion systems, can play a critical role in helping the industry meet these environmental targets. These technologies enable vessels to optimize fuel consumption, improve performance, and minimize emissions during operations. Furthermore, with the increase in global environmental awareness and green shipping initiatives, operators are more willing to adopt environmentally friendly technologies.

Additionally, several countries and regions are offering financial incentives and subsidies for shipping companies that adopt eco-friendly technologies. Governments are supporting the development and installation of energy-efficient systems and pollution-reducing solutions in the shipping industry. As part of their green transition strategies, ship owners are turning to these advanced electronics for more sustainable operations.

Challenging Factors

Integration and Compatibility with Existing Systems

Despite the clear benefits of marine electronics, integrating them with existing systems on older vessels can pose significant challenges. Many shipping companies operate fleets that are equipped with legacy equipment, which may not be compatible with modern marine electronics solutions.

The integration of new systems with outdated infrastructure can result in operational inefficiencies, increased downtime, and a higher risk of system malfunctions. This challenge is particularly evident for vessels that have been in operation for many years and may not be equipped to handle the latest technological advancements.

Retrofitting older vessels with the newest marine electronics often requires substantial modification of their electrical and mechanical systems, which can be costly and time-consuming. For smaller companies or vessels operating on a tight budget, such retrofits can be financially unfeasible.

Moreover, ensuring that newly installed electronics are fully compatible with older systems across various platforms can be a complex and challenging process. Different manufacturers may provide solutions with varying standards and specifications, making it difficult to create a seamless integration between the various electronic systems on a vessel. Incompatible systems can also lead to data inaccuracies and miscommunication between devices, potentially compromising safety and operational efficiency.

Growth Factors

Surge in Maritime Trade and Technological Advancements

The Marine Electronics market is experiencing significant growth due to several factors. A key driver is the increasing volume of global maritime trade. As economies continue to globalize, the demand for efficient and secure shipping solutions grows, pushing the need for advanced marine electronics.

Vessels are now equipped with cutting-edge navigation, communication, and automation systems to ensure safer, more efficient, and environmentally compliant operations. This surge in demand for innovative solutions is fueling market expansion. Another important growth factor is the adoption of digitalization and automation technologies in the maritime industry.

Solutions like satellite-based communication systems, automatic identification systems (AIS), and integrated bridge systems (IBS) are transforming marine operations, enhancing connectivity, safety, and operational efficiency. These technologies enable real-time monitoring of ship locations, speed, and fuel consumption, allowing for better fleet management and decision-making.

Emerging Trends

Sustainability and Smart Shipping

The growing focus on sustainability and green shipping is one of the emerging trends shaping the Marine Electronics market. With increasing regulations around emissions and environmental protection, ship operators are turning to energy-efficient technologies like hybrid power systems and eco-friendly fuel solutions, alongside advanced monitoring and management systems to reduce emissions.

Additionally, the use of autonomous shipping vessels, though in its early stages, is gaining traction. These autonomous systems rely on integrated marine electronics to enable vessels to operate safely with minimal human intervention.

Business Benefits

Enhanced Efficiency and Cost Savings

The adoption of advanced marine electronics provides ship operators with various business benefits, such as enhanced operational efficiency, improved safety, and reduced operating costs.

For example, integrating predictive maintenance systems can help reduce downtime by predicting equipment failures before they occur, leading to lower repair costs and improved vessel availability. Additionally, real-time data analytics help operators optimize fuel consumption, enhancing cost savings and reducing carbon footprints.

Regional Analysis

In 2023, North America held a dominant market position in the global Marine Electronics market, capturing more than a 38.3% share, translating to approximately USD 2.24 billion in revenue. This leadership can be attributed to the region’s robust maritime infrastructure, the presence of key players in the marine electronics sector, and the high adoption of advanced technology in the shipping industry.

The U.S. and Canada, in particular, have well-established shipping routes and a significant number of commercial and recreational vessels, which continuously drive demand for sophisticated marine electronic systems. The region’s dominance is further supported by increasing investments in research and development, particularly in areas such as satellite communication, navigation systems, and automation technology.

North America’s strong emphasis on safety regulations and environmental compliance also propels the adoption of advanced marine electronics, as vessels must meet stringent operational standards. Additionally, the U.S. Navy and other government agencies contribute substantially to the demand for high-performance marine systems, creating a steady revenue stream for marine electronics manufacturers.

North America’s maritime sector is experiencing a shift towards more energy-efficient and sustainable operations, and marine electronics play a crucial role in supporting this transformation. As the region focuses on reducing its carbon footprint.

Technologies like hybrid power systems, eco-friendly fuel monitoring, and real-time emissions tracking are becoming integral. The demand for intelligent and connected systems for fleet management, navigation, and communication is expected to continue growing in North America as these trends evolve.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

Adrie Marine Electronics Solutions Pvt. Ltd. is a prominent player in the marine electronics sector, known for offering a wide range of services, including the supply, installation, and maintenance of marine electronics.

The company has made significant strides in expanding its market presence by forging strategic partnerships and acquisitions, which allow it to enhance its product offerings and extend its reach in global markets. With a focus on high-quality navigation, communication, and safety equipment, Adrie Marine continues to innovate by incorporating the latest technologies into its solutions.

Elcome International LLC, headquartered in Dubai, is a leading distributor and integrator of marine electronics, recognized for its extensive portfolio of solutions for both the commercial and leisure sectors.

The company has been actively expanding its footprint through strategic partnerships with major international marine electronics manufacturers. In recent years, Elcome has strengthened its position by launching cutting-edge products, particularly in the fields of navigation systems, communication devices, and automation technology.

Furuno Electric Co. Ltd. is one of the most well-established names in the global marine electronics industry, recognized for its innovative and reliable products. The company has maintained its leadership in the market through continuous investment in research and development, resulting in a steady stream of new product launches.

Furuno’s expertise spans a broad range of marine electronics, including radar systems, sonar, GPS, and communication devices. Recent product innovations focus on improving vessel safety, navigation accuracy, and operational efficiency. Furuno has also expanded its operations through strategic mergers and acquisitions, strengthening its position in key regions.

Top Key Players in the Market

- Adrie Marine Electronics Solutions Pvt. Ltd.

- Elcome International LLC

- Furuno Electric Co. Ltd.

- Garmin Ltd.

- Icom America Inc.

- Japan Radio Co. Ltd.

- Johnson Outdoors Inc.

- Kongsberg Gruppen ASA

- Kraken Robotics Inc.

- Navico

- Northrop Grumman Corp.

- Raymarine

- SRT Marine Systems Plc

- Teledyne Technologies Inc.

- thyssenkrupp AG

- Other Key Players

Recent Developments

- In 2023: Furuno Electric Co. Ltd. unveiled a state-of-the-art navigation system designed to enhance the operational efficiency and safety of commercial vessels. This new system integrates radar, GPS, and Automatic Identification System (AIS) technologies to provide real-time situational awareness for maritime operations.

- In 2024: Elcome International LLC, a major player in the marine electronics industry, recently expanded its portfolio to include advanced integrated communication solutions tailored for both commercial and recreational vessels.

Report Scope

Report Features Description Market Value (2023) USD 5.85 Bn Forecast Revenue (2033) USD 9.71 Bn CAGR (2024-2033) 5.20% Largest Market North America Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Hardware, Software, Services), By Type (Navigation System, Communication System, Entertainment System, Others), By Vessel Type (Merchant Marine, Naval Ships, Fishing Vessels, Recreational Boats, Offshore Oil & Gas) Regional Analysis North America (US, Canada), Europe (Germany, UK, Spain, Austria, Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, Thailand, Rest of Asia-Pacific), Latin America (Brazil), Middle East & Africa(South Africa, Saudi Arabia, United Arab Emirates) Competitive Landscape Adrie Marine Electronics Solutions Pvt. Ltd., Elcome International LLC, Furuno Electric Co. Ltd., Garmin Ltd., Icom America Inc., Japan Radio Co. Ltd., Johnson Outdoors Inc., Kongsberg Gruppen ASA, Kraken Robotics Inc., Navico, Northrop Grumman Corp., Raymarine, SRT Marine Systems Plc, Teledyne Technologies Inc., ThyssenKrupp AG, Other Key Players Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Adrie Marine Electronics Solutions Pvt. Ltd.

- Elcome International LLC

- Furuno Electric Co. Ltd.

- Garmin Ltd.

- Icom America Inc.

- Japan Radio Co. Ltd.

- Johnson Outdoors Inc.

- Kongsberg Gruppen ASA

- Kraken Robotics Inc.

- Navico

- Northrop Grumman Corp.

- Raymarine

- SRT Marine Systems Plc

- Teledyne Technologies Inc.

- thyssenkrupp AG

- Other Key Players