Global Bleisure Tourism Market By Tour Type (Solo, Group), By Travel Type (Domestic, International), By Travel Duration (2-4 days, 1 week, Above 1 month), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 133671

- Number of Pages: 304

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

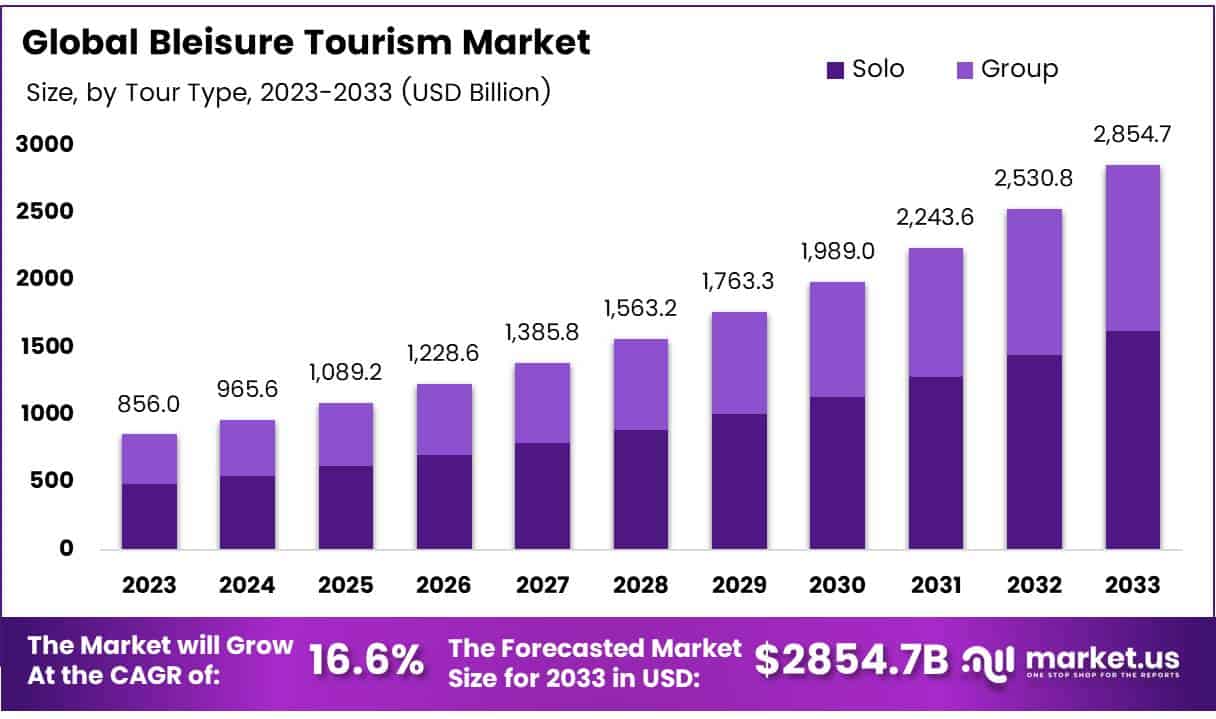

The Global Bleisure Tourism Market size is expected to be worth around USD 2854.7 Billion by 2033, from USD 856.0 Billion in 2023, growing at a CAGR of 12.8% during the forecast period from 2024 to 2033.

Bleisure tourism represents a burgeoning niche within the travel industry where business and leisure travel intersect. This trend involves extending business trips to include leisure activities, offering an appealing blend of work-related engagements with relaxation and exploration.

The bleisure tourism market encompasses services and packages tailored to the needs of business travelers who wish to incorporate leisure experiences into their trips. This market segment caters to accommodations, smart transportation, and entertainment options that are conducive to both professional obligations and personal enjoyment.

The bleisure tourism sector is poised for significant growth, driven by changing work cultures and the increasing emphasis on work-life balance. The demand for bleisure travel reflects a shift in professional dynamics where remote work and flexible schedules are becoming more commonplace, enabling more extensive and enjoyable business trips.

Opportunities within this market are vast, particularly in developing tailored travel offerings that cater to the needs of business-leisure travelers, such as customizable travel packages and loyalty programs. Additionally, destinations and hospitality businesses that strategically market themselves as bleisure-friendly can attract this lucrative segment, ensuring they offer both top-tier business facilities and leisure amenities.

Government regulations and investments play a crucial role in shaping the bleisure travel landscape. Regulatory support, such as visa facilitations for business travelers, tax incentives for companies promoting bleisure activities, and safety standards for travelers, are pivotal.

Furthermore, governments can invest in infrastructure that supports bleisure travel, such as convention centers with leisure facilities or business luxury hotels near tourist attractions.

Recent data underscores the growing appeal and sustainability of bleisure travel. According to TravelPerk, a staggering 81% of business travelers engage in bleisure activities, with 61% incorporating leisure activities into their business itineraries and 41% extending their stays for leisure purposes. This trend is particularly prominent among Millennials, where 86% add leisure time to business trips, highlighting generational differences in travel preferences.

Furthermore, the duration of these extensions tends to be brief, with 39% of bleisure trips lasting two nights and 31% extending to three nights, indicating a preference for short, yet meaningful, leisure experiences. These insights not only reveal the preferences of bleisure travelers but also guide service providers in creating packages that cater to the duration and nature of these extensions.

The financial impact of bleisure travel is significant, as evidenced by American Airlines, which reported nearly half of its $13.46 billion revenue in 2023 stemmed from bleisure itineraries, a record high. This revenue boost signals the economic potential of catering to bleisure travelers for airlines and the broader hospitality industry.

Corporate policies are also adapting to support bleisure travel. Pre-pandemic, 57% of businesses had travel policies that permitted adding leisure time to business trips. Post-pandemic, the desire for such extensions has soared, with 89% of surveyed participants expressing a wish to include vacation time in their next corporate trip.

Key Takeaways

- The global Bleisure Tourism Market is projected to reach USD 2854.7 billion by 2033, growing at a CAGR of 12.8% from 2024 to 2033.

- Solo travelers dominated the Bleisure Tourism Market in 2023, holding a 51.3% share in the Tour Type segment.

- Domestic travel was the leading segment in the Bleisure Tourism Market in 2023, accounting for 50.3% of the Travel Type share.

- The 2-4 days travel duration segment led the Bleisure Tourism Market in 2023, capturing 43.6% of the share.

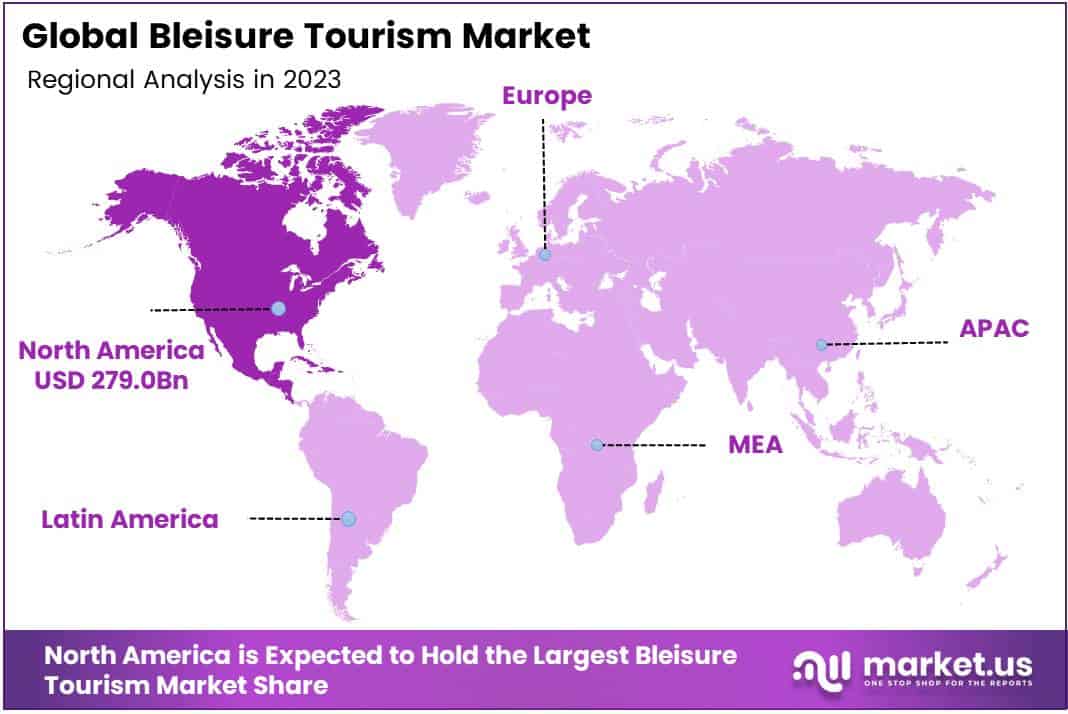

- North America held the largest regional share of the Bleisure Tourism Market in 2023, with a 32.6% share valued at USD 279 billion.

Tour Type Analysis

Solo Segments Dominate Bleisure Tourism with 51.3%

In 2023, Solo held a dominant market position in the By Tour Type Analysis segment of the Bleisure Tourism Market, capturing a 51.3% share. This significant portion reflects the growing trend of individual travelers blending business trips with leisure activities.

Solo travelers often seek flexibility and personalized experiences, driving demand for customized tours and accommodations that cater to individual interests and schedules. The increase in solo bleisure travel is largely fueled by the rise of digital platforms that facilitate easy travel arrangements and offer tailored recommendations, enhancing the overall travel experience.

Group segment benefits from the collaborative nature of group travel where costs are shared, and experiences are enjoyed collectively. Group bleisure trips are popular among corporate teams and organizations looking to foster team bonding alongside work-related travel.

These trips often involve structured itineraries that include team-building activities, workshops, and leisure time, which are attractive to businesses aiming to boost employee morale and productivity while on the move.

Travel Type Analysis

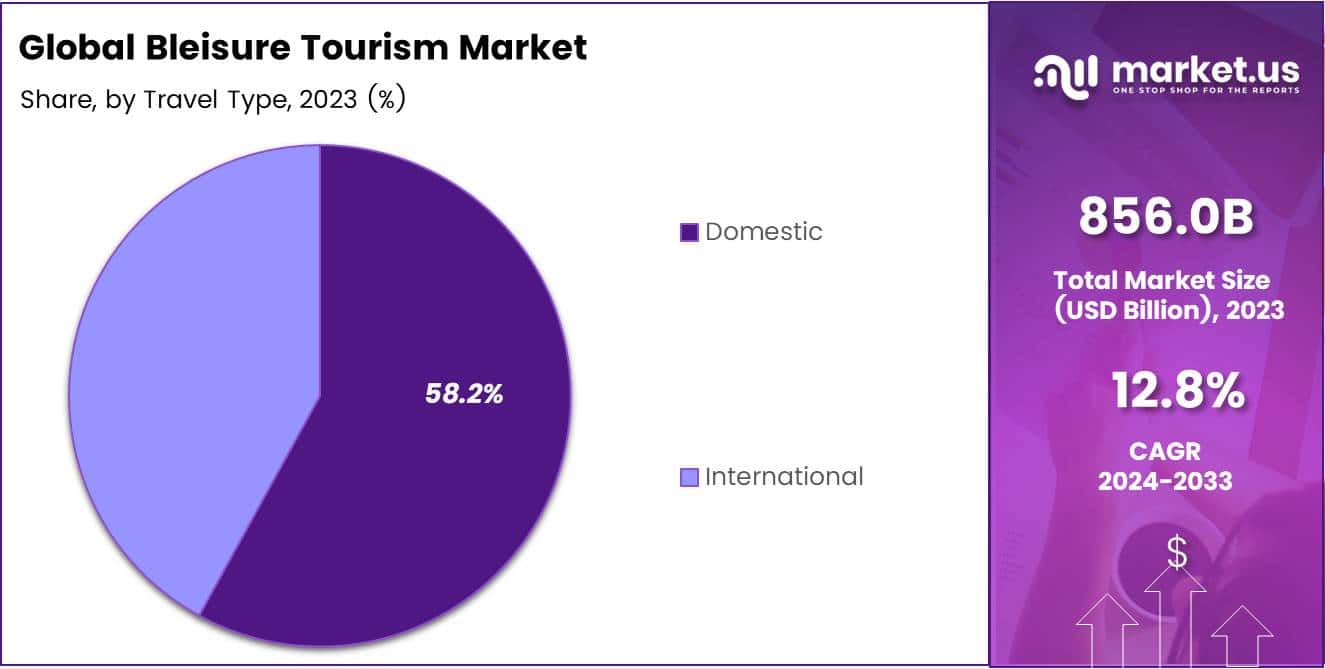

Domestic Travel Captures 58.2% Share in 2023 Bleisure Tourism Market by Travel Type

In 2023, Domestic travel held a dominant market position in the By Travel Type Analysis segment of the Bleisure Tourism Market, capturing a significant 58.2% share. This substantial portion underscores a growing preference among business travelers to blend their business trips with leisure activities within their home country.

The appeal of domestic bleisure travel is primarily driven by the convenience it offers, such as reduced travel times and familiarity with the travel environment, which lowers the overall stress associated with planning and execution.

Moreover, domestic destinations often provide cost-effective options for extending business trips, which is particularly attractive in an economic climate that encourages budget-conscious decisions.

On the other hand, International travel, while still a vital part of the bleisure tourism market, caters more to those looking for a transformative escape by integrating business with leisure travel abroad.

This segment appeals to individuals who are eager to explore new cultures and exotic locations, even if it means higher travel costs and more extensive planning.

As global travel restrictions continue to ease, the international segment is anticipated to gain a stronger foothold, offering enriched experiences that are worth the extra investment.

Travel Duration Analysis

Dominance of Short Stays with 2-4 Days Leading at 43.6% Share

In 2023, the 2-4 days segment held a dominant market position in the By Travel Duration Analysis of the Bleisure Tourism Market, capturing a 43.6% share.

This duration appeals primarily to business travelers who extend their professional trips for leisure purposes without significantly disrupting their work schedules. The convenience of adding a few leisure days to a business trip makes this duration segment particularly attractive for maximizing short travel periods effectively.

The 1-week segment followed, reflecting preferences for a balanced mix of business and extended leisure activities. This duration allows travelers to explore destinations more thoroughly, attend additional networking events, or simply relax and rejuvenate before returning to work.

Although less dominant than the 2-4 days segment, the 1-week travel duration maintains a steady appeal among those who can afford slightly longer absences from their professional roles.

The above 1-month segment caters to a niche market within bleisure tourism, comprising travelers who engage in prolonged business projects or choose to deeply immerse themselves in the local culture post-business engagements. This segment is less common but is gaining traction among digital nomads and professionals involved in long-term international projects.

Key Market Segments

By Tour Type

- Solo

- Group

By Travel Type

- Domestic

- International

By Travel Duration

- 2-4 days

- 1 week

- Above 1 month

Drivers

Growing Trend of Mixing Business with Pleasure

The increasing popularity of bleisure tourism is primarily driven by the rise in global business travel. As professionals travel more for work, they are seizing the opportunity to blend their business trips with leisure activities.

This trend is supported by the widespread acceptance of remote work, which provides the flexibility to extend stays and enjoy destinations without compromising work responsibilities.

Furthermore, the millennial generation, known for valuing experiences over material goods, is contributing significantly to this market’s growth. They frequently incorporate leisure elements into their business travels, effectively doubling the value of each trip.

This shift towards integrating work with leisure not only enhances travel experiences but also supports a more balanced lifestyle, making bleisure travel an increasingly attractive option for today’s workforce.

Restraints

Corporate Budget Constraints Limit Bleisure Tourism Growth

Corporate budget limitations are a significant restraint in the bleisure tourism market. When the economy faces downturns or companies decide to cut costs, one of the first budgets to get slashed is travel.

This reduction directly impacts the frequency and extravagance of business trips, which in turn limits opportunities for bleisure travel where employees extend their business trips for leisure purposes.

Additionally, not all corporate cultures are open to or fully understand the concept of combining business with leisure. This lack of awareness or misunderstanding can further restrict the adoption of bleisure travel as a formal policy within companies, making it difficult for employees to seamlessly blend work-related travel with personal exploration and relaxation.

These financial and cultural barriers are crucial factors that businesses and the tourism industry must navigate to tap into the potential benefits of bleisure travel.

Growth Factors

Expanding Business Travel Boosts Bleisure Opportunities in Emerging Markets

The bleisure tourism market is finding significant growth opportunities as business travel expands in emerging markets such as Asia and Latin America. As more professionals travel for work to these regions, there is a rising trend of extending their business trips to include leisure activities. This blending of business and leisure, or bleisure,” appeals to travelers looking to maximize their travel experiences.

To capitalize on this trend, travel agencies have opportunities to collaborate with corporations to design customized travel packages that cater to the needs of business travelers who wish to explore their destination beyond work commitments. Additionally, there’s a growing demand for sustainable tourism.

Developing green travel solutions can attract environmentally conscious travelers who value sustainability. By focusing on these areas, companies in the bleisure travel market can create attractive offerings that meet the evolving preferences of modern travelers, thereby driving further growth in this sector.”

Emerging Trends

Rise of Bleisure Cities

In the dynamic world of travel, the Bleisure Tourism market is evolving swiftly, driven by several engaging trends. Foremost among these is the rise of bleisure cities, where destinations are transforming into hubs for both work and play.

These cities are being chosen for their excellent business facilities alongside rich cultural, historical, and recreational attractions, making them perfect for extending a business trip into a leisure getaway.

Additionally, the trend of solo bleisure travel is on the rise, with more individuals choosing to explore a destination on their own after their business obligations are fulfilled. These solo adventurers are reshaping travel norms, valuing both the freedom to explore at their own pace and the opportunity to unwind.

Another significant trend is the preference for micro-trips, which sees travelers opting for shorter but more frequent getaways that combine business with leisure, adding value to their trips without a significant commitment of time. These trends highlight a blurring of lines between work and leisure, a testament to the changing attitudes towards travel and professional life.

Regional Analysis

North America with a Market Share of 32.6% Valued at USD 279 Billion

The bleisure tourism market has witnessed substantial growth across various regions, each presenting unique trends and contributions to the industry. In North America, the market is particularly robust, holding a dominating position with a 32.6% market share, valued at approximately USD 279 billion.

This dominance is fueled by a high volume of business and luxury travel, particularly in the United States and Canada, where travelers often extend their business trips to include leisure activities, taking advantage of the diverse cultural, natural, and urban landscapes available.

Regional Mentions:

Europe follows closely, leveraging its rich historical heritage and extensive transport links that facilitate easy travel between major business hubs and scenic destinations. The integration of business hubs with iconic tourist attractions in cities like London, Paris, and Berlin makes Europe an attractive bleisure destination. The market here is bolstered by corporate policies that increasingly accommodate leisure extensions to business trips.

Asia-Pacific is rapidly expanding in the bleisure market, driven by the economic rise of countries like China and India, coupled with their burgeoning middle classes and increasing international business engagements. The region’s diverse cultural attractions and booming hospitality sectors are pivotal in making it a strong competitor in the bleisure space.

The Middle East & Africa region, though smaller in comparison, is gaining traction thanks to its luxury tourism combined with commercial hubs like Dubai and Johannesburg. Business travelers to these cities often seize the opportunity for leisure experiences in nearby exotic and luxury destinations.

Latin America is also carving out a space in the bleisure market, with its rich cultural offerings and natural beauty. Countries like Brazil and Mexico are seeing growth in corporate travel, with many travelers keen to explore the locales beyond business engagements.

Overall, while North America currently leads the market, other regions are rapidly making strides, each contributing distinctively to the global dynamics of the bleisure tourism market.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global Bleisure Tourism Market has witnessed significant contributions from leading companies like American Express Travel, which remains a cornerstone in blending business and leisure travel with their bespoke services and extensive global reach.

Travel Leaders has capitalized on its extensive network to offer tailored experiences that cater to both corporate and leisure needs, enriching the traveler’s experience.

JTB Business Travel has consistently innovated in providing seamless travel solutions that integrate business schedules with leisure activities, enhancing the overall travel experience.

AVIAREPS AG, known for its strong market presence in international travel management, has leveraged its expertise to facilitate efficient travel itineraries that accommodate both business obligations and leisure pursuits.

Carlson Wagonlit Travel plays a pivotal role by utilizing data-driven insights to customize travel experiences that accommodate the intricate needs of today’s hybrid travelers.

BCD Travel stands out with its strategic focus on integrating corporate travel management with leisure extensions, thereby offering comprehensive solutions that appeal to the modern bleisure traveler.

Top Key Players in the Market

- American Express Travel

- Travel Leaders

- JTB Business Travel

- AVIAREPS AG

- Carlson Wagonlit Travel

- World Travel Holding Inc.

- Expedia, Inc.

- CT Business Travel

- IMC International

- BCD Travel

Recent Developments

- In March 2024, Saudi Arabia announced plans to attract $13 billion in private sector investments in its tourism sector, aiming to bolster infrastructure and enhance visitor experiences across the kingdom.

- In November 2024, Saudi Arabia revealed a $933 million investment for 17 tourism projects in Al-Ahsa, adding 1,800 hotel rooms and advancing regional travel goals under Saudi Vision 2030.

- In March 2024, Oman launched a US$31 billion tourism investment plan as part of its Vision 2040, focusing on sustainable development and enhancing the nation’s appeal to international visitors.

- In March 2024, Saudi Arabia targeted $80 billion in investments to expand its tourism offerings, reflecting a strong commitment to transforming the sector and attracting global tourists.

Report Scope

Report Features Description Market Value (2023) USD 856.0 Billion Forecast Revenue (2033) USD 2854.7 Billion CAGR (2024-2033) 12.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Tour Type (Solo, Group), By Travel Type (Domestic, International), By Travel Duration (2-4 days, 1 week, Above 1 month) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape American Express Travel, Travel Leaders, JTB Business Travel, AVIAREPS AG, Carlson Wagonlit Travel, World Travel Holding Inc., Expedia, Inc., CT Business Travel, IMC International, BCD Travel Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- American Express Travel

- Travel Leaders

- JTB Business Travel

- AVIAREPS AG

- Carlson Wagonlit Travel

- World Travel Holding Inc.

- Expedia, Inc.

- CT Business Travel

- IMC International

- BCD Travel