Global Maritime Surveillance Market Size, Share, Upcoming Investments Report By Component (Solution, Services), By Application (Surveillance and Tracking, Search and Rescue, Maritime Traffic Management, Navigation, Other Applications), By End-User (Military and Defense, Commercial, Other End-Users), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: November 2024

- Report ID: 133679

- Number of Pages: 256

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

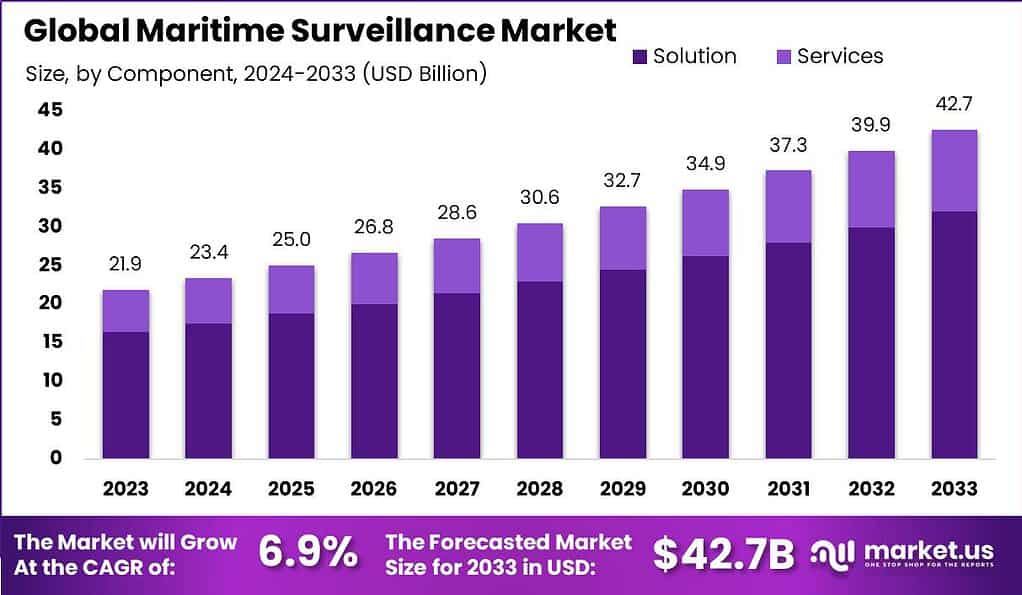

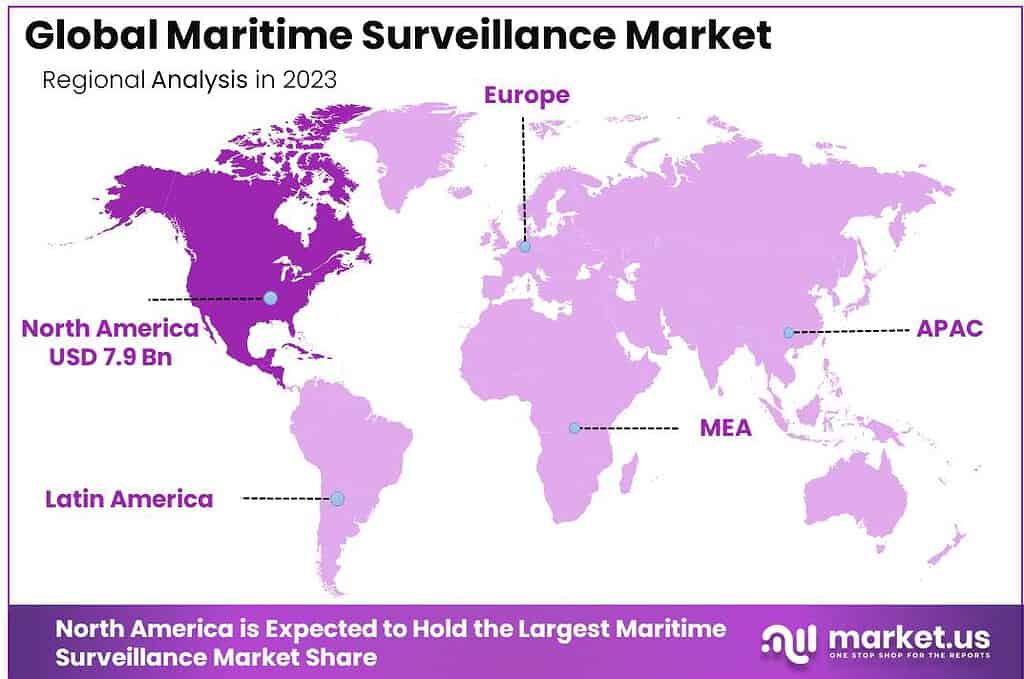

The Global Maritime Surveillance Market size is expected to be worth around USD 42.7 Billion By 2033, from USD 21.9 Billion in 2023, growing at a CAGR of 6.90% during the forecast period from 2024 to 2033. In 2023, North America captured over 34.1% of the global maritime surveillance market, contributing USD 7.9 billion in revenue and holding a dominant market position.

Maritime surveillance involves the monitoring and control of maritime activities, primarily focused on ensuring safety, security, and environmental protection across global waters. This practice is critical in managing maritime traffic, detecting illegal activities such as smuggling and piracy, enforcing law at sea, and conducting search and rescue operations.

The maritime surveillance market has grown significantly, spurred by increasing maritime security concerns, the expansion of sea-borne trade, and stringent regulatory standards by maritime organizations worldwide. Nations are investing more in advanced surveillance technologies, including radar systems, maritime drones and satellite communications, to enhance their maritime domain awareness.

Several key factors are driving the growth of the maritime surveillance market such as the rise in international maritime security threats, including piracy and territorial disputes, has heightened the demand for advanced surveillance and monitoring systems. The ongoing expansion of maritime commerce necessitates robust systems to ensure the safety and efficiency of shipping routes.

Additionally, technological advancements in satellites, unmanned vehicles, and radar systems have transformed maritime surveillance capabilities, making detection and response more effective. Governments worldwide are also increasing their investment in coastal security, further boosting market growth.

There is a strong demand for maritime surveillance systems that can provide high-resolution images and real-time data, which are crucial for tracking vessels and identifying potential threats. This demand is propelled by the need to safeguard maritime routes which are critical for international trade.

Maritime surveillance systems are gaining popularity, especially in regions with vast coastlines and heavy maritime traffic. The digital transformation of maritime operations has accelerated their adoption, while growing geopolitical tensions have highlighted the strategic need for advanced surveillance capabilities, further driving demand.

The market presents numerous opportunities, particularly in the development of AI-driven analytics for the data collected through maritime surveillance activities. There is also potential for growth in developing unmanned systems, such as autonomous underwater vehicles (AUVs) and unmanned surface vehicles (USVs), which can perform prolonged surveillance missions without requiring direct human oversight.

Expansion in the maritime surveillance market is being driven by technological innovations and strategic alliances between countries. As maritime threats evolve, the need for enhanced surveillance technologies becomes more critical, prompting countries to expand their capabilities to protect their waterways.

Key Takeaways

- The Global Maritime Surveillance Market size is expected to reach USD 42.7 Billion by 2033, up from USD 21.9 Billion in 2023, with a CAGR of 6.90% during the forecast period from 2024 to 2033.

- In 2023, the Solution segment dominated the market, capturing more than 75.1% of the share, driven by the widespread adoption of advanced maritime surveillance technologies, such as radar systems, automatic identification systems (AIS), and satellite-based tracking solutions.

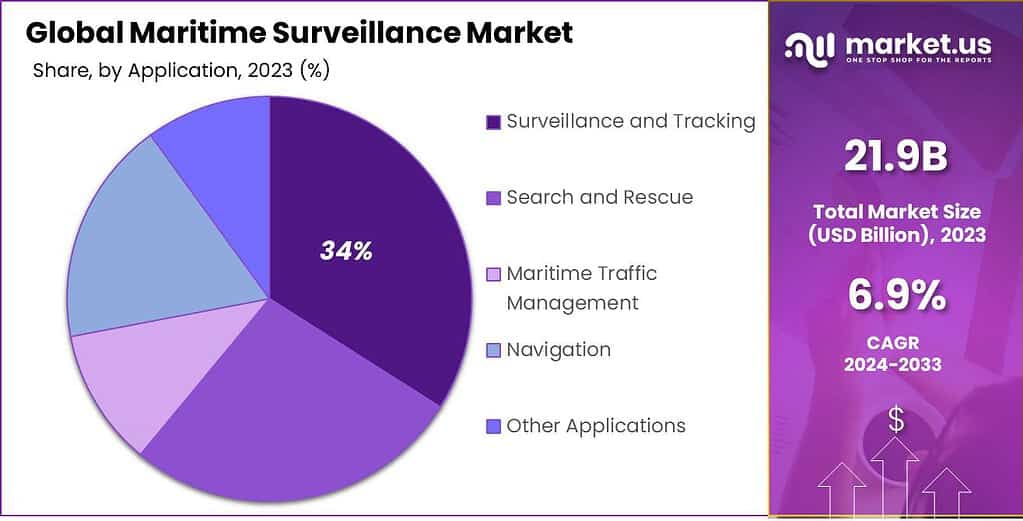

- The Surveillance and Tracking segment held a significant market share in 2023, accounting for over 34.0%.

- In 2023, the Military and Defense segment led the market, commanding more than 59.5% of the share in the maritime surveillance market.

- North America held a dominant market position in 2023, contributing USD 7.9 billion in revenue and accounting for more than 34.1% of the global maritime surveillance market share.

Impact of AI on Maritime Surveillance Industry

The role of Artificial Intelligence (AI) in maritime surveillance and security is becoming increasingly pivotal as technological advancements continue to evolve. AI’s integration into maritime operations is transforming the field, making it more efficient, secure, and safe.

AI enhances maritime security through several key applications:

- Threat Detection and Analysis: AI systems employ advanced algorithms to identify and analyze patterns and anomalies that might be missed by human operators. This capability is crucial for the early detection of potential threats, such as unauthorized vessel activities and piracy, thus enabling quicker responses.

- Real-time Data Analytics and Decision Support: By processing vast amounts of data from various sources, AI provides actionable insights almost instantaneously. This integration of data sources, including satellite imagery, Automatic Identification System (AIS) data, and radar, helps in enhancing situational awareness and supports better decision-making.

- Predictive Maintenance: Utilizing AI for predictive maintenance can foresee equipment failures before they occur, reducing downtime and maintenance costs. This is essential in the maritime industry, where equipment reliability is critical for safe and uninterrupted operations.

- Autonomous Operations: AI-driven unmanned vehicles, such as autonomous drones and underwater vehicles, extend the capabilities of maritime surveillance. These technologies allow for the coverage of vast and hard-to-reach areas, enhancing monitoring and operational efficiency.

- Environmental and Regulatory Compliance: AI aids in monitoring environmental compliance and helps vessels adhere to maritime regulations. This is increasingly important as the industry faces stricter environmental regulations and aims to reduce its carbon footprint.

For instance, In September 2024, Seadronix unveiled their NAVISS 2.0 True-AI Ship Navigation and Monitoring System at the Maritime Fair, marking a significant advancement in maritime technology. This latest version promises to revolutionize how ships navigate and monitor their surroundings, enhancing safety and situational awareness at sea. The introduction of NAVISS 2.0 could potentially set new standards in the shipping industry, offering ship operators a more intuitive and reliable tool to manage their vessels efficiently.

Component Analysis

In 2023, the Solution segment held a dominant market position within the maritime surveillance market, capturing more than a 75.1% share. This substantial market share can be primarily attributed to the increasing demand for advanced surveillance systems designed to enhance maritime security, monitor maritime traffic, and protect marine resources.

Solutions in this segment typically encompass a range of technologies, including radar systems, sensors, AIS receivers, and surveillance cameras, integrated into comprehensive systems that provide real-time monitoring and data analysis capabilities. The predominance of the Solution segment is further reinforced by the growing need for national and border security against threats such as piracy, illegal fishing, and smuggling.

Governments and maritime authorities worldwide are investing heavily in advanced surveillance technology to ensure the safety of their waters, which has propelled the demand for integrated surveillance solutions. These technologies not only aid in detecting and tracking illegal activities but also play a crucial role in search and rescue operations, environmental monitoring, and managing the impact of human activities on marine ecosystems.

Additionally, the expansion of the maritime surveillance market in the Solutions segment is driven by technological advancements in satellite-based earth observation, which enhances maritime domain awareness on a global scale. The integration of artificial intelligence and machine learning algorithms has significantly improved the accuracy and efficiency of data analysis, making surveillance systems more robust and reliable.

Overall, the Solution segment’s dominance in the maritime surveillance market is expected to continue as technological innovations proliferate and the need for enhanced maritime security becomes increasingly paramount. The continuous advancements in surveillance technology, along with strategic investments by governmental and private entities, are likely to foster substantial growth in this segment, ensuring it remains critical to global maritime safety and security strategies.

Application Analysis

In 2023, the Surveillance and Tracking segment held a dominant market position within the maritime surveillance market, capturing more than a 34% share. This segment’s substantial market share can be attributed to the escalating global emphasis on enhancing maritime security, protecting sea lanes, and monitoring maritime activities.

Surveillance and tracking systems are pivotal in providing continuous and comprehensive monitoring of maritime zones, helping to detect, identify, and respond to potential threats or illegal activities such as piracy, smuggling, and unauthorized vessel intrusions. The growth of the Surveillance and Tracking segment is bolstered by the integration of advanced technologies, including high-definition cameras, satellite communications, and radar systems.

These technologies enable real-time data collection and analytics, significantly enhancing maritime domain awareness. Furthermore, the deployment of Automatic Identification Systems (AIS) and Long-Range Identification and Tracking (LRIT) systems has become increasingly prevalent, providing critical data that improves the effectiveness of maritime surveillance and tracking operations.

Technological advancements such as the incorporation of artificial intelligence and machine learning have further refined the capabilities of surveillance and tracking systems. These technologies facilitate the analysis of vast amounts of data to identify patterns and predict potential incidents, enhancing preemptive measures and strategic planning.

Additionally, the growing use of unmanned aerial vehicles (UAVs) and autonomous underwater vehicles (AUVs) in maritime surveillance contributes to the comprehensive coverage and efficiency of maritime operations. Considering these factors, the Surveillance and Tracking segment is poised for sustained growth.

As maritime traffic continues to increase and the global maritime landscape evolves, the demand for advanced surveillance and tracking solutions will likely remain robust. This will ensure continued investment and development in this sector, driving innovation and maintaining its critical role in global maritime safety and security strategies.

End-User Analysis

In 2023, the Military and Defense segment held a dominant market position within the maritime surveillance market, capturing more than a 59.5% share. This commanding market share is chiefly attributed to heightened global security concerns, territorial disputes, and the critical need for national defense preparedness.

Military and defense forces globally rely extensively on maritime surveillance systems to monitor sea borders, protect maritime interests, and ensure national security against potential maritime threats, including territorial incursions and illegal maritime activities. The expansion of the Military and Defense segment is significantly driven by the adoption of sophisticated maritime surveillance technologies that provide enhanced situational awareness and operational efficiency.

Technologies such as radar systems, satellite communications, and cyber surveillance are integral components of military maritime operations. These systems facilitate real-time tracking, monitoring, and strategic planning, essential for maintaining maritime domain awareness and conducting naval operations effectively.

Furthermore, ongoing technological advancements, including the integration of unmanned systems like drones and autonomous vessels, have revolutionized maritime surveillance capabilities for military applications. These innovations not only extend the reach and effectiveness of surveillance operations but also improve safety by reducing the need for manned operations in high-risk environments.

The strategic collaboration between governments and technology providers to upgrade and expand maritime surveillance infrastructures also underscores the sustained growth and development within this segment. Given these dynamics, the Military and Defense segment is poised to maintain its prominence in the maritime surveillance market.

Continued investments in defense budgets, coupled with advancements in surveillance technology, are expected to drive further growth, ensuring that this segment remains at the forefront of global maritime security initiatives.

Key Market Segments

By Component

- Solution

- Services

By Application

- Surveillance and Tracking

- Search and Rescue

- Maritime Traffic Management

- Navigation

- Other Applications

By End-User

- Military and Defense

- Commercial

- Other End-Users

Driver

Escalating Maritime Security Threats

The maritime domain faces a growing array of security threats, including piracy, smuggling, human trafficking, and territorial disputes. These challenges have intensified due to increased global trade, leading to higher vessel traffic and, consequently, more opportunities for illicit activities.

There is a heightened demand for advanced maritime surveillance systems to monitor vast oceanic expanses, detect suspicious activities, and ensure the safety of maritime operations. Governments and international organizations are investing in technologies like satellite-based Automatic Identification Systems (AIS) and unmanned aerial vehicles to enhance situational awareness and respond promptly to potential threats.

Restraint

High Implementation and Maintenance Costs

Implementing comprehensive maritime surveillance systems requires substantial financial investment. The deployment of advanced technologies, such as satellite-based AIS and sophisticated radar systems, involves significant capital expenditure. Additionally, the maintenance of these systems demands ongoing operational costs, including regular updates, personnel training, and infrastructure support.

For many developing nations, these financial requirements pose a considerable barrier, limiting their ability to adopt and sustain effective maritime surveillance measures. The disparity in resources between developed and developing countries can lead to uneven surveillance capabilities, creating vulnerabilities in global maritime security.

Opportunity

Technological Advancements in Surveillance Systems

Rapid advancements in technology present significant opportunities to enhance maritime surveillance capabilities. The integration of artificial intelligence (AI) and machine learning algorithms enables the analysis of vast amounts of data from various sources, facilitating the early detection of anomalies and potential threats.

The development of unmanned systems, such as drones and autonomous underwater vehicles, allows for continuous monitoring of maritime zones without risking human lives. Furthermore, the improvement of satellite imaging and communication technologies provides real-time data transmission, enhancing situational awareness.

Challenge

Ensuring Data Security and Privacy

The increasing reliance on digital technologies for maritime surveillance introduces challenges related to data security and privacy. The vast amounts of data collected and transmitted by surveillance systems are susceptible to cyber-attacks, unauthorized access, and data breaches.

Ensuring the integrity and confidentiality of this information is crucial, as compromised data can lead to severe security breaches, including the manipulation of vessel tracking information or the exposure of sensitive maritime operations. Addressing this challenge requires the implementation of robust cybersecurity measures, regular system audits, and the development of international standards and protocols to protect data within the maritime surveillance framework.

Emerging Trends

Maritime surveillance is undergoing a significant transformation, driven by technological advancements and evolving security challenges. A notable trend is the integration of artificial intelligence (AI) and machine learning into surveillance systems. These technologies enhance the detection of illicit activities by identifying complex patterns and anomalies in maritime behavior.

The deployment of unmanned systems, such as autonomous drones and underwater vehicles, is also on the rise. These platforms extend surveillance reach and efficiency, covering vast and previously inaccessible maritime zones. Equipped with advanced sensors, they provide real-time data, facilitating timely decision-making and reducing the reliance on manned patrols.

Additionally, the use of satellite-based monitoring is becoming more prevalent. Satellites equipped with radar and optical imagery capabilities offer continuous and wide-area coverage, essential for monitoring vast oceanic regions. This capability is crucial for tracking vessel movements, detecting illegal fishing activities, and responding to environmental hazards.

Business Benefits

Investing in advanced maritime surveillance technologies offers substantial benefits for businesses operating in the maritime sector. Enhanced surveillance capabilities lead to improved security of maritime assets, including vessels and cargo. By effectively monitoring and deterring illicit activities such as piracy and smuggling, companies can safeguard their operations and reduce potential losses.

Enhanced situational awareness through integrated surveillance systems also facilitates better decision-making. Access to real-time data enables businesses to respond promptly to emerging threats or operational challenges, minimizing downtime and maintaining the continuity of maritime operations.

Furthermore, compliance with international maritime regulations is more efficiently achieved through advanced surveillance. Accurate tracking and reporting mechanisms ensure adherence to environmental and safety standards, thereby avoiding legal penalties and enhancing the company’s reputation.

Regional Analysis

In 2023, North America held a dominant market position, capturing more than a 34.1% share, contributing to USD 7.9 billion in revenue in the global maritime surveillance market. This leadership stems from the region’s robust maritime infrastructure and substantial investments in advanced surveillance technologies.

Governments across North America, particularly the United States and Canada, prioritize securing extensive coastlines and waterways against evolving threats such as smuggling, illegal fishing, and maritime terrorism. The region’s dominance is further driven by heavy investments in modernizing naval capabilities. Key players in North America are integrating cutting-edge technologies such as artificial intelligence, machine learning, and advanced sensors into maritime surveillance systems.

These innovations enhance the real-time detection of threats, offering better situational awareness and improved response times. Additionally, collaborations between private companies and defense departments contribute significantly to technological advancements, reinforcing North America’s leadership in the sector.

For instance, In early 2024, French maritime surveillance company Unseenlabs announced plans to expand its satellite constellation by launching its 12th and 13th nanosatellites in March. This development marks a significant milestone, positioning Unseenlabs over halfway to completing its network, which aims to offer near real-time tracking of ships by 2025. Currently, its network of 11 satellites has the capability to monitor and locate maritime signals globally, providing updates every four to six hours.

The strategic importance of the maritime domain in North America also plays a vital role. The United States, with its critical ports and global naval operations, relies heavily on efficient surveillance systems to maintain economic and national security. Similarly, Canada’s Arctic waterways and Atlantic routes are increasingly monitored using advanced systems, addressing challenges posed by melting ice and increased shipping traffic.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

In the realm of maritime surveillance, several companies stand out due to their innovations and contributions to the industry.

Thales Group has firmly established itself as a leader in maritime surveillance. This French multinational company excels in providing advanced technologies that cater to defense, security, and aerospace sectors. Thales leverages its extensive experience and cutting-edge technology to offer solutions that enhance the safety and efficiency of maritime operations.

RTX Corporation (formerly Raytheon Technologies) is another giant in the maritime surveillance sector. RTX excels in integrating sophisticated sensor technologies and radar systems that are pivotal for maritime defense and security. Their products are designed to provide exceptional situational awareness in the maritime domain, helping naval forces and security agencies to detect and track threats effectively.

Northrop Grumman Corporation, an American global aerospace and defense technology company, is at the forefront of maritime surveillance. Their expertise in creating high-tech surveillance aircraft and unmanned systems sets them apart.

Top Key Players in the Market

- Thales Group

- RTX Corporation

- Northrop Grumman Corporation

- Leonardo S.p.A.

- Indra Sistemas S.A.

- Saab AB

- BAE Systems Plc

- Elbit Systems Ltd.

- Kongsberg Defence & Aerospace

- L3Harris Technologies, Inc.

- Other Key Players

Recent Developments

- In May 2024, Fincantieri acquired Leonardo’s underwater armaments systems business for up to €415 million. This acquisition strengthens Fincantieri’s position in the underwater defense sector, enhancing its capabilities in manufacturing underwater missiles and sonar systems.

- In January 2024, the maritime surveillance company PierSight successfully secured around $6.1 million in seed funding, with Elevation Capital and Alpha Wave Ventures leading the effort. This funding boost aims to enhance their satellite-based monitoring solutions, marking a significant stride in maritime safety and operational efficiency.

- Earlier, in April 2023, Honeywell made a strategic move by acquiring Compressor Controls Corporation (CCC) for $670 million. CCC, known for its advanced turbomachinery control systems, fits perfectly into Honeywell’s broader plan to bolster its automation and control offerings, particularly for maritime applications.

- In December 2023, The U.S. Navy awarded Raytheon, an RTX business, an $80 million contract to prototype the Advanced Electronic Warfare (ADVEW) system for the F/A-18 E/F Super Hornet. This system aims to replace legacy electronic warfare systems with a consolidated solution, enhancing the aircraft’s electronic warfare capabilities.

Report Scope

Report Features Description Market Value (2023) USD 21.9 Bn Forecast Revenue (2033) USD 42.7 Bn CAGR (2024-2033) 6.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Solution, Services), By Application (Surveillance and Tracking, Search and Rescue, Maritime Traffic Management, Navigation, Other Applications), By End-User (Military and Defense, Commercial, Other End-Users) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thales Group, RTX Corporation, Northrop Grumman Corporation, Leonardo S.p.A., Indra Sistemas S.A., Saab AB, BAE Systems Plc, Elbit Systems Ltd., Kongsberg Defence & Aerospace, L3Harris Technologies, Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Maritime Surveillance MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample

Maritime Surveillance MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Thales Group

- RTX Corporation

- Northrop Grumman Corporation

- Leonardo S.p.A.

- Indra Sistemas S.A.

- Saab AB

- BAE Systems Plc

- Elbit Systems Ltd.

- Kongsberg Defence & Aerospace

- L3Harris Technologies, Inc.

- Other Key Players