Global Offshore Wind Turbine Market Size, Share, And Growth Analysis Report By Capacity (Up to 5 MW, 5 MW to 8 MW, Above 8 MW), By Water Depth (Shallow Water, Transitional Water, Deep Water), By Foundation (Floating, Fixed, Monopile, Tripod, Gravity Base, Jacket, Others), By Drive Technology (Direct-Drive Turbines, Gearbox Turbines), By Location (Nearshore, Offshore, Far shore), By Application (Commercial, Industrial, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143527

- Number of Pages: 276

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

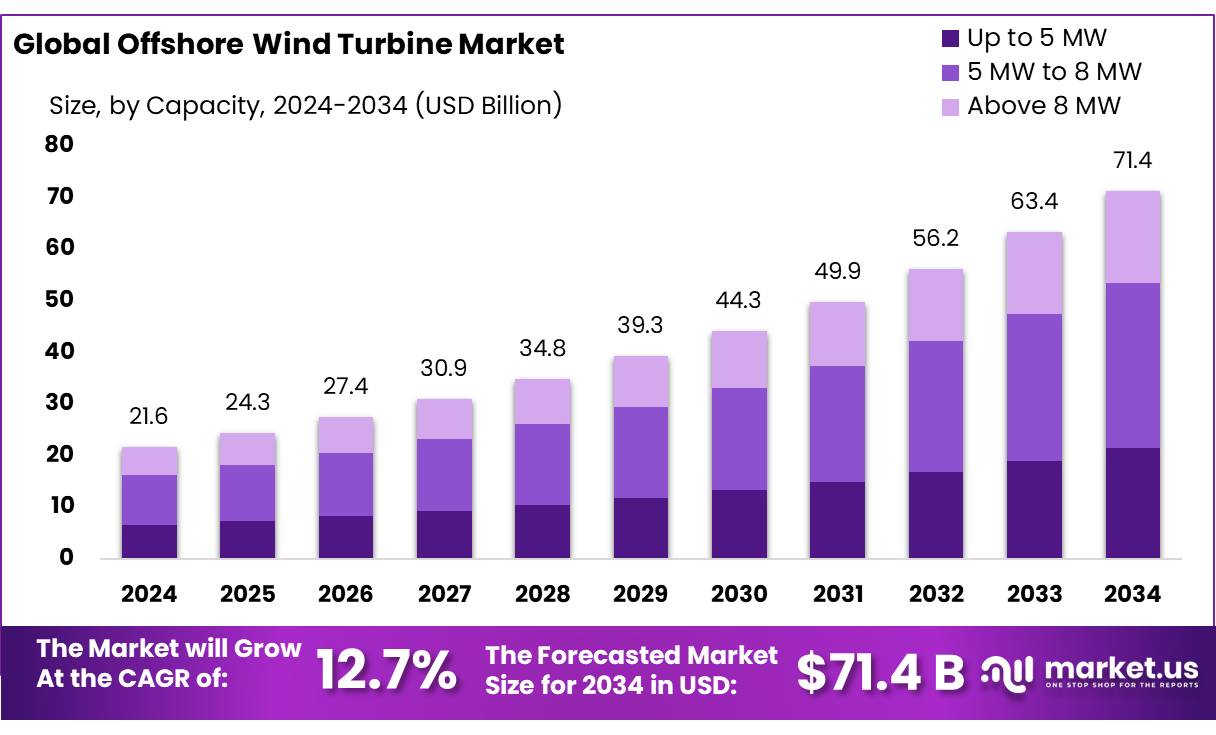

The Global Offshore Wind Turbine Market size is expected to be worth around USD 71.4 Bn by 2034, from USD 21.6 Bn in 2024, growing at a CAGR of 12.7% during the forecast period from 2025 to 2034.

Offshore wind turbines have emerged as a pivotal component in the global transition toward renewable energy, harnessing the robust and consistent wind resources found over oceans to generate electricity. Unlike their onshore counterparts, offshore wind farms are situated in open waters, allowing for the installation of larger turbines capable of producing substantial amounts of energy.

Several key factors are propelling the expansion of the offshore wind industry. Foremost is the escalating global demand for clean and renewable energy sources to mitigate climate change and reduce reliance on fossil fuels. Governments worldwide are setting ambitious targets to curtail carbon emissions, with offshore wind energy playing a crucial role in achieving these objectives.

For instance, the United States has set a goal to deploy 30 gigawatts (GW) of new offshore wind energy by 2030, a move anticipated to support approximately 77,000 jobs, power 10 million homes, and cut 78 million metric tons of carbon emissions.

Technological advancements have significantly enhanced the efficiency and feasibility of offshore wind projects. The development of floating wind turbines, capable of being anchored in deeper waters where wind speeds are higher and more consistent, has opened new avenues for energy generation.

Government initiatives and international collaborations are further accelerating the growth of the offshore wind sector. In Europe, the North Seas Energy Cooperation (NSEC), comprising countries like Belgium, Denmark, France, Germany, Ireland, Luxembourg, the Netherlands, Norway, and Sweden, aims to create an integrated offshore energy grid.

The future growth opportunities in the offshore wind industry are substantial. For example, the United Kingdom secured 131 clean energy projects in a recent state auction, aiming to supply electricity to 11 million homes, with over 5 GW attributed to offshore wind projects. Such developments highlight the sector’s capacity to contribute significantly to global energy demands while fostering economic growth and job creation.

Key Takeaways

- Offshore Wind Turbine Market size is expected to be worth around USD 71.4 Bn by 2034, from USD 21.6 Bn in 2024, growing at a CAGR of 12.7%.

- 5 MW to 8 MW capacity segment for offshore wind turbines held a dominant position in the market, capturing more than a 45.30% share.

- Shallow Water held a dominant market position, capturing more than a 48.20% share of the offshore wind turbine market.

- Fixed Foundations held a dominant market position, capturing more than a 79.30% share of the offshore wind turbine market.

- Direct-Drive Turbines held a dominant market position within the offshore wind turbine sector, capturing more than a 58.40% share.

- Nearshore segment of the offshore wind turbine market held a commanding position, securing more than a 49.10% share.

- Commercial segment within the offshore wind turbine market secured a leading position, capturing more than a 58.30% share.

- Asia-Pacific (APAC) region emerges as a significant player, commanding a substantial 34.40% market share with a valuation of approximately $7.4 billion.

By Capacity

Offshore Wind Turbines in the 5 MW to 8 MW Range Lead with a 45.3% Market Share

In 2024, the 5 MW to 8 MW capacity segment for offshore wind turbines held a dominant position in the market, capturing more than a 45.30% share. This range has become increasingly popular due to its optimal balance between cost-efficiency and power output, making it a preferred choice for many new offshore wind projects globally.

As developers aim to maximize energy production while managing installation and maintenance costs, turbines within this capacity range offer the necessary efficiency to meet these requirements. The trend towards selecting 5 MW to 8 MW turbines is expected to persist as technology advances and as these units prove capable of delivering reliable power in diverse marine environments.

By Water Depth

Shallow Water dominates with 48.20% due to its cost-efficiency and ease of installation.

In 2024, Shallow Water held a dominant market position, capturing more than a 48.20% share of the offshore wind turbine market. This strong market presence is largely due to the favorable installation conditions in shallow waters, which generally range from 10 to 60 meters in depth. These conditions allow for easier and more cost-effective installation compared to deeper waters, making it an attractive option for many offshore wind projects.

In 2023, the Shallow Water segment had already accounted for around 47.10% of the market share, showing steady growth as technological advancements have further lowered installation and operational costs. This trend is expected to continue in the coming years, as Shallow Water sites are considered more accessible and less expensive to develop than deeper water locations.

By Foundation

Fixed Foundations dominate with 79.30% due to their stability and cost-effectiveness in shallow waters.

In 2024, Fixed Foundations held a dominant market position, capturing more than a 79.30% share of the offshore wind turbine market. This segment’s popularity is driven by its stability and efficiency, particularly in shallow waters where fixed foundations are the most suitable and cost-effective solution. These foundations are anchored to the seabed and provide a solid base for turbines, making them ideal for sites with water depths typically ranging from 10 to 60 meters.

By Drive Technology

Direct-Drive Turbines Lead with 58.4% Due to Superior Efficiency and Lower Maintenance Needs

In 2024, Direct-Drive Turbines held a dominant market position within the offshore wind turbine sector, capturing more than a 58.40% share. This technology, favored for its reliability and efficiency, stands out in the renewable energy landscape. Unlike geared turbines, direct-drive systems do not require a gearbox, which reduces mechanical complexity and minimizes maintenance demands.

This characteristic is particularly valuable in the harsh, remote environments where offshore turbines often operate, making direct-drive turbines a preferred choice for new offshore wind projects. Their robust design and lower operational costs contribute significantly to their market dominance, promising continued growth and preference in upcoming developments projected into 2025.

By Location

Nearshore Wind Turbines Command a 49.1% Market Share

In 2024, the nearshore segment of the offshore wind turbine market held a commanding position, securing more than a 49.10% share. This segment benefits from its proximity to shorelines, reducing the logistical challenges and costs associated with installation and maintenance compared to more remote offshore locations.

The accessibility of nearshore sites also facilitates the integration of wind power into existing electrical grids, enhancing energy transmission efficiency. As the push for renewable energy continues to grow, nearshore wind turbines are increasingly favored for their blend of practicality and effective energy production, making them a significant contributor to the global shift towards sustainable energy sources.

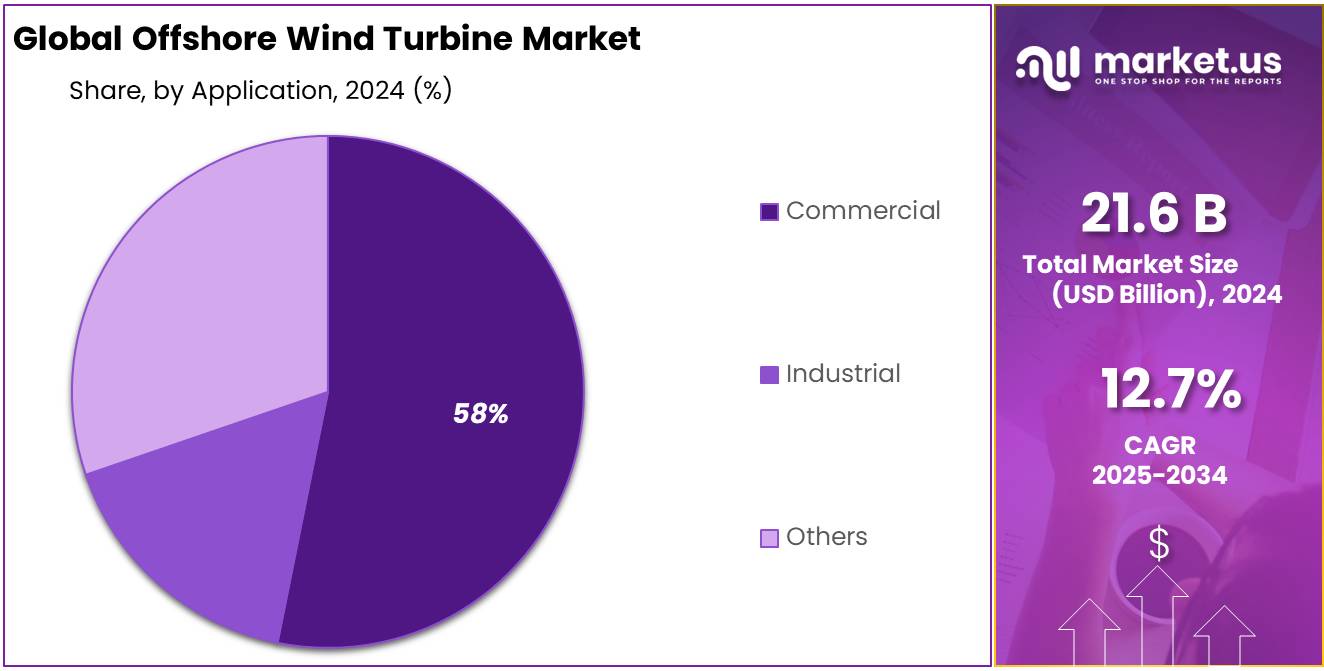

By Application

Commercial Applications Dominate with 58.3% Share Due to Robust Demand for Clean Energy

In 2024, the commercial segment within the offshore wind turbine market secured a leading position, capturing more than a 58.30% share. This segment’s prominence is primarily driven by the escalating global demand for sustainable and clean energy solutions, aimed at reducing carbon footprints and mitigating climate change effects.

Commercial offshore wind projects benefit from economies of scale, which lower energy production costs and enhance the feasibility of large-scale deployments. These factors make commercial applications highly attractive to investors and governments alike, positioning them as key contributors to the growth in renewable energy infrastructure projected to continue through 2025.

Key Market Segments

By Capacity

- Up to 5 MW

- 5 MW to 8 MW

- Above 8 MW

By Water Depth

- Shallow Water

- Transitional Water

- Deep Water

By Foundation

- Floating

- Fixed

- Monopile

- Tripod

- Gravity Base

- Jacket

- Others

By Drive Technology

- Direct-Drive Turbines

- Gearbox Turbines

By Location

- Nearshore

- Offshore

- Far shore

By Application

- Commercial

- Industrial

- Others

Drivers

Government Subsidies Propel Offshore Wind Turbine Adoption

One major driving factor for the growth of the offshore wind turbine market is the substantial support from government subsidies. These financial incentives are crucial as they help offset the high initial costs associated with the development and installation of offshore wind farms. For instance, the U.S. Department of Energy has been actively supporting the offshore wind industry through initiatives like the Wind Energy Technologies Office, which funds projects aimed at reducing costs and improving the performance of offshore wind technologies.

In Europe, countries like Germany and the United Kingdom have long histories of promoting wind power through feed-in tariffs and other supportive measures, making them leaders in the offshore wind sector. These subsidies not only make the projects more economically viable but also attract private investment into the renewable energy sector. As a result, the installed capacity for offshore wind has seen substantial growth. According to the Global Wind Energy Council, Europe installed 4.9 GW of new offshore wind capacity in 2023 alone.

Moreover, these government-led initiatives often come with stipulations that ensure local economic benefits, such as job creation in the manufacturing and maintenance of wind turbines. This not only boosts the local economy but also promotes a sustainable energy future. The continuation and expansion of these subsidies are expected to drive further growth in the offshore wind turbine market, making clean energy more accessible and affordable globally.

Restraints

High Installation Costs Challenge Offshore Wind Turbine Expansion

A significant restraining factor for the offshore wind turbine market is the high cost of installation. These costs are considerably higher than those associated with onshore wind projects and other more traditional forms of energy production. Building wind farms offshore involves complex engineering challenges and the use of specialized ships and equipment, all of which contribute to increased initial investments.

For example, the construction of offshore wind farms requires heavy-lift vessels and dynamic positioning systems to install large turbines in deep waters. According to a report by the National Renewable Energy Laboratory (NREL), the average capital cost for offshore wind projects is approximately $4,000 per kilowatt, nearly double the expense for onshore wind projects.

These high costs are further exacerbated by the maintenance challenges posed by harsh marine environments. Offshore wind turbines are exposed to saltwater corrosion, strong winds, and wave action, which can lead to more frequent repairs and replacements compared to their onshore counterparts. The U.S. Energy Information Administration (EIA) notes that maintenance costs for offshore wind turbines can be up to 100% higher than those for onshore wind turbines.

While government subsidies and technological advancements are helping to lower these costs gradually, they remain a substantial barrier. Without ongoing financial support from policies like investment tax credits or enhanced subsidy schemes, the pace of offshore wind development might slow, particularly in regions where government support is uncertain.

Opportunity

Technological Innovations Fuel Offshore Wind Turbine Market Growth

A significant growth opportunity in the offshore wind turbine market is driven by ongoing technological advancements that increase the efficiency and capacity of wind turbines. As turbines become more powerful, they can generate more electricity from fewer installations, reducing both environmental impact and operational costs.

Recent developments have seen the introduction of larger turbine blades and enhanced drive systems, capable of harnessing wind energy more effectively. For instance, the newest models of turbines now feature blades that are over 100 meters long, almost doubling the capture area compared to those from a decade ago. This innovation significantly boosts the energy output per turbine. According to the European Wind Energy Association, modern offshore turbines can generate enough electricity to power 7,000 homes per year, a substantial increase from previous capacities.

Governments across the globe are recognizing the potential of these technological advances. The U.S. Department of Energy, through its Offshore Wind Technologies Market Report, has documented a trend towards larger turbines and is actively supporting research and development in this area. This support not only drives advancements but also attracts private sector investment into research and development, ensuring a steady pace of innovation.

Moreover, as the technology advances, the cost of energy production from offshore wind continues to drop, making it more competitive with traditional fossil fuels and onshore wind energy solutions. This price competitiveness, coupled with the environmental benefits of clean, renewable energy, presents a compelling case for increased investment and expansion in offshore wind capacities.

Trends

Floating Turbines: Pioneering the Future of Offshore Wind

A groundbreaking trend in the offshore wind turbine market is the adoption and development of floating turbines. Unlike traditional fixed-bottom turbines, which are limited to shallower waters, floating turbines can be deployed in deep water environments. This innovation drastically expands the potential locations for offshore wind farms, particularly in regions where deep waters are close to shore.

Floating wind turbines harness wind power in water depths exceeding 60 meters, where conventional fixed structures are not feasible. According to the Global Wind Energy Council, as of late 2024, there are several pilot projects and commercial-scale developments underway that utilize this technology, signaling a shift towards more versatile and extensive use of wind resources.

Governments are increasingly supportive of this emerging technology due to its potential to dramatically increase the global capacity for wind energy. The European Union, for example, has included floating wind as a key component of its strategy to increase renewable energy production, with goals to boost offshore wind capacity to 300 GW by 2050. Similarly, the U.S. Department of Energy has allocated funds specifically for advancing floating turbine technologies through its Advanced Research Projects Agency-Energy.

This trend not only opens up new regions for wind energy projects but also reduces environmental and visual impacts compared to traditional offshore turbines. By enabling placement far from coastlines, floating turbines can generate energy without interfering with coastal aesthetics or near-shore marine ecosystems.

The ongoing advancements and increasing governmental support underscore the potential for floating turbines to significantly contribute to the growth of renewable energy sources worldwide, making offshore wind a more versatile and feasible option across the globe.

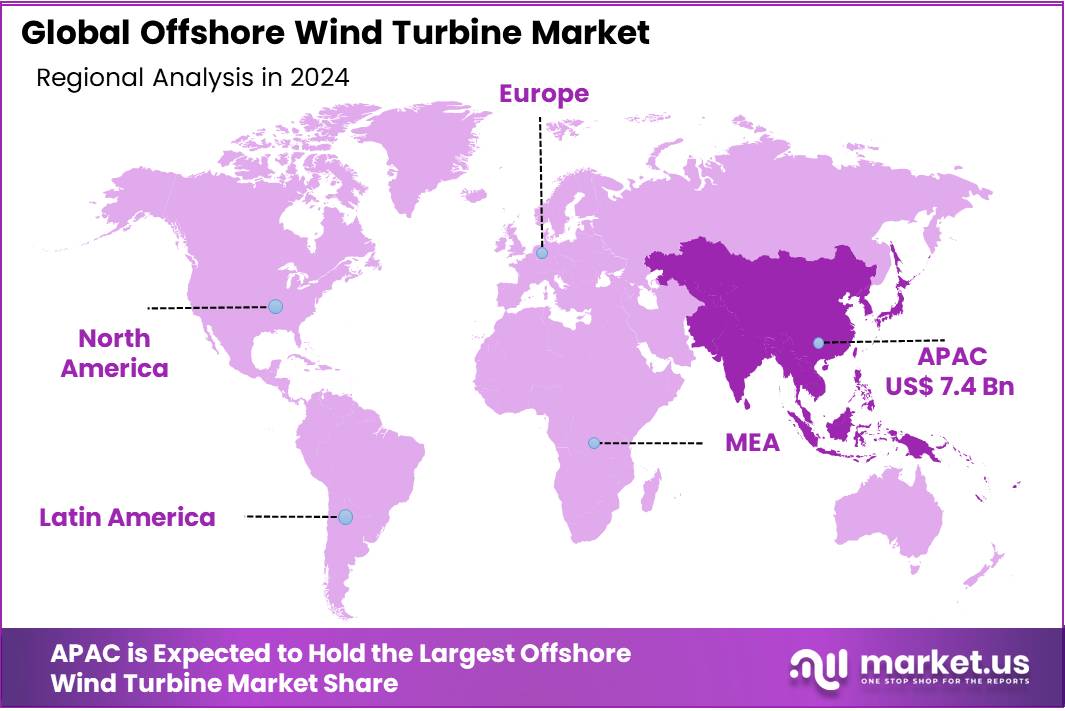

Regional Analysis

In the dynamic landscape of the global offshore wind turbine market, the Asia-Pacific (APAC) region emerges as a significant player, commanding a substantial 34.40% market share with a valuation of approximately $7.4 billion. This robust growth is fueled by several factors, including aggressive government targets for renewable energy, substantial investments in wind power infrastructure, and technological advancements in turbine technology.

Nations such as China, Japan, and South Korea are at the forefront of this expansion. China, in particular, leads the charge with its ambitious government mandates aimed at increasing renewable energy capacity to reduce carbon emissions and combat pollution. The country’s significant coastline and government subsidies have facilitated extensive offshore wind farm developments, making it one of the largest markets for offshore wind turbines in the region.

Japan and South Korea are also making notable strides in this sector. Japan’s focus on diversifying its energy mix, particularly after the Fukushima nuclear incident, has led to increased investments in renewable energy, with offshore wind being a critical component. South Korea’s New Renewable Energy Plan aims to achieve a substantial percentage of its energy from renewable sources by 2030, with offshore wind expected to contribute a large share.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Bergey Windpower stands out as a prominent player in the small wind turbine market, specializing in systems ideal for remote and residential applications. The company focuses on reliability and sustainability, offering products designed to provide long-term, cost-effective solutions for wind energy generation. Their commitment to innovation and quality has established Bergey Windpower as a trusted name in renewable energy.

China State Shipbuilding Corporation (CSSC) has ventured into the offshore wind power sector, leveraging its extensive experience in shipbuilding to produce robust wind turbines. CSSC aims to capitalize on China’s growing renewable energy market, focusing on developing advanced offshore wind technologies that promise high efficiency and durability in harsh sea conditions.

Envision Group is rapidly becoming a significant force in the global renewable energy market, with a strong focus on smart and efficient wind turbine solutions. The company’s use of digital tools to enhance turbine performance and grid integration highlights its innovative approach to maximizing wind energy potential.

EOLink’s novel approach involves floating wind turbine technology, which enables the harnessing of wind power in deep-water environments previously inaccessible to traditional turbines. Their design reduces the cost of offshore wind energy production, making it more competitive and appealing. EOLink’s pioneering technology positions it as a forward-thinking player in the offshore wind sector.

Top Key Players

- Bergey Windpower CSSC

- Doosan Corporation

- ENERCON

- ENESSERE

- Envision Group

- EOLINK

- General Electric

- Goldwind

- Mingyang Smart Energy Group

- NORDEX

- Orsted

- Senvion

- Siemens Gamesa Renewable Energy

- Suzlon Energy Limited

- Vattenfall

- Vestas

- WEG

- XEMC Windpower Co., Ltd.

Recent Developments

In 2024, Bergey Windpower continues to focus on enhancing turbine efficiency and reducing the environmental footprint of its installations.

In 2024 Doosan Corporation, the company embarked on a national project to develop 10MW-class wind turbines, aiming to increase the localization of turbine components to 70% by the following year.

In 2024, EOLINK is set to commission a 5MW floating offshore wind turbine at the SEM-REV test site off the coast of Le Croisic.

Report Scope

Report Features Description Market Value (2024) USD 21.6 Bn Forecast Revenue (2034) USD 71.4 Bn CAGR (2025-2034) 12.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Capacity (Up to 5 MW, 5 MW to 8 MW, Above 8 MW), By Water Depth (Shallow Water, Transitional Water, Deep Water), By Foundation (Floating, Fixed, Monopile, Tripod, Gravity Base, Jacket, Others), By Drive Technology (Direct-Drive Turbines, Gearbox Turbines), By Location (Nearshore, Offshore, Far shore), By Application (Commercial, Industrial, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Bergey Windpower CSSC, Doosan Corporation, ENERCON, ENESSERE, Envision Group, EOLINK, General Electric, Goldwind, Mingyang Smart Energy Group, NORDEX, Orsted, Senvion, Siemens Gamesa Renewable Energy, Suzlon Energy Limited, Vattenfall, Vestas, WEG, XEMC Windpower Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Offshore Wind Turbine MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Offshore Wind Turbine MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Bergey Windpower CSSC

- Doosan Corporation

- ENERCON

- ENESSERE

- Envision Group

- EOLINK

- General Electric

- Goldwind

- Mingyang Smart Energy Group

- NORDEX

- Orsted

- Senvion

- Siemens Gamesa Renewable Energy

- Suzlon Energy Limited

- Vattenfall

- Vestas

- WEG

- XEMC Windpower Co., Ltd.