Global Lithium Sulfur Battery Market By Type (Liquid, Semi-solid, Solid), By Battery Capacity (Below 1000 Wh/kg, 1000 - 2000 Wh/kg, Above 2000 Wh/kg), By End-use (Automotive, Aerospace, Consumer Electronics, Energy Storage Systems, Medical Devices, Military and Defense, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 142769

- Number of Pages: 265

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

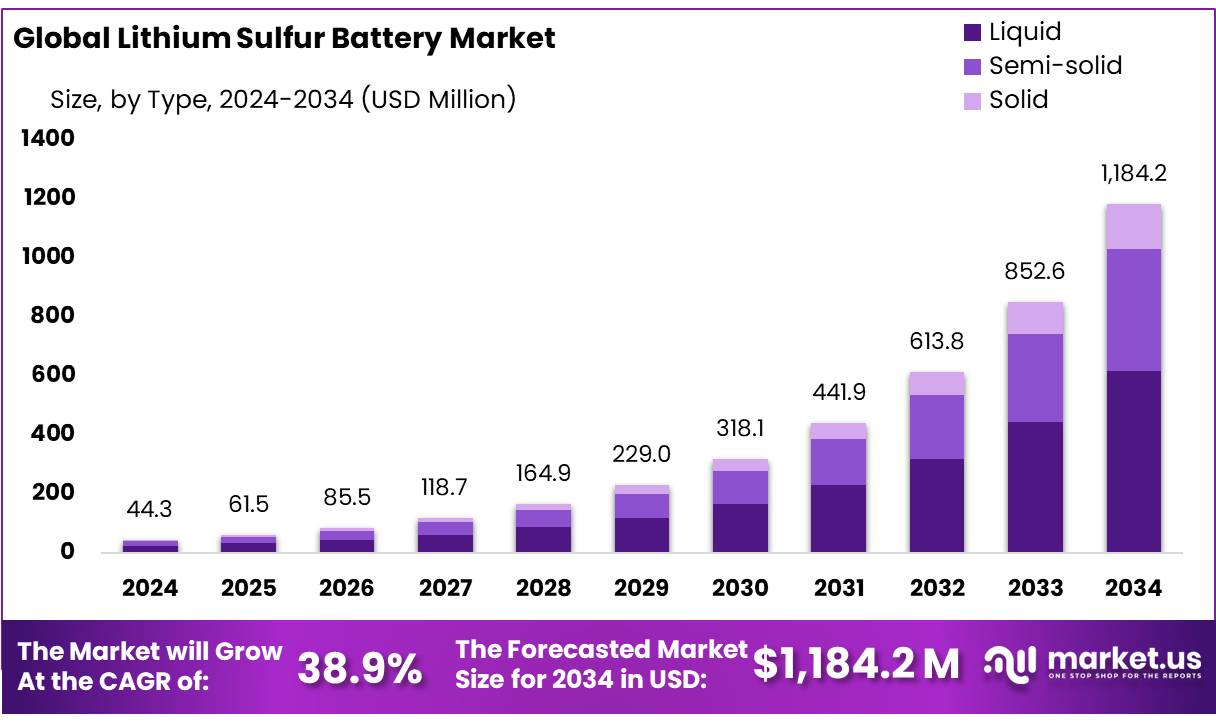

The Global Lithium Sulfur Battery Market size is expected to be worth around USD 1184.2 Mn by 2034, from USD 44.3 Mn in 2024, growing at a CAGR of 38.9% during the forecast period from 2025 to 2034.

The lithium-sulfur (Li-S) battery market is emerging as a highly promising sector within the advanced battery technologies landscape. Characterized by its high energy density, potential for lower manufacturing costs, and reduced environmental impact, lithium-sulfur batteries offer a significant advancement over conventional lithium-ion batteries. They utilize sulfur as a cathode material and metallic lithium as an anode, enabling a theoretical energy density of approximately 2,500 watt-hours per kilogram, which is nearly five times higher than that of lithium-ion batteries.

Li-S battery market is in a nascent stage, primarily driven by research and development activities. The technology is gradually transitioning from the laboratory scale to pilot projects and small-scale commercial deployments. Several startups and established companies are investing heavily to overcome challenges such as the short cycle life and low conductivity of sulfur. According to industry reports, the global lithium-sulfur battery market size was valued at around $130 million in 2022 and is projected to witness robust growth through the next decade.

Governments and industry bodies are playing a crucial role in the development and adoption of lithium-sulfur batteries. For example, the U.S. Department of Energy (DOE) has funded multiple projects under its Advanced Research Projects Agency-Energy (ARPA-E) to develop next-generation battery technologies, including lithium-sulfur. In Europe, initiatives such as the European Battery Alliance aim to foster the battery manufacturing ecosystem, with a focus on advancing innovative technologies such as Li-S batteries. These programs are crucial for bridging the gap between research and market-ready products.

Additionally, the integration of renewable energy sources with grid storage systems offers another lucrative avenue for deployment. As technology matures, it is expected that by 2030, Li-S batteries could capture a notable share of the market currently dominated by lithium-ion batteries, particularly in applications where weight and energy density are critical parameters.

Key Takeaways

- The global lithium-sulfur battery market is projected to grow from USD 44.3 million in 2024 to USD 1184.2 million by 2034, with a CAGR of 38.9%.

- Liquid lithium-sulfur batteries dominated the market in 2024 with a 52.20% share, preferred for their high energy density and longer cycle life.

- Batteries with a capacity range of 1000 to 2000 Wh/kg captured over 45.20% of the market in 2024, ideal for electric aviation and long-range vehicles.

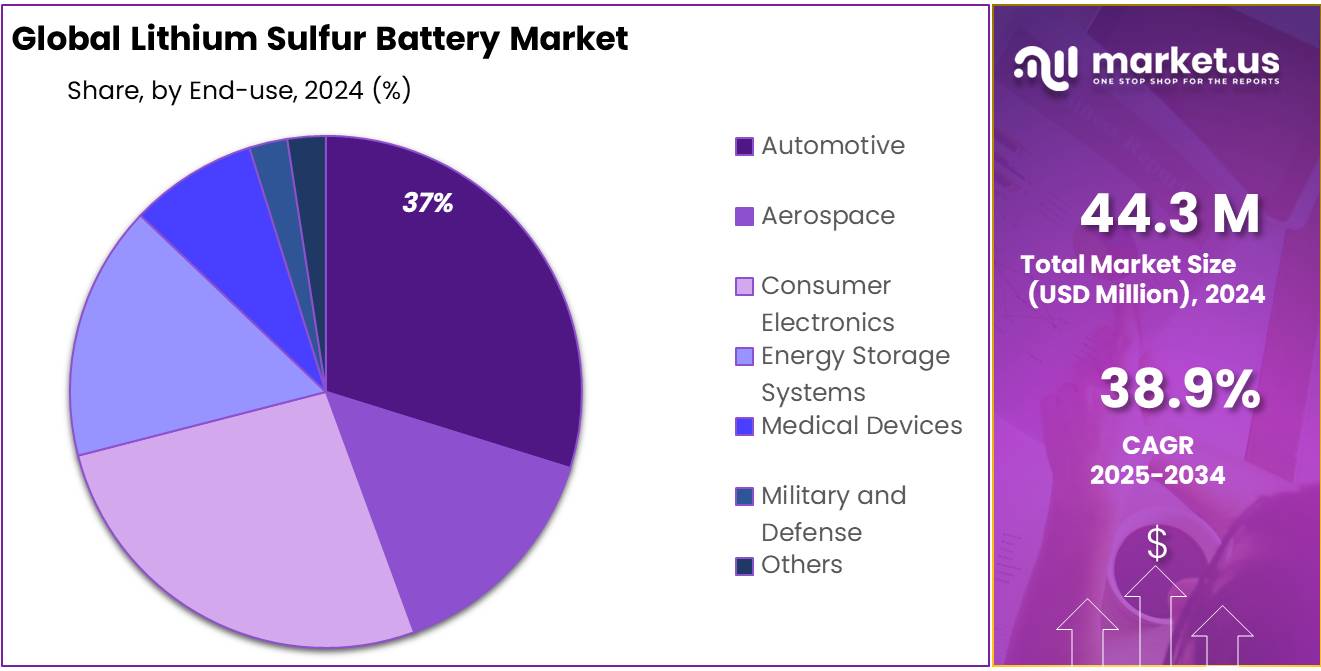

- The automotive sector was the largest market for lithium-sulfur batteries in 2024, holding a 37.70% share, driven by the burgeoning electric vehicle industry.

- Asia-Pacific led the global market, holding a 43.30% share in 2024, driven by advances in energy storage technologies and a growing electric vehicle market.

By Type

Liquid Lithium-Sulfur Batteries Lead with Over 52% Market Share, Fueled by Advanced Technological Integration

In 2024, liquid lithium-sulfur batteries established a significant foothold in the market, securing a commanding share of 52.20%. This dominance is primarily due to their superior energy density and longer cycle life compared to other battery types. Industries that demand high energy output and longer operational lifespans, such as electric vehicles and renewable energy storage systems, increasingly favor liquid lithium-sulfur batteries.

Their adoption is further encouraged by ongoing advancements in battery technology, which aim to overcome challenges related to sulfur dissolution and thus enhance the battery’s overall performance and durability. As the technology matures and scales up, projections for 2025 suggest a continued growth trajectory, driven by the escalating demand for efficient and sustainable energy storage solutions.

By Battery Capacity

Batteries with 1000 – 2000 Wh/kg Capacity Command a 45.2% Market Share, Highlighting High-Energy Demands

In 2024, lithium-sulfur batteries with a capacity ranging from 1000 to 2000 Wh/kg carved out a significant niche, seizing more than 45.20% of the market share. This segment’s popularity stems from its ability to meet the high-energy requirements of various applications, including electric aviation and long-range electric vehicles. These batteries are particularly valued for their high energy density, which translates into longer operating times and reduced weight—a critical factor in transportation and mobile applications.

The industry’s inclination towards higher capacity batteries is driven by the push for more energy-efficient technologies that can sustain longer usage periods without frequent recharges. Looking ahead to 2025, this segment is expected to maintain its growth momentum as advancements in battery technology continue to expand the practical applications of high-capacity lithium-sulfur batteries.

By End-use

Automotive Sector Leads Lithium-Sulfur Battery Market with 37.7% Share, Driven by EV Expansion

In 2024, the automotive sector held a commanding position in the lithium-sulfur battery market, capturing more than a 37.70% share. This dominance is largely fueled by the rapid growth of the electric vehicle (EV) industry, where the demand for more efficient and higher capacity batteries is continuously increasing. Lithium-sulfur batteries are particularly attractive in this context due to their higher energy density and potential for lighter weight, which can significantly extend the driving range of EVs while reducing the vehicle’s overall mass.

As automakers strive to meet stringent global emissions standards and consumer demand for greener transportation options, the integration of lithium-sulfur batteries is anticipated to grow. Moving into 2025, further advancements in battery technology and increased production capacities are expected to solidify the role of lithium-sulfur batteries in powering the next generation of electric vehicles.

Key Market Segments

By Type

- Liquid

- Semi-solid

- Solid

By Battery Capacity

- Below 1000 Wh/kg

- 1000 – 2000 Wh/kg

- Above 2000 Wh/kg

By End-use

- Automotive

- Aerospace

- Consumer Electronics

- Energy Storage Systems

- Medical Devices

- Military and Defense

- Others

Drivers

Enhanced Government Support and Subsidies Fuel Growth in the Lithium-Sulfur Battery

One of the primary driving factors for the lithium-sulfur battery market is the increasing level of government support and subsidies for clean energy technologies. Governments worldwide are implementing policies that promote the adoption of green technologies, particularly in the automotive and energy storage sectors. This shift is largely in response to the urgent need to reduce carbon emissions and reliance on fossil fuels.

In the United States, for instance, the Department of Energy (DOE) has launched several initiatives to accelerate the advancement and deployment of next-generation battery technologies, including lithium-sulfur batteries. The DOE’s Office of Energy Efficiency and Renewable Energy (EERE) specifically targets improvements in battery performance and cost, aiming to reduce the price of battery packs to less than $80 per kilowatt-hour, which would make electric vehicles and renewable energy storage solutions more competitive. Details on these initiatives can be found directly on the DOE’s official website.

Furthermore, the European Commission has included battery innovation and manufacturing as key elements in its European Green Deal, with substantial funding earmarked to support research and industrial scaling in this sector. The plan includes a comprehensive strategy to enhance the battery value chain, as noted in public resources and releases available through the European Commission’s official portal.

These government actions not only provide financial incentives but also help build a regulatory framework that encourages the development and integration of lithium-sulfur batteries in various applications. As these policies continue to evolve, they are expected to remain a significant catalyst for growth and innovation in the lithium-sulfur battery market well into the future.

Restraints

Limited Lifespan Due to Polysulfide Dissolution

One of the main challenges hindering the widespread adoption of lithium-sulfur (Li-S) batteries is their limited lifespan, primarily caused by the dissolution of polysulfides into the electrolyte during charge and discharge cycles. This phenomenon leads to the “shuttle effect,” resulting in capacity loss and reduced efficiency over time.

Early studies highlighted this issue, with Li-S batteries demonstrating rapid capacity degradation after as few as 50 charge cycles. Researchers at Florida International University (FIU) observed that without intervention, these batteries became nearly ineffective after approximately 20 cycles. However, by introducing platinum nanoparticles—constituting just 0.02% of the battery’s composition—into the sulfur electrode, they achieved a remarkable improvement, maintaining 92% battery retention after 500 charge cycles.

Advancements in battery design have also contributed to lifespan improvements. A team at the University of Michigan developed a Li-S battery capable of enduring up to 1,000 charge cycles, equating to a ten-year lifespan under typical usage conditions. Despite these advancements, challenges persist, and further research is essential to fully harness the potential of Li-S batteries for long-term applications.

To address these challenges, various strategies are under investigation, including the development of advanced electrolytes, novel electrode materials, and structural modifications aimed at stabilizing the polysulfide species and mitigating the shuttle effect. These efforts are crucial for enhancing the practicality and commercial viability of Li-S batteries in applications such as electric vehicles and large-scale energy storage systems.

Opportunity

Enhanced Energy Density for Extended Range in Electric Vehicles

One of the most promising growth opportunities for lithium-sulfur (Li-S) batteries lies in their potential to significantly enhance the energy density of electric vehicle (EV) batteries, thereby extending driving range and reducing the frequency of charging.

Li-S batteries are known for their high theoretical energy density, offering up to 550 Wh/kg, which is substantially higher than the energy density of conventional lithium-ion batteries. This characteristic makes them particularly attractive for EV applications, where battery weight and capacity are critical factors influencing vehicle performance and range.

In India, the adoption of EVs is gaining momentum, supported by various government initiatives aimed at promoting clean energy and reducing carbon emissions. The government’s push towards electrification presents a significant market for advanced battery technologies like Li-S batteries.

However, to fully realize the potential of Li-S batteries in EVs, challenges such as limited lifespan and performance stability need to be addressed. Ongoing research and development efforts are crucial to overcome these hurdles and unlock the full potential of Li-S technology in enhancing EV performance.

By focusing on improving the energy density of Li-S batteries, manufacturers can contribute to the development of more efficient and longer-range EVs, aligning with global sustainability goals and meeting the evolving demands of consumers.

Trends

Advancements in Nanotechnology for Enhanced Battery Performance

Recent developments in nanotechnology have significantly improved the performance of lithium-sulfur (Li-S) batteries, offering promising prospects for energy storage solutions.

Researchers have engineered graphene/sulfur/carbon nanocomposites that enhance the electrical conductivity of sulfur, resulting in improved charge and discharge performance. This innovation addresses one of the fundamental challenges of Li-S batteries, making them more viable for practical applications.

In a notable advancement, a team from Monash University’s Department of Mechanical and Aerospace Engineering developed an ultra-high capacity Li-S battery capable of powering a smartphone for five days. This breakthrough demonstrates the potential of Li-S batteries to surpass the energy storage capabilities of current lithium-ion

These technological strides are supported by significant investments and collaborations. For instance, Zeta Energy received a $4 million grant from the U.S. Department of Energy’s ARPA-E program to advance its lithium-sulfur batteries. This funding underscores the government’s commitment to fostering innovation in energy storage technologies.

Moreover, the U.S. administration has announced over $3 billion in grants to enhance domestic production of advanced batteries and materials for electric vehicles, aiming to reduce reliance on foreign supply chains and bolster national manufacturing capabilities.

Regional Analysis

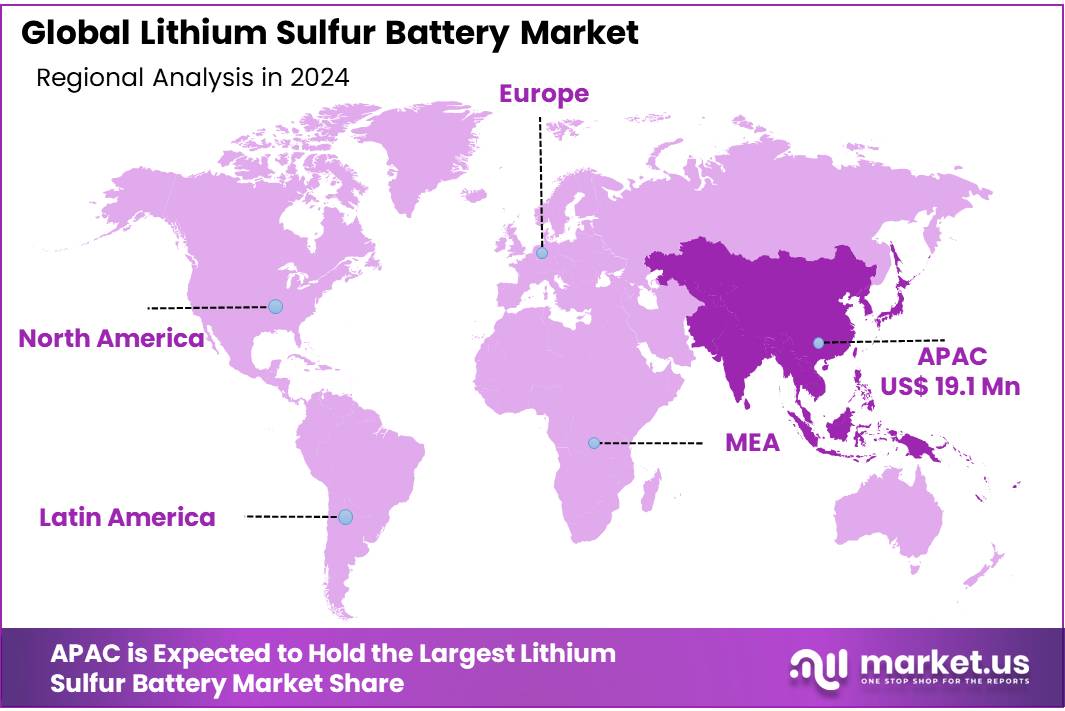

The Asia-Pacific (APAC) region is currently the dominant market for lithium-sulfur (Li-S) batteries, accounting for 43.30% of the global market share. The region’s strong performance is driven by significant advancements in energy storage technologies and growing demand for electric vehicles (EVs). In 2025, the market for lithium-sulfur batteries in APAC is projected to reach approximately USD 19.1 million, with continued growth expected due to ongoing investments and developments in the renewable energy and EV sectors.

China, as the largest market in the APAC region, benefits from its vast manufacturing capacity and the Chinese government’s aggressive push towards clean energy solutions. The country is expected to maintain its position at the forefront of battery innovations, with substantial funding directed toward the development of advanced energy storage technologies, including lithium-sulfur batteries. Japan and South Korea are also contributing significantly to market growth, with South Korea investing heavily in research and development for next-generation battery technologies.

The strong growth of electric vehicle sales in the region further supports the demand for lithium-sulfur batteries. Additionally, government incentives and policies promoting the transition to cleaner energy solutions are playing a crucial role in driving market expansion. The APAC region is expected to continue dominating the global lithium-sulfur battery market, propelled by technological advancements, favorable government policies, and the rapid growth of the electric vehicle market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

PolyPlus Battery Company is a leading innovator in the development of lithium-sulfur batteries, specializing in the enhancement of energy storage systems. The company focuses on advancing its proprietary technology, particularly the solid-state battery design, to improve the performance and longevity of lithium-sulfur batteries. PolyPlus has garnered attention for its breakthrough technology, which aims to overcome the limitations of traditional lithium-ion batteries, making it a strong contender in the next-generation battery market.

NexTech Batteries is at the forefront of the development of advanced lithium-sulfur batteries, focusing on high energy density and long lifecycle performance. The company is dedicated to producing environmentally friendly and efficient energy storage solutions for electric vehicles (EVs) and other renewable energy applications. NexTech’s approach is rooted in scalable and cost-effective battery technologies, positioning it to address key challenges in the growing EV and energy storage markets.

Li-S Energy Limited is an Australian-based company that specializes in the development of lithium-sulfur battery technology. With a focus on improving energy density and performance, Li-S Energy aims to create batteries that deliver superior power, efficiency, and longevity. The company’s advancements in Li-S batteries have attracted attention from electric vehicle manufacturers and renewable energy providers seeking high-performance and cost-effective energy storage solutions.

Lyten, Inc. is a technology-driven company specializing in the development of advanced materials for energy storage systems, including lithium-sulfur batteries. With a focus on innovation, Lyten has developed a proprietary 3D-structured sulfur composite designed to increase energy density and battery life. The company is actively collaborating with various industries to bring high-performance, sustainable battery solutions to the automotive, aerospace, and renewable energy markets, with an emphasis on reducing carbon footprints.

Top Key Players

- PPBC (POLYPLUS BATTERY COMPANY)

- NEXTECH BATTERIES

- LYTEN, INC.

- LI-S ENERGY LIMITED

- ZETA ENERGY LLC

- ADEKA CORPORATION

- GELION PLC

- THEION GMBH

- COHERENT CORP.

- GINER INC.

- GS YUASA INTERNATIONAL LTD.

- CONAMIX

- GLOBAL GRAPHENE GROUP

- GRAPHENE BATTERIES AS

- MSE SUPPLIES LLC

- NEI CORPORATION

- RECHARGION ENERGY PRIVATE LIMITED

- XIAMEN TOB NEW ENERGY TECHNOLOGY CO., LTD.

Recent Developments

In December 2024, Zeta Energy, a key player in the Li-S sector, partnered with Stellantis to develop cost-effective lithium-sulfur batteries for electric vehicles, targeting commercial use by 2030.

January 2024 Lyten, Inc: The company received a $4 million grant from the U.S. Department of Energy to accelerate electric vehicle battery production

In 2024 PolyPlus Battery Company (PPBC), the global lithium-sulfur battery market is projected to reach approximately USD 90.1 million, with PPBC playing a crucial role in this expansion.

Report Scope

Report Features Description Market Value (2024) USD 44.3 Mn Forecast Revenue (2034) USD 1184.2 Mn CAGR (2025-2034) 38.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Liquid, Semi-solid, Solid), By Battery Capacity (Below 1000 Wh/kg, 1000 – 2000 Wh/kg, Above 2000 Wh/kg), By End-use (Automotive, Aerospace, Consumer Electronics, Energy Storage Systems, Medical Devices, Military and Defense, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape PPBC, NEXTECH BATTERIES, LYTEN, INC., LI-S ENERGY LIMITED, ZETA ENERGY LLC, ADEKA CORPORATION, GELION PLC, THEION GMBH, COHERENT CORP., GINER INC., .GS YUASA INTERNATIONAL LTD., CONAMIX, GLOBAL GRAPHENE GROUP, GRAPHENE BATTERIES AS, MSE SUPPLIES LLC, NEI CORPORATION, RECHARGION ENERGY PRIVATE LIMITED, XIAMEN TOB NEW ENERGY TECHNOLOGY CO., LTD Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Lithium Sulfur Battery MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Lithium Sulfur Battery MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- PPBC (POLYPLUS BATTERY COMPANY)

- NEXTECH BATTERIES

- LYTEN, INC.

- LI-S ENERGY LIMITED

- ZETA ENERGY LLC

- ADEKA CORPORATION

- GELION PLC

- THEION GMBH

- COHERENT CORP.

- GINER INC.

- GS YUASA INTERNATIONAL LTD.

- CONAMIX

- GLOBAL GRAPHENE GROUP

- GRAPHENE BATTERIES AS

- MSE SUPPLIES LLC

- NEI CORPORATION

- RECHARGION ENERGY PRIVATE LIMITED

- XIAMEN TOB NEW ENERGY TECHNOLOGY CO., LTD.