Global Transformer Fluid Market By Form (Mineral Oil, Ester Liquids, Bio-based Oil, Synthetic Oil, and Others), By Nature (Transformer, Reactor, Switchgear, Hydraulic Thrusters, Dashpots, Oil Filled Electrical Equipment, and Others), By End-use (Transmission And Distribution, Power Generation, Locomotives And Railway Lines, and Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 142435

- Number of Pages: 311

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

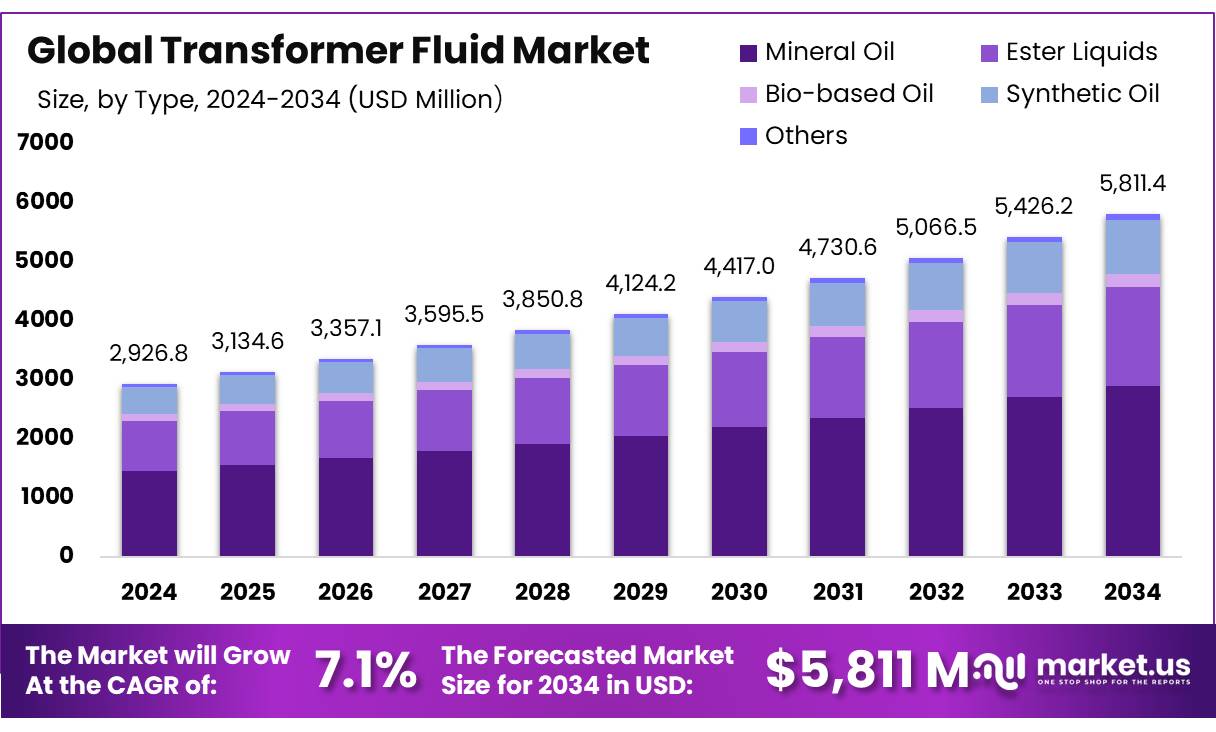

The Global Transformer Fluid Market size is expected to be worth around USD 5811.4 Million by 2034, from USD 2,926.8 Million in 2024, growing at a CAGR of 7.1% during the forecast period from 2025 to 2034.

Transformer fluid, also known as transformer oil, is a specialized liquid used in electrical transformers to provide insulation and facilitate heat dissipation. It serves two primary functions: insulating the internal components of the transformer, preventing electrical breakdown, and helping to cool the transformer by transferring heat generated during its operation. Transformer fluid is typically made from mineral oils, though synthetic and biodegradable oils, such as silicone oils or vegetable-based oils, are also used in certain applications.

The global transformer fluid market is a key segment of the electrical industry, driven by the increasing demand for transformers across various sectors, including energy, power distribution, and industrial applications. Transformer fluids, primarily used for insulating and cooling electrical transformers, play a crucial role in ensuring the reliable operation and longevity of these devices.

The market for transformer fluids is largely influenced by factors such as the growth in electricity consumption, the expansion of power transmission networks, and the ongoing need for transformer maintenance and upgrade in both developing and developed regions.

Key Takeaways

- The global transformer fluid market was valued at USD 2,926.8 million in 2024.

- The global transformer fluid market is projected to grow at a CAGR of 7.1% and is estimated to reach USD 5,811.4 million by 2034.

- Among types, mineral oil accounted for the largest market share of 8%.

- Among applications, transformers accounted for the majority of the market share at 3%.

- Based on end-use, transmission & distribution held the major revenue share 7%.

- Asia-Pacific is estimated as the largest market for transformer fluid with a share of 7% of the market share.

- North America is anticipated to register the highest CAGR of 5%.

- Europe with a revenue share of 6% in 2024 and expected to register a CAGR of 6.6%.

Type Analysis

Simple Transformer Fluids Dominated the Market, Owing to Their Widespread Application Across Various Industries

The transformer fluid market is segmented based on mineral oil, ester liquids, bio-based oil, synthetic oil, others. In 2024, the type mineral oil segment held a significant revenue share of 49.8% due to its long-established dominance, cost-effectiveness, and reliable performance in electrical transformers.

Mineral oil-based transformer fluids have been widely used for decades because of their excellent insulating properties, heat dissipation capabilities, and availability at a relatively low cost compared to other alternatives. The global infrastructure in power generation and distribution systems is largely built on transformers that utilize mineral oil as a coolant and insulator, creating a large installed base that continues to drive demand.

Additionally, mineral oil’s stability, non-flammability, and ease of maintenance contribute to its continued use, even in regions where there is a growing preference for more sustainable options. While alternatives such as bio-based oils and synthetic oils are gaining traction, mineral oil’s reliability, affordability, and widespread availability ensure it remains the dominant choice in 2024.

Global Transformer Fluid Market, By Type, 2020-2024 (USD Mn)

Type 2020 2021 2022 2023 2024 Mineral Oil 1,214.24 1,270.48 1,330.06 1,389.71 1,458.41 Ester Liquids 624.39 670.78 723.14 780.76 848.13 Bio-based Oil 84.00 89.79 96.32 103.47 111.84 Synthetic Oil 360.13 382.58 406.61 431.26 459.36 Others 39.11 41.37 43.78 46.23 49.03 Application Analysis

The Transformer Fluid Market Was Dominated By the Personal Care & Cosmetics Industry.

Based on application, the market is further divided into transformer, reactor, switchgear, hydraulic thrusters, dashpots, oil filled electrical equipment, others. In 2024, the transformer sector holds the largest share of the global transformer fluid market, commanding a significant 44.3% of the total market. This dominance is primarily due to the critical role that transformer fluids play in ensuring the insulation and cooling of electrical transformers, which are essential components of power distribution systems.

As the demand for electricity continues to grow globally, there is an increased need for transformers to handle higher loads and ensure the stable transmission of electrical power. Transformer fluids are crucial for maintaining the reliable operation and efficiency of transformers by preventing overheating and electrical breakdowns. The growth of the energy and power infrastructure, especially in emerging markets where new transformer installations are being rolled out at a rapid pace, further strengthens the transformer sector’s dominance in the market. Additionally, as transformers are integral to the electrical grid, the demand for transformer fluids is expected to continue to rise in line with global energy consumption.

Global Transformer Fluid Market, By Application, 2020-2024 (USD Mn)

Application 2020 2021 2022 2023 2024 Transformer 995.40 1,058.92 1,129.71 1,205.91 1,295.32 Reactor 401.45 418.28 436.00 453.55 473.85 Switchgear 330.44 346.06 362.58 379.11 398.11 Hydraulic Thrusters 231.56 243.60 256.37 269.27 284.03 Dashpots 173.85 185.81 198.68 212.00 227.20 Oil Filled Electrical Equipment 123.95 133.02 142.81 153.20 164.74 Others 65.21 69.33 73.75 78.39 83.52 End-Use Analysis

The Transformer Fluid Market Was Dominated By the Personal Care & Cosmetics Industry.

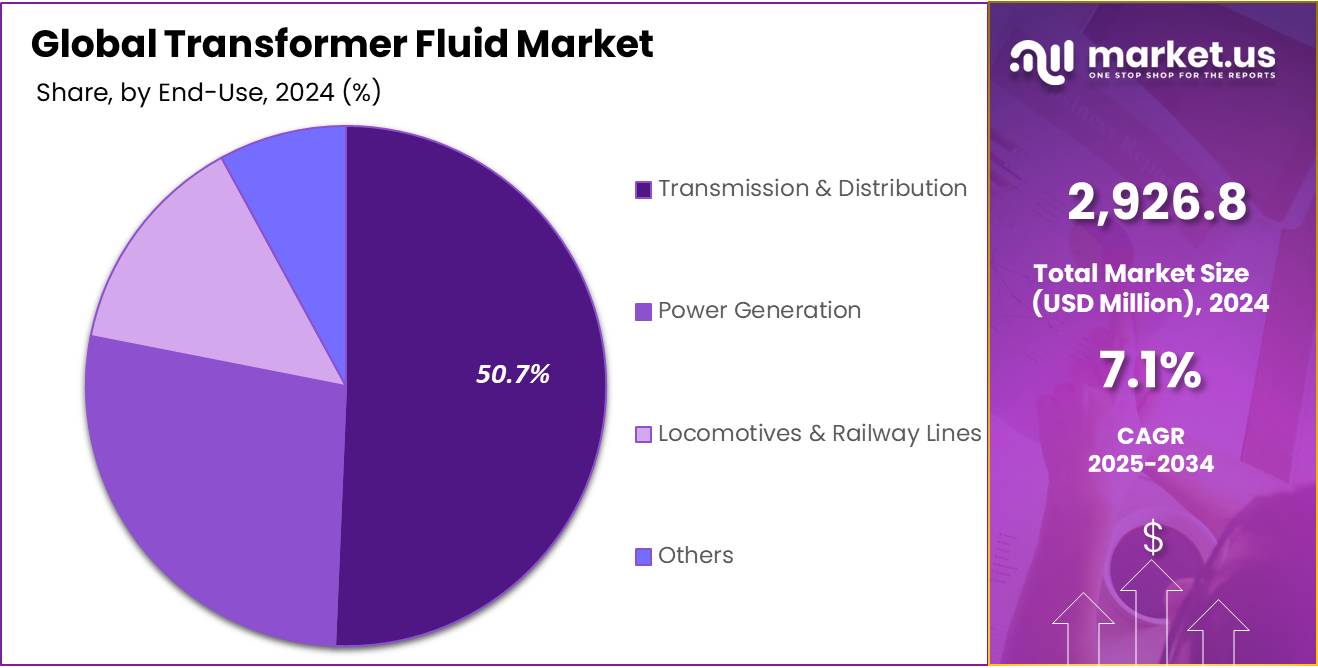

Based on application, the market is further divided into transmission & distribution, power generation, locomotives & railway lines and others. In 2024, the transmission and distribution sector holds the largest share of the global transformer fluid market, commanding 50.7% of the total market. This dominance is primarily attributed to the critical role that transmission and distribution networks play in delivering electricity from power plants to consumers.

Transformer fluids are essential in the insulation and cooling of transformers used in these networks, ensuring efficient operation and preventing overheating, which could lead to system failures. With the increasing global demand for reliable electricity and the expansion of power grids in both developing and developed regions, the need for transformers and, consequently, transformer fluids, continues to rise. The ongoing upgrades and maintenance of existing transmission and distribution systems, along with the growing investments in smart grids and renewable energy integration, further contribute to the transmission and distribution sector’s substantial market share in the transformer fluid industry. This trend is expected to continue, driven by the global push for energy efficiency and grid reliability.

Global Transformer Fluid Market, By End-Use, 2020-2024 (USD Mn)

End-Use 2020 2021 2022 2023 2024 Transmission & Distribution 1,144.56 1,219.79 1,301.10 1,385.80 1,483.04 Power Generation 638.09 672.33 710.93 752.92 802.35 Locomotives & Railway Lines 339.83 355.78 372.65 389.52 408.92 Others 199.39 207.10 215.22 223.20 232.47 Key Market Segments

By Type

- Mineral Oil

- Naphthenic

- Paraffinic

- Ester Liquids

- Bio-based Oil

- Synthetic Oil

- Others

By Application

- Transformer

- Power Transformers

- Distribution Transformers

- Instrument Transformers

- Others

- Reactor

- Switchgear

- Hydraulic Thrusters

- Dashpots

- Oil Filled Electrical Equipment

- Others

By End-Use

- Transmission And Distribution

- Power Generation

- Coal

- Nuclear Plants

- Wind Energy

- Solar

- Others

- Locomotives & Railway Lines

- Others

Drivers

Increasing Global Energy Demand and Consumption is Estimated to Boost The Transformer Fluid Market.

The increasing global energy demand and consumption are significant drivers for the growth of the transformer fluid market. As countries strive to meet rising electricity needs, the demand for efficient transmission and distribution infrastructure continues to surge, directly influencing the demand for transformer fluids.

According to the International Energy Agency (IEA), Global electricity demand is forecast to grow by around 4% in 2024, up from 2.5% in 2023, driven by urbanization, industrial growth, and the electrification of transport and heating sectors.

Emerging economies, particularly in Asia and Africa, are experiencing exponential growth in energy consumption, which necessitates the expansion of power grids and the installation of new transformers. In 2022, global electricity consumption reached an estimated 26,823 TWh, and the IEA projects that by 2030, demand could increase by 2.5% per year due to rapid industrialization and the digitalization of economies.

Restraints

Fluctuating Raw Material Prices May Hinder the Market Growth For A Certain Extent

Fluctuating raw material prices can significantly hinder the growth of the global transformer fluid market. The volatility in prices for essential raw materials such as crude oil and copper, which are key components in the production of various types of transformer oils, impacts production costs and market stability. For instance, the price of crude oil and its derivatives directly influences the cost of mineral oils, which are commonly used as transformer fluids. Similarly, copper, used in the manufacturing of transformers, has seen price increases which, in turn, affect the overall costs of transformer production and maintenance.

During periods of economic instability or geopolitical tensions, such as the COVID-19 pandemic or conflicts like the war in Ukraine, raw material prices have shown significant fluctuations. For instance, the pandemic led to a sharp increase in steel prices in the United States by up to 250% from pre-pandemic levels, largely due to disruptions in the supply chain and a sudden rebound in demand. These disruptions emphasize the vulnerability of the transformer fluid market to global economic shifts and underline the importance of supply chain resilience.

Opportunity

Rapid Urbanization and Industrialization Anticipated To Create More Opportunities

Rapid urbanization and industrialization are significant drivers of the global transformer fluid market, presenting numerous opportunities for growth and development. As more people migrate to urban areas and industries expand, the demand for reliable and efficient electrical infrastructure intensifies. This trend is especially pronounced in emerging economies across Asia, Africa, and Latin America, where urbanization rates are accelerating at unprecedented speeds.

Urbanization leads to a concentrated demand for robust electrical infrastructure to support residential buildings, commercial establishments, public services, and transportation systems. Cities, with their dense populations and complex infrastructure, require an immense amount of electrical power for lighting, heating, cooling, transportation, and communication systems. This surge in electrical demand necessitates the installation of more transformers to step up and step down electrical voltages as required for safe and efficient use. Transformers, integral to managing this urban electrical load, rely heavily on transformer fluids for cooling and insulation.

Trends

Shift Towards Eco-Friendly Fluids

The shift towards eco-friendly fluids in the transformer fluid market is a significant trend driven by increased environmental awareness, stricter regulatory standards, and a broader push towards sustainability in energy infrastructure. This trend is particularly evident as industries and governments seek to reduce the environmental impact associated with the use and disposal of traditional transformer fluids like mineral oils, which are derived from petroleum and pose significant environmental hazards in the event of leaks or spills.

Ester-based fluids, derived from natural sources, have a fire point around 360 ºC and a flashpoint of 320 ºC, making them significantly safer than traditional mineral oils. These fluids are not only biodegradable, minimizing environmental risks, but they also offer enhanced fire safety properties compared to traditional mineral oils.

Geopolitical Impact Analysis

Geopolitical War and Disruptions In The Global Supply Chain Are Adversely Affecting The Growth Of The Transformer Fluid Market.

Particularly, the Russia-Ukraine conflict has had profound effects on energy markets, including the raw materials essential for transformer fluid production. The conflict led to immediate disruptions in the supply chains, significantly affecting the availability and prices of crude oil and associated derivatives used in the production of mineral-based transformer fluids. Russia is a major global oil exporter, and sanctions imposed on Russian oil by the United States, European Union, and other countries resulted in reduced oil supply on the global market, leading to increased prices.

For instance, the price of Brent crude oil spiked, reaching highs not seen in many years, which in turn increased the cost of oil-derived transformer fluids. Manufacturers of transformer fluids faced higher raw material costs, which often had to be passed on to the consumers, leading to increased prices for transformer fluids globally. In the final quarter of 2023, global oil demand growth decelerated to 1.7 million barrels per day (mb/d), a significant drop from the 3.2 mb/d growth seen during the second and third quarters of the previous year. OPEC forecasts that non-OECD oil demand will rise by approximately 2 mb/d, with notable increases expected from China, India, the Middle East, and other Asian regions.

China, recognized as the world’s second-largest economy following the U.S., experienced a population decline for the second consecutive year, bringing its total to 1.4 billion. Over the last 15 years, China has been a primary catalyst for global economic expansion, contributing to 35 percent of the increase in global nominal GDP, compared to the 27 percent contributed by the U.S., according to the IMF. In 2023, the U.S. was responsible for two-thirds of the 2.2 mb/d growth in non-OPEC+ oil supply. Looking ahead to 2024, non-OPEC+ production is projected to lead growth, expected to account for nearly 1.5 mb/d.

Regional Analysis

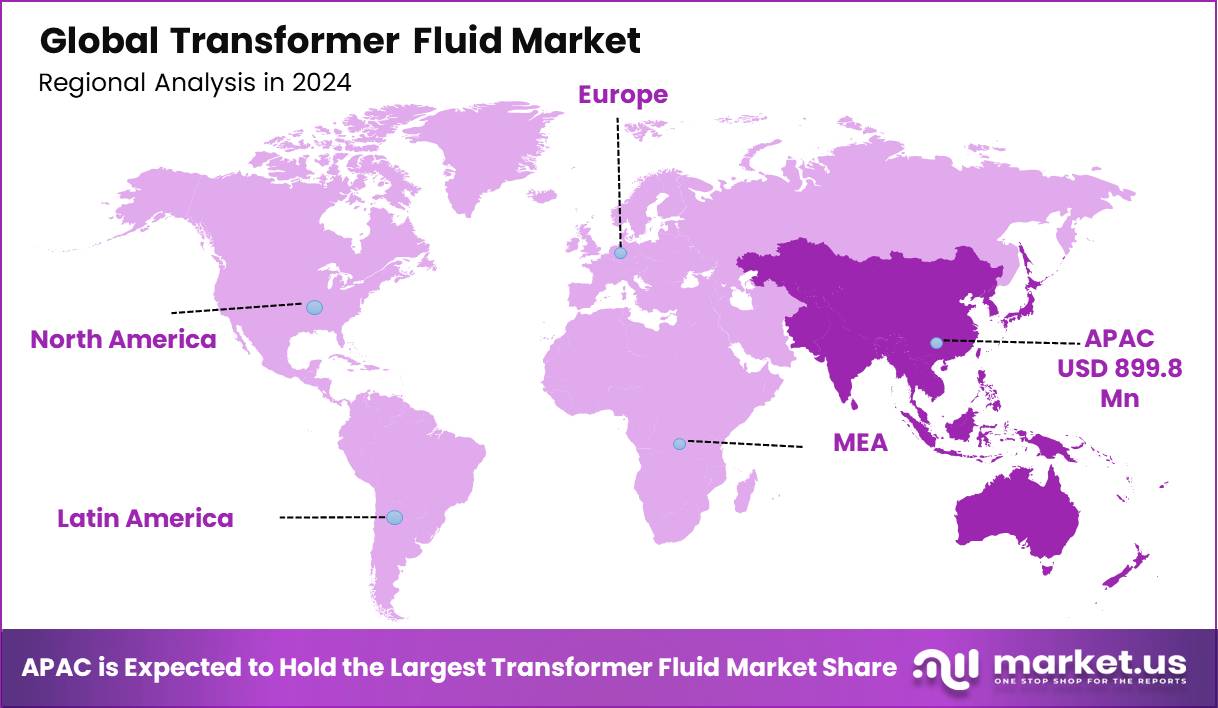

Asia-Pacific Held the Largest Share of the Global Transformer Fluid Market

In 2024, Asia-Pacific dominated the global transformer fluid market, accounting for 30.7% of the total market share driven by several key factors. The region’s rapid industrialization and urbanization have led to an increasing demand for electricity, which in turn drives the need for transformers in power distribution systems. Countries like China, India, and Japan are major contributors to this demand, as they invest heavily in expanding their power infrastructure to meet growing energy needs.

Additionally, the Asia-Pacific region is home to a large number of aging transformers that require regular maintenance and upgrades, further boosting the demand for transformer fluids. The government initiatives to modernize power grids and enhance electricity access in rural areas also contribute significantly to the growth of the transformer fluid market. Furthermore, the region’s focus on sustainable and energy-efficient technologies is pushing the adoption of eco-friendly transformer fluids, adding to the market’s expansion.

Global Transformer Fluid Market, By Region, 2020-2024 (USD Mn)

Region 2020 2021 2022 2023 2024 North America 682.24 724.54 770.61 818.97 874.74 Europe 631.09 663.54 698.79 735.45 778.06 Asia Pacific 701.50 745.06 792.52 842.34 899.81 Middle East & Africa 186.97 197.02 207.92 219.27 232.43 Latin America 120.06 124.85 130.06 135.42 141.74 Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

To Maintain a Competitive Edge, Major Companies In The Transformer Fluid Market Focus On Product Innovation and Research & Development (R&D)

Companies in the transformer fluid market adopt several strategies to maintain and expand their market presence, increase profitability, and stay competitive. These strategies often focus on innovation, customer satisfaction, sustainability, and market expansion.

Many companies are diversifying their portfolios by offering a range of transformer fluids, including mineral oils, synthetic oils, and bio-based oils, catering to different needs and preferences of customers. By leveraging these strategies, companies in the transformer fluid market can maintain their competitive edge, adapt to changing market conditions, and continue to innovate and meet the evolving needs of the power and energy industries.

The following are some of the major players in the industry

- Nynas AB

- Ergon, Inc.

- Shell Plc

- APAR Industries Limited

- Exxon Mobil Corporation

- Sinopec Lubricant Company

- Petro-Canada

- Gandhar Oil Refinery (India) Limited

- Lubrita International

- Phillips 66 Company

- Gulf Oil International

- Dow Chemical Company

- Cargill, Incorporated

- Sasol Limited

- San Joaquin Refining Co. Inc.

- Other Key Players

Key Development

- January 2024, Shell U.K. Limited has completed the acquisition of MIDEL and MIVOLT from Manchester-based M&I Materials Ltd. This strategic move strengthens Shell’s global lubricants portfolio by adding synthetic and natural ester-based transformer fluids and services. MIDEL is renowned for its premium ester-based dielectric transformer fluids, widely used by utilities and original equipment manufacturers (OEMs) globally. MIVOLT offers immersion cooling fluids for electric vehicle batteries, battery energy storage systems, and data centers.

- August 2023, Apar Industries has introduced POWEROIL TO NE Premium, a high-performance K Class Natural Ester-based transformer oil. This oil is formulated from renewable plant-based feedstocks, making it highly biodegradable and environmentally friendly.

- May 2024, Ergon International Inc. expanded its partnership with Nordmann Rassmann at the beginning of 2024. This expansion is part of a broader strategy to enhance their collaborative efforts in Europe, particularly in the rubber processing industry. As a result, Ergon’s naphthenic mineral oils have become a valuable addition to Nordmann’s product portfolio, offering customers a range of high-quality materials for rubber manufacturing.

Report Scope

Report Features Description Market Value (2024) US$ 2,926.8 Mn Market Volume (2024) XX Ton Forecast Revenue (2034) US$ 5,811.4 Mn CAGR (2025-2034) 7.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Mineral Oil, Ester Liquids, Bio-based Oil, Synthetic Oil, and Others), By Nature (Transformer, Reactor, Switchgear, Hydraulic Thrusters, Dashpots, Oil Filled Electrical Equipment, and Others), By End-use (Transmission & Distribution, Power Generation, Locomotives & Railway Lines, and Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Nynas AB, Ergon, Inc., Shell Plc, APAR Industries Limited, Exxon Mobil Corporation, Sinopec Lubricant Company, Petro-Canada, Gandhar Oil Refinery (India) Limited, Lubrita International, Phillips 66 Company, Gulf Oil International, Dow Chemical Company, Cargill, Incorporated, Sasol Limited, San Joaquin Refining Co. Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Nynas AB

- Ergon, Inc.

- Shell Plc

- APAR Industries Limited

- Exxon Mobil Corporation

- Sinopec Lubricant Company

- Petro-Canada

- Gandhar Oil Refinery (India) Limited

- Lubrita International

- Phillips 66 Company

- Gulf Oil International

- Dow Chemical Company

- Cargill, Incorporated

- Sasol Limited

- San Joaquin Refining Co. Inc.

- Other Key Players