Global Automatic Generation Control Market Size, Share, And Business Benefits By Component (Hardware, Services, Software), By Operation Type (Turbine Governor Control, Load Frequency Control, Economic Dispatch, Others), By Application (Thermal Power Plants, Hydropower Plants, Nuclear Power Plants, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 142879

- Number of Pages: 273

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

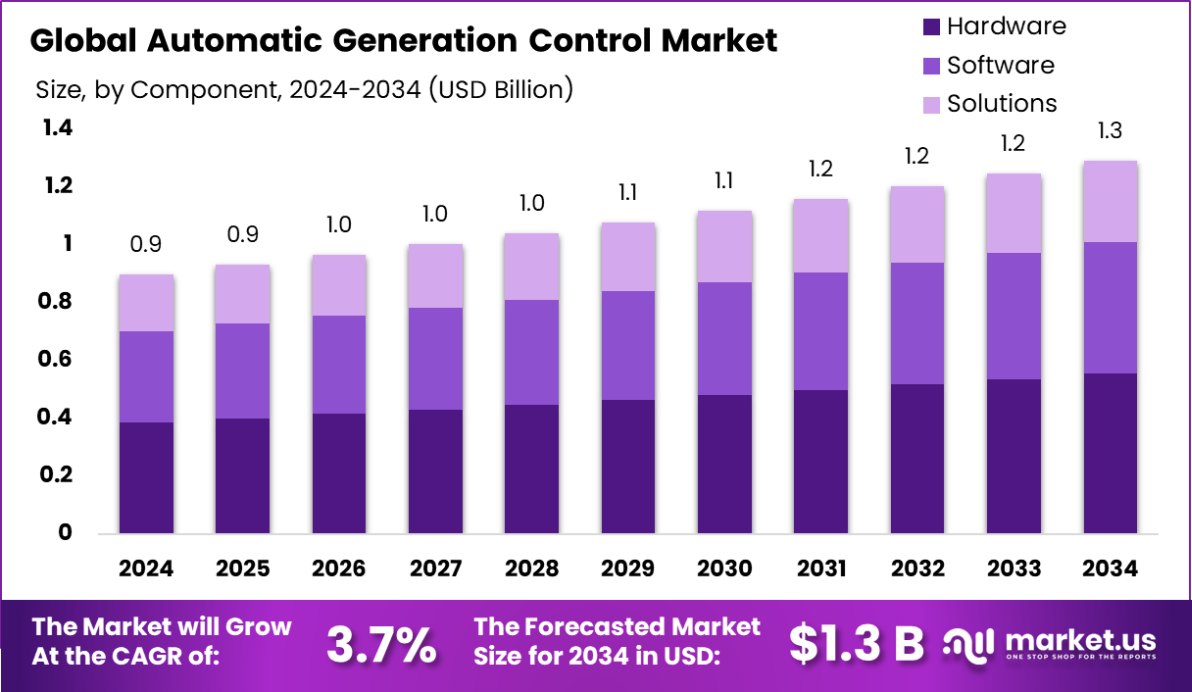

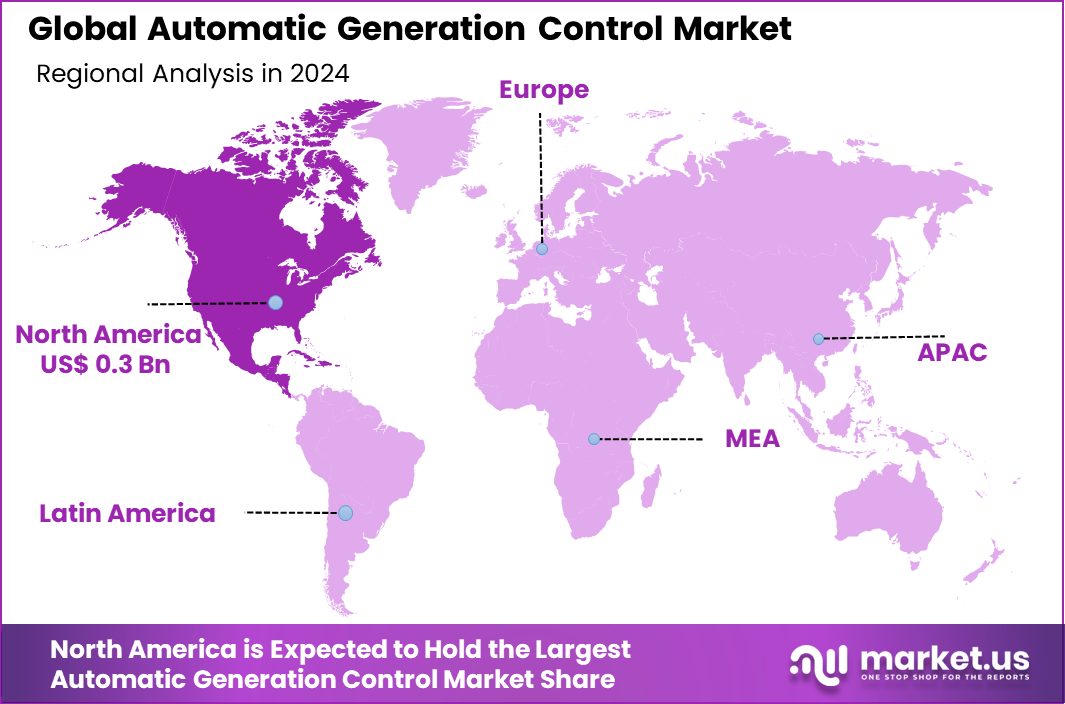

Global Automatic Generation Control Market is expected to be worth around USD 1.3 billion by 2034, up from USD 0.9 billion in 2024, and grow at a CAGR of 3.7% from 2025 to 2034. The Automatic Generation Control market in North America reached USD 0.3 billion, capturing a 39.30% share.

Automatic Generation Control (AGC) is a crucial component of modern power systems that ensures real-time balancing of power supply and demand across multiple power plants. It automatically adjusts the output of generators to maintain system frequency and tie-line power flows within predefined limits. This control mechanism is essential for grid stability, especially as renewable energy sources like wind and solar introduce variability in power generation.

The Automatic Generation Control (AGC) market is witnessing significant growth, driven by the increasing integration of renewable energy, grid modernization initiatives, and rising power demand. Countries are investing in advanced AGC solutions to enhance grid stability and optimize energy distribution. With the expansion of smart grids and digital energy management systems, utilities are leveraging AGC to improve efficiency and reliability.

The rapid expansion of pumped storage projects is boosting AGC deployment. India plans to support 15,000 MW of cumulative pumped storage capacity, emphasizing the need for advanced AGC systems. Tata Power’s 1,800 MW pumped hydro project at Shirawta and its 600 MW Bhutan project highlight the growing investment in flexible power solutions that require AGC integration for stable operations.

Rising grid complexity due to fluctuating renewable energy necessitates AGC adoption. NHPC’s Rs 318.8 billion Dibang Multipurpose Project, set for completion in 2032, exemplifies large-scale hydropower investments that demand sophisticated AGC to regulate frequency variations. Moreover, budgetary support for enabling infrastructure, including Rs 1 crore per MW for projects up to 200 MW, further drives the demand for AGC in new power developments.

Government policies and financial infrastructure support create vast opportunities for AGC providers. With India offering Rs 200 crore plus Rs 0.75 crore per MW for large projects, companies have incentives to integrate AGC solutions into hydropower and pumped storage developments. As utilities seek real-time grid balancing, AGC adoption is set to rise, fostering advancements in automation and digital energy solutions.

Key Takeaways

- Global Automatic Generation Control Market is expected to be worth around USD 1.3 billion by 2034, up from USD 0.9 billion in 2024, and grow at a CAGR of 3.7% from 2025 to 2034.

- Hardware dominates the Automatic Generation Control market, holding a 43.20% share due to increasing grid automation.

- Load Frequency Control leads AGC operations, accounting for 38.30% of market adoption globally.

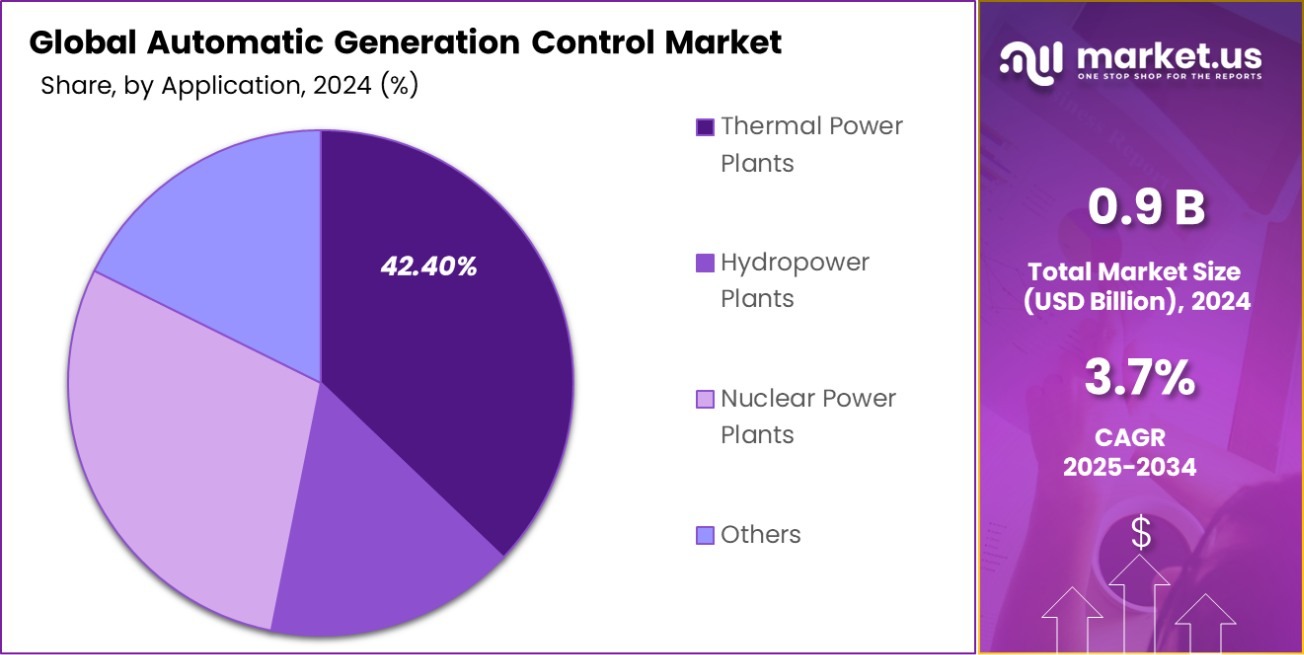

- Thermal Power Plants drive AGC demand, representing 42.40% of total application share.

- North America dominated the AGC market with a significant 39.30% market share, amounting to USD 0.3 billion.

By Component Analysis

Hardware dominates the Automatic Generation Control Market, holding a 43.20% share, driven by grid modernization investments.

In 2024, Hardware held a dominant market position in the By Component segment of the Automatic Generation Control (AGC) Market, with a 43.20% share. This substantial market share can be attributed to the critical role that hardware components play in the efficient functioning of AGC systems. Hardware, including controllers, sensors, and other integral components, is essential for the real-time regulation and stabilization of power grid frequencies, ensuring reliable and efficient electricity generation.

The growing demand for renewable energy sources, such as wind and solar power, has further increased the reliance on advanced AGC hardware for grid management. As power generation from intermittent sources fluctuates, the need for precise control systems powered by robust hardware becomes even more prominent. Moreover, the expansion of grid infrastructure to accommodate increasing energy demands and the integration of smart grid technologies has fueled the demand for hardware solutions capable of supporting AGC systems.

The hardware segment is expected to continue its dominance as power utilities increasingly invest in automation technologies and system upgrades to enhance grid reliability and reduce operational costs. The continuous advancements in hardware technology, such as improved sensor accuracy and better communication systems, are also driving growth in this market segment, positioning hardware as a critical enabler of future AGC solutions.

By Operation Type Analysis

Load Frequency Control leads with 38.30% share, ensuring grid stability amid rising renewable energy integration challenges.

In 2024, Load Frequency Control held a dominant market position in the By Operation Type segment of the Automatic Generation Control (AGC) Market, with a 38.30% share. This significant market share highlights the critical importance of load frequency control in maintaining grid stability and ensuring the continuous balance between electricity supply and demand.

Load Frequency Control (LFC) is a key function of AGC systems, designed to regulate the frequency of power grids by adjusting the output of generators in response to fluctuations in load. The growing need for reliable and efficient electricity generation, particularly with the integration of renewable energy sources, has accelerated the adoption of LFC systems. These systems are essential for managing the variability and unpredictability associated with renewable generation, such as solar and wind power.

The increasing demand for more robust and resilient grid systems, especially in regions with growing populations and energy consumption, has further driven the dominance of Load Frequency Control. Additionally, advancements in grid management technologies and improved communication networks have enhanced the effectiveness of LFC, solidifying its leading position in the AGC market.

The continued investment in smart grid solutions and energy efficiency initiatives is expected to sustain the growth of the Load Frequency Control segment, reinforcing its importance in the modern energy landscape.

By Application Analysis

Thermal Power Plants account for 42.40% share, relying on AGC systems for enhanced efficiency and load management.

In 2024, Thermal Power Plants held a dominant market position in the By Application segment of the Automatic Generation Control (AGC) Market, with a 42.40% share. This leading market position can be attributed to the critical role that thermal power plants play in providing consistent and reliable electricity generation, especially in regions where thermal energy remains the primary source of power.

Thermal power plants are essential for maintaining grid stability, particularly in areas where renewable energy sources, such as wind and solar, are not yet fully integrated or cannot consistently meet demand. The integration of AGC systems in thermal plants allows for precise regulation of output to match the fluctuating demand for electricity, making them key players in ensuring reliable grid operations.

The continued reliance on thermal power plants for baseload generation, coupled with the increasing need for flexible and responsive grid management, is expected to support the growth of the AGC market in this segment. As power generation systems become more automated and efficient, the demand for advanced AGC solutions in thermal power plants is set to rise.

Additionally, the ongoing modernization and upgrading of thermal plants to meet environmental regulations and improve efficiency further contribute to the prominence of this segment within the AGC market.

Key Market Segments

By Component

- Hardware

- Services

- Software

By Operation Type

- Turbine Governor Control

- Load Frequency Control

- Economic Dispatch

- Others

By Application

- Thermal Power Plants

- Hydropower Plants

- Nuclear Power Plants

- Others

Driving Factors

Increasing Integration of Renewable Energy Sources

One of the primary driving factors behind the growth of the Automatic Generation Control (AGC) Market is the increasing integration of renewable energy sources, such as wind and solar power, into the electricity grid. Unlike traditional power sources, renewable energy generation is intermittent and often unpredictable, which can lead to imbalances in grid frequency and stability.

AGC systems play a crucial role in managing these fluctuations by automatically adjusting the output of conventional power plants to maintain the desired frequency. As more countries transition toward greener energy sources, the demand for AGC solutions that can efficiently handle renewable energy integration has significantly risen. This trend is expected to continue as the global energy landscape shifts toward sustainability, boosting the AGC market.

Restraining Factors

High Initial Cost of AGC Systems

One of the key restraining factors in the Automatic Generation Control (AGC) market is the high initial cost associated with implementing AGC systems. The installation and integration of AGC solutions require significant investment in advanced hardware, software, and infrastructure. This high upfront cost can be a barrier, particularly for smaller utility companies or power plants operating with limited budgets.

While AGC systems offer long-term benefits in terms of improved grid stability and operational efficiency, the initial financial burden can delay adoption. Additionally, the complexity of integrating AGC systems with existing power plants and grid management infrastructure further adds to the cost.

Growth Opportunity

Expansion of Smart Grid Infrastructure Globally

A significant growth opportunity for the Automatic Generation Control (AGC) market lies in the global expansion of smart grid infrastructure. Smart grids use advanced technologies to monitor and manage electricity flows more efficiently, enabling real-time data collection and enhanced communication between generation sources and the grid.

This modernized infrastructure creates a favorable environment for the implementation of AGC systems, which are crucial for maintaining grid stability, especially with the increasing penetration of renewable energy sources.

As governments and utilities invest in smart grids to enhance energy efficiency and reliability, the demand for AGC solutions is expected to rise. This trend offers a major opportunity for market players to expand their customer base and drive further growth in the AGC sector.

Latest Trends

Adoption of Cloud-Based AGC Systems

A key trend in the Automatic Generation Control (AGC) market is the growing adoption of cloud-based AGC systems. Cloud technology offers significant advantages in terms of scalability, flexibility, and cost-effectiveness. By leveraging cloud-based platforms, utilities can access real-time data, monitor system performance remotely, and improve decision-making processes for grid management.

Cloud-based AGC solutions also allow for easier integration with other smart grid technologies, enabling more efficient control of generation resources. This trend is particularly beneficial for smaller utilities and power plants that may not have the resources for large, on-site infrastructure.

As the demand for more agile, scalable, and efficient AGC solutions increases, cloud-based systems are becoming a popular choice for enhancing grid stability and supporting renewable energy integration

Regional Analysis

In 2024, North America held a 39.30% share of the Automatic Generation Control market, valued at USD 0.3 billion.

In 2024, North America dominated the Automatic Generation Control (AGC) market with a share of 39.30%, valued at USD 0.3 billion. The region’s leadership is driven by the increasing demand for reliable grid stability amidst growing renewable energy integration, coupled with a well-established energy infrastructure. Key countries, such as the United States and Canada, continue to prioritize the modernization of power grids, boosting the demand for advanced AGC systems.

Europe follows as a significant market player, owing to the rapid adoption of renewable energy sources and stringent environmental regulations aimed at reducing carbon emissions. The region is focusing on enhancing grid management technologies to accommodate fluctuating renewable energy outputs, increasing the need for AGC systems.

The Asia Pacific region is experiencing rapid growth in the AGC market, driven by the region’s increasing industrialization, energy demand, and renewable energy investments, particularly in countries like China and India. These nations are upgrading their energy infrastructure, leading to a rise in AGC system adoption.

The Middle East & Africa, and Latin America are emerging markets for AGC solutions. Although their market shares are currently smaller, these regions are focusing on modernizing their energy grids, presenting substantial future growth opportunities in the AGC market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, key players in the global Automatic Generation Control (AGC) market, including ABB Ltd., Alfen N.V., Atlas Copco, Briggs & Stratton Corporation, and Caterpillar Inc., are driving significant advancements and shaping market trends.

ABB Ltd., with its extensive experience in power and automation technologies, continues to lead the AGC market by providing advanced grid management solutions. ABB’s innovations in digitalization, control systems, and software platforms have enabled utilities to effectively manage grid frequency and ensure stability. Their ability to integrate AGC systems with renewable energy sources positions them as a critical player in this growing market.

Alfen N.V. is recognized for its cutting-edge solutions in the energy sector, particularly in smart grid infrastructure. Their strong focus on renewable energy integration and energy storage solutions has increased the demand for their AGC technologies. With a growing presence in Europe, Alfen’s solutions are driving market penetration in renewable-heavy regions.

Atlas Copco is leveraging its expertise in power generation equipment and energy solutions to cater to the AGC market. The company’s range of generators, combined with AGC functionality, enhances grid stability, particularly in areas with fluctuating demand.

Briggs & Stratton Corporation, known for its power equipment and engines, has expanded its product line to support AGC technologies. The company’s presence in both residential and commercial power systems gives it a broad market reach.

Caterpillar Inc. is a key player in providing large-scale, robust power solutions for grid management. Their AGC systems are integral to critical infrastructure, particularly in regions with growing energy demands.

Top Key Players in the Market

- ABB Ltd.

- Alfen N.V.

- Atlas Copco

- Briggs & Stratton Corporation

- Caterpillar Inc.

- Emerson Electric Co.

- Generac Holdings, Inc.

- HIMOINSA SL

- Honeywell International Inc.

- Landis Gyr Limited

- Mitsubishi Electric Corporation

- NR Electric Co., Ltd

- Prysmian Group

- Rockwell Automation, Inc.

- Schneider Electric SE

- Siemens AG

- Toshiba Corporation

- Trilliant Holdings Inc.

- Woodward, Inc.

Recent Developments

- In 2024, ABB signed an agreement to acquire Födisch Group, enhancing its position in continuous emission monitoring systems, which can indirectly support AGC by providing real-time data for more efficient energy management. The acquisition is expected to close before the end of 2024.

- In 2024, Alfen updated its strategy in H2 2024, focusing on core markets and products. While not directly related to AGC, this strategic shift aims to enhance overall energy efficiency and grid management capabilities.

Report Scope

Report Features Description Market Value (2024) USD 0.9 Billion Forecast Revenue (2034) USD 1.3 Billion CAGR (2025-2034) 3.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Hardware, Services, Software), By Operation Type (Turbine Governor Control, Load Frequency Control, Economic Dispatch, Others), By Application (Thermal Power Plants, Hydropower Plants, Nuclear Power Plants, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ABB Ltd., Alfen N.V., Atlas Copco, Briggs & Stratton Corporation, Caterpillar Inc., Emerson Electric Co., Generac Holdings, Inc., HIMOINSA SL, Honeywell International Inc., Landis Gyr Limited, Mitsubishi Electric Corporation, NR Electric Co., Ltd, Prysmian Group, Rockwell Automation, Inc., Schneider Electric SE, Siemens AG, Toshiba Corporation, Trilliant Holdings Inc., Woodward, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automatic Generation Control MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Automatic Generation Control MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB Ltd.

- Alfen N.V.

- Atlas Copco

- Briggs & Stratton Corporation

- Caterpillar Inc.

- Emerson Electric Co.

- Generac Holdings, Inc.

- HIMOINSA SL

- Honeywell International Inc.

- Landis Gyr Limited

- Mitsubishi Electric Corporation

- NR Electric Co., Ltd

- Prysmian Group

- Rockwell Automation, Inc.

- Schneider Electric SE

- Siemens AG

- Toshiba Corporation

- Trilliant Holdings Inc.

- Woodward, Inc.