Solar Photovoltaics Wafer Market Size, Share, And Business Benefits By Product (Monocrystalline, Multicrystalline, Bifacial), By Technology (PERC, TOPCon, IBC, HJT, TWINCUT), By Material (Cz-Si, FZ-Si, Diamond Wire Sawn), By End-use (Utility, Residential, Commercial, Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 141803

- Number of Pages: 358

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

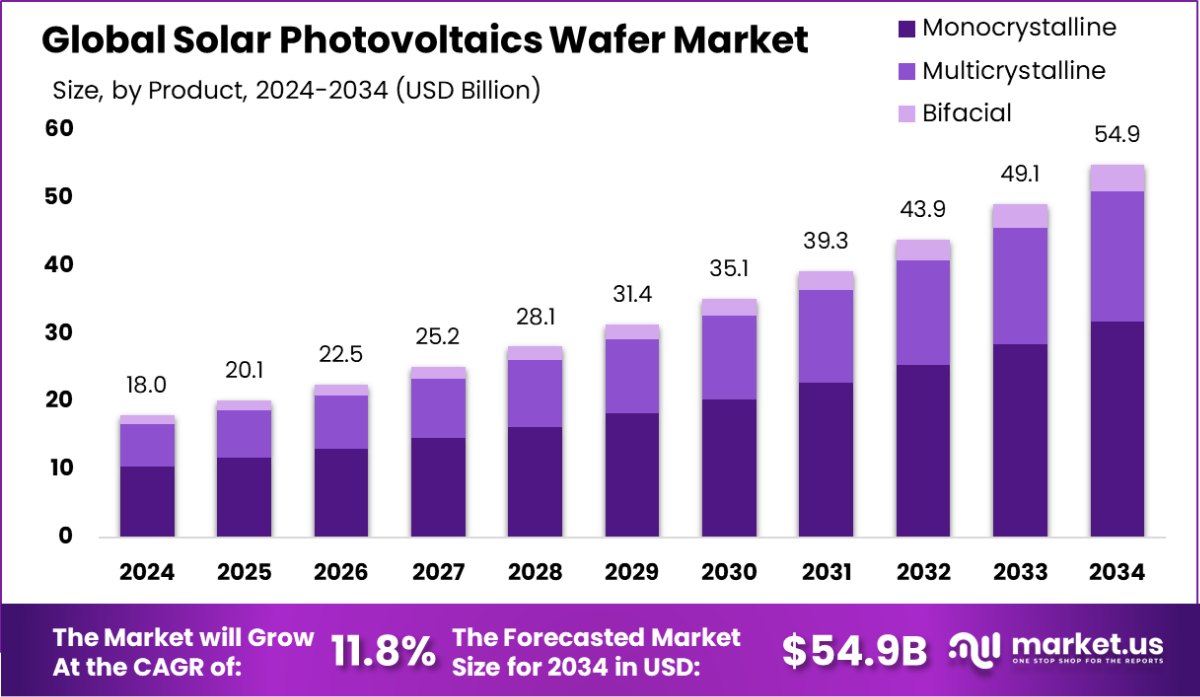

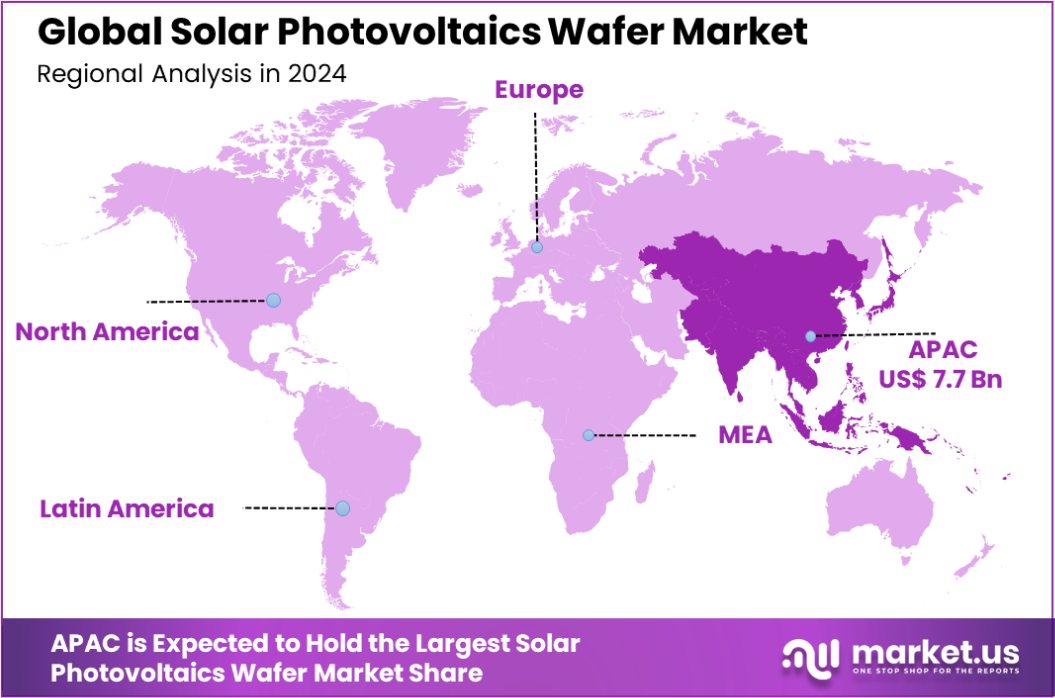

Global Solar Photovoltaics Wafer Market is expected to be worth around USD 54.9 billion by 2034, up from USD 18.0 billion in 2024, and grow at a CAGR of 11.8% from 2025 to 2034. Asia-Pacific’s robust growth in the Solar Photovoltaics Wafer Market is reflected in its substantial USD 7.7 billion valuation.

A solar photovoltaics (PV) wafer is a thin slice of semiconductor material, such as silicon, used in the manufacture of solar cells. These wafers are crucial because they form the base where photovoltaic materials are deposited to create solar cells, which convert sunlight into electricity. The efficiency and cost-effectiveness of solar cells largely depend on the quality and processing of these wafers.

The solar photovoltaics wafer market involves the production and distribution of these semiconductor wafers to meet the demand of the solar energy industry. This market is driven by the increasing adoption of solar energy across the globe as countries and companies push toward renewable energy sources to reduce carbon emissions and combat climate change.

The growth of the solar photovoltaics wafer market is primarily fueled by the global shift toward sustainable energy sources. Governments worldwide are offering incentives and subsidies to encourage solar energy adoption, which directly boosts the demand for solar PV wafers. Technological advancements that enhance the efficiency and reduce the production costs of these wafers also contribute significantly to market growth.

Demand for solar PV wafers is escalating due to the rising installation of solar power systems in residential, commercial, and utility-scale projects. The decreasing cost of solar installations, coupled with increasing awareness about the benefits of solar energy, continues to drive the uptake of solar technology and, by extension, the need for high-quality wafers.

The solar PV wafer market is ripe with opportunities, especially in emerging markets in Asia, Africa, and South America, where solar power is just beginning to gain substantial ground. Innovations in wafer technology, like the development of thinner wafers without compromising on efficiency, open new avenues for cost reduction and enhanced performance in solar modules.

In 2024, JA Solar expanded its China production capacity with an $870 million investment, planning new wafer projects aimed at achieving capacities of 40GW for p-type cells and 36GW for n-type cells by year-end. Simultaneously, LONGi Green Energy secured a $1.88 billion wafer supply agreement with Tongwei Solar, set to span three years, reinforcing its stance in the Solar Photovoltaics Wafer Market.

Key Takeaways

- Global Solar Photovoltaics Wafer Market is expected to be worth around USD 54.9 billion by 2034, up from USD 18.0 billion in 2024, and grow at a CAGR of 11.8% from 2025 to 2034.

- Monocrystalline products dominate the Solar Photovoltaics Wafer Market, holding a substantial 58.7% share.

- PERC technology, specifically Passivated Emitter and Rear Cell, claims 47.8% of the technology segment.

- Czochralski Silicon (Cz-Si), a key material, significantly leads with a 78.2% share in the market.

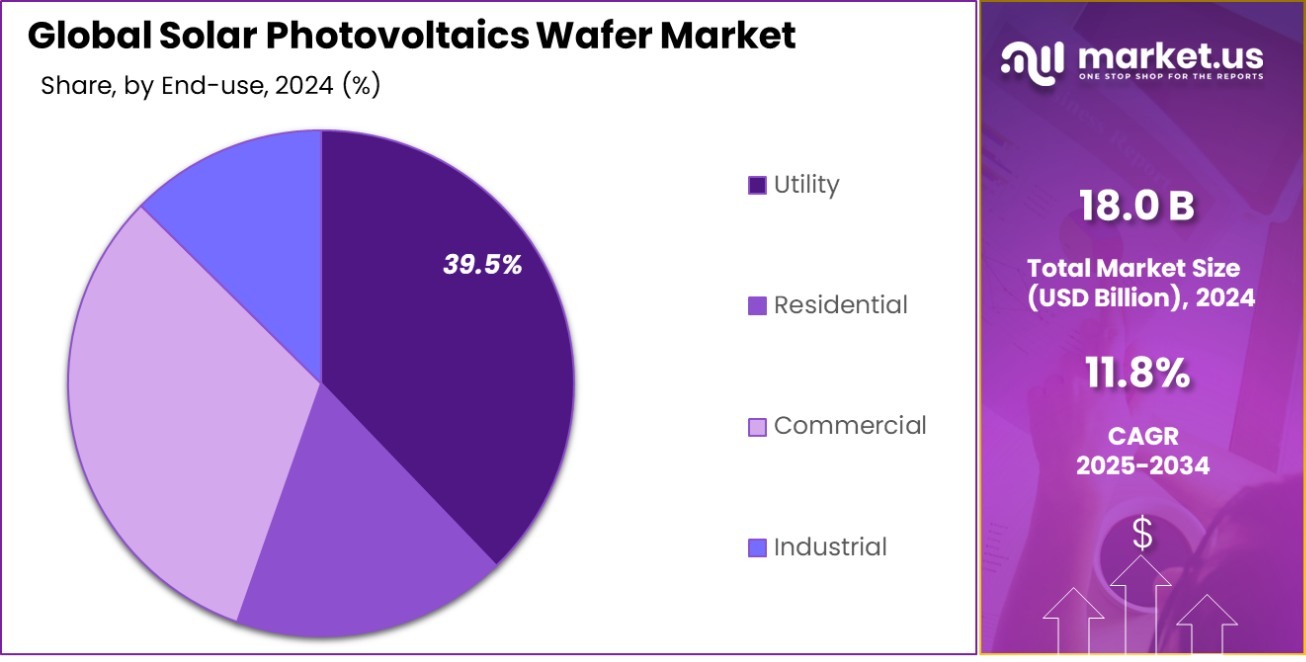

- Utility end-use captures 39.5% of the market, reflecting its major role in solar energy deployment.

- Asia-Pacific region leads global solar energy initiatives, boasting a market size of USD 7.7 billion in photovoltaic wafers.

By Product Analysis

Monocrystalline wafers dominate, holding a 58.7% market share in solar PV.

In 2024, Monocrystalline held a dominant market position in the By-Product segment of the Solar Photovoltaics Wafer Market, with a 58.7% share. This dominance is largely attributed to the superior efficiency rates that monocrystalline wafers offer compared to their polycrystalline and thin-film counterparts.

The increasing demand for high-performance solar solutions, especially in residential and commercial applications where space is at a premium, has significantly driven the adoption of monocrystalline wafers.

Market trends indicate a growing preference for these wafers as they provide a higher output of power in limited spaces, making them ideal for rooftop solar installations and small-scale solar parks. Moreover, technological advancements have led to improved manufacturing processes, reducing the cost and enhancing the accessibility of monocrystalline solar wafers.

As solar technology continues to evolve, the demand for monocrystalline wafers is expected to remain robust, supported by their efficiency and the ongoing push for renewable energy sources across various sectors. This segment’s strong position highlights its critical role in the broader adoption of solar energy technologies worldwide.

By Technology Analysis

PERC technology claims 47.8% of the solar PV wafer market.

In 2024, PERC (Passivated Emitter and Rear Cell) held a dominant market position in the By Technology segment of the Solar Photovoltaics Wafer Market, with a 47.8% share. This prominence is primarily due to the technological advantages that PERC offers in enhancing the efficiency of solar cells. By adding a passivation layer at the rear of the cell, PERC technology significantly boosts the capture of solar energy, leading to higher energy output compared to standard PV cells.

The adoption of PERC technology has been particularly strong in regions with high solar installation rates, where maximizing energy yield per square meter is crucial. As the solar industry continues to seek more cost-effective and higher-efficiency solutions, PERC’s ability to deliver superior performance without a corresponding increase in costs has made it a preferred choice among solar module manufacturers.

Furthermore, ongoing advancements in PERC technology are expected to further enhance its market share as manufacturers continue to refine the process to achieve even greater efficiency and longevity of solar cells. This segment’s solid market share underscores its pivotal role in driving the evolution and adoption of advanced solar technologies globally.

By Material Analysis

Czochralski Silicon leads with 78.2% in the solar photovoltaics wafer sector.

In 2024, Cz-Si (Czochralski Silicon) held a dominant market position in the By Material segment of the Solar Photovoltaics Wafer Market, with a 78.2% share. This substantial market share can be attributed to the Czochralski process’s ability to produce high-purity monocrystalline silicon wafers, which are preferred for their high efficiency and reliability in solar applications.

The process involves the growth of a single crystal silicon ingot by melting polycrystalline silicon in a crucible, which is then drawn up carefully to form a monocrystalline structure. The dominance of Cz-Si in the market is reinforced by its widespread adoption in manufacturing high-performance solar cells that cater to the increasing demand for renewable energy sources.

As the solar industry progresses towards more sustainable and efficient energy solutions, the quality of silicon wafers remains a critical factor. Cz-Si wafers offer superior light absorption and conversion capabilities, which makes them highly effective in photovoltaic applications that require high energy yields.

Given the ongoing advancements in solar technology and the growing environmental concerns, the market for Cz-Si is anticipated to maintain its leading position, driven by continuous improvements in its production process and the scaling of operations to meet global energy needs efficiently.

By End-use Analysis

Utility applications use 39.5% of solar photovoltaics wafers in their projects.

In 2024, the Utility segment held a dominant market position in the By End-use category of the Solar Photovoltaics Wafer Market, with a 39.5% share. This leading position reflects the significant scale-up of solar energy projects implemented by utility companies worldwide. As utilities aim to meet growing energy demands while reducing carbon footprints, solar PV wafers have become essential components in large-scale solar installations.

The reliance on utility-scale solar farms, which use vast numbers of solar panels to generate electricity on a large scale, drives the demand for high-quality, efficient solar PV wafers. These installations not only help to stabilize the grid but also provide a significant amount of renewable energy, supporting governmental objectives toward sustainable energy transitions.

The dominance of the Utility segment is further bolstered by favorable government policies, including incentives and subsidies that encourage renewable energy investments, particularly in solar power. With the continuous advancements in solar technology and the decreasing cost of solar components, utility companies are increasingly investing in photovoltaic systems, ensuring sustained growth and a robust market position for this segment.

Key Market Segments

By Product

- Monocrystalline

- Multicrystalline

- Bifacial

By Technology

- PERC

- TOPCon

- IBC

- HJT

- TWINCUT

By Material

- Cz-Si

- FZ-Si

- Diamond Wire Sawn

By End-use

- Utility

- Residential

- Commercial

- Industrial

Driving Factors

Global Push for Renewable Energy Adoption

The primary driving factor for the Solar Photovoltaics Wafer Market is the worldwide initiative towards adopting renewable energy sources. Governments globally are implementing policies that favor green energy, leading to substantial investments in solar power. As countries aim to reduce carbon emissions and dependence on fossil fuels, solar energy emerges as a key player.

This shift not only promotes the use of solar panels but directly increases the demand for solar photovoltaics wafers, which are crucial in manufacturing efficient and reliable solar cells. The surge in solar energy projects across both developed and developing nations is a testament to this ongoing trend.

Restraining Factors

High Initial Costs Hinder Market Growth

A significant restraining factor for the Solar Photovoltaics Wafer Market is the high initial investment required for solar technologies. Despite the long-term benefits and potential savings associated with solar energy, the upfront cost of photovoltaic systems, primarily driven by the price of solar wafers and installation, remains a hurdle for many potential adopters.

This is particularly challenging in less developed regions where financial resources are limited. High costs deter residential, commercial, and even some utility-scale projects from transitioning to solar power, thus slowing down the market expansion and the broader adoption of solar energy solutions.

Growth Opportunity

Emerging Markets Present Significant Expansion Opportunities

One of the most significant growth opportunities for the Solar Photovoltaics Wafer Market lies in the emerging markets of Asia, Africa, and Latin America. These regions exhibit rapid economic growth, increasing energy demand, and abundant solar resources. As governments in these areas focus on sustainable development, there is a heightened push towards renewable energy sources, especially solar power.

This shift is likely to result in increased deployments of solar energy systems, thereby driving the demand for photovoltaic wafers. Additionally, improving economic conditions and governmental support through subsidies and incentives make solar investments increasingly viable in these markets.

Latest Trends

Technological Innovations Enhance Solar Wafer Efficiency

A key trend in the Solar Photovoltaics Wafer Market is the continuous technological innovation aimed at enhancing the efficiency of solar wafers. As the solar industry evolves, manufacturers are increasingly focusing on developing thinner and more efficient wafers that can convert more sunlight into electricity.

This includes innovations like PERC (Passivated Emitter and Rear Cell) technology, which improves light absorption and energy conversion rates. Such advancements not only boost the performance of solar panels but also reduce material costs and increase the appeal of solar investments. This trend is crucial for maintaining the competitiveness of solar technology in the renewable energy market.

Regional Analysis

The Asia-Pacific Solar Photovoltaics Wafer Market dominates with a 43.3% share, valued at USD 7.7 billion.

In the Solar Photovoltaics Wafer Market, the Asia-Pacific region stands out as the dominant force, commanding a substantial 43.3% market share, translating into a market value of USD 7.7 billion. This preeminence is largely driven by massive investments in solar energy across countries like China, India, and Japan. China, in particular, continues to lead in solar installations, backed by strong governmental support and large-scale projects aimed at enhancing energy security while reducing carbon emissions.

Meanwhile, North America and Europe are also showing significant growth in the market due to their strong policy frameworks supporting renewable energy. The European Union’s ambitious targets for carbon neutrality are pushing rapid advancements and installations of solar technologies, including the development of more efficient photovoltaic wafers. In North America, the United States is spearheading growth with state-level incentives and an increasing shift toward green energy by major corporations.

The markets in Latin America and the Middle East & Africa, though smaller in comparison, are emerging as potential growth areas. These regions benefit from abundant solar resources and are beginning to see more government initiatives encouraging renewable energy investments, indicating a promising future for solar wafer demand.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global Solar Photovoltaics Wafer Market saw significant contributions from key companies like Hanwha Q CELLS, JA Solar, JinkoSolar, Lanco Solar, LDK Solar, LONGi, and Maxeon Solar Technologies, each playing a pivotal role in shaping industry dynamics.

Hanwha Q CELLS has been at the forefront, leveraging its advanced technological capabilities to produce high-efficiency solar wafers, which has solidified its market presence globally. This company’s strategy focuses on expanding its production capacity and enhancing the efficiency of its products, which is crucial for maintaining its competitive edge.

JA Solar continues to impress with its commitment to innovation and quality. Its products are well-regarded for their durability and performance, making JA Solar a preferred choice for large-scale solar projects. The company’s ongoing research and development efforts are aimed at reducing the cost per watt, which is a significant market driver.

JinkoSolar remains a dominant player due to its extensive manufacturing footprint and global distribution network. Its ability to scale production quickly and efficiently allows it to meet the growing demand for solar energy solutions worldwide, maintaining a strong position in the market.

Lanco Solar, though smaller compared to its competitors, specializes in providing customized solar solutions, which has carved out a niche market presence. This focus on tailored solutions allows Lanco Solar to compete effectively, particularly in emerging markets.

LDK Solar and LONGi are notable for their vertical integration strategies, which enable better control over the manufacturing process and cost efficiencies. LONGi, in particular, has made significant strides in producing monocrystalline wafers, which are known for their high efficiency and are increasingly preferred in both residential and commercial solar applications.

Maxeon Solar Technologies stands out with its innovative solar cell designs that maximize light absorption and enhance energy production. The company’s focus on high-end, premium quality products allows it to command a strong pricing power and maintain profitability in competitive markets.

Top Key Players in the Market

- Canadian Solar

- Comtec Solar

- First Solar

- GCL-Poly Energy Holdings Limited

- Green Energy Technology

- GT Advanced Technologies

- Hanwha Q CELLS

- JA Solar

- JinkoSolar

- Lanco Solar

- LDK Solar

- LONGI

- Maxeon Solar Technologies

- MEMC Electronic Materials, Inc.

- Nexolon Co., Ltd.

- REC Group

- Renesola

- Renewable energy corporation

- Siltronic

- Sino-American Silicon Products Inc. (SAS)

- Solarworld

- SunPower

- Targray Technology International Inc

- Trina Solar

- Wacker Chemie

- Xinyi Solar

- Zhonghuan Semiconductor Corporation

Recent Developments

- In 2023, Qcells announced plans to establish a fully integrated US solar manufacturing supply chain, including a 3.3GW ingot and wafer manufacturing plant in Bartow County, Georgia, set to break ground in Q1 2023 and reach full capacity by 2024.

- In 2023, Maxeon Solar Technologies acquired Complete Solaria’s solar panel patent portfolio in September 2023, which includes patents for shingled cell solar panel technology. This acquisition is expected to enhance Maxeon’s wafer technology capabilities through 2024 and beyond.

Report Scope

Report Features Description Market Value (2024) USD 18.0 Billion Forecast Revenue (2034) USD 54.9 Billion CAGR (2025-2034) 11.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Monocrystalline, Multicrystalline, Bifacial), By Technology (PERC, TOPCon, IBC, HJT, TWINCUT), By Material (Cz-Si, FZ-Si, Diamond Wire Sawn), By End-use (Utility, Residential, Commercial, Industrial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Canadian Solar, Comtec Solar, First Solar, GCL-Poly Energy Holdings Limited, Green Energy Technology, GT Advanced Technologies, Hanwha Q CELLS, JA Solar, JinkoSolar, Lanco Solar, LDK Solar, LONGI, Maxeon Solar Technologies, MEMC Electronic Materials, Inc., Nexolon Co., Ltd., REC Group, Renesola, Renewable energy corporation, Siltronic, Sino-American Silicon Products Inc. (SAS), Solarworld, SunPower, Targray Technology International Inc, Trina Solar, Wacker Chemie, Xinyi Solar, Zhonghuan Semiconductor Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Solar Photovoltaics Wafer MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Solar Photovoltaics Wafer MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Canadian Solar

- Comtec Solar

- First Solar

- GCL-Poly Energy Holdings Limited

- Green Energy Technology

- GT Advanced Technologies

- Hanwha Q CELLS

- JA Solar

- JinkoSolar

- Lanco Solar

- LDK Solar

- LONGI

- Maxeon Solar Technologies

- MEMC Electronic Materials, Inc.

- Nexolon Co., Ltd.

- REC Group

- Renesola

- Renewable energy corporation

- Siltronic

- Sino-American Silicon Products Inc. (SAS)

- Solarworld

- SunPower

- Targray Technology International Inc

- Trina Solar

- Wacker Chemie

- Xinyi Solar

- Zhonghuan Semiconductor Corporation