Global Hearing Aid Batteries Market Size, Share, And Business Benefits By Battery Type (Zinc-Air Batteries, Lithium Ion Rechargeable Batteries, Silver-Zinc Rechargeable Batteries), By Type (Disposable Batteries, Rechargeable Batteries), By Battery Size (Size 10, Size 13, Size 312, Size 675), By Distribution Channel (Pharmacies/Drugstores, Online Retail, Specialty Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 141818

- Number of Pages: 259

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

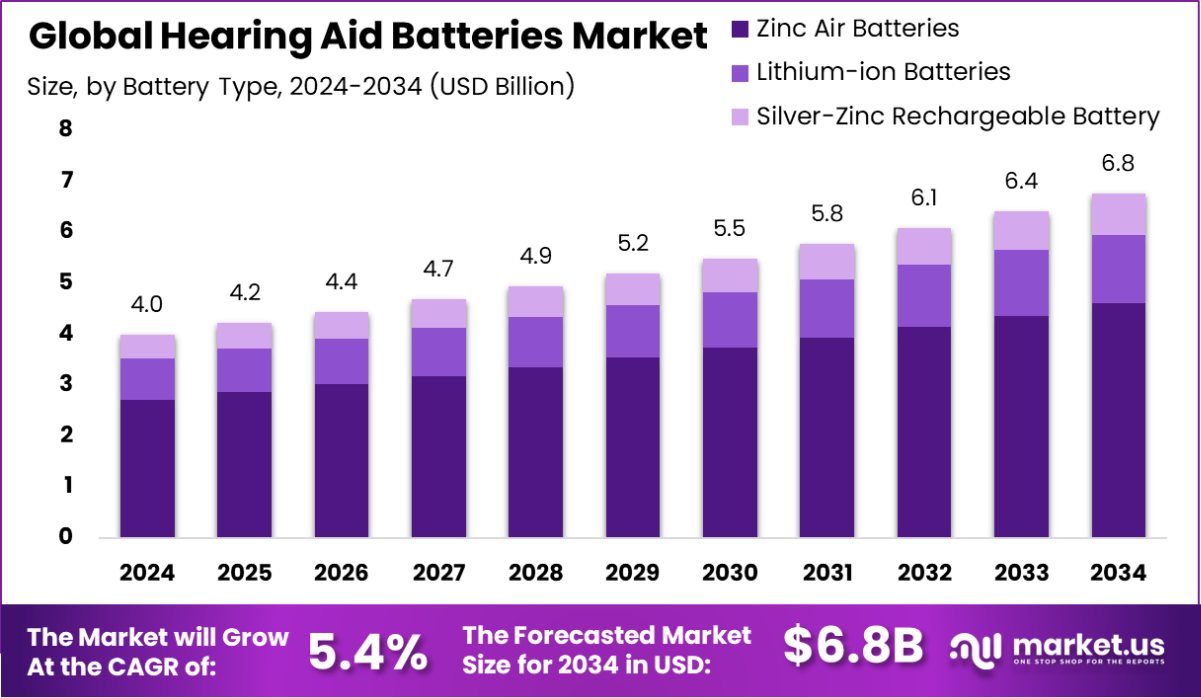

Global Hearing Aid Batteries Market is expected to be worth around USD 6.8 billion by 2034, up from USD 4.0 billion in 2024, and grow at a CAGR of 5.4% from 2025 to 2034. In North America, the increasing elderly population and insurance coverage drove the Hearing Aid Batteries Market growth to USD 1.98 billion.

Hearing aid batteries are specialized power cells designed to operate hearing aids, which are devices that amplify sound for individuals with hearing loss. These batteries are typically very small, button-shaped, and come in various sizes to fit different models and styles of hearing aids. The most common types are zinc-air batteries, which activate when exposed to air and have a shelf life that depends on how long they are exposed to air after their protective seal is removed.

The hearing aid batteries market encompasses the production, distribution, and sales of batteries specifically for use in hearing aids. This market is driven by the increasing prevalence of hearing impairments coupled with the rising geriatric population globally. Advancements in hearing aid technology, which require reliable and longer-lasting batteries, also contribute to the market dynamics.

One significant growth factor in the hearing aid batteries market is the technological advancements in hearing aid devices, including wireless and Bluetooth capabilities, which require more efficient and powerful batteries. Additionally, public health campaigns and improved accessibility to healthcare services have raised awareness about hearing impairments, encouraging more people to adopt hearing aids.

Demand for hearing aid batteries is primarily driven by the aging population worldwide, as age-related hearing loss is the most common cause of this condition. The increase in life expectancy and aging demographics in countries around the world are expected to sustain the demand for hearing aids and, consequently, for batteries. Rayovac introduced a new high-power battery line called Rayovac Extreme in April 2024, designed for hearing aids requiring greater than 130 dB output and/or greater than a 4 mA drain.

There are substantial opportunities in developing longer-lasting and faster-charging batteries as users seek more convenience and efficiency from their hearing aids. The shift toward rechargeable hearing aid batteries is a notable trend, providing significant growth opportunities for manufacturers to innovate and capture market share. Moreover, expansion in emerging markets presents a lucrative avenue, given the increasing healthcare investments and rising awareness about hearing loss in these regions.

Key Takeaways

- Global Hearing Aid Batteries Market is expected to be worth around USD 6.8 billion by 2034, up from USD 4.0 billion in 2024, and grow at a CAGR of 5.4% from 2025 to 2034.

- The Hearing Aid Batteries Market sees Zinc Air Batteries dominating with a 68.2% market share.

- Disposable batteries lead, capturing 77.2% of the market by type.

- Size 312 (Brown) is the most popular battery size, holding a 38.2% share.

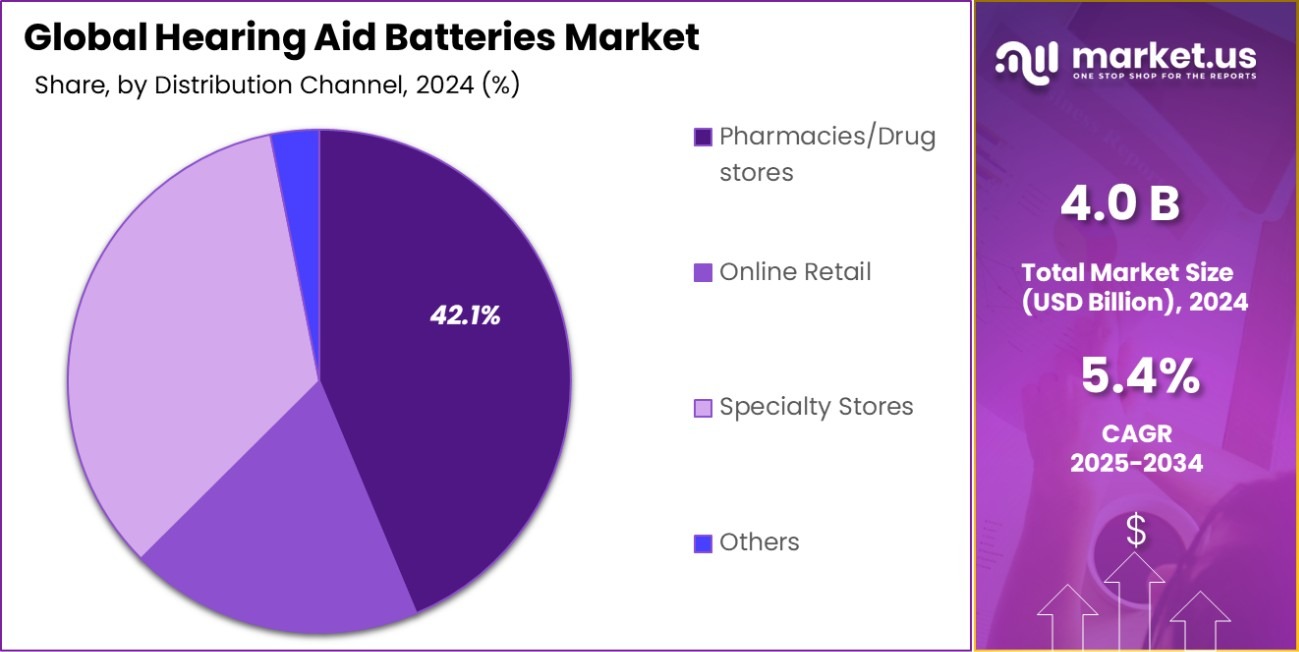

- Pharmacies and drugstores are the primary distribution channels, with a 42.1% market share.

- Strong healthcare infrastructure and high hearing aid adoption contributed to North America’s 49.5% market share, reaching USD 1.98 billion.

By Battery Type Analysis

Zinc-air batteries dominate the hearing aid batteries market, accounting for 68.2% of total sales.

In 2024, Zinc Air Batteries held a dominant market position in the By Battery Type segment of the Hearing Aid Batteries Market, with a 68.2% share. Their widespread adoption stems from superior energy density, cost-effectiveness, and long shelf life, making them the preferred choice for hearing aid manufacturers and consumers.

The demand surge aligns with the increasing prevalence of hearing impairment, particularly among the aging population. Additionally, their stable voltage output enhances auditory performance, driving further consumer preference.

In the regional landscape, North America and Europe emerged as leading markets, fueled by high hearing aid adoption rates and supportive healthcare policies. Meanwhile, Asia-Pacific exhibited the fastest growth, supported by an expanding elderly demographic and rising disposable income. Countries such as China, Japan, and India witnessed notable market penetration, fostering growth in the segment.

Technological advancements in battery miniaturization and improved zinc-air formulations are further strengthening market dominance. However, the advent of rechargeable lithium-ion alternatives poses competitive pressure.

Despite this, the cost efficiency and reliability of zinc-air batteries are expected to sustain their market leadership in the foreseeable future. Key industry players continue investing in product enhancements to reinforce their market standing and meet evolving consumer demands.

By Type Analysis

Disposable batteries lead the market, representing 77.2% of hearing aid battery consumption globally.

In 2024, Disposable Batteries held a dominant market position in the By Type segment of the Hearing Aid Batteries Market, with a 77.2% share. Their widespread use is driven by affordability, ease of replacement, and compatibility with various hearing aid models. Consumers prefer disposable batteries due to their consistent performance and availability, especially in regions with limited access to rechargeable alternatives. The aging population and the rising prevalence of hearing impairment further bolster the demand for these batteries.

In terms of regional distribution, North America and Europe dominated the market, attributed to high healthcare accessibility and strong distribution networks. Meanwhile, Asia-Pacific registered the highest growth rate, with increasing awareness and healthcare improvements driving demand. Key markets such as China, Japan, and India contributed significantly to expansion.

Despite growing interest in rechargeable lithium-ion batteries, disposable variants remain the preferred choice due to cost efficiency and longer storage life. Manufacturers focus on enhancing battery longevity and eco-friendly disposal options to maintain their market share. Additionally, government initiatives for hearing aid accessibility in developing regions are expected to sustain demand for disposable batteries, reinforcing their market leadership in the forecast period.

By Battery Size Analysis

Size 312 (Brown) batteries hold the largest share, contributing 38.2% to market demand.

In 2024, Size 312 (Brown) held a dominant market position in the By Battery Size segment of the Hearing Aid Batteries Market, with a 38.2% share. This dominance is attributed to its widespread use in behind-the-ear (BTE) and in-the-ear (ITE) hearing aids, which remain popular among users requiring moderate to severe hearing assistance. The balance between compact design and extended battery life makes Size 312 a preferred choice for consumers seeking reliability and efficiency.

North America and Europe led the market, driven by high hearing aid adoption rates and advanced healthcare infrastructure. Meanwhile, Asia-Pacific demonstrated significant growth, supported by increasing health awareness and an expanding elderly population in key countries like China, Japan, and India. Rising disposable income and improved access to hearing care solutions further strengthened demand in these regions.

Market players continue investing in technological advancements to enhance battery performance, ensuring a longer lifespan and stable power output. Despite competition from rechargeable hearing aid batteries, Size 312 remains a preferred option due to affordability and ease of replacement. As hearing aid usage increases worldwide, consistent demand for Size 312 batteries is expected, reinforcing its market leadership in the coming years.

By Distribution Channel Analysis

Pharmacies and drugstores serve as the primary distribution channel, capturing 42.1% of sales.

In 2024, Pharmacies/Drugstores held a dominant market position in the By Distribution Channel segment of the Hearing Aid Batteries Market, with a 42.1% share. This dominance is driven by the convenience, accessibility, and trust associated with pharmacy-based purchases, particularly among elderly consumers who frequently visit these establishments for healthcare needs. Pharmacies also benefit from personalized customer service, ensuring that individuals select the correct battery type for their hearing aids.

North America and Europe emerged as the largest markets, supported by well-established pharmacy chains, insurance coverage, and strong healthcare infrastructure. In contrast, Asia-Pacific displayed significant growth, driven by expanding retail pharmacy networks and rising awareness about hearing health in countries such as China, Japan, and India. The preference for in-person purchases in these regions further fueled sales through pharmacies.

Despite the rising penetration of online distribution channels, pharmacies remain the preferred option due to immediate availability, professional recommendations, and bundled purchase options with hearing aid accessories. Key industry players continue to partner with major pharmacy chains to enhance market penetration.

Key Market Segments

By Battery Type

- Zinc-Air Batteries

- Lithium Ion Rechargeable Batteries

- Silver-Zinc Rechargeable Batteries

By Type

- Disposable Batteries

- Rechargeable Batteries

By Battery Size

- Size 10

- Size 13

- Size 312

- Size 675

By Distribution Channel

- Pharmacies/Drugstores

- Online Retail

- Specialty Stores

- Others

Driving Factors

Growing Aging Population Boosts Hearing Aid Adoption

The aging population is a key driver for the hearing aid batteries market. As people age, the risk of hearing loss increases, leading to higher demand for hearing aids and, in turn, batteries. With global life expectancy rising, more individuals require hearing assistance, fueling consistent market growth.

Countries with large elderly populations, such as the United States, Japan, and Germany, are witnessing a surge in hearing aid adoption. Additionally, government initiatives and healthcare policies that support senior citizens contribute to market expansion.

The demand for long-lasting, efficient, and affordable batteries is increasing, prompting manufacturers to enhance battery performance. With hearing loss becoming more common among seniors, the market for hearing aid batteries is expected to remain strong in the coming years.

Restraining Factors

Rising Popularity of Rechargeable Batteries Limits Growth

The increasing adoption of rechargeable hearing aid batteries is a major challenge for the disposable battery market. Many modern hearing aids now use lithium-ion rechargeable batteries, which offer longer life, convenience, and reduced waste. Users prefer rechargeable options as they eliminate the need for frequent replacements and provide cost savings over time.

Manufacturers are investing heavily in rechargeable technology, making these batteries more accessible and affordable. Additionally, environmental concerns and government regulations on battery disposal and recycling are encouraging a shift toward sustainable alternatives.

As rechargeable hearing aids become more advanced and widely available, demand for traditional disposable batteries is slowing. This trend is expected to impact the growth of disposable hearing aid batteries in the long run.

Growth Opportunity

Expansion in Emerging Markets Drives New Demand

Emerging markets present a huge growth opportunity for the hearing aid batteries market. Countries in Asia-Pacific, Latin America, and Africa are experiencing rising disposable incomes, improving healthcare infrastructure, and increasing awareness of hearing loss solutions.

Governments and health organizations are launching programs to provide affordable hearing aids to underserved populations, boosting battery demand. Additionally, the growing elderly population in these regions is driving higher adoption of hearing devices.

As more people gain access to hearing aids, the need for reliable and cost-effective batteries will rise. Manufacturers can expand their reach by partnering with local distributors and pharmacies. The increasing presence of global hearing aid brands in these regions further supports market growth, creating new business opportunities.

Latest Trends

Smart Batteries with Wireless Connectivity Gain Popularity

The hearing aid batteries market is witnessing a shift toward smart batteries with wireless connectivity. These advanced batteries allow real-time monitoring of battery life through smartphone apps, helping users track usage and receive low-battery alerts.

Manufacturers are developing Bluetooth-enabled batteries that improve power efficiency and optimize hearing aid performance. This trend is driven by consumer demand for convenience and better user experience.

Smart batteries also support automatic adjustments based on sound environments, enhancing hearing aid functionality. As technology integration in healthcare devices grows, the adoption of smart batteries is expected to increase significantly. Major battery brands are investing in innovation and partnerships with hearing aid manufacturers, making connected battery solutions a key trend in the market.

Regional Analysis

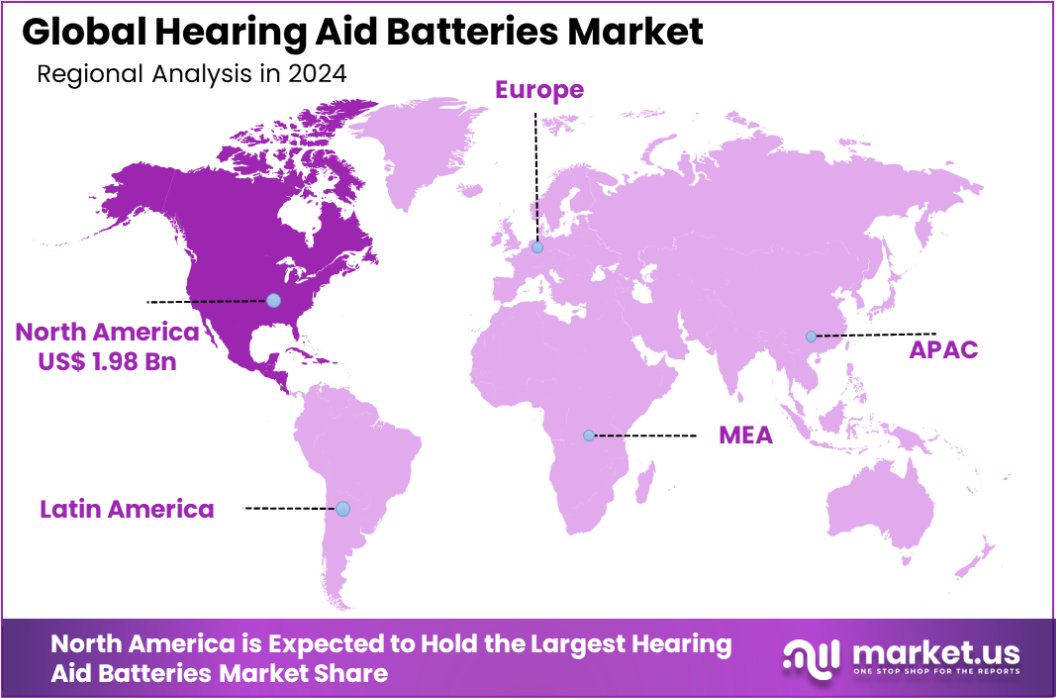

North America dominated the Hearing Aid Batteries Market in 2024, holding a 49.5% share, valued at USD 1.98 billion.

In 2024, North America dominated the Hearing Aid Batteries Market, holding a 49.5% share, valued at USD 1.98 billion. The region’s dominance is attributed to a high prevalence of hearing impairment, strong healthcare infrastructure, and widespread adoption of advanced hearing aids. The United States and Canada lead in hearing aid battery sales, supported by insurance coverage and favorable reimbursement policies.

Europe follows closely, driven by an aging population and government-backed healthcare initiatives. Countries like Germany, France, and the United Kingdom exhibit high demand for both disposable and rechargeable batteries. Meanwhile, Asia-Pacific is the fastest-growing region, fueled by rising disposable incomes, an expanding elderly demographic, and improving healthcare access. China, Japan, and India contribute significantly to market expansion.

In contrast, the Middle East & Africa, and Latin America hold a smaller share but are witnessing gradual growth due to increasing awareness and accessibility to hearing solutions. Key markets such as Brazil, Mexico, South Africa, and the UAE are expected to see higher adoption rates in the coming years. With rising hearing aid penetration and technological advancements, regional markets continue to support overall industry growth.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Duracell, Energizer, and ICellTech played a significant role in shaping the global Hearing Aid Batteries Market, leveraging innovation, strong distribution networks, and brand reliability to maintain competitive positions.

Duracell remained a market leader, benefiting from its strong consumer trust, extensive retail presence, and superior battery performance. The company’s long-lasting zinc-air batteries continued to dominate, catering to the growing demand for consistent power output and reliability. Duracell’s strategic partnerships with hearing aid manufacturers and pharmacy chains further strengthened its market share, particularly in North America and Europe.

Energizer maintained a strong foothold in the market by focusing on battery longevity, eco-friendly production, and global accessibility. Its premium Energizer® EZ Turn & Lock batteries gained traction among elderly users seeking ease of handling. The company’s expansion in Asia-Pacific and Latin America positioned it for future growth, driven by increasing hearing aid adoption and improving healthcare infrastructure.

ICellTech carved out a competitive space by offering cost-effective yet high-performance batteries, making it a preferred choice in price-sensitive markets. The company’s focus on bulk supply to audiology clinics and healthcare facilities helped drive demand. Additionally, its emphasis on sustainable battery production aligned with global trends toward environmentally responsible solutions.

Top Key Players in the Market

- Duracell

- Energizer

- ICellTech

- MAXELL UK LTD

- Panasonic

- Rayovac

- RAYOVAC

- Starkey Laboratories

- Toshiba Batteries

- VARTA

- VARTA Consumer Batteries GmbH & Co

- Widex

- Zpower

Recent Developments

- In January 2025, Starkey released the Signature Series, including the world’s smallest rechargeable hearing aid, the Signature CIC R NW, with up to 38 hours of battery life.

- In February 2025, Duracell announced the establishment of its new Global Headquarters for Research and Development in Atlanta, Georgia, investing $56 million and creating 110 jobs.

Report Scope

Report Features Description Market Value (2024) USD 4.0 Billion Forecast Revenue (2034) USD 6.8 Billion CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Battery Type (Zinc-Air Batteries, Lithium Ion Rechargeable Batteries, Silver-Zinc Rechargeable Batteries), By Type (Disposable Batteries, Rechargeable Batteries), By Battery Size (Size 10, Size 13, Size 312, Size 675), By Distribution Channel (Pharmacies/Drugstores, Online Retail, Specialty Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Duracell, Energizer, ICellTech, MAXELL UK LTD, Panasonic, Rayovac, RAYOVAC, Starkey Laboratories, Toshiba Batteries, VARTA, VARTA Consumer Batteries GmbH & Co, Widex, Zpower Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Hearing Aid Batteries MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Hearing Aid Batteries MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Duracell

- Energizer

- ICellTech

- MAXELL UK LTD

- Panasonic

- Rayovac

- RAYOVAC

- Starkey Laboratories

- Toshiba Batteries

- VARTA

- VARTA Consumer Batteries GmbH & Co

- Widex

- Zpower