Global Industrial Energy-Efficiency Services Market Size, Share, And Business Benefits By Service (Energy Auditing or Consulting, Monitoring and Verification, Product and System optimization, Energy Management Software, Others), By Deployment (Cloud-based, On-premises), By End-use (Petrochemicals and Chemicals, Power, Food and Beverage, Manufacturing, Mining, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 142904

- Number of Pages: 307

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

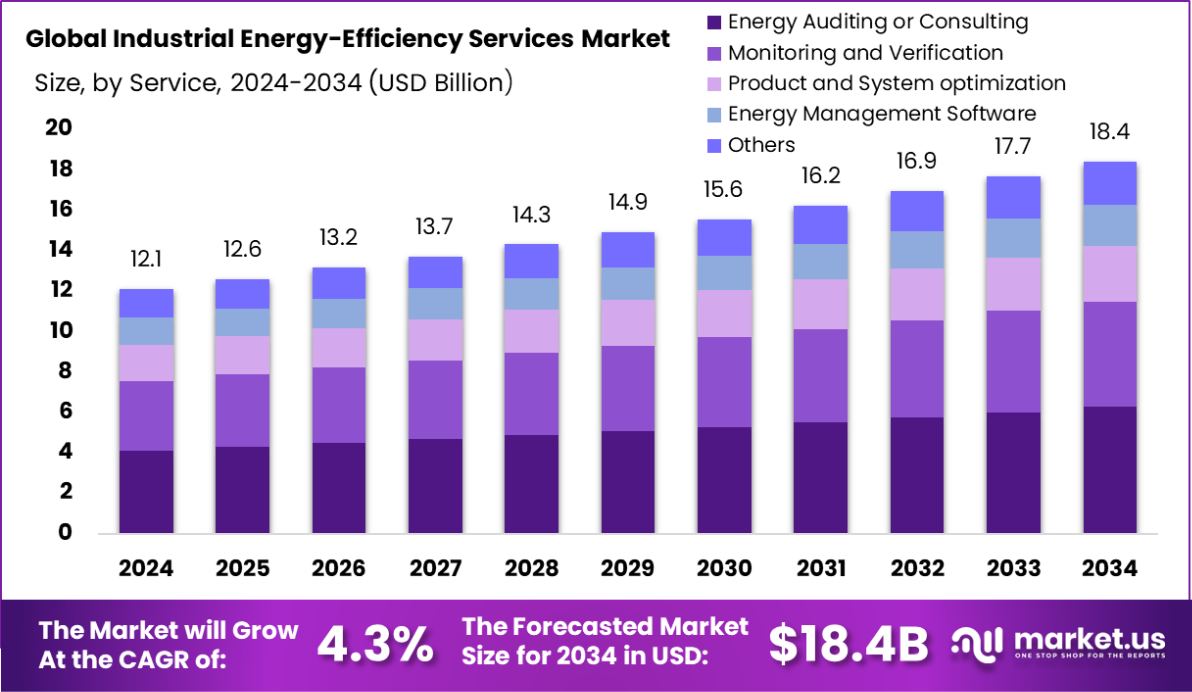

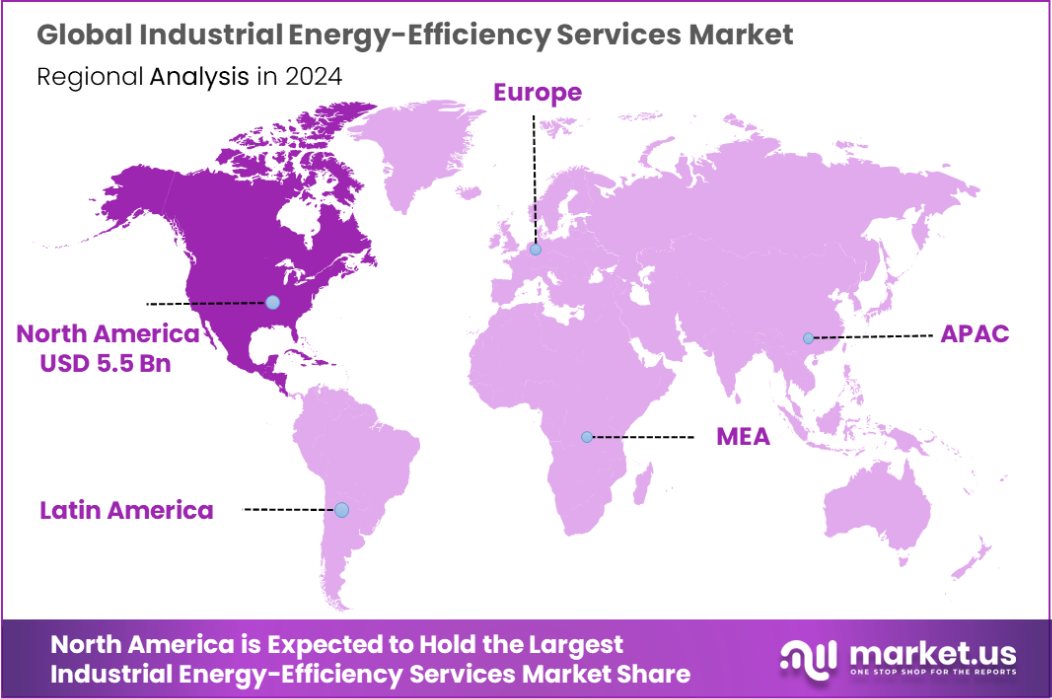

Global Industrial Energy-Efficiency Services Market is expected to be worth around USD 18.4 billion by 2034, up from USD 12.1 billion in 2024, and grow at a CAGR of 4.3% from 2025 to 2034. With a 45.60% market share, North America dominates the Industrial Energy-Efficiency Services Market, totaling USD 5.5 billion in value.

Industrial Energy-Efficiency Services involve strategies and solutions aimed at reducing energy consumption and enhancing operational efficiency in manufacturing and industrial facilities. These services encompass a broad range of activities, including energy audits, system optimization, implementation of energy-efficient technologies, and consultation to improve overall energy use. The goal is to help industries lower energy costs, reduce their environmental impact, and comply with regulations by optimizing their energy usage.

The Industrial Energy-Efficiency Services Market refers to the sector that provides these energy optimization services to industrial clients. This market includes companies that offer consulting, project management, and implementation services tailored to industrial settings. It caters to sectors such as manufacturing, chemicals, automotive, and others, focusing on enhancing their energy efficiency through technological upgrades and process improvements.

One major growth factor in this market is the increasing global emphasis on reducing carbon footprints and adhering to stringent environmental regulations. Industries are compelled to adopt energy-efficient operations to meet these standards, driving demand for specialized services. Additionally, the rising cost of energy is pushing companies to seek ways to cut energy expenses, further fueling market growth.

Demand in the Industrial Energy-Efficiency Services Market is largely driven by the need for cost reduction among industries facing high operational costs due to energy usage. Furthermore, the shift toward sustainable practices and the pressure to comply with national and international energy consumption norms are significantly influencing demand patterns in this sector.

There are substantial opportunities in emerging markets where industrialization is growing rapidly, and energy efficiency is becoming a critical factor for sustainable development. Advances in technology, such as IoT and AI, also open new avenues for service providers to offer more integrated and sophisticated solutions that promise even greater energy savings and operational efficiency improvements.

Key Takeaways

- Global Industrial Energy-Efficiency Services Market is expected to be worth around USD 18.4 billion by 2034, up from USD 12.1 billion in 2024, and grow at a CAGR of 4.3% from 2025 to 2034.

- Energy auditing or consulting services hold a 34.20% share in the Industrial Energy-Efficiency Services Market.

- Cloud-based deployment dominates the market, accounting for 57.20% of the Industrial Energy-Efficiency Services Market.

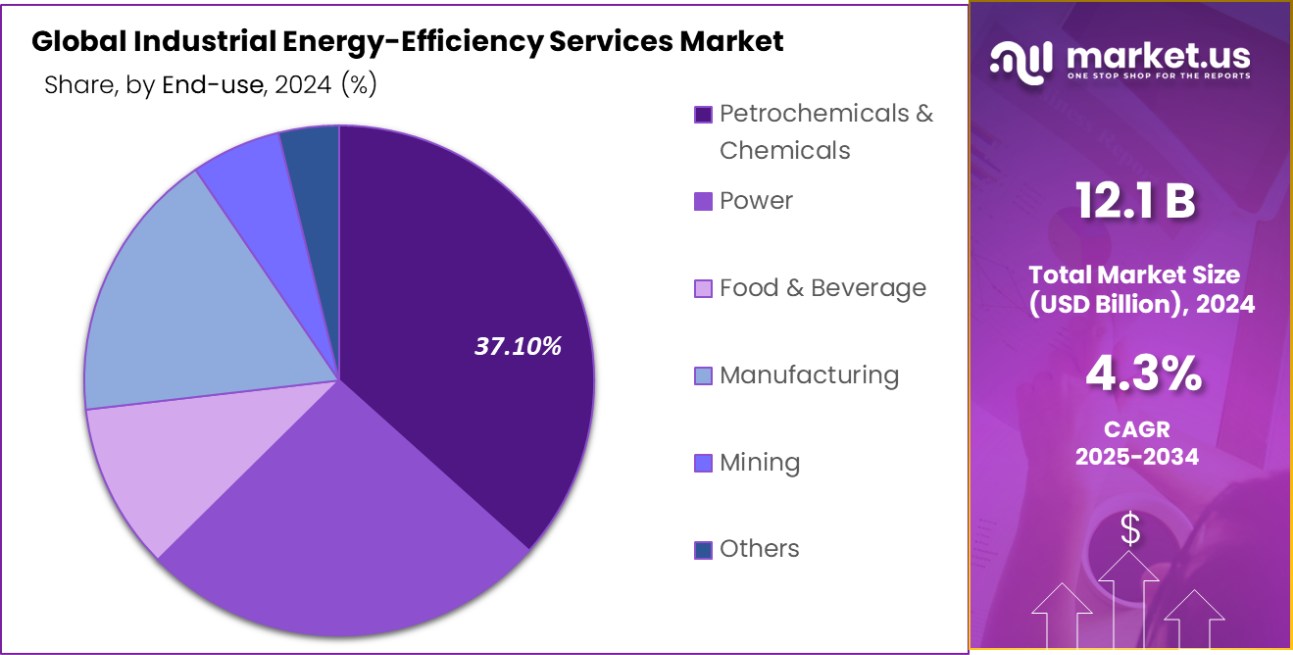

- In the Industrial Energy-Efficiency Services Market, petrochemicals and chemicals represent 37.10% of end-use applications.

- In North America, the Industrial Energy-Efficiency Services Market reaches a substantial value of USD 5.5 billion, with a 45.60% share.

By Service Analysis

Energy auditing and consulting services command a 34.20% share, reflecting significant market impact.

In 2024, Energy Auditing or Consulting held a dominant market position in the by-service segment of the Industrial Energy-Efficiency Services Market, commanding a 34.20% share. This segment benefits from a growing awareness among industries about the potential cost savings and operational efficiencies achievable through energy optimization.

Energy audits provide a critical first step for businesses looking to identify areas where energy use can be minimized and are essential for developing strategic energy management plans. The high share reflects the priority that companies place on understanding their energy consumption patterns and the effectiveness of their current energy practices.

The demand for these services is further driven by increasing regulatory pressures and environmental policies that require industries to reduce their carbon emissions and improve energy utilization. Companies are leveraging energy consulting services to comply with these regulations and to enhance their corporate sustainability profiles.

Additionally, technological advancements in energy monitoring and the integration of IoT devices have expanded the scope and accuracy of energy audits, making them more appealing to industrial clients. As industries continue to focus on reducing operational costs and environmental impacts, the role of energy consulting as a pivotal entry point for broader energy efficiency initiatives is expected to strengthen further.

By Deployment Analysis

Cloud-based deployment holds 57.20% of the market, underscoring tech integration.

In 2024, Cloud-based solutions held a dominant market position in the by-deployment segment of the Industrial Energy-Efficiency Services Market, with a 57.20% share. This significant market share underscores the pivotal role of cloud technology in facilitating more scalable, flexible, and cost-effective energy management solutions for industrial applications.

The adoption of cloud-based platforms allows for the continuous monitoring and analysis of energy data across various operations, enabling real-time optimizations and predictive maintenance strategies that substantially reduce energy wastage and operational costs.

The preference for cloud-based deployment is also driven by the ease of integration with existing industrial systems and the capability to remotely manage multiple facilities, which is particularly advantageous for companies with geographically dispersed operations.

Moreover, cloud platforms support the deployment of advanced analytics and artificial intelligence to further enhance energy optimization efforts, making them a go-to choice for industries looking to leverage cutting-edge technology in their energy-efficiency initiatives.

As industries increasingly prioritize sustainability and cost-efficiency, the demand for cloud-based energy efficiency services is expected to grow, reinforcing its dominant position in the market. This trend is likely to continue as more companies recognize the strategic value of cloud solutions in achieving their energy and environmental goals.

By End-use Analysis

Petrochemicals and chemicals sectors lead with 37.10% in energy-efficiency service uptake.

In 2024, Petrochemicals and Chemicals held a dominant market position in the By End-use segment of the Industrial Energy-Efficiency Services Market, with a 37.10% share. This leading position reflects the critical importance of energy management within these sectors, which are both energy-intensive and under increasing pressure to reduce environmental impacts and comply with strict regulations.

The high energy demand inherent in petrochemical and chemical manufacturing processes makes them prime candidates for energy-efficiency improvements, which can lead to significant cost savings and enhanced sustainability.

The implementation of energy-efficiency services in these industries focuses on optimizing process heating systems, enhancing equipment efficiency, and improving waste management practices. These measures not only reduce energy consumption but also cut down on greenhouse gas emissions, aligning with global environmental goals.

Moreover, the adoption of advanced technologies such as IoT and AI for better energy data management and predictive maintenance further drives the efficiency and effectiveness of these initiatives.

As global environmental standards become more stringent and as energy costs continue to rise, the petrochemical and chemical sectors are likely to maintain or even increase their investment in energy-efficiency services to stay competitive and compliant. This trend underpins the significant market share held by these industries in the energy-efficiency services sector.

Key Market Segments

By Service

- Energy Auditing or Consulting

- Monitoring and Verification

- Product and System optimization

- Energy Management Software

- Others

By Deployment

- Cloud-based

- On-premises

By End-use

- Petrochemicals and Chemicals

- Power

- Food and Beverage

- Manufacturing

- Mining

- Others

Driving Factors

Rising Energy Costs Drive Efficiency Investments

One of the top driving factors in the Industrial Energy-Efficiency Services Market is the escalating cost of energy. As energy prices continue to rise, industries are increasingly seeking ways to reduce their energy expenses, which directly impact their overall operational costs.

Investing in energy-efficiency services allows companies to optimize their energy usage, leading to significant cost savings over time. This is particularly crucial for energy-intensive sectors such as manufacturing, where energy consumption can account for a substantial portion of operational expenses.

By implementing energy-efficient technologies and practices, businesses not only cut costs but also enhance their competitiveness in the market. The push towards more sustainable operations further amplifies the demand for these services, making this factor a key driver of growth in the energy-efficiency services sector.

Restraining Factors

High Initial Costs Limit Market Adoption

A significant restraining factor in the Industrial Energy-Efficiency Services Market is the high initial investment required for energy-efficient technologies and services. Many industrial firms face budget constraints that make it challenging to allocate substantial funds upfront for EE upgrades.

Although these investments typically lead to considerable energy savings and reduced operational costs over time, the initial cost can be a barrier for smaller enterprises and those in sectors with tight profit margins.

This financial hurdle can delay or deter the adoption of advanced energy management systems, even if the long-term benefits are clear. Addressing this issue through financial incentives or more cost-effective solutions could help overcome this barrier and increase the uptake of energy-efficiency services across more industries.

Growth Opportunity

Technological Advancements Offer Significant Market Expansion Opportunities

Technological advancements present a major growth opportunity within the Industrial Energy-Efficiency Services Market. The integration of IoT, artificial intelligence, and real-time data analytics into energy management systems has revolutionized how industries monitor and optimize energy usage.

These technologies enable more precise control over energy consumption, predictive maintenance to prevent equipment failures, and overall operational efficiencies that were not previously possible. As these technologies continue to evolve and become more cost-effective, their adoption is expected to spread, opening up substantial markets in various industrial sectors.

Companies that innovate and integrate these advanced technologies into their offerings are well-positioned to capitalize on this growth opportunity, helping industries meet both their financial and environmental targets more effectively.

Latest Trends

Sustainability Goals Shape Energy-Efficiency Services Demand

A key trend influencing the Industrial Energy-Efficiency Services Market is the increasing focus on sustainability goals by industries across the globe. As companies commit to reducing their carbon footprints and meeting environmental regulations, there is a heightened demand for services that can enhance energy efficiency.

This trend is driving the development and implementation of green technologies and practices within industrial operations. Companies are not only looking to comply with legal standards but also aiming to enhance their public image and appeal to a more environmentally conscious consumer base.

The shift towards sustainable business practices is pushing the energy-efficiency services market to innovate, creating more effective solutions that cater to the green mandates of modern industries.

Regional Analysis

North America holds a commanding 45.60% share of the Industrial Energy-Efficiency Services Market, valued at USD 5.5 billion.

In the Industrial Energy-Efficiency Services Market, regional dynamics vary significantly. North America emerges as the dominating region, holding 45.60% of the market with revenues reaching USD 5.5 billion.

This dominance is attributed to stringent regulatory standards and the high adoption of advanced technologies aimed at reducing energy consumption in industrial sectors. In contrast, Europe follows closely, driven by aggressive climate policies and the push towards sustainability from the European Union, fostering growth in energy-efficient solutions.

Asia Pacific also shows robust growth, fueled by rapid industrialization and increasing energy costs. Countries like China and India are heavily investing in energy-efficiency measures to sustain their industrial growth while minimizing environmental impacts.

The Middle East & Africa, and Latin America are slower in adoption but show potential due to rising awareness and governmental initiatives aimed at energy conservation. The varying pace of economic development and regulatory environments across these regions influence the adoption rates and market penetration of industrial energy-efficiency services, shaping the global landscape of this market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global Industrial Energy-Efficiency Services Market is experiencing significant growth, driven by regulatory pressures, cost-saving initiatives, and advancements in energy management technologies. Several key players are shaping the competitive landscape by offering innovative solutions tailored to industrial clients.

CoolPlanet Ltd. is gaining traction with its data-driven approach to energy optimization. The company leverages AI-powered analytics and IoT solutions to enhance energy efficiency, particularly for industrial facilities looking to reduce emissions and operational costs.

Dalkia, a subsidiary of EDF Group, maintains a strong presence in energy-efficiency services, particularly in Europe. The company’s expertise in district heating, energy audits, and process optimization makes it a preferred partner for industries aiming to achieve long-term sustainability.

DNV Group AS plays a crucial role in industrial energy efficiency by offering independent advisory services and compliance solutions. With growing regulatory requirements, industries are increasingly relying on DNV’s expertise in energy audits, certification, and performance benchmarking.

Econoler Inc. focuses on energy efficiency consulting and financing strategies, enabling industrial clients to adopt cost-effective solutions. The company’s presence in developing markets presents growth opportunities, as many industries seek financial and technical support for energy optimization.

Electricité de France SA (EDF), a global energy leader, integrates energy-efficiency services with its broader renewable energy portfolio. EDF’s industrial clients benefit from advanced energy management solutions, reinforcing its market dominance.

Top Key Players in the Market

- CoolPlanet Ltd.

- Dalkia

- DNV Group AS

- Econoler Inc.

- Electricite de France SA

- Enel Spa

- ENGIE SA

- General Electric Co.

- Getec

- Honeywell International Inc.

- ISTA

- Johnson Controls International Plc

- Ramboll Group AS

- Rockwell Automation Inc.

- Schneider Electric SE

- SGS SA

- Siemens AG

- TERI

- TotalEnergies SE

- Veolia

Recent Developments

- In November 2024, CoolPlanet partnered with Musanadah to deliver energy and sustainability services in Saudi Arabia and Bahrain, supporting the Saudi Green Initiative and Vision 2030.

- In June 2024, ComEd plans to launch the Market Development Initiative (MDI) in Illinois, aiming to equip individuals with essential skills and training for careers in the energy-efficiency sector. This initiative seeks to not only enhance workforce readiness but also accelerate the growth of energy-efficient solutions across the state.

- In November 2023, TARSHID, Saudi Arabia’s National Energy Services Company, joined forces with Enova, a leading provider of integrated energy and facilities management services, to introduce energy savings guarantee programs for public sector buildings. This collaboration is focused on driving sustainability efforts by optimizing energy consumption and reducing operational costs in government facilities.

Report Scope

Report Features Description Market Value (2024) USD 12.1 Billion Forecast Revenue (2034) USD 18.4 Billion CAGR (2025-2034) 4.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service (Energy Auditing or Consulting, Monitoring and Verification, Product and System optimization, Energy Management Software, Others), By Deployment (Cloud-based, On-premises), By End-use (Petrochemicals and Chemicals, Power, Food and Beverage, Manufacturing, Mining, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape CoolPlanet Ltd., Dalkia, DNV Group AS, Econoler Inc., Electricite de France SA, Enel Spa, ENGIE SA, General Electric Co., Getec, Honeywell International Inc., ISTA, Johnson Controls International Plc, Ramboll Group AS, Rockwell Automation Inc., Schneider Electric SE, SGS SA, Siemens AG, TERI, TotalEnergies SE, Veolia Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Industrial Energy-Efficiency Services MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Industrial Energy-Efficiency Services MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- CoolPlanet Ltd.

- Dalkia

- DNV Group AS

- Econoler Inc.

- Electricite de France SA

- Enel Spa

- ENGIE SA

- General Electric Co.

- Getec

- Honeywell International Inc.

- ISTA

- Johnson Controls International Plc

- Ramboll Group AS

- Rockwell Automation Inc.

- Schneider Electric SE

- SGS SA

- Siemens AG

- TERI

- TotalEnergies SE

- Veolia