Global Thin Film Solar Cell Market Size, Share, And Business Benefits By Type (Cadmium Telluride, Amorphous Thin-film Silicon, Copper Indium Gallium Selenide, Microcrystalline Tandem Cells, Thin-film Polycrystalline Silicon, Others), By Substrate (Plastic, Metal, Glass), By Technology (On-grid, Off-grid), By Application (Residential, Commercial, Utility), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 142760

- Number of Pages: 259

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

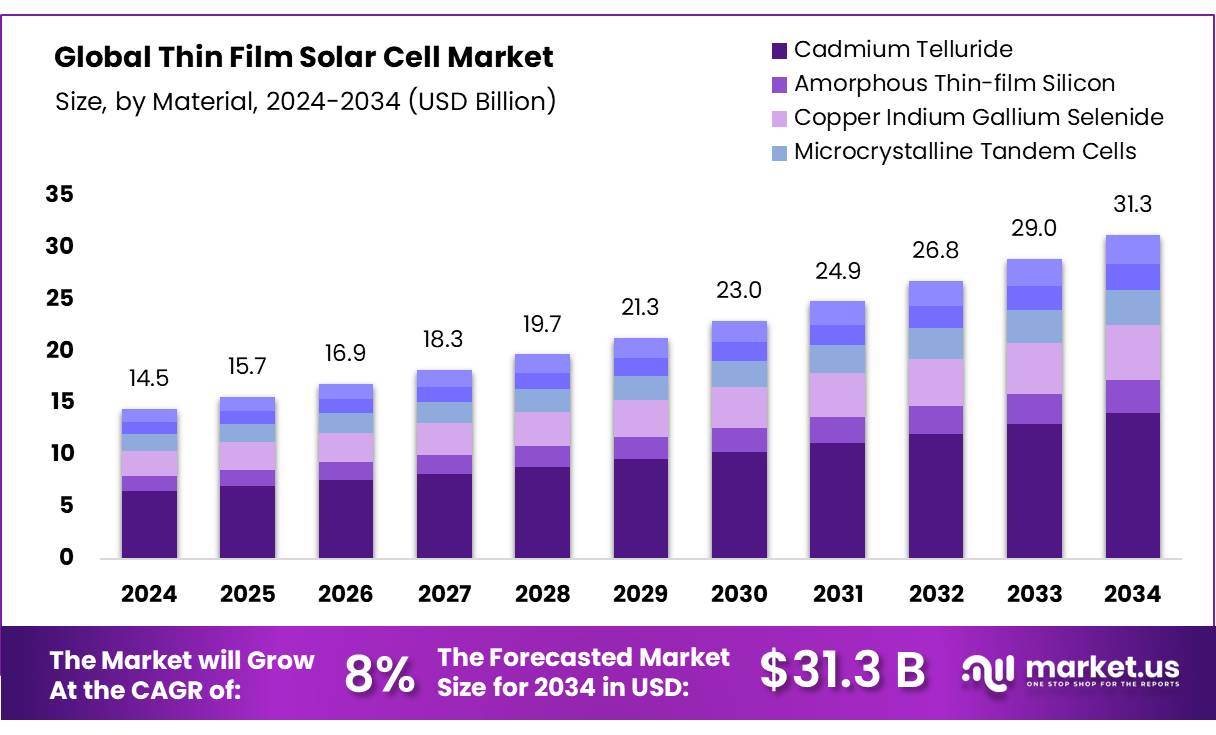

The Global Thin Film Solar Cell Market size is expected to be worth around USD 31.3 Billion by 2034, from USD 14.5 Billion in 2024, growing at a CAGR of 8.0% during the forecast period from 2025 to 2034.

The Thin Film Solar Cell Market has emerged as a pivotal segment within the renewable energy sector, characterized by its lightweight, flexible, and cost-effective photovoltaic solutions. Thin film solar cells, utilizing materials such as cadmium telluride (CdTe), amorphous silicon (a-Si), and copper indium gallium selenide (CIGS), offer an alternative to traditional crystalline silicon-based cells, catering to diverse applications ranging from residential rooftops to large-scale utility projects.

The industrial scenario reflects a competitive and dynamic landscape, with advancements in manufacturing techniques, such as roll-to-roll processing, reducing production costs, and enhancing scalability. The market is witnessing significant investments in research and development to improve energy conversion efficiencies, currently averaging around 12-15% for commercial thin film cells, compared to 18-22% for crystalline silicon.

The CdTe segment dominates with a 45% market share, attributed to its cost-effectiveness and suitability for utility-scale applications. On-grid installations lead with a 76% share, driven by expanding electricity distribution networks, while building-integrated photovoltaics (BIPV) are gaining traction due to their aesthetic and functional integration into urban architecture.

Thin-film solar cells offer the most promising options for substantially reducing the cost of photovoltaic systems. A multiplicity of options, in terms of materials and devices, are currently being developed worldwide. Some of the leading contenders are amorphous and polycrystalline silicon, compound semiconductor thin films such as CuInSe2-based alloys, and CdTe thin-film solar cells.

Key Takeaways

- Thin Film Solar Cell Market is expected to hit USD 31.3 Bn by 2034, from USD 14.5 Bn in 2024, CAGR 8.0% (2025–2034).

- Cadmium Telluride (CdTe) holds a 45.5% share due to cost-effectiveness, high efficiency, and low production costs, and it is favored for large-scale solar.

- Glass-based thin film solar cells dominate with 57.4% share, valued for durability, efficiency, ideal for residential, commercial use.

- The on-grid segment leads with a 76.3% share, leveraging grid integration for efficient energy distribution and supporting large-scale solar power.

- The utility segment captures a 49.2% share, driven by utility-scale solar projects, rising renewable demand, and government policies.

- APAC holds a 47.9% share, USD 6.9 Bn, boosted by urbanization, industrialization, and strong government backing for solar energy.

By Type

Cadmium Telluride (CdTe) held a dominant market position, capturing more than a 45.5% share of the global thin film solar cell market. This segment’s strong performance can be attributed to its cost-effectiveness and relatively higher efficiency compared to other thin film technologies.

CdTe solar cells offer several advantages, including lower production costs and a shorter payback period for the energy used in their manufacture, making them a preferred choice for large-scale photovoltaic projects.

The demand for CdTe-based solar cells has been primarily driven by their superior performance in lower light conditions, which enables consistent energy generation even on cloudy or overcast days. Additionally, CdTe solar cells are known for their ease of installation and integration into existing building materials, further propelling their adoption across residential and commercial applications.

By Substrate

Glass held a dominant market position, capturing more than a 57.4% share of the thin film solar cell market based on substrate type. This substantial market share is largely due to the material’s durability and effectiveness in protecting photovoltaic cells while allowing optimal light transmission.

Glass substrates are favored for both residential and commercial solar installations because they enhance the longevity and efficiency of solar panels. The preference for glass as a substrate in thin film solar cells is also driven by its ability to withstand harsh environmental conditions, which is crucial for maintaining the performance of solar installations over their operational life.

By Technology

On-grid technology held a dominant market position in the thin film solar cell sector, capturing more than a 76.3% share. This substantial market preference is attributed to the growing integration of solar energy into the main electricity grids, which allows for more efficient energy distribution and utility-scale electricity generation.

On-grid thin film solar systems are particularly favored due to their ability to offset traditional energy consumption and reduce reliance on fossil fuels, aligning with global energy policies aimed at enhancing sustainability.

The widespread adoption of on-grid systems is also supported by governmental incentives, including feed-in tariffs and net metering policies, which have made investments in on-grid solar technology financially attractive for both private and commercial entities.

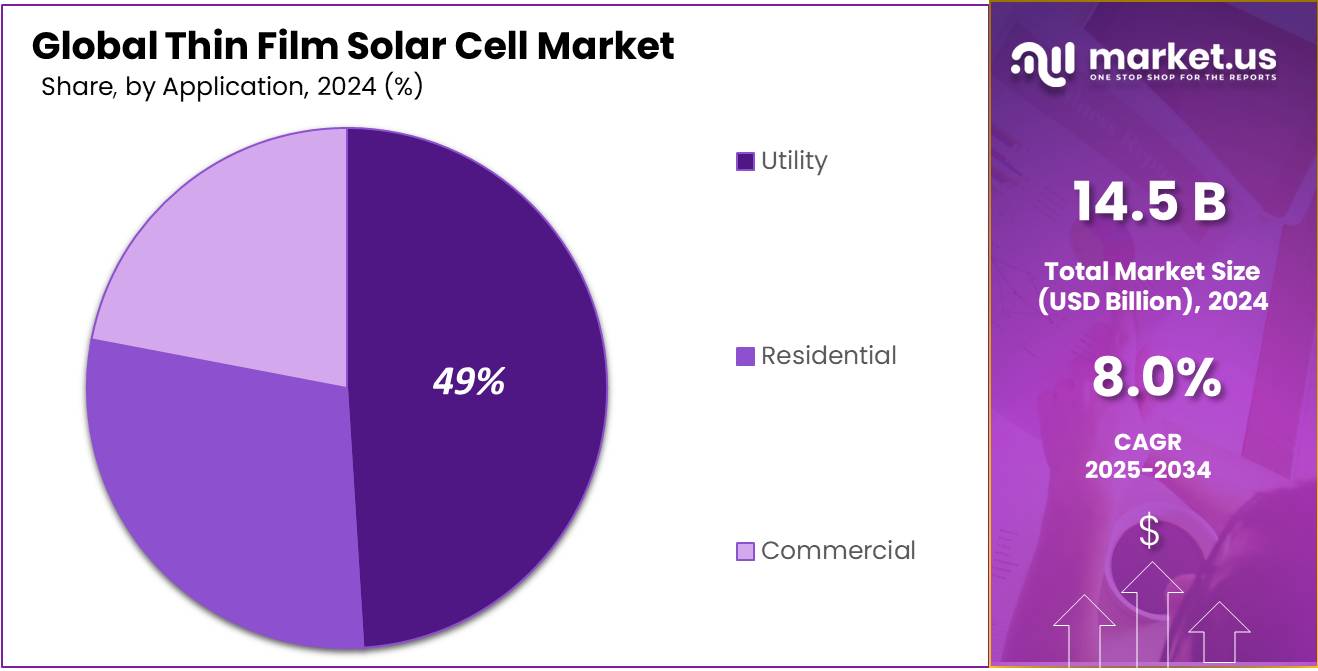

By Application

The Utility segment held a dominant market position in the thin film solar cell market, capturing more than a 49.2% share. This prominence is primarily due to the escalating demand for large-scale renewable energy solutions that utilities can integrate into their existing grids to meet both regulatory requirements and growing consumer demand for green energy.

Utility-scale solar farms utilizing thin film technology benefit from lower installation costs and higher efficiencies over large areas, making them particularly viable for expansive solar projects.

The utility sector’s preference for thin film solar cells is also driven by the adaptability of these technologies to diverse environmental conditions, including areas with variable sunlight exposure. This versatility enhances the appeal of thin film solar cells for utility applications, where consistent performance and reliability are crucial.

Key Market Segments

By Type

- Cadmium Telluride

- Amorphous Thin-Film Silicon

- Copper Indium Gallium Selenide

- Microcrystalline Tandem Cells

- Thin-film Polycrystalline Silicon

- Others

By Substrate

- Plastic

- Metal

- Glass

By Technology

- On-grid

- Off-grid

By Application

- Residential

- Commercial

- Utility

Drivers

Government Incentives Boosting Thin Film Solar Cell Adoption

One major driving factor for the growth of the thin film solar cell market is the robust support from government initiatives around the world. These incentives are designed to make solar energy more accessible and affordable, thereby accelerating the adoption of solar technology across both residential and commercial sectors.

Governments globally are providing a range of financial incentives, such as tax credits, rebates, and feed-in tariffs to encourage the installation of solar energy systems. For example, the United States Department of Energy reported that the Investment Tax Credit (ITC), which offers a 26% tax credit for solar systems on residential and commercial properties, has significantly driven the uptake of solar installations.

In Germany, the Renewable Energy Sources Act (EEG) incentivizes the production of renewable energy by guaranteeing fixed feed-in tariffs for solar power producers for a period of 20 years. This long-term security on returns has led to a noticeable increase in the deployment of solar technologies, including thin film solar cells.

Restraints

Material Scarcity and Cost Challenges

A significant restraint impacting the growth of the thin film solar cell market is the scarcity and cost of critical raw materials used in manufacturing these cells.

Thin film technologies, such as those using cadmium telluride (CdTe) or copper indium gallium selenide (CIGS), depend on rare or limited materials, which can pose challenges in scaling up production without causing an increase in costs.

According to the U.S. Geological Survey, the price fluctuations and limited availability of indium can directly impact the production costs of CIGS solar cells, potentially making them less competitive compared to other photovoltaic technologies.

Opportunity

Expanding Applications in Building-Integrated Photovoltaics (BIPV)

One major growth factor for the thin film solar cell market is the expanding application of these technologies in Building-Integrated Photovoltaics (BIPV). BIPV incorporates photovoltaic materials into building structures such as windows, facades, and roofing, not just as an energy source but also as an integral part of the building envelope.

This dual functionality offers significant advantages in urban architecture, promoting both aesthetic value and energy efficiency. The flexibility and lightweight nature of thin film solar cells make them particularly suitable for BIPV applications.

They can be integrated seamlessly into various building materials, which is a distinct advantage over more rigid traditional solar panels. According to the International Energy Agency (IEA), the global BIPV market is expected to grow substantially, driven by increasing interest in sustainable building practices and the continuous urbanization in emerging economies.

Trends

Rising Demand for Portable and Flexible Energy Solutions

Thin film technology’s inherent flexibility and lightweight characteristics make it an ideal candidate for portable energy applications, such as powering electronic devices, emergency equipment, and temporary installations where traditional energy sources are impractical.

As global mobility increases, the demand for devices and systems that can operate independently of fixed power sources continues to grow. Thin film solar cells are increasingly being integrated into consumer electronics, outdoor gear, and even wearable technology, providing a continuous power supply in a variety of settings.

According to the International Renewable Energy Agency (IRENA), the global market for portable solar chargers is projected to expand rapidly, driven by the proliferation of mobile devices and the growing trend toward sustainability among consumers.

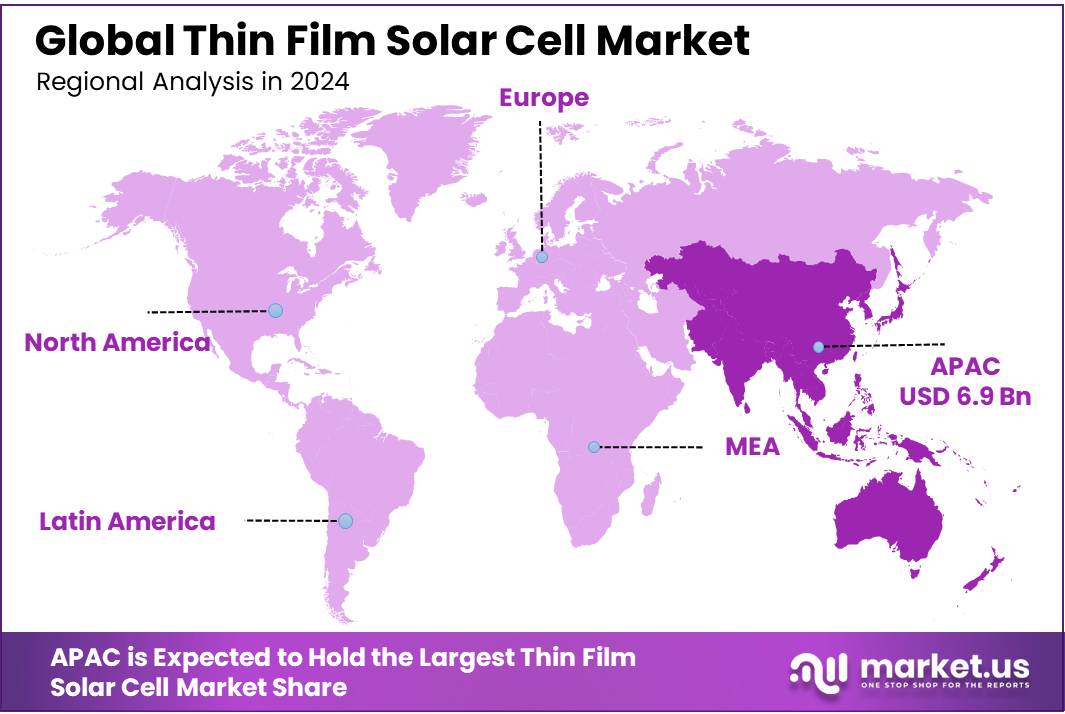

Regional Analysis

The Asia-Pacific (APAC) region holds a commanding position in the thin film solar cell market, accounting for 47.9% of the global market with a valuation of approximately USD 6.9 billion.

This dominance is primarily driven by the rapid industrialization and urbanization in major economies such as China, India, and Japan, where there is a significant shift toward renewable energy sources to meet increasing energy demands and reduce carbon emissions.

China leads the APAC market, benefiting from strong governmental support through subsidies and initiatives aimed at enhancing the country’s solar energy capacity. India follows, with its National Solar Mission aiming to achieve 100 GW of solar energy.

Japan also contributes notably to the APAC market’s growth with its well-established technological advancements and substantial investments in solar energy research and development.

The strategic governmental policies across these leading APAC nations, combined with advancements in manufacturing processes and the decreasing cost of solar technologies, ensure that the APAC region not only retains its leadership position but also drives the future expansion of the global thin film solar cell market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

- ALPS Technology Inc. is recognized in the thin film solar cell market for its innovative approaches in manufacturing high-efficiency photovoltaic modules. The company focuses on leveraging advanced materials and proprietary technology to enhance the performance and durability of its solar products.

- Ascent Solar Technologies Inc. specializes in the production of photovoltaic modules based on CIGS thin film solar technology. Known for its lightweight, flexible solar panels, Ascent Solar caters to diverse markets, including consumer electronics, aerospace, and emergency power solutions.

- Canadian Solar stands out as a leading manufacturer of solar photovoltaic modules and a provider of solar energy solutions. While primarily known for its traditional solar panels, Canadian Solar has also made significant advancements in thin film solar cell technology.

- Exeger Operations AB innovates with its unique dye-sensitized solar cell technology, designed to enhance indoor and outdoor light harvesting. The company’s thin film solar cells are tailored for integration into consumer electronics and other products requiring low light energy solutions.

- First Solar is a prominent player in the thin film solar cell market, known for its advanced thin film solar panels made primarily from cadmium telluride (CdTe). With a strong focus on sustainable manufacturing processes and end-of-life panel recycling, First Solar aims to minimize environmental impact while providing substantial cost efficiencies.

Top Key Players in the Market

- ALPS Technology Inc.

- Ascent Solar Technologies Inc.

- Canadian Solar.

- Exeger Operations AB

- First Solar

- Folsom AG

- Fujikura Europe Ltd.

- G24 Power Ltd.

- Global Solar, Inc.

- Greatcell

- Green Brilliance Renewable Energy

- Hanergy mobile energy

- Hankey Asia Ltd.

- Kaneka corporation

- Konica Minolta Sensing Europe B.V.

- Merck KGaA

- MiaSole Hi-Tech Corp.

- Mitsubishi Heavy Industries

- Oxford PV

- Peccell Technologies, Inc.

- Ricoh

- Sharp Corporation

- Shunfeng International Clean Energy

- Solaris Technology Industry, Inc.

- Solaronix SA

- Sony Corporation

- SUNG

- Suniva Inc

- SunPower Corporation

- Tata Power Solar Systems Ltd.

- Trina Solar

- Trony Solar.

- Xunlight Kunshan Co. Ltd.

Recent Developments

- In April 2024, Ascent Solar Technologies Inc. announced a partnership with the University of Stuttgart’s Institute for Building Energetics to develop lightweight, flexible CIGS (copper indium gallium selenide) thin-film solar modules for building-integrated photovoltaics (BIPV).

- In May 2024, First Solar was selected by the U.S. Department of Energy (DOE) for a USD 71 Mn investment to advance CdTe thin film solar photovoltaics, focusing on improving efficiency and reducing costs.

- In May 2024, Canadian Solar secured a USD 250 Mn investment from BlackRock to expand its thin film solar module production, focusing on N-type TOPCon and CdTe technologies.

Report Scope

Report Features Description Market Value (2024) USD 14.5 Billion Forecast Revenue (2034) USD 31.3 Billion CAGR (2025-2034) 8.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Cadmium Telluride, Amorphous Thin-film Silicon, Copper Indium Gallium Selenide, Microcrystalline Tandem Cells, Thin-film Polycrystalline Silicon, Others), By Substrate (Plastic, Metal, Glass), By Technology (On-grid, Off-grid), By Application (Residential, Commercial, Utility) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ALPS Technology Inc., Ascent Solar Technologies Inc., Canadian Solar., Exeger Operations AB, First Solar, Folsom AG, Fujikura Europe Ltd., G24 Power Ltd., Global Solar, Inc., Greatcell, Green Brilliance Renewable Energy, Hanergy mobile energy, Hankey Asia Ltd., Kaneka corporation, Konica Minolta Sensing Europe B.V., Merck KGaA, MiaSole Hi-Tech Corp., Mitsubishi Heavy Industries, Oxford PV, Peccell Technologies, Inc., Ricoh, Sharp Corporation, Shunfeng International Clean Energy, Solaris Technology Industry, Inc., Solaronix SA, Sony Corporation, SUNG, Suniva Inc, SunPower Corporation, Tata Power Solar Systems Ltd., Trina Solar, Trony Solar., Xunlight Kunshan Co. Ltd. Customization Scope Customization for segments, region/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited Users and Printable PDF)  Thin Film Solar Cell MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Thin Film Solar Cell MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ALPS Technology Inc.

- Ascent Solar Technologies Inc.

- Canadian Solar.

- Exeger Operations AB

- First Solar

- Folsom AG

- Fujikura Europe Ltd.

- G24 Power Ltd.

- Global Solar, Inc.

- Greatcell

- Green Brilliance Renewable Energy

- Hanergy mobile energy

- Hankey Asia Ltd.

- Kaneka corporation

- Konica Minolta Sensing Europe B.V.

- Merck KGaA

- MiaSole Hi-Tech Corp.

- Mitsubishi Heavy Industries

- Oxford PV

- Peccell Technologies, Inc.

- Ricoh

- Sharp Corporation

- Shunfeng International Clean Energy

- Solaris Technology Industry, Inc.

- Solaronix SA

- Sony Corporation

- SUNG

- Suniva Inc

- SunPower Corporation

- Tata Power Solar Systems Ltd.

- Trina Solar

- Trony Solar.

- Xunlight Kunshan Co. Ltd.