Global Cable Accessories Market Size, Share, And Business Benefits By Installation (Overhead Cable Accessories, Underground Cable Accessories, Submarine Cable Accessories), By Voltage (Low Voltage Cable Accessories, Medium Voltage Cable Accessories, High Voltage Cable Accessories), By End-use (Energy and Power, Infrastructure and Construction, Oil and Gas, Telecommunication, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 142818

- Number of Pages: 215

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

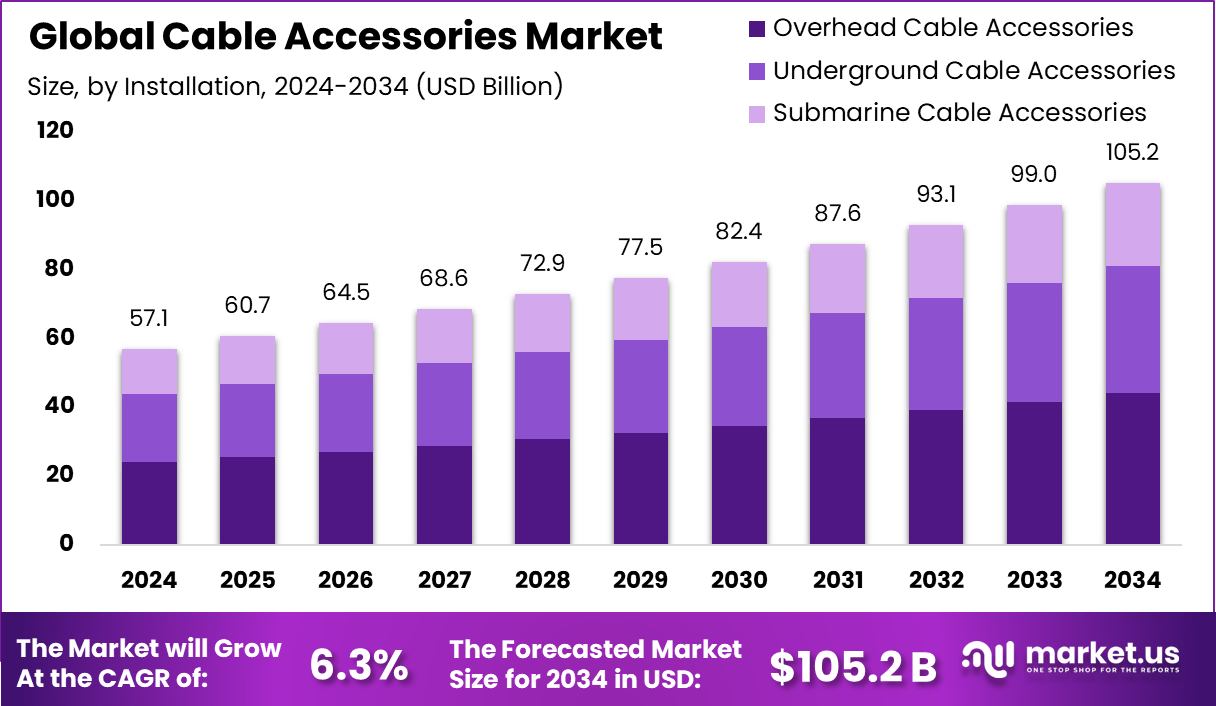

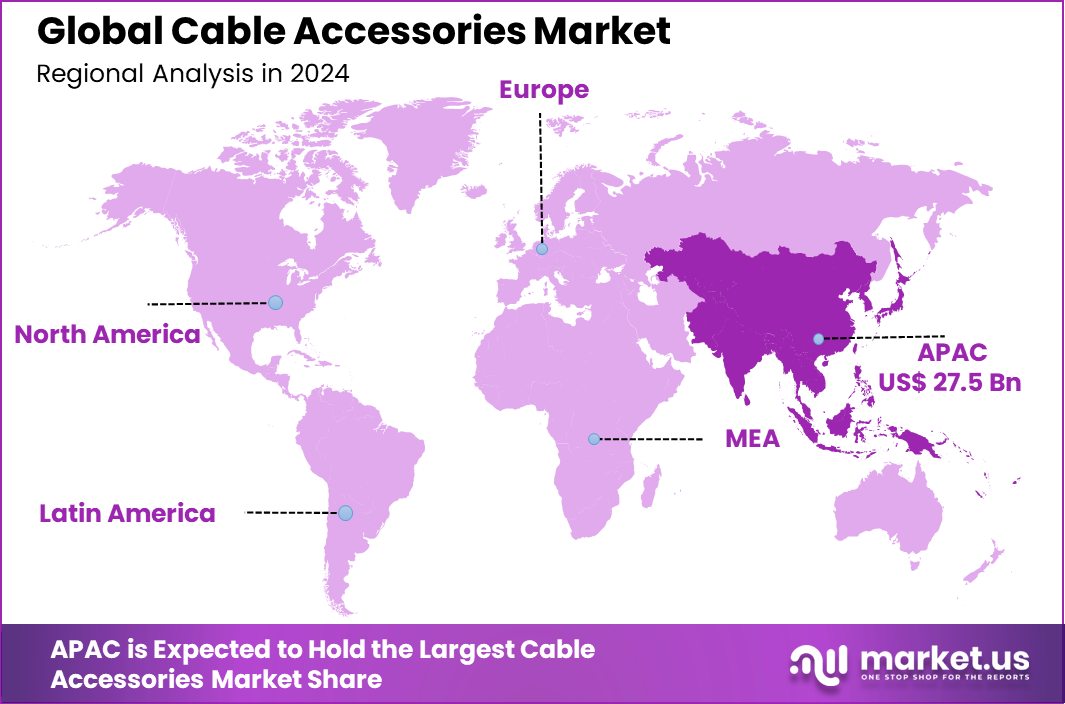

Global Cable Accessories Market is expected to be worth around USD 105.2 billion by 2034, up from USD 57.1 billion in 2024, and grow at a CAGR of 6.3% from 2025 to 2034. The Cable Accessories Market in Asia-Pacific dominates with a 48.30% share, valued impressively at USD 27.5 billion.

Cable accessories are integral components used to connect and secure electrical cables in various applications, ensuring reliable and efficient power distribution. These accessories include joints, terminations, and other hardware essential for the installation, operation, and maintenance of cable systems. The Cable Accessories Market encompasses all elements involved in manufacturing, distributing, and installing these vital parts.

One significant growth factor in the cable accessories market is the increasing demand for electricity globally, driven by rapid urbanization and industrialization. This demand promotes the expansion of power distribution networks, necessitating robust, efficient cable accessories, especially in emerging economies. The market benefits from technological advancements that improve the reliability and efficiency of power transmission systems.

The opportunity for market expansion is further enhanced by the growing focus on renewable energy sources, requiring extensive and updated grid infrastructure. Cable accessories are crucial in connecting and maintaining the integrity of networks that integrate renewable energy sources with traditional grids.

The secured $265 million in Islamic financing underscores a strategic initiative to boost production capacity and tap into new markets. An additional $65 million allocated for specific expansion plans points to targeted growth areas, likely emphasizing regions with rapid infrastructure development.

Specializing in premium high-voltage cable accessories from 66 to 220 kV and EHV cable systems up to 400 kV, the company is well-positioned within the market to cater to the high-end segment, where precision and reliability are paramount. This specialization in higher voltage ranges addresses the growing complexity of modern energy systems and the global shift toward more extensive and capable grid networks.

Key Takeaways

- Global Cable Accessories Market is expected to be worth around USD 105.2 billion by 2034, up from USD 57.1 billion in 2024, and grow at a CAGR of 6.3% from 2025 to 2034.

- Underground cable accessories hold a significant 53.20% share of the market, indicating robust demand for secure installations.

- Low voltage cable accessories command 42.30% of the market, essential for residential and light commercial applications.

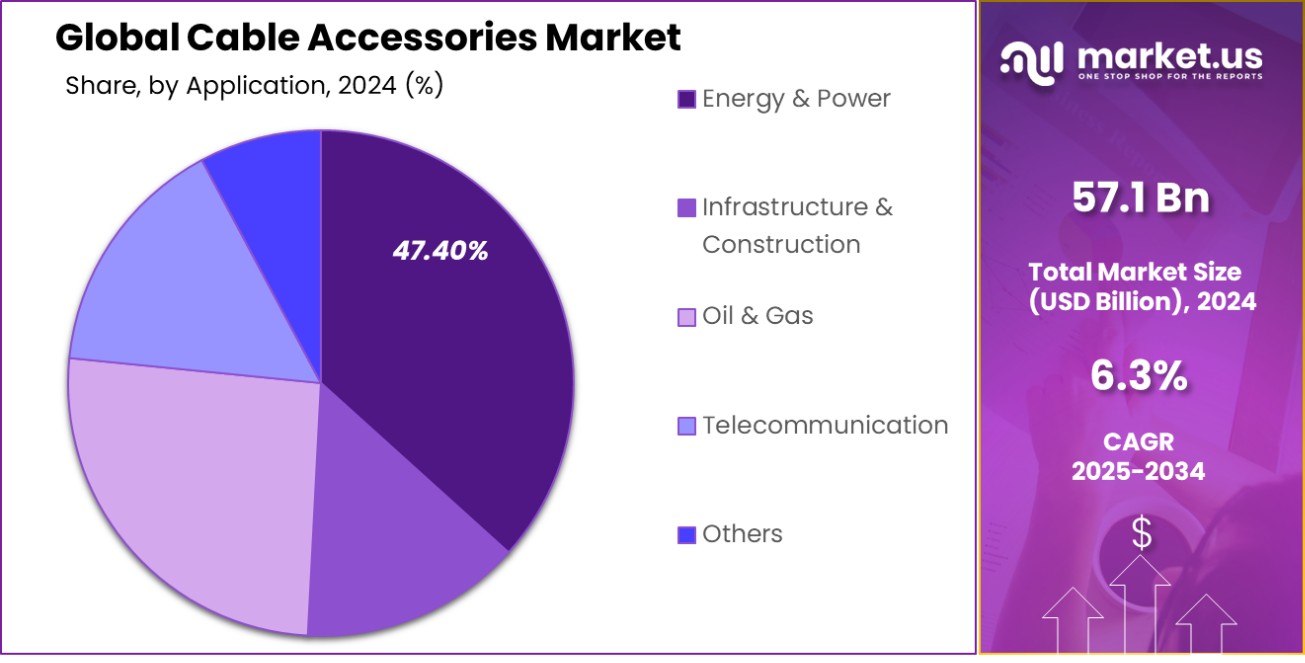

- In the cable accessories market, energy and power sectors dominate, contributing 47.40% to overall demand.

- Holding 48.30% of the market, Asia-Pacific leads in Cable Accessories, with revenues reaching USD 27.5 billion.

By Installation Analysis

Underground Cable Accessories hold 53.20% of the market by installation type.

In 2024, Underground Cable Accessories held a dominant market position in the By Installation segment of the Cable Accessories Market, with a 53.20% share. This substantial market share reflects the increasing reliance on underground cable systems, which are essential for ensuring the reliability and safety of electrical transmission in densely populated or environmentally sensitive areas.

The preference for underground installations is driven by their lower susceptibility to environmental hazards and minimal physical footprint, making them ideal for urban settings where space is at a premium and aesthetic concerns are significant.

The segment’s growth is further supported by extensive investments in infrastructure development projects across the globe, including upgrades to aging power grids and expansions in new residential and commercial areas. Additionally, regulatory policies favoring underground cabling to mitigate risks such as electrical hazards and service interruptions have bolstered the demand for underground cable accessories.

As utilities and construction sectors continue to emphasize resilience and safety in electrical transmission systems, the market for underground cable accessories is expected to maintain its leading position, underscored by a strong push towards more secure and visually unobtrusive power solutions.

By Voltage Analysis

Low Voltage Cable Accessories account for 42.30% of the market by voltage.

In 2024, Low Voltage Cable Accessories held a dominant market position in the By Voltage segment of the Cable Accessories Market, with a 42.30% share. This leadership stems from the widespread use of low-voltage systems in residential and commercial buildings, where they are essential for distributing power safely and efficiently.

Low voltage cable accessories are crucial for applications that involve electrical wiring in homes, office buildings, and industrial units, catering to everyday power needs and electronic appliances.

The prominence of low voltage cable accessories in the market is also due to their critical role in the renewable energy sector. Solar power systems, for instance, often utilize low voltage connections to link panels to inverters, highlighting the segment’s adaptability to emerging energy technologies. Moreover, the growing emphasis on energy efficiency and safe electrical practices has spurred the adoption of advanced low voltage accessories designed to minimize power losses and enhance the reliability of electrical systems.

As urbanization continues and the push for sustainable building practices intensifies, the demand for efficient and reliable low voltage cable accessories is expected to remain robust. This will likely ensure sustained market growth, driven by both the increasing electrical needs of modern urban environments and the ongoing enhancements in cable accessory technology.

By End-use Analysis

Energy and Power is the largest end-use sector at 47.40%.

In 2024, Energy and Power held a dominant market position in the by-end-use segment of the Cable Accessories Market, with a 47.40% share. This commanding presence is largely attributable to the global surge in energy consumption and the corresponding expansion of both traditional and renewable energy infrastructure. Cable accessories play a pivotal role in these developments, ensuring efficient, reliable, and safe energy distribution across vast networks.

The robust position of this segment is supported by significant investments in power generation projects, grid modernization initiatives, and the upgrading of aging infrastructure to meet the increasing electrical demands of growing populations. As nations aim to enhance their energy security and transition toward sustainable energy sources, the demand for high-performance cable accessories that can handle complex and high-load environments continues to rise.

Furthermore, the push for renewable energy sources, such as wind and solar, which require extensive and often intricate cable networks, has notably driven the adoption of advanced cable accessories within this sector. The continued focus on optimizing energy systems for better performance and reduced environmental impact positions the Energy and Power segment to maintain its leadership in the Cable Accessories Market moving forward.

Key Market Segments

By Installation

- Overhead Cable Accessories

- Underground Cable Accessories

- Submarine Cable Accessories

By Voltage

- Low Voltage Cable Accessories

- Medium Voltage Cable Accessories

- High Voltage Cable Accessories

By End-use

- Energy and Power

- Infrastructure and Construction

- Oil and Gas

- Telecommunication

- Others

Driving Factors

Increasing Electrification in Emerging Economies

As emerging economies continue to develop, there is a significant rise in the demand for electrical infrastructure to support industrial growth, urbanization, and improved living standards. This increase in electrification efforts is a major driving factor for the Cable Accessories Market.

The expansion of power grids, along with new residential and commercial developments, requires extensive networks of cables and corresponding accessories to ensure effective power distribution and system reliability.

Additionally, governments in these regions are investing heavily in upgrading their existing electrical systems to enhance efficiency and reduce power loss, further stimulating the demand for a variety of cable accessories. This ongoing development is crucial for supporting economic growth and sustainability in emerging markets.

Restraining Factors

High Installation Costs Limit Market Expansion

One of the primary restraining factors in the Cable Accessories Market is the high cost associated with the installation of advanced cable systems. The initial outlay for quality cable accessories, combined with the expenses of skilled labor for installation and maintenance, can be prohibitively expensive.

This is particularly impactful in developing countries and regions with limited financial resources, where budget constraints may lead to the postponement or cancellation of upgrades to electrical infrastructure.

Additionally, the complexity of integrating these accessories into existing systems often requires additional investments in training and technology. These financial barriers not only slow down the pace of modernization efforts but also restrict the accessibility of advanced cable solutions in economically challenged areas.

Growth Opportunity

Expansion of Renewable Energy Projects Drives Growth

The ongoing global shift towards renewable energy presents significant growth opportunities for the Cable Accessories Market. As countries increasingly invest in solar, wind, and other renewable energy sources to meet their carbon reduction targets, the need for robust cable management systems escalates.

Cable accessories are critical in ensuring the efficient and reliable operation of renewable energy installations. They help manage and protect the intricate wiring and connections essential for harnessing and distributing renewable energy.

Furthermore, the variability and decentralized nature of renewable energy sources require advanced cable accessories that can withstand diverse environmental conditions and maintain energy flow. This trend not only supports sustainable development but also drives continual innovation and demand in the cable accessories sector.

Latest Trends

Smart Grid Technology Adoption Fuels Market Trends

The adoption of smart grid technology is a leading trend in the Cable Accessories Market. Smart grids utilize digital communications technology to manage and distribute electricity more efficiently and reliably. This technology requires advanced cable accessories that can handle increased data flows and connectivity demands.

As utilities aim to improve grid management and accommodate the integration of renewable energy sources, the demand for intelligent cable accessories equipped with sensors and monitoring systems is rising.

These components are essential for real-time data transmission and help in predictive maintenance, enhancing grid reliability and performance. The shift toward smart grids represents a significant transformation in the power sector, pushing the Cable Accessories Market towards more innovative and technologically advanced solutions.

Regional Analysis

In the Asia-Pacific, the Cable Accessories Market captures a commanding 48.30% share, amounting to USD 27.5 billion.

In the global Cable Accessories Market, the Asia-Pacific region stands out as the most dominant, holding a significant 48.30% share and valued at USD 27.5 billion. This dominance is primarily driven by rapid industrialization, urbanization, and extensive infrastructure development projects across major economies such as China, India, and Southeast Asia.

The region’s commitment to expanding and upgrading its power distribution networks to meet the growing industrial and residential demand for electricity fuels the demand for cable accessories.

In contrast, North America and Europe also show substantial market activity, focusing on upgrading aging power infrastructure and integrating renewable energy sources. These regions emphasize enhancing grid reliability and efficiency with advanced cable accessories.

Meanwhile, the Middle East & Africa, and Latin America are experiencing gradual growth. These regions are increasingly investing in new energy projects and modernizing their power infrastructure, which presents potential growth opportunities for the cable accessories market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global Cable Accessories Market saw significant contributions from key players that shaped industry dynamics, notably ABB Ltd., Bahra Advanced Cable Manufacture Co. Ltd., Brugg Group, Caledonian Cables Ltd., Dubai Cable Company, and Elsewedy Electric. Each of these companies brought unique strengths to the market, driving innovation and competition.

ABB Ltd., a powerhouse in technology and automation, continued to lead with its high-quality cable accessories that cater to a variety of industrial, commercial, and residential applications. The company’s focus on integrating digital technology into its offerings, particularly for smart grids, positioned it at the forefront of market trends.

Bahra Advanced Cable Manufacture Co. Ltd. made significant strides by focusing on the Middle East market, providing tailored solutions that meet the extreme environmental conditions of the region. This strategic focus on region-specific needs helped them carve out a significant market share.

Brugg Group, renowned for its high-performance cable systems, remained a key player in Europe, capitalizing on the continent’s push toward renewable energy and the modernization of power grids. Their innovative, durable products have been pivotal in complex installations involving high voltages and long distances.

Caledonian Cables Ltd. offered a range of versatile cable accessories that supported the telecommunications and energy sectors, demonstrating adaptability and responsiveness to the evolving market demands, especially in the UK and Europe.

Dubai Cable Company (Ducab) and Elsewedy Electric, both rooted in emerging markets, capitalized on regional growth opportunities. Ducab’s strategic investments in expanding its product range and Elsewedy’s focus on energy solutions across Africa helped both companies enhance their presence and meet the increasing demands of developing economies.

Top Key Players in the Market

- ABB Ltd.

- Bahra Advanced Cable Manufacture Co. Ltd.

- Brugg Group

- Caledonian Cables Ltd.

- Dubai Cable Company

- Elsewedy Electric

- Furukawa Electric Co., Ltd

- Hebei New Baofeng Wire & Cable Co., Ltd.

- Ls Cable & System Ltd.

- Nexans S.A.

- Nkt A/S

- Prysmian Group

- Sumitomo Electric Industries, Ltd.

- Tele-Fonika Kable Group

Recent Developments

- In March 2025, ABB completed the acquisition of Siemens’s wiring Accessories business in China, enhancing its market reach and complementing its smart building technologies portfolio.

- In April 2024, Prysmian Group, a leading worldwide cable manufacturer, successfully acquired Encore Wire, a prominent electrical building wire and cable producer based in Texas. This strategic acquisition enhances Prysmian’s foothold in North America, significantly expanding its product offerings and market reach. The move aligns with Prysmian’s aggressive growth plans in the commercial, industrial, and residential sectors, boosting its manufacturing capabilities and complementing its existing operations.

- In May 2024, ABB has partnered with Niedax Group, a top international provider of cable management solutions, to form a new joint venture. This collaboration is aimed at addressing the surging demand for cable tray systems across North America. The joint venture strategically positions both companies to capitalize on the growing market needs and expand their operational footprint in the region.

Report Scope

Report Features Description Market Value (2024) USD 57.1 Billion Forecast Revenue (2034) USD 105.2 Billion CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Installation (Overhead Cable Accessories, Underground Cable Accessories, Submarine Cable Accessories), By Voltage (Low Voltage Cable Accessories, Medium Voltage Cable Accessories, High Voltage Cable Accessories), By End-use (Energy and Power, Infrastructure and Construction, Oil and Gas, Telecommunication, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ABB Ltd., Bahra Advanced Cable Manufacture Co. Ltd., Brugg Group, Caledonian Cables Ltd., Dubai Cable Company, Elsewedy Electric, Furukawa Electric Co., Ltd, Hebei New Baofeng Wire & Cable Co., Ltd., Ls Cable & System Ltd., Nexans S.A., Nkt A/S, Prysmian Group, Sumitomo Electric Industries, Ltd., Tele-Fonika Kable Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ABB Ltd.

- Bahra Advanced Cable Manufacture Co. Ltd.

- Brugg Group

- Caledonian Cables Ltd.

- Dubai Cable Company

- Elsewedy Electric

- Furukawa Electric Co., Ltd

- Hebei New Baofeng Wire & Cable Co., Ltd.

- Ls Cable & System Ltd.

- Nexans S.A.

- Nkt A/S

- Prysmian Group

- Sumitomo Electric Industries, Ltd.

- Tele-Fonika Kable Group