Global Alternative Energy Market Size, Share, Growth Analysis Report By Type (Hydroelectric Power, Solar Energy, Wind Power, Bioenergy, Geothermal Energy, Others), By End-use ( Industrial, Residential, Commercial) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143499

- Number of Pages: 381

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

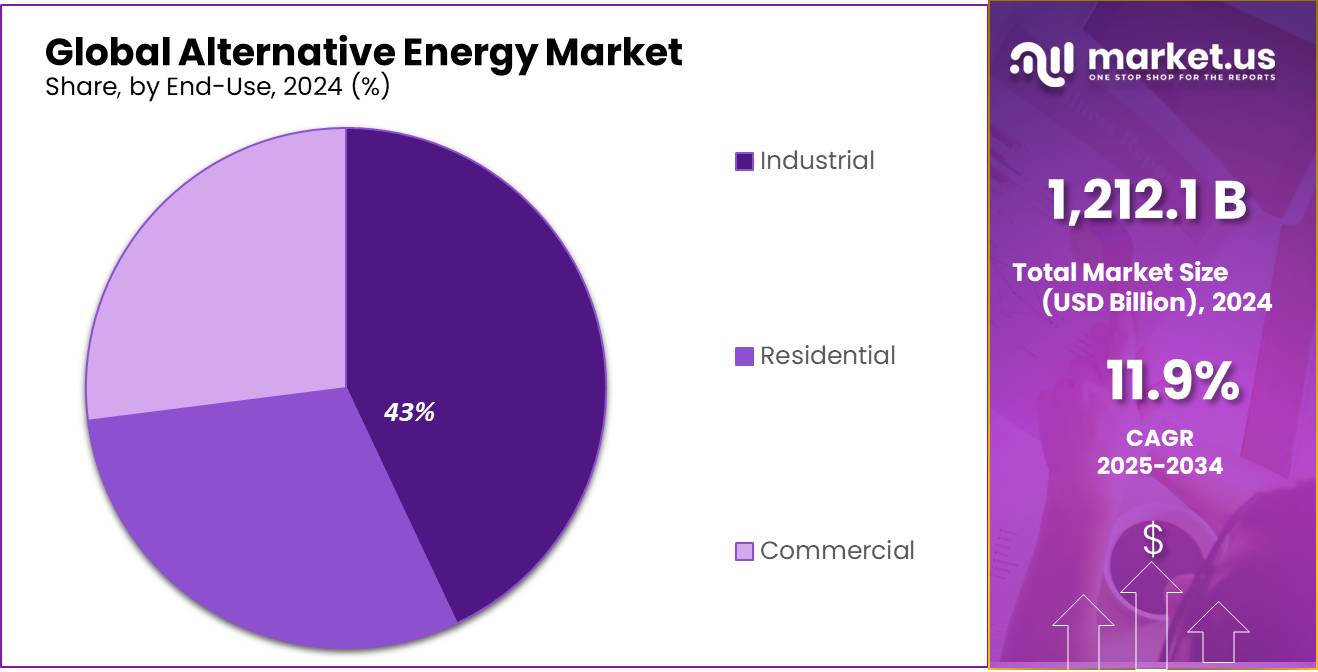

The Global Alternative Energy Market size is expected to be worth around USD 3731.1 Bn by 2034, from USD 1212.1 Bn in 2024, growing at a CAGR of 11.9% during the forecast period from 2025 to 2034.

The alternative energy sector encompasses a diverse range of energy sources that differ from traditional fossil fuels, primarily focusing on renewable and less environmentally damaging options such as solar, wind, hydroelectric, and geothermal power. The push towards alternative energy sources has gained significant momentum, driven by the global need to reduce greenhouse gas emissions and mitigate climate change. As of 2025, this industry is witnessing transformative growth, supported by technological advancements and increasing societal awareness regarding sustainable practices.

Solar and wind energy lead the charge, with solar capacity worldwide exceeding 700 gigawatts and wind energy reaching around 650 gigawatts due to technological improvements and cost reductions. Hydroelectric power continues to contribute significantly to global energy supply, providing stable, reliable, and renewable energy across various continents.

Several factors drive the adoption of alternative energy. Primarily, the global commitment to the Paris Agreement has prompted countries to decrease their carbon footprints, fostering a conducive environment for renewable energy investments. Technological advancements have significantly reduced the cost of renewable energy technologies, making them more competitive with conventional energy sources. For example, the cost of solar photovoltaic (PV) installations has dropped by over 80% since 2010.

Government policies play a crucial role in this transition. For instance, the European Union’s Green Deal aims to make Europe climate-neutral by 2050, catalyzing substantial investments in the renewable sector. In the United States, federal tax credits for solar and wind installations have been extended through the end of the decade, providing a stable policy environment that encourages continued growth in the sector.

The future of alternative energy appears promising, with numerous growth opportunities on the horizon. The ongoing development of battery storage technologies is critical, as it addresses the variability of wind and solar energies and ensures a steady supply of power. Investment in this technology is expected to rise, with projections suggesting the market could reach $13 billion by 2030.

Key Takeaways

- Alternative Energy Market size is expected to be worth around USD 3731.1 Bn by 2034, from USD 1212.1 Bn in 2024, growing at a CAGR of 11.9%.

- Hydroelectric Power held a dominant market position, capturing more than a 47.30% share of the alternative energy market.

- Industrial sector held a dominant market position, capturing more than a 43.50% share of the alternative energy market.

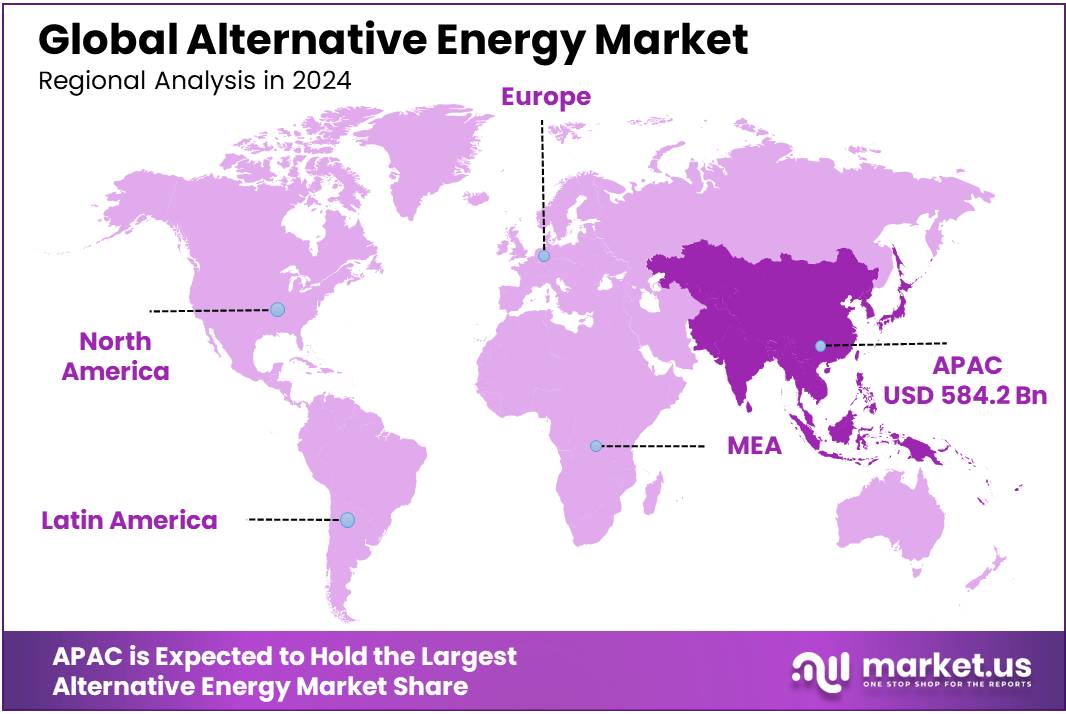

- Asia-Pacific (APAC) region held a dominant position in the global alternative energy market, accounting for 48.20% of the total market share, valued at approximately USD 584.2 billion.

By Type

Hydroelectric Power Dominates with 47.30% in 2024, Leading the Alternative Energy Market

In 2024, Hydroelectric Power held a dominant market position, capturing more than a 47.30% share of the alternative energy market. This substantial share is attributed to the long-standing infrastructure and capacity of hydroelectric power plants, which continue to provide a significant portion of the world’s renewable energy supply. Over the past few years, investments in hydroelectric projects have remained steady, allowing them to maintain their leadership in the sector. Hydroelectric energy offers a reliable and consistent power source, benefiting from economies of scale and proven technology.

Moving forward into 2025, this segment is expected to maintain its strong position, with slight growth anticipated in certain regions driven by increased government incentives for renewable energy and further investments in upgrading older plants. However, the growth rate in this segment may slow as newer technologies, such as solar and wind, begin to capture more attention and investment in the alternative energy space. Despite these shifts, hydroelectric power will likely remain a cornerstone of global renewable energy production for years to come.

By End-use

Industrial Sector Leads with 43.50% Share in 2024 in the Alternative Energy Market

In 2024, the Industrial sector held a dominant market position, capturing more than a 43.50% share of the alternative energy market. This segment’s significant share reflects the growing trend of industries shifting towards more sustainable energy sources to meet both regulatory requirements and environmental goals. Many industries, including manufacturing, chemical production, and mining, have been increasingly adopting renewable energy solutions such as solar, wind, and bioenergy to reduce their carbon footprint and improve operational efficiency.

In 2025, the Industrial sector is expected to continue its lead, with further adoption of alternative energy solutions driven by stricter environmental regulations and a push for greener, more cost-effective energy sources. The ongoing trend of industrial companies investing in energy-efficient technologies and renewable energy projects is likely to sustain the sector’s strong position, although competition from other end-use segments, such as residential and commercial, could start to grow as these sectors also become more energy-conscious. Despite these shifts, the Industrial sector will remain a key driver of the alternative energy market for the foreseeable future.

Key Market Segments

By Type

- Hydroelectric Power

- Solar Energy

- Wind Power

- Bioenergy

- Geothermal Energy

- Others

By End-use

- Industrial

- Residential

- Commercial

Drivers

Government Initiatives and Incentives Driving Growth in the Alternative Energy Sector

One of the major driving factors behind the growth of the alternative energy market is the increasing role of government initiatives and incentives aimed at reducing carbon emissions and promoting the use of renewable energy sources. Governments across the globe have set ambitious targets for transitioning from fossil fuels to more sustainable forms of energy. This support comes in the form of subsidies, tax incentives, grants, and favorable policies that encourage businesses and industries to adopt alternative energy solutions.

For example, in the United States, the Biden Administration has set a goal to reduce the nation’s greenhouse gas emissions by 50% to 52% below 2005 levels by 2030. This is part of a broader push to achieve a net-zero economy by 2050. To support this transition, the government is implementing programs such as the Clean Energy Tax Credit, which provides financial benefits to businesses that invest in renewable energy infrastructure. According to the U.S. Department of Energy, the country has seen a surge in solar and wind energy installations, with the renewable energy sector providing nearly 20% of the nation’s electricity by the end of 2022.

Similarly, in Europe, the European Union has committed to reducing its emissions by at least 55% by 2030 and achieving net-zero emissions by 2050 under its European Green Deal. These policies have resulted in increased funding for renewable energy projects and greater investments in technologies like wind, solar, and bioenergy. A report from the European Commission indicates that renewable energy contributed 22% of the EU’s total energy consumption in 2020, with renewable electricity accounting for 39% of the total electricity production.

Government support is not just about policy but also includes financial backing for research and development, enabling technological advancements in energy storage and efficiency. These efforts, combined with the strong demand for cleaner energy solutions from the private sector, are creating a solid foundation for the continued growth of the alternative energy market.

Restraints

High Initial Costs and Financial Barriers Hindering Alternative Energy Adoption

One major restraining factor for the growth of the alternative energy market is the high initial costs associated with renewable energy infrastructure. Despite the long-term savings and environmental benefits, many businesses and industries, including those in the food sector, face significant financial challenges when transitioning to alternative energy solutions. The upfront investment required for installing solar panels, wind turbines, or bioenergy facilities can be a substantial barrier, especially for small and medium-sized enterprises (SMEs).

For example, the installation of commercial-scale solar power systems can cost between $2,000 to $3,000 per installed kilowatt, depending on location and system size. According to the U.S. Department of Energy, the average cost of installing solar energy systems has been decreasing over the past decade, but the initial investment still remains a barrier for many food organizations and other industries. This high capital requirement often deters businesses from making the switch to renewable energy, as it may take several years to recover the upfront costs through energy savings.

In the food industry, where margins can be tight, this financial burden is even more pronounced. Large food manufacturers such as Nestlé and Unilever have made significant strides in renewable energy adoption, with Nestlé aiming to achieve net-zero emissions by 2050. However, even these large companies face challenges in scaling up their use of alternative energy across their operations. For example, Nestlé has invested in solar and wind power projects, but it still faces hurdles in many regions due to the financial complexity and the high capital needed for full implementation.

Despite government incentives like tax credits or grants for renewable energy adoption, these programs often do not fully cover the upfront costs, which means that companies must still rely on significant investment from their own funds or through loans. As a result, the financial barrier remains a key restraining factor for broader adoption of alternative energy solutions, especially in industries with tighter budgets like food production.

Opportunity

Expansion of Renewable Energy in Food Industry as a Growth Opportunity

One major growth opportunity for the alternative energy market lies in the expanding adoption of renewable energy within the food industry. As food production accounts for a significant portion of global greenhouse gas emissions, many food companies are increasingly looking to renewable energy solutions to reduce their environmental footprint and achieve sustainability targets. With increasing demand for transparency and sustainability from consumers, many leading food organizations are turning to alternative energy to meet both regulatory standards and consumer expectations.

For instance, Unilever, one of the world’s largest food and beverage companies, has committed to sourcing 100% of its energy from renewable sources by 2030. This ambitious goal is part of Unilever’s larger effort to reduce its carbon footprint and become more sustainable across its global operations. According to the company’s sustainability report, Unilever had already achieved 60% renewable energy usage by 2020, with plans to scale this up rapidly in the coming years. Similarly, Nestlé is also accelerating its efforts to shift towards renewable energy, with a goal to reach net-zero emissions by 2050. The company has invested in solar and wind energy projects across its global network, driving both environmental and cost-saving benefits.

The rise of green energy technology, combined with strong government incentives, offers food companies a growing opportunity to further transition to renewable sources. Governments around the world are offering subsidies, tax incentives, and grants to encourage businesses to adopt solar, wind, and bioenergy solutions. For example, the U.S. Department of Energy’s renewable energy initiatives, such as the Clean Energy Tax Credit, provide businesses with tax reductions for adopting renewable energy solutions. This makes it financially more feasible for companies to integrate these technologies.

Trends

Increasing Adoption of Solar and Wind Energy in the Food Industry

A major trend in the alternative energy market is the growing adoption of solar and wind energy solutions by companies, especially in the food industry. As businesses face increasing pressure to meet sustainability goals and reduce their carbon footprint, renewable energy sources like solar and wind are becoming essential to their operations. The food industry, known for its high energy consumption in manufacturing, storage, and distribution, is among the leaders in transitioning to renewable energy to not only lower environmental impact but also reduce operational costs.

A prominent example is General Mills, one of the largest food manufacturers globally, which has committed to achieving 100% renewable energy usage across its global operations by 2030. According to the company’s 2020 sustainability report, General Mills had already reached 39% renewable energy usage, primarily from solar and wind projects. By continuing to scale these projects, they aim to significantly cut their carbon emissions and align with global climate goals.

Another major player, Danone, has set similar goals, with the company’s “One Planet. One Health” vision emphasizing its commitment to becoming carbon neutral by 2050. In 2021, Danone announced that it had already achieved a 75% reduction in carbon emissions across its operations, largely due to the integration of renewable energy sources like wind and solar into its manufacturing processes. The company continues to expand its renewable energy efforts, leveraging government incentives and partnerships to finance solar and wind projects across its plants worldwide.

The growing trend is further supported by government initiatives that make renewable energy adoption more financially feasible. For instance, in the United States, the Biden administration has been focusing on increasing clean energy investments, with the Department of Energy offering tax credits and funding programs to businesses that install renewable energy systems. This encourages even smaller food companies to consider solar and wind power as viable energy solutions for their operations.

Regional Analysis

In 2024, the Asia-Pacific (APAC) region held a dominant position in the global alternative energy market, accounting for 48.20% of the total market share, valued at approximately USD 584.2 billion. This remarkable market share is driven by a combination of rapid industrialization, government support for renewable energy, and a growing awareness of environmental concerns. APAC is home to some of the world’s largest renewable energy markets, such as China, India, and Japan, all of which have made significant investments in solar, wind, and hydroelectric power.

China, as the world’s largest producer and consumer of renewable energy, plays a pivotal role in the growth of the alternative energy market in the APAC region. The country has set ambitious targets to achieve carbon neutrality by 2060 and is expected to continue expanding its solar and wind energy capacity in the coming years. India, too, has been investing heavily in renewable energy, with the government setting a target of 500 GW of non-fossil fuel-based energy by 2030. The APAC region’s substantial market share is further supported by Japan’s continued shift towards solar and wind energy, especially following the Fukushima disaster, which led to a reevaluation of its energy policies.

Government initiatives in countries like China and India, including subsidies, tax incentives, and large-scale renewable energy projects, have propelled the region to the forefront of the global transition to clean energy. As a result, APAC is poised to remain a dominant force in the alternative energy market, driving both growth and innovation in renewable energy technologies.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Acciona SA is a global leader in renewable energy, specializing in the development, construction, and operation of wind, solar, and hydroelectric power projects. With a strong presence in both Europe and Latin America, the company focuses on sustainable infrastructure solutions. Acciona has committed to achieving net-zero emissions by 2050, with a growing portfolio in renewable energy generation and sustainable infrastructure projects, making it a key player in the global energy transition.

The Adani Group, a multinational conglomerate based in India, has become a significant player in the renewable energy sector. With a focus on solar energy, the group aims to become the world’s largest renewable energy company by 2030. Adani Green Energy, a subsidiary of the group, is rapidly expanding its renewable portfolio, focusing on solar power plants, wind energy, and energy storage, while contributing to India’s renewable energy targets.

APR Energy is a global provider of fast-track power solutions, including alternative energy generation. The company focuses on providing temporary, scalable, and cost-effective renewable energy solutions, including solar and hybrid systems. APR Energy works with governments, utilities, and industries worldwide to address energy shortages and support the transition to cleaner energy, with an emphasis on mobile power solutions for remote areas.

Constellation Energy Corporation is a leading energy provider in the U.S. that focuses on providing clean, reliable, and affordable energy solutions. The company is a major player in the alternative energy space, with a growing portfolio of renewable energy assets, including wind, solar, and energy storage solutions. Constellation is committed to reducing its carbon footprint and helping clients transition to more sustainable energy sources through various renewable energy options.

Top Key Players

- Acciona SA

- Adani group

- APR Energy

- Capstone infrastructure corporation

- Constellation Energy Corporation

- Duke Energy

- EDF

- Enel Spa

- General Electric

- Geronimo Energy

- Innergex

- Invenergy

- LONGi

- NextEra Energy Resources, LLC

- Northland Power Inc.

- Ontario Power Generation Inc.

- Ormat Technologies Inc.

- ReNewPower

- Seminole Electric Cooperative

- THE TATA POWER COMPANY LIMITED

- Trina solar

- Xcel Energy Inc.

Recent Developments

December 2024, Acciona Energía achieved commercial operation for the Union Solar Farm in Ohio, contributing 325 MWp to the grid and powering nearly 62,000 households.

In 2024, AGEL expanded its operational capacity to approximately 5,290 MW, including 2,250 MW at the Khavda Renewable Energy Park in Gujarat.

December 31, 2024, Capstone’s portfolio includes approximately 885 MW of installed capacity, encompassing 35 facilities such as wind, solar, hydro, biomass, and natural gas power plants.

Report Scope

Report Features Description Market Value (2024) USD 1212.1 Bn Forecast Revenue (2034) USD 3731.1 Bn CAGR (2025-2034) 11.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Hydroelectric Power, Solar Energy, Wind Power, Bioenergy, Geothermal Energy, Others), By End-use ( Industrial, Residential, Commercial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Acciona SA, Adani group, APR Energy, Capstone infrastructure corporation, Constellation Energy Corporation, Duke Energy, EDF, Enel Spa, General Electric, Geronimo Energy, Innergex, Invenergy, LONGi, NextEra Energy Resources, LLC, Northland Power Inc., Ontario Power Generation Inc., Ormat Technologies Inc., ReNewPower, Seminole Electric Cooperative, THE TATA POWER COMPANY LIMITED, Trina solar, Xcel Energy Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Alternative Energy MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Alternative Energy MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Acciona SA

- Adani group

- APR Energy

- Capstone infrastructure corporation

- Constellation Energy Corporation

- Duke Energy

- EDF

- Enel Spa

- General Electric

- Geronimo Energy

- Innergex

- Invenergy

- LONGi

- NextEra Energy Resources, LLC

- Northland Power Inc.

- Ontario Power Generation Inc.

- Ormat Technologies Inc.

- ReNewPower

- Seminole Electric Cooperative

- THE TATA POWER COMPANY LIMITED

- Trina solar

- Xcel Energy Inc.