Global Hydrothermal Treatment Market Size, Share, Business Benefits By Type (Hydrothermal Liquefaction (HTL), Hydrothermal Carbonization (HTC), Hydrothermal Gasification (HTG), Wet Air Oxidation (WAO), Hydrothermal Refining (HTR)), By Product (Solid Fuel, Liquid Fertilizer, Livestock Feed), By Application (Fuel, Fertilizer, Feed, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 136092

- Number of Pages: 203

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

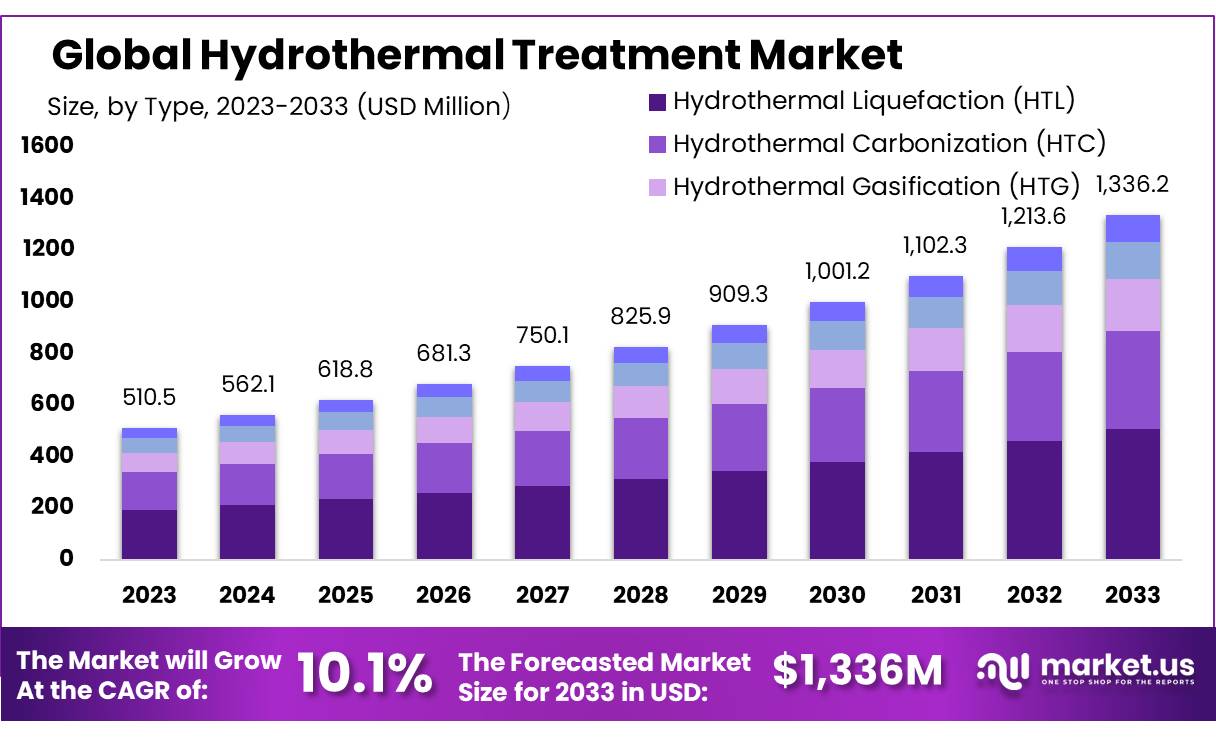

The Global Hydrothermal Treatment Market size is expected to be worth around USD 1336.2 Mn by 2033, from USD 510.5 Mn in 2023, growing at a CAGR of 10.1% during the forecast period from 2024 to 2033.

Hydrothermal Treatment refers to a chemical process that involves the use of water at elevated temperatures (typically between 100°C and 374°C) and pressures (up to 22 MPa) to alter the physical and chemical properties of materials. This technique is commonly employed in various industries, including chemical processing, waste treatment, and material science.

It works by applying high-pressure steam or superheated water to break down complex organic or inorganic compounds, often to transform waste into useful by-products or to enhance the properties of materials such as biomass, minerals, or polymers. In applications such as biofuel production, hydrothermal treatment can be used to convert organic waste into valuable resources like bio-oil or biogas.

The chemical industry is one of the leading adopters of hydrothermal treatment. For instance, in 2023, the chemical sector accounted for roughly 38% of the market share. This is largely due to regulatory pressure on industries to reduce their carbon footprint and manage waste more sustainably.

Hydrothermal treatment is particularly important for converting organic waste into renewable energy sources like bio-oil or biogas, offering a cleaner alternative to traditional incineration. Countries like Japan and Germany have led the way in adopting HT for waste-to-energy applications, with Japan’s Environmental Protection Agency investing around USD 2 million in Hydrothermal Treatment research and development in 2023.

On the regulatory front, governments worldwide are pushing for greener technologies. For instance, the European Union set ambitious targets to cut waste sent to landfills by 40% by 2025, promoting innovations such as hydrothermal treatment. In the U.S., the Department of Energy allocated over USD 50 million in 2023 to fund research into sustainable waste management solutions, including HT technology for recycling and biomass conversion.

In terms of industry partnerships, one notable development in 2023 was a collaboration between US-based Calysta Inc. and China National Petroleum Corporation (CNPC) to scale up hydrothermal treatment for producing sustainable protein from agricultural waste. The partnership, valued at USD 15 million, highlights the growing interest in HT as a solution for both waste management and resource recovery.

Additionally, the hydrothermal carbonization (HTC) method, a specific variant of hydrothermal treatment, is gaining popularity in the biomass sector for turning organic waste into solid fuel. HTC market adoption is expected to increase by 20% by 2025, especially in regions with significant agricultural waste, such as the U.S., Brazil, and India.

Key Takeaways

- Hydrothermal Treatment Market size is expected to be worth around USD 1336.2 Mn by 2033, from USD 510.5 Mn in 2023, growing at a CAGR of 10.1%.

- Hydrothermal Liquefaction (HTL) held a dominant market position, capturing more than a 38.2% share of the hydrothermal treatment market.

- Solid Fuel held a dominant market position, capturing more than a 46.2% share of the hydrothermal treatment market.

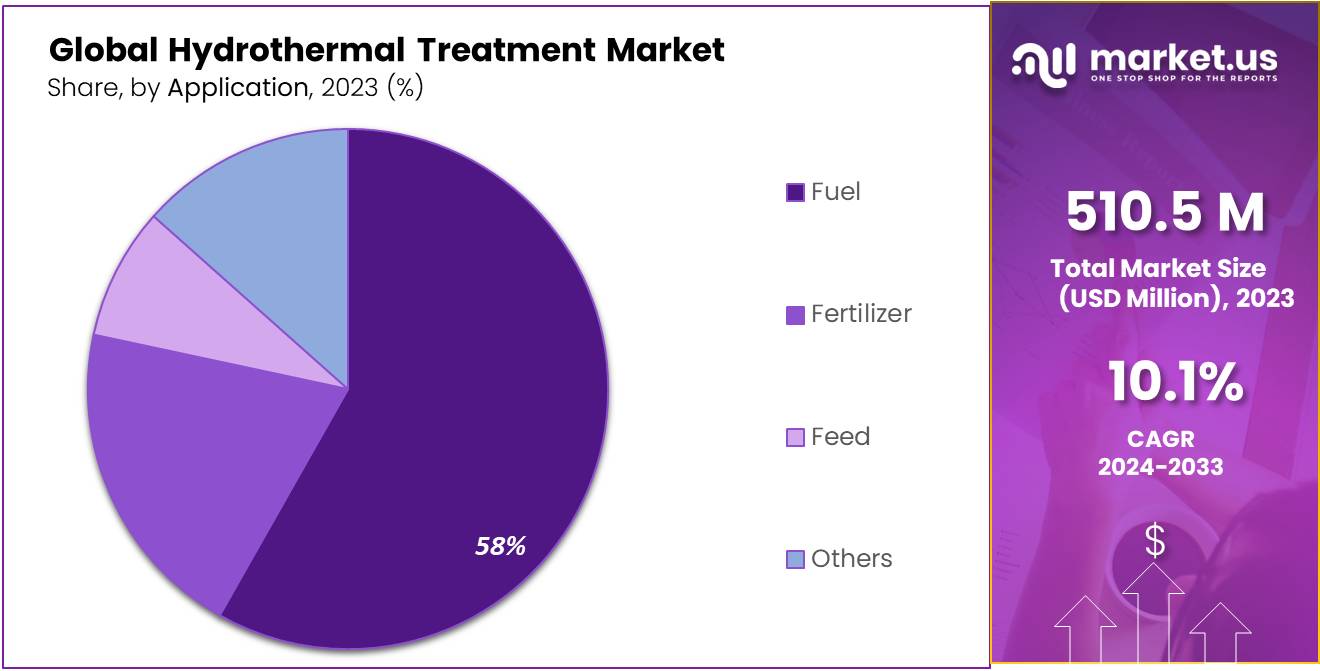

- Fuel held a dominant market position, capturing more than a 58.1% share of the hydrothermal treatment market.

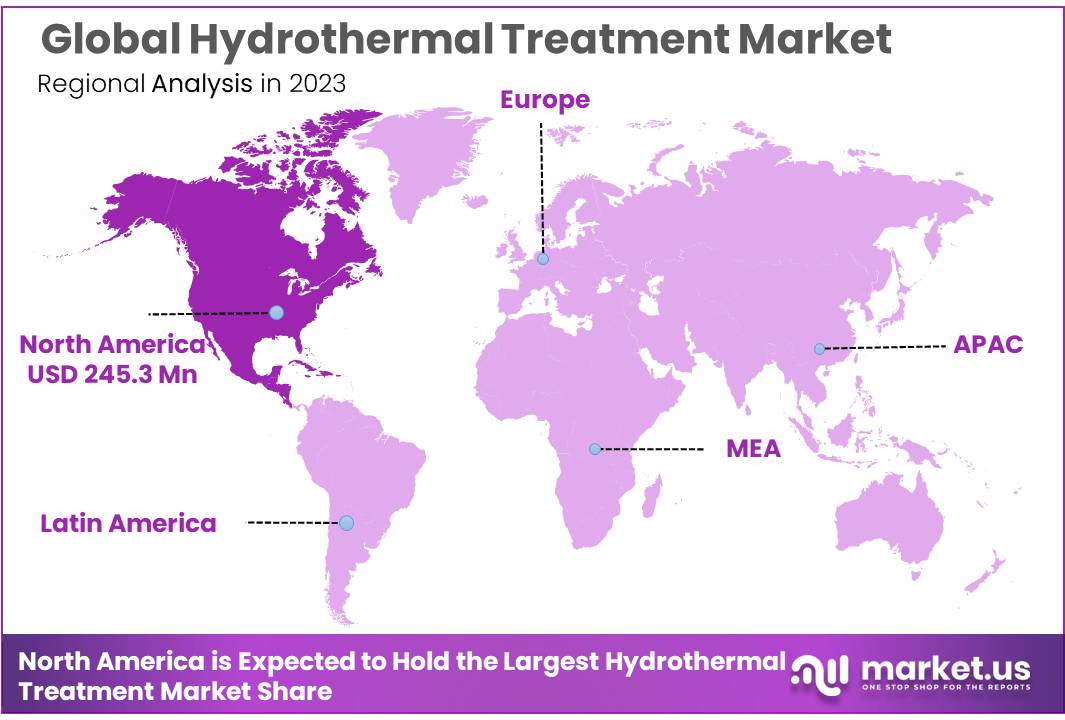

- North America dominated the hydrothermal treatment market, capturing a substantial share of 48.1%, valued at USD 245.3 million.

By Type

In 2023, Hydrothermal Liquefaction (HTL) held a dominant market position, capturing more than a 38.2% share of the hydrothermal treatment market. HTL is gaining momentum due to its ability to convert wet biomass into valuable biofuels and chemicals. This process operates at high temperatures and pressures, breaking down complex organic materials into liquid bio-oil, making it an attractive option for sustainable energy production.

The widespread interest in renewable energy sources and the increasing push for waste-to-energy technologies have significantly fueled the growth of HTL. Furthermore, the ability of HTL to process a wide range of feedstocks, including algae, agricultural waste, and municipal solid waste, has driven its adoption across various industries.

Hydrothermal Carbonization (HTC) followed closely behind, accounting for a substantial portion of the market. HTC is primarily used for converting organic waste into high-energy-density biochar, which has applications in soil enhancement and carbon sequestration.

As environmental concerns rise and more emphasis is placed on waste management and carbon reduction strategies, HTC is becoming an increasingly popular technology. Its ability to process wet organic materials, which are typically difficult to handle using conventional methods, makes it a valuable tool for both waste-to-energy initiatives and carbon-negative technologies.

Hydrothermal Gasification (HTG), while smaller in market share compared to HTL and HTC, has been gaining attention due to its potential to produce hydrogen and synthetic natural gas (SNG) from organic materials. The HTG process involves converting organic waste into gases like hydrogen, methane, and carbon dioxide under high pressure and temperature.

This technology is particularly relevant in the context of the growing hydrogen economy and the global push towards cleaner energy sources. As industries seek alternatives to traditional fossil fuels, HTG is expected to grow as an essential method for producing renewable hydrogen and other gases.

Wet Air Oxidation (WAO) is another important segment in the hydrothermal treatment market, although it holds a smaller share compared to the other technologies. WAO is primarily used for the treatment of organic pollutants in wastewater, helping to break down harmful compounds into simpler, less toxic substances. With increasing concerns about water quality and the rising demand for wastewater treatment technologies, WAO has seen gradual adoption in various industries, especially in municipal and industrial wastewater treatment plants.

Hydrothermal Refining (HTR), a relatively newer method in the market, also plays a crucial role in transforming organic feedstocks into high-value products, including biofuels and chemicals. HTR works by refining biomass at high temperatures and pressures to produce liquid fuels, gases, and other chemical products. While still emerging, it is expected to grow steadily due to its potential to generate high-quality fuels and chemicals from renewable sources, aligning with global sustainability goals.

By Product

In 2023, Solid Fuel held a dominant market position, capturing more than a 46.2% share of the hydrothermal treatment market. This segment has experienced consistent growth as demand for renewable and sustainable energy sources continues to rise. Solid fuel produced through hydrothermal treatment, primarily in the form of biochar or hydrochar, offers significant advantages in energy generation and carbon sequestration.

The increasing interest in waste-to-energy solutions, especially in the context of reducing greenhouse gas emissions, has driven the growth of solid fuel. Additionally, the use of solid fuels in power plants, industrial processes, and as a replacement for coal in certain applications has reinforced its strong market presence in 2023.

Liquid Fertilizer emerged as the second-largest segment in 2023, accounting for a growing share of the market as well. Hydrothermal treatment processes like Hydrothermal Liquefaction (HTL) and Hydrothermal Carbonization (HTC) produce liquid fertilizers rich in essential nutrients, making them highly attractive for agricultural applications.

The global focus on sustainable farming practices and reducing dependency on chemical fertilizers, liquid fertilizers derived from hydrothermal treatment have gained popularity. The rise in organic farming, coupled with the need for more eco-friendly fertilization solutions, has driven the expansion of this market segment.

Livestock Feed, while a smaller portion of the market, also demonstrated steady growth in 2023. The production of high-quality animal feed from hydrothermal treatment processes provides an alternative to traditional feed ingredients. This product segment benefits from the increasing demand for protein-rich feed sources in the livestock industry.

Additionally, the rise in demand for sustainable and cost-effective animal feed solutions has pushed the adoption of hydrothermal treatment technologies in this area, although the segment remains relatively smaller compared to solid fuel and liquid fertilizers.

By Application

In 2023, Fuel held a dominant market position, capturing more than a 58.1% share of the hydrothermal treatment market. This segment has seen significant growth, primarily driven by the increasing demand for alternative and renewable energy sources. Hydrothermal treatment processes like Hydrothermal Liquefaction (HTL) and Hydrothermal Gasification (HTG) are capable of converting wet biomass, agricultural residues, and municipal waste into high-quality biofuels such as bio-oil and biogas.

Global efforts to transition to cleaner energy, the fuel segment continues to benefit from policy support, investments in renewable energy, and rising concerns over fossil fuel dependency. The ability of hydrothermal treatment to provide a reliable and sustainable fuel source is a key factor fueling its market dominance.

Fertilizer is another important application within the hydrothermal treatment market, accounting for a significant portion of the market in 2023. The growing demand for organic and sustainable farming practices has positioned hydrothermal treatment-derived fertilizers as an eco-friendly alternative to traditional chemical fertilizers.

Through processes like Hydrothermal Carbonization (HTC), organic waste is converted into nutrient-rich liquid fertilizers that help improve soil health and crop yield. With the rise in organic agriculture and the need for more sustainable farming practices, the fertilizer application segment is poised for steady growth.

The Livestock Feed application, while smaller in comparison to fuel and fertilizer, has been growing steadily. In 2023, the feed segment accounted for a moderate share of the market, driven by the need for sustainable animal feed solutions.

By utilizing hydrothermal treatment, agricultural and food waste can be converted into high-quality, nutritious feed for livestock. This process provides an effective way to reduce waste and create value-added products that can support the agricultural industry’s circular economy goals.

Key Market Segments

By Type

- Hydrothermal Liquefaction (HTL)

- Hydrothermal Carbonization (HTC)

- Hydrothermal Gasification (HTG)

- Wet Air Oxidation (WAO)

- Hydrothermal Refining (HTR)

By Product

- Solid Fuel

- Liquid Fertilizer

- Livestock Feed

By Application

- Fuel

- Fertilizer

- Feed

- Others

Drivers

Increasing Demand for Renewable Energy and Sustainable Waste Management

One of the major driving factors for the growth of the hydrothermal treatment market is the increasing demand for renewable energy and sustainable waste management solutions. Governments worldwide are implementing stringent environmental regulations and encouraging the transition to cleaner energy sources, which directly benefits hydrothermal treatment technologies.

These processes, including Hydrothermal Liquefaction (HTL), Hydrothermal Carbonization (HTC), and Hydrothermal Gasification (HTG), offer promising solutions for converting organic waste into renewable biofuels and valuable by-products, such as biochar, liquid fertilizers, and animal feed.

According to the International Energy Agency (IEA), the renewable energy sector is expected to grow at a rapid pace, with renewables accounting for nearly 90% of the global electricity expansion by 2025. This increase in demand for cleaner energy sources aligns with the growing interest in hydrothermal treatment processes, which can efficiently convert wet biomass and waste materials into high-quality biofuels.

Specifically, biofuels produced through hydrothermal treatment can significantly reduce greenhouse gas emissions compared to traditional fossil fuels, making them an attractive alternative in energy generation.

In addition, the global push for reducing waste and increasing recycling is also driving the hydrothermal treatment market. The United Nations Environment Programme (UNEP) reports that approximately 2.01 billion tons of municipal solid waste were generated globally in 2020, and this number is projected to increase to 3.4 billion tons by 2050.

Waste management becoming a growing challenge, hydrothermal treatment offers an effective solution for converting organic waste into useful products like biofuels, biochar, and fertilizers, reducing landfill usage and promoting sustainability.

Furthermore, governments in countries like the United States and European Union are offering incentives to encourage the development and adoption of renewable energy technologies, including hydrothermal treatment.

The U.S. Department of Energy, for instance, allocated over $7 billion in 2022 for clean energy projects, including waste-to-energy technologies. This financial support helps advance research and development in the hydrothermal treatment market, providing a solid foundation for future growth.

Restraints

High Capital and Operational Costs

One of the major restraining factors for the growth of the hydrothermal treatment market is the high capital and operational costs associated with the technology. Hydrothermal treatment processes, such as Hydrothermal Liquefaction (HTL) and Hydrothermal Gasification (HTG), require significant investments in infrastructure, equipment, and maintenance. This high initial cost can deter smaller companies or businesses in developing regions from adopting the technology.

According to the U.S. Department of Energy (DOE), the capital cost for hydrothermal liquefaction systems can range between $10 million to $30 million per plant depending on its capacity and location. Furthermore, operating costs for hydrothermal treatment technologies are also considerable, as the process requires high-pressure and high-temperature conditions, leading to significant energy consumption.

The U.S. National Renewable Energy Laboratory (NREL) has reported that the energy requirements for HTL systems can be up to 3.5 times higher than traditional biomass conversion methods, which impacts the overall operational efficiency.

The financial burden of these high upfront investments and ongoing operational costs makes it challenging for many businesses, particularly small and medium-sized enterprises, to adopt hydrothermal treatment technologies. The scalability of these technologies also becomes a concern, as larger facilities may require even more significant capital investment, further hindering widespread adoption.

Governments and industry stakeholders are aware of these challenges, which is why there is ongoing research into reducing costs through improved technology and economies of scale. For instance, the European Union’s Horizon 2020 program has funded multiple projects aimed at developing cost-effective hydrothermal treatment technologies, with a focus on reducing both capital and operational costs by improving efficiency and utilizing low-cost feedstocks.

Opportunity

Expansion in Waste-to-Energy Solutions

A major growth opportunity for the hydrothermal treatment market lies in the increasing global focus on waste-to-energy (WTE) solutions. As the world faces mounting waste disposal challenges and the need for cleaner energy sources, hydrothermal treatment technologies present a promising solution.

The ability of these processes, such as Hydrothermal Liquefaction (HTL) and Hydrothermal Carbonization (HTC), to convert wet biomass and organic waste into valuable biofuels, biochar, and other useful products is driving interest in waste-to-energy applications.

According to the International Renewable Energy Agency (IRENA), the global waste-to-energy market is projected to grow at a compound annual growth rate (CAGR) of 8.2% from 2023 to 2030. This growth is fueled by the need to reduce landfill waste, lower carbon emissions, and produce sustainable energy.

In fact, the global WTE capacity is expected to reach 41 GW by 2025, up from 28 GW in 2020, driven by increased investments in cleaner technologies and government incentives aimed at promoting waste recycling and energy recovery.

Governments worldwide are also introducing supportive policies that create a favorable environment for waste-to-energy technologies. For example, the European Union has set ambitious waste recycling and carbon reduction targets, aiming to recycle 65% of municipal waste by 2035 and reduce landfill waste to no more than 10% by 2035.

These initiatives are expected to significantly boost the adoption of hydrothermal treatment processes, as they can help convert organic waste, such as food scraps and agricultural residues, into renewable energy and valuable by-products.

Additionally, the growing concern over the environmental impact of traditional waste disposal methods, such as incineration and landfilling, is driving the demand for more sustainable alternatives. Hydrothermal treatment processes not only reduce the environmental impact of waste but also provide a circular economy model by transforming waste into useful resources, including fuels, fertilizers, and livestock feed. This makes hydrothermal treatment an appealing solution for both municipalities and industries looking to meet sustainability goals.

Trends

Focus on Circular Economy and Waste Valorization

A significant trend shaping the hydrothermal treatment market is the growing emphasis on the circular economy and waste valorization. As global awareness of environmental sustainability rises, industries and governments are increasingly focused on transforming waste into valuable resources.

Hydrothermal treatment technologies, including Hydrothermal Liquefaction (HTL) and Hydrothermal Carbonization (HTC), are at the forefront of this trend, offering innovative solutions for converting organic waste into biofuels, fertilizers, and high-value chemicals. This shift aligns with efforts to reduce waste, lower carbon emissions, and maximize the utility of resources.

According to a report from the European Commission, the circular economy is expected to create up to 700,000 jobs across Europe by 2030, while generating up to EUR 1.8 trillion in economic benefits. As part of this movement, the EU is actively investing in technologies that enhance waste-to-resource conversion, with significant support for hydrothermal treatment processes. In fact, the EU’s Horizon 2020 program has allocated millions of euros to research and development projects aimed at advancing hydrothermal treatment as a means of waste valorization.

Additionally, the global push for reducing landfill waste is propelling the adoption of hydrothermal technologies. The World Bank reports that more than 2 billion tons of waste are generated globally every year, with over 30% of that waste being mismanaged. The need for sustainable waste management solutions is growing, and hydrothermal treatment offers a pathway to reduce the environmental impact of organic waste by converting it into valuable products like biofuels and biochar.

The trend toward circular economy practices is also supported by increasing government regulations and incentives. For example, the U.S. Environmental Protection Agency (EPA) has introduced programs that encourage waste-to-energy projects and support technologies that promote resource recovery. The U.S. government has set a goal to reduce landfill waste by 50% by 2030, and hydrothermal treatment processes are seen as essential tools in meeting these targets.

Regional Analysis

In 2023, North America dominated the hydrothermal treatment market, capturing a substantial share of 48.1%, valued at USD 245.3 million. This dominance is largely driven by the region’s strong emphasis on renewable energy solutions, waste management, and sustainable technologies.

The United States, in particular, is a key player, with ongoing government initiatives supporting waste-to-energy projects and biofuel production. The U.S. Department of Energy (DOE) has been actively investing in advanced biomass conversion technologies, including hydrothermal treatment, which is expected to further boost market growth in the region.

Europe holds a significant share in the market as well, with the circular economy movement and increasing emphasis on sustainability driving the demand for hydrothermal treatment technologies. The European Union’s Green Deal and the Circular Economy Action Plan aim to cut down waste, enhance resource efficiency, and reduce carbon emissions, making hydrothermal treatment an attractive solution. Europe’s focus on advanced waste management solutions is expected to result in the growth of the market in countries like Germany, France, and the UK.

In the Asia Pacific region, the market is witnessing rapid growth, particularly in countries like China and India. The region’s burgeoning population, industrialization, and urbanization have led to a significant increase in waste generation, driving demand for waste-to-energy solutions. Additionally, government initiatives such as China’s 13th Five-Year Plan for Ecological and Environmental Protection are encouraging the adoption of cleaner technologies.

Middle East & Africa and Latin America are expected to show gradual growth, driven by rising industrial activities and government support for sustainable energy solutions. However, these regions currently have smaller market shares compared to North America, Europe, and Asia Pacific.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The hydrothermal treatment market is characterized by a diverse range of players focused on advancing sustainable waste-to-energy solutions. Antaco and C-Green are notable for their innovative hydrothermal carbonization (HTC) technologies, which convert organic waste into high-energy-density products like biochar, helping to reduce waste and enhance carbon sequestration.

CPL Industries specializes in the production of hydrochar through hydrothermal treatment processes, serving the growing demand for renewable solid fuels and biochar in agriculture and energy sectors. Additionally, Genifuel Corporation is prominent for its Hydrothermal Liquefaction (HTL) technology, focusing on converting wet biomass into valuable biofuels and chemicals, supporting the renewable energy transition.

Other key players like EIT InnoEnergy and FERROVIAL are actively investing in the development of scalable hydrothermal treatment solutions. EIT InnoEnergy, a European innovation engine, has supported various projects aimed at optimizing the efficiency of hydrothermal treatment for energy recovery. FERROVIAL, a global infrastructure and services company, integrates hydrothermal treatment into its waste-to-energy solutions, advancing circular economy initiatives.

Players such as Siemens and Veolia have also entered the market, bringing their expertise in industrial automation and resource management to improve the efficiency and scalability of hydrothermal treatment technologies. Meanwhile, HTCycle, Ingelia, and KANKYO GROUP OF COMPANIES contribute significantly with their proprietary systems designed to process organic waste into valuable by-products like biofuels and fertilizers.

Top Key Players

- Antaco

- C-Green

- CPL Industries

- DA INVENT

- DBFZ

- EIT InnoEnergy

- FERROVIAL

- Genifuel Corporation

- Hokuto Kogyo

- HTCycle

- Ingelia

- KANKYO GROUP OF COMPANIES

- Kinava

- Merrick

- Seche Environnement

- Shinko Technos Co., Ltd.

- Siemens

- Somax Bioenergy

- Terra Nova Energy GmbH

- TerraNova

- UNIWASTEC

- Veolia

Recent Developments

In 2024 Antaco, the company plans to expand its operations further, with several large-scale facilities in development across the UK and Europe, targeting a 50% increase in capacity.

2024, C-Green plans to further scale its operations, aiming for an additional 40% increase in its processing capacity and expanding its presence in Europe and North America.

Report Scope

Report Features Description Market Value (2023) USD 510.5 Mn Forecast Revenue (2033) USD 1336.2 Mn CAGR (2024-2033) 10.1% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Hydrothermal Liquefaction (HTL), Hydrothermal Carbonization (HTC), Hydrothermal Gasification (HTG), Wet Air Oxidation (WAO), Hydrothermal Refining (HTR)), By Product (Solid Fuel, Liquid Fertilizer, Livestock Feed), By Application (Fuel, Fertilizer, Feed, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Antaco, C-Green, CPL Industries, DA INVENT, DBFZ, EIT InnoEnergy, FERROVIAL, Genifuel Corporation, Hokuto Kogyo, HTCycle, Ingelia, KANKYO GROUP OF COMPANIES, Kinava, Merrick, Seche Environnement, Shinko Technos Co., Ltd., Siemens, Somax Bioenergy, Terra Nova Energy GmbH, TerraNova, UNIWASTEC, Veolia Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Hydrothermal Treatment MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample

Hydrothermal Treatment MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Antaco

- C-Green

- CPL Industries

- DA INVENT

- DBFZ

- EIT InnoEnergy

- FERROVIAL

- Genifuel Corporation

- Hokuto Kogyo

- HTCycle

- Ingelia

- KANKYO GROUP OF COMPANIES

- Kinava

- Merrick

- Seche Environnement

- Shinko Technos Co., Ltd.

- Siemens

- Somax Bioenergy

- Terra Nova Energy GmbH

- TerraNova

- UNIWASTEC

- Veolia