Global Material Handling Equipment Telematics Market Size, Share, Growth Analysis By Product (Aerial Work Platform, Forklift (Truck Mounted Forklift, Articulated Forklift, Side Loader, Other), Cranes (Port Crane, Truck-mounted Crane, Others), Earthmoving Equipment (Spreader, Articulated Wheel Loader, Farm Implements, Road Work Vehicle, Self-propelling AG Machine, Others), Truck (Military Vehicle, Trailer, Others), Tractor (Terminal Tractor, Tow Tractor, Others), Telehandler, Others (Sweeper and Scrubber, Personnel and Burden Carrier, Power Generation or Light Station, Others)), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 142715

- Number of Pages: 236

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

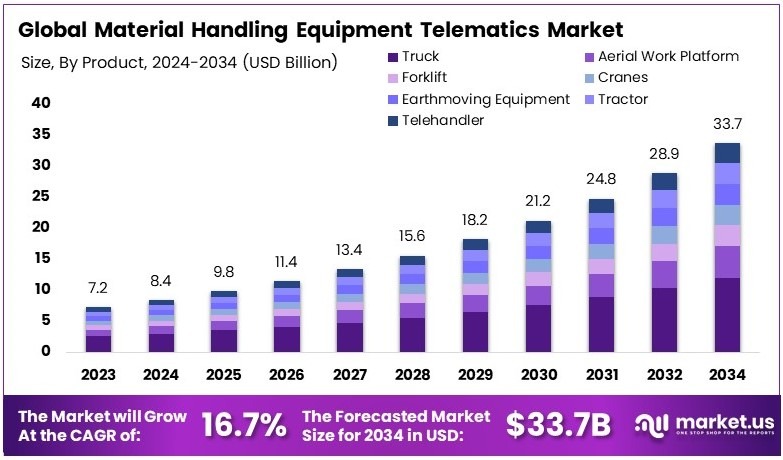

The Global Material Handling Equipment Telematics Market size is expected to be worth around USD 33.7 Billion by 2034, from USD 7.2 Billion in 2024, growing at a CAGR of 16.7% during the forecast period from 2025 to 2034.

Material Handling Equipment Telematics is a technology that uses sensors, GPS, and data analytics to monitor and manage forklifts, cranes, and other warehouse equipment. It helps track location, usage, fuel efficiency, and maintenance needs. This improves operational efficiency, reduces downtime, and enhances safety in warehouses and industrial sites.

The Material Handling Equipment Telematics Market includes companies that provide telematics solutions for industrial and warehouse equipment. The market is growing due to the demand for automation, real-time tracking, and predictive maintenance. Businesses use telematics to optimize equipment usage, lower costs, and improve logistics efficiency.

According to the International Federation of Robotics (IFR), the number of operational industrial robots reached 4.1 million by 2023. Additionally, the rise of IIoT is expected to add $15 trillion to global GDP by 2030. Consequently, material handling equipment telematics is becoming essential for improving efficiency, reducing downtime, and optimizing asset management.

Material handling equipment telematics is transforming warehouses and manufacturing facilities. Real-time tracking improves productivity, while predictive maintenance reduces equipment failure. Moreover, automation is expanding rapidly. By 2025, over 4 million warehouse robots are expected in 50,000 warehouses. This trend highlights the growing reliance on smart logistics solutions to meet increasing global trade and e-commerce demands.

The market is growing as businesses adopt automation. Warehouses use forklifts handling 5,000-pound loads, pallet jacks moving 5,500 pounds, and conveyor systems transporting bulk materials. Additionally, 94% of companies automate repetitive tasks. With 66% of knowledge workers benefiting from automation, telematics ensures smoother operations and improved supply chain visibility.

Market saturation varies by industry. Developed markets see high telematics adoption, while emerging regions still invest in basic automation. However, demand is rising as companies seek efficiency. Moreover, increased competition among telematics providers is driving innovation. Companies integrating AI and IoT gain an advantage, ensuring real-time equipment monitoring and reducing operational costs.

On a broader scale, telematics improves logistics and trade efficiency. According to UNCTAD, global trade is projected to increase by $350 billion in early 2024. Meanwhile, smart warehouses enhance supply chain resilience. In contrast, companies without telematics face inefficiencies, higher costs, and slower deliveries, limiting competitiveness in the fast-growing logistics industry.

Key Takeaways

- The Material Handling Equipment Telematics Market was valued at USD 7.2 billion in 2024 and is expected to reach USD 33.7 billion by 2034, with a CAGR of 16.7%.

- In 2024, Trucks dominated the product segment with 35.6%, driven by demand for fleet management solutions.

- In 2024, Forklifts held a significant share, benefiting from warehouse automation and logistics expansion.

- In 2024, Cranes were widely adopted, particularly in the construction and shipping industries.

- In 2024, Telematics software solutions gained traction, offering real-time equipment monitoring.

- In 2024, Mining and construction led in end-use industries, driven by safety regulations and efficiency needs.

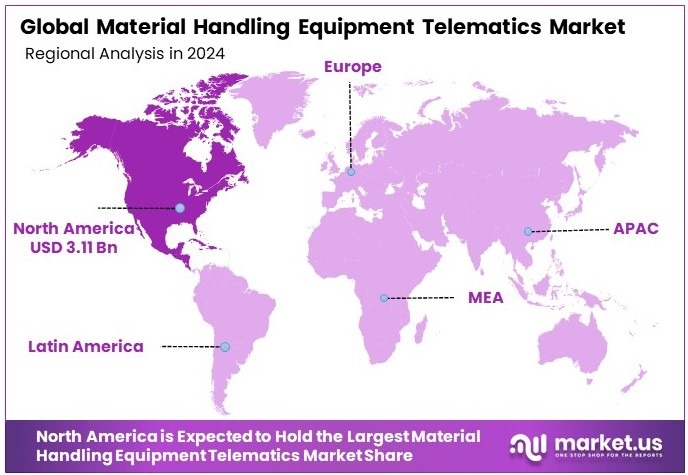

- In 2024, North America dominated with 43.2% market share, valued at USD 3.11 billion, due to high adoption of IoT in material handling.

Product Analysis

Trucks dominate with 35.6% due to their versatility and essential role in transportation.

In the Material Handling Equipment Telematics Market, the Product segment is crucial, with Trucks leading the way, holding a 35.6% market share. This dominance is largely because trucks are versatile and fundamental to the transportation of goods across various industries.

They are equipped with advanced telematics systems that enhance operational efficiency, provide critical real-time data, and improve the overall logistics chain by enabling better fleet management and monitoring.

Other sub-segments like Aerial Work Platforms, Forklifts, Cranes, Earthmoving Equipment, Tractors, and Telehandlers also play significant roles. Aerial Work Platforms are used extensively in construction and maintenance, providing safe and efficient access to heights. Forklifts are indispensable in warehouses for loading and unloading goods.

Cranes are critical for lifting heavy materials in construction sites, while Earthmoving Equipment is essential in both construction and mining industries for moving large amounts of earth. Tractors and Telehandlers are used in agriculture and construction for their power and versatility.

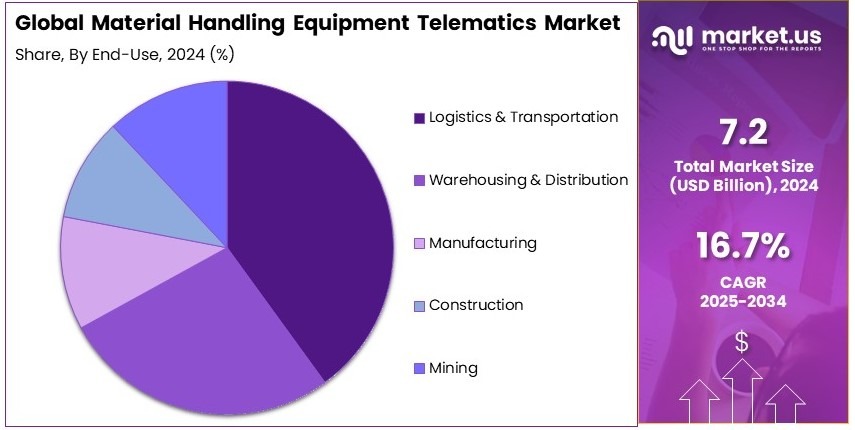

End-Use Industry Analysis

Logistics & Transportation leads with a significant impact due to the high dependency on efficient material handling.

In the context of End-Use Industry, the Logistics & Transportation sector stands out in the Material Handling Equipment Telematics Market. This sector relies heavily on efficient and effective material handling systems to ensure timely delivery and management of goods.

Telematics plays a crucial role here by providing vital data that helps in optimizing routes, maintaining vehicles in good condition, and ensuring that the cargo is handled efficiently, which is essential for minimizing delays and reducing costs.

Other important industries include Warehousing & Distribution, Manufacturing, Construction, and Mining. In Warehousing & Distribution, telematics is used to streamline operations and improve inventory management.

Manufacturing relies on telematics to enhance equipment efficiency and safety. In Construction, telematics supports fleet management and operational efficiency, which are critical for project timelines and budget management. Mining uses telematics for safety monitoring and operational optimization, crucial in an environment where equipment efficiency and worker safety are paramount.

Key Market Segments

By Product

- Aerial Work Platform

- Forklift

- Truck Mounted Forklift

- Articulated Forklift

- Side Loader

- Other

- Cranes

- Port Crane

- Truck-mounted Crane

- Others

- Earthmoving Equipment

- Spreader

- Articulated Wheel Loader

- Farm Implements

- Road Work Vehicle

- Self-propelling AG Machine

- Others

- Truck

- Military Vehicle

- Trailer

- Others

- Tractor

- Terminal Tractor

- Tow Tractor

- Others

- Telehandler

- Others

- Sweeper & Scrubber

- Personnel & Burden Carrier

- Power Generation/Light Station

- Others

By End-Use Industry

- Logistics & Transportation

- Warehousing & Distribution

- Manufacturing

- Construction

- Mining

Driving Factors

Real-Time Tracking and AI-Powered Maintenance Drive Market Growth

The increasing demand for real-time tracking and fleet optimization in warehouses is a key factor driving the material handling equipment telematics market. Companies are investing in telematics solutions to monitor equipment location, usage, and performance, ensuring maximum operational efficiency. Real-time tracking helps warehouse managers reduce downtime, optimize fleet utilization, and enhance overall logistics operations.

Additionally, the adoption of AI-powered predictive maintenance is revolutionizing material handling equipment management. AI-driven analytics can detect early signs of wear and tear, allowing operators to schedule maintenance before costly breakdowns occur. This reduces unexpected downtime and extends the lifespan of equipment, ultimately improving warehouse productivity.

The growing use of IoT sensors is also transforming asset management. These sensors provide real-time data on equipment performance, fuel consumption, and environmental conditions. With IoT-enabled telematics, warehouse operators can track assets remotely, prevent equipment failures, and improve overall safety.

Furthermore, the expansion of cloud-based telematics solutions is enhancing remote monitoring capabilities. Cloud platforms allow businesses to store and analyze vast amounts of data, providing insights into fleet efficiency and performance trends. As more companies embrace digital transformation, cloud-based telematics solutions are expected to gain widespread adoption, driving market growth.

Restraining Factors

High Costs and Cybersecurity Risks Restrain Market Growth

Despite its advantages, the adoption of telematics in material handling equipment faces several challenges. One of the major barriers is the high initial cost of implementing telematics solutions. Many businesses, especially small and medium-sized enterprises (SMEs), struggle with the upfront investment required for hardware, software, and integration services. This limits widespread adoption across industries.

Cybersecurity risks also pose a significant concern for connected equipment. As material handling telematics systems rely on cloud storage and wireless communication, they become vulnerable to cyber threats.

Data breaches and unauthorized access to sensitive operational data can disrupt warehouse operations and compromise asset security. Ensuring robust cybersecurity measures is critical for gaining user confidence.

Another challenge is the integration of telematics with legacy warehouse management systems. Many warehouses still operate on outdated software and infrastructure, making it difficult to implement modern telematics solutions seamlessly. Companies must invest in system upgrades or customized integration processes, which can be costly and time-consuming.

Furthermore, the reliance on stable network connectivity is a key limitation. For telematics solutions to function effectively, they require continuous data transmission. In warehouses with weak internet coverage or connectivity issues, real-time monitoring and predictive maintenance capabilities may be affected. Addressing these technical challenges is essential to improving adoption rates in the market.

Growth Opportunities

5G and Autonomous Vehicles Provide Growth Opportunities

Advancements in 5G technology are creating new opportunities for material handling equipment telematics. With faster and more reliable data transmission, 5G enables real-time communication between equipment, telematics platforms, and warehouse management systems. This technology enhances tracking accuracy, predictive analytics, and overall fleet efficiency.

The development of autonomous material handling vehicles is another significant opportunity. Companies are integrating telematics into self-driving forklifts, automated guided vehicles (AGVs), and robotic warehouse equipment. These autonomous systems improve logistics efficiency by reducing human intervention and ensuring seamless inventory movement. As demand for automation grows, telematics-enabled autonomous vehicles will become a standard in modern warehouses.

The growing adoption of augmented reality (AR) for equipment diagnostics is also transforming maintenance practices. AR-based telematics solutions allow technicians to visualize equipment issues in real-time, improving repair accuracy and reducing downtime. AR applications provide step-by-step repair guidance, making maintenance more efficient and cost-effective.

Furthermore, the expansion of telematics applications in cold storage and perishable goods handling is a growing trend. Warehouses dealing with temperature-sensitive products, such as food and pharmaceuticals, are adopting telematics solutions to monitor storage conditions. By ensuring proper temperature control, businesses can reduce product spoilage, improve regulatory compliance, and enhance supply chain efficiency.

Emerging Trends

AI Analytics and Digital Twins Are Latest Trending Factors

The increased use of AI-driven analytics is a major trend shaping the material handling equipment telematics market. AI algorithms analyze large datasets to identify inefficiencies, predict equipment failures, and optimize warehouse operations. With AI-powered insights, businesses can make data-driven decisions that improve productivity and reduce operational costs.

Another emerging trend is the integration of digital twins for real-time equipment performance simulation. Digital twin technology creates a virtual replica of material handling equipment, allowing operators to monitor performance, detect potential issues, and optimize processes. By simulating real-world conditions, companies can improve equipment design, test new strategies, and enhance overall efficiency.

The growth of electric and hybrid material handling equipment with smart connectivity is also influencing the market. As warehouses shift towards sustainable practices, electric forklifts and hybrid AGVs equipped with telematics are gaining traction. These vehicles offer real-time monitoring of battery health, energy consumption, and operational performance, ensuring efficient fleet management.

Additionally, the rising adoption of blockchain technology is enhancing secure and transparent equipment tracking. Blockchain-based telematics solutions provide a decentralized and tamper-proof system for tracking equipment usage, maintenance history, and asset movement. This improves data security, reduces fraud, and enhances supply chain visibility.

Regional Analysis

North America Dominates with 43.2% Market Share in the Material Handling Equipment Telematics Market

North America leads the Material Handling Equipment Telematics Market with a commanding 43.2% share, totaling USD 3.11 billion. This prominent market position is driven by widespread adoption of automation and digital transformation in logistics and manufacturing sectors.

The key factors contributing to this dominance include advanced technological infrastructure, substantial investments in IoT and telematics solutions, and a robust regulatory framework supporting workplace safety and efficiency. The region’s commitment to enhancing operational productivity through technology has fostered significant growth in telematics adoption.

Looking forward, North America is poised to maintain its leadership in the global market as companies continue to leverage telematics for data-driven decision-making and to enhance operational efficiencies. The trend towards smart warehousing and the increasing importance of supply chain visibility are expected to further propel the demand for advanced telematics solutions.

Regional Mentions:

- Europe: Europe remains a strong player in the Material Handling Equipment Telematics Market, focusing on integration of telematics to enhance equipment efficiency and safety. The region’s emphasis on regulatory compliance and energy efficiency continues to drive adoption.

- Asia Pacific: Rapid industrialization and the expansion of the logistics sector fuel growth in Asia Pacific’s telematics market. Countries like China and Japan are adopting these technologies to improve fleet management and operational safety.

- Middle East & Africa: The Middle East and Africa are gradually increasing their market share, with investments in infrastructure development and a growing focus on logistics efficiency driving the adoption of telematics.

- Latin America: Latin America is seeing modest growth in telematics adoption, driven by the need to modernize equipment and improve competitiveness in the logistics and manufacturing sectors.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

In the Material Handling Equipment Telematics Market, top players include Caterpillar, Toyota Material Handling, The Raymond Corporation, and CLARK. These companies significantly influence the market through their advanced telematics solutions, which enhance operational efficiency and safety in material handling.

Caterpillar leads with robust telematics systems that monitor equipment performance and health, thereby optimizing maintenance schedules and reducing downtime. Toyota Material Handling is known for integrating smart technologies into their products, which facilitate real-time tracking and management of material handling operations, ensuring high productivity levels.

The Raymond Corporation specializes in providing precise and scalable telematics solutions tailored to warehouse operations, helping businesses monitor and improve their logistics activities effectively. CLARK rounds out the group by offering innovative telematics that enhance the connectivity and intelligence of their fleet, making operations more data-driven and efficient.

These industry leaders are driving the adoption of telematics in material handling, providing technologies that not only boost operational efficiencies but also contribute to the safety and longevity of handling equipment. Their efforts are pivotal in shaping a more connected and responsive material handling environment.

Major Companies in the Market

- Caterpillar

- Toyota Material Handling

- The Raymond Corporation

- CLARK

- MLE B.V.

- Konecranes

- Hiab

- MCE (Mahindra Construction Equipment)

- Doosan Corporation

- HD Hyundai Construction Equipment India Private Limited

- Trackunit Corporation

- JLG Industries

- ZTR Control Systems LLC

- Others

Recent Developments

- United Rentals and H&E Equipment Services: On January 14, 2025, United Rentals announced its plan to acquire H&E Equipment Services for approximately $4.8 billion. This acquisition will expand United Rentals’ equipment fleet by nearly 64,000 units and is projected to generate around $130 million in annual cost synergies within two years of closing.

- Cargotec’s Kalmar Division and Lonestar: In August 2023, Cargotec’s Kalmar division acquired the product and intellectual property rights for Lonestar electric terminal tractors in the USA. Lonestar Specialty Vehicles, located in Texarkana, will serve as Kalmar’s contract manufacturing partner, enhancing its electric terminal tractor offerings in line with the industry’s shift towards sustainable solutions.

Report Scope

Report Features Description Market Value (2024) USD 7.2 Billion Forecast Revenue (2034) USD 33.7 Billion CAGR (2025-2034) 16.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Aerial Work Platform, Forklift (Truck Mounted Forklift, Articulated Forklift, Side Loader, Other), Cranes (Port Crane, Truck-mounted Crane, Others), Earthmoving Equipment (Spreader, Articulated Wheel Loader, Farm Implements, Road Work Vehicle, Self-propelling AG Machine, Others), Truck (Military Vehicle, Trailer, Others), Tractor (Terminal Tractor, Tow Tractor, Others), Telehandler, Others (Sweeper and Scrubber, Personnel and Burden Carrier, Power Generation or Light Station, Others)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Caterpillar, Toyota Material Handling, The Raymond Corporation, CLARK, MLE B.V., Konecranes, Hiab, MCE (Mahindra Construction Equipment), Doosan Corporation, HD Hyundai Construction Equipment India Private Limited, Trackunit Corporation, JLG Industries, ZTR Control Systems LLC, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Material Handling Equipment Telematics MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Material Handling Equipment Telematics MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Caterpillar

- Toyota Material Handling

- The Raymond Corporation

- CLARK

- MLE B.V.

- Konecranes

- Hiab

- MCE (Mahindra Construction Equipment)

- Doosan Corporation

- HD Hyundai Construction Equipment India Private Limited

- Trackunit Corporation

- JLG Industries

- ZTR Control Systems LLC

- Others