Global Crane Market Size, Share, Growth Analysis By Product Type (Mobile Cranes, Fixed Cranes), By Operation Type (Hydraulic Cranes, Electric Cranes, Hybrid Cranes), By Application (Construction, Mining, Shipping and Port, Oil and Gas, Transportation and Logistics, Industrial Manufacturing), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 137869

- Number of Pages: 374

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

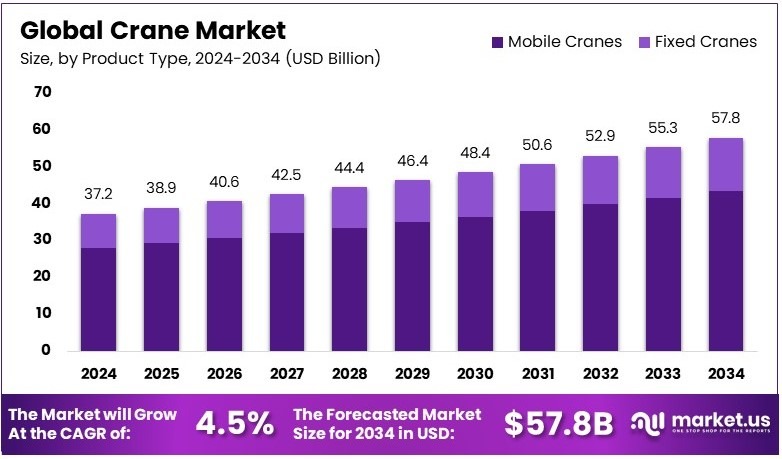

The Global Crane Market size is expected to be worth around USD 57.8 Billion by 2034, from USD 37.2 Billion in 2024, growing at a CAGR of 4.5% during the forecast period from 2025 to 2034.

A crane is a large machine used for lifting and moving heavy materials. It operates using cables, pulleys, and a movable arm. Cranes are common on construction sites and in ports. They help in assembling structures and loading or unloading heavy items in a controlled and safe manner.

The crane market refers to the business and trade surrounding the manufacturing, sale, and use of cranes. It includes various types of cranes, from small lifting devices to large construction machines. The market is driven by construction needs, industrial projects, and logistics services requiring heavy lifting solutions.

The crane market is experiencing robust growth, driven by rapid urbanization and the escalating need for advanced construction machinery. Innovations such as Liebherr’s LTM 1400-6.1 crane, which features enhanced lifting capacities and safety features, are propelling cranes to the forefront of essential construction equipment.

The construction sector is on an upward trajectory, projected to reach $15.7 trillion by 2025, with an annual growth rate of 8.1%. This expansion is heavily supported by substantial investments in urban infrastructure alongside advancements in construction technologies.

For example, in the United States, construction spending topped $2 trillion in the first half of 2024, underscoring significant opportunities in both residential and non-residential construction. Companies like Liebherr are at the forefront, enhancing operational efficiencies and safety with their cutting-edge crane technologies.

Government policies and investments are pivotal in shaping the crane market. The European Bank for Reconstruction and Development’s investment levels, which reached a record €16.6 billion in 2024, underscore this trend.

These investments not only bolster the construction sector but also advance green financing initiatives, significantly impacting the demand for modern cranes that meet new environmental and safety standards. Such strategic government actions ensure a consistent demand for technologically advanced cranes in the market.

Key Takeaways

- The Crane Market was valued at USD 37.2 Billion in 2024, and is expected to reach USD 57.8 Billion by 2034, with a CAGR of 4.5%.

- In 2024, Mobile Cranes dominate the type segment with 75.1%, reflecting their key role in diverse construction tasks.

- In 2024, Hybrid Cranes lead the operation segment with 34.2%, underlining their growing adoption in efficient lifting solutions.

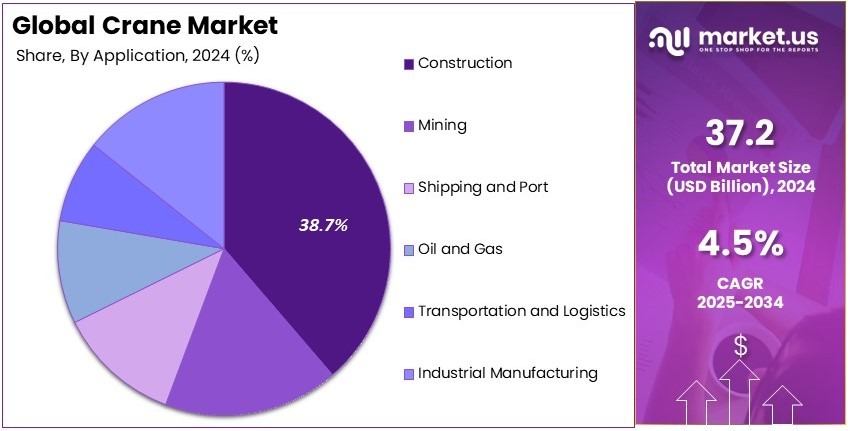

- In 2024, Construction dominates the application segment with 38.7%, emphasizing its critical influence on market demand.

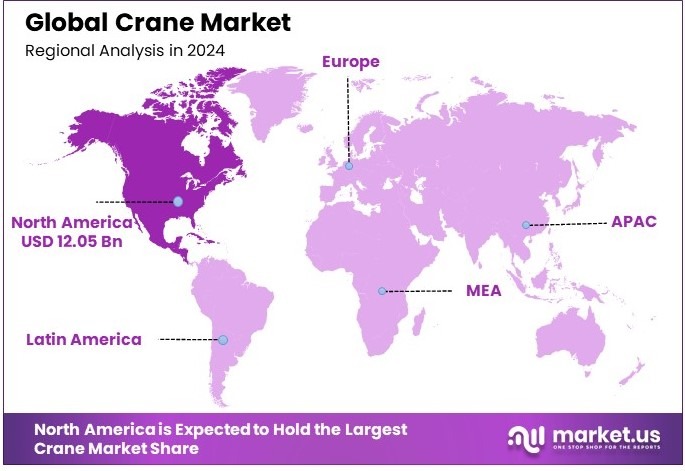

- In 2024, North America leads the regional market with 32.4% and a value of USD 12.05 Bn, highlighting its strategic importance.

Type Analysis

Mobile cranes dominate with 75.1% due to their versatility and efficiency in handling diverse lifting tasks.

The crane market, segmented by product type, showcases significant diversity in applications and operational capabilities. Among these, Mobile Cranes emerge as the dominant sub-segment, capturing a substantial 75.1% of the market.

This prevalence is largely attributed to the mobile cranes’ adaptability and efficiency, crucial for various industries, including construction and transportation.

Mobile Cranes are further categorized into Truck-Mounted Cranes, Rough Terrain Cranes, All-Terrain Cranes, and Crawler Cranes. Truck-Mounted Cranes are favored for their mobility and ease of setup, playing a pivotal role in quick transit and lifting operations at multiple sites within the same day.

Rough Terrain Cranes, designed for stability and performance in uneven terrains, are indispensable in off-road construction projects. All-Terrain Cranes combine the ruggedness of rough terrain units with the speed of truck-mounted models, making them ideal for a wide range of sites.

Lastly, Crawler Cranes, known for their substantial lifting capacity and stability, are essential in large-scale construction projects and installations.

Operation Analysis

Hybrid cranes dominate with 34.2% due to their environmental efficiency and adaptability in diverse operating conditions.

In the operation type segment, Hybrid Cranes take the lead, representing a growing preference for sustainable and versatile lifting solutions in the industry.

Hybrid cranes, which combine the benefits of electric and hydraulic systems, offer reduced emissions and better fuel efficiency, aligning with the increasing environmental regulations across global markets.

Hydraulic Cranes and Electric Cranes are the other key sub-segments within this category. Hydraulic Cranes are known for their powerful lifting capabilities and reliability, making them suitable for a variety of heavy-duty tasks.

On the other hand, Electric Cranes are gaining traction for their quiet operation and zero emissions, which are particularly valued in indoor environments and urban settings where noise and pollution restrictions are stringent.

Application Analysis

The construction industry dominates with 38.7% due to extensive urbanization and infrastructure development.

The Application segment of the crane market is critical, with Construction leading as the dominant sub-segment. This segment’s growth is fueled by global trends towards urbanization and the expansion of infrastructure, requiring robust and reliable cranes to manage the heavy lifting of materials and other construction elements.

Other significant applications include Mining, Shipping and Port, Oil and Gas, Transportation and Logistics, and Industrial Manufacturing. Mining relies on cranes for the extraction and transportation of materials, whereas Shipping and Port operations use cranes for cargo handling and ship maintenance.

The Oil and Gas industry utilizes cranes for offshore and onshore oil extraction and pipeline installation tasks. Transportation and Logistics depend on cranes for loading and unloading of goods, and Industrial Manufacturing uses cranes for assembling heavy equipment and managing warehouse operations.

Key Market Segments

By Product Type

- Mobile Cranes

- Truck-Mounted Cranes

- Rough Terrain Cranes

- All-Terrain Cranes

- Crawler Cranes

- Fixed Cranes

- Tower Cranes

- Overhead Cranes

- Gantry Cranes

By Operation Type

- Hydraulic Cranes

- Electric Cranes

- Hybrid Cranes

By Application

- Construction

- Mining

- Shipping and Port

- Oil and Gas

- Transportation and Logistics

- Industrial Manufacturing

Driving Factors

Crane Market Growth Driven by Urbanization, Infrastructure, and Innovation

The Crane Market grows steadily thanks to several key influences that work together. Urban construction spurs demand as skyscrapers and large complexes rise. This construction boom pushes crane sales and upgrades. Investment in infrastructure also adds to growth.

When governments allocate funds for roads and bridges, they often require cranes. These projects boost the market by increasing crane use. Renewable energy projects further drive growth. Wind farms and solar installations need cranes for setup, creating new market opportunities.

Advancements in automation make cranes more efficient. Modern machines with AI reduce manual errors and improve safety. Companies can increase productivity and lower costs using smart cranes. This shift attracts more buyers, expanding the market.

As urbanization continues, infrastructure needs rise. For example, a city planning a new airport will rely heavily on cranes. Overall, these factors create a strong foundation for growth. They collectively enhance market prospects and encourage innovation.

Restraining Factors

Economic and Regulatory Challenges Restrain Market Growth

The crane industry faces several hurdles that slow its progress. Rising raw material prices increase costs. This makes new equipment expensive. Strict safety and emissions laws also pose challenges.

Firms must invest in compliance and upgrades. A shortage of skilled operators means cranes may not be used efficiently. In some regions, this gap affects productivity. Large cranes present logistical issues.

Transporting large cranes can be difficult and costly, especially in remote areas. Each factor restricts market growth in different ways. For instance, higher costs may delay new purchases. Strict rules require expensive modifications.

A lack of operators could result in underused equipment. Difficult transport limits project scope. When these challenges combine, they create barriers to expansion. Comp

Growth Opportunities

Innovation Provides Opportunities

The Crane Market has many opportunities through innovation and new applications. Electric and hybrid cranes are becoming popular for sustainable operations. They lower emissions and attract eco-conscious buyers. The rise of IoT changes maintenance.

Real-time data helps schedule repairs and avoid downtime. This technology saves money and boosts productivity. Construction equipment rental markets grow as small contractors prefer flexible options. This trend increases revenue streams for manufacturers and service providers.

Modular construction techniques also open new prospects. These methods often need specialized cranes, driving niche markets. Companies that adapt to these trends can lead the market. For example, a crane manufacturer might design a hybrid model to meet green standards.

Partnering with tech firms for IoT integration shows clear pathways for growth. Innovations not only meet current demands but also anticipate future needs. They make operations smoother and more cost-effective. Embracing these trends allows players to capitalize on new business avenues.

Emerging Trends

Smart Trends Are Latest Trending Factor

The Crane Market is shaped by emerging trends that promise future growth. Smart cranes equipped with AI features are gaining attention. They provide better safety and efficiency on job sites. Modular crane designs also attract interest.

These flexible machines adapt to diverse needs, making them popular in various industries. Eco-friendly cranes emphasize low emissions. They meet strict regulations and eco-conscious preferences. The growing use of cranes in prefabricated construction is another trend.

These machines speed up assembly and reduce waste. Each trend impacts the market uniquely. AI enhances decision-making and reduces errors. Modular designs bring versatility and cost savings.

Eco-friendly approaches align with global sustainability goals. Prefabrication supports faster project delivery. For instance, a construction firm in a busy city may opt for smart, low-emission cranes to cut costs and meet regulations. This highlights how trends shape purchasing decisions.

Regional Analysis

North America Dominates with 32.4% Market Share

North America commands the Crane Market with a significant 32.4% share, which translates to a revenue of USD 12.05 billion. This dominance is fueled by extensive infrastructure projects, robust manufacturing sectors, and high investment in construction and energy sectors.

The region benefits from a stable economic environment, advanced technological infrastructure, and a skilled workforce, which are pivotal for the crane market. Additionally, the push towards renewable energy projects and the revitalization of urban infrastructure contribute to the high demand for cranes.

The future influence of North America in the global Crane Market is expected to strengthen as the region continues to invest in infrastructure and renewable energy projects. The need for advanced and specialized cranes is likely to increase, supporting the region’s strong position in the market.

Regional Mentions:

- Europe: Europe holds a significant portion of the Crane Market, driven by stringent safety regulations and a focus on renewable energy projects. The region’s emphasis on technologically advanced cranes aids in its steady market growth.

- Asia Pacific: Asia Pacific is experiencing rapid growth in the Crane Market, fueled by extensive urban development and industrialization, especially in China and India. These countries are major contributors to the region’s high demand for various types of cranes.

- Middle East & Africa: The Middle East and Africa are witnessing increased demand in the Crane Market, mainly due to investments in infrastructure and oil & gas projects. The region’s market growth is supported by the construction of new cities and energy projects.

- Latin America: Latin America’s Crane Market is growing, with investments in construction and mining industries. Brazil and Mexico are particularly notable for their development projects that demand a wide range of crane services.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

In the global Crane Market, the top players include Liebherr Group, Tadano Ltd., Manitowoc Company, Inc., and Terex Corporation. These companies play a pivotal role in shaping industry trends and market dynamics due to their substantial market shares, technological innovations, and comprehensive product portfolios.

Liebherr Group stands out with its vast array of cranes, including mobile, tower, and crawler cranes, known for their reliability and high performance. The company’s strong focus on R&D enables it to continuously innovate and meet the diverse needs of the construction, mining, and maritime sectors.

Tadano Ltd. is renowned for its hydraulic mobile cranes and aerial work platforms. With a commitment to safety and efficiency, Tadano’s products are favored for their advanced engineering and sustainability, which align with the global shift towards environmentally friendly construction practices.

Manitowoc Company, Inc., another key player, specializes in lattice-boom cranes, tower cranes, and mobile telescopic cranes. The company is dedicated to enhancing operational efficiency and has embraced cutting-edge technologies, including internet of things (IoT) enhancements, to improve crane functionality and operator safety.

Terex Corporation offers a broad range of lifting solutions, including tower cranes and rough terrain cranes, making it a significant competitor in various markets, from construction to utilities. Terex’s strategy focuses on operational excellence and customer-centric innovation, ensuring it remains competitive in evolving market conditions.

Together, these companies not only lead in market share but also drive technological advancements and competitive strategies within the industry. Their ongoing investments in technology and new product development are crucial for maintaining leadership and adapting to the changing demands of the global market.

Major Companies in the Market

- Liebherr Group

- Tadano Ltd.

- Manitowoc Company, Inc.

- Terex Corporation

- Zoomlion Heavy Industry Science & Technology Co., Ltd.

- XCMG Construction Machinery Co., Ltd.

- Sany Group

- Konecranes Plc

- PALFINGER AG

- Hitachi Construction Machinery Co.

- Kobelco Construction Machinery Co., Ltd.

- Sumitomo Heavy Industries

- Link-Belt Cranes

Recent Developments

- Tadano Ltd. and IHI Transport Machinery: On November 2024, Tadano Ltd. acquired IHI Transport Machinery’s crane business. This strategic move aims to expand Tadano’s product portfolio to include a wider range of lifting equipment, such as tower and port cranes, thereby enhancing its market presence.

- Konecranes and Kocks Kranbau GmbH: On April 2024, Konecranes acquired Kocks Kranbau GmbH. This acquisition significantly expands Konecranes’ reach in the port services sector, enhancing its ability to provide advanced lifting solutions to ports worldwide.

Report Scope

Report Features Description Market Value (2024) USD 37.2 Billion Forecast Revenue (2034) USD 57.8 Billion CAGR (2025-2034) 4.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Mobile Cranes: Truck-Mounted Cranes, Rough Terrain Cranes, All-Terrain Cranes, Crawler Cranes, Fixed Cranes: Tower Cranes, Overhead Cranes, Gantry Cranes), By Operation Type (Hydraulic Cranes, Electric Cranes, Hybrid Cranes), By Application (Construction, Mining, Shipping and Port, Oil and Gas, Transportation and Logistics, Industrial Manufacturing) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Liebherr Group, Tadano Ltd., Manitowoc Company, Inc., Terex Corporation, Zoomlion Heavy Industry Science & Technology Co., Ltd., XCMG Construction Machinery Co., Ltd., Sany Group, Konecranes Plc, PALFINGER AG, Hitachi Construction Machinery Co., Kobelco Construction Machinery Co., Ltd., Sumitomo Heavy Industries, Link-Belt Cranes Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Liebherr Group

- Tadano Ltd.

- Manitowoc Company, Inc.

- Terex Corporation

- Zoomlion Heavy Industry Science & Technology Co., Ltd.

- XCMG Construction Machinery Co., Ltd.

- Sany Group

- Konecranes Plc

- PALFINGER AG

- Hitachi Construction Machinery Co.

- Kobelco Construction Machinery Co., Ltd.

- Sumitomo Heavy Industries

- Link-Belt Cranes