Global IoT in Oil and Gas Market Size, Share, Statistics Analysis Report By Component (Solution (Software, Hardware), Services), By Operations (Upstream, Midstream, Downstream), By Application (Pipeline Monitoring, Asset Management, Production Optimization, Other Applications), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: January 2025

- Report ID: 137005

- Number of Pages: 203

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- U.S. IoT in Oil and Gas Market Size

- Component Analysis

- Operations Analysis

- Application Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Emerging Trends

- Business Benefits

- Key Regions and Countries

- Key Player Analysis

- Top Opportunities Awaiting for Players

- Recent Developments

- Report Scope

Report Overview

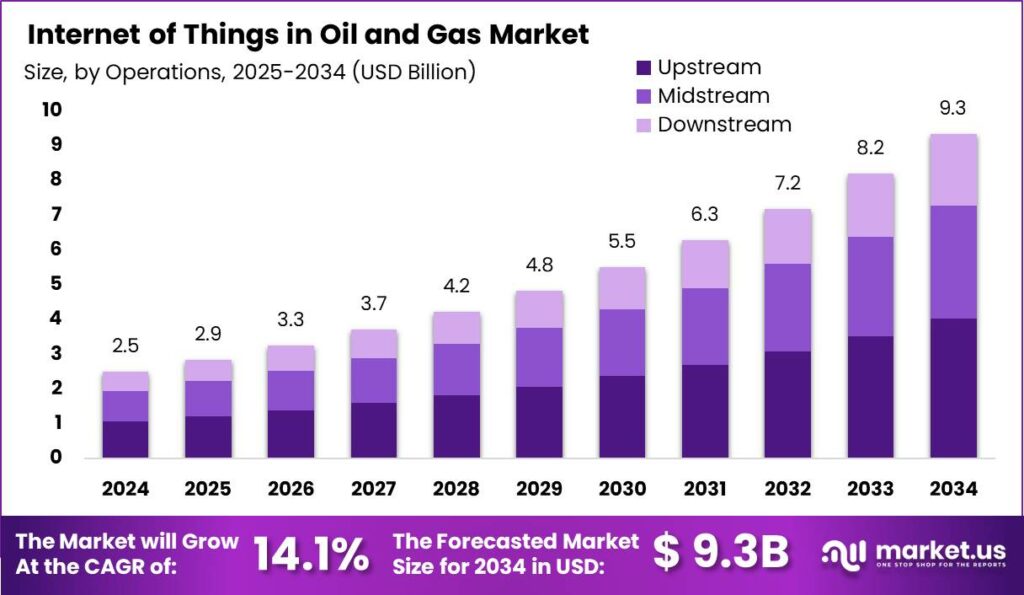

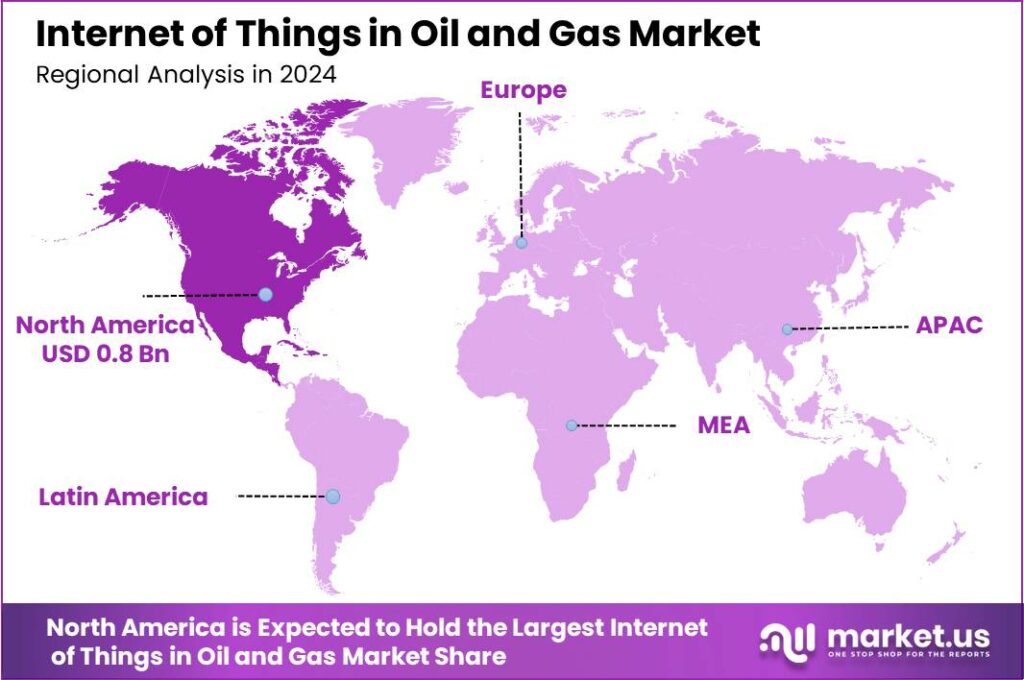

The Global IoT in Oil and Gas Market size is expected to be worth around USD 9.3 Billion By 2034, from USD 2.5 Billion in 2024, growing at a CAGR of 14.10% during the forecast period from 2025 to 2034. In 2024, North America held a dominant position in the Internet of Things (IoT) in the oil and gas market, capturing over 34.1% of the market share, with revenues reaching USD 0.8 billion.

The Internet of Things (IoT) in the oil and gas industry refers to the sophisticated integration of sensors, smart devices, and data analytics into a cohesive network. This technology facilitates the real-time collection, analysis, and sharing of data, transforming operations by enhancing efficiency, reducing waste, and optimizing resource management across the sector.

The market for IoT in the oil and gas industry encompasses the sale of IoT devices, software, and services that facilitate the enhanced connectivity and automation of oil and gas operations. This market is witnessing substantial growth driven by the need for operational efficiency and cost reduction in response to fluctuating oil prices and regulatory pressures.

The deployment of IoT solutions allows for real-time monitoring of assets, which can significantly reduce downtime and maintenance costs while improving the productivity of oil and gas operations. Several key factors are driving the adoption of IoT in the oil and gas industry. The primary driver is the need to enhance operational efficiency and reduce operating costs. IoT enables predictive maintenance of equipment, which can preempt costly failures and minimize downtime.

Additionally, stringent environmental regulations are pushing companies towards adopting cleaner and more efficient technologies, with IoT playing a crucial role in monitoring and reducing emissions. The push for digital transformation within the industry also acts as a catalyst for IoT adoption, as companies seek to leverage digital data for strategic decision-making.

The demand for IoT solutions in the oil and gas industry is on the rise, driven by the sector’s need to increase productivity and efficiency while ensuring safety and compliance with environmental laws. The ability of IoT technologies to provide comprehensive monitoring and predictive maintenance is particularly valued, as it can lead to significant cost savings and risk mitigation.

According to Digi International, the use of cellular, satellite, and LPWA connectivity devices in the oil and gas industry is set to grow significantly. Analysts predict that by 2028, the number of these devices will more than double to over 18 million units. This surge reflects the growing reliance on advanced technologies to optimize operations and improve efficiency across the sector.

A separate study by Inmarsat highlights that 80% of oil and gas companies see IoT (Internet of Things) as a critical tool for reducing their carbon footprint. This indicates a clear shift toward leveraging technology not only for operational benefits but also for environmental responsibility.

However, there’s a gap in the adoption of predictive maintenance technologies, which could significantly enhance efficiency. Currently, less than 25% of oil and gas operators are utilizing predictive maintenance tools. This is concerning given that unplanned maintenance, according to a Deloitte study, can account for up to 20% of an organization’s operational budget.

Technological advancements are central to the expansion of the IoT in oil and gas market. Innovations in sensor technology, data analytics, and machine learning are enhancing the capabilities of IoT platforms, enabling more sophisticated monitoring and predictive analytics. Integration with artificial intelligence (AI) and big data solutions is further empowering the sector to leverage vast amounts of operational data to drive efficiency and productivity.

The IoT in oil and gas market presents numerous opportunities for technology providers and oil and gas companies alike. As the industry moves toward remote operations and automation, there is significant potential for the expansion of IoT solutions that can offer enhanced connectivity and real-time data analysis. Opportunities also exist in developing IoT solutions that can withstand harsh operational environments typical of oil and gas extraction sites.

Key Takeaways

- The Global Internet of Things in Oil and Gas Market size is expected to reach USD 9.3 Billion by 2034, up from USD 2.5 Billion in 2024, growing at a CAGR of 14.10% from 2025 to 2034.

- In 2024, the solution segment held a dominant market position in the IoT oil and gas market, capturing more than 74.8% of the share.

- The Upstream segment dominated the IoT oil and gas sector in 2024, accounting for more than 43.0% of the market share.

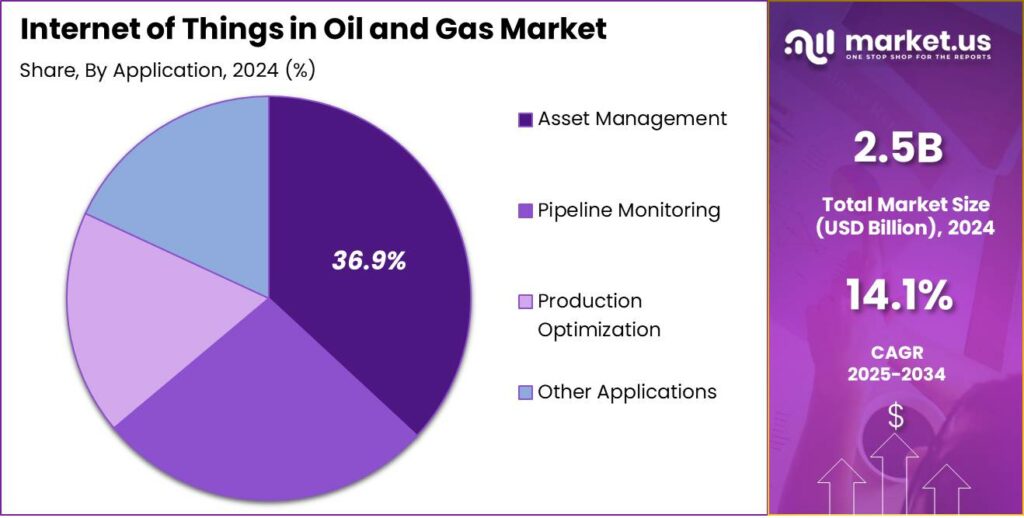

- In 2024, the Asset Management segment led the IoT oil and gas industry, holding a more than 36.9% share.

- North America held the largest market share in the IoT oil and gas market in 2024, capturing more than 34.1% of the market with revenues reaching USD 0.8 billion.

U.S. IoT in Oil and Gas Market Size

In 2024, the US market for Internet of Things (IoT) in oil and gas was valued at USD 0.67 billion. This significant valuation underscores the United States’ leading role in adopting IoT technologies within the oil and gas sector, driven by several key factors.

The United States dominates this market segment due to its robust technological infrastructure and strong emphasis on innovation and efficiency in energy operations. American oil and gas companies have been early adopters of digital technologies, including IoT, to enhance operational efficiencies, reduce costs, and improve safety measures.

The presence of major IoT and technology companies like IBM, Intel, and Cisco, who have substantial investments in developing cutting-edge IoT solutions, further propels this market forward. Additionally, the regulatory environment in the U.S. supports the adoption of IoT technologies by emphasizing safety and environmental sustainability, which encourages companies to invest in technology that can monitor and manage oil and gas operations more effectively.

In 2024, North America held a dominant market position in the Internet of Things (IoT) in the oil and gas market, capturing more than a 34.1% share with revenues reaching USD 0.8 billion. This region’s leadership can be attributed to several factors that underscore its pioneering role in integrating IoT solutions within the oil and gas sector.

North America, particularly the United States and Canada, is home to some of the world’s largest and most technologically advanced oil and gas companies, which are keen to adopt new technologies to enhance operational efficiency and reduce environmental impacts. North America’s focus on safety and environmental sustainability has driven the adoption of IoT technologies for compliance and operational safety.

The region’s strong technological infrastructure and substantial investments in research and development have fostered innovation in IoT applications tailored to oil and gas operations. These advancements have led to the development of sophisticated IoT solutions that improve exploration, production, and distribution processes.

Furthermore, the competitive market dynamics in North America encourage oil and gas companies to leverage IoT solutions to enhance productivity and cost-efficiency. The presence of a highly skilled workforce and cutting-edge technological capabilities facilitates the deployment and integration of complex IoT systems across the oil and gas value chain.

Component Analysis

In 2024, the solution segment held a dominant market position within the Internet of Things (IoT) in the oil and gas market, capturing more than a 74.8% share. This substantial market share can be largely attributed to the critical need for integrated hardware and software solutions that enhance operational efficiencies in oil and gas operations.

Hardware components like sensors, actuators, and GPS tools are vital for data acquisition and monitoring physical processes, while software solutions enable data analysis, visualization, and operational control, making them indispensable for modern oil and gas enterprises.

The leadership of the solution segment is further underscored by the increasing reliance on real-time data for decision-making in the oil and gas sector. Software solutions facilitate the real-time analysis and management of vast amounts of data generated by hardware devices, allowing for timely decisions that can significantly impact efficiency and cost management.

Moreover, technological advancements in IoT hardware, such as improvements in sensor technology, have reduced costs and enhanced the functionality of IoT solutions in oil and gas operations. The ability of these devices to operate in harsh and remote environments makes them even more valuable to the sector.

Operations Analysis

In 2024, the Upstream segment held a dominant market position within the Internet of Things (IoT) in the oil and gas sector, capturing more than a 43.0% share. This segment’s leadership is primarily due to its critical role in exploration and production activities where IoT technologies significantly enhance efficiency and safety.

The integration of IoT devices allows for real-time monitoring and data analysis, leading to more precise drilling and reduced operational risks. These advancements are vital in locations that are remote or environmentally sensitive, where precision and safety are paramount.

The Upstream sector benefits uniquely from IoT by facilitating predictive maintenance of equipment and automated drilling solutions. These innovations reduce downtime and extend the life of critical equipment, which are essential for maintaining continuous production and reducing costs.

The ability to predict equipment failure before it occurs and to automate complex drilling operations not only enhances efficiency but also helps in managing the environmental impact of drilling activities, aligning with global sustainability goals. Furthermore, the adoption of IoT in the Upstream segment is accelerated by the increasing complexity of oil and gas exploration.

Application Analysis

In 2024, the Asset Management segment held a dominant market position within the Internet of Things (IoT) in the oil and gas industry, capturing more than a 36.9% share. This segment’s prominence stems from its crucial role in optimizing the utilization and operational efficiency of assets, which is pivotal in an industry characterized by heavy investments in infrastructure and equipment.

The significant investment in IoT for Asset Management is driven by the need to reduce operational costs and enhance asset performance. Through the integration of IoT devices,companies gain insights into the condition and performance of their assets.

Moreover, the Asset Management segment benefits from advancements in IoT technology that facilitate detailed asset tracking and inventory management. These advancements support better decision-making regarding asset repair or replacement, thus optimizing capital expenditure.

The growing regulatory pressure on safety and environmental compliance further boosts the adoption of IoT in asset management. Regulatory bodies are increasingly mandating stringent monitoring and reporting requirements for equipment safety and emissions.

Key Market Segments

By Component

- Solution

- Software

- Hardware

- Services

By Operations

- Upstream

- Midstream

- Downstream

By Application

- Pipeline Monitoring

- Asset Management

- Production Optimization

- Other Applications

Driver

Enhanced Operational Efficiency

The integration of Internet of Things (IoT) technologies in the oil and gas sector significantly enhances operational efficiency. By deploying IoT-enabled sensors and devices, companies can monitor equipment health, track real-time data on temperature, pressure, and flow rates, and optimize production processes.

This real-time monitoring facilitates predictive maintenance, reducing unexpected equipment failures and minimizing downtime. Consequently, operational costs are lowered, and productivity is increased. For instance, IoT applications in upstream operations enable more precise exploration and drilling, leading to improved resource extraction and reduced environmental impact.

Restraint

Data Security and Privacy Concerns

The implementation of IoT technologies in the oil and gas industry raises significant data security and privacy concerns. The vast network of interconnected devices creates potential vulnerabilities to cyberattacks, where malicious actors could disrupt operations, steal sensitive data, or even cause physical harm.

Ensuring robust cybersecurity measures is essential to protect sensitive information and maintain operational integrity. This includes implementing strong authentication protocols, encryption, and vulnerability management practices. Additionally, the shortage of skilled personnel with expertise in IoT and digital technologies poses a challenge in effectively managing and securing these complex systems.

Opportunity

Environmental Monitoring and Sustainability

The oil and gas industry faces increasing pressure to reduce its environmental impact and comply with stringent regulations. IoT technologies offer significant opportunities in environmental monitoring and promoting sustainability.

By deploying IoT-enabled sensors, companies can continuously monitor emissions, detect leaks, and track energy consumption in real-time. This proactive approach allows for immediate corrective actions, minimizing environmental hazards and ensuring compliance with environmental standards.

Furthermore, IoT solutions contribute to optimizing resource utilization, reducing waste, and enhancing energy efficiency.IoT in environmental monitoring helps meet regulations while promoting energy efficiency, reducing carbon footprints, and supporting sustainability goals.

Challenge

Integration with Existing Infrastructure

Integrating IoT technologies with existing infrastructure in the oil and gas industry presents a significant challenge. Legacy systems may not be compatible with modern IoT solutions, requiring costly upgrades or complete overhauls. The complexity of existing operations and the scale of infrastructure further complicate the integration process.

Additionally, managing the vast volumes of data generated by IoT sensors necessitates advanced data management and analytics tools to derive actionable insights. The shortage of skilled personnel with expertise in IoT and digital technologies adds to the challenge, as there is a growing need for experts who can manage and analyze large datasets effectively.

Emerging Trends

One significant development is the integration of IoT sensors for real-time monitoring of equipment and infrastructure. These sensors collect data on parameters like pressure, temperature, and flow rates, enabling predictive maintenance and reducing unplanned downtime.

Another trend involves the use of IoT in ensuring worker safety. Wearable devices equipped with IoT technology monitor workers’ vital signs and environmental conditions, providing alerts in case of hazardous situations. This proactive approach helps in preventing accidents and ensuring a safer working environment.

IoT is also facilitating remote operations, allowing companies to monitor and control processes in real-time from distant locations. This capability is particularly beneficial for operations in remote or hazardous areas, reducing the need for on-site personnel and minimizing risks.

Business Benefits

One of the primary advantages is improved operational efficiency. IoT sensors enable real-time monitoring of equipment performance, allowing for predictive maintenance and reducing downtime. This leads to increased productivity and optimized operations.

Cost optimization is also achieved through IoT implementation. By enabling remote real-time asset management across a complex network of equipment, IoT technology helps improve product yield, energy efficiency, and unit downtime, leading to cost savings.

Additionally, IoT facilitates better data collection and analytics, which are crucial for decision-making in the oil and gas industry. Real-time data generated from IoT devices can be analyzed to gain insights into operations, equipment performance, and environmental conditions, enabling companies to make informed decisions and optimize processes.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

In the dynamic landscape of the Internet of Things (IoT) in the oil and gas industry, several key players stand out for their innovative contributions and market influence.

Schneider Electric has established itself as a leader in the IoT space within the oil and gas industry, thanks to its comprehensive suite of technologies that enhance efficiency and sustainability. The company specializes in energy management and automation solutions that are pivotal for optimizing production and reducing operational costs in the oil and gas sector.

Semtech is recognized for its development of advanced semiconductor products that play a crucial role in the IoT applications for the oil and gas industry. Their technology is particularly known for its robust performance in harsh environmental conditions, which is critical in oil and gas operations.

Siemens AG is a global powerhouse in industrial manufacturing, technology, and automation, with a strong presence in the IoT for oil and gas markets. Their IoT systems integrate seamlessly with existing infrastructure, providing oil and gas operators with enhanced data analytics, process automation, and connectivity solutions.

Top Key Players in the Market

- Schneider Electric

- Semtech

- Siemens AG

- Rockwell Automation

- Cisco Systems, Inc.

- Emerson Electric Co.

- ABB

- IBM Corporation

- Microsoft Corporation

- Open Automation Software

- Telit Cinterion

- SumatoSoft

- Other Key Players

Top Opportunities Awaiting for Players

In the dynamic world of oil and gas, the Internet of Things (IoT) offers a multitude of opportunities to enhance operations and drive efficiency.

- Enhanced Drilling and Production Optimization: IoT technologies can significantly improve the efficiency of drilling and production processes by enabling real-time monitoring and control. Sensors and IoT devices can be used to track equipment health, monitor well conditions, and optimize drilling operations, leading to increased operational efficiency and reduced downtime.

- Advanced Pipeline Monitoring and Maintenance: The deployment of IoT in pipeline monitoring can help prevent leaks and ensure the integrity of pipeline infrastructure. Real-time data collection and analysis from IoT sensors can detect potential leaks, corrosion, and other threats, allowing for proactive maintenance and reduced environmental risks.

- Fleet and Asset Management: IoT enables more efficient management of fleet and assets through real-time tracking and predictive maintenance. This not only reduces operational costs but also extends the lifespan of equipment, ensuring that assets are optimally utilized and maintenance schedules are effectively managed.

- Safety and Environmental Monitoring: IoT devices can play a crucial role in enhancing safety protocols by providing real-time environmental monitoring. This includes detecting hazardous conditions, ensuring compliance with safety standards, and minimizing the risk, which is paramount in high-risk industries like oil and gas.

- Integration with AI and Big Data Analytics: Combining IoT with artificial intelligence (AI) and big data analytics can transform data into actionable insights. This integration enables enhanced decision-making capabilities, improved operational efficiencies, and the ability to predict and mitigate potential issues before they occur.

Recent Developments

- In October 2024, IBM acquired Prescinto, a provider of asset performance management software for renewables. This acquisition aims to enhance IBM’s Maximo Application Suite, supporting clients’ sustainability initiatives and optimizing the performance of energy assets, including those in the oil and gas sector.

- In December 2024, ABB completed the acquisition of Aurora Motors, a U.S. provider of vertical pump motors. This acquisition is expected to enhance ABB’s product offerings and support its global customer base, including those in the oil and gas sector.

Report Scope

Report Features Description Market Value (2024) USD 2.5 Bn Forecast Revenue (2034) USD 9.3 Bn CAGR (2025-2034) 14.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Solution (Software, Hardware), Services), By Operations (Upstream, Midstream, Downstream), By Application (Pipeline Monitoring, Asset Management, Production Optimization, Other Applications) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Schneider Electric, Semtech, Siemens AG, Rockwell Automation, Cisco Systems, Inc., Emerson Electric Co., ABB, IBM Corporation, Microsoft Corporation, Open Automation Software, Telit Cinterion, SumatoSoft, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  IoT in Oil and Gas MarketPublished date: January 2025add_shopping_cartBuy Now get_appDownload Sample

IoT in Oil and Gas MarketPublished date: January 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Schneider Electric

- Semtech

- Siemens AG

- Rockwell Automation

- Cisco Systems, Inc.

- Emerson Electric Co.

- ABB

- IBM Corporation

- Microsoft Corporation

- Open Automation Software

- Telit Cinterion

- SumatoSoft

- Other Key Players