Circulating Tumor Cells Market By Technology [CTC Detection & Enrichment Methods (Immunocapture {Negative Selection and Positive Selection}, Size-based Separation (Membrane-based and Microfluidic-based), Combined Methods, and Density-based Separation), CTC Direct Detection Methods (Microscopy, SERS, and Others), and CTC Analysis], By Application [Clinical/ Liquid Biopsy (Risk Assessment and Screening & Monitoring) and Research (Cancer Stem Cell & Tumorogenesis Research and Drug/Therapy Development)], By Product (Blood Collection Tubes, Devices or Systems, and Kits & Reagents), By Specimen (Blood, Bone Marrow, and Others), By End-use (Research & Academic Institutes, Hospital & Clinics, and Diagnostic Centers), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2025

- Report ID: 137258

- Number of Pages: 268

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

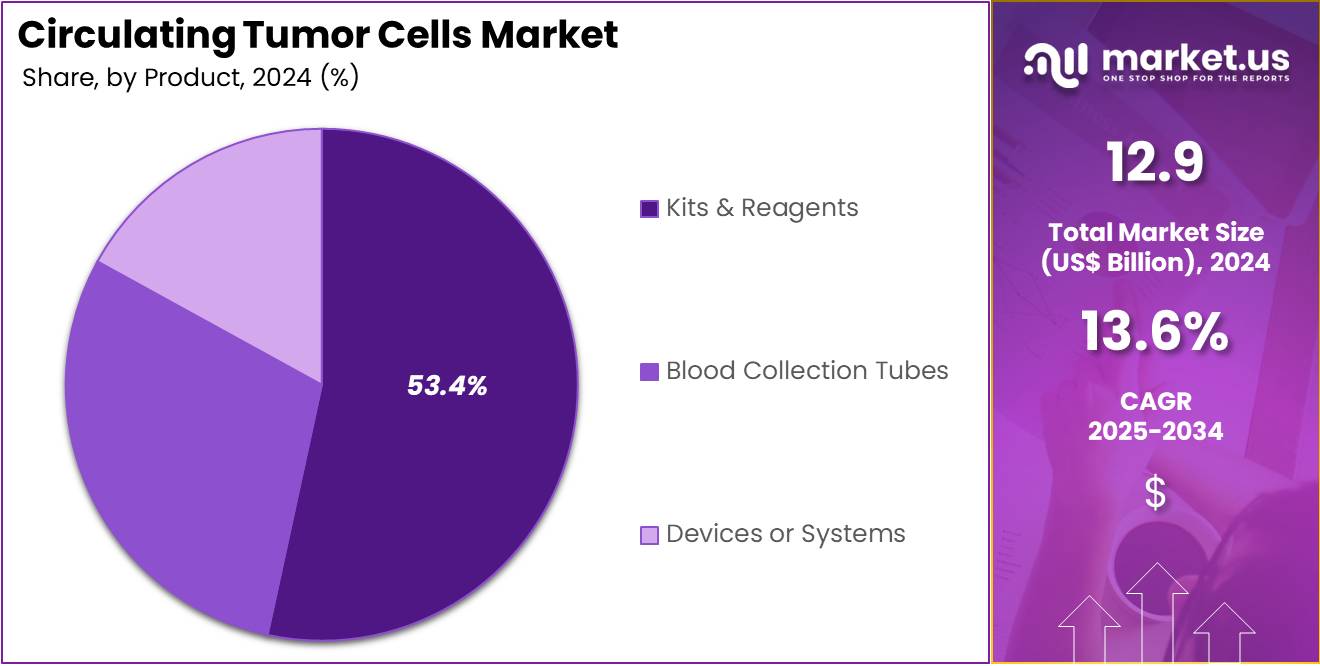

The Global Circulating Tumor Cells Market Size is expected to be worth around US$ 46.2 Billion by 2034, from US$ 12.9 Billion in 2024, growing at a CAGR of 13.6% during the forecast period from 2025 to 2034.

Growing advancements in cancer diagnostics and the increasing demand for noninvasive testing methods are driving the growth of the circulating tumor cells (CTCs) market. CTCs play a critical role in the early detection, monitoring, and prognosis of cancer by providing valuable insights into tumor progression and metastasis. As precision medicine becomes more prevalent, CTCs are increasingly used for personalized treatment strategies, allowing clinicians to tailor therapies based on the molecular characteristics of a patient’s tumor.

The market is benefiting from advancements in liquid biopsy technologies, which enable the detection and analysis of CTCs in blood samples, offering a less invasive alternative to traditional biopsy methods. In May 2023, Menarini Silicon Biosystems collaborated with Alivio Health to offer CELLSEARCH liquid biopsy tests to Alivio Health’s clients and members. These tests enable noninvasive analysis of CTCs, supporting clinical decision-making and potentially facilitating earlier diagnoses and more effective treatments.

Recent trends also highlight the growing use of CTCs in monitoring treatment responses, detecting minimal residual disease, and assessing tumor heterogeneity. The rising demand for personalized cancer therapies and the increasing number of cancer cases globally present significant opportunities for the CTCs market, as more healthcare providers adopt these advanced diagnostic tools to improve patient outcomes.

Key Takeaways

- In 2024, the market for Circulating Tumor Cells generated a revenue of US$ 12.9 billion, with a CAGR of 13.6%, and is expected to reach US$ 46.2 billion by the year 2034.

- The technology segment is divided into TC detection & enrichment methods, CTC direct detection methods, and CTC analysis, with CTC detection & enrichment methods taking the lead in 2024 with a market share of 58.3%.

- Considering application, the market is divided into clinical/ liquid biopsy and research. Among these, research held a significant share of 62.7%.

- Furthermore, concerning the product segment, the market is segregated into blood collection tubes, devices or systems, and kits & reagents. The kits & reagents sector stands out as the dominant player, holding the largest revenue share of 53.4% in the Circulating Tumor Cells market.

- The specimen segment is segregated into blood, bone marrow, and others, with the blood segment leading the market, holding a revenue share of 69.5%.

- Considering end-use, the market is divided into research & academic institutes, hospital & clinics, and diagnostic centers. Among these, research & academic institutes held a significant share of 51.1%.

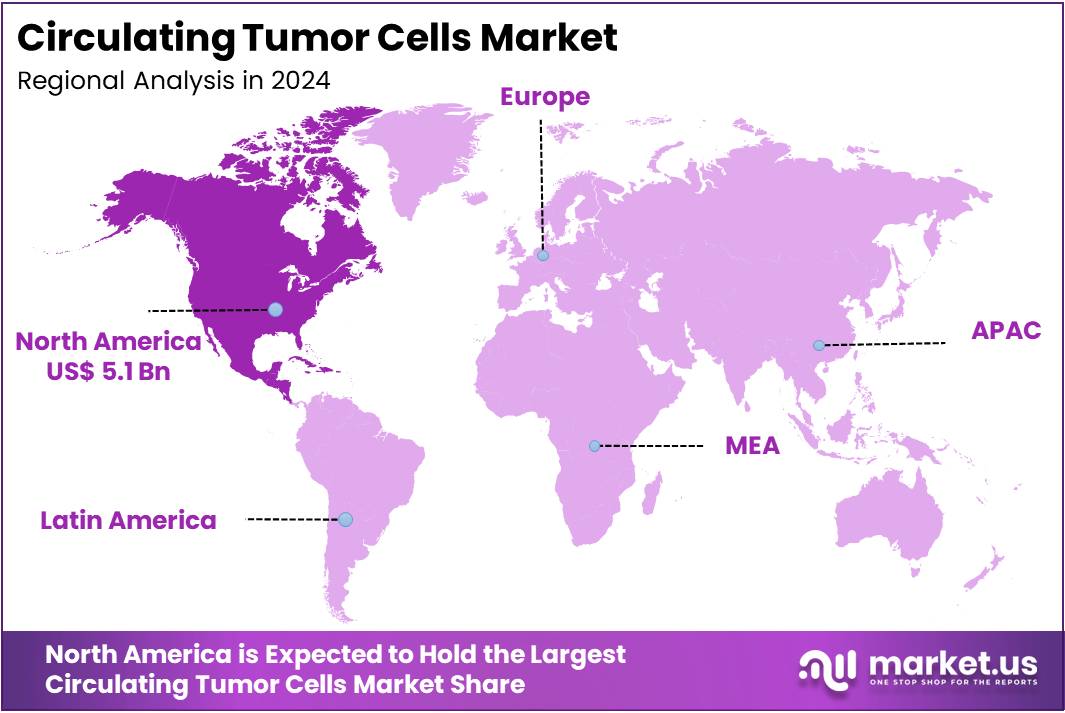

- North America led the market by securing a market share of 39.6% in 2024.

Technology Analysis

The CTC detection & enrichment methods segment led in 2024, claiming a market share of 58.3% owing to the increasing demand for non-invasive, early cancer detection technologies. Advancements in microfluidic technologies and magnetic bead-based separation methods are anticipated to enhance the sensitivity and efficiency of CTC enrichment, making these methods more widely used in clinical and research applications.

The rising prevalence of cancer and the growing shift towards personalized medicine are likely to drive the demand for more accurate and reliable CTC detection methods. Additionally, the increasing adoption of liquid biopsy techniques is projected to contribute to the growth of this segment, as it allows for continuous monitoring of cancer progression and therapy response. The ability to detect CTCs at early stages will be crucial in developing better cancer treatments, further fueling the demand for CTC detection and enrichment technologies.

Application Analysis

The research held a significant share of 62.7% due to the increasing use of CTCs in cancer research and liquid biopsy applications. Researchers are expected to focus on improving the understanding of cancer metastasis and monitoring disease progression using CTCs. The growing demand for non-invasive testing methods in oncology is likely to fuel the need for more advanced CTC detection technologies in research settings.

Additionally, the increasing emphasis on personalized medicine, where treatment plans are tailored to individual genetic profiles, will likely further drive research on CTCs. As more cancer biomarkers are discovered and validated, the research segment is expected to grow rapidly, with CTCs serving as a valuable tool for both preclinical studies and clinical trials.

Product Analysis

The kits & reagents segment had a tremendous growth rate, with a revenue share of 53.4% owing to the increasing demand for easy-to-use, standardized solutions for CTC isolation, detection, and analysis. As liquid biopsy technology continues to advance, the demand for specialized kits and reagents, including blood collection tubes and assay kits, is likely to rise.

These products are expected to simplify the process of CTC isolation and improve the reproducibility of results, making them essential for both clinical diagnostics and research applications. The growing number of diagnostic labs and research institutes focused on cancer genomics and liquid biopsy is projected to contribute to the growth of the kits and reagents segment. Additionally, the need for reliable and efficient detection of CTCs in real-time will further fuel the demand for these products, driving innovation in this segment.

Specimen Analysis

The blood segment grew at a substantial rate, generating a revenue portion of 69.5% as blood remains the most commonly used specimen for CTC detection. The increasing preference for non-invasive blood-based diagnostics in cancer detection is expected to drive demand for CTC blood collection methods. Blood specimens are anticipated to become the primary sample for liquid biopsy due to the ease of collection, minimizing patient discomfort while providing valuable diagnostic information.

The growing use of blood as a specimen in clinical trials, combined with the ability to detect CTCs in early cancer stages, is projected to drive this segment’s growth. Furthermore, the increasing adoption of blood-based CTC testing in cancer monitoring and therapy response assessment is likely to propel this segment forward.

End-use Analysis

The research & academic institutes segment grew at a substantial rate, generating a revenue portion of 51.1% due to the increasing focus on cancer research and the development of non-invasive cancer diagnostics. Academic institutions are anticipated to be key drivers of innovation in CTC detection and analysis, with CTCs serving as a valuable tool for understanding cancer metastasis and progression.

Research institutes are projected to invest more in CTC-based technologies, as they provide important insights into tumor biology and the potential for personalized treatment options. The rising number of academic studies exploring liquid biopsy and CTCs in oncology is expected to contribute to the growth of this segment. As funding for cancer research increases globally, research and academic institutions are likely to continue driving advancements in CTC detection technologies.

Key Market Segments

By Technology

- CTC Detection & Enrichment Methods

- Immunocapture

- Negative Selection

- Positive Selection

- Size-based Separation

- Membrane-based

- Microfluidic-based

- Combined Methods

- Density-based Separation

- Immunocapture

- CTC Direct Detection Methods

- Microscopy

- SERS

- Others

- CTC Analysis

By Application

- Clinical/ Liquid Biopsy

- Risk Assessment

- Screening & Monitoring

- Research

- Cancer Stem Cell & Tumorogenesis Research

- Drug/Therapy Development

By Product

- Blood Collection Tubes

- Devices or Systems

- Kits & Reagents

By Specimen

- Blood

- Bone Marrow

- Others

By End-use

- Research & Academic Institutes

- Hospital & Clinics

- Diagnostic Centers

Drivers

Growing Prevalence Of Cancer Is Driving The Circulating Tumor Cells Market

Growing prevalence of cancer significantly drives the circulating tumor cells market by increasing the demand for early detection and personalized treatment solutions. In 2023, the Pan American Health Organization reported approximately 20 million new cancer cases globally, alongside 10 million cancer-related deaths. This alarming rise in cancer incidence underscores the urgent need for advanced diagnostic tools that can identify and monitor cancer progression with high precision.

Circulating tumor cells (CTCs) offer a minimally invasive method to detect metastasis and evaluate treatment efficacy, making them invaluable in clinical settings. As healthcare providers strive to improve patient outcomes, the integration of CTC analysis into routine diagnostics becomes essential. Additionally, advancements in technologies such as microfluidics and molecular profiling enhance the sensitivity and specificity of CTC detection, further boosting market growth.

The increasing adoption of liquid biopsies, which rely on CTCs for comprehensive cancer profiling, drives the demand for sophisticated CTC platforms and related services. Furthermore, rising investments in cancer research and the development of targeted therapies create a favorable environment for the expansion of the circulating tumor cells market.

Governments and private sectors are anticipated to allocate more resources towards innovative cancer diagnostics, fostering the growth of CTC technologies. As the global burden of cancer continues to rise, the circulating tumor cells market is expected to expand, supported by the continuous advancements in diagnostic methodologies and the increasing emphasis on personalized medicine.

Restraints

Growing Concerns Over Data Privacy Are Restraining The Circulating Tumor Cells Market

A significant restraint in the circulating tumor cells market is the growing concerns over data privacy, which hinder the widespread adoption and trust in advanced diagnostic technologies. As CTC analysis involves the handling of sensitive genetic and clinical data, ensuring the security and confidentiality of this information becomes paramount.

High-profile data breaches and misuse of medical information have heightened awareness and anxiety among patients and healthcare providers about the potential risks associated with data sharing. Regulatory frameworks such as the General Data Protection Regulation (GDPR) in Europe and the Health Insurance Portability and Accountability Act (HIPAA) in the United States impose stringent requirements on data handling practices, increasing the compliance costs for companies in the market.

Additionally, the ethical implications of genetic data usage and the potential for genetic discrimination deter some individuals from opting for CTC-based diagnostics. Smaller laboratories and healthcare institutions may struggle to implement robust data security measures due to limited resources, further restricting market penetration.

The complexity of navigating diverse regulatory landscapes across different regions adds another layer of challenge, slowing down the deployment of CTC technologies globally. Moreover, the fear of unauthorized access and data breaches can reduce consumer confidence, limiting the willingness to adopt new diagnostic tools. Consequently, these growing data privacy concerns act as a significant barrier to the expansion of the circulating tumor cells market, restricting its ability to fully capitalize on the increasing demand for advanced cancer diagnostics.

Opportunities

High Occurrence Of Breast Cancer Among Women

High occurrence of breast cancer among women creates substantial opportunities for the circulating tumor cells market by driving the need for effective monitoring and treatment strategies. According to Breast Cancer Statistics and Resources, an estimated 297,790 women in the United States are expected to be diagnosed with breast cancer in 2023, making it the most common cancer among American women.

This high incidence rate necessitates advanced diagnostic tools that can detect cancer spread early and monitor treatment responses accurately. Circulating tumor cells provide a critical biomarker for assessing metastasis and tailoring personalized therapy plans, enhancing the management of breast cancer. Additionally, the increasing awareness and proactive health screenings among women contribute to the early detection and continuous monitoring of breast cancer, boosting the demand for CTC-based diagnostics.

Advances in technologies such as next-generation sequencing and single-cell analysis enhance the capability of CTCs to provide detailed insights into tumor biology and treatment efficacy. The integration of CTC analysis with digital health platforms allows for real-time monitoring and data-driven decision-making, improving patient outcomes and fostering trust in personalized medicine approaches. Furthermore, rising investments in breast cancer research and the development of targeted therapies create a conducive environment for the growth of the circulating tumor cells market.

As healthcare providers aim to offer more precise and effective treatments, the adoption of CTC technologies is expected to surge, particularly in oncology centers focused on breast cancer. This trend not only drives market expansion but also encourages continuous innovation in CTC detection and analysis, positioning the circulating tumor cells market as a pivotal component in the fight against breast cancer.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly impact the bovine serum albumin market. On the positive side, the growing demand for biopharmaceuticals and biotechnology advancements drives increased usage of serum albumin in drug formulation, diagnostics, and research. Expansion in emerging markets, coupled with rising healthcare investments, further supports growth.

However, economic slowdowns or recessions can lead to reduced research budgets, slowing market growth. Geopolitical instability, such as trade restrictions and regulatory changes, could affect the availability and cost of raw materials needed for serum albumin production. Ethical concerns surrounding animal-derived products also contribute to market challenges. Despite these factors, the market is expected to continue its growth, fueled by ongoing research and the increasing need for high-quality serum albumin in the pharmaceutical and biotechnology industries.

Trends

Surge in Demand for Animal-Free Bovine Serum Driving the Market

Rising demand for animal-free bovine serum is driving significant growth in the bovine serum albumin market. High awareness of animal welfare concerns and increasing preference for cruelty-free products are expected to accelerate the adoption of animal-free alternatives. The increasing focus on sustainability and the need for safer, more ethical products are projected to enhance the market for animal-free serum.

In August 2023, Dyadic International, Inc. introduced its animal-free bovine serum albumin, claiming structural equivalence to traditional animal-derived albumin. This breakthrough paves the way for new commercialization opportunities in fields such as human therapeutics, diagnostic kits, cell culture media, PCR, vaccine development, and broader research initiatives. As the trend for animal-free products grows, the market is anticipated to experience expanded opportunities, particularly in research and therapeutic applications.

Regional Analysis

North America is leading the Circulating Tumor Cells Market

North America dominated the market with the highest revenue share of 39.6% owing to the increasing prevalence of cancer, advancements in liquid biopsy technologies, and growing demand for non-invasive diagnostic tools. According to the American Cancer Society, approximately 238,340 new cases of lung cancer are expected to be diagnosed in the United States in 2023, with an estimated 127,070 fatalities attributed to the disease.

This rising cancer incidence has intensified the demand for innovative diagnostic solutions, including CTC-based tests, which offer a less invasive method for early cancer detection and monitoring treatment efficacy. The development of advanced CTC isolation and detection technologies, along with improved sensitivity and specificity, has further boosted market growth.

Additionally, the increasing adoption of personalized medicine, which requires precise molecular profiling of cancers, has also driven the demand for CTC-based assays. As research in oncology continues to progress and the need for early-stage cancer detection becomes more urgent, the circulating tumor cells market in North America is expected to experience continued expansion.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to the region’s rising cancer burden and expanding healthcare infrastructure. As the incidence of cancers, particularly lung, breast, and liver cancers, continues to increase across countries such as China, India, and Japan, the demand for advanced diagnostic tools like CTC-based tests is expected to rise.

The growing emphasis on early cancer detection and monitoring in these regions will likely contribute to market expansion. Furthermore, the region’s increasing focus on personalized and precision medicine is anticipated to drive the adoption of CTC-based assays, which offer critical insights into tumor characteristics and treatment responses.

With advancements in liquid biopsy technology and a growing awareness of the benefits of non-invasive cancer diagnostics, the circulating tumor cells market in Asia Pacific is estimated to witness robust growth. Governments’ increasing investments in cancer research and the rising number of healthcare initiatives to combat cancer are also expected to support market development in the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the circulating tumor cells market focus on developing advanced detection and isolation technologies to enhance diagnostic accuracy and enable personalized cancer treatment. Companies invest heavily in research to innovate solutions like microfluidic systems and automated platforms that streamline workflows in oncology research.

Collaborations with pharmaceutical firms and research institutions help expand applications in drug development and clinical trials. Geographic expansion into regions with rising cancer incidence and healthcare investments supports market growth. Many players also emphasize compliance with stringent regulatory standards to ensure reliability and trust in their products.

Menarini Silicon Biosystems is a key player in this market, offering cutting-edge solutions such as the CELLSEARCH system for detecting and analyzing tumor cells. The company focuses on innovation and precision to provide reliable tools for both research and clinical applications. Menarini’s global presence and commitment to advancing oncology diagnostics reinforce its leadership in the industry.

Top Key Players in the Circulating Tumor Cells Market

- Bio-Techne

- Bio-Techne Corporation

- Cell Microsystems

- Epic Sciences

- Menarini Silicon Biosystems

- Miltenyi Biotec

- Precision for Medicine

- QIAGEN

- Rarecells Diagnostics

Recent Developments

- In August 2023: Cell Microsystems enhanced its technological capabilities by acquiring Fluxion Biosciences, Inc. This acquisition allows for advanced measurements of electrical currents across cell membranes, offering deeper insights into ion channel activity and cellular signaling.

- In June 2023: Bio-Techne announced its acquisition of LunaPhore, a Swiss company specializing in advanced tissue imaging and analysis technologies. By incorporating LunaPhore’s innovations, Bio-Techne aims to develop a complete, end-to-end workflow for tissue research. The acquisition is anticipated to be finalized in the first quarter of 2024.

- In March 2023: Miltenyi Biotec acquired Lino Biotech AG. This acquisition brought Lino Biotech’s cutting-edge biosensor technology into Miltenyi’s portfolio, with the aim of advancing assay development and enhancing quality control processes across the field.

Report Scope

Report Features Description Market Value (2024) US$ 12.9 Billion Forecast Revenue (2034) US$ 46.2 Billion CAGR (2025-2034) 13.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Technology (CTC Detection & Enrichment Methods (Immunocapture {Negative Selection and Positive Selection}, Size-based Separation {Membrane-based and Microfluidic-based}, Combined Methods, and Density-based Separation), CTC Direct Detection Methods (Microscopy, SERS, and Others), and CTC Analysis), By Application (Clinical/ Liquid Biopsy (Risk Assessment and Screening & Monitoring) and Research (Cancer Stem Cell & Tumorogenesis Research and Drug/Therapy Development)), By Product (Blood Collection Tubes, Devices or Systems, and Kits & Reagents), By Specimen (Blood, Bone Marrow, and Others), By End-use (Research & Academic Institutes, Hospital & Clinics, and Diagnostic Centers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Bio-Techne , Bio-Techne Corporation, Cell Microsystems , Epic Sciences, Menarini Silicon Biosystems, Miltenyi Biotec, Precision for Medicine, QIAGEN, and Rarecells Diagnostics. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Circulating Tumor Cells MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample

Circulating Tumor Cells MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Bio-Techne

- Bio-Techne Corporation

- Cell Microsystems

- Epic Sciences

- Menarini Silicon Biosystems

- Miltenyi Biotec

- Precision for Medicine

- QIAGEN

- Rarecells Diagnostics