Global Cancer Gene Therapy Market Analysis By Therapy (Gene Induced Immunotherapy, Oncolytic Virotherapy, Gene Transfer), By Indication (Breast Cancer, Ovarian Cancer, Pancreatic Cancer, Others), By End Use (Biopharmaceutical Companies, Research Institutes, Diagnostic Centers, Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 136368

- Number of Pages: 258

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

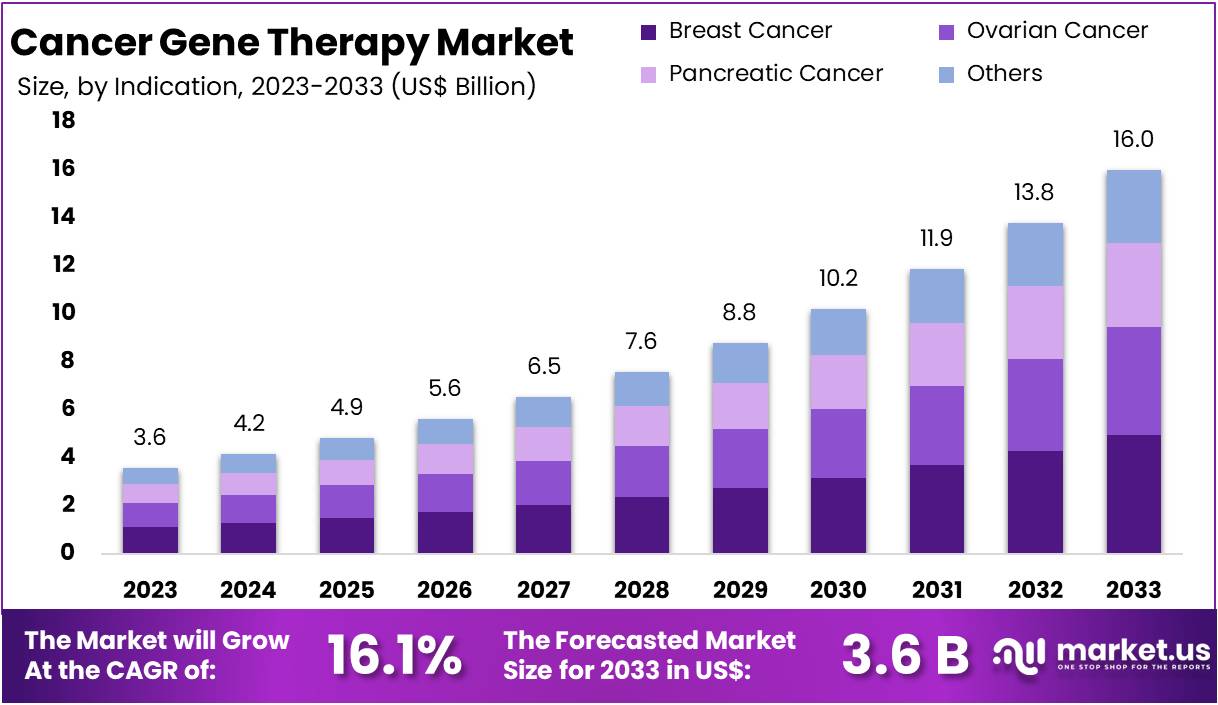

The Global Cancer Gene Therapy Market size is expected to be worth around US$ 16 Billion by 2033, from US$ 3.6 Billion in 2023, growing at a CAGR of 16.1% during the forecast period from 2024 to 2033. North America emerged as the dominant region, securing over 36.5% of the market share with a valuation of US$ 1.3 billion for the year.

Cancer gene therapy is an emerging field in oncology that modifies genetic material within cells to treat or prevent cancer. This innovative approach involves replacing mutated genes, inactivating faulty ones, or introducing new genes to combat the disease. The market for cancer gene therapy is expanding rapidly, driven by technological advancements, increasing cancer prevalence, and supportive regulatory frameworks.

Recent breakthroughs highlight the transformative potential of cancer gene therapy. According to the Cancer Progress Report, the FDA approved 14 new anticancer treatments between August 2022 and July 2023, including a pioneering gene therapy for bladder cancer.

According to recent updates by Wikipedia, Chimeric Antigen Receptor (CAR) T-cell therapies have emerged as a groundbreaking treatment for various cancers. Studies highlight that as of 2023, six CAR T-cell products have received regulatory approval. For instance, these therapies have shown effectiveness in treating conditions such as lymphoma, multiple myeloma, and pediatric B-cell precursor acute lymphoblastic leukemia. Approved products include Yescarta, Tecartus, Breyanzi, Carvykti, Abecma, and Kymriah.

Gene editing technologies like CRISPR are reshaping cancer therapeutics. For example, a British patient achieved remission from T-cell acute lymphoblastic leukemia in December 2022 after receiving CRISPR-based therapy reported by Wikipedia. Similarly, personalized cancer vaccines are showing promise. A study in November 2024 reported that an experimental vaccine for triple-negative breast cancer kept 16 out of 18 patients cancer-free for three years. These advancements reflect the market’s potential to offer targeted, effective solutions.

The cancer gene therapy market is fueled by significant investments and growing demand. According to Beacon Intelligence, the sector attracted USD 85 billion in investments in 2023, rebounding from a decline between 2020 and 2022. This growth is attributed to recent drug approvals and expanded therapeutic indications. Companies are increasingly investing in innovative therapies to meet the rising demand for cancer treatments.

Strategic collaborations are enhancing manufacturing capabilities. For instance, Atara Biotherapeutics sold its California cell therapy manufacturing facility to FUJIFILM Diosynth Biotechnologies for $100 million in April 2022. This partnership aims to strengthen the production of allogeneic cell therapies, including those for cancer gene therapy. Such alliances are crucial for scaling up production to meet market needs.

Regulatory frameworks play a pivotal role in market growth. Gene therapies undergo rigorous evaluation for safety and efficacy before approval. The increasing number of FDA-approved gene therapies reflects a supportive environment for innovation. However, compliance with stringent regulations remains a critical factor for market players.

How Does Artificial Intelligence Help to Improve the Cancer Gene Therapy Market?

Artificial Intelligence (AI) significantly accelerates drug development in cancer gene therapy. By rapidly analyzing large datasets, AI identifies potential gene targets and therapeutic agents, speeding up the creation of tailored treatments. This quick analysis is vital for adapting therapies to combat various cancer types efficiently.

AI enhances precision medicine by analyzing patients’ genetic data to design personalized treatments. It predicts the effectiveness of specific therapies based on genetic mutations, allowing treatments to be customized for each individual. This personalized approach ensures that treatments are more effective and directly target the genetic underpinnings of a patient’s cancer.

In gene editing, AI supports tools like CRISPR by pinpointing accurate gene targets. It optimizes the delivery mechanisms of these gene-editing tools, improving precision while minimizing unwanted side effects. This precision is crucial for ensuring that gene therapy is both safe and effective in targeting only cancerous cells without affecting healthy ones.

AI also streamlines clinical trials and enhances diagnostic capabilities. By selecting suitable trial candidates and monitoring results in real time, AI makes clinical trials more efficient. Additionally, it advances the analysis of medical images, aiding in the precise detection and classification of tumors at a molecular level, which is essential for the targeted application of gene therapies.

Key Takeaways

- By 2033, the Global Cancer Gene Therapy Market is projected to reach a value of approximately US$ 16 Billion, growing at a CAGR of 16.1%.

- Gene Induced Immunotherapy was the leading therapy in the Cancer Gene Therapy Market in 2023, securing a 38.22% market share.

- In the indication segment of the Cancer Gene Therapy Market, Gene Induced Immunotherapy was also predominant in 2023 with a 31.51% share.

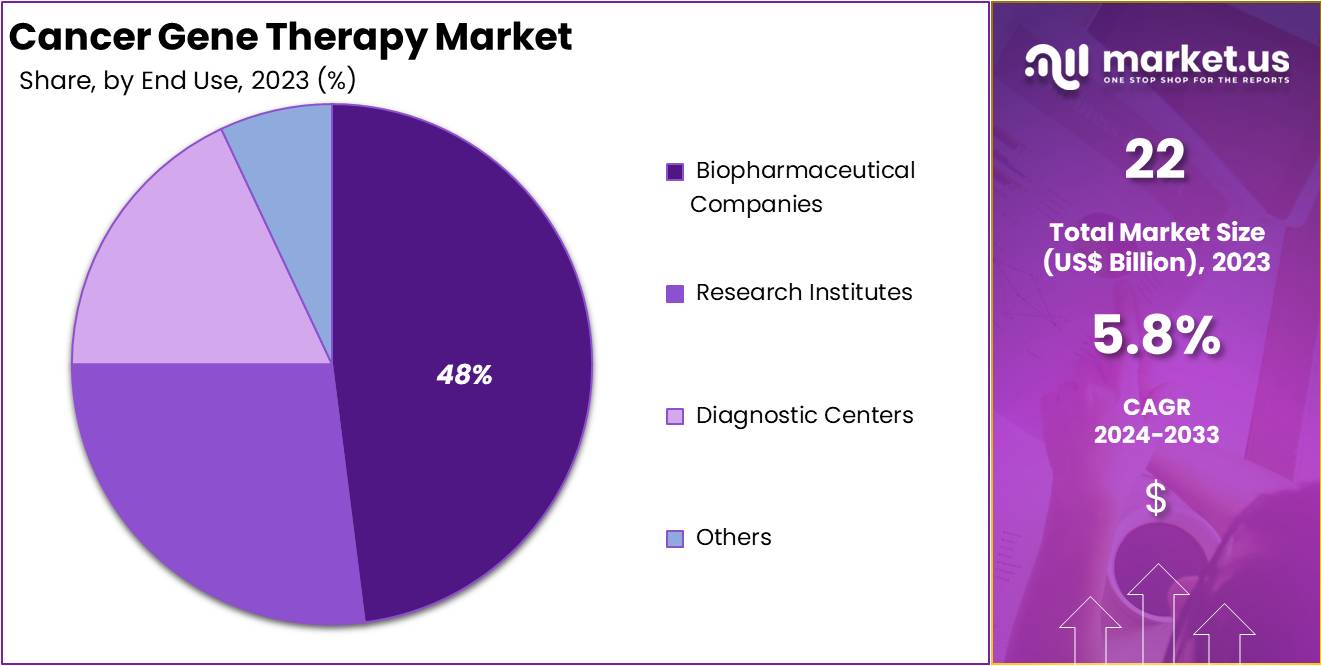

- Biopharmaceutical Companies were the main end users in the Cancer Gene Therapy Market in 2023, holding a 48.62% market share.

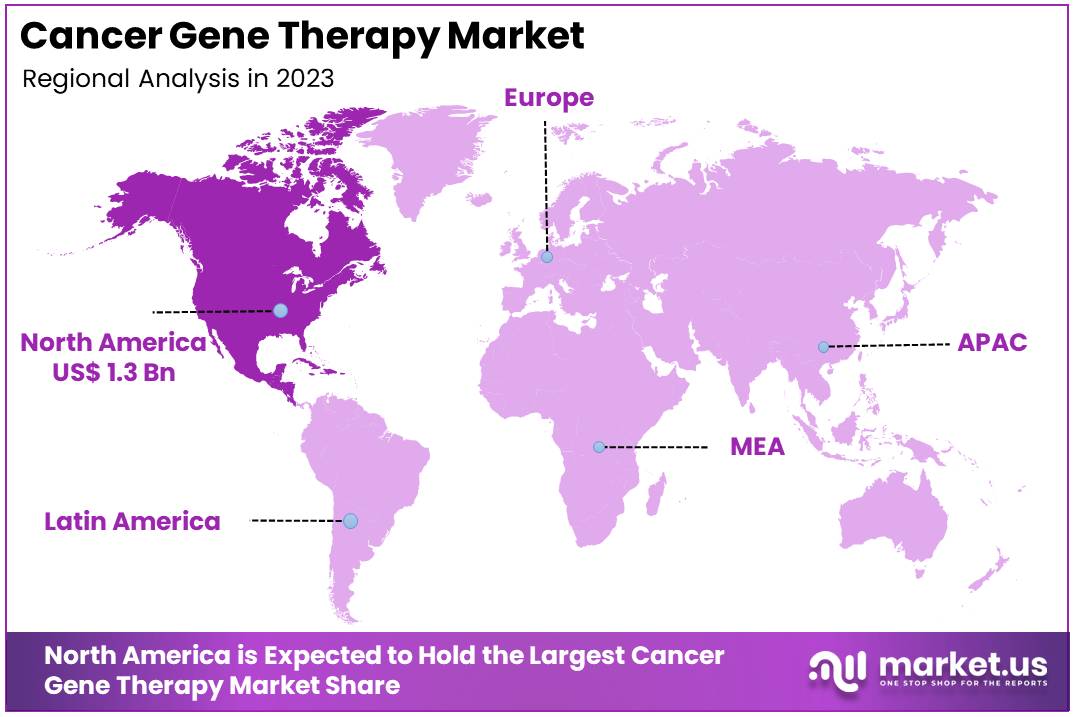

- North America was the largest market for Cancer Gene Therapy in 2023, capturing a 36.5% share and valued at US$ 1.3 billion.

Therapy Analysis

In 2023, Gene Induced Immunotherapy held a dominant market position in the Therapy Segment of the Cancer Gene Therapy Market, capturing more than a 38.22% share. This method boosts the immune system to better target and destroy cancer cells. Its growing acceptance is driven by its ability to tailor treatments to individual patients, making it a preferred choice in personalized medicine.

The popularity of Gene Induced Immunotherapy stems from its potential for long-term cancer remission. Continuous innovations and investments in biotechnology have facilitated its advancement. As clinical trials progress, the treatment is set to become more integrated into standard care. This could lead to wider adoption worldwide, benefiting more patients.

Oncolytic Virotherapy is another vital area of the market. It employs genetically modified viruses to attack only cancer cells, leaving healthy cells unharmed. This method also primes the immune system against tumors, providing a dual mechanism for fighting cancer. The specificity of oncolytic viruses in targeting cancer cells has led to increased interest and research in this therapy.

Gene Transfer technology is advancing rapidly within the market, driven by breakthroughs in gene editing tools like CRISPR. It works by altering patient genes to correct defective ones or introduce new functions. Improvements in the delivery systems and vectors used for gene transfer are enhancing its effectiveness and safety. The potential of this method to treat a broad range of cancers continues to drive its development and integration into therapeutic practices.

Indication Analysis

In 2023, Gene Induced Immunotherapy held a dominant market position in the Indication Segment of the Cancer Gene Therapy Market, capturing more than a 31.51% share. This method has gained traction due to its effectiveness in enhancing the body’s immune response against cancer cells.

Breast cancer represents the largest application area within this segment, driven by rising incidence rates and increased awareness of gene therapy treatments. The segment’s growth is further supported by technological advancements in gene delivery systems and the development of more targeted therapies.

Ovarian cancer and pancreatic cancer are other key areas where gene therapy is making significant inroads. For ovarian cancer, gene therapy offers potential for personalized treatment strategies, which can significantly improve patient outcomes. In pancreatic cancer, the application of gene therapy is expanding due to the urgent need for more effective treatments against this highly aggressive cancer type.

End Use Analysis

In 2023, Biopharmaceutical Companies held a dominant market position in the End Use Segment of the Cancer Gene Therapy Market, capturing more than a 48.62% share. This significant portion is driven by extensive investments in research and development. These companies focus on creating and distributing gene therapies to treat various cancers, demonstrating their pivotal role in advancing cancer treatment technologies.

Research institutes also play an essential part in this market. They conduct foundational science and preliminary experiments essential for developing new gene therapy methods. Their work often leads to collaborations with biopharmaceutical companies, aiming to bring scientific discoveries into practical, clinical use.

Diagnostic centers contribute significantly by identifying patients suitable for gene therapy based on genetic analysis. This precise approach ensures that therapies are more effective, matching treatments to the unique genetic profiles of individuals. Such centers are crucial for the personalized medicine aspect of cancer gene therapy.

Key Market Segments

By Therapy

- Gene Induced Immunotherapy

- Oncolytic Virotherapy

- Gene Transfer

By Indication

- Breast Cancer

- Ovarian Cancer

- Pancreatic Cancer

- Others

By End Use

- Biopharmaceutical Companies

- Research Institutes

- Diagnostic Centers

- Others

Drivers

Advancements in Genetic Engineering Technologies

Advancements in genetic engineering technologies are revolutionizing the cancer gene therapy market by enhancing the precision, safety, and efficacy of therapeutic approaches. Tools like CRISPR-Cas9 and other gene-editing platforms allow scientists to target and modify specific genes associated with cancer, enabling tailored treatments for patients. These technologies significantly reduce off-target effects, making therapies safer and more effective. Moreover, breakthroughs in delivery mechanisms, such as viral and non-viral vectors, ensure that modified genes reach the intended sites in the body efficiently.

As these innovations continue to evolve, they enable the development of novel therapies addressing previously untreatable cancers. The ability to correct mutations, enhance immune responses, and modify tumor environments opens new avenues for personalized and effective cancer treatments, boosting the market growth of cancer gene therapy. This progress aligns with the increasing demand for precision medicine and improves treatment outcomes, positioning genetic engineering advancements as a crucial driver of this rapidly growing market.

Restraints

High Cost of Treatment

The high cost of treatment is a significant restraint in the cancer gene therapy market. Developing gene therapies involves extensive research, advanced technology, and rigorous clinical trials, all of which require substantial financial investments. For instance, AJMC has mentioned the cost of a single gene therapy treatment can range from $65,000 to over $3 million, depending on the complexity and customization required.

Additionally, manufacturing these therapies requires state-of-the-art facilities, specialized equipment, and adherence to strict regulatory standards, further driving up costs. These expenses often translate to higher treatment prices, making these innovative therapies unaffordable for many patients, especially in low- and middle-income regions. Limited insurance coverage and reimbursement policies exacerbate the issue, as they may not fully cover these expensive treatments, leaving patients with significant out-of-pocket expenses.

Consequently, the high cost restricts the adoption of gene therapy to a smaller, more affluent patient base, limiting its widespread availability and impeding market growth. Addressing these financial barriers is crucial for improving accessibility and ensuring broader adoption of cancer gene therapies globally.

Opportunities

Rising Prevalence of Cancer

The increasing global prevalence of cancer presents a significant growth opportunity for the Cancer Gene Therapy Market. With over 19 million new cases of cancer reported annually worldwide, the demand for innovative treatments is higher than ever. Traditional therapies like chemotherapy and radiation often come with severe side effects and limited efficacy for advanced stages of cancer. Gene therapy, by contrast, offers a targeted and personalized approach, addressing the genetic mutations that drive cancer progression.

This rising prevalence not only underscores the need for advanced solutions but also encourages investments in research and development for gene-based treatments. As healthcare systems prioritize precision medicine, gene therapy is increasingly viewed as a viable alternative for delivering more effective and less invasive cancer treatments. Furthermore, the growing awareness about advanced treatment options and increasing healthcare spending reinforce the market’s potential to address this critical healthcare challenge.

Trends

Increased Collaboration and Partnerships in the Cancer Gene Therapy Market

Collaboration and partnerships have emerged as a significant trend in the cancer gene therapy market. Pharmaceutical companies, biotechnology firms, and research institutions are joining forces to expedite the development and commercialization of advanced gene therapies for cancer. These collaborations leverage shared expertise, cutting-edge technologies, and resources to overcome challenges such as high development costs and complex regulatory pathways.

For example, partnerships often focus on pooling resources to enhance clinical trial efficiency and ensure broader access to innovative therapies. Collaborative efforts also facilitate the integration of novel delivery methods and genome-editing technologies like CRISPR into therapeutic pipelines. Additionally, such alliances often result in co-development agreements or licensing deals, accelerating the transition of promising therapies from the research phase to market availability.

The trend is not only driving innovation but also fostering a competitive advantage for participating entities, ensuring faster and more effective solutions for treating various cancers. As a result, these partnerships are shaping the market’s growth trajectory, making life-saving therapies more accessible to patients worldwide.

Regional Analysis

In 2023, North America held a dominant market position in the Cancer Gene Therapy Market, capturing more than a 36.5% share and holding a market value of US$ 1.3 billion for the year. This region’s leadership is primarily driven by several key factors. First, there is a high incidence of cancer, which increases the demand for innovative treatments. Additionally, North America boasts robust healthcare infrastructure and significant investments in biotechnology and medical research, facilitating the development and approval of gene therapies.

Advanced technological capabilities also contribute to North America’s leading position. The region is home to some of the world’s leading biotech firms and research institutions, which are at the forefront of genetic research and cancer therapy innovations. Moreover, favorable government policies and substantial funding support from both public and private sectors enhance research activities.

Furthermore, the presence of a well-established regulatory framework supports the swift approval of gene therapies, ensuring they reach the market and patients quicker than in other regions. This streamlined process attracts companies looking to develop and commercialize their therapies efficiently.

The patient population in North America is also more aware and receptive to participating in clinical trials, which is crucial for the advancement of gene therapies. This engagement helps in faster recruitment for trials and more comprehensive data collection, speeding up therapy development and approval processes.

Overall, these elements combine to reinforce North America’s dominant position in the global Cancer Gene Therapy Market, highlighting the region’s pivotal role in shaping the future of cancer treatment.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The cancer gene therapy market is highly competitive with major players and holding significant shares due to their extensive product portfolios and global reach. CRISPR Therapeutics specializes in gene-based medicine, focusing on CRISPR/Cas9 technology for genetic diseases, including cancer. They invest heavily in research, with a product portfolio featuring therapies for various cancers. Strengths include strong R&D capabilities; however, dependency on regulatory approvals is a weakness. Recent collaborations aim to commercialize gene-based medicines effectively.

Pfizer Inc., a global pharmaceutical leader, has a diversified oncology gene therapy portfolio. Financially robust, Pfizer invests in next-generation treatments. The company focuses on innovation and strategic partnerships to enhance its oncology pipeline, positioning itself strongly in the market.

GSK plc is increasing its presence in revolutionary cancer gene therapies. It boasts a stable financial base and a product range focusing on precision medicine. GSK’s growth strategy includes strategic acquisitions and collaborations, aiming to enhance its offerings in innovative cancer therapies amidst regulatory challenges.

Merck KGaA and Novartis AG are significant contributors to the cancer gene therapy field. Merck KGaA invests in healthcare innovations, with a strong emphasis on R&D for expanding its cancer therapy sector. Novartis leads in innovation, focusing on next-generation therapies and strengthening its oncology portfolio through development and acquisitions. Other key players include biotech firms and startups pioneering in gene therapy research.

Market Key Players

- CRISPR Therapeutics

- Pfizer Inc.

- GSK plc

- Merck KGaA

- Novartis AG

- AstraZeneca

- Atara Biotherapeutics Inc.

- Adaptimmune

- American Gene Technologies

- Genelux Corporation

- ImmunoACT

Industrial Advantages and Opportunities For Market Players

Cancer gene therapy offers significant business benefits for market key players. It enables the development of unique, targeted treatments that expand therapeutic options beyond traditional methods like chemotherapy. This not only differentiates companies in a competitive market but also allows for premium pricing strategies due to the innovative nature of these therapies. Additionally, securing patents for new gene therapies can protect investments and ensure long-term profitability through market exclusivity.

The industry gains considerable advantages from the advancement of gene therapy. It drives technological innovation across genetic engineering and biotechnology, fostering developments even in peripheral fields. The complexity of gene therapy encourages collaborative efforts between various stakeholders, including biotech firms, pharmaceutical companies, and academic institutions. This collaboration enhances integration and streamlines the approach to healthcare solutions.

There are numerous opportunities for market key players in the realm of cancer gene therapy. Expanding into emerging markets can be particularly lucrative, given the rising incidence of cancer and the increasing demand for personalized treatments. Moreover, the pursuit of personalized medicine offers new market segments and populations for targeted therapies, enhancing individual patient outcomes and broadening market reach.

Finally, integrating cutting-edge technologies like artificial intelligence and machine learning can revolutionize the development of gene therapies. These technologies improve predictive analytics, which is crucial for optimizing therapy outcomes and safety profiles. Additionally, securing funding from governmental and non-governmental organizations can help mitigate the significant costs associated with developing and commercializing gene therapies, making ambitious projects more feasible.

Recent Developments

- In December 2024: GSK’s Phase III clinical trial, known as FIRST-ENGOT-OV44, achieved its primary endpoint. This trial was focused on a combination therapy of Zejula (niraparib) and Jemperli (dostarlimab) for treating advanced ovarian cancer. The study showed a statistically significant improvement in progression-free survival (PFS) when Jemperli was added to standard chemotherapy along with niraparib maintenance. This positive outcome reflects GSK’s ongoing commitment to advancing cancer therapy, although the overall survival endpoint wasn’t met.

- In Oct 2024: Merck, recently disclosed a significant €70 million expansion at its Bioconjugation Center of Excellence in St. Louis, Missouri. This substantial investment is set to triple the current manufacturing capacity, substantially enhancing Merck’s offerings in contract development and manufacturing organization (CDMO). This development underscores Merck’s ongoing commitment to its clients and patients, reinforcing its position as a dedicated partner in the healthcare industry. This expansion is expected to bolster the company’s capacity to meet the growing demand for antibody-drug conjugates (ADCs), reflecting its strategic focus on expanding its footprint in biopharmaceutical manufacturing.

- In December 2023: CRISPR Therapeutics, in collaboration with Vertex Pharmaceuticals, received FDA approval for Casgevy, a gene-editing therapy for sickle cell disease (SCD) and transfusion-dependent beta-thalassemia (TDT). This approval marks the first-ever gene-editing treatment cleared for human illness. Casgevy is anticipated to achieve significant sales due to its first-to-market advantage, with projected global sales reaching $593 million.

- In December 2023: Pfizer completed its acquisition of Seagen Inc., a leader in Antibody-Drug Conjugate (ADC) technology, for approximately $43 billion. This acquisition significantly enhances Pfizer’s oncology portfolio by adding Seagen’s ADC technology and four in-line medicines, which include ADCETRIS®, PADCEV®, TIVDAK®, and TUKYSA®. This move is expected to bolster Pfizer’s position in cancer treatment, potentially leading to transformative cancer care advancements.

Report Scope

Report Features Description Market Value (2023) US$ 3.6 Billion Forecast Revenue (2033) US$ 16 Billion CAGR (2024-2033) 16.1% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Therapy (Gene Induced Immunotherapy, Oncolytic Virotherapy, Gene Transfer), By Indication (Breast Cancer, Ovarian Cancer, Pancreatic Cancer, Others), By End Use (Biopharmaceutical Companies, Research Institutes, Diagnostic Centers, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape CRISPR Therapeutics, Pfizer Inc., GSK plc, Merck KGaA, Novartis AG, AstraZeneca, Atara Biotherapeutics Inc., Adaptimmune, American Gene Technologies, Genelux Corporation, ImmunoACT Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- CRISPR Therapeutics

- Pfizer Inc.

- GSK plc

- Merck KGaA

- Novartis AG

- AstraZeneca

- Atara Biotherapeutics Inc.

- Adaptimmune

- American Gene Technologies

- Genelux Corporation

- ImmunoACT