Global Liquid Biopsy Market By Product Type (Instruments, Consumables Kits and Reagents, Software and Services) By Biomarker Type (Circulating Tumor Cells (CTCs), Circulating Tumor DNA (ctDNA), Extracellular Vesicles (EVs), Other Biomarker Types) By Technology (Multi-gene-parallel Analysis (NGS) and Single Gene Analysis (PCR Microarrays)) by Application (Cancer, Lung Cancer, Prostate Cancer, Breast Cancer, Colorectal Cancer, Leukemia, Gastrointestinal Cancer, Reproductive Health and Other Applications) By End-use (Hospitals and Laboratories, Specialty Clinics, Academic and Research Centers Other End-Uses) By Clinical Application (Therapy Selection, Treatment Monitoring, Early Cancer Screening, Recurrence Monitoring and Other Clinical Applications) and forecast 2024-2033

- Published date: Jan 2024

- Report ID: 28756

- Number of Pages: 271

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Technology Analysis

- Biomarker Analysis

- Product Type Analysis

- Application Analysis

- End-Use Analysis

- Кеу Маrkеt Ѕеgmеntѕ

- Driver

- Restraint

- Opportunity

- Challenge

- Regional Analysis

- Key Regions and Countries Covered іn This Rероrt

- Market Share & Key Players Analysis

- Recent Development

- Report Scope

Report Overview

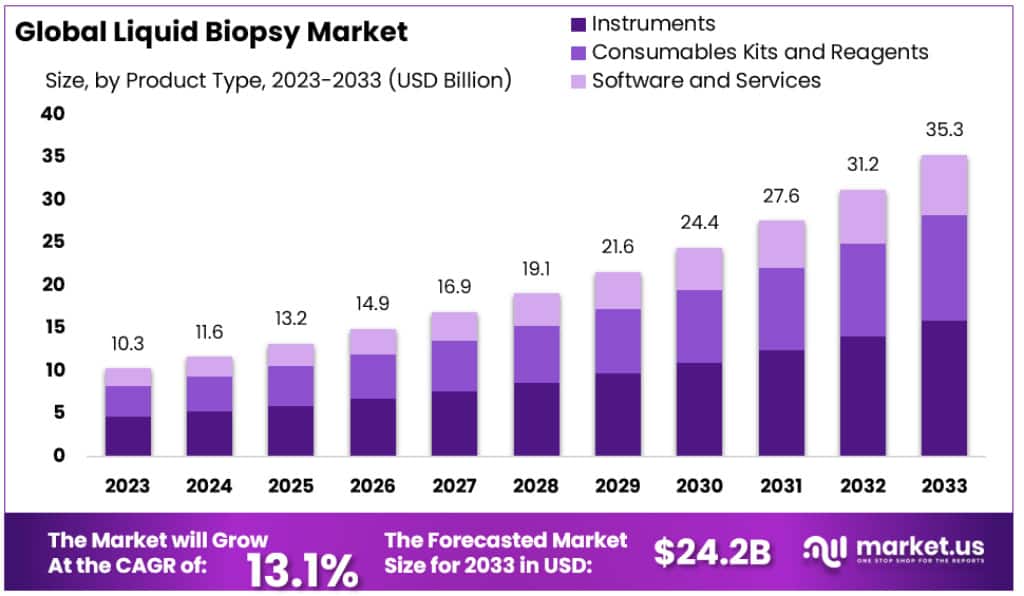

The global liquid biopsy market size is expected to be worth around USD 35.3 billion by 2033, from USD 10.3 billion in 2023, growing at a CAGR of 13.1% during the forecast period from 2023 to 2033.

A liquid biopsy is a blood test that finds cancer tumors. When a tumor grows, some parts can break away and float in your blood. This test can find these parts, like circulating tumor cells (CTCs) and circulating tumor DNA (ctDNA). These pieces in your blood show if you have cancer and give genetic info about it. This test is quite new, and it has some uses approved by the FDA. Scientists are still studying it to see how helpful it can be in treating cancer.

According to the American Cancer Society (ACS), 235,760 Americans were diagnosed with non-small cell lung disease in 2021. This is the most common type of lung cancer in the U.S. 1 in 17 men and 1 out of 15 women are at high risk of developing lung cancer in their lifetimes.

According to the GLOBOCAN 2020 predictions by the International Agency for Research on Cancer, there were approximately 19.3 million new cancer cases and 10 million deaths from cancer in 2020. Breast cancer is now the most prevalent type of cancer in the world, due to its rising cases among women. Liquid biopsy tests are increasingly being used to detect and eliminate the prevalence of cancer cases in these targeted populations.

Key Takeaways

- Market Value: The Liquid Biopsy Market was valued at approximately USD 10.3 billion in 2023 and is expected to reach around USD 35.3 billion by 2033.

- Growth Rate: The market is growing at a CAGR of 13.1% from 2023 to 2033.

- Technology Share: In 2023, Multi-Gene-Parallel Analysis (NGS) held a whopping 72.8% of the market revenue.

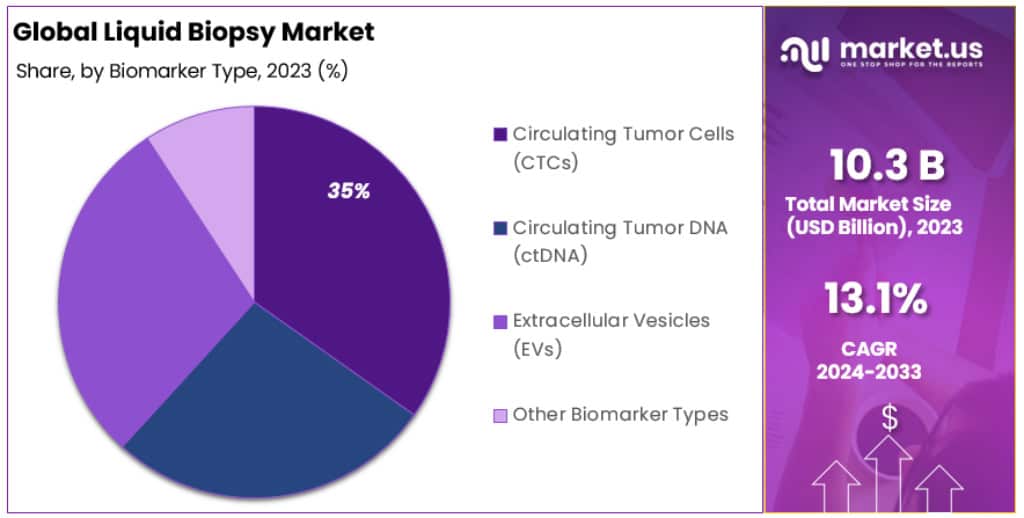

- Biomarker Contribution: Circular Nucleic Acids made up over 34.78% of the global revenue in 2023.

- Instruments’ Role: Instruments accounted for a dominant 44.9% of the market share in 2023.

- Cancer Diagnosis: Over 77% of the market share in 2023 was for cancer detection using liquid biopsy.

- Hospital and Labs Participation: Hospitals and laboratories were major players, owning more than 47.2% of the market in 2023.

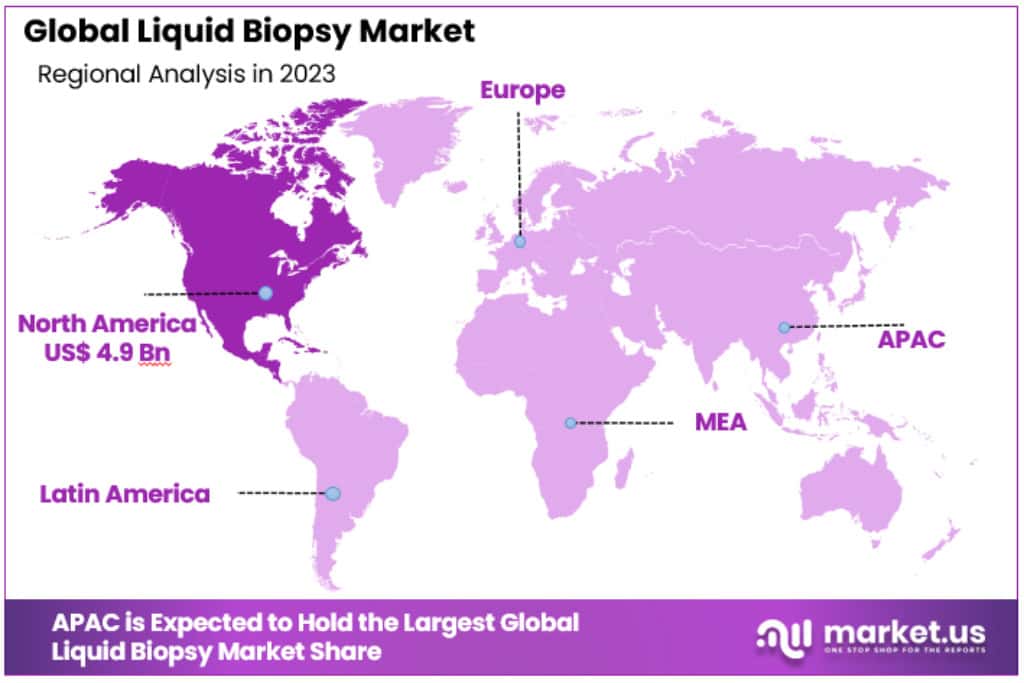

- North America’s Lead: This region was at the forefront, generating over 47.1% of global revenues in 2023.

- Lung Cancer Cases: In 2021, 235,760 Americans were diagnosed with non-small cell lung disease.

- Risk of Lung Cancer: 1 in 17 men and 1 out of 15 women have a high risk of developing lung cancer during their lifetimes.

- Cancer Stats 2020: Roughly 19.3 million new cancer cases and 10 million deaths from cancer were reported worldwide.

- Breast Cancer: It has emerged as the most prevalent type of cancer globally due to its increasing cases among women.

- Screening Initiative: The National Breast and Cervical Cancer Early Detection Program (NBCCEDP) assisted over 260,000 women with breast cancer screening in 2020.

- Funding for Development: BioMark Diagnostics Solutions Inc. got a funding of US$825,000 for the advancement of its liquid biopsy method for lung cancer screening.

- Emerging Markets: Countries like India, China, South Korea, and Brazil are presenting ample growth opportunities for the liquid biopsy market.

Technology Analysis

In terms of Technology, the Multi-Gene-Parallel Analysis (NGS) segment dominated this market, accounting for over 72.8% of global revenues in 2023. NGS technology is able to detect mutations that could cause tumorigenesis, and can also detect resistance mechanisms that might have evolved from pre-existing cells after treatment.

Recent advances in Next-Generation Sequencing (NGS) technology have resulted in significant cost savings in sequencing. This has also allowed for high accuracy and precision. Such kind of advanced technologies allows for the screening of unknown variants and for targeted panels to detect ctDNA mutations with high sensitivity. NGS, half of the time or more, can detect stage-1 and 2 lung cancer patients, with a MAF of 0.1%.

Market leaders have also made rapid developments, which has helped propel this market forward. Twist Bioscience Corp. will introduce the Twist NGS Methylation Detection System for liquid biopsy and epigenetic analysis in February 2021. Biodesix Inc. also announced plans to offer a 52-gene NGS blood test in April 2021, to expand its molecular testing capabilities.

Biomarker Analysis

With respect to Biomarkers, this market’s largest segment, Circular Nucleic Acids, accounted for over 34.78% of global revenues in 2023. This segment has plenty of scope for clinical application for Circulating Tumor DNA (ctDNA), in liquid biopsy. Recent years have seen new opportunities for diagnostic laboratories, molecular diagnosis, treatment monitoring, and treatment of cancer using liquid biopsy analysis based on ctDNA. It can precisely determine the progression of tumor cells, provide a prognosis, and assist in targeted therapy.

Academic and Research Centres in translational cancer are now using liquid biopsies for the detection of ctDNA in tumor cells. Future liquid biopsy applications will have a lot of potential for detecting different types of cancer using ctDNA as a biomarker. CtDNA is an alternative to invasive procedures and can be used to perform molecular profiling for tumor DNA in cancer patients.

Product Type Analysis

In 2023, when we look at the liquid biopsy market, it’s clear that Instruments played a big role, holding a strong market position by grabbing over 44.9% of the market share. These Instruments are the tools and machines used for collecting and studying liquid biopsy samples, like blood. They are crucial because they help experts precisely find circulating tumor cells (CTCs) and circulating tumor DNA (ctDNA) in the blood. Many labs and healthcare facilities have adopted advanced and automatic Instruments, which has boosted this segment’s growth.

Next in line are Consumables Kits and Reagents, which also had a significant presence in the market. These are like the important materials needed for carrying out liquid biopsy tests efficiently. With the growing popularity of liquid biopsy tests, the use of these kits and reagents has gone up, contributing to the overall growth of this segment.

Another important part of the market is Software and Services. These include special computer programs and expert help to make sense of the data from liquid biopsy tests. As these tests become more complex, the need for advanced software and knowledgeable services has increased, driving the growth of this segment.

In summary, in 2023, the liquid biopsy market had three major segments: Instruments, Consumables Kits and Reagents, and Software and Services. Instruments took the lead, followed by Consumables Kits and Reagents, while Software and Services played a critical role in making sense of the data from these tests. Together, these segments are shaping the future of liquid biopsy in cancer diagnosis and monitoring.

Application Analysis

In 2023, cancer was the biggest player in the liquid biopsy market, holding over 77% of the share. This is because liquid biopsy is incredibly valuable for diagnosing and tracking cancer, making it a top application. Among different types of cancer, lung cancer, prostate cancer, breast cancer, colorectal cancer, leukemia, and gastrointestinal cancer also had a significant presence in the market, showing that liquid biopsy can be helpful for various cancer types.

Additionally, in the realm of reproductive health, liquid biopsy started making strides. Although it had a smaller piece of the market, it’s gaining attention for non-invasive prenatal testing and fertility assessments. As technology improves and people become more aware, this segment is expected to grow further, contributing to the liquid biopsy market’s expansion.

End-Use Analysis

Hospitals and laboratories were the leaders in the liquid biopsy market, with a strong hold on more than 47.2% of the market share in 2023. This is because hospitals and labs are the primary places where liquid biopsy tests are conducted due to their advanced equipment and expert staff, making them key players.

Specialty clinics also played a significant role, providing specialized care and expertise for specific medical conditions. Academic and research centers were active participants in the market, contributing to advancements in liquid biopsy technology and its applications. Other end-uses, though holding a smaller portion of the market, represented various settings where liquid biopsy found utility. As liquid biopsy continues to evolve, its adoption across different end-uses is expected to contribute to the market’s growth.

Кеу Маrkеt Ѕеgmеntѕ

Product Type

- Instruments

- Consumables Kits and Reagents

- Software and Services

Biomarker Type

- Circulating Tumor Cells (CTCs)

- Circulating Tumor DNA (ctDNA)

- Extracellular Vesicles (EVs)

- Other Biomarker Types

Technology

- Multi-gene-parallel Analysis (NGS)

- Single Gene Analysis (PCR Microarrays)

Application

- Cancer

- Lung Cancer

- Prostate Cancer

- Breast Cancer

- Colorectal Cancer

- Leukemia

- Gastrointestinal Cancer

- Others

- Reproductive Health

- Other Applications

End-use

- Hospitals and Laboratories

- Specialty Clinics

- Academic and Research Centers

- Other End-Uses

Clinical Application

- Therapy Selection

- Treatment Monitoring

- Early Cancer Screening

- Recurrence Monitoring

- Other Clinical Applications

Driver

Cancer Awareness Initiatives

Global health organizations and governments worldwide have been working hard over the last decade to increase cancer awareness. For example, the WHO’s National Cancer Control program aims to reduce cancer deaths and improve patients’ lives. In the US, the National Breast and Cervical Cancer Early Detection Program (NBCCEDP) offers breast cancer screening to uninsured and low-income patients. In 2020, it helped over 260,000 women with breast cancer screening and over 116,000 women with cervical cancer screening. These efforts drive the use of liquid biopsies for early cancer detection.

Restraint

Challenges with Sensitivity

Detecting cancer DNA (ctDNA) in liquid biopsies can be tricky because it’s sometimes very low in cancer patients’ blood, especially after treatment. Some cancers, like gliomas and sarcomas, don’t shed much ctDNA, making it hard to use liquid biopsies for profiling. The reasons for low ctDNA levels aren’t clear, but it might be linked to tumor location or certain barriers in the body.

Opportunity

Growth in Emerging Countries

Countries like India, China, South Korea, Brazil, Turkey, Russia, and South Africa offer growth chances for the liquid biopsy market. They have more cancer cases, larger populations, better healthcare systems, rising incomes, and more medical tourism. Asia Pacific, in particular, is attractive due to flexible regulations and fewer data requirements.

Challenge

Uncertainty with Reimbursement

Limited reimbursement, especially for panel-based tests, can slow down the use of liquid biopsies. While some tests get approval and coverage, others face hurdles, and it’s often up to Medicare contractors to decide. This can create challenges for liquid biopsy companies, affecting their growth prospects.

Regional Analysis

North America held the largest share and was the dominant regional market, accounting for over 47.1% of global revenues in 2023. The United States leads this market due to higher investments and the existence of a number of biotechnology organizations producing the tests. Several organizations, including the American Society of Clinical Oncology (ASCO), support the use of liquid biopsy. This, in turn, is a major factor expected to drive market expansion in North America.

Canada is following the lead of the United States in the usage of liquid biopsy testing since only FDA-approved tests are authorized in the nation. Furthermore, several biotechnology firms compete in the industry, which is projected to boost market expansion over the forecast period. The government initiatives aimed at increasing subsidies and investments towards the development of liquid biopsy tests are projected to strengthen this country’s market.

BioMark Diagnostics Solutions Inc. received US$825,000 in funding to develop BioMark’s liquid biopsy method for screening lung cancer. Consortium for Industrial Research and Innovation in Medical Technology and Spark grant from the Canadian Cancer Society and Brain Canada Foundation made up the majority of the funding.

Key Regions and Countries Covered іn This Rероrt

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- Latin America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Saudi Arabia

- Rest of MEA

The major players are helping to boost market growth prospects by increasing their cancer diagnostics portfolios. Along with that, industry experts are also launching innovative products concerning non-cancer applications. This is leading to an increase in liquid biopsy products in the competitive landscape. The prominent players are aiming at product launches that will help facilitate advanced clinical applications and elevate the healthcare infrastructure.

For Instance, F. HOFFMANN-LA ROCHE AG was one of the most prominent industry players in the global market. The company announced in August 2020 that its FoundationOne Liquid CDx was approved by the U.S. FDA for the diagnosis of solid tumors.

Кеу Маrkеt Рlауеrѕ

- ANGLE plc

- Oncimmune

- Guardant Health, Inc.

- Myriad Genetics, Inc.

- Biocept, Inc.

- Lucence Health Inc.

- Freenome Holdings, Inc.

- F. Hoffmann-La Roche Ltd.

- QIAGEN

- Illumina, Inc.

- Thermo Fisher Scientific, Inc.

- Epigenomics AG

- Other Key Players

Recent Development

- August 2023: Thermo Fisher Scientific introduced the first tests that can check both DNA and RNA for myeloid measurable residual disease (MRD) assessment. This helps doctors monitor this specific type of disease more effectively.

- May 2023: QIAGEN launched a new diagnostic test called therascreen EGFR Plus RGQ PCR Kit. It’s used to find sensitive mutations in a gene called EGFR, which is important for certain health conditions.

- March 2023: Guardant Health released the Guardant360 Response test. This test helps doctors see if cancer treatment is working or if the cancer is becoming resistant by checking changes in the DNA found in the bloodstream.

- February 2023: Grail got special recognition from the FDA for its Galleri multi-cancer early detection test. This test can help find different types of cancer early on.

- January 2023: Illumina introduced the TruSight Oncology 500 ctDNA test. It’s a special kind of test that can find over 500 genetic changes linked to cancer in the DNA floating in the bloodstream.

Report Scope

Report Features Description Market Value (2023) USD 10.3 Billion Forecast Revenue (2033) USD 35.3 Billion CAGR (2024-2033) 13.1% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Instruments, Consumables Kits and Reagents, Software and Services) By Biomarker Type (Circulating Tumor Cells (CTCs), Circulating Tumor DNA (ctDNA), Extracellular Vesicles (EVs), Other Biomarker Types) By Technology (Multi-gene-parallel Analysis (NGS) and Single Gene Analysis (PCR Microarrays)) by Application (Cancer, Lung Cancer, Prostate Cancer, Breast Cancer, Colorectal Cancer, Leukemia, Gastrointestinal Cancer, Reproductive Health and Other Applications) By End-use (Hospitals and Laboratories, Specialty Clinics, Academic and Research Centers Other End-Uses) By Clinical Application (Therapy Selection, Treatment Monitoring, Early Cancer Screening, Recurrence Monitoring and Other Clinical Applications) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape ANGLE plc, Oncimmune, Guardant Health, Inc., Myriad Genetics, Inc., Biocept, Inc., Lucence Health Inc., Freenome Holdings, Inc., F. Hoffmann-La Roche Ltd., QIAGEN, Illumina, Inc., Thermo Fisher Scientific, Inc., Epigenomics AG and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

Q. What is the size of Liquid Biopsy Market ?The global liquid biopsy market is projected to reach USD 35.3 billion by 2033, growing at a CAGR of 13.1%

Q. What are the major growth factors of Liquid Biopsy Market?The market is driven by the rising incidence and prevalence of cancer and the increasing preference for non-invasive treatment procedures.

Q. What is the total market value of liquid biopsy market report ?The global liquid biopsy market size reached USD 10.3 billion in 2023 and is predicted to reach USD 35.3 billion by 2033.

Q. Which region will lead the global liquid biopsy market?North America dominated the global liquid biopsy market in 2022 and will lead the market in near future.

Q. Who are the prominent key players in the Liquid Biopsy Market?Qiagen N.V., Myriad Genetics Inc., BIOCEPT Inc., Guardant Health, Inc., F. Hoffmann-La Roche Ltd., Illumina Inc., Genomic Health, Inc., Bio-Rad Laboratories, Inc., Angle plc, Oncimmune are some of the prominent key players in the Liquid Biopsy Market.

-

-

- ANGLE plc

- Oncimmune

- Guardant Health, Inc.

- Myriad Genetics, Inc.

- Biocept, Inc.

- Lucence Health Inc.

- Freenome Holdings, Inc.

- F. Hoffmann-La Roche Ltd.

- QIAGEN

- Illumina, Inc.

- Thermo Fisher Scientific, Inc.

- Epigenomics AG

- Other Key Players