Global Solid Tumor Therapeutics Market Analysis By Therapy Type (Chemotherapy, Immunotherapy, Targeted Therapy, Tyrosine kinase inhibitors, Proteasome inhibitor, Hedgehog pathway inhibitor, Others), By Route of Administration (Oral, Parenteral, Others), By End-Users (Hospitals, Specialty Clinics, Homecare, Others, Distribution Channel) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb 2024

- Report ID: 135794

- Number of Pages: 369

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

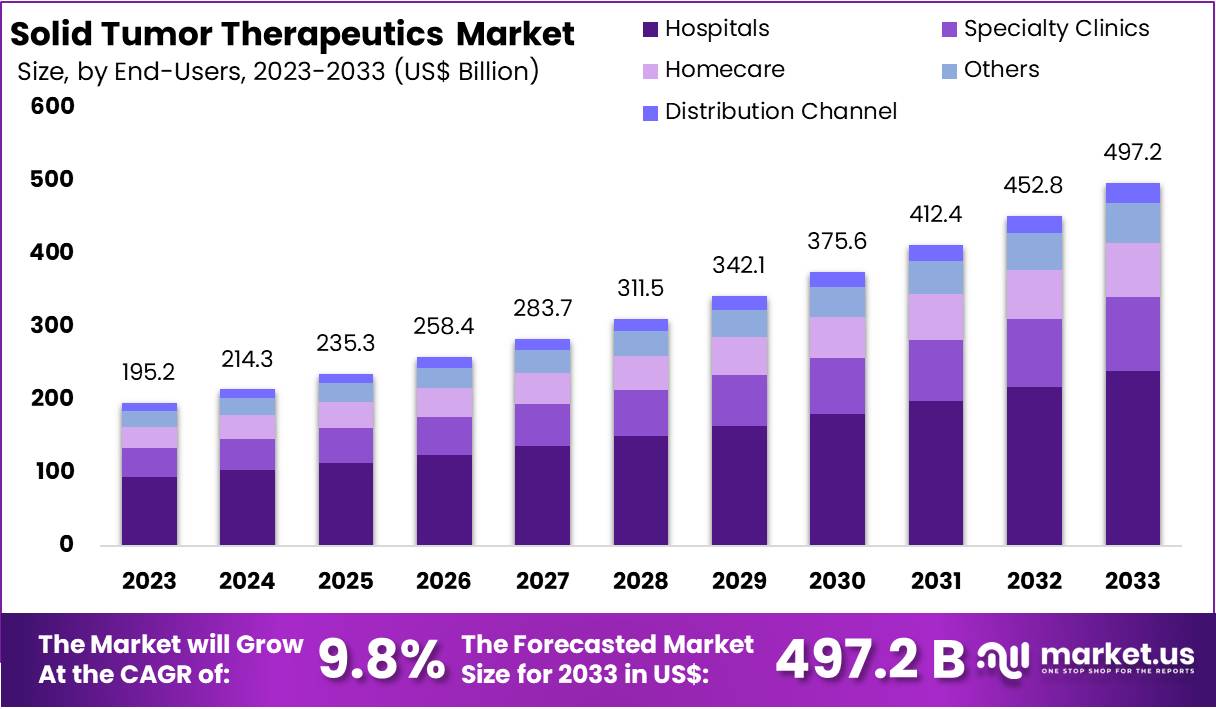

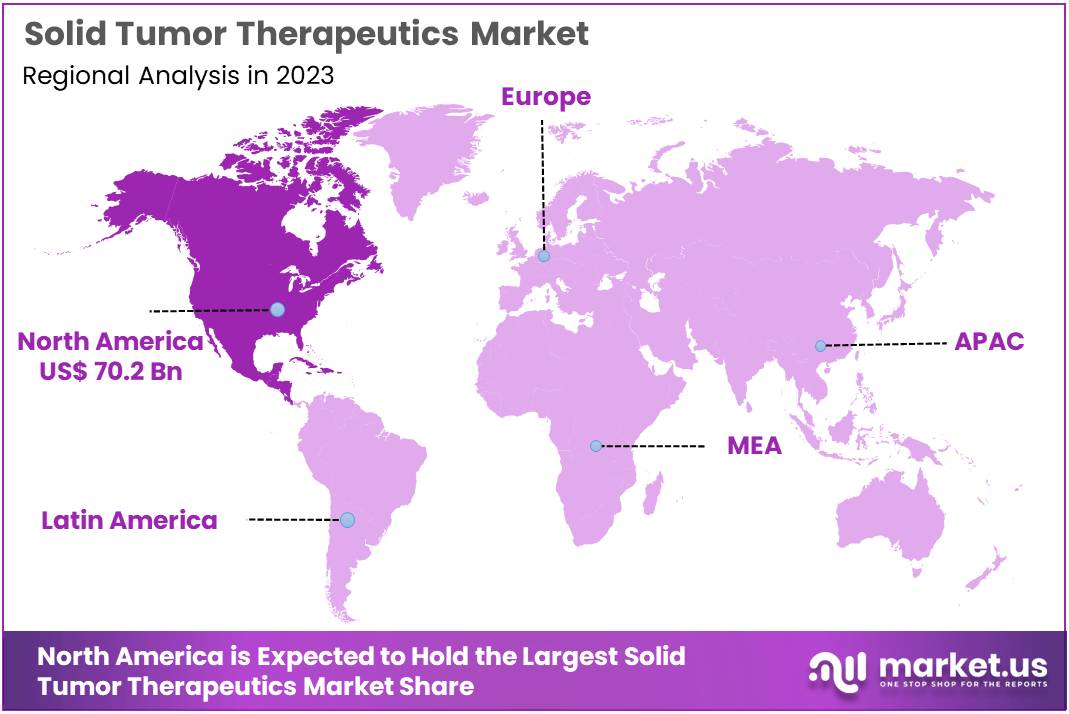

The Global Solid Tumor Therapeutics Market size is expected to be worth around US$ 497.2 Billion by 2033, from US$ 195.2 Billion in 2023, growing at a CAGR of 9.8% during the forecast period from 2024 to 2033. North America maintained a leading market position, accounting for over 36% of the market share with a valuation of US$ 70.2 billion in the year.

Solid tumor therapeutics encompass treatments targeting abnormal masses of tissue caused by uncontrolled cell growth in organs like the breast, lung, colon, and prostate. Unlike hematological malignancies, solid tumors are localized and include cancers such as carcinoma, sarcoma, and localized lymphomas. Current treatment strategies include chemotherapy, radiotherapy, targeted therapy, immunotherapy, surgical interventions, and emerging modalities like CAR T-cell therapy and oncolytic viral therapies.

According to the Global Cancer Observatory, India reported 1,413,316 new cancer cases in 2022, with an incidence rate of 100.4 per 100,000 individuals. Breast cancer was the most common cancer among women, while lip and oral cavity cancers were predominant among men. A study by NCDIR India projects a 12.8% increase in cancer incidence by 2025 compared to 2020. The northeastern and northern regions are expected to bear the highest disease burden.

The economic burden of cancer is substantial, spanning direct medical costs and indirect losses such as reduced workforce productivity. A study published by JAMA Network estimates that the global economic cost of cancer will total $25.2 trillion from 2020 to 2050. This equates to about 0.55% of the annual global GDP. In India, cancer-related disability-adjusted life years (DALYs) are projected to rise from 26.7 million in 2021 to 29.8 million by 2025.

On December 16, 2024, Merck announced the discontinuation of two experimental cancer drugs, vibostolimab and favezelimab. These drugs, tested in combination with Keytruda, failed to meet trial expectations. According to Reuters, this decision allows Merck to focus on other potentially viable cancer therapies, underscoring the high-risk nature of oncology drug development and the importance of resource allocation in the competitive pharmaceutical landscape.

Moderna’s mRNA-based cancer vaccine, mRNA-4157/V940, has delivered promising results in clinical trials. A phase 2 study showed that, when combined with pembrolizumab (Keytruda), the vaccine reduced the risk of cancer recurrence or death by 49%. According to Time, this personalized vaccine targets specific tumor mutations, representing a transformative step in cancer immunotherapy and personalized medicine.

In 2024, Sanofi announced a multi-year collaboration with AQEMIA, leveraging generative AI and advanced physics algorithms to accelerate drug discovery. The partnership, valued at $140 million, focuses on developing innovative drug molecules for various therapeutic areas, including cancer. This collaboration highlights the growing importance of artificial intelligence in revolutionizing oncology research and expediting the development of effective treatments.

The solid tumor therapeutics market is evolving rapidly, driven by advancements in immunotherapy, personalized vaccines, and AI-powered drug discovery. However, the growing cancer burden, especially in regions like India, underscores the need for sustained innovation and investment. Companies like Moderna and Sanofi are setting new benchmarks in treatment development, while strategic pivots by firms like Merck reflect the challenges and opportunities in this critical healthcare segment.

Key Takeaways

- The Global Solid Tumor Therapeutics Market is projected to reach US$ 497.2 billion by 2033, growing at a 9.8% CAGR from 2024 to 2033.

- In 2023, chemotherapy dominated therapy types, holding over 28% market share, reflecting its key role in treating solid tumors.

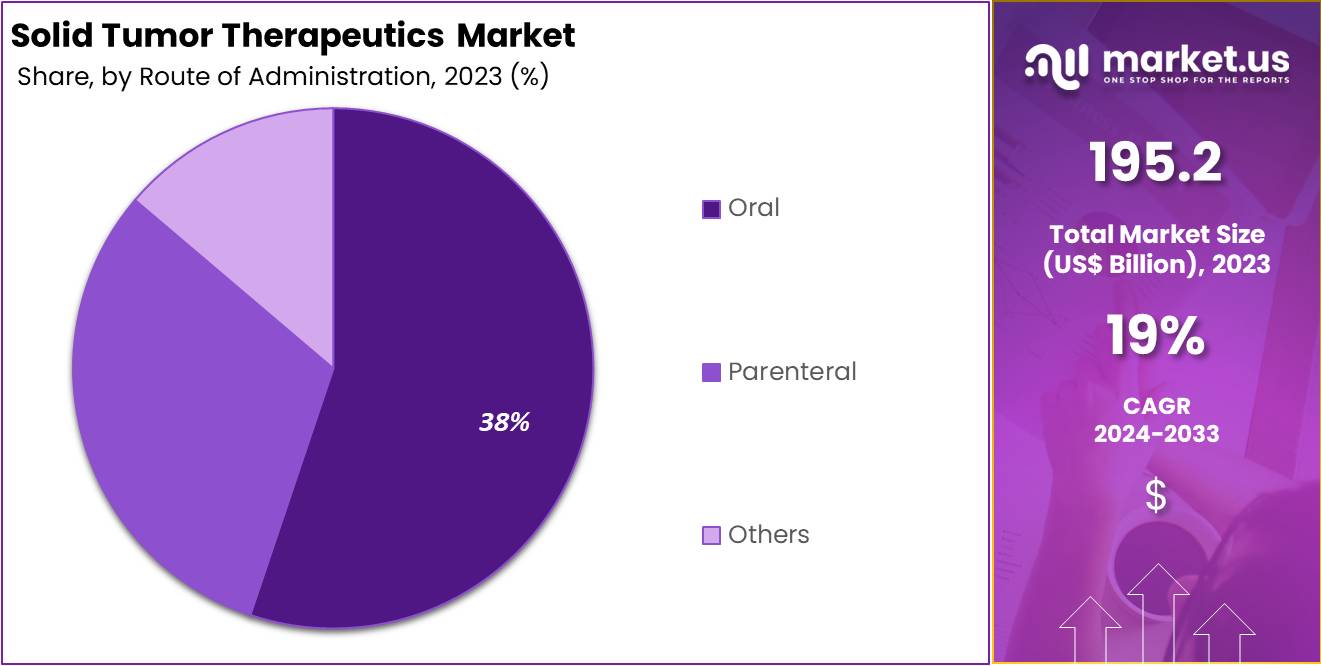

- The oral route of administration led the market in 2023, capturing over 38% market share, driven by patient convenience and compliance.

- Hospitals dominated end-users in 2023, accounting for over 48% market share, due to their advanced infrastructure and specialized care facilities.

- North America led the market in 2023, holding a 36% share with a valuation of US$ 70.2 billion, driven by advanced healthcare systems.

Therapy Type Analysis

In 2023, the Chemotherapy segment held a dominant market position in the Therapy Type Segment of the Solid Tumor Therapeutics Market, capturing more than a 28% share. Chemotherapy remains foundational in treating cancer. It targets fast-dividing cells, typical of cancerous growths, and is essential in comprehensive treatment plans.

Immunotherapy has gained traction by leveraging the immune system to fight cancer. Innovations in this segment, like checkpoint inhibitors and cancer vaccines, are expanding its role in achieving durable remission in patients.

Targeted therapies have revolutionized cancer treatment by focusing on specific molecular targets. These therapies reduce damage to healthy cells, thereby enhancing patient outcomes. The growth of this segment is fueled by continuous discoveries of new molecular targets.

Other significant segments include Tyrosine kinase inhibitors, Proteasome inhibitors, and Hedgehog pathway inhibitors. Each targets unique aspects of cell growth and survival. The Others category continues to explore new therapeutic avenues, addressing resistance and targeting novel aspects of tumor biology.

Route of Administration Analysis

In 2023, the oral segment held a dominant market position in the Route of Administration Segment of the Solid Tumor Therapeutics Market, capturing more than a 38% share. This significant portion reflects the high preference for oral medications. Patients and healthcare providers often favor oral treatments for their ease of use. They simplify the administration process and are ideal for long-term treatment plans, particularly in the home setting.

The preference for oral medications is largely due to their non-invasive nature. Unlike injectable options, oral treatments do not require professional administration or visits to healthcare facilities. This convenience factor plays a crucial role in patient compliance and satisfaction. It ensures that treatment continues uninterrupted, which is vital for the effectiveness of cancer therapy.

Technological advancements have significantly enhanced the development of oral therapeutics. Improvements in drug formulation techniques have increased the efficacy and bioavailability of oral cancer drugs. These advancements make oral treatments not only more effective but also reduce potential side effects associated with higher doses or intravenous delivery. This progress supports the growing reliance on oral medications in managing solid tumors.

Despite the advantages, the oral route faces challenges such as drug resistance and adverse side effects. These issues necessitate ongoing research and development efforts to refine oral chemotherapy options. Future innovations are expected to focus on improving drug delivery systems and enhancing patient adherence to treatment regimens. Such developments will likely maintain or even increase the popularity of oral therapies in the solid tumor therapeutics market.

End-Users Analysis

In 2023, the hospitals segment held a dominant market position in the end-users segment of the Solid Tumor Therapeutics Market, capturing more than a 48% share. Hospitals are key players due to their comprehensive services, which include advanced cancer diagnostics and treatment capabilities. They are equipped with the latest technologies for oncology treatments, enabling them to administer complex therapies effectively.

Specialty clinics are another significant part of this market. These clinics offer specialized care by focusing on individual cancer types. They provide personalized treatment plans tailored to the unique needs of their patients. Their expertise in specific tumor treatments helps them secure a notable market share.

The homecare services segment is expanding as it allows patients to receive treatments comfortably at home. This option is becoming popular for its convenience and the personalized care it offers in a familiar setting. Such services are increasingly supported by telehealth technologies, enhancing patient experiences and outcomes.

Other key contributors include community cancer centers and research institutes. These facilities often engage in critical clinical trials and are essential in developing new therapies. Additionally, diverse distribution channels, including pharmacies and online platforms, ensure that therapies are accessible to all. These platforms support the growing demand for at-home care and online consultations.

Key Market Segments

By Therapy Type

- Chemotherapy

- Immunotherapy

- Targeted Therapy

- Tyrosine kinase inhibitors

- Proteasome inhibitor

- Hedgehog pathway inhibitor

- Others

By Route of Administration

- Oral

- Parenteral

- Others

By End-Users

- Hospitals

- Specialty Clinics

- Homecare

- Others

- Distribution Channel

Drivers

Increasing Prevalence of Cancer

The rising incidence of various solid tumors, including breast, lung, and colorectal cancers, significantly drives the demand for effective cancer therapeutics. As the prevalence of these cancers increases globally, there is an urgent need for advanced treatment options that can effectively manage and potentially reduce mortality rates associated with these serious conditions.

Global trends towards personalized medicine are further propelling the development of targeted therapies. These therapies are designed to enhance treatment outcomes by focusing on the unique genetic profiles of individual tumors. This approach not only improves the efficacy of treatments but also minimizes side effects, leading to better patient care.

The market for cancer therapeutics is thus experiencing robust growth, fueled by both the increasing demand for effective treatments and the shift towards personalized medical approaches. As research continues to advance, targeted therapies are becoming more refined, offering hope for improved survival rates and quality of life for cancer patients. This ongoing evolution in cancer care underscores the importance of innovation in the pharmaceutical industry.

According to the Cancer Pressroom, the global incidence of cancer is on the rise, posing significant public health challenges. In 2022, approximately 20 million new cases of cancer were diagnosed worldwide, with a concerning 9.7 million cases resulting in death. This alarming statistic highlights the growing burden of this disease on global health systems and underscores the urgent need for enhanced diagnostic and treatment strategies.

A study by leading health researchers projects a dramatic increase in cancer cases over the coming decades. By 2050, it is anticipated that annual cancer cases could soar to 35 million. This projection serves as a stark reminder of the escalating impact of cancer and the critical need for sustained investment in oncology research and healthcare infrastructure.

For instance, the rising cancer rates necessitate a greater focus on preventive measures, early detection, and the development of more effective therapeutic options. The growing prevalence of cancer worldwide demands a coordinated and proactive approach to cancer care, aiming to reduce the incidence and mortality rates associated with this devastating disease.

Restraints

High Costs Impacting Cancer Treatment Accessibility

The high costs associated with cancer treatments pose significant challenges to market expansion and patient accessibility. Developing cancer therapeutics involves extensive research, clinical trials, and regulatory approvals, driving up expenses. According to reports, these financial demands limit the availability of advanced therapies, particularly in regions with underdeveloped healthcare infrastructure. Such high costs hinder access to essential treatments, creating disparities in patient care. Addressing affordability remains a pressing need to improve cancer treatment accessibility worldwide.

Cancer treatment costs vary significantly across countries and healthcare settings. For example, in India, treatment expenses range from ₹90,561 (approximately $1,134) to ₹27,67,149 (around $34,650), depending on the cancer type, stage, and modality. Notably, private hospitals charge substantially higher fees than public institutions, exacerbating affordability challenges. This disparity highlights the need for targeted measures to reduce costs and enhance access for low- and middle-income populations.

A 2020 study by The Week revealed that out-of-pocket expenses accounted for 93% of total cancer treatment costs in India. The average expenditure was approximately ₹1,16,218, placing a significant financial burden on patients and their families. For instance, such expenses can force households to deplete savings or incur debts, intensifying economic hardships. Addressing these high costs is crucial for improving equity and accessibility in cancer care.

Cancer-related healthcare spending in the United States underscores the growing financial strain of cancer care. According to estimates, expenditure reached $161.2 billion in 2017. This figure is projected to rise to $246 billion by 2030, reflecting increased demand for advanced treatments and supportive care. Such financial growth challenges healthcare systems to ensure sustainable and equitable access to cancer therapies.

The financial burden of cancer care is a global concern, particularly in low- and middle-income countries. For example, limited access to affordable treatment options restricts patient outcomes and market growth. Addressing these challenges requires collaborative efforts to reduce research costs, enhance public healthcare investments, and implement policies for equitable treatment access. Ensuring affordability is critical to advancing global cancer care.

Opportunities

Advancements in Genomic Profiling

Advancements in genomic profiling are unlocking significant opportunities in developing innovative therapies. According to MDPI, next-generation sequencing (NGS) technologies have revolutionized the field by enabling rapid and cost-effective analysis of DNA and RNA. Comprehensive genomic profiling (CGP), facilitated by NGS, assesses multiple genes simultaneously for mutations, copy number variations, and other alterations. This precision provides insights into various diseases, particularly cancer, and paves the way for tailored treatments. These targeted therapies are more effective and have fewer side effects compared to conventional methods.

In oncology, CGP has become a cornerstone of precision medicine. Studies by Springerlink show that CGP identifies specific molecular aberrations within tumors, guiding the selection of therapies suited to an individual’s cancer profile. For instance, integrating CGP into clinical practice improves patient outcomes significantly compared to standard treatments. This approach marks a paradigm shift in cancer care, enabling more personalized and efficient treatment strategies. It also holds promise for enhancing therapeutic efficacy in other diseases.

The impact of CGP is evident in the treatment of solid tumors. According to Wikipedia, genomic profiling in lung adenocarcinoma revealed that 76% of tumors activate receptor tyrosine kinase pathways, providing potential targets for therapy. Similarly, studies of colorectal carcinoma have identified distinct molecular subtypes through genomic analysis. These findings aid in the development of highly specific treatments. For example, targeted strategies based on such molecular insights offer new hope for patients battling these conditions.

Precision medicine leverages genomic profiling to offer customized treatment plans. For example, genomic data enables medical professionals to design therapies tailored to individual genetic profiles, as highlighted by MDPI. This shift minimizes side effects while improving efficacy. Targeted treatments are especially impactful in oncology, broadening the therapeutic landscape. By focusing on unique biomarkers, genomic profiling is transforming healthcare, ensuring treatments are effective and patient-specific.

Trends

Integration of Immunotherapy

The integration of immunotherapy into cancer treatment is transforming oncology care, offering new hope for patients. Immunotherapies such as checkpoint inhibitors and CAR-T cell therapies enhance the body’s immune response to effectively target and destroy cancer cells. These therapies are now widely adopted in treating various cancers, including melanoma, lung, and breast cancers. According to clinical trials, immunotherapies significantly improve survival rates, making them an essential part of advancements in personalized cancer care. Their growing adoption underlines their importance in modern oncology solutions.

Checkpoint inhibitors work by blocking proteins that suppress immune responses, enabling the immune system to combat cancer more effectively. Similarly, CAR-T cell therapies reprogram T-cells to attack tumors with precision. For example, these therapies have demonstrated remarkable success in clinical trials, leading to their accelerated adoption. Their effectiveness is also driving substantial investments in research, fostering the development of innovative immunotherapy approaches to enhance treatment outcomes.

According to recent studies, the combination of botensilimab and balstilimab shows promise in treating bowel cancer, the most common form of the disease. In a trial involving 101 patients, 61% of the tumors either shrank or remained stable after six months. This combination immunotherapy offers new treatment options for patients with previously unresponsive forms of bowel cancer. These findings highlight the potential of tailored drug combinations in addressing complex cancer cases, further advancing oncology care.

The cancer immunotherapy drug development pipeline is also shifting toward innovation. For instance, clinical trials for CAR-T cell therapies increased by 5.6%, while other T-cell therapies rose by 24.2%. Additionally, trials for natural killer cell therapies increased by 7.7%, and therapies involving bacteria grew by 28.6%. These trends reflect a growing focus on diversifying therapeutic strategies, fueling breakthroughs in cancer treatment.

Regional Analysis

In 2023, North America secured a leading position in the solid tumor therapeutics market, holding over 36% market share with a valuation of US$ 70.2 billion. This dominance is primarily due to the region’s advanced healthcare infrastructure and substantial investment in cancer research. These elements ensure early access to innovative cancer treatments, fostering a robust market growth.

North America’s healthcare prowess is supported by extensive funding and high patient awareness regarding cancer therapies. The presence of world-renowned cancer research centers further propels the development and quick adoption of novel therapeutic solutions. This environment is pivotal for the continuous introduction of advanced treatment options.

Regulatory frameworks in North America, particularly the proactive role of the FDA, significantly influence the market. Efficient regulatory policies facilitate the swift approval and oversight of new drugs. This regulatory advantage not only speeds up the commercialization process but also enhances patient access to effective treatments.

Looking ahead, North America’s leadership in the market faces potential challenges from rapidly growing regions like Asia-Pacific. To sustain its market dominance, North America must address issues such as the escalating costs of cancer care and focus on making treatments more accessible and affordable. Continual innovation and responsive healthcare policies will be key to maintaining its leading position.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Solid Tumor Therapeutics Market is significantly influenced by major industry players who lead advancements and broaden treatment accessibility. F. Hoffmann-La Roche Ltd. is known for its robust research and development, creating innovative oncology treatments. Mylan N.V., recently merged into Viatris, enhances the market with affordable generic and specialty pharmaceuticals. Their focus on biosimilars is crucial for providing cost-effective cancer treatment options.

Teva Pharmaceutical Industries Ltd. contributes through its extensive range of generic drugs, including therapies for solid tumors. Their commitment to producing high-volume, lower-cost medicines supports global cancer treatment efforts, especially in regions with limited resources. Sanofi’s involvement emphasizes developing targeted oncology drugs that disrupt tumor growth, focusing on personalized and effective treatment solutions.

Pfizer Inc. is another key player with a comprehensive portfolio in the oncology sector, continually innovating cancer treatments. Their work is pivotal in developing new therapies and enhancing existing ones, making significant strides in the fight against cancer. Additional market contributors focus on niche segments, including targeted and immunotherapies, expanding treatment options and supporting diverse patient needs. This collective effort by all players is vital for progressing cancer treatment globally.

Market Key Players

- F. Hoffmann-La Roche Ltd.

- Mylan N.V.

- Teva Pharmaceutical Industries Ltd.

- Sanofi

- Pfizer Inc.

- GlaxoSmithKline plc

- Novartis AG

- Merck & Co. Inc.

- Allergan

- AstraZeneca

- Johnson & Johnson Private Limited

- Hikma Pharmaceuticals PLC

- Bristol-Myers Squibb Company

- Bayer AG

Recent Developments

- In November 2024: Sanofi participated in an $89 million Series D financing round for Agomab Therapeutics. This investment is aimed at advancing Agomab’s clinical development of novel therapies for fibrotic diseases, which are critical in addressing solid tumor environments like idiopathic pulmonary fibrosis and fibrostenosing Crohn’s disease.

- In June 2024: Roche received a positive recommendation from the Committee for Medicinal Products for Human Use (CHMP) for Vabysmo to treat retinal vein occlusion (RVO). If approved, Vabysmo will be the first and only bispecific antibody treatment available for nearly one million people with RVO in the European Union. Vabysmo is already approved in the US and Japan for RVO and in over 95 countries for neovascular age-related macular degeneration and diabetic macular edema.

- In October 2023: Teva and Sanofi established an exclusive collaboration to co-develop and co-commercialize the drug duvakitug (anti-TL1A) for the treatment of ulcerative colitis (UC) and Crohn’s disease (CD), which are types of inflammatory bowel disease but have implications in solid tumor therapies due to their mechanism. Teva received an upfront payment of $500 million from Sanofi shortly after the agreement was closed and could receive up to $1 billion in development and launch milestones.

Report Scope

Report Features Description Market Value (2023) US$ 195.2 Billion Forecast Revenue (2033) US$ 497.2 Billion CAGR (2024-2033) 9.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Therapy Type (Chemotherapy, Immunotherapy, Targeted Therapy, Tyrosine kinase inhibitors, Proteasome inhibitor, Hedgehog pathway inhibitor, Others), By Route of Administration (Oral, Parenteral, Others), By End-Users (Hospitals, Specialty Clinics, Homecare, Others, Distribution Channel) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape F. Hoffmann-La Roche Ltd., Mylan N.V., Teva Pharmaceutical Industries Ltd., Sanofi, Pfizer Inc., GlaxoSmithKline plc, Novartis AG, Merck & Co. Inc., Allergan, AstraZeneca, Johnson & Johnson Private Limited, Hikma Pharmaceuticals PLC, Bristol-Myers Squibb Company, Bayer AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Solid Tumor Therapeutics MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample

Solid Tumor Therapeutics MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- F. Hoffmann-La Roche Ltd.

- Mylan N.V.

- Teva Pharmaceutical Industries Ltd.

- Sanofi

- Pfizer Inc.

- GlaxoSmithKline plc

- Novartis AG

- Merck & Co. Inc.

- Allergan

- AstraZeneca

- Johnson & Johnson Private Limited

- Hikma Pharmaceuticals PLC

- Bristol-Myers Squibb Company

- Bayer AG