Global Gas Detection Equipment Market Size, Share Analysis Report By Product Type (Fixed Gas Detectors, Portable Gas Detectors, Wireless Gas Detectors), By End-User (Oil and Gas, Chemical and Petrochemical, Mining, Manufacturing, Utilities, Commercial and Residential), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: May 2025

- Report ID: 28496

- Number of Pages: 235

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

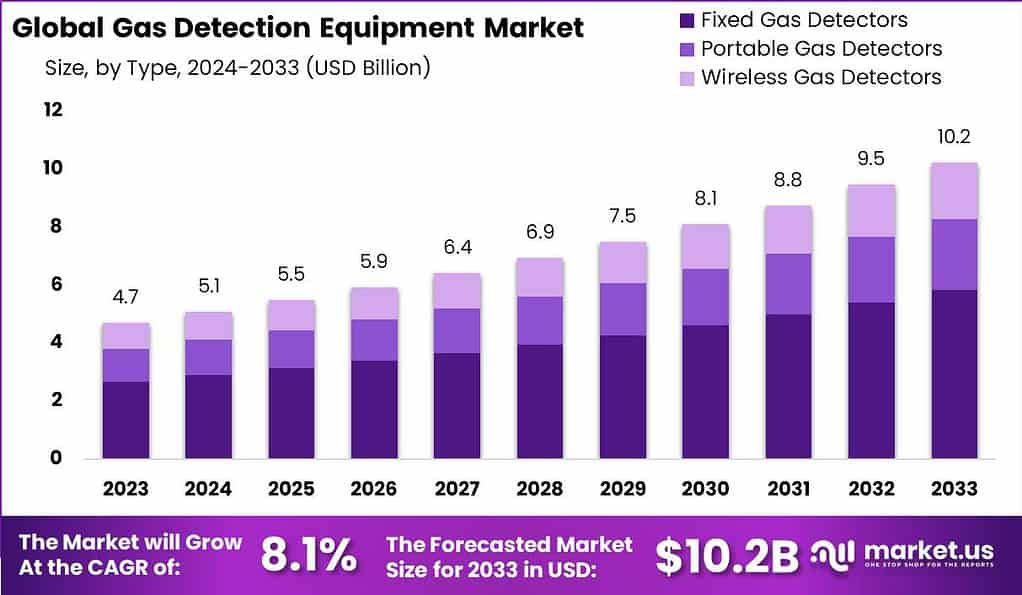

The Global Gas Detection Equipment Market size is expected to be worth around USD 10.2 Billion by 2033, from USD 4.7 Billion in 2023, growing at a CAGR of 8.1% during the forecast period from 2024 to 2033.

Gas detection equipment plays a vital role in ensuring safety across various industries by identifying hazardous gases and preventing potential accidents. These devices are designed to detect the presence of toxic or combustible gases, providing real-time alerts to avert disasters. The equipment is broadly categorized into fixed and portable detectors, each serving specific operational needs.

Fixed detectors are permanently installed in facilities to continuously monitor environments, while portable detectors offer flexibility for personnel working in diverse locations. The global gas detection equipment market is experiencing significant growth, driven by stringent safety regulations and technological advancements.

Several factors are propelling the demand for gas detection equipment. The escalating emphasis on workplace safety, coupled with rapid industrialization, has heightened the need for reliable gas monitoring solutions. Industries such as oil and gas, chemicals, mining, and manufacturing are increasingly adopting these devices to comply with safety regulations and protect workers.

Technological advancements are significantly influencing market trends. The integration of IoT and wireless connectivity in gas detectors has enhanced real-time monitoring capabilities, allowing for immediate response to hazardous situations. Infrared (IR) technology, accounting for over 32% of the market share in 2023, offers high accuracy and rapid response times, making it a preferred choice for industrial applications.

In the gas detection equipment market, a concentrated competitive landscape is observed, with the top five companies accounting for approximately 65% of the total market share. This concentration underscores the significant influence and market power wielded by leading players such as Honeywell, Drägerwerk, MSA Safety, Industrial Scientific, and Riken Keiki.

Among these, Honeywell emerges as the market leader, commanding over 25% of the market share. This dominant position can be attributed to its comprehensive product range and extensive global distribution network, enabling widespread market penetration and customer access.

Drägerwerk, headquartered in Germany, occupies the second position with a 15% market share, distinguished by its substantial investments in the advancement of wireless gas detection technologies. This focus on innovation positions Drägerwerk as a key player in shaping the market’s technological frontier.

The landscape of the gas detection equipment market is also characterized by dynamic investment activities, with venture capital and private equity investments in gas detection startups surging to over $400 million in 2021. Emerging entities such as Sensor Electronics, Cubic Sensor and Control, and Industrial Scientific are among the beneficiaries of this influx of capital, indicating a robust interest in innovative solutions within the sector.

Market consolidation has become a notable trend, evidenced by significant mergers and acquisitions, including MSA Safety’s strategic acquisition of Bacharach for $337 million, and Drägerwerk’s acquisition of STS Group. These transactions not only reflect the strategic endeavors of established companies to expand their product offerings and market footprint but also highlight the ongoing realignment within the industry landscape.

Key Takeaways

- The global gas detection equipment market is estimated to grow to approximately USD 10.2 billion by 2033, reflecting a robust Compound Annual Growth Rate (CAGR) of 8.1% from 2024 to 2033.

- Fixed Gas Detectors Dominance: In 2023, fixed gas detectors held a dominant market share of over 57%, owing to their critical role in continuous monitoring and safety assurance in industrial settings.

- Oil and Gas Sector Leadership: The oil and gas industry led in market share in 2023, capturing over 25% of the gas detection equipment market.

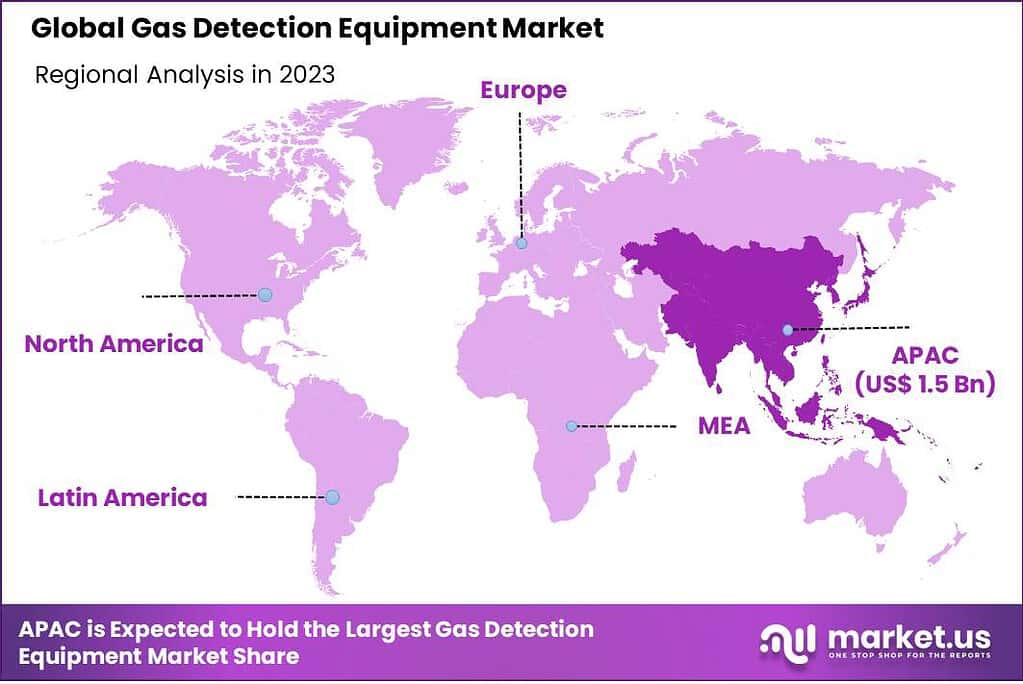

- Asia-Pacific Dominance: In 2023, the Asia-Pacific region held the largest market share of over 32.8%, attributed to rapid industrialization, urbanization, and stringent safety regulations, particularly in countries like China, India, and Southeast Asia.

Analysts’ Viewpoint

Investment opportunities in the gas detection equipment market are abundant, particularly in regions experiencing rapid industrial growth. Asia-Pacific, holding more market share in 2023, is witnessing increased investments in manufacturing and chemical industries, driving the demand for gas detection systems. North America is also experiencing robust growth due to stringent workplace safety regulations and the adoption of advanced technologies.

Businesses stand to benefit significantly from the implementation of gas detection equipment. Beyond ensuring compliance with safety regulations, these devices contribute to the prevention of accidents, protection of assets, and enhancement of overall operational safety. The integration of advanced detection systems can lead to reduced downtime, lower insurance premiums, and improved employee morale.

The regulatory environment plays a crucial role in shaping the gas detection equipment market. Agencies such as the Occupational Safety and Health Administration (OSHA) and the Health and Safety Executive have established stringent guidelines mandating the use of gas detection systems in hazardous environments.

Type Analysis

In 2023, the Fixed Gas Detectors segment held a dominant market position, capturing more than a 57% share of the global gas detection equipment market. This segment’s leading status can be attributed to its critical role in continuous monitoring and safety assurance in industrial environments.

Fixed gas detectors are permanently installed in strategic locations to provide round-the-clock surveillance against hazardous gas leaks, making them indispensable in industries such as oil and gas, chemicals, and manufacturing. Their ability to integrate with centralized control systems for real-time monitoring and alerting significantly enhances workplace safety and regulatory compliance.

The preference for fixed gas detectors over other types stems from their reliability, durability, and lower need for maintenance, aligning with the operational requirements of high-risk environments. These systems are designed to operate in extreme conditions, offering precise and continuous monitoring capabilities that are vital for preventing accidents and minimizing the risk of gas exposure to workers.

Moreover, the ongoing advancements in sensor technology and the integration of IoT and AI for predictive analytics further bolster the adoption of fixed gas detectors, driving their market dominance. Furthermore, the economic rationale behind the widespread adoption of fixed gas detectors is grounded in their cost-effectiveness over the long term.

Despite the initial higher investment compared to portable or wireless options, the long-term operational savings, reduced downtime, and enhanced safety protocols make fixed gas detectors a preferred choice for many businesses. This segment’s prominence is expected to continue as industries worldwide increasingly prioritize safety and regulatory compliance, coupled with technological advancements that improve detection accuracy and system integration.

End-User Analysis

In 2023, the Oil and Gas segment held a dominant market position in the gas detection equipment market, capturing more than a 25% share. This significant market share can be primarily attributed to the inherent high-risk nature of the oil and gas industry, where the detection and monitoring of hazardous gases are critical for ensuring operational safety and environmental compliance.

The exploration, extraction, refining, and transportation processes associated with oil and gas operations present numerous opportunities for gas leaks, making the deployment of advanced gas detection systems essential for preventing potential accidents and health hazards. The leadership of the Oil and Gas segment in the gas detection equipment market is further reinforced by stringent regulatory standards and safety guidelines imposed by governments and international bodies.

These regulations mandate the use of gas detection equipment to protect workers and the environment from the harmful effects of gas leaks, driving the adoption of both fixed and portable gas detection solutions in this sector. Additionally, the push towards operational efficiency and the need to minimize downtime in oil and gas operations have led to the increased integration of smart and wireless gas detection technologies that offer real-time monitoring and data analysis capabilities.

Moreover, the investment in safety measures, including gas detection equipment, is viewed within the oil and gas industry as a critical investment in ensuring uninterrupted operations and safeguarding against the significant financial and reputational damages that can result from gas leak incidents.

The evolving technological landscape, featuring advancements in gas detection technologies such as IoT connectivity, AI-driven analytics, and improved sensor sensitivity, continues to enhance the effectiveness and appeal of gas detection solutions in the oil and gas sector.

Key Market Segments

Type

- Fixed Gas Detectors

- Portable Gas Detectors

- Wireless Gas Detectors

End-User

- Oil and Gas

- Chemical and Petrochemical

- Mining

- Manufacturing

- Utilities

- Commercial and Residential

Driver

Technological Advancements in Gas Detection Equipment

The continuous innovation in gas detection technology represents a significant driver for the gas detection equipment market. Advances such as enhanced sensor sensitivity, integration with the Internet of Things (IoT), and the development of wireless and smart detection systems have significantly improved the efficiency, accuracy, and usability of gas detection equipment.

For instance, In June 2024, CO2Meter introduced Gaslab, a new wireless industrial gas detection safety series tailored to meet the evolving needs of industrial safety and compliance. Gaslab has been engineered to monitor a broad spectrum of gas types and concentration levels across diverse operational environments, including manufacturing, food processing, healthcare, and environmental monitoring.

These technological improvements enable real-time monitoring and analysis of hazardous gases, facilitating immediate response to potential dangers and improving safety standards across various industries. Moreover, the advent of miniaturized, portable detectors has expanded the applications of gas detection equipment, making it more accessible and convenient for a broader range of users.

Restraint

High Cost of Advanced Gas Detection Systems

One of the primary restraints facing the gas detection equipment market is the high cost associated with advanced gas detection systems. The development and integration of new technologies such as IoT connectivity, wireless communication, and advanced sensor capabilities into gas detection equipment increase the overall cost of these devices.

For many small and medium-sized enterprises (SMEs) and in developing regions, the initial investment and maintenance costs of cutting-edge gas detection solutions can be prohibitively expensive. This financial barrier limits the accessibility of advanced gas detection technologies for a segment of the market, potentially slowing down market growth.

Moreover, the need for ongoing maintenance, calibration, and potential replacement of sensors adds to the total cost of ownership, further deterring budget-conscious customers from investing in advanced gas detection solutions.

Opportunity

Increasing Industrial Safety Regulations Globally

The tightening of industrial safety regulations globally presents a significant opportunity for the gas detection equipment market. Governments and international regulatory bodies are implementing stricter safety standards and guidelines to protect workers and environments from the hazards of gas leaks.

These regulations mandate the use of gas detection equipment in industries such as oil and gas, chemicals, mining, and manufacturing, where the risk of hazardous gas exposure is high. This regulatory push is compelling companies to invest in advanced gas detection systems to ensure compliance, avoid penalties, and safeguard their workforce and operations.

As a result, the demand for gas detection equipment is expected to surge, offering ample growth opportunities for manufacturers and suppliers to expand their market presence, innovate new solutions, and meet the increasing safety requirements of various industries.

Challenge

Lack of Awareness and Training

A significant challenge in the gas detection equipment market is the lack of awareness and training among potential users. Despite the availability of advanced gas detection technologies, the effectiveness of these systems is often compromised by insufficient knowledge and training on their proper use and maintenance.In many instances, end-users are not fully informed about the capabilities of their gas detection equipment, how to interpret warnings accurately, or the importance of regular maintenance and calibration. This gap in knowledge can lead to misuse or underutilization of gas detection systems, undermining workplace safety.

Addressing this challenge requires comprehensive training programs and educational initiatives from manufacturers and regulatory bodies to ensure that end-users are well-informed about the best practices for using and maintaining gas detection equipment, thereby maximizing its potential to prevent accidents and save lives.

Regional Analysis

In 2023, the Asia-Pacific (APAC) region held a dominant market position in the gas detection equipment market, capturing more than a 32.8% share. The demand for Gas Detection Equipment in North America was valued at US$ 1.5 billion in 2023 and is anticipated to grow significantly in the forecast period.

This prominence is largely attributable to the rapid industrialization and urbanization in major APAC economies such as China, India, and Southeast Asia.These developments have led to a surge in manufacturing activities, energy production, and construction projects, all of which require stringent safety measures, including the deployment of gas detection equipment. The region’s commitment to improving workplace safety standards, in conjunction with regulatory bodies enforcing stricter safety regulations, has significantly contributed to the demand for gas detection systems.

Additionally, the APAC region is witnessing significant investments in infrastructure and technology, which further boosts the adoption of advanced gas detection solutions. The increasing awareness of occupational health hazards and the rising demand for sustainable and safe industrial operations are driving the market for gas detection equipment.

Moreover, the presence of several key players in the APAC market, coupled with the entry of emerging companies offering innovative solutions, is facilitating the accessibility and affordability of gas detection equipment. This scenario is expected to sustain the growth momentum of the APAC gas detection equipment market, making it a leading region in terms of market share and technological adoption.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The competitive landscape of the gas detection equipment market is characterized by its highly fragmented nature, reflecting the presence of numerous players competing on various fronts such as technological innovation, geographic presence, and product differentiation. This fragmentation indicates a market that is not only diverse but also dynamic, with companies continuously seeking strategies to enhance their market positions and meet the evolving needs of their customers.

For instance, ABB Ltd., a leading player in the gas detection equipment market, took a significant step forward by announcing the launch of HoverGuard. This innovative product represents a leap in gas detection technology, utilizing drone-based systems to detect gas leaks. HoverGuard is designed to improve the efficiency and safety of gas leak detection by offering the ability to cover large areas quickly, access difficult-to-reach locations, and provide real-time data on gas concentrations.

Top Market Leaders

- Honeywell International Inc.

- Drägerwerk AG & Co. KGaA

- MSA Safety Incorporated

- Industrial Scientific Corporation

- RAE Systems by Honeywell

- BW Technologies by Honeywell

- Teledyne Technologies Incorporated

- Sierra Monitor Corporation

- Sensidyne, LP

- GfG Gesellschaft für Gerätebau mbH

- RKI Instruments Inc.

- Other Key Players

Recent Developments

- In May 2024, Samon launched the GLACIÄR X5, an advanced industrial gas detector specifically designed for refrigeration environments. The GLACIÄR X5 features both single and dual-sensor technology, making it suitable for deployment in Zone 1 and Zone 2 hazardous areas. Its design focuses on enhancing safety in high-risk locations where gas leaks could lead to operational shutdowns or health hazards.

- In March 2024, Teledyne Gas and Flame Detection introduced the OLCT 100-XP-MS, a next-generation line of flammable gas detectors. This product line integrates cutting-edge MEMS (Micro-Electro Mechanical Systems) sensor technology, known for its high precision, low power consumption, and long-term stability.

Report Scope

Report Features Description Market Value (2023) US$ 4.7 Bn Forecast Revenue (2033) US$ 10.2 Bn CAGR (2024-2033) 8.1% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Fixed Gas Detectors, Portable Gas Detectors, Wireless Gas Detectors), By End-User (Oil and Gas, Chemical and Petrochemical, Mining, Manufacturing, Utilities, Commercial and Residential) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Honeywell International Inc., Drägerwerk AG & Co. KGaA, MSA Safety Incorporated, Industrial Scientific Corporation, RAE Systems by Honeywell, BW Technologies by Honeywell, Teledyne Technologies Incorporated, Sierra Monitor Corporation, Sensidyne LP, GfG Gesellschaft für Gerätebau mbH, RKI Instruments Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the current size of the global gas detection equipment market?The Global Gas Detection Equipment Market size is expected to be worth around USD 10.2 Billion by 2033, from USD 4.7 Billion in 2023, growing at a CAGR of 8.1% during the forecast period from 2024 to 2033.

What are the key factors driving the growth of the gas detection equipment market?The growth of the market can be attributed to the increasing demand for gas detection equipment in industries such as oil & gas, chemicals, mining, and manufacturing, where the risk of gas leaks and exposure to toxic gases is high.

Which regions are expected to witness significant growth in the gas detection equipment market?The Asia-Pacific region is expected to witness significant growth in the gas detection equipment market due to rapid industrialization, urbanization, and increasing investments in infrastructure development in countries such as China, India, and Japan.

What are the key challenges faced by the gas detection equipment market?The gas detection equipment market faces several challenges, including the high cost of gas detection equipment, especially for advanced technologies such as infrared and laser-based gas detectors.

What are the key players operating in the gas detection equipment market?The key players operating in the gas detection equipment market include Honeywell International Inc., Drägerwerk AG & Co. KGaA, MSA Safety Incorporated, Industrial Scientific Corporation, RAE Systems by Honeywell, BW Technologies by Honeywell, Teledyne Technologies Incorporated, Sierra Monitor Corporation, Sensidyne LP, GfG Gesellschaft für Gerätebau mbH, RKI Instruments Inc., Other Key Players

Gas Detection Equipment MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample

Gas Detection Equipment MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Honeywell International Inc.

- Drägerwerk AG & Co. KGaA

- MSA Safety Incorporated

- Industrial Scientific Corporation

- RAE Systems by Honeywell

- BW Technologies by Honeywell

- Teledyne Technologies Incorporated

- Sierra Monitor Corporation

- Sensidyne, LP

- GfG Gesellschaft für Gerätebau mbH

- RKI Instruments Inc.

- Other Key Players