Global Geospatial Analytics Market By Component (Software, Services), By Type (Surface and Field Analytics, Network & Location Analytics, Geovisualization), By Solution ( Geocoding and Reverse Geocoding, Data Integration and ETL, Report Visualization, Thematic Mapping & Spatial Analysis), By Technologies (Remote Sensing, Global Positioning System, Geographic Information System, 3D Scanning), By Deployment Mode (Cloud, On-premises), By Organization Size (Large Enterprises, SMEs), By Application( Surveying, Medicine & Public Safety, Military Intelligence), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov. 2023

- Report ID: 108391

- Number of Pages: 288

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

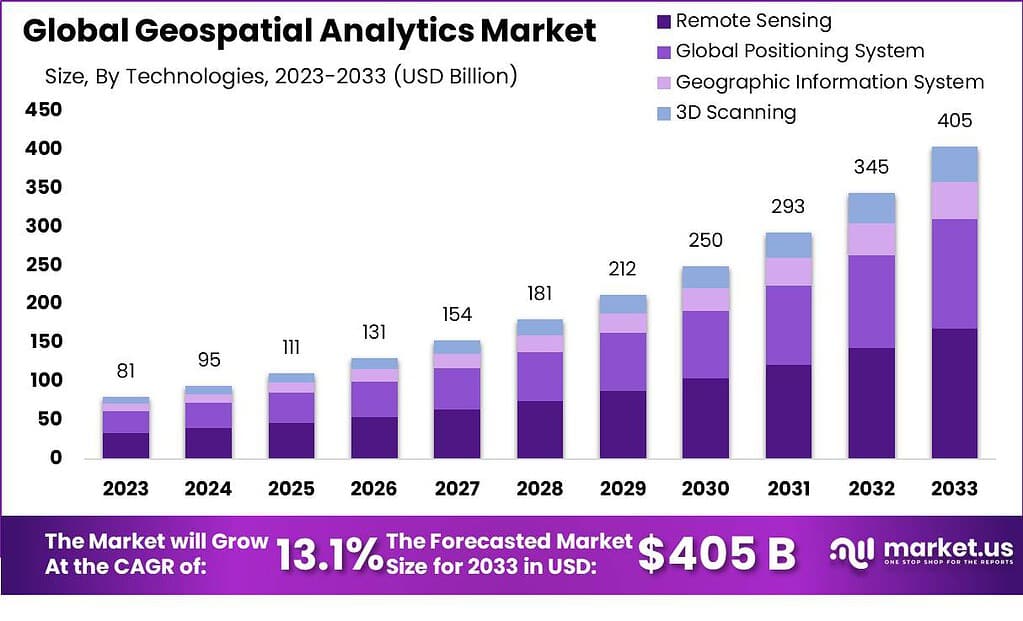

The Global Geospatial Analytics Market size is expected to be worth around USD 405 Billion By 2033, from USD 95 billion in 2024, growing at a CAGR of 13.1% during the forecast period from 2024 to 2033.

Geospatial analytics involves the collection, manipulation, and display of geographic information system (GIS) data along with imagery from GPS and satellite photographs. It uses geographic coordinates and specific identifiers like street addresses and zip codes to create detailed geographic models and visualizations. This helps in more accurate modeling and prediction of trends across various applications.

The geospatial analytics market has been experiencing robust growth due to the increasing integration of geospatial data with mainstream technologies. Industries such as real estate, agriculture, defense, and transportation utilize geospatial analytics to enhance decision-making processes. The market’s expansion is fueled by the surge in location-based services, the need for enhanced business intelligence, and the rising demand for aerial analytics.

Several factors are propelling the geospatial analytics market forward. These include the rising need for predictive analytics to aid in decision-making processes and the growing adoption of geospatial analytics in planning and development across urban and rural areas. The increasing availability of spatial data and enhancement in data processing capabilities due to technological advancements are also significant drivers

The demand for geospatial analytics is driven by its capability to provide enhanced visualization and ability to solve complex problems with geographical elements at their core. Industries such as agriculture, defense, and transportation are increasingly relying on geospatial data to optimize operations, manage resources, and enhance situational awareness.

The geospatial analytics market is ripe with opportunities, particularly in the development and integration of AI and machine learning technologies. These advancements are enhancing the efficiency and accuracy of spatial data analysis. The expansion of IoT and smart city projects around the globe also presents substantial opportunities for the deployment of geospatial technologies.

Technological progress in the field of geospatial analytics has been rapid. Innovations such as real-time data streaming, cloud computing, and advanced AI algorithms have transformed how spatial data is collected, processed, and analyzed. These technologies allow for the handling of large datasets more efficiently and provide deeper insights into spatial patterns and relationships.

Businesses benefit from geospatial analytics through enhanced decision-making capabilities, improved efficiency, and cost reductions in various operations. The technology offers businesses critical insights into market trends, consumer behavior, and logistical operations, enabling them to optimize strategies and operations accordingly. It also plays a crucial role in risk management and scenario planning, especially in industries like insurance, real estate, and public safety.

Key Takeaways

- Impressive Growth Projection: The Geospatial Analytics Market is expected to reach a substantial value of USD 405 billion by 2033, with a steady Compound Annual Growth Rate (CAGR) of 13.1% over the forecast period.

- What is Geospatial Analytics?: Geospatial analytics is all about using location-based data to gain valuable insights. It involves analyzing spatial data, satellite images, AI, and machine learning algorithms to extract meaningful information from location-related data.

- Vital for Multiple Industries: Geospatial analytics has a broad impact across various sectors, including urban planning, agriculture, environmental monitoring, and disaster management. It empowers these industries to make informed decisions and promote sustainable development.

- AI and ML Integration: The technology employs Artificial Intelligence (AI) and Machine Learning (ML) algorithms to automate tasks such as classification, anomaly detection, and predictions based on geospatial data.

- Application in Urban Planning: Urban planning benefits significantly from geospatial analytics by helping cities become smarter and more efficient.

- Location-Based Data Insights: Geospatial analytics applies statistical techniques to geographic and spatial data sets, generating maps and applying analytical methods to extract valuable insights from geographical data.

- Integration into Existing IT Systems: Geospatial systems are easily integrated into a company’s existing IT infrastructure, making it accessible and compatible with various business processes.

- Technological Advancements: The growth of the Geospatial Analytics Market is driven by technological advancements, with companies like Kongsberg Geospatial and CarteNav Solutions using cutting-edge geospatial visualization solutions to enhance mission-critical systems.

- Rising Demand for Location-Based Solutions: The increasing demand for location-based solutions, especially in smart cities’ investments, contributes significantly to the market’s growth.

Component Insights

In 2022, the geospatial analytics market exhibited a notable trend in its segmental composition. The software segment emerged as the frontrunner, seizing a commanding market position with a significant share of over 66%. This dominance can be attributed to the critical role that software plays in enabling geospatial analytics processes, offering a range of functionalities to cater to diverse industry needs.

Within the software segment, several sub-categories played pivotal roles in shaping the market landscape. These include mapping software, spatial analysis tools, geo-visualization solutions, and data management platforms. Each of these software components contributed uniquely to the segment’s overall success.

Mapping software serves as an integral element in geospatial analytics, providing the foundation for spatial data representation and analysis. Spatial analysis tools offer advanced features to extract meaningful insights from geospatial data for informed decision-making. Geo-visualization software presents complex spatial information in an easily understandable visual format to promote communication and understanding, while data management programs ensure efficient storage, retrieval, manipulation of geospatial data to support geospatial analytics systems seamlessly.

At the same time, services market for geospatial analytics also played a pivotal role in its expansion. This segment encompassed services such as system integration, training and geo-consultation, as well as support and maintenance. These services are indispensable in ensuring the effective deployment and operation of geospatial analytics solutions.

System integration services enable organizations to seamlessly integrate geospatial analytics software into their existing infrastructure, ensuring a harmonious flow of data and processes. Training and geo-consultation services equip users with the necessary skills and insights to harness the full potential of geospatial analytics tools, fostering competence and confidence among users. Lastly, support and maintenance services provide continuous assistance to resolve issues and ensure the uninterrupted performance of geospatial analytics systems.

Type Insights

In 2022, the geospatial analytics market experienced a significant segmentation, with the surface & field analytics segment emerging as the dominant force, securing a substantial market share of over 58.3%. This dominance underscores the pivotal role played by surface & field analytics in the geospatial analytics landscape.

Surface & field analytics constitute a critical sub-segment within the geospatial analytics market. It encompasses a wide array of applications, focusing on the analysis of geospatial data related to physical surfaces and field conditions. This segment’s prominence can be attributed to its extensive applicability across various industries, including agriculture, environmental monitoring, and infrastructure development.

Within the surface & field analytics segment, several specialized applications and tools have contributed to its commanding position. These applications are designed to assess and analyze data pertaining to land use, soil composition, vegetation health, and topographic features. Furthermore, surface & field analytics play a vital role in precision agriculture, enabling farmers to make informed decisions regarding crop management, irrigation, and resource allocation.

In parallel, the geospatial analytics market also witnessed the influence of other key segments, such as network & location analytics and geo-visualization. Network & location analytics focus on the analysis of spatial data related to networks, transportation, and logistics. This segment plays a pivotal role in optimizing route planning, supply chain management, and location-based services.

Geo-visualization, another integral segment, is instrumental in transforming complex geospatial data into visual representations that are easily interpretable. It aids decision-makers in grasping spatial insights intuitively, facilitating effective communication and problem-solving.

Solution Insights

In 2022, Geocoding & Reverse Geocoding solutions played a pivotal role in the geospatial analytics market. Geocoding involves the process of converting addresses or place names into geographic coordinates, while reverse geocoding reverses this, transforming coordinates into meaningful location data. These solutions are the foundation for accurately pinpointing locations on maps and enabling precise location-based analysis. They are widely employed in various applications, from navigation systems to targeted marketing campaigns.

Data Integration & ETL solutions also held a significant position in the geospatial analytics landscape. These solutions are responsible for seamlessly combining data from multiple sources and preparing it for analysis. ETL, which stands for Extract, Transform, Load, ensures that data is cleansed, transformed, and loaded into analytical systems efficiently. In an era of big data, these solutions are instrumental in ensuring the quality and reliability of geospatial data, making it ready for insightful analysis.

Report Visualization solutions emerged as a crucial component in 2022 for translating complex geospatial data into clear and informative reports. These solutions enable the creation of visually appealing and easy-to-understand reports, charts, and graphs, aiding decision-makers in comprehending the significance of spatial insights. Report visualization enhances communication and facilitates data-driven decision-making across various industries, from real estate to urban planning.

Thematic Mapping & Spatial Analysis solutions played a vital role in 2022, enabling users to derive valuable insights from geospatial data. Thematic mapping involves the representation of data on maps, often using color-coding or other visual techniques to highlight patterns or trends. Spatial analysis, on the other hand, involves advanced calculations and statistical techniques to uncover hidden relationships within spatial data. These solutions are instrumental in fields like environmental monitoring, urban planning, and disaster management.

By Technologies Insights

Remote Sensing was a big deal in the geospatial analytics market in 2022. It uses sensors and instruments like satellites, planes, and drones to collect data about the Earth’s surface from far away. This provides super valuable imagery and info about land cover, weather, and environmental changes. It’s used in agriculture, forestry, environmental monitoring, and disaster management to help decision makers gain insights from a global perspective.

GPS continued to be essential for geospatial analytics in 2022. It uses satellites to pinpoint the exact location of stuff on Earth. GPS technology has become indispensable for navigation, asset tracking, and location-based services in industries like transportation, logistics and surveying. Real-time tracking enables real-time geolocation services which increase efficiency and decision making processes.

Geographic Information System (GIS) tech also remained fundamental for geospatial analytics in 2022. GIS integrates spatial data from various sources to enable the creation, analysis and visualization of maps and geographic information. It supports numerous applications for urban planning and natural resource management to epidemiology and public safety. GIS empowers organizations to make informed decisions based on location insights.

3D Scanning gained importance in geospatial analytics in 2022. It captures three-dimensional data points from physical objects or environments. This is critical for making detailed, accurate 3D models of objects, structures, and landscapes. It’s extensively used in architecture, engineering, construction, and archaeology, enabling precise measurements and visualizations for design and analysis.

By Deployment Mode Insights

Cloud deployment was a popular option for many organizations in the geospatial analytics space in 2022. Think of the cloud as like a virtual locker where you can store and access your geospatial data and tools over the internet. It makes it super easy to get to your stuff from anywhere. Cloud offers flexibility, scalability, and cost savings. You can quickly ramp up computing power when you need it, without managing physical servers.

On-premises deployment is when you keep everything at your own location. In 2022, some organizations preferred this approach, especially if they wanted maximum control over their geospatial data and systems. With on-premises, you have your own servers and hardware running the analytics tools. It can be a good choice if you have specific security or compliance needs.

Both cloud and on-premises have upsides and downsides. Cloud is convenient, flexible, cost-friendly, while on-premises gives more control. In 2022, the right choice came down to each organization’s specific priorities and requirements. Some valued the flexibility of cloud, while others needed the security of on-premises.

By Organization Size Insights

Large enterprises were major players in the geospatial analytics market in 2022. These are the big established companies with tons of resources, employees, and operations. Large enterprises often have huge amounts of data, and geospatial analytics helps them make sense of it. They use it for optimizing supply chains, managing large real estate portfolios, and strategic decisions based on location data. For them, geospatial analytics is a powerful tool to stay competitive and efficient.

SMEs (small and medium-sized enterprises) also had a piece of the geospatial analytics pie in 2022. SMEs are smaller, more agile companies with limited resources compared to large enterprises. They may not have massive operations, but they still benefit from geospatial insights. SMEs use it to make informed choices about local markets, find optimal store locations, and efficiently manage assets. Geospatial analytics helps level the playing field for SMEs to compete with the big guys.

By Application

Imagine the Surveying segment as the foundation of geospatial analytics in 2022. It held a prominent position, capturing more than a 21.3% share of the market. Surveying is all about measuring and mapping the physical world. It’s used in various industries like construction, real estate, and land management. Surveyors rely on geospatial analytics to create accurate maps and measurements, ensuring that buildings are in the right place and land is used efficiently.

Geospatial analytics played a crucial role in healthcare and public safety. In 2022, it helped doctors and emergency responders save lives. For instance, it can pinpoint the nearest hospital in an emergency, track disease outbreaks, and plan for disaster responses. It’s like having a GPS for healthcare and safety.

Military Intelligence relied on geospatial analytics for strategic advantage. It’s like a high-tech spy tool that helps the military understand terrain, monitor potential threats, and plan missions. In 2022, this segment used geospatial data to make informed decisions and protect national security.

When natural disasters strike, this segment comes into play. Geospatial analytics helped in predicting, preparing for, and responding to disasters like hurricanes, earthquakes, and wildfires. It’s all about saving lives and minimizing damage when Mother Nature gets unruly.

Businesses used geospatial analytics for smart marketing in 2022. It’s like a marketing GPS that helps companies target their ads to the right people in the right places. By analyzing location data, businesses could tailor their marketing strategies and reach their audience effectively.

Geospatial analytics played a significant role in addressing climate change. It helped track environmental changes, monitor deforestation, and plan for sustainable land use. In 2022, it was all about being environmentally responsible and adapting to a changing world.

Think of urban planning as the architects of cities. Geospatial analytics helped in designing smart, efficient cities. It’s used to plan transportation systems, optimize land use, and make cities more livable. In 2022, urban planners relied on geospatial data to create cities of the future.

Beyond these major segments, there were many other niche applications for geospatial analytics. These included archaeology, wildlife conservation, and even gaming. The possibilities were endless, and geospatial analytics was like a Swiss army knife, useful in countless ways.

Key Market Segmentation

By Component

- Software

- Mapping

- Spatial Analysis

- Geo-visualization

- Data Management

- Services

- System Integration

- Training & Geo-consultation

- Support & Maintenance

By Type

- Surface & Field Analytics

- Network & Location Analytics

- Geo-visualization

- Others

By Solution

- Geocoding & Reverse Geocoding

- Data Integration & ETL

- Report Visualization

- Thematic Mapping & Spatial Analysis

By Technologies

- Remote Sensing

- Global Positioning System

- Geographic Information System

- 3D Scanning

By Deployment Mode

- Cloud

- On-premises

By Organization Size

- Large Enterprises

- SMEs

By Application

- Surveying

- Medicine & Public Safety

- Military Intelligence

- Disaster Risk Reduction & Management

- Marketing Management

- Climate Change Adaptation (CCA)

- Urban Planning

- Others

Regional Analysis

North America, particularly the United States and Canada, are dominant forces in the geospatial analytics market. This region boasts many leading tech firms as well as impressive infrastructure. Plus there’s growing demand for location services from various industries – all factors which contribute to its steady expansion.

Europe plays an integral role in geospatial analytics. Countries like Britain, Germany and France are actively adopting geospatial technology for urban planning purposes as well as agriculture monitoring and environmental protection monitoring. Europe stands out with its steady economic development while maintaining an eye toward sustainability.

Asia-Pacific nations such as China, India and Japan are experiencing an impressive surge in the geospatial analytics market. Factors like increasing urbanization, infrastructure development, and e-commerce growth are driving demand for location insights here. Asia-Pacific is poised for major expansion moving forward.

Latin America is an emerging geospatial analytics market. Governments and businesses in Brazil, Mexico, and others are recognizing the value of geographic data for decision making. While smaller than other regions now, Latin America holds immense potential.

The Middle East and Africa see increasing traction for geospatial analytics in sectors like agriculture, mining, and urban planning. This region has unique challenges where geospatial analytics can help. The market here is gradually ramping up, fueled by infrastructure development and growing awareness of benefits.

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The geospatial analytics market is characterized by a dynamic landscape with several key players making significant contributions to its growth and evolution. These players are at the forefront of developing innovative solutions, expanding their market reach, and shaping the industry.

Top Key Players

- Harris Corporation

- RMSI

- DigitalGlobe Inc.

- Fugro N.V.

- Hexagon AB

- ESRI

- General Electric Co.

- MacDonald

- Trimble Navigation LTD.

- Bentley Systems Inc.

Recent Development

- Google Geospatial Creator (May 2023): Google launched the Google Geospatial Creator, a powerful tool designed to enable users to create immersive Augmented Reality (AR) experiences. This tool utilizes Photorealistic 3D Tiles and ARCore from Google Maps Platform. It allows users to place digital content accurately and visually within the real world, akin to the experience provided by Google Earth and Google Street View. This development highlights the growing importance of AR in geospatial analytics and its potential for enhancing location-based experiences.

- HxGN AgrOn Control Room (April 2023): Hexagon AB introduced the HxGN AgrOn Control Room, a mobile app tailored for managers and directors of agricultural companies. This app facilitates real-time monitoring of all field operations, enabling quick problem identification and resolution. The app is expected to enhance operational efficiency, save time, and improve safety in agricultural activities. It exemplifies the integration of geospatial analytics in agriculture for better decision-making and productivity.

- ESRI India’s Indo ArcGIS (December 2022): ESRI India announced the availability of its Indo ArcGIS offerings on Indian public clouds and services. This development seeks to streamline the management, collection, forecasting, and analysis of location-based data. It highlights India’s rising importance of geospatial analytics and increased reliance on cloud solutions for geospatial data analysis.

- Trimble R12i GNSS Receiver (May 2022): Trimble launched the Trimble R12i GNSS receiver, featuring a powerful tilt adjustment feature. This innovation is designed to enhance land surveying efficiency by allowing surveyors to work more quickly and precisely. It showcases the integration of advanced technology into geospatial tools to optimize fieldwork.

- Foursquare’s Acquisition of Unfolded (May 2021): Foursquare acquired Unfolded, a U.S.-based provider of location-based services and goods, including data enrichment analytics and geographic data visualization. This acquisition aims to expand Foursquare’s access to diverse data sets, both first and third-party, and integrate them with geographical features. It demonstrates the growing interest in enriching geospatial analytics with various data sources for more comprehensive insights.

Report Scope

Report Features Description Market Value (2023) US$ 80.7 Bn Forecast Revenue (2033) US$ 268.1 Bn CAGR (2023-2032) 13.1% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Solutions, Services), By Spectrum (Sub-6 GHz, mmWave), By Network (Public, Private), By Vertical (Manufacturing, Automotive and Transportation, Smart Cities and others) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Harris Corporation, RMSI, DigitalGlobe Inc., Fugro N.V., Hexagon AB, ESRI, General Electric Co., MacDonald, Trimble Navigation LTD., Bentley Systems Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Geospatial Analytics?Geospatial analytics involves analyzing and interpreting data that has a geographical or spatial element. It uses techniques like GIS (Geographic Information Systems), GPS (Global Positioning System), and remote sensing to understand and visualize data in terms of geographical space.

What is the Geospatial Analytics Market?The Geospatial Analytics Market encompasses businesses and services that provide tools, software, and expertise for conducting geospatial analysis. This market serves various industries, including urban planning, agriculture, defense, transportation, and environmental monitoring.

Who are the key players in the Geospatial Analytics Market?Key players often include Harris Corporation, RMSI, DigitalGlobe Inc., Fugro N.V., Hexagon AB, ESRI, General Electric Co., MacDonald, Trimble Navigation LTD., Bentley Systems Inc.

What are the driving factors of the Geospatial Analytics Market?Major drivers include advancements in technology (like AI and machine learning), increased use of location-based services, the availability of high-resolution satellite imagery, and the growing need for predictive analytics in planning and decision-making.

How big is the spatial analysis market?The Global Geospatial Analytics Market size is expected to reach USD 268.1 billion by 2033, exhibiting an impressive CAGR of 13.10% between 2022 and 2032, from its current value of USD 80.7 billion in 2022.

What are 4 geospatial technologies?- Geographic Information Systems (GIS): Software that allows for the mapping and analysis of geographic data.

- Global Positioning System (GPS): A network of satellites providing location and time information globally.

- Remote Sensing: The process of detecting and monitoring the physical characteristics of an area by measuring its reflected and emitted radiation from a distance, typically from satellite or aircraft.

- Photogrammetry: The art and science of obtaining reliable measurements by using photographs, particularly aerial photographs.

Geospatial Analytics MarketPublished date: Nov. 2023add_shopping_cartBuy Now get_appDownload Sample

Geospatial Analytics MarketPublished date: Nov. 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Harris Corporation

- RMSI

- DigitalGlobe Inc.

- Fugro N.V.

- Hexagon AB

- ESRI

- General Electric Co.

- MacDonald

- Trimble Navigation LTD.

- Bentley Systems Inc.