Global AI-Powered Storage Market Size, Share Analysis Report By Storage System (Network Attached Storage (NAS), Direct Attached Storage (DAS), Storage Area Network (SAN)), By Offering (Hardware, Software), By Storage Medium (Solid State Drive (SSD), Hard Disk Drive (HDD)), By End-Users (Enterprise, Government Bodies, Cloud Service Providers, Telecom Companies), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: May 2025

- Report ID: 73263

- Number of Pages: 348

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

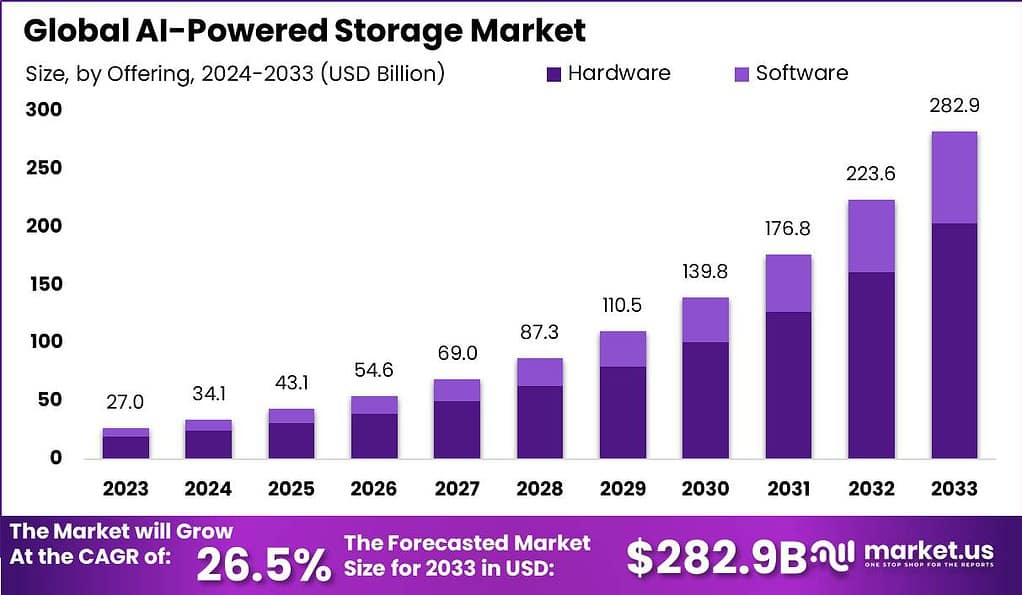

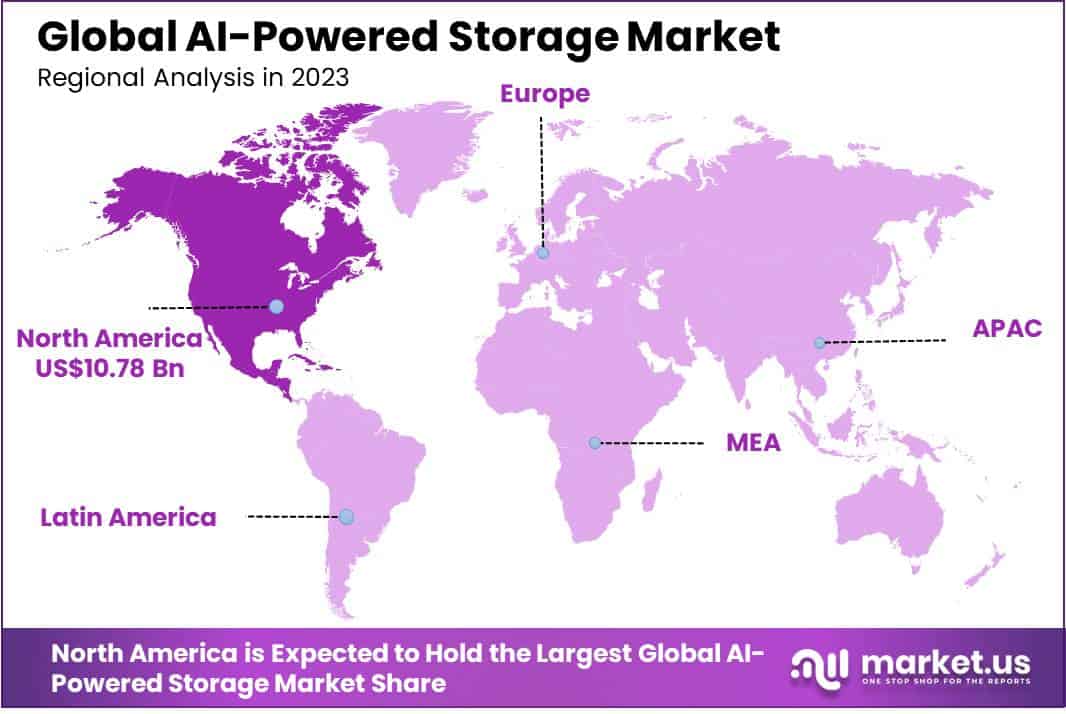

The Global AI-Powered Storage Market size is expected to be worth around USD 282.9 Billion by 2033, from USD 34.1 Billion in 2024, growing at a CAGR of 26.5% during the forecast period from 2024 to 2033. In 2023, North America maintained a leading position in the global AI-powered storage market, accounting for over 40% of the total revenue share.

AI-powered storage refers to intelligent data storage systems that integrate artificial intelligence (AI) and machine learning (ML) technologies to enhance data management, retrieval, and analysis. These systems leverage AI algorithms to optimize storage operations, automate data classification, and predict storage needs, thereby improving efficiency and reducing manual intervention.

The global AI-powered storage market has witnessed significant growth in recent years, driven by the exponential increase in data generation and the need for advanced data management solutions. This growth is attributed to the rising adoption of AI technologies across various sectors, including healthcare, finance, and manufacturing, which require advanced storage solutions to manage large volumes of data efficiently.

Top Driving Factors for this market include the surge in data volumes generated by IoT devices, social media, and enterprise applications, necessitating advanced storage solutions. Additionally, the increasing demand for real-time data analytics and the need for scalable and secure storage infrastructures are propelling the adoption of AI-powered storage systems.

Demand Analysis indicates a growing need for storage solutions that can handle complex and unstructured data efficiently. Industries are seeking systems that offer high performance, scalability, and intelligent data management to support their digital transformation initiatives.

A major reason to boost the demand for AI-powered storage is the necessity for real-time data processing and analytics. Organizations require storage systems that can quickly adapt to changing data patterns and provide immediate insights, which AI-powered solutions are well-equipped to deliver.

Market Trends show a shift towards hybrid and multi-cloud storage environments, where AI-powered storage systems play a crucial role in managing data across diverse platforms. The integration of AI in storage solutions is also leading to the development of self-managing and self-healing storage infrastructures.

From an analyst’s viewpoint, Pure Storage (PSTG) stands out in the market with its provision of AI operations and predictive analytics integrated into flash storage solutions. With a current market capitalization of approximately $6 billion, Pure Storage offers advanced capabilities that enable organizations to optimize data management processes and enhance operational efficiency.

NetApp (NTAP) is strategically positioned in the market, focusing on the development of AI-driven capabilities for data management and storage optimization. With a market capitalization of around $14 billion, NetApp’s efforts to leverage artificial intelligence technologies reflect a proactive approach to address the growing complexities of data storage and management.

Western Digital (WDC) has made significant strides in advancing its data analytics capabilities through the acquisition of AI startup cline. With a market capitalization of $16 billion, Western Digital is poised to leverage data-driven analytics to optimize storage infrastructure and address the evolving needs of its customer base.

Key Takeaways

- The AI-Powered Storage Market is anticipated to achieve a remarkable valuation of USD 282.9 Billion by 2033, exhibiting a robust CAGR of 26.5% from 2024 to 2033.

- In 2023, the Hardware segment held a dominant market position, capturing over 72% share, showcasing the critical role of advanced hardware components in facilitating efficient storage, processing, and analysis of large data volumes generated by AI applications.

- Direct Attached Storage (DAS) emerged as the dominant segment in 2023, capturing over 35% market share. DAS systems offer high-speed data access and simplicity in deployment, making them particularly attractive for industries prioritizing performance and ease of use.

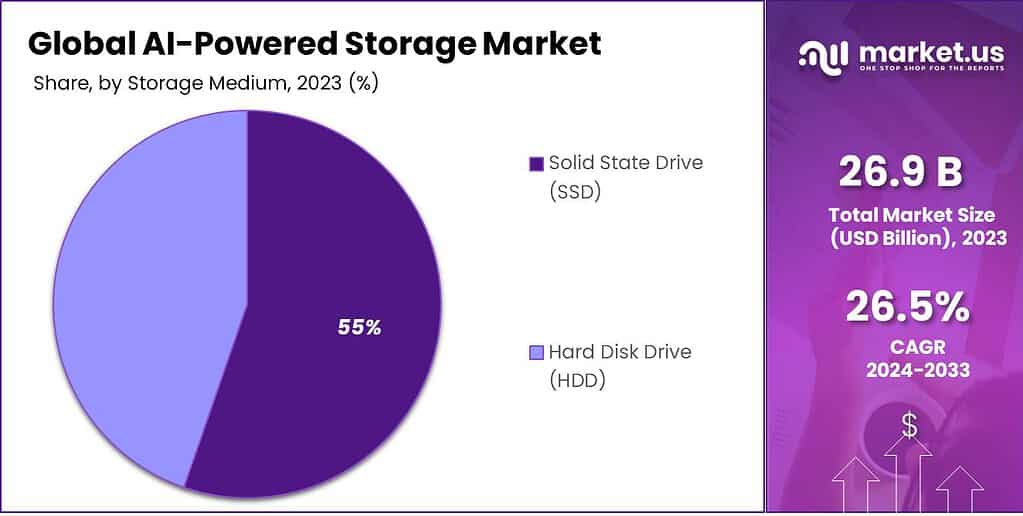

- In 2023, the Solid-State Drive (SSD) Segment held a dominant market position, capturing more than a 55% share of the AI-powered storage market.

- The Enterprise segment led the market in 2023, capturing over 37% share. This dominance is attributed to the increasing reliance of enterprises on data-driven decision-making processes and the need for efficient data management systems, driving the demand for AI-powered storage solutions.

- North America held a dominant market position in 2023, accounting for over 40% share. The region’s strong technological infrastructure, coupled with significant investments in AI research and development, propelled the growth of AI-powered storage solutions.

US Market Size

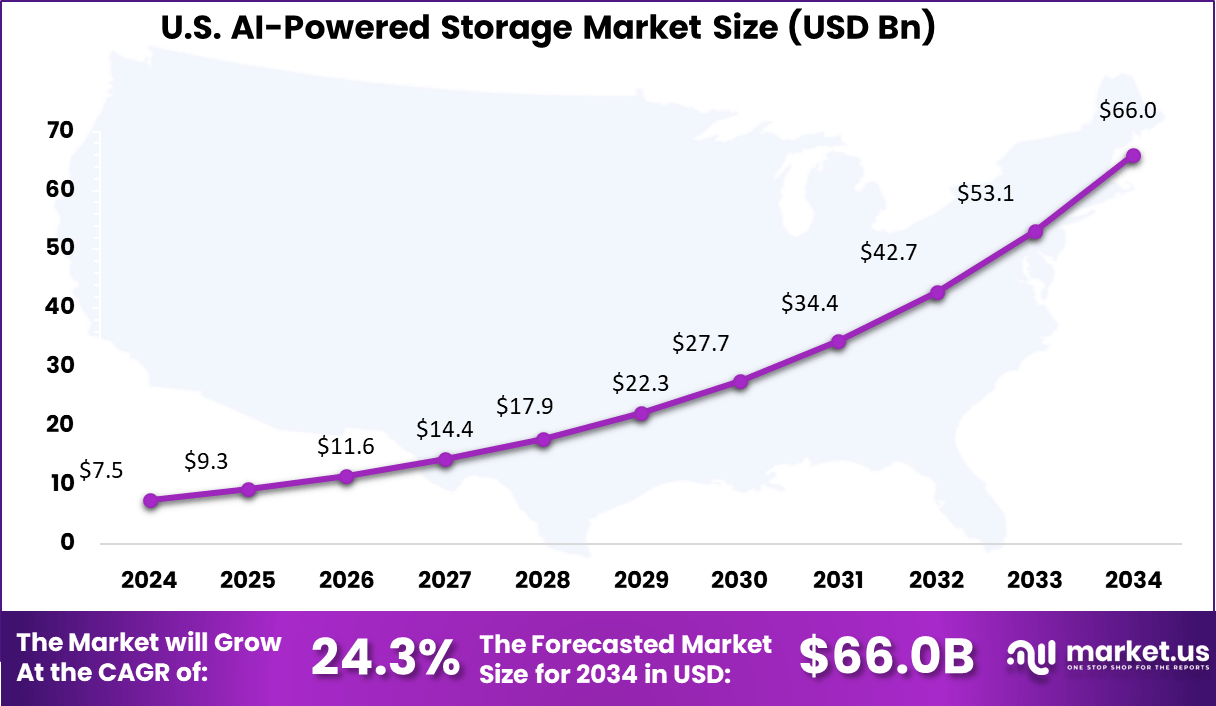

The U.S. AI-powered storage market was valued at USD 7.5 billion in 2024 and is anticipated to reach approximately USD 65.2 billion by 2034, expanding at a robust CAGR of 24.3% during the forecast period from 2025 to 2034.

This significant growth trajectory is being driven by the escalating demand for intelligent data management systems capable of handling vast, unstructured datasets generated by AI workloads across sectors such as healthcare, autonomous systems, finance, and industrial IoT.

The market expansion is further supported by continuous advancements in edge AI computing, real-time analytics, and machine learning operations (MLOps), which require high-speed, scalable storage infrastructure.

In addition, increasing investments from both private and public sectors, alongside a strong innovation pipeline from U.S.-based tech giants, are reinforcing the country’s leadership in AI infrastructure development. As enterprises prioritize data efficiency and faster retrieval systems, the U.S. AI-powered storage market is set to evolve into a cornerstone of next-generation digital transformation.

In 2023, North America secured a dominant position in the global AI-powered storage market, capturing over 40% of the total market share. The regional demand was valued at approximately USD 10.78 billion, reflecting North America’s early and aggressive adoption of AI-driven infrastructure across multiple sectors.

Key industries such as autonomous systems, healthcare diagnostics, finance, and advanced manufacturing have increasingly relied on high-performance storage systems to support large-scale machine learning models and real-time data processing.The widespread presence of hyperscale data centers, strong government support for AI research, and continuous investment from major U.S.-based technology companies have collectively accelerated regional growth.

Moreover, the need for scalable, low-latency, and intelligent storage solutions to manage growing volumes of unstructured and time-sensitive data has solidified North America’s leadership in this segment. As AI workloads continue to intensify, the region remains at the forefront of innovation in AI-powered storage technologies.

Offering Analysis

In 2023, the hardware segment held a commanding position in the global AI-powered storage market, accounting for over 72% of the total revenue. This stronghold is primarily attributed to the increasing demand for high-performance storage infrastructure required to support intensive AI workloads such as deep learning model training, inferencing, and large-scale data analytics.

Enterprises are investing significantly in AI-specific hardware including GPUs, TPUs, and AI-integrated storage accelerators, which are fundamental to achieving faster data processing and minimizing latency. The continued integration of AI across sectors such as automotive, healthcare, and BFSI has led to a growing dependence on AI-capable infrastructure, thereby reinforcing the dominance of the hardware segment.

Unlike software, hardware components provide the physical backbone necessary to execute complex computations at the edge and in data centers. As organizations prioritize faster data throughput and minimal system downtime, demand for customized hardware configurations will remain elevated, further boosting this segment’s share in the near future.

Storage System Analysis

The Direct Attached Storage (DAS) segment emerged as the leading storage system in 2023, securing over 35% of the total market share. The growth of this segment is largely due to the high-speed, low-latency access DAS systems provide, which is essential for AI operations that depend on real-time data processing.

Unlike Network Attached Storage (NAS) or Storage Area Network (SAN) systems, DAS solutions connect directly to servers without requiring a network in between, thereby reducing complexity and enhancing data access speeds. This model is particularly preferred by small and mid-sized enterprises and localized data centers where cost-effectiveness, easy installation, and direct control over data management are crucial.

Additionally, with the increase in on-device AI and edge computing applications, where localized storage plays a vital role, DAS systems are expected to maintain strong traction. Their ability to efficiently support AI workloads without complex storage architectures gives them a distinct advantage in environments where responsiveness is key.

Storage Medium Analysis

Within storage mediums, the solid-state drive (SSD) segment accounted for over 55% of the AI-powered storage market in 2023, leading the segment decisively. This dominance stems from SSDs’ superior performance characteristics – namely faster read/write speeds, lower power consumption, and greater durability compared to hard disk drives (HDDs).

In AI-based environments, where massive volumes of structured and unstructured data need to be accessed in real time, SSDs offer the reliability and throughput required for seamless operations. Furthermore, the decreasing cost per gigabyte of SSDs has made them increasingly accessible to both large enterprises and mid-sized businesses.

As the need for real-time analytics, machine vision, and high-frequency trading systems continues to grow, SSD adoption is expected to deepen. These drives are not only essential for data centers but are also being integrated into edge devices that require intelligent local storage to process data close to its source.

Based on End-Users Analysis

The enterprise segment led the AI-powered storage market by end-users in 2023, holding more than 37% of the global market share. Enterprises across verticals have rapidly adopted AI-powered storage systems to improve efficiency, reduce manual intervention, and optimize data workflows.

The explosion of enterprise data, driven by customer behavior analytics, IoT applications, and enterprise resource planning (ERP) systems, necessitates storage infrastructure that is scalable, intelligent, and resilient. Large corporations are increasingly investing in hybrid storage models that combine on-premise AI capabilities with cloud-based backup to ensure both speed and security.

The enterprise sector’s focus on data governance, regulatory compliance, and cost-effective operations has accelerated the deployment of AI-powered storage that supports predictive analytics and autonomous management features. This segment is expected to remain the largest end-user as data-centric strategies become foundational to enterprise growth and innovation.

Key Market Segments

By Offering

- Hardware

- Software

By Storage System

- Network Attached Storage (NAS)

- Direct Attached Storage (DAS)

- Storage Area Network (SAN)

By Storage Medium

- Solid State Drive (SSD)

- Hard Disk Drive (HDD)

Based on End-Users

- Enterprise

- Government Bodies

- Cloud Service Providers

- Telecom Companies

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Enhanced Operational Efficiency through Intelligent Automation

The integration of AI-powered storage within Enterprise Resource Planning (ERP) systems has significantly improved operational efficiency. By automating routine tasks such as data entry, invoice processing, and inventory management, organizations have reduced manual workload and minimized errors. This automation enables staff to focus on strategic activities, thereby enhancing productivity.

AI algorithms analyze vast datasets to identify patterns and trends, facilitating predictive analytics for demand forecasting and resource allocation. This capability allows businesses to anticipate market changes and adjust operations proactively. For instance, AI-driven ERP systems can predict inventory requirements based on historical sales data, ensuring optimal stock levels and reducing holding costs.

Moreover, AI-powered storage solutions offer real-time data access and processing, enabling swift decision-making. The scalability of these systems ensures that as data volumes grow, performance remains unaffected, maintaining efficiency across all business functions. According to a report by NetSuite, AI integration in ERP systems has transformed them into intelligent platforms that adapt to changing conditions and optimize business processes in real-time .

Restraint

High Implementation Costs

A major restraint facing the AI-powered storage market is the high implementation and maintenance costs associated with these advanced systems. Deploying AI-powered storage solutions involves significant initial investments in hardware, software, and skilled personnel to manage and optimize AI functionalities.

Small and medium-sized enterprises (SMEs), in particular, may find these costs prohibitive, limiting their ability to adopt such technologies. Additionally, the complexity of integrating AI-powered storage with existing IT infrastructure can further escalate costs and deter organizations from upgrading their storage solutions. This financial barrier can slow down market growth, as potential users might opt for traditional storage systems that, while less efficient, come with lower upfront costs.

Opportunity

Market Expansion Driven by Data Growth

The exponential growth of enterprise data presents a significant opportunity for AI-powered storage in ERP systems. As businesses generate and collect increasing amounts of data, the need for efficient storage solutions that can manage, analyze, and retrieve information swiftly becomes critical. AI-powered storage systems address this need by offering scalable, high-performance solutions capable of handling large datasets.

These systems enable advanced data analytics, supporting functions such as predictive maintenance, customer behavior analysis, and supply chain optimization. By leveraging AI, organizations can derive actionable insights from their data, leading to improved decision-making and competitive advantage.

Furthermore, the adoption of AI-powered storage solutions aligns with digital transformation initiatives across various industries. As companies seek to modernize their operations and embrace data-driven strategies, the demand for intelligent storage systems integrated with ERP platforms is expected to rise.

Challenge

Data Complexity and Integration Issues

Implementing AI-powered storage within ERP systems poses challenges related to data complexity and integration. Organizations often deal with diverse data types, including structured, semi-structured, and unstructured data, originating from various sources. Managing and integrating this heterogeneous data into a cohesive system requires sophisticated tools and processes.

Data quality issues, such as inconsistencies, duplicates, and inaccuracies, can hinder the effectiveness of AI algorithms. Ensuring data integrity and consistency across different departments and systems is essential for reliable analytics and decision-making. Moreover, integrating AI-powered storage with existing ERP systems may involve significant technical challenges, including compatibility issues and the need for custom development.

Organizations must also address concerns related to data security and compliance, particularly when handling sensitive information. Implementing robust security measures and adhering to regulatory requirements are critical to maintaining trust and avoiding legal repercussions. A report by TierPoint emphasizes the challenges associated with managing and storing massive AI data, highlighting the importance of addressing data complexity and performance issues .

Key Players Analysis

In the rapidly evolving AI-powered storage market, several key players have established themselves as leaders, driving innovation and setting standards for efficiency and reliability. These companies not only provide advanced storage solutions but also contribute to the market’s growth through research and development, strategic partnerships, and a focus on addressing the complex needs of businesses in the era of digital transformation.

Top Market Leaders

- Intel Corporation

- HPE

- NVIDIA Corporation

- IBM

- Samsung Electronics

- Pure storage

- NetApp

- Micron Technology

- Dell Technologies

- Toshiba

- CISCO

- Hitachi

- Lenovo

- Other key players

Recent Developments

- In May 2024, Huawei introduced its new A800 AI storage system, targeting the rising need for ultra-fast data infrastructure in AI training environments. Built to handle multi-petabyte datasets, the A800 comes with a scale-out architecture that enables petabytes-per-second bandwidth and delivers up to 100 million IOPS, positioning it as a key enabler for next-generation AI workloads.

- In May 2024, NetApp® rolled out its next-generation AFF A-Series systems, designed to help enterprises meet the growing demands of digital transformation. These systems are optimized for high-performance workloads such as VMware, Generative AI, and enterprise-grade databases.

Report Scope

Report Features Description Market Value (2023) US$ 27.0 Bn Forecast Revenue (2033) US$ 282.9 Bn CAGR (2024-2033) 26.5% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Storage System (Network Attached Storage (NAS), Direct Attached Storage (DAS), Storage Area Network (SAN)), By Offering (Hardware, Software), By Storage Medium (Solid State Drive (SSD), Hard Disk Drive (HDD)), By End-Users (Enterprise, Government Bodies, Cloud Service Providers, Telecom Companies) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Intel Corporation, HPE, NVIDIA Corporation, IBM, Samsung Electronics, Pure storage, NetApp, Micron Technology, Dell Technologies, Toshiba, CISCO, Hitachi, Lenovo, Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the AI-Powered Storage Market?The AI-Powered Storage Market refers to the segment of the storage industry that incorporates artificial intelligence (AI) and machine learning (ML) technologies to enhance storage infrastructure, optimize data management, and improve overall storage efficiency and performance.

How big is AI-Powered Storage Market?The Global AI-Powered Storage Market size is expected to be worth around USD 282.9 Billion by 2033, from USD 27.0 Billion in 2023, growing at a CAGR of 26.5% during the forecast period from 2024 to 2033.

What Are the Benefits of AI-Powered Storage Solutions?AI-Powered storage solutions offer several benefits, including improved storage efficiency and utilization, enhanced performance and scalability, reduced storage costs, simplified management and administration, proactive identification and resolution of storage issues, and support for data-driven decision-making processes.

What Are Some Challenges Associated with Adopting AI-Powered Storage?Challenges associated with adopting AI-Powered storage solutions may include concerns about data privacy and security, complexity of integration with existing infrastructure, compatibility with legacy storage systems, skill gaps in AI and ML expertise, and the need for upfront investment in hardware, software, and training.

Who are the key players in the AI-Powered Storage Market?Some key players operating in AI-Powered Storage Market include Intel Corporation, HPE, NVIDIA Corporation, IBM, Samsung Electronics, Pure storage, NetApp, Micron Technology, Dell Technologies, Toshiba, CISCO, Hitachi, Lenovo, Other key players

-

-

- Intel Corporation

- HPE

- NVIDIA Corporation

- IBM

- Samsung Electronics

- Pure storage

- NetApp

- Micron Technology

- Dell Technologies

- Toshiba

- CISCO

- Hitachi

- Lenovo

- Other key players