Global Edge AI Market Size, Share, Industry Analysis Report By Component (Hardware, Software, Edge Cloud Infrastructure, Services), By End-Use Industry (IT & Telecom, Healthcare, Consumer Electronics, Automotive, Government, Manufacturing, Other End-Use Industries), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 105284

- Number of Pages: 242

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

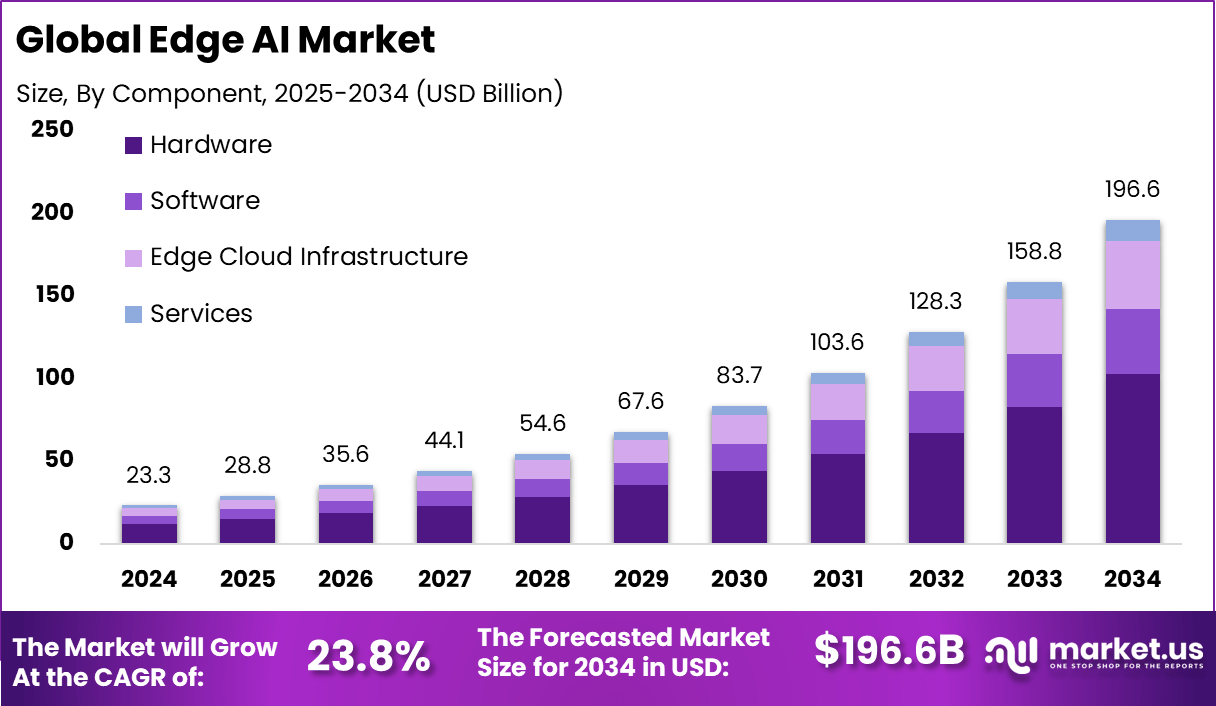

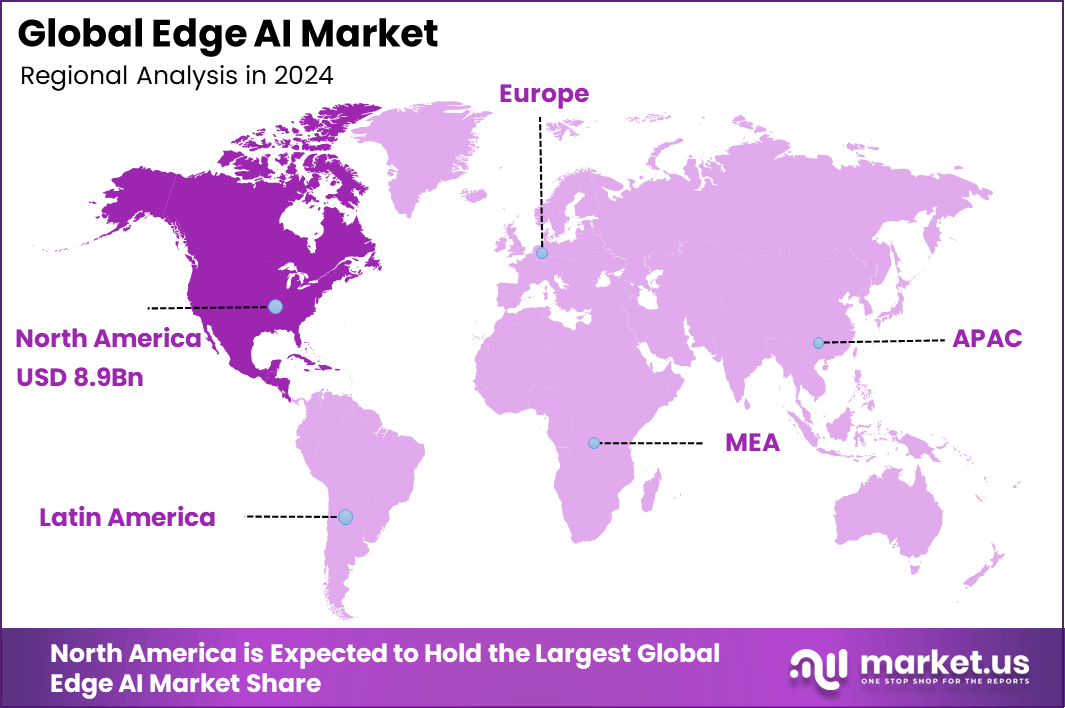

The Global Edge AI Market generated USD 23.3 billion in 2024 and is predicted to register growth from USD 28.8 billion in 2025 to about USD 196.6 billion by 2034, recording a CAGR of 23.8% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 38.4% share, holding USD 8.9 Billion revenue.

The edge AI market refers to computing systems and platforms that perform artificial intelligence (AI) processing close to where data is generated rather than relying entirely on centralized cloud infrastructure. These systems support applications in smart devices, autonomous vehicles, industrial automation, healthcare monitoring, and smart cities.

One of the primary drivers is the increasing demand for real-time data processing with minimal latency, especially in applications such as autonomous mobility, manufacturing monitoring and healthcare diagnostics. The rising deployment of Internet of Things (IoT) devices and sensors is also accelerating demand for processing at the edge rather than sending all data to the cloud.

Key technologies enabling edge AI solutions include specialized hardware such as AI accelerators and neural processing units, as well as software frameworks optimized for on-device inference. Hybrid computing models combining cloud and edge are gaining traction, and sensor integration and embedded AI modules are becoming more common in devices.

For instance, In March 2025, Arm introduced the Armv9 edge AI platform, aimed at enhancing AI performance, efficiency, and security for IoT and edge devices. The platform features the Cortex-A320 processor, which delivers faster AI processing, supported by the Ethos-U85 AI accelerator to optimize edge intelligence and energy efficiency.

Quick Market Facts

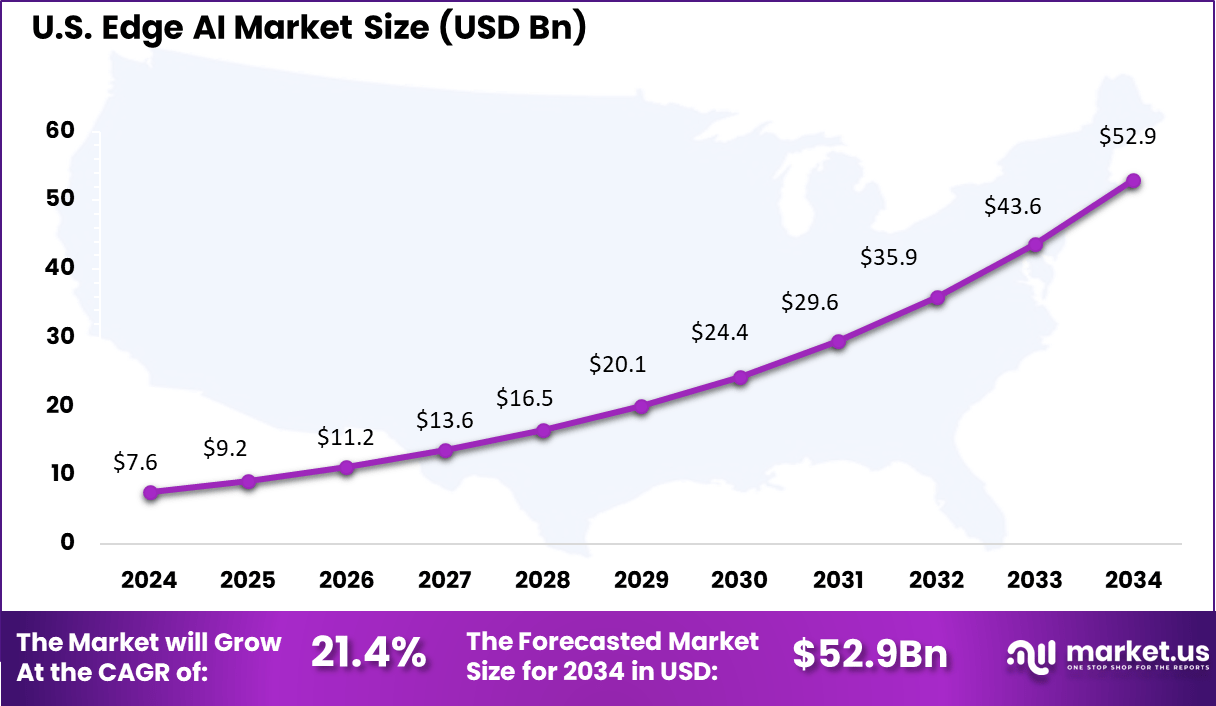

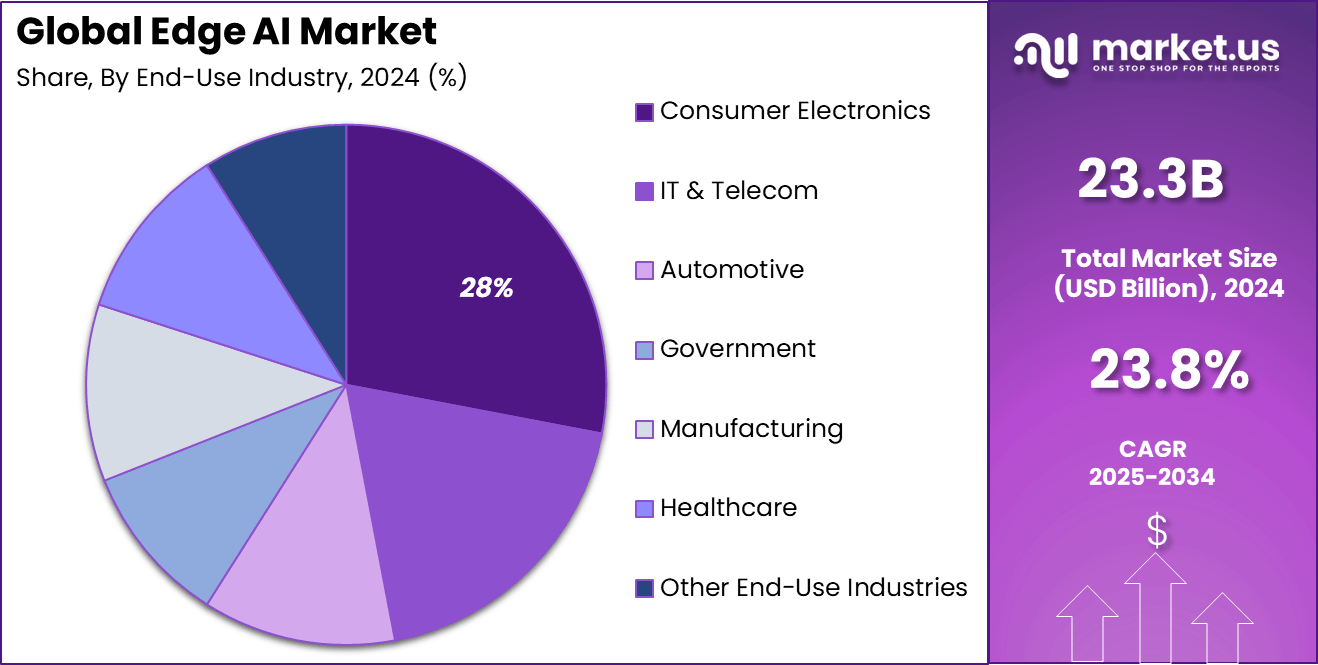

Key Market Segments Leading Segments Market Share By Component Hardware 52.4% By End-Use Industry Consumer Electronics 28% Region North America 38.4% Country U.S. USD 7.615 Bn (CAGR: 21.4%) According to a recent survey by Accenture, 83% of executives across multiple industries believe that edge computing will be essential to remain competitive in the future. The significant impact of edge computing is underscored by projections indicating that by 2026, edge computing AI chip shipments will reach 1.6 billion units globally.

Furthermore, the Edge AI Hardware Market is expected to grow substantially, with its size projected to be worth around USD 43 billion by 2033, up from USD 8 billion in 2023, representing a CAGR of 19.2% during the forecast period from 2024 to 2033.

The efficiency of edge intelligence devices is highlighted by expectations that these devices will handle 18.2 zettabytes of data per minute by 2025, significantly reducing cloud traffic by up to 99% by the same year. This rapid growth and efficiency improvement emphasize the critical role that edge AI will play in the technological landscape of the near future.

Role of Generative AI

Generative AI is playing an increasingly important part in Edge AI by enabling devices to create content, make decisions, and adapt locally without heavy cloud dependence. Around 44% of organizations are currently piloting generative AI programs while 10% already have them in production, showing a strong move toward embedding these technologies at the edge.

This local generative capability allows for quicker responses and more personalized experiences, reducing latency significantly compared to cloud-only models. As such, generative AI is extending Edge AI’s usefulness beyond simple data processing to creative and adaptive functions, enhancing its value in real-world applications.

This growing adoption is backed by the fact that about 71% of global companies use generative AI in at least one core business function. It helps improve productivity by automating repetitive tasks and speeding up content generation, which can save employees 2 to 4 hours weekly. This productivity boost is critical for industries relying on edge devices, like manufacturing and healthcare, where timely and intelligent local decision-making impacts outcomes directly.

North America Market Size

In 2024, North America accounts for 38.4% of the edge AI market, driven by early adoption of smart devices, strong cloud-to-edge integration strategies, and widespread industrial automation. Enterprises across technology, retail, and logistics sectors are prioritizing on-device intelligence to enhance decision-making and reduce operational delays. The region’s robust semiconductor research base and government initiatives supporting digital infrastructure expansion have strengthened its global leadership.

Within this region, the United States holds a market value of about USD 7.615 billion with a 21.4% CAGR, reflecting its aggressive AI deployment strategy. Investments in chip fabrication, edge computing frameworks, and connected vehicle projects continue to accelerate adoption. North America’s balanced ecosystem of hardware developers, software platforms, and AI-driven service providers positions it as a key incubator for scalable edge AI applications across both consumer and enterprise domains.

Component Analysis

In 2024, Hardware accounts for around 52.4% of the global edge AI market, supported by the increasing integration of AI processors and accelerators within edge devices. These include compact chips and microcontrollers capable of real-time data processing without reliance on cloud systems. The demand from IoT devices, autonomous systems, and industrial applications is encouraging manufacturers to embed more computational capacity directly into devices.

This hardware-led shift is essential for reducing latency, improving data privacy, and cutting bandwidth costs for real-time AI tasks. Continuous investment in specialized processors such as GPUs, TPUs, and neural processing units is driving this segment forward. Hardware innovations are enabling higher performance per watt, making AI feasible even in power-sensitive contexts like drones or wearable devices.

As energy efficiency improves and production costs fall, edge AI hardware continues to evolve as the foundation for low-latency, intelligent automation across industries. Its growth reflects the wider technological trends that prioritize local intelligence over cloud-dependent frameworks.

Market Share (%) By Component Analysis, 2018-2024

Component 2018 2019 2020 2021 2022 2023 2024 Hardware 53.2% 53.0% 52.9% 52.8% 52.7% 52.5% 52.4% Software 18.0% 18.1% 18.2% 18.3% 18.5% 18.6% 18.7% Edge Cloud Infrastructure 19.7% 19.6% 19.6% 19.6% 19.6% 19.5% 19.5% Services 9.2% 9.2% 9.3% 9.3% 9.3% 9.4% 9.4% End-Use Industry Analysis

In 2024, Consumer electronics leads with a 28% share, highlighting how AI capabilities are now central to modern smart devices. Smartphones, TVs, smart speakers, and wearables increasingly use on-device AI for speech recognition, image enhancement, and personalized responses.

The growing preference for privacy-preserving features and instant offline functionality strengthens this segment’s momentum. Manufacturers are embedding compact AI accelerators into consumer gadgets to deliver enhanced responsiveness and tailored user experiences. The expansion of connected home ecosystems is further boosting adoption.

Market Share (%) By End-Use Industry Analysis, 2018-2024

End-Use Industry 2018 2019 2020 2021 2022 2023 2024 IT & Telecom 20.3% 20.4% 20.5% 20.6% 20.7% 20.8% 20.9% Automotive 9.0% 9.1% 9.2% 9.3% 9.5% 9.6% 9.7% Government 4.3% 4.3% 4.3% 4.3% 4.3% 4.3% 4.3% Manufacturing 5.6% 5.6% 5.6% 5.6% 5.6% 5.6% 5.6% Healthcare 7.4% 7.6% 7.8% 8.0% 8.2% 8.4% 8.5% Consumer Electronics 28.7% 28.6% 28.5% 28.4% 28.3% 28.1% 28.0% Other End-Use Industries 24.7% 24.4% 24.1% 23.8% 23.5% 23.2% 22.9% Edge AI helps manage multitasking across devices while minimizing data exchange with external servers. It also improves user experience by enabling adaptive learning based on personal usage patterns. As digital lifestyles mature, consumer electronics will remain an early and strong adopter of edge AI due to its direct impact on convenience, functionality, and interactivity in daily use.

Key Market Segments

Component

- Hardware

- Software

- Edge Cloud Infrastructure

- Services

End-Use Industry

- Consumer Electronics

- IT & Telecom

- Healthcare

- Automotive

- Government

- Manufacturing

- Other End-Use Industries

Emerging Trends

One of the key trends in Edge AI today is the shift of AI workloads from centralized data centers to decentralized edge devices such as smartphones and industrial sensors. About 62% of companies are investing in this transfer to reduce delays and improve privacy by processing sensitive data locally. The integration of AI into wearables and robotics is also rising, enabling more real-time and autonomous functions on the device level.

Additionally, developments in 5G networks are accelerating this shift by providing faster and more reliable connectivity that supports edge computing. Another important trend is the increasing convergence of Edge AI with Internet of Things (IoT) and cloud platforms. This hybrid approach allows devices to perform immediate analytics locally while offloading more complex tasks to the cloud.

It is estimated that 55% of businesses are actively using this combined edge-cloud model to optimize resource use and scalability. These trends highlight a future where edge devices will not only collect data but also collaborate with cloud systems seamlessly, improving efficiency and enabling new use cases across industries.

Growth Factors

The rapid growth of the Edge AI market is driven by the increasing demand for real-time data processing and decision-making at the data source. About 42% of marketing and sales teams regularly use AI technologies to analyze data faster and gain actionable insights.

Edge AI’s capability to reduce latency and bandwidth costs by processing data locally is a huge benefit for applications like autonomous vehicles and smart cities, where delays can impact safety or usability. Additionally, the rollout of 5G networks is a strong growth factor, enhancing the speed and capacity needed for edge devices to communicate effectively.

Nearly 37% of enterprises highlight 5G as a key enabler for edge AI deployments. This, combined with rising IoT device counts, is fueling demand for edge AI solutions that offer low-latency and privacy-centric computing. These factors combined make Edge AI a strategic technology that businesses are eager to adopt for efficiency and innovation.

Driver

Demand for Real-time Data Processing

Edge AI’s growth is driven largely by the increasing need for instant data processing at the source. Many industries require immediate decision-making capabilities with low latency, which traditional cloud-based systems cannot always guarantee.

Edge AI processes data locally on devices like sensors or cameras, enabling faster responses, crucial for applications in autonomous vehicles, industrial automation, and healthcare. This reduces delays and allows real-time reactions to changing conditions, making operations more efficient and effective.

Local data processing also enhances privacy by limiting the transfer of sensitive information to the cloud. This makes Edge AI appealing to sectors that handle confidential data, further pushing market demand as companies prioritize data security alongside speed.

Restraint

Limited Edge Device Resources

The Edge AI market faces constraints related to the limited computing power, memory, and storage capacity of edge devices compared to centralized cloud servers. Devices like smartphones, sensors, or industrial equipment often have minimal hardware capabilities, which restricts the complexity of AI algorithms they can run. This limitation results in challenges when deploying advanced AI models that require high processing capabilities or large datasets.

Additionally, ensuring that these devices operate efficiently while conserving battery life is difficult, especially for battery-powered or remote edge units. This can slow adoption since developers must optimize AI models to fit these hardware constraints, which requires specialized expertise and increases development time.

Opportunity

Integration with IoT and 5G

A significant opportunity in Edge AI lies in its synergy with the expanding Internet of Things (IoT) ecosystem and 5G networks. Together, these technologies enable distributed computing where data generated by millions of IoT devices is analyzed locally rather than sent to the cloud. This reduces latency, cuts bandwidth costs, and improves responsiveness for applications like smart cities, agriculture monitoring, and industrial automation.

The rollout of 5G further accelerates the potential for Edge AI by providing high-speed, reliable connectivity that supports seamless interaction between edge devices and cloud systems. This combination opens new possibilities for real-time analytics, autonomous systems, and improved operational efficiency across sectors.

Challenge

Standardization and Integration Complexity

Edge AI adoption is challenged by the lack of standardized hardware and software platforms. The diversity of edge devices, networks, and AI frameworks leads to difficulties in ensuring seamless integration across heterogeneous systems. Companies face complexities in developing and deploying AI models that can work uniformly on different edge setups, slowing down deployment at scale.

Moreover, managing security, data privacy, and interoperability in this fragmented landscape adds to the challenge. The absence of unified protocols forces organizations to invest extra resources in customization and testing, which can delay time-to-market and increase costs.

Top Use Cases for Edge AI

- Autonomous Vehicles: Edge AI enhances real-time data processing for navigation and safety systems in autonomous vehicles, improving decision-making processes during driving.

- Smart Manufacturing: In manufacturing, edge AI is used for real-time machinery monitoring, predictive maintenance, and supply chain optimization, enhancing overall operational efficiency.

- Video Surveillance: Edge AI supports real-time analysis and response in video surveillance systems, crucial for security and monitoring applications.

- Retail Customer Experience: Retailers use edge AI to enhance customer interaction and management through personalized shopping experiences and inventory management.

- Remote Patient Monitoring: In healthcare, edge AI facilitates real-time patient monitoring and diagnostics, critical in settings where immediate medical response is required.

Key Players Analysis

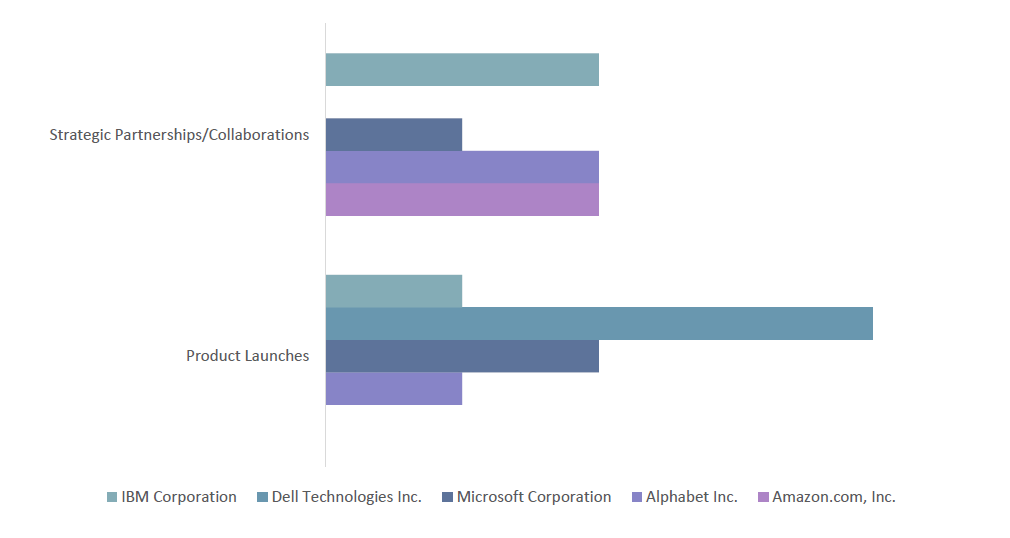

The Edge AI Market is dominated by leading technology companies such as NVIDIA Corporation, Microsoft Corporation, IBM Corporation, and Alphabet, Inc. These organizations are driving advancements in AI model deployment at the network edge, reducing latency and improving real-time decision-making.

Semiconductor innovators including Intel Corporation, Qualcomm Incorporated, and Advanced Micro Devices, Inc. (AMD) play a crucial role in enabling high-performance edge computing hardware. Their processors and AI accelerators are optimized for efficient on-device inference, supporting power-sensitive applications in IoT, robotics, and mobile devices.

Additional participants such as Dell Technologies Inc. and other key market players focus on developing AI-ready edge infrastructure and integrated systems for enterprises. Their offerings combine computing, storage, and analytics capabilities within localized environments, ensuring security, scalability, and faster insights.

Strategic Mapping

Top Key Players in the Market

- NVIDIA Corporation

- Microsoft Corporation

- IBM Corporation

- Alphabet, Inc.

- Intel Corporation

- Qualcomm Incorporated

- Advanced Micro Devices, Inc.

- Dell Technologies Inc.

- Other Key Players

Recent Developments

- In March 2025, Arm introduced the Armv9 Edge AI Platform, integrating the Cortex-A320 processor and Ethos-U85 NPU to enhance AI performance in IoT applications. The Cortex-A320 delivers 10× faster machine learning performance compared to its predecessor, while the Ethos-U85 achieves up to 4 TOPs at 1 GHz, combining power efficiency with high throughput. The platform also features Arm Kleidi libraries, which streamline AI workload optimization without additional developer intervention

- In September 2024, NVIDIA unveiled the Jetson Orin X, its latest edge AI platform developed to enhance real-time data processing for autonomous systems and smart city applications. The platform integrates advanced AI processing units with improved energy efficiency, supporting rapid deployment across industries such as automotive and robotics.

- In September 2024, Intel introduced the Movidius Myriad X2, a high-performance Edge AI module engineered for demanding edge computing environments. It features enhanced neural network processing and superior image recognition capabilities, enabling efficient operations across diverse use cases, including smart cameras and industrial IoT applications.

- In September 2024, Google Cloud launched the Edge TPU 3.0, designed to accelerate machine learning models at the edge. This solution delivers faster inferencing and lower latency, supporting real-time data processing for smart city, retail, and healthcare applications.

Report Scope

Report Features Description Market Value (2024) USD 23.3 Billion Forecast Revenue (2034) USD 196.6 Billion CAGR(2025-2034) 23.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, nd Emerging Trends Segments Covered By Component (Hardware, Software, Edge Cloud Infrastructure, Services), By End-Use Industry (IT & Telecom, Healthcare, Consumer Electronics, Automotive, Government, Manufacturing, Other End-Use Industries) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape NVIDIA Corporation, Microsoft Corporation, IBM Corporation, Alphabet, Inc., Intel Corporation, Qualcomm Incorporated, Advanced Micro Devices, Inc., Dell Technologies Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to choose from: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users, Printable PDF) Frequently Asked Questions (FAQ)

What is Edge AI?Edge AI refers to the deployment of artificial intelligence (AI) algorithms on devices at the edge of the network, closer to where data is generated. Instead of sending data to centralized cloud servers for processing, AI tasks are performed locally on edge devices, enabling faster decision-making and reduced latency.

How big is Edge AI Market?The Global Edge AI Market size is expected to be worth around USD 163 Billion By 2033, from USD 19 Billion in 2023, growing at a CAGR of 24.1% during the forecast period from 2024 to 2033.

What are the key factors driving the growth of the Edge AI Market?Key factors include the increasing need for low-latency AI processing, the growth of IoT devices, advancements in AI algorithms, the demand for real-time data analysis, and the push for enhanced data privacy by processing information on local devices rather than in the cloud.

What are the current trends and advancements in the Edge AI Market?Current trends include the integration of AI capabilities in edge devices, the use of specialized AI processors, the development of energy-efficient edge AI solutions, and the adoption of edge AI in industries such as healthcare, automotive, and retail for real-time decision-making and analytics.

-

-

- NVIDIA Corporation

- Microsoft Corporation

- IBM Corporation

- Alphabet, Inc.

- Oracle Corporation

- Honeywell International Inc.

- Google LLC

- Intel Corporation

- Xilinx, Inc.

- Dell Technologies Inc.

- Other Key Players