Global Logistics Market Size, Share, Growth Analysis By Mode of Transport (Roadways, Waterways, Airways, Railways), By Category (Conventional Logistics, E-Commerce Logistics, By Model (3PL/Contract Logistics, 4PL/Lead Logistics, Others), By Type (Forward Logistics, Reverse Logistics), By Operation (Domestic, International), By End Use (Retail & E-commerce, Healthcare, Consumer Electronics, Aerospace & Defense, Food & Beverages, Automotive, Industrial Machinery and Equipment, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 142304

- Number of Pages: 332

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

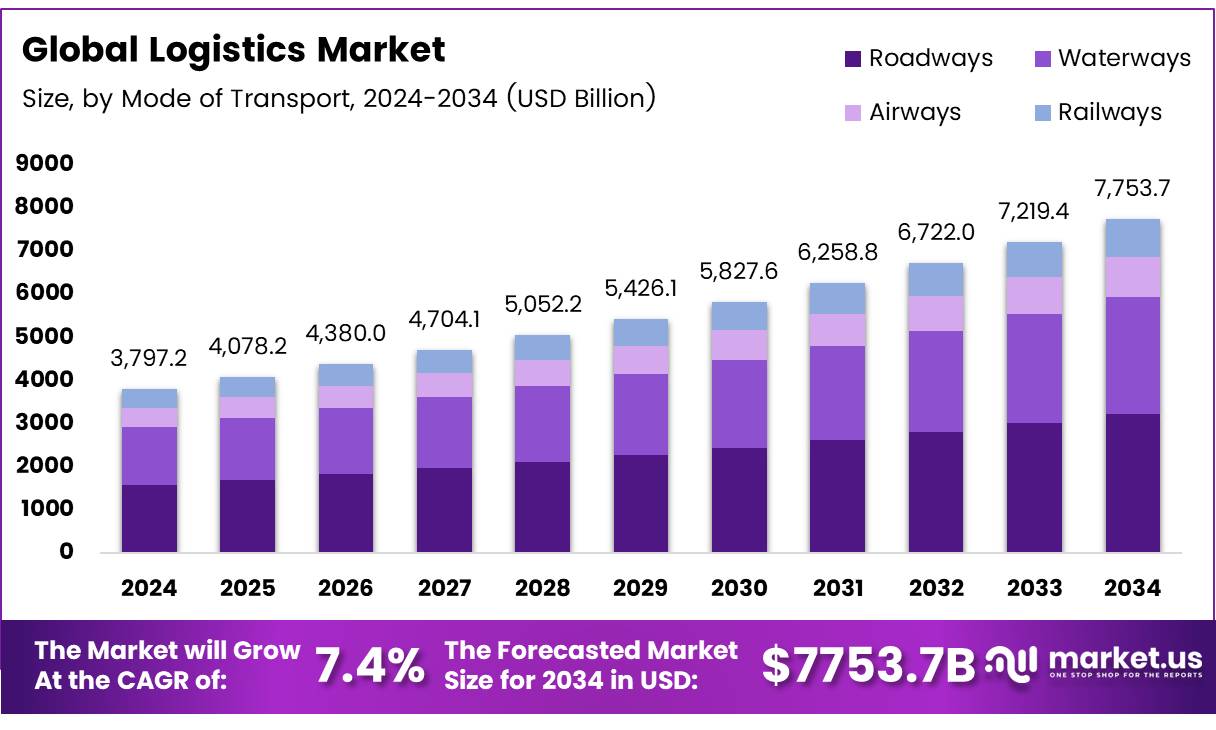

The Global Logistics Market size is expected to be worth around USD 7753.7 Billion by 2034, from USD 3,797.2 Billion in 2024, growing at a CAGR of 7.4% during the forecast period from 2025 to 2034.

The logistics market refers to the comprehensive management of the flow of goods, services, and information from the point of origin to the point of consumption. It includes activities such as transportation, warehousing, freight forwarding, and value-added logistics services. This sector plays a crucial role in facilitating trade and ensuring the efficient movement of goods, contributing significantly to the global economy.

Logistics encompasses a wide range of functions, from transportation services to complex supply chain management solutions. As an essential component of business operations, logistics supports industries such as manufacturing, retail, and e-commerce, enabling them to meet demand in a timely and cost-effective manner. The logistics industry is also closely linked with advancements in technology, like automation and AI, to enhance efficiency and reduce costs.

The logistics market, particularly in emerging economies like India, has witnessed substantial growth. According to SMEfutures, logistics is one of India’s largest industries, valued at approximately $215 billion, with an annual growth rate of 10.5%. This growth is primarily driven by increasing demand from e-commerce, retail, and industrial sectors.

As logistics costs account for up to 30% of total delivery expenses (Contimod), businesses are focusing on optimizing logistics operations to improve efficiency and reduce overall costs. Transportation costs, which represent nearly 58% of logistics expenses (Contimod), remain a major area of focus for cost reduction and innovation.

The growth in the logistics market presents significant opportunities for businesses to invest in advanced technologies like automation, IoT, and AI-driven solutions. These technologies have the potential to reduce operational inefficiencies, lower transportation costs, and improve customer satisfaction.

In addition, governments across the world are increasing investments in infrastructure development, with policies focused on improving road networks, ports, and airports. These investments aim to enhance the efficiency of logistics operations and support the expansion of the sector.

Key Takeaways

- The global logistics market is projected to grow from USD 3,797.2 billion in 2024 to USD 7753.7 billion by 2034, at a CAGR of 7.4%.

- Road transport led the mode of transport analysis with a 43.6% share in 2024, valued for its direct shipment capabilities and broad geographical reach.

- Transportation Services dominated the service analysis segment, holding a 29.6% share, driven by the need for efficient and timely delivery across global supply chains.

- 3PL/Contract Logistics captured a 71.6% share in the model analysis segment, favored for its comprehensive services that enhance supply chain efficiency.

- Retail & E-commerce was the leading end-use segment, accounting for 29.6% of the market, propelled by the rise of online shopping and e-commerce logistics demands.

- Asia Pacific was the largest regional market, with a 35.5% share, fueled by rapid industrialization, e-commerce growth, and digital transformations in China and India.

Mode of Transport Analysis

Roadways Continue to Lead in Transport Logistics with a 43.6% Market Share

In 2024, roadways maintained a dominant position in the By Mode of Transport Analysis segment of the logistics market, commanding a 43.6% share. This substantial market presence can be attributed to the flexibility and convenience of road transport, which enables direct shipment deliveries and extensive geographical coverage.

Waterways also played a significant role, favored for their cost-efficiency and high capacity, ideal for bulk goods. This mode of transport is particularly beneficial in regions with accessible water bodies, supporting large-scale international trade.

Airways, while less dominant, were essential for rapid deliveries and high-value goods. The speed and reliability of air transport make it indispensable for time-sensitive shipments, albeit at a higher cost compared to other modes.

Railways, known for their environmental sustainability and large carrying capacity, continued to be a critical component of the logistics infrastructure. Rail transport is particularly effective for long-distance, heavy freight, offering a balance between cost-efficiency and speed.

Together, these modes form the backbone of a diverse and robust logistics system, each playing a vital role tailored to specific market needs and cargo characteristics.

Service Analysis

Transportation Services Lead the Logistics Market with a 29.6% Share in 2024

In 2024, Transportation Services maintained a leading position in the By Service Analysis segment of the Logistics Market, capturing a 29.6% share. This segment’s prominence can be attributed to the increasing demand for timely and efficient delivery mechanisms across global supply chains. Integration & Consulting Services also played a pivotal role, facilitating seamless operations and strategic enhancements in logistics practices.

Freight Forwarding Services contributed significantly by streamlining international and domestic shipments, thus optimizing the supply chain management. Meanwhile, Inventory Management Services saw a surge in adoption, driven by the need for sophisticated stock management solutions that minimize overstocking and understocking scenarios.

The Warehousing and Distribution Services sector was marked by advancements in automation and real-time data analytics, which enhanced the throughput and reliability of logistics operations. Lastly, Value-Added Logistics Services emerged as a crucial differentiator, offering additional services such as product assembly and packaging, which further enhanced customer satisfaction and retention rates.

These segments collectively underscore the dynamic nature of the logistics industry, where each component is integral to the holistic optimization of supply chain activities.

Model Analysis

3PL/Contract Logistics Leads with 71.6% Share in By Model Analysis of Logistics Market

In 2024, 3PL/Contract Logistics maintained a dominant position in the By Model Analysis segment of the Logistics Market, capturing a substantial 71.6% share. This model’s prominence can be attributed to its comprehensive service offerings that address the multifaceted needs of businesses seeking efficient supply chain solutions. Businesses have increasingly relied on third-party providers to enhance logistical efficiency, reduce operational costs, and improve customer service, thereby driving the growth of 3PL/Contract Logistics.

The 4PL/Lead Logistics model also marked its presence, albeit with a smaller market share, by offering more strategic and integrative management solutions in logistics. This model appeals to organizations looking for higher control and optimization in their supply chains, providing a holistic approach to managing logistics operations.

Other logistics models accounted for the remaining market share, highlighting a niche but vital role in catering to specific logistic requirements that do not conform to the traditional 3PL and 4PL structures. These include proprietary logistics operations among vertically integrated firms and specialized logistic services that address unique market demands.

Overall, the logistics market has seen a diversified approach in the adoption of various logistic models, with 3PL/Contract Logistics leading due to its ability to provide turnkey solutions across diverse industries.

End Use Analysis

Dominance of Retail & E-commerce in the Logistics Market by End Use Analysis

In 2024, Retail & E-commerce held a dominant market position in the By End Use Analysis segment of the Logistics Market, securing a 29.6% share. This sector’s prominence is largely due to the exponential growth of online shopping platforms and the increasing consumer preference for e-commerce solutions. The logistics demands driven by e-commerce are significant, encompassing a wide range of services from warehousing to last-mile delivery, thereby fueling growth in this sector.

The Healthcare sector also shows substantial engagement with the logistics market, driven by the critical need for timely deliveries and the management of sensitive medical products. Meanwhile, the Consumer Electronics sector leverages logistics for managing highly dynamic product lifecycles and global distribution networks.

Further, the Aerospace & Defense sector relies on precise logistics services to handle complex supply chains involving highly regulated components. The Food & Beverages sector depends on efficient logistics to ensure the freshness and quality of perishables, directly impacting consumer satisfaction and safety.

The Automotive industry continues to integrate logistics to streamline component delivery to assembly lines and manage finished vehicle distribution. Similarly, Industrial Machinery and Equipment sectors depend on robust logistics to ensure timely delivery of essential heavy machinery.

The Others category, which includes varied industries such as construction and textiles, also significantly utilizes logistics to meet diverse supply chain requirements, underscoring the versatility and critical nature of logistics services across different market segments.

Operation Analysis

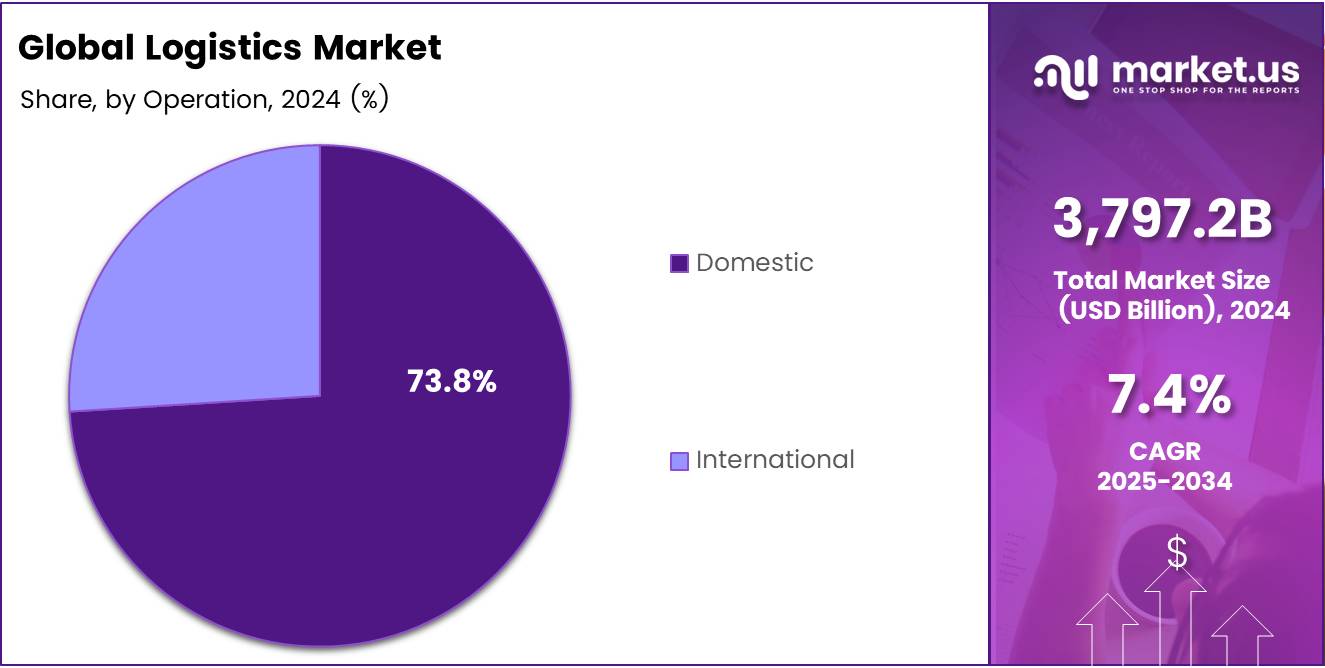

Domestic Operations Lead with Overwhelming 73.8% Market Share in Logistics

In 2024, the logistics market witnessed significant dominance in the By Operation Analysis segment by domestic operations, holding a substantial 73.8% market share. This prominent position can be attributed to the robust internal supply chains and the efficient management of goods transportation within national boundaries. Domestic logistics operations have been increasingly optimized through advanced routing technologies and improved warehouse management systems, which have significantly enhanced operational efficiencies.

On the other hand, international logistics accounted for the remainder of the market share. While smaller in comparison, this segment is crucial for global trade and is driven by factors such as cross-border e-commerce growth and international trade agreements.

The international segment faces distinct challenges, including higher costs and more complex regulatory environments compared to domestic logistics. However, advancements in global trade management software and increased investment in cargo shipping technologies are likely to bolster the growth of international logistics operations in the coming years.

This analysis underscores the current landscape of the logistics market, highlighting the pivotal role of domestic logistics in maintaining the flow of goods on a national scale, while also pointing towards the strategic importance and potential growth areas within international logistics.

Key Market Segments

By Mode of Transport

- Roadways

- Waterways

- Airways

- Railways

By Service

- Transportation Services

- Integration & Consulting Services

- Freight Forwarding Services

- Inventory Management Services

- Warehousing and Distribution Services

- Value-Added Logistics Services

By Category

- Conventional Logistics

- E-Commerce Logistics

By Model

- 3PL/Contract Logistics

- 4PL/Lead Logistics

- Others

By Type

- Forward Logistics

- Reverse Logistics

By Operation

- Domestic

- International

By End Use

- Retail & E-commerce

- Healthcare

- Consumer Electronics

- Aerospace & Defense

- Food & Beverages

- Automotive

- Industrial Machinery and Equipment

- Others

Drivers

E-commerce Expansion Boosts Logistics Demand

The logistics market is primarily driven by the substantial growth of e-commerce and online shopping, which necessitates advanced supply chain solutions for efficient order fulfillment and delivery.

This trend is coupled with the globalization of trade, where expanded international trade networks demand robust logistics support to handle increased cross-border goods transactions. Additionally, technological advancements are significantly shaping the logistics sector; the integration of artificial intelligence, the Internet of Things, and automation technologies enhances operational efficiencies and helps in cost reduction.

Urbanization further influences market dynamics, as more people moving to urban areas increase the need for effective logistics services to manage the distribution and availability of goods in these densely populated regions. These factors collectively contribute to the robust growth and continual evolution of the logistics market.

Restraints

High Fuel Costs Create Barriers for the Logistics Market

In the logistics sector, high fuel costs represent a significant restraint, as the unpredictability of fuel prices directly influences the operational expenses of transportation services. This volatility not only raises the cost of delivering goods but also affects pricing strategies and profitability margins across the logistics industry. Furthermore, the logistics market faces challenges imposed by stringent regulatory constraints.

These include complex compliance requirements related to cross-border transportation and stringent safety standards, which complicate operations and necessitate additional resources.

These factors collectively heighten the operational hurdles for logistics providers, potentially hindering market expansion and affecting service delivery. Such constraints emphasize the need for strategic planning and innovation within the logistics sector to mitigate these impacts and maintain competitive advantage.

Growth Factors

Expanding Horizons in Last-Mile Delivery Innovations

The logistics market is witnessing substantial growth opportunities, particularly through innovations in last-mile delivery. This sector is transforming as demand escalates for quicker and more efficient delivery methods.

Notably, the integration of advanced technologies such as drones and autonomous vehicles is pivotal. These technologies are not only enhancing the speed and efficiency of deliveries but are also pivotal in addressing the increasing consumer expectations for immediate and precise service.

The adoption of such innovative solutions in last-mile logistics is expected to significantly reduce delivery times, cut down on operational costs, and improve overall customer satisfaction.

As a result, companies that invest in these cutting-edge technologies are likely to secure a competitive advantage and capture greater market share. This trend is a clear indicator of how technological advancements are reshaping the landscape of the logistics industry, making it an exciting area for growth and investment.

Emerging Trends

AI-Driven Predictive Analytics Reshaping the Logistics Market

In the logistics sector, the integration of AI-powered predictive analytics is profoundly transforming operations by enhancing demand forecasting and predictive maintenance capabilities. This trend is pivotal in optimizing inventory levels and reducing operational costs, enabling companies to anticipate market demands more accurately and maintain equipment more effectively.

Simultaneously, blockchain technology is gaining traction, providing unmatched transparency and security across supply chains, thereby bolstering trust and efficiency among stakeholders. Moreover, robotic process automation (RPA) is revolutionizing logistics by automating mundane tasks, thus significantly improving operational efficiency and reducing human error.

Additionally, the shift towards smart warehousing is evident as more logistics companies adopt IoT devices, RFID technology, and automation systems to scale operations and increase throughput. These advancements collectively contribute to a more agile and responsive logistics industry, ready to meet the evolving demands of global commerce.

Regional Analysis

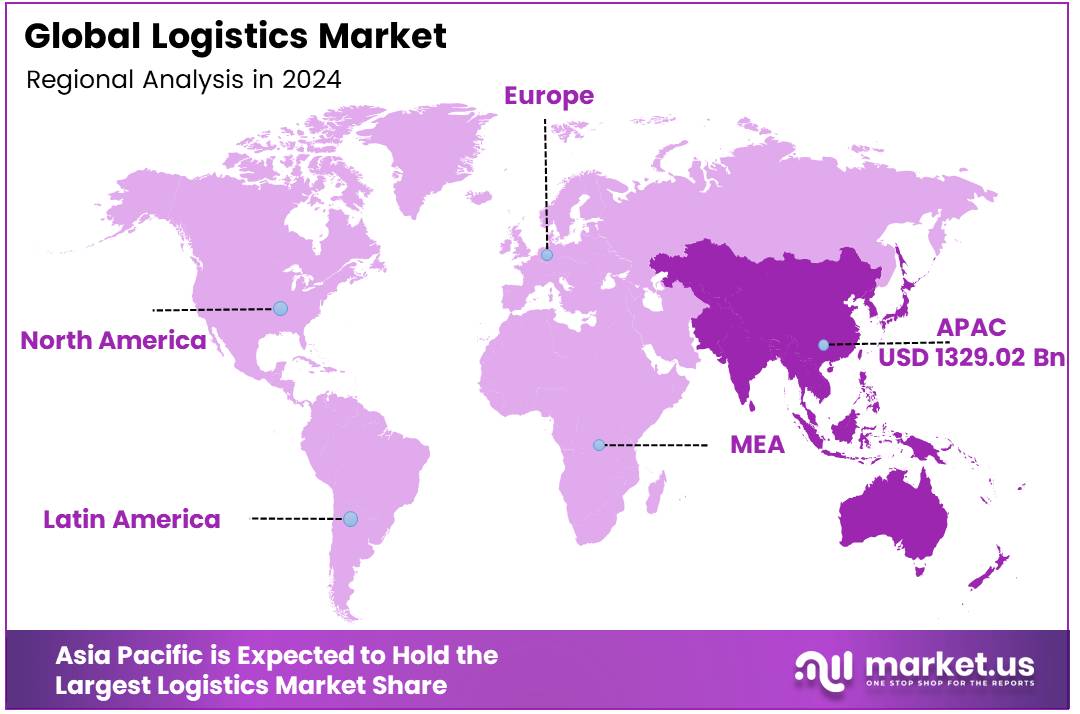

Asia Pacific Leads Global Logistics with 35.5% Market Share, Driven by Industrial Growth and E-commerce Expansion

The Asia Pacific region, commanding the largest share of the global logistics market at 35.5%, valued at approximately USD 1329.02 billion, spearheads growth through rapid industrialization and the expansion of manufacturing sectors. Enhanced by the surge in e-commerce and robust digital transformation initiatives in major economies such as China and India, Asia Pacific stands as the dominant force in the logistics landscape.

Regional Mentions:

In North America, the logistics sector is significantly bolstered by advanced technological integration and robust infrastructure, which are vital for efficient transportation and warehousing services. The market benefits from a strong emphasis on e-commerce and the adoption of real-time delivery systems, driving substantial growth.

Europe’s logistics market focuses on sustainable and environmentally friendly logistics solutions, driven by stringent regulatory standards and a heightened awareness of environmental impacts. Innovations in supply chain management and a shift towards more sustainable transport modes, such as rail and inland waterways, are prominent in the region.

The Middle East & Africa are enhancing their logistics capabilities through expanded trade routes and substantial investments in infrastructure development. The strategic geographical positioning and integration of digital technologies are set to increase the region’s influence in the global logistics sphere.

In Latin America, the logistics market is growing, primarily fueled by the expansion of the retail sector and improvements in transportation infrastructure. Despite facing challenges such as political instability and infrastructural deficiencies, strategic reforms and foreign investments are beginning to bolster logistics operations across the region.

Overall, these regional insights reflect the diverse dynamics and strategic developments shaping the global logistics market, with Asia Pacific leading the charge due to its substantial market size and rapid growth trajectory.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2024, the global logistics market is expected to continue its robust growth trajectory, buoyed by increasing globalization, e-commerce proliferation, and technological advancements. Among the key players driving this growth are several well-established companies that have demonstrated resilience, innovation, and strategic expansion.

Nippon Express has capitalized on its extensive network in Asia to enhance intra-regional trade flows. Its strategic focus on eco-friendly logistics solutions is also expected to bolster its market position as sustainability becomes a critical consideration for supply chain management.

FedEx remains a leader in express parcel delivery, with significant investments in automation and blockchain for enhanced tracking and security of packages. These technological integrations are anticipated to improve operational efficiencies and customer satisfaction.

Maersk, with its integrated shipping and logistics services, is poised to leverage its digital transformation initiatives to offer more transparent and reliable supply chain solutions, particularly in volatile markets such as those influenced by geopolitical tensions.

XPO Logistics and C.H. Robinson Worldwide, Inc. are set to expand their logistics offerings by integrating advanced analytics and AI to optimize shipping routes and reduce costs, thus enhancing their competitive edge in a cost-sensitive market.

DB Schenker and Kuehne + Nagel focus on expanding their global footprint by strengthening their presence in emerging markets, which are pivotal growth areas for the logistics sector. Both companies are enhancing their logistics platforms to support complex supply chains that require agile and adaptable solutions.

United Parcel Service of America, Inc. (UPS) continues to invest in fleet modernization and alternative fuels to meet the increasing demand for eco-friendly delivery options, aligning with global sustainability goals.

Overall, these key players in the global logistics market are strategically positioned to address the dynamic challenges of the logistics industry, emphasizing technological innovation, sustainability, and market expansion to maintain and enhance their market dominance in 2024.

Top Key Players in the Market

- Nippon Express

- J.B. Hunt Transport Services

- FedEx

- Maersk

- XPO Logistics

- C.H. Robinson Worldwide, Inc.

- Kuehne + Nagel

- DB Schenker

- United Parcel Service of America, Inc.

- Toll Group

- CEVA Logistics (The CMA CGM Group)

- Kerry Logistics

- Expeditors International

- Deutsche Post AG

- DSV

Recent Developments

- In November 2024, the ecommerce logistics startup Locad successfully raised $9 million in new funding to enhance its operational capabilities and expand its market reach.

- In January 2025, Emiza, a logistics firm, secured Rs 100 crore in funding, aiming to boost its infrastructure and streamline its supply chain services.

- In February 2025, Shadowfax, a logistics startup on the verge of an IPO, raised Rs 34 crore in funding to fortify its technological framework and increase its operational efficiency.

- In September 2023, Kale Logistics from India raised $30 million to push its global expansion efforts, intending to enhance international trade facilitations.

Report Scope

Report Features Description Market Value (2024) USD 3,797.2 Billion Forecast Revenue (2034) USD 7753.7 Billion CAGR (2025-2034) 7.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Mode of Transport(Roadways, Waterways, Airways, Railways), By Category(Conventional Logistics, E-Commerce Logistics, By Model(3PL/Contract Logistics, 4PL/Lead Logistics, Others), By Type(Forward Logistics, Reverse Logistics), By Operation(Domestic, International), By End Use(Retail & E-commerce, Healthcare, Consumer Electronics, Aerospace & Defense, Food & Beverages, Automotive, Industrial Machinery and Equipment, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Nippon Express, J.B. Hunt Transport Services, FedEx, Maersk, XPO Logistics, C.H. Robinson Worldwide, Inc., Kuehne + Nagel, DB Schenker, United Parcel Service of America, Inc., Toll Group, CEVA Logistics (The CMA CGM Group), Kerry Logistics, Expeditors International, Deutsche Post AG, DSV Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Nippon Express

- J.B. Hunt Transport Services

- FedEx

- Maersk

- XPO Logistics

- C.H. Robinson Worldwide, Inc.

- Kuehne + Nagel

- DB Schenker

- United Parcel Service of America, Inc.

- Toll Group

- CEVA Logistics (The CMA CGM Group)

- Kerry Logistics

- Expeditors International

- Deutsche Post AG

- DSV