Global IoT Powered Logistics Market Size, Share Analysis Report By Technology (Machine Learning, Natural Language Processing (NLP), Computer Vision, Others), By Application (Inventory Control & Planning, Transportation Network Design, Purchasing & Supply Management, Demand Planning & Forecasting, Others), By Industry Vertical (Automotive, Food and Beverages, Manufacturing, Healthcare, Retail, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: January 2025

- Report ID: 138640

- Number of Pages: 353

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

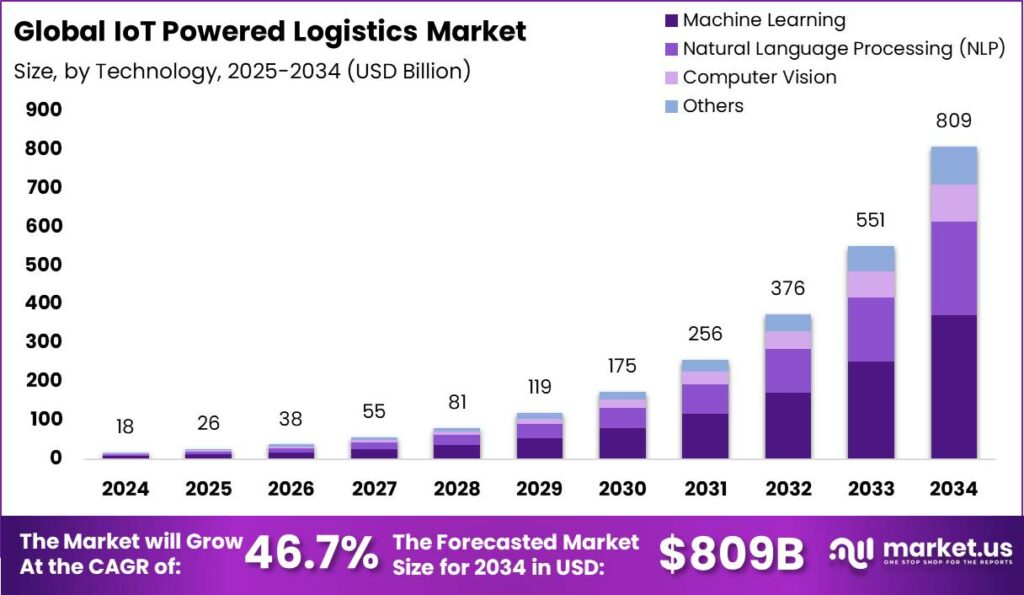

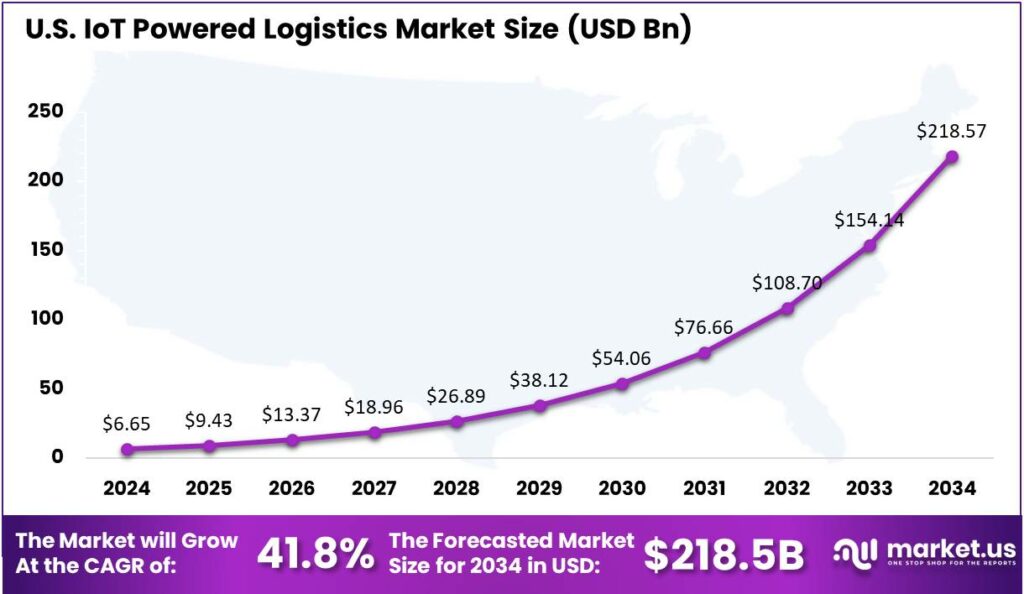

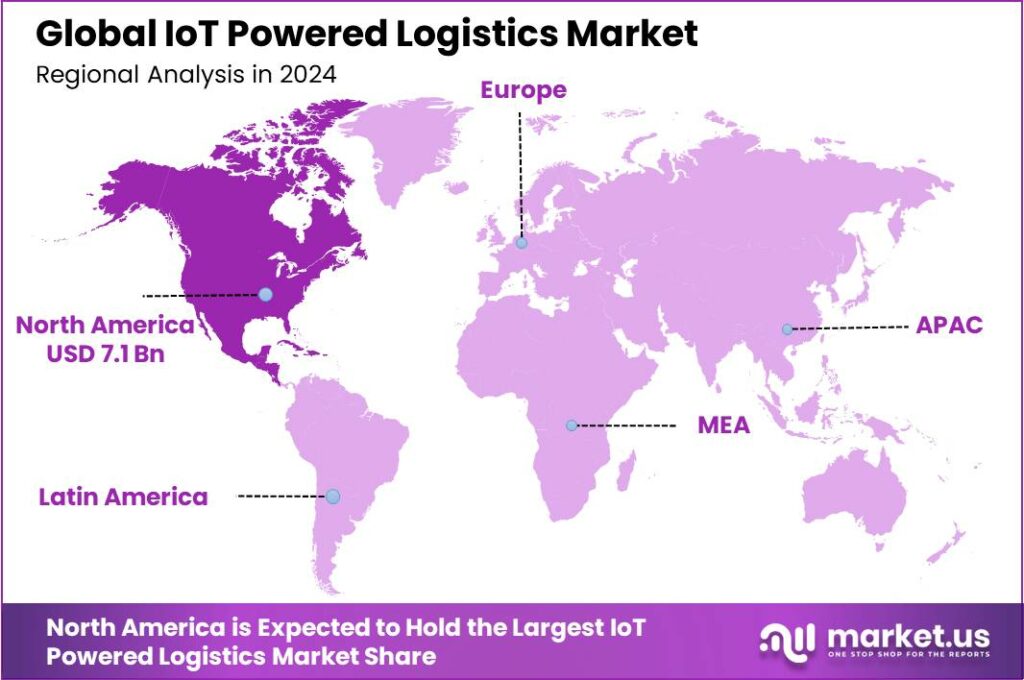

The Global IoT Powered Logistics Market size is expected to be worth around USD 809 Billion By 2034, from USD 17.5 Billion in 2024, growing at a CAGR of 46.72% during the forecast period from 2025 to 2034. In 2024, North America led the IoT-powered logistics market with over 41% share, or about USD 7.1 billion in revenue. The U.S. market, valued at USD 6.65 billion, is expected to grow at a CAGR of 41.8%.

IoT Powered Logistics refers to the integration of Internet of Things (IoT) technology within the logistics and supply chain industries to enhance the efficiency, visibility, and tracking of goods in transit. By embedding sensors, RFID tags, GPS devices, and other IoT solutions into logistics systems, businesses can gather real-time data, monitor shipments, and track vehicle conditions.

These technologies provide valuable insights, allowing companies to optimize routes, manage inventory, prevent delays, and improve overall operational performance. IoT-enabled devices streamline the supply chain by connecting warehouses, trucks, and customers, creating a seamless flow of information for smarter, more responsive logistics.

The rapid growth of the IoT-powered logistics market is driven by the demand for efficiency and cost optimization in supply chain management. IoT solutions offer real-time tracking of inventory and shipments, reducing losses and enhancing delivery accuracy. The rise of e-commerce and the need for faster deliveries are also fueling the demand, as businesses aim to ensure seamless, timely service for customers.

Advancements in IoT infrastructure, including the expansion of 5G networks and cloud computing, are making it easier for logistics companies to deploy these technologies at scale. Real-time data collection and analysis enable organizations to make informed decisions, boosting logistics efficiency, lowering costs, and improving customer satisfaction.

IoT in logistics is gaining traction across industries like retail, manufacturing, and transportation. By tracking goods, vehicles, conditions, and driver behavior, IoT enhances efficiency and enables personalized services like real-time updates and predictive maintenance.

The market also offers promising opportunities, especially with the integration of AI and ML for automation. IoT also helps companies meet sustainability goals by optimizing fuel use, reducing waste, and cutting emissions. The expansion of 5G networks further boosts IoT device connectivity and performance.

In developed regions, IoT is increasingly seen as a standard in logistics management, while in emerging markets, adoption is growing rapidly as companies recognize the efficiency gains and cost reductions. As industries become more integrated and supply chains continue to globalize, the demand for IoT-powered logistics solutions will likely increase, paving the way for new applications and innovations in the sector.

Key Takeaways

- The Global IoT Powered Logistics Market is projected to reach a value of around USD 809 Billion by 2034, growing from USD 17.5 Billion in 2024, at a CAGR of 46.72% during the forecast period from 2025 to 2034.

- In 2024, the Machine Learning segment held a dominant market position, accounting for more than 46% of the market share in the IoT-powered logistics sector.

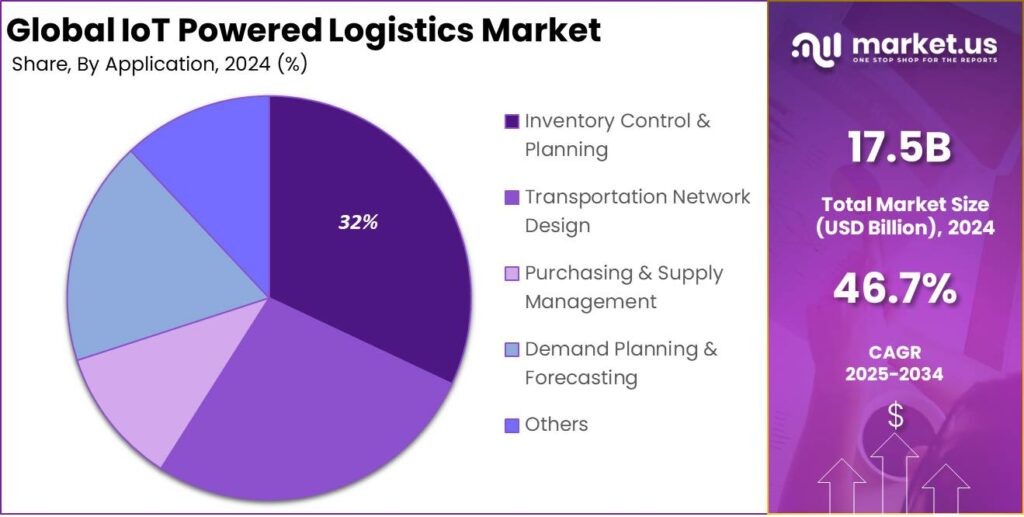

- The Inventory Control & Planning segment captured over 32% of the IoT-powered logistics market share in 2024, holding a dominant position.

- The Retail segment also dominated the market in 2024, representing more than 29% of the total share in the IoT-powered logistics market.

- North America held a leading position in the global IoT-powered logistics market in 2024, commanding over 41% of the global market share, which translated to an approximate revenue of USD 7.1 billion.

- The U.S. IoT-powered logistics market, valued at USD 6.65 billion in 2024, is expected to experience substantial growth, with a projected CAGR of 41.8%.

U.S. Market Size and Growth

The U.S. IoT-powered logistics market, currently valued at USD 6.65 billion in 2024, is expected to experience significant growth, with a projected compound annual growth rate (CAGR) of 41.8%. This rapid expansion reflects the increasing adoption of Internet of Things (IoT) technologies within the logistics and supply chain sectors.

Integrating IoT devices boosts operational efficiency, real-time tracking, predictive maintenance, and route optimization. The growth of the market is fueled by the push for digital transformation in logistics and supply chain management, alongside advancements like 5G that enhance real-time data processing and analytics.

As companies look to optimize their operations and gain a competitive edge, IoT solutions are becoming indispensable. Moreover, as customer expectations for faster deliveries and seamless experiences grow, logistics providers are turning to IoT-powered technologies to meet these demands, which is further fueling the market’s rapid expansion.

In 2024, North America held a dominant market position in the IoT-powered logistics market, capturing more than 41% of the global share, equating to a revenue of approximately USD 7.1 billion. This leadership stems from the region’s advanced tech infrastructure, early IoT adoption, and the presence of key players in logistics, transportation, and technology.

The United States, in particular, stands as a global leader in IoT innovation, with numerous logistics companies incorporating IoT devices to streamline operations, enhance efficiency, and meet rising consumer expectations for faster deliveries.

North America’s strong position is backed by its established logistics networks, including trucking fleets, warehouses, and distribution centers, all leveraging IoT for real-time tracking, predictive maintenance, and route optimization. The adoption of cloud computing, big data, and AI further accelerates IoT integration in the region’s logistics industry.

North America benefits from strong R&D investments in IoT and partnerships between tech providers and logistics operators, driving innovations like autonomous vehicles, smart tracking systems, and real-time monitoring platforms.

Technology Analysis

In 2024, Machine Learning segment held a dominant market position, capturing more than a 46% share in the IoT-powered logistics market. Machine learning (ML) is becoming increasingly essential in transforming logistics operations, as it enables the automated analysis of vast amounts of data generated by IoT sensors and devices.

ML algorithms can predict demand, optimize routes, and improve fleet management, all of which contribute to reduced operational costs and enhanced delivery efficiency. As more logistics companies embrace data-driven decision-making, ML’s ability to analyze complex data patterns in real-time makes it the leading technology in the market.

The reason Machine Learning has emerged as the dominant technology is primarily due to its ability to continuously improve logistics operations through predictive analytics. In logistics, factors such as weather, traffic patterns, and delays can be unpredictable, and ML algorithms are well-suited to forecast these disruptions and suggest alternative solutions.

By analyzing historical data, these models help logistics companies not only optimize their supply chain but also anticipate future challenges, allowing for more proactive decision-making. As a result, ML-driven platforms are increasingly becoming integral to supply chain visibility and operational optimization.

Application Analysis

In 2024, the Inventory Control & Planning segment held a dominant market position, capturing more than a 32% share of the IoT-powered logistics market. This segment’s strong performance can be attributed to the increasing need for real-time tracking and management of inventory.

IoT technologies, like smart sensors, RFID tags, and automated data collection, provide businesses with better inventory visibility across the supply chain. This improves stock accuracy, reduces the risk of stockouts or overstocking, and enables faster response to demand fluctuations.

One of the main reasons for the leading position of the Inventory Control & Planning segment is its critical role in improving overall supply chain efficiency. By integrating IoT sensors, companies can monitor inventory in real-time, providing accurate, up-to-date information that supports better decision-making.

This not only improves forecasting accuracy but also helps businesses optimize their storage capacities, reduce waste, and streamline warehouse operations. Additionally, with the rise of e-commerce and omnichannel retail, inventory management has become more complex, and IoT-powered solutions offer a way to handle this complexity more effectively.

Industry Vertical Analysis

In 2024, the Retail segment held a dominant market position, capturing more than a 29% share of the IoT-powered logistics market. This segment’s leadership is largely driven by the rapid growth of e-commerce and the increasing demand for streamlined, efficient supply chains.

Retailers are under constant pressure to offer faster deliveries, maintain accurate stock levels, and provide an enhanced customer experience. IoT technologies enable real-time tracking of goods, from warehouses to last-mile delivery, ensuring that retailers can meet consumer expectations for speed and reliability while also improving operational efficiency.

A key factor contributing to the Retail segment’s dominance is the growing need for inventory visibility and management. With the expansion of omnichannel retail models, managing inventory across multiple platforms online stores, physical stores, and distribution centers has become increasingly complex.

IoT devices, such as smart sensors and RFID tags, allow retailers to track products in real time, optimizing stock levels and reducing the risk of overstocking or stockouts. This visibility not only supports inventory management but also aids in demand forecasting, helping retailers better align their stock with customer needs and purchasing patterns.

Key Market Segments

By Technology

- Machine Learning

- Natural Language Processing (NLP)

- Computer Vision

- Others

By Application

- Inventory Control & Planning

- Transportation Network Design

- Purchasing & Supply Management

- Demand Planning & Forecasting

- Others

By Industry Vertical

- Automotive

- Food and Beverages

- Manufacturing

- Healthcare

- Retail

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Increasing Demand for Real-Time Tracking

One of the primary drivers of IoT-powered logistics is the growing demand for real-time tracking and monitoring of shipments. As businesses and consumers increasingly demand faster and more reliable delivery services, logistics companies are turning to IoT devices to provide live updates on cargo status.

IoT sensors and devices can track location, temperature, humidity, and condition of goods, offering complete visibility throughout the supply chain. This helps reduce delays, improve accuracy, and enhance customer satisfaction. Real-time tracking also allows businesses to proactively address potential issues, such as delays or damage, by adjusting routes or intervening when necessary.

Restraint

High Initial Investment

Companies need to invest in sensors, IoT platforms, software, and a strong data analytics system to make full use of IoT in their logistics operations. For small and medium-sized enterprises (SMEs), the upfront costs can be prohibitive, delaying their adoption of IoT technologies. Additionally, there are costs associated with training staff and integrating these new systems with existing infrastructure.

While the long-term benefits of improved efficiency, reduced waste, and enhanced customer service may outweigh the initial costs, many companies are still hesitant to make such large investments. This becomes particularly challenging in industries with tight margins where the return on investment (ROI) is not immediately apparent.

Opportunity

Automation and Predictive Analytics

IoT offers significant opportunities in the realm of logistics through automation and predictive analytics. With the data collected from IoT devices, logistics companies can implement AI-driven systems to predict potential issues before they arise, such as predicting delivery delays or identifying when equipment might fail.

Automation can also optimize the supply chain by automatically adjusting routes, adjusting inventory levels, and even triggering reorders when stocks run low. This results in cost savings, greater operational efficiency, and a reduction in human error. For instance, smart warehouses can use IoT-enabled robotics to automate sorting, packing, and shipping, significantly speeding up operations while reducing labor costs.

Challenge

Data Security and Privacy

A significant challenge in IoT-powered logistics is ensuring the security and privacy of the massive amounts of data generated by IoT devices. Logistics companies collect sensitive data such as shipment details, inventory levels, and tracking information that could potentially be exploited if compromised.

Cyberattacks targeting IoT networks have become more frequent, and logistics companies must invest heavily in cybersecurity to protect their systems from threats. As IoT systems become more interconnected, the complexity of securing these devices and networks grows. A breach in one part of the supply chain can have a cascading effect across the entire logistics operation, leading to significant disruptions.

Emerging Trends

One of the most significant trends emerging from IoT integration is the use of smart sensors. These sensors track goods in transit, providing constant updates on location, temperature, humidity, and more. As a result, businesses can monitor the condition of products in real-time, ensuring optimal storage and transportation conditions.

Another key trend is the adoption of IoT-enabled fleet management systems. These systems gather data from vehicles, helping companies optimize routes, monitor fuel consumption, and predict maintenance needs. This not only reduces operational costs but also enhances the overall efficiency of the logistics process.

The rise of predictive analytics is also closely tied to IoT in logistics. By analyzing vast amounts of data collected by IoT devices, companies can forecast demand, identify potential delays, and predict equipment failures before they occur.

Business Benefits

- Improved Operational Efficiency: IoT helps optimize routing, reduce delays, and streamline operations, leading to cost savings.

- Enhanced Customer Satisfaction: Real-time data allows businesses to provide better visibility and timely delivery, improving customer experience.

- Predictive Maintenance: With IoT, businesses can predict equipment failures and schedule maintenance before issues arise, reducing downtime.

- Better Inventory Management: IoT sensors help track inventory levels and provide insights, reducing stockouts and overstock situations.

- Data-Driven Decision Making: The vast data collected by IoT devices can help companies make more informed, strategic decisions.

Key Player Analysis

In the rapidly growing market of IoT-powered logistics, several key players are leading the charge by offering innovative solutions.

IBM has been a significant player in the IoT-powered logistics space, bringing cutting-edge technologies like artificial intelligence (AI) and blockchain into its solutions. With its robust cloud platform and data analytics capabilities, IBM provides businesses with tools to optimize supply chain management, improve asset tracking, and enhance operational visibility.

Intel Corporation is another major player in the IoT-powered logistics market, providing the necessary hardware solutions that drive IoT applications. Intel’s processors, edge computing technology, and sensors are crucial in supporting real-time data processing and high-performance analytics for logistics operations.

Amazon Web Services (AWS) is a dominant force in the IoT space, offering cloud-based solutions that help logistics companies manage vast amounts of data generated by connected devices. AWS’s IoT Core platform allows businesses to securely connect and manage their devices at scale, providing real-time tracking and analytics.

Top Key Players in the Market

- IBM Corporation

- Intel Corporation

- Amazon Web Services, Inc.

- Microsoft Corporation

- Oracle Corporation

- NVIDIA Corporation

- Transportation Applied Intelligence, LLC

- Pluto7

- GEODIS

- Other Key Players

Top Opportunities Awaiting for Players

- Enhanced Supply Chain Visibility: One of the most significant opportunities IoT presents to the logistics industry is the ability to provide real-time tracking and visibility of shipments. IoT sensors and devices can transmit data on the condition and location of goods throughout the supply chain. Businesses investing in IoT solutions for tracking are likely to see improved operational efficiency and customer trust.

- Predictive Maintenance and Reduced Downtime: IoT devices, such as sensors installed on trucks, ships, or warehouse equipment, can monitor the health of machinery and vehicles in real time. This data allows companies to anticipate when maintenance is required, preventing equipment failures before they occur. Predictive maintenance also leads to cost savings by reducing emergency repairs and increasing the lifespan of assets.

- Smart Warehousing and Automation: IoT-powered smart warehousing is transforming the way inventory is stored, tracked, and managed. Through IoT sensors and automated systems, warehouses can operate more efficiently, reduce human error, and cut costs. RFID tags and IoT-enabled robots can improve inventory accuracy, while automated guided vehicles (AGVs) can move goods without human intervention.

- Route Optimization and Fuel Efficiency: IoT technologies can provide logistics companies with real-time data on traffic conditions, weather, and vehicle performance. This data helps optimize routes and reduce fuel consumption by selecting the most efficient path for deliveries. With rising fuel costs and growing concerns about sustainability, companies that leverage IoT for route optimization stand to benefit both financially and environmentally.

- Customer-Centric Experiences through IoT-Enabled Personalization: IoT allows for more personalized and efficient customer experiences by offering precise delivery windows, proactive notifications, and real-time tracking.Additionally, with IoT data, logistics companies can gain better insights into customer preferences, enabling them to tailor their offerings for specific markets or clients.

Recent Developments

- January 2024: Oracle was recognized as a leader in the Gartner Magic Quadrant for Warehouse Management Systems, highlighting its advancements in IoT integration for logistics management. This recognition underscores Oracle’s commitment to enhancing operational efficiency through technology.

- November 2024: Intel launched the IoT RFP Ready Kit Solutions Playbook, which provides a comprehensive guide for system integrators on implementing IoT solutions in logistics. This initiative is aimed at enhancing connectivity and data analysis capabilities within supply chains.

Report Scope

Report Features Description Market Value (2024) USD 17.5 Bn Forecast Revenue (2034) USD 809 Bn CAGR (2025-2034) 46.72% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Technology (Machine Learning, Natural Language Processing (NLP), Computer Vision, Others), By Application (Inventory Control & Planning, Transportation Network Design, Purchasing & Supply Management, Demand Planning & Forecasting, Others), By Industry Vertical (Automotive, Food and Beverages, Manufacturing, Healthcare, Retail, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IBM Corporation, Intel Corporation, Amazon Web Services, Inc., Microsoft Corporation, Oracle Corporation, NVIDIA Corporation, Transportation Applied Intelligence, LLC, Pluto7, GEODIS, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  IoT Powered Logistics MarketPublished date: January 2025add_shopping_cartBuy Now get_appDownload Sample

IoT Powered Logistics MarketPublished date: January 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- IBM Corporation

- Intel Corporation

- Amazon Web Services, Inc.

- Microsoft Corporation

- Oracle Corporation

- NVIDIA Corporation

- Transportation Applied Intelligence, LLC

- Pluto7

- GEODIS

- Other Key Players