Global Secure Logistics Market Size, Share, Growth Analysis By Type (Static, Mobile), By Application (Cash Management, Diamonds, Jewelry & Precious Metals, Manufacturing, Others), By Mode of Transport (Road, Rail, Air), By End-User (Financial Institutions, Retailers, Government, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 141595

- Number of Pages: 340

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

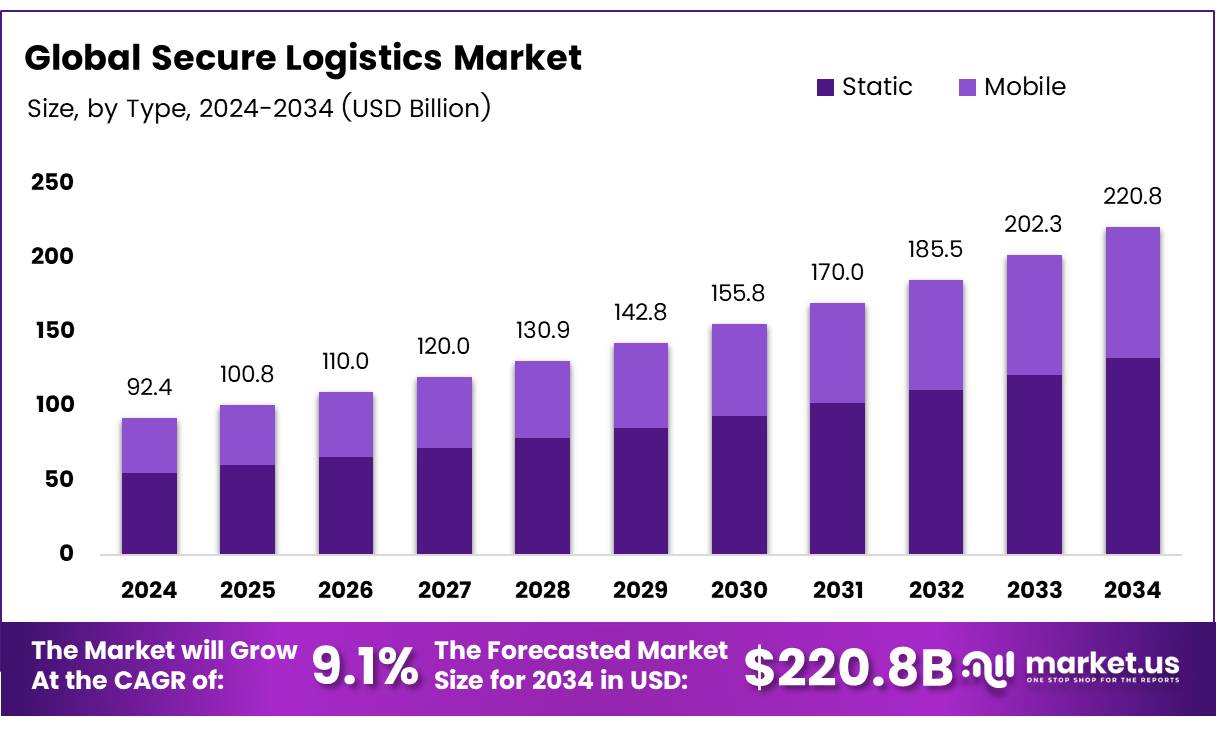

The Global Secure Logistics Market size is expected to be worth around USD 220.8 Billion by 2034, from USD 92.4 Billion in 2024, growing at a CAGR of 9.1% during the forecast period from 2025 to 2034.

The secure logistics market encompasses the systems and processes involved in transporting and handling goods and information in a secure manner. This market caters primarily to industries requiring high-security measures, such as banking and finance, pharmaceuticals, and high-value retail, to mitigate risks associated with theft, tampering, and other security threats.

The integration of technology, such as real-time tracking systems, biometric security, and advanced locking mechanisms, plays a crucial role in enhancing the security features of logistics services, thereby driving the demand for secure logistics solutions.

According to Study, the logistics industry worldwide was worth over 8.4 trillion euros in 2021 and is projected to exceed 13.7 billion euros by 2027, indicating substantial growth potential within this sector. The expansive growth underscores the increasing reliance on secure and efficient logistics solutions across global markets, reflecting broader economic activities and heightened security awareness among corporations and governments alike.

The secure logistics market is poised for significant growth, driven by escalating demands across various sectors for enhanced security measures in logistics operations. This growth is further supported by substantial government investments and stringent regulations aimed at improving the overall safety and integrity of transportation networks.

For instance, the U.S. Department of Transportation aims to decrease the rate of U.S. roadway fatalities from 1.37 per 100 million vehicle miles traveled in 2021 to 1.22 per 100 million vehicle miles traveled by 2023. Such initiatives underscore the commitment to not only enhancing road safety but also ensuring the secure transit of goods and services across extensive logistics networks.

Furthermore, the robust infrastructure and high volume of freight and passenger transport in countries like China, where nearly a million freight trains were operational and the number of train passengers reached 2.2 billion in 2022, illustrate the scale and scope of logistics operations that require stringent security measures.

Governmental roles in shaping the secure logistics landscape cannot be understated. Investments in transportation safety and infrastructure directly influence the logistics market by enforcing standards that ensure secure and efficient operations. Regulations not only mandate certain security measures but also promote innovation within the industry, as companies strive to meet or exceed these standards.

Such dynamics foster a competitive environment where technological advancements are leveraged to improve security protocols, thereby enhancing the overall value proposition of secure logistics services in a global marketplace.

Key Takeaways

- The Global Secure Logistics Market is projected to shrink from USD 220.8 Billion in 2024 to USD 92.4 Billion by 2034, at a CAGR of 9.1%.

- Static solutions lead the market type with a 60% share in 2024, indicating strong demand for non-mobile, high-security logistics systems.

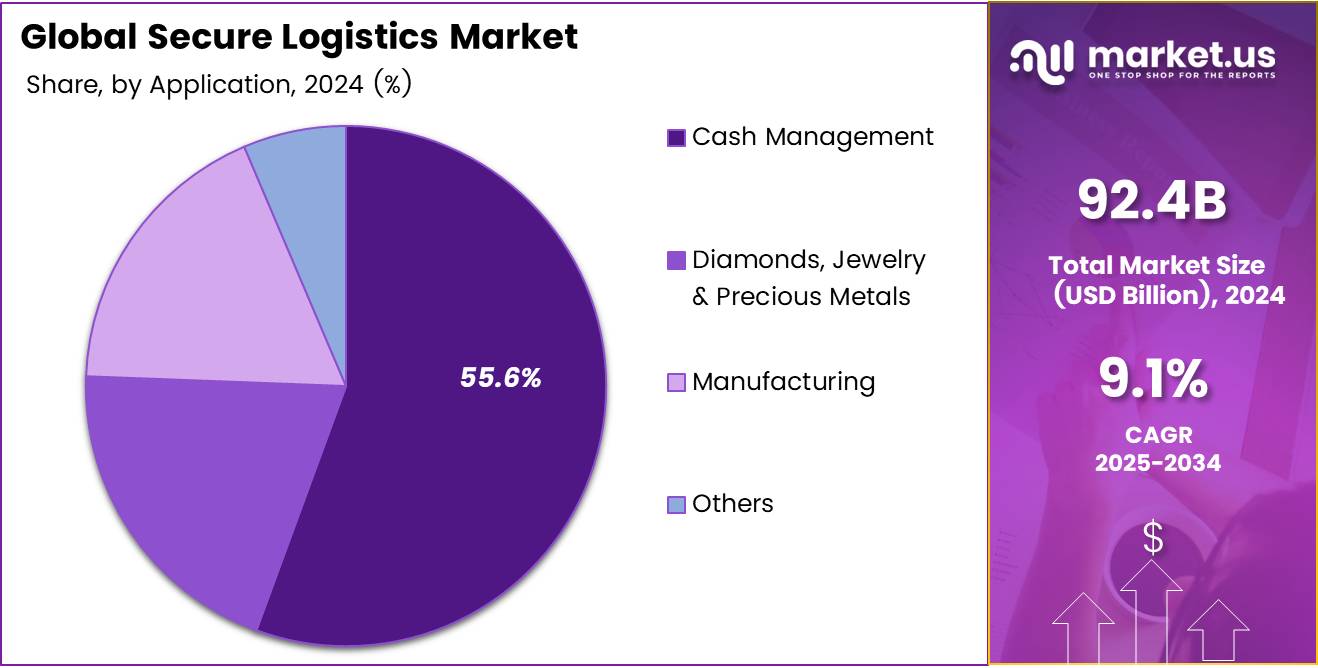

- Cash Management dominates the application segment with a 55.6% share, driven by the need for secure cash handling across banking and retail sectors.

- Road transportation is the preferred mode in secure logistics due to its flexibility, reach, and cost-efficiency, minimizing cargo handling risks.

- Financial Institutions are the primary end-users, heavily relying on secure logistics for transporting valuables, driven by strict regulatory demands.

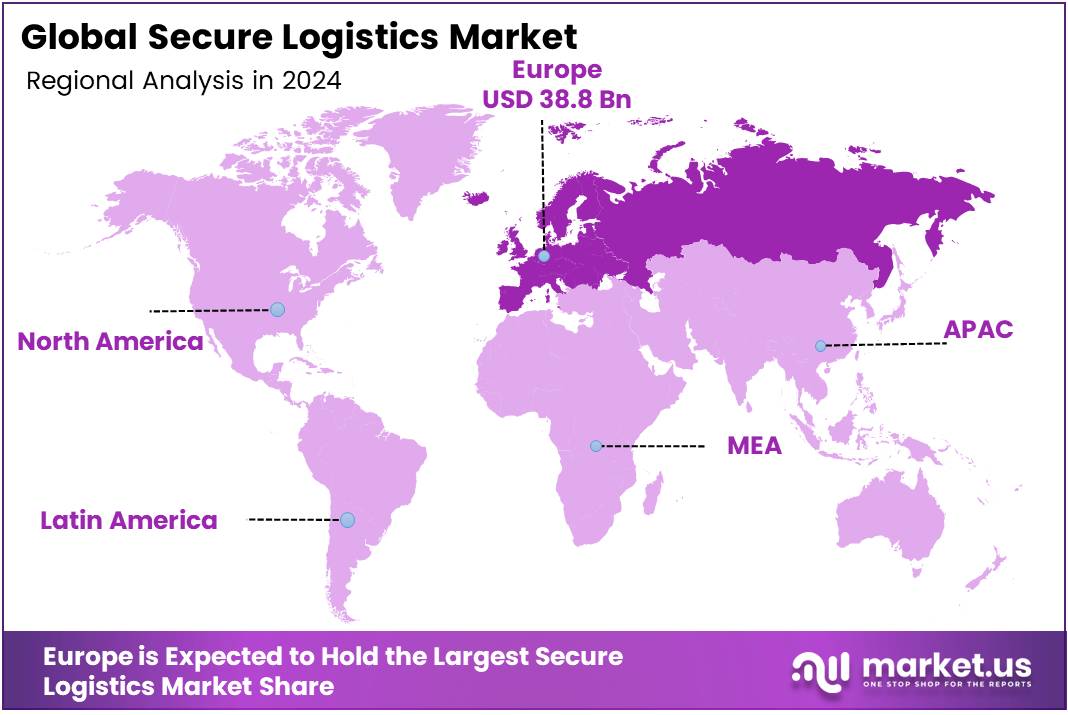

- Europe is the leading region with a 42% market share, fueled by strong banking sectors and regulatory standards in countries like Germany, the UK, and France.

Type Analysis

Static Solutions Lead Secure Logistics with a 60% Market Share in 2024

In 2024, Static solutions maintained a commanding presence in the Secure Logistics Market, capturing a significant 60% share in the By Type Analysis segment. This dominant position underscores the robust demand for static secure logistics systems, which are integral to operations requiring high security and consistent monitoring without the need for mobility.

These static systems are primarily deployed in fixed locations such as banks, large corporations, and government facilities where the emphasis is on safeguarding sensitive materials against external threats.

Conversely, the Mobile segment, offering flexibility and dynamic response capabilities, accounted for the remaining market share. Although smaller in comparison, this segment is vital for entities requiring adaptable solutions for varied locations and temporary setups. Mobile systems are particularly favored in scenarios where logistical operations are spread across multiple sites or need temporary security enhancements.

The stark contrast in market share between these segments highlights the prevailing preference for static solutions in environments where security cannot be compromised by the potential vulnerabilities of mobile systems. As organizations continue to prioritize risk management and loss prevention, static secure logistics solutions remain a cornerstone of enterprise security strategies.

Application Analysis

Cash Management Leads Secure Logistics Market with 55.6% Share in 2024

In 2024, Cash Management held a dominant market position in the By Application Analysis segment of the Secure Logistics Market, commanding a substantial 55.6% share. This segment’s prominence is primarily attributed to the increasing need for secure cash handling and transportation services across various sectors, including banking and retail. The heightened demand reflects ongoing concerns over security and the efficient management of cash flow, which is critical in today’s economy.

Following Cash Management, the Diamonds, Jewelry & Precious Metals segment also captured a significant portion of the market. This segment benefits from the high value and security requirements associated with transporting these assets, necessitating specialized secure logistics services.

The Manufacturing segment, while smaller, still plays a crucial role in the market due to the need to transport valuable components and finished goods safely. This need drives demand for secure logistics solutions that can ensure the integrity and confidentiality of shipments.

The Others category, encompassing various smaller and niche markets, also contributes to the overall market landscape by addressing specific logistical challenges that require tailored security measures.

Overall, the dominance of the Cash Management segment underscores the critical importance of security in financial transactions and the robust growth prospects for specialized logistics services in high-stakes environments.

Mode of Transport Analysis

Robust Dominance of Road Transport in Secure Logistics

In 2024, Road held a dominant market position in the By Mode of Transport Analysis segment of the Secure Logistics Market, affirming its pivotal role due to its flexibility, extensive reach, and cost-efficiency. The road segment facilitated rapid, door-to-door service, reducing the need for additional handling of cargo, which significantly diminishes the risk of theft or damage, thus ensuring higher security and reliability in logistics operations.

Rail transport, while less dominant, offered substantial benefits in terms of environmental sustainability and the capacity to transport large volumes over long distances without frequent stops. It is particularly effective for bulk shipments and heavy goods, providing secure logistics with predictable schedules and lower chances of theft, courtesy of limited access to freight on the move.

Air transport, although the least utilized for secure logistics in terms of volume, commanded a premium due to its speed and reduced handling. This mode is preferred for high-value, low-volume shipments needing swift and secure delivery across vast distances. Despite its higher costs, the demand for air logistics continues to grow, driven by increasing needs for rapid, international secure delivery solutions.

Each mode of transport presents unique advantages in the Secure Logistics Market, shaping the distribution dynamics and strategic decision-making in the industry.

End-User Analysis

Financial Institutions Lead in Secure Logistics with Strong Market Influence

In 2024, Financial Institutions held a dominant market position in the By End-User Analysis segment of the Secure Logistics Market. This sector, pivotal in handling transactions and assets, relies heavily on secure logistics for transporting valuable items such as currency, documents, and precious metals. Their leading role is underpinned by stringent regulatory requirements and the critical need for high-security measures, driving the adoption of advanced logistical solutions.

Retailers follow, implementing robust secure logistics to manage the flow of goods, especially high-value items, from warehouses to points of sale. This segment’s growth is propelled by the rising necessity for security in managing increasing online sales and preventing retail shrinkage.

Government entities also significantly invest in secure logistics, primarily for the safe handling and transportation of confidential documents, national treasures, and sensitive equipment. This need is amplified by the global emphasis on national security and infrastructure protection.

Lastly, the Others category encompasses various industries that require secure logistics services to a lesser degree but are gradually recognizing their importance as they expand operations and face increased security challenges.

Each segment’s reliance on secure logistics underlines its broad applications and critical role in ensuring the integrity and safety of transported assets.

Key Market Segments

By Type

- Static

- Mobile

By Application

- Cash Management

- Diamonds, Jewelry & Precious Metals

- Manufacturing

- Others

By Mode of Transport

- Road

- Rail

- Air

By End-User

- Financial Institutions

- Retailers

- Government

- Others

Drivers

Rising Global Cash Circulation Boosts Secure Logistics Market

As cash continues to be a predominant form of payment worldwide, there is an escalating demand for secure logistics services to manage and transport these assets efficiently. This necessity is particularly pronounced with the expansion of retail and banking sectors, which require robust mechanisms for handling and safeguarding cash and other valuables.

Additionally, sectors such as pharmaceuticals and consumer electronics are increasingly seeking secure logistics solutions to transport high-value products, driven by both the intrinsic value of the goods and the critical need for integrity and safety during transit.

Compounding these factors are heightened security concerns stemming from risks like cargo theft and terrorism, which necessitate advanced and stringent security protocols in logistics operations. As such, the market for secure logistics is experiencing significant growth, propelled by the combined forces of economic activities and evolving security challenges.

Restraints

High Costs Challenge the Adoption of Secure Logistics Services

As an analyst observing the secure logistics market, it’s apparent that one of the primary restraints is the high costs associated with implementing robust secure logistics services.

These services demand significant investment in advanced security technology and skilled personnel to manage operations effectively. This substantial financial burden can be prohibitive, particularly for smaller organizations, making it challenging for them to adopt or expand these services.

Additionally, the market faces complexities due to stringent regulatory compliance required across different regions. Navigating these diverse international laws and regulations not only complicates operations but also incurs considerable costs. These challenges collectively pose barriers to market entry and can stifle the growth potential of secure logistics services, impacting overall market dynamics.

Growth Factors

Emerging Markets Fuel Secure Logistics Expansion

The secure logistics market is poised for significant growth, particularly through the expansion into emerging markets, which offers a wealth of opportunities across sectors like retail, banking, and healthcare. These regions, characterized by their fast-paced economic development, are seeing a surge in demand for robust security measures to safeguard the increasing flow of high-value transactions and sensitive information.

Additionally, the integration of Internet of Things (IoT) and smart technologies is revolutionizing asset tracking, monitoring, and management during transit, enhancing both security and operational efficiency. The sector is also witnessing innovations such as the development of automated and robotic systems that minimize human error and improve handling efficiency.

Moreover, forming strategic partnerships with e-commerce platforms is becoming crucial, as these platforms frequently manage a high volume of valuable transactions, necessitating secure and efficient logistic solutions. Together, these advancements present a dynamic landscape for stakeholders in the secure logistics market to explore new territories, innovate, and form lucrative collaborations, thereby driving market growth and resilience.

Emerging Trends

Contactless Deliveries Drive Innovation in the Secure Logistics Market

In the evolving landscape of the secure logistics market, several key trends are shaping the future. Firstly, the rise of contactless deliveries post-pandemic has spurred innovations in secure, minimal-contact delivery methods, aligning with health safety and efficiency demands.

Secondly, there is an increasing use of data analytics and artificial intelligence, enhancing the ability to predict threats and optimize delivery routes, thus bolstering security measures. Moreover, the shift towards electric and autonomous vehicles in logistics marks a significant stride towards reducing human error and enhancing operational efficiency.

Lastly, an enhanced focus on cybersecurity is crucial as logistics networks become increasingly digitized, necessitating stronger defenses against potential cyber-attacks. These trends collectively underscore a dynamic shift towards more secure, efficient, and technologically advanced logistics operations.

Regional Analysis

Europe Leads Secure Logistics Market with 42% Share, Valued at $38.8 Billion

Europe stands as the dominating region in the secure logistics market, commanding a significant 42.0% market share valued at USD 38.8 billion. This substantial market dominance is primarily due to the robust banking and financial sectors in countries like Germany, the UK, and France, coupled with stringent regulatory standards driving the demand for secure and compliant logistics solutions. The presence of major market players and advanced technology infrastructure also contribute to Europe’s leading position.

Regional Mentions:

North America follows closely, leveraging advanced technological integrations in security systems and a strong emphasis on regulatory compliance across industries such as pharmaceuticals and retail. The region shows a high adoption rate of secure logistics services to combat the increasing incidents of cargo theft, further supported by a sophisticated logistics infrastructure.

In Asia Pacific, the market is experiencing rapid growth due to the expanding e-commerce sector and increasing cross-border trade activities, especially in China, India, and Southeast Asia. The region’s market expansion is bolstered by improvements in logistics infrastructure and the rising need for secure transportation of high-value goods.

The Middle East & Africa region is witnessing growth in secure logistics due to the rising importance of security in oil and gas and precious commodities transportation. Initiatives to improve infrastructure and the increasing presence of international logistics providers are factors positively influencing the market in this region.

Latin America’s market is gradually maturing with advancements in logistics services and an increased focus on crime prevention in cargo transit. Countries like Brazil and Mexico are seeing a steady demand for secure logistics solutions due to prevalent cargo theft issues, driving the adoption of more sophisticated and secure logistics practices.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the global Secure Logistics Market in 2024, key players such as Brink’s Incorporated, Prosegur, and G4S Limited are expected to continue leading the industry through innovations in technology and strategic expansions.

Brink’s Incorporated, with its robust network and established reputation, is likely to enhance its digital capabilities to meet the growing demand for secure logistics in e-commerce and retail banking. The company’s efforts in integrating IoT and AI for real-time tracking and enhanced security measures should further solidify its market position.

Prosegur, known for its specialized transport and cash management services, might focus on expanding its geographical footprint, particularly in emerging markets where demand for secure logistics is rapidly increasing. The company’s investment in cybersecurity measures and the development of smart safes and automated cash handling systems are anticipated to cater effectively to the evolving needs of financial institutions.

G4S Limited, with its global presence and diverse service offerings, is expected to leverage its expertise in risk management to offer integrated security solutions that address the complexities of transporting high-value goods across international borders. The acquisition by Allied Universal could potentially broaden G4S’s service capabilities, allowing it to offer a more comprehensive suite of secure logistics solutions.

Overall, as the Secure Logistics Market grows in 2024, these key players will likely invest heavily in technology and sustainability, ensuring compliance with international security standards while innovating to meet client-specific needs in a competitive landscape.

Top Key Players in the Market

- Brink’s Incorporated

- CargoGuard

- Prosegur

- Allied Universal

- PlanITROI, Inc.

- Securitas AB

- CMS Info Systems (CMS)

- G4S Limited

- GardaWorld

- Lemuir Group

- Loomis AB

- Maltacourt

Recent Developments

- In November 2024, the ecommerce logistics startup Locad successfully raised $9 million in new funding to enhance their supply chain solutions and expand their global footprint.

- In January 2025, the logistics firm Emiza secured Rs 100 crore in funding, aiming to improve its warehousing capabilities and increase operational efficiency across India.

- In May 2024, the logistics technology startup Cargado raised $6.8 million in seed funding to develop its innovative shipping platform and accelerate growth in key markets.

Report Scope

Report Features Description Market Value (2024) USD 92.4 Billion Forecast Revenue (2034) USD 220.8 Billion CAGR (2025-2034) 9.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Static, Mobile), By Application (Cash Management, Diamonds, Jewelry & Precious Metals, Manufacturing, Others), By Mode of Transport (Road, Rail, Air), By End-User (Financial Institutions, Retailers, Government, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Brink’s Incorporated, CargoGuard, Prosegur, Allied Universal, PlanITROI, Inc., Securitas AB, CMS Info Systems (CMS), G4S Limited, GardaWorld, Lemuir Group, Loomis AB, Maltacourt Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Brink’s Incorporated

- CargoGuard

- Prosegur

- Allied Universal

- PlanITROI, Inc.

- Securitas AB

- CMS Info Systems (CMS)

- G4S Limited

- GardaWorld

- Lemuir Group

- Loomis AB

- Maltacourt