Global Livestock Identification Market Size, Share, Statistics Analysis Report By Solution (Hardware (Electronic Identification Tags, Visual Identification Tags, Readers & Applications, Others (Sensors, Boluses, etc.)), Software (On-Cloud, Livestock Record-Keeping Software), Services (Data Analytics, Maintenance & Support)), By Application (Breeding Record, Animal Ownership Identification, Disease Management & Control, Milk Traceability), By Usage (Permanent, Non-Permanent), By Livestock Type (Cattle, Poultry, Swine, Other Livestock Types), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 142297

- Number of Pages: 350

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- U.S. Livestock Identification Market

- Solution Analysis

- Application Analysis

- Usage Analysis

- Livestock Type Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Emerging Trends

- Business Benefits

- Key Player Analysis

- Top Opportunities Awaiting for Players

- Recent Developments

- Report Scope

Report Overview

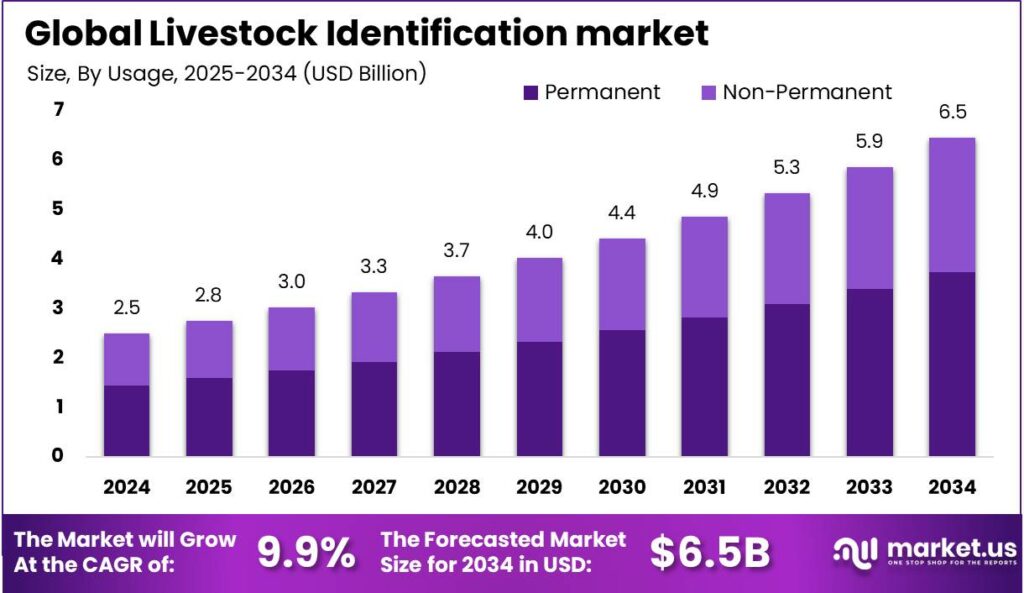

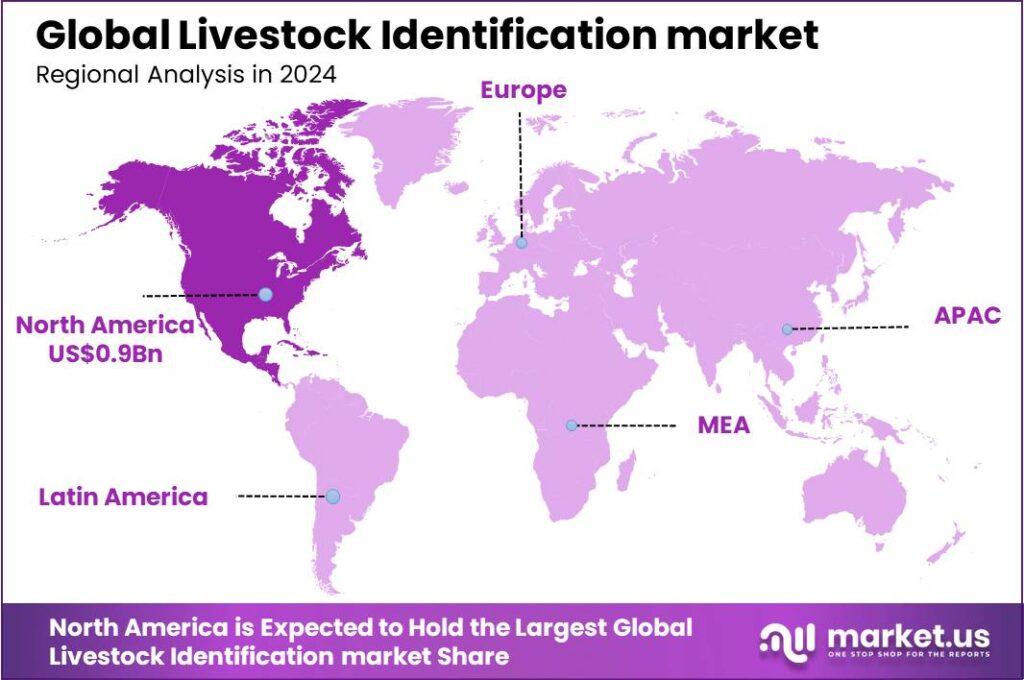

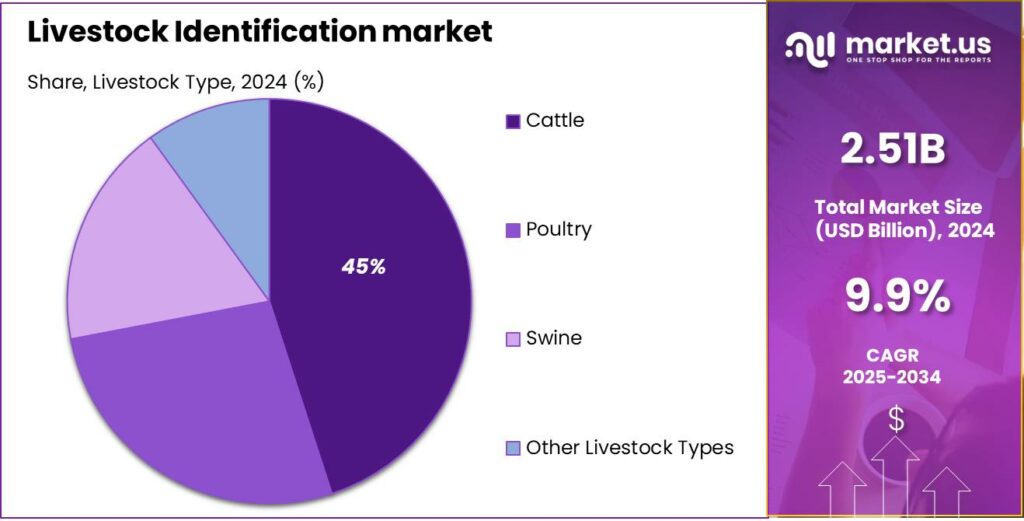

The Global Livestock Identification market size is expected to be worth around USD 6.5 Billion By 2034, from USD 2.51 Billion in 2024, growing at a CAGR of 9.90% during the forecast period from 2025 to 2034. North America held a dominant position in the livestock identification market in 2024, securing more than 37% of the market share, with revenues reaching approximately $0.9 billion.

Livestock identification refers to the process of tagging animals with unique identifiers, which can include ear tags, RFID chips, tattoos, and other marking systems. These identifiers enable the tracking of individual animals throughout their lifecycle, supporting effective management, disease control, and traceability from farm to fork.

The livestock identification market encompasses a range of products and technologies designed for animal tracking and data management, catering to the needs of farmers, ranchers, and regulatory bodies. This market plays a crucial role in ensuring animal health, welfare, and compliance with national and international livestock management standards.

Key factors driving the growth of the livestock identification market include stringent government regulations on animal traceability, which promote the adoption of identification systems for better food safety and quality. Additionally, the growing use of technology in agriculture, such as IoT devices and cloud-based systems, is enabling more efficient and accurate animal tracking.

Additionally, the rising consumer demand for transparency in food production processes and the need for disease outbreak management are further driving the market’s expansion. These factors, combined with the global increase in livestock production to meet the growing protein demand, are significantly contributing to the robust growth of the livestock identification market.

The livestock identification market is growing, especially in regions with high agricultural output. Increased awareness of animal welfare and public health drives this growth, as stakeholders recognize the importance of detailed animal records. Advanced identification technologies are essential for complying with welfare standards and improving farm management and efficiency.

The livestock identification market offers opportunities for developing more humane, less invasive identification methods. Emerging markets provide growth potential, where traditional practices can be enhanced with modern technology. Additionally, integrating with broader farm management systems allows companies to offer comprehensive solutions for health monitoring and productivity optimization.

Technological innovations, such as RFID tags, biometric identification, and GPS tracking, are transforming the livestock identification market. These advancements provide real-time data, reduce animal stress, and minimize human contact. Ongoing improvements focus on enhancing the durability and readability of identification tags to endure environmental challenges.

The livestock identification market is set to expand as technology increasingly integrates into agriculture, especially in developing countries. This expansion is driven by rising demands for food safety, supply chain transparency, and sustainable farming practices, all of which rely on efficient livestock management systems.

Key Takeaways

- The Global Livestock Identification market size is projected to reach USD 6.5 Billion by 2034, up from USD 2.51 Billion in 2024, growing at a CAGR of 9.90% during the forecast period from 2025 to 2034.

- In 2024, the Hardware segment held a dominant market position within the livestock identification market, capturing more than a 64% share.

- The Breeding Record segment held a dominant position in the livestock identification market in 2024, accounting for more than 30% of the market share.

- In 2024, the Permanent segment held a dominant market position in the livestock identification market, with a share exceeding 58%.

- The Cattle segment dominated the livestock identification market in 2024, capturing over 45% of the market share.

- North America held a dominant position in the livestock identification market in 2024, securing more than 37% of the market share, with revenues reaching approximately $0.9 billion.

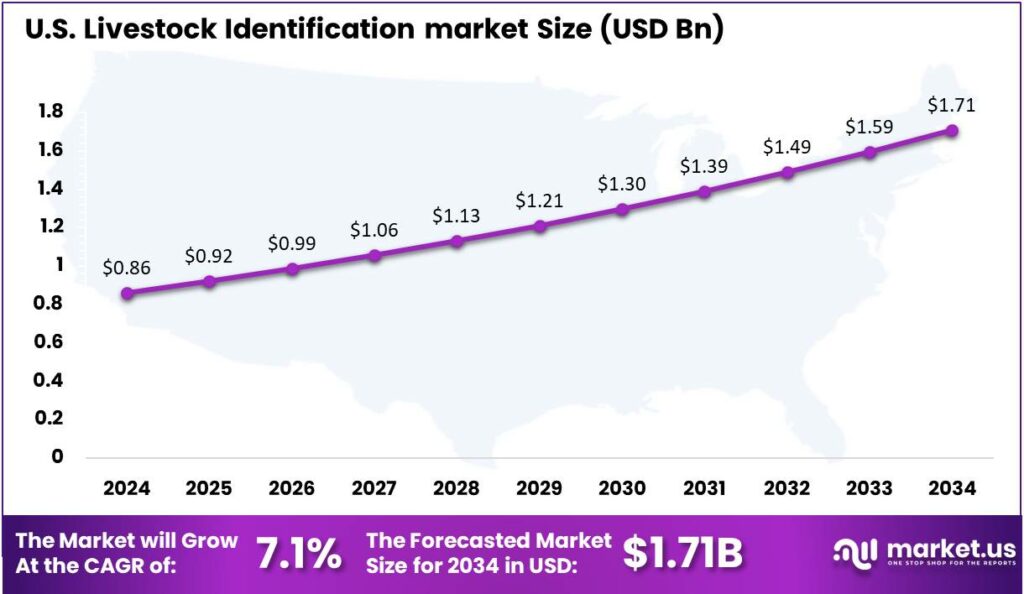

- In 2024, the U.S. Livestock Identification market was valued at $0.86 billion, with a projected CAGR of 7.1%.

U.S. Livestock Identification Market

In 2024, the U.S. Livestock Identification market was estimated to be valued at $0.86 billion, with a projected compound annual growth rate (CAGR) of 7.1%.

The market growth is driven by factors such as increased technology adoption in agriculture, regulatory mandates for livestock tracking, and concerns about animal health and food safety. Livestock identification systems, including ear tags, RFID devices, and management software, improve disease tracing, breeding efficiency, and supply chain management by tracking animals’ origin, health, and ownership.

Advancements in technology, such as wireless solutions and data analytics, are driving innovation in the sector, attracting large-scale farmers and ranchers. This shift towards precision farming enhances productivity and sustainability. The U.S. Livestock Identification market’s growth highlights its key role in modern agriculture and food supply chains.

In 2024, North America held a dominant market position in the Livestock Identification market, capturing more than a 37% share with revenues reaching approximately $0.9 billion. This leadership can be primarily attributed to stringent regulatory requirements, advanced agricultural technologies, and a well-established farming infrastructure.

North America’s prominence is driven by strict animal identification regulations aimed at improving food safety, managing disease outbreaks, and supporting international trade. The USDA’s National Animal Identification System (NAIS) mandates specific tracking methods, boosting demand for identification solutions in the region.

Technological adoption in North American agriculture is key to market growth. Farmers and ranchers are early adopters of RFID tags, GPS tracking, and livestock management software, which help ensure regulatory compliance and improve operational efficiency, driving the growth of the Livestock Identification market in the region.

The presence of leading market players investing in R&D strengthens North America’s position in the Livestock Identification market. Continuous innovation in reliable, efficient, and cost-effective solutions, combined with strong regulations and advanced infrastructure, ensures North America leads and sets trends globally.

Solution Analysis

In 2024, the Hardware segment held a dominant market position within the livestock identification market, capturing more than a 64% share. This segment comprises electronic identification tags, visual identification tags, readers, and other related devices such as sensors and boluses.

The predominance of the Hardware segment is largely driven by the essential role these tools play in the practical aspects of livestock management. These hardware solutions provide the foundational infrastructure for effective identification and tracking, essential for regulatory compliance and operational efficiency in livestock management.

Drivers of Hardware Segment Growth The leadership of the Hardware segment can be attributed to several factors. Primarily, the increasing implementation of stringent government regulations regarding animal traceability necessitates robust identification systems. These regulations are enforced to ensure food safety and disease traceability, pushing livestock owners towards adopting reliable and durable hardware solutions.

The integration of advanced technologies like RFID and IoT into livestock management has boosted demand for hardware solutions. These technologies enhance traditional tags and readers, enabling real-time data collection and monitoring, highlighting the growing reliance on sophisticated hardware in the market.

Application Analysis

In 2024, the Breeding Record segment held a dominant position in the livestock identification market, capturing more than a 30% share. This segment’s prominence is largely due to the critical role that breeding management plays in livestock farming.

Efficient breeding record-keeping helps in maintaining genetic diversity, optimizing productivity, and enhancing the overall health of the herd. Farmers and breeders rely on sophisticated identification systems to track lineage and breeding history, ensuring that the best genetic traits are passed on to future generations.

Disease Management & Control is a key application in the livestock identification market. Identification systems help monitor animal health, prevent disease spread, and enable quick isolation of infected animals. They also support accurate vaccination records and efficient veterinary care management.

The Milk Traceability segment highlights the increasing consumer demand for transparency in the dairy industry. Livestock identification systems enable product traceability from source to shelf, boosting consumer confidence in quality and safety. This traceability ensures compliance with global food safety standards, enhances supply chain integrity, and strengthens consumer trust in dairy products.

Usage Analysis

In 2024, the Permanent segment held a dominant market position in the Livestock Identification market, capturing more than a 58% share. This segment’s leadership is primarily due to its critical role in ensuring long-term traceability and compliance with international standards and regulations.

Permanent identification methods, such as RFID ear tagging and tattoos, are preferred for their durability and reliability. These methods provide lifelong identification without the need for replacement, making them efficient for long-term monitoring and management. This permanence enables tracking of livestock from birth to slaughter, playing a crucial role in disease control and prevention, essential for public health safety and food security.

The growing global demand for meat and dairy products requires strict livestock management practices. Permanent identification methods support effective management of breeding, veterinary care, and nutritional monitoring. They ensure a seamless flow of information, optimizing production and improving the efficiency of livestock operations.

Government policies promoting traceability in the food supply chain encourage the adoption of permanent identification methods. In regions with strict animal welfare laws, like North America and Europe, regulatory bodies push for these solutions to ensure accountability and transparency in livestock management.

Livestock Type Analysis

In 2024, the cattle segment held a dominant position in the livestock identification market, capturing more than a 45% share. This leadership can be attributed to several factors that underscore the importance of cattle in agricultural economies globally.

The high value of cattle in dairy and meat production requires effective tracking and management systems to optimize health, productivity, and compliance. Identification methods like ear tags, RFID, and microchips are essential in managing these valuable livestock, driving widespread adoption in the industry.

The dominance of the cattle segment is reinforced by strict government regulations on cattle tracking. In North America and Europe, policies require livestock identification to trace animals from birth to slaughter. These regulations improve food safety, manage disease outbreaks, and support international trade, driving the widespread adoption of identification technologies in the cattle industry.

The scale of the cattle industry also contributes to its dominant market share. Countries like the United States, Brazil, and China, with large cattle herds driven by high demand for beef and dairy, rely on advanced identification systems to manage herds efficiently and meet export standards. This need for effective management has solidified the segment’s market leadership.

Key Market Segments

By Solution

- Hardware

- Electronic Identification Tags

- Visual Identification Tags

- Readers & Applications

- Others (Sensors, Boluses, etc.)

- Software

- On-Cloud

- Livestock Record-Keeping Software

- Services

- Data Analytics

- Maintenance & Support

By Application

- Breeding Record

- Animal Ownership Identification

- Disease Management & Control

- Milk Traceability

By Usage

- Permanent

- Non-Permanent

By Livestock Type

- Cattle

- Poultry

- Swine

- Other Livestock Types

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Leveraging IoT and RFID for Smart Livestock Monitoring

The integration of advanced technologies such as the Internet of Things (IoT) and Radio Frequency Identification (RFID) has significantly enhanced livestock monitoring and identification processes. RFID tags and sensors facilitate real-time tracking of animals, enabling farmers to monitor health metrics, movement patterns, and overall well-being.

This technological advancement not only improves operational efficiency but also contributes to better disease management and resource allocation. For instance, the adoption of 5G networks and advanced IoT sensors is expected to further fuel the livestock monitoring market. By leveraging these technologies, farmers can make data-driven decisions, leading to increased productivity and sustainability in livestock operations.

Restraint

Infrastructure Challenges in Developing Regions

In many developing regions, the lack of supporting infrastructure poses a significant barrier to the adoption of electronic livestock identification systems. Challenges such as unreliable power supply, limited internet connectivity, and inadequate technical support hinder the effective implementation and operation of these technologies.

Without the necessary infrastructure, farmers may struggle to maintain the functionality of identification systems, leading to data inaccuracies and reduced effectiveness in monitoring and managing livestock. The initial investment for implementing electronic livestock identification, like RFID tags and biometric systems, can be high, especially for small-scale farmers. Costs include the devices, infrastructure, software integration, and training.This infrastructural deficiency can impede the growth of the livestock identification market in these regions.

Opportunity

Blockchain Integration for Better Supply Chain Traceability

The integration of blockchain technology with livestock identification systems presents a significant opportunity to enhance transparency and traceability within the supply chain. Blockchain’s immutable ledger allows for secure documentation of animal movements, health records, and ownership changes, ensuring data integrity and fostering trust among stakeholders.

This integration can lead to improved food safety, as consumers gain access to verifiable information regarding the origin and handling of animal products. Moreover, it can streamline regulatory compliance and facilitate swift responses to disease outbreaks by providing accurate and accessible records. Embracing blockchain technology in livestock identification can thus revolutionize the industry by promoting efficiency and accountability.

Challenge

Privacy and security risks from data breaches

The digitization of livestock identification systems raises concerns regarding data security and privacy. As these systems collect and store sensitive information about livestock and farm operations, they become potential targets for cyberattacks. Unauthorized access to such data can lead to breaches of confidentiality, financial losses, and compromised animal welfare.

Farmers may be apprehensive about adopting electronic identification methods due to fears of data misuse or exposure. Addressing these concerns requires the implementation of robust cybersecurity measures, comprehensive data protection policies, and ongoing education for stakeholders to build trust and ensure the safe utilization of digital livestock identification technologies.

Emerging Trends

The field of livestock identification is experiencing significant advancements, driven by technological innovations and the need for improved traceability. One prominent trend is the adoption of Radio Frequency Identification (RFID) technology, which enables the electronic tagging of animals.

Another emerging trend is the integration of biometric systems, such as retinal scanning and DNA profiling, into livestock management practices. These technologies provide precise identification, thereby improving breeding programs and disease control measures.

Additionally, the use of Global Positioning System (GPS) technology is gaining traction in livestock management. GPS allows for the tracking of animal movements, aiding in pasture management and reducing the risk of livestock theft.

The integration of these technologies represents a shift towards precision livestock farming, where data-driven decisions enhance productivity and animal welfare. As these trends continue to evolve, they are expected to play a crucial role in the future of livestock management.

Business Benefits

Implementing advanced livestock identification systems offers numerous benefits to agricultural businesses. One significant advantage is the improvement in data accuracy. Electronic identification tags equipped with RFID technology enable real-time data collection, reducing human error and ensuring precise record-keeping.

Enhanced traceability is another critical benefit. With unique identifiers assigned to each animal, businesses can monitor the entire lifecycle of livestock, from birth to processing. This traceability is essential for disease control, as it allows for swift identification and isolation of affected animals, thereby minimizing the spread of illnesses.

Moreover, effective livestock identification systems contribute to food safety. In the event of a foodborne illness outbreak, the ability to trace animal products back to their source enables prompt recalls and protects consumer health. This capability not only safeguards public health but also maintains the integrity of the supply chain.

Key Player Analysis

- Merck & Co., Inc. stands out in the livestock identification market for its comprehensive solutions that combine identification with animal health. Their expertise in veterinary pharmaceuticals and vaccines positions them to provide innovative identification systems that improve disease management and animal welfare.

- Avid Identification Systems, Inc. specializes in animal identification technology, offering a broad range of products such as RFID ear tags, implants, and other tracking solutions. They are recognized for their commitment to improving livestock traceability and supporting producers in managing herd health efficiently.

- Datamars is another significant player in the livestock identification sector, known for its innovative RFID solutions and smart technology. They provide a variety of animal identification products that enhance traceability, optimize animal management, and ensure food safety. Datamars differentiates itself through its global reach and its strong focus on developing efficient and cost-effective solutions for the livestock industry.

Top Key Players in the Market

- Merck & Co., Inc.

- Avid Identification Systems, Inc.

- Datamars

- HID Global Corp.(ASSA ABLOY)

- Shearwell Data Limited

- AEG Identification Systems

- Avery Dennison Corp.

- GAO RFID

- Fitbark

- RFID, Inc.

- Datamars

- Nedap N.V.

- MS Schippers

- Leader Products

- Caisley International Gmbh

- Kupsan Tag Company

- Other Key Players

Top Opportunities Awaiting for Players

- Technological Innovations: Advanced technologies such as Internet of Things (IoT) and Radio Frequency Identification (RFID) are revolutionizing livestock monitoring and identification. These technologies facilitate real-time tracking and health monitoring, greatly improving the efficiency of livestock management.

- Enhanced Animal Welfare: Increasing concern for animal welfare is driving demand for sophisticated livestock identification systems. These systems enable better management practices and more targeted care, which are critical for improving the overall health and well-being of animals. This shift is also being propelled by a growing public awareness and regulatory mandates aimed at ensuring animal welfare.

- Blockchain for Traceability: Integration of blockchain technology offers significant opportunities for enhancing supply chain transparency and traceability in the livestock industry. This technology ensures accurate documentation of animal movements and health events, thereby improving the reliability of the data and reducing fraud.

- Expansion in Emerging Markets: The livestock identification market is witnessing significant growth opportunities in developing countries, particularly in regions like Asia-Pacific. Government initiatives, such as mandatory tagging of livestock, are instrumental in driving this growth. For instance, India has implemented regulations requiring ear tags for cattle to prevent illegal movements and ensure proper management.

- Sustainability and Climate Resilience: As the agricultural sector adapts to climate change, there is a heightened focus on developing sustainable and resilient farming practices. Livestock identification systems play a crucial role in these efforts, offering solutions that contribute to more sustainable management of livestock and adherence to environmental regulations.

Recent Developments

- Jaap de Wit, Director of Supply Chain at Westfort, led a project with LeeO to modernize pig identification using RFID ear tags and a transport app. Piloted with 100 farmers, the system enhances traceability, efficiency, and animal welfare, managing 75 weekly transport movements for around 10,000 pigs.

Report Scope

Report Features Description Market Value (2024) USD 2.51 Bn Forecast Revenue (2034) USD 6.5 Bn CAGR (2025-2034) 9.90% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Solution (Hardware (Electronic Identification Tags, Visual Identification Tags, Readers & Applications, Others (Sensors, Boluses, etc.)), Software (On-Cloud, Livestock Record-Keeping Software), Services (Data Analytics, Maintenance & Support), By Application (Breeding Record, Animal Ownership Identification, Disease Management & Control, Milk Traceability), By Usage (Permanent, Non-Permanent), By Livestock Type (Cattle, Poultry, Swine, Other Livestock Types) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Merck & Co., Inc., Avid Identification Systems, Inc., Datamars, HID Global Corp.(ASSA ABLOY), Shearwell Data Limited, AEG Identification Systems, Avery Dennison Corp., GAO RFID, Fitbark, RFID, Inc., Datamars, Nedap N.V., MS Schippers, Leader Products, Caisley International Gmbh, Kupsan Tag Company, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Livestock Identification marketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Livestock Identification marketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Merck & Co., Inc.

- Avid Identification Systems, Inc.

- Datamars

- HID Global Corp.(ASSA ABLOY)

- Shearwell Data Limited

- AEG Identification Systems

- Avery Dennison Corp.

- GAO RFID

- Fitbark

- RFID, Inc.

- Datamars

- Nedap N.V.

- MS Schippers

- Leader Products

- Caisley International Gmbh

- Kupsan Tag Company

- Other Key Players